Market Overview

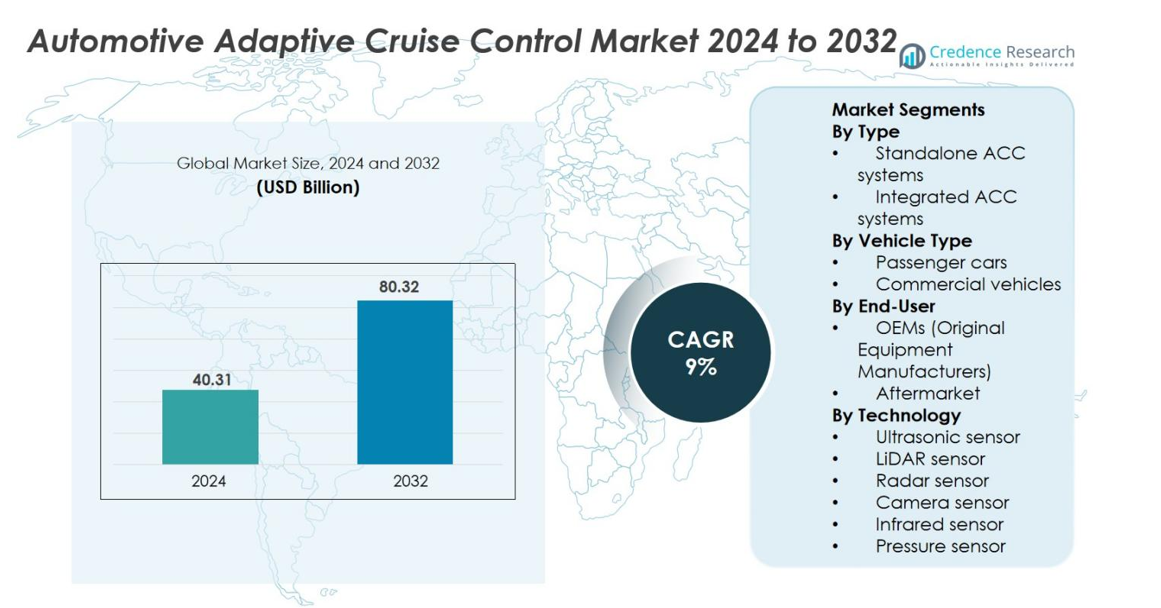

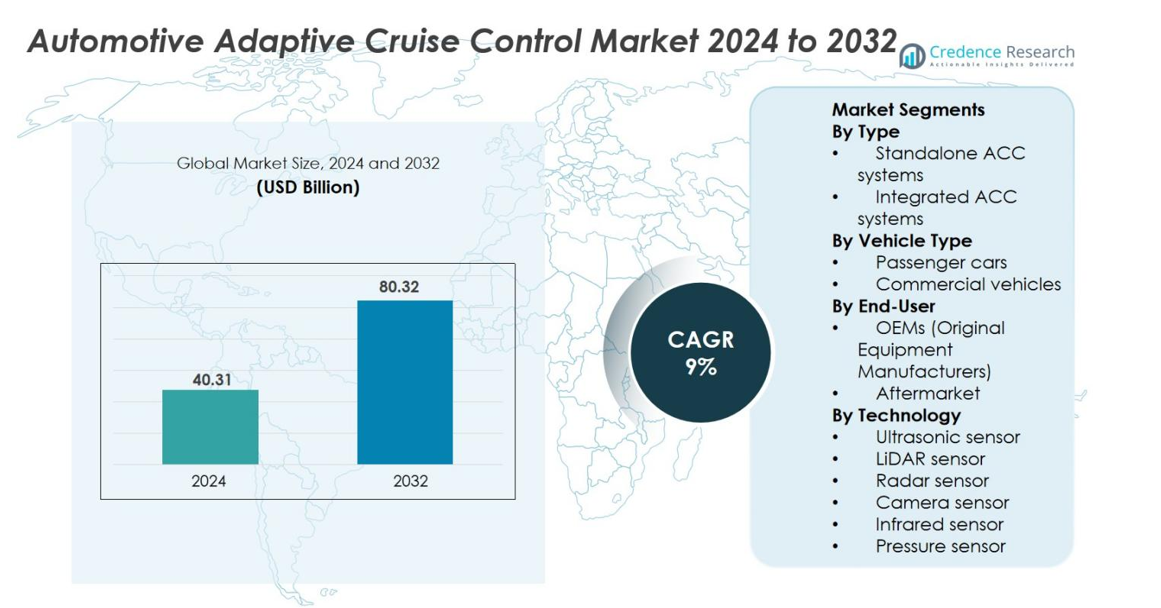

The Automotive Adaptive Cruise Control Market size was valued at USD 40.31 billion in 2024 and is anticipated to reach USD 80.32 billion by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Adaptive Cruise Control Market Size 2024 |

USD 40.31 billion |

| Automotive Adaptive Cruise Control Market, CAGR |

9% |

| Automotive Adaptive Cruise Control Market Size 2032 |

USD 80.32 billion |

The Automotive Adaptive Cruise Control (ACC) Market is primarily driven by key players such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, and Valeo SA. These companies lead the market with their innovative technologies, strong R&D capabilities, and strategic partnerships with automakers. In terms of regional performance, Asia Pacific holds the largest market share of 49.96% in 2024, driven by high vehicle production, rapid adoption of ADAS, and increasing demand for electric vehicles (EVs). Europe and North America follow, with market shares of 27.3% and 26.0%, respectively, supported by stringent safety regulations and consumer demand for advanced driver assistance systems.

Market Insights

- The Automotive Adaptive Cruise Control (ACC) Market size is valued at USD 40.31 billion in 2024 and is projected to reach USD 80.32 billion by 2032, growing at a CAGR of 9% during the forecast period.

- Rising demand for advanced driver assistance systems (ADAS) is a major market driver, as consumers prioritize safety and automation in vehicles.

- Key trends include the integration of ACC with electric and autonomous vehicles, which is expanding the scope of ACC systems beyond traditional vehicle types.

- The market faces restraints such as high initial costs, particularly for premium vehicles, and challenges in integrating ACC with existing vehicle technologies.

- Asia Pacific leads the market with a share of 49.96% in 2023, followed by Europe at 27.3% and North America at 26.0%. Passenger cars dominate the market, holding 72.6% of the total share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Automotive Adaptive Cruise Control (ACC) market is primarily segmented into Standalone ACC systems and Integrated ACC systems. Integrated ACC systems hold a dominant market share of 58.4% in 2024 due to their growing adoption in advanced driver assistance systems (ADAS) and seamless integration with other vehicle control systems. These systems provide enhanced safety and convenience, driving demand across passenger and commercial vehicles. The Standalone ACC systems, while accounting for 41.6% of the market, are still widely used in entry-level vehicles and offer cost-effective solutions, contributing to their steady market presence.

- For instance, Bosch’s ACC technology uses its 77 GHz long-range radar sensor with a detection range of up to 250 meters and supports target separation at speeds up to 160 km/h, enabling seamless integration with lane-keeping and emergency braking systems.

By Vehicle Type

The market is divided into Passenger Cars and Commercial Vehicles, with Passenger Cars leading with a market share of 72.6% in 2024. The increasing focus on driver safety, convenience, and fuel efficiency in passenger vehicles has driven the adoption of ACC systems in this segment. Meanwhile, Commercial Vehicles, accounting for 27.4% of the market, are witnessing growing demand for ACC systems due to their potential to reduce driver fatigue, enhance safety, and improve fuel efficiency, especially in long-haul transportation and logistics.

- For instance, Mercedes-Benz equips its E-Class and S-Class models with Distronic ACC, which operates at speeds up to 210 km/h and uses a multi-mode radar system capable of monitoring objects within a 250-meter range.

By End-User

The Automotive Adaptive Cruise Control market is also categorized by End-User into OEMs (Original Equipment Manufacturers) and the Aftermarket. OEMs dominate the market, holding a significant share of 81.2% in 2024. This dominance is driven by the integration of ACC systems in new vehicle models as part of ADAS packages, which is increasingly standard across premium and mid-range vehicles. The Aftermarket segment, accounting for 18.8%, is growing as vehicle owners seek to retrofit ACC systems to enhance their vehicle’s safety and convenience, especially in older models.

Key Growth Drivers

Rising Demand for Advanced Driver Assistance Systems (ADAS)

The growing demand for Advanced Driver Assistance Systems (ADAS) is a major driver for the Automotive Adaptive Cruise Control (ACC) market. As consumers increasingly prioritize vehicle safety, convenience, and automation, automakers are integrating ACC as a core feature in both premium and mid-range vehicles. The adoption of ADAS technologies, including ACC, is accelerating due to their ability to enhance driver experience by reducing fatigue, improving safety, and providing more efficient vehicle control, thus driving the market’s expansion.

- For instance, Hyundai’s Smart Cruise Control (SCC) in the Sonata and Santa Fe models uses a front radar that scans up to 180 meters and integrates machine learning algorithms that adapt to individual driver behavior to enhance ACC responsiveness.

Government Regulations and Safety Standards

Stringent government regulations and safety standards are significantly boosting the growth of the ACC market. Regulatory bodies worldwide are mandating the inclusion of safety technologies, such as ACC, to improve road safety. For instance, the European Union has imposed strict regulations requiring new vehicles to be equipped with certain ADAS technologies, including ACC, by 2024. These regulatory requirements are encouraging manufacturers to incorporate ACC systems as standard, further driving the market’s growth and ensuring greater adoption of the technology across all vehicle segments.

- For instance, the European Union’s General Safety Regulation (GSR) mandates features such as Intelligent Speed Assistance and Lane Keeping Assist from 2024, prompting OEMs like Volkswagen to upgrade ACC functions in models such as the Golf, where the radar sensor monitors distances up to 160 meters.

Technological Advancements in Vehicle Automation

Technological advancements in vehicle automation are driving the market for Automotive Adaptive Cruise Control. The increasing development of autonomous and semi-autonomous driving technologies is making ACC systems more advanced, enabling them to operate seamlessly alongside other driver assistance technologies. Innovations such as better sensor integration, machine learning algorithms, and improved radar and lidar technologies are enhancing the capabilities of ACC systems, making them more reliable, efficient, and accurate, thus fostering their adoption across the automotive industry.

Key Trends & Opportunities

Integration with Electric and Autonomous Vehicles

A significant trend in the Automotive Adaptive Cruise Control market is its integration with electric and autonomous vehicles. As electric vehicles (EVs) and autonomous driving technologies gain traction, automakers are designing ACC systems to work seamlessly with these vehicles. ACC’s role in enhancing the safety and efficiency of EVs is becoming increasingly important, as these vehicles rely heavily on advanced driver assistance systems. This integration offers opportunities for further market growth, particularly as autonomous vehicles enter the mass-market stage.

- For instance, Tesla integrates adaptive cruise functionality into its Full Self-Driving (FSD) suite using eight external cameras delivering up to 250 meters of forward visibility, supported by a neural network that processes 36 trillion operations per second on its in-house FSD computer.

Growing Aftermarket Adoption

The increasing adoption of ACC systems in the aftermarket presents a significant opportunity for the market. As more vehicle owners seek to retrofit ACC in older models, aftermarket suppliers are offering affordable and easily integrated solutions. This trend is especially noticeable in regions with large vehicle populations, such as North America and Europe. Aftermarket solutions offer a cost-effective way for consumers to upgrade their vehicles with advanced safety features, providing a substantial growth opportunity for manufacturers and suppliers catering to this segment.

Key Challenges

High Initial Costs of ACC Systems

One of the key challenges facing the Automotive Adaptive Cruise Control market is the high initial cost of these systems, especially in premium vehicles. While ACC enhances safety and convenience, the price of integration can be a significant barrier for budget-conscious consumers. This challenge is particularly evident in emerging markets, where price sensitivity is higher. Despite the growing demand for ACC systems, manufacturers need to find ways to reduce costs through economies of scale and technological advancements to ensure widespread adoption.

Integration with Existing Vehicle Technologies

Another challenge in the ACC market is the complexity of integrating adaptive cruise control systems with existing vehicle technologies. Vehicles equipped with legacy systems may face compatibility issues when retrofitting new ACC systems, especially in older models. Additionally, ensuring seamless integration with other ADAS components like lane-keeping assist, emergency braking, and parking sensors can be complex and require significant engineering efforts. Overcoming these technical barriers is crucial for manufacturers to ensure the widespread implementation and effectiveness of ACC systems across all vehicle types.

Regional Analysis

North America

North America accounted for a market share of 26.0% in 2023 for the automotive adaptive cruise control (ACC) market, driven by high penetration of advanced driver assistance systems (ADAS) and strong regulatory support. Automakers in the region are equipping new models with ACC solutions as standard, supported by mature infrastructure and consumer expectations for safety and automation. The presence of leading manufacturers and technology firms accelerates innovation in ACC modules, radar, and sensor technologies. This favorable ecosystem positions North America for sustained ACC market growth through the forecast period.

Europe

Europe represented 27.3% of the global ACC market in 2023, benefiting from robust vehicle safety regulations and increasing mandate adoption of ADAS features. Stringent legislation from the European Union, such as the General Safety Regulation, has made ACC systems more prevalent in new vehicle platforms. Additionally, strong consumer demand for premium safety features in both luxury and mainstream vehicles spurs ACC integration. Combined with established OEMs and Tier‑1 suppliers in Germany, France, and the UK, Europe remains a strategic market for adaptive cruise control deployment.

Asia Pacific

Asia Pacific held a dominant share of 49.96% of the global ACC market in 2023, as rapid vehicle production, rising urbanization, and strong EV adoption fuel demand for safety technologies. China, Japan, and India lead the region with aggressive rollouts of ADAS features and increasing consumer willingness to pay for advanced systems. The region also benefits from lower manufacturing costs and expanding aftermarket retrofit initiatives. Consequently, Asia Pacific continues to serve as the growth engine of the ACC market across the forecast period.

Latin America, Middle East & Africa (LAMEA)

Latin America, the Middle East, and Africa (LAMEA) represent a smaller share of the global ACC market but offer meaningful expansion opportunities. The combined region holds a market share of 6.1% and is witnessing rising vehicle sales, growing awareness of road safety, and improving infrastructure, all of which drive ACC system adoption. OEMs and Tier‑1 suppliers view LAMEA as the next frontier for ACC growth, especially as regulatory environments evolve and retrofit options become more accessible.

Market Segmentations

By Type

- Standalone ACC systems

- Integrated ACC systems

By Vehicle Type

- Passenger cars

- Commercial vehicles

By End-User

- OEMs (Original Equipment Manufacturers)

- Aftermarket

By Technology

- Ultrasonic sensor

- LiDAR sensor

- Radar sensor

- Camera sensor

- Infrared sensor

- Pressure sensor

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the automotive adaptive cruise control (ACC) market features major players such as Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG, Denso Corporation, Magna International Inc. and Valeo SA, which dominate supply for Tier‑1 ADAS systems. These firms leverage their extensive R&D capabilities, long-standing OEM relationships and global footprint to deliver integrated ACC sensors, ECUs, and software modules. They continue to push innovation in radar‑LiDAR fusion, AI‑driven perception and cost‑optimised architectures to meet regulatory safety mandates and consumer demand. Meanwhile, a growing number of autonomous‑tech startups and regional suppliers are entering the market, intensifying competition and driving down component costs. As ACC becomes a standard feature across mid‑range and premium vehicles, companies that can scale production, ensure supply‑chain resilience and achieve system reliability will capture greater share. Strategic partnerships, software upgrades, geographic expansion and platform modularity are emerging as key differentiators in this competitive environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Robert Bosch GmbH

- Valeo SA

- ZF Friedrichshafen AG

- Continental AG

- Magna International Inc

- Mando Corporation

- Hitachi Automotive Systems Ltd.

- Hyundai Motor Company

- Denso Corporation

- Nidec Elesys America Corporation

Recent Developments

- In September 2025, Bosch showcased its intelligent hardware and software solutions at IAA Mobility 2025, emphasizing support for adaptive cruise control via next-gen vehicle architectures.

- In August 2025, Robert Bosch GmbH announced two new system-on-chips (SoCs: SX600 and SX601) designed for use in advanced driver assistance features including adaptive cruise control.

- In March 2025, Magna International Inc. and NVIDIA Corporation expanded their partnership to enhance AI-powered adaptive cruise control systems.

Report Coverage

The research report offers an in-depth analysis based on Type, Vehicle Type, End User, Technology and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- ACC systems will increasingly serve as foundational components for semi‑autonomous driving platforms, enabling automakers to scale from Level 2 to Level 3 automation in passenger and commercial vehicles.

- The rising regulatory push for mandatory advanced driver‑assistance systems (ADAS) across major markets will accelerate ACC adoption in new vehicles worldwide.

- Integration of ACC with electrified vehicle architectures will broaden adoption, as automakers boost sensor and ECU content in EVs to enhance safety and driving convenience.

- Sensor fusion technologies combining radar, LiDAR, camera and ultrasonic inputs will drive higher reliability of ACC systems and open up premium‑feature differentiation.

- Growth in connected vehicle and vehicle‑to‑everything (V2X) infrastructure will enhance ACC system performance, enabling predictive speed and distance control based on real‑time traffic data.

- Aftermarket retrofit opportunities will expand, particularly in mature markets, as consumers upgrade older vehicles with ACC kits to enhance safety and resale value.

- Regional growth in Asia Pacific and emerging economies will outpace mature markets, driven by rising vehicle sales, increasing safety awareness and growing local manufacturing ecosystems.

- Tier‑1 suppliers and OEMs will increasingly pursue software‑defined modular ACC architectures, enabling feature updates over the air and reducing hardware cost per unit across vehicle segments.

- Cost reduction efforts, including consolidated sensor modules, cheaper processing units and higher volume production, will enable ACC to migrate into lower vehicle segments and volume models.

- Competitive differentiation will shift from hardware alone to system‑level performance, reliability and user experience — companies offering robust fail‑safe, predictive and adaptive ACC functionality will capture higher margins.