Market Overview

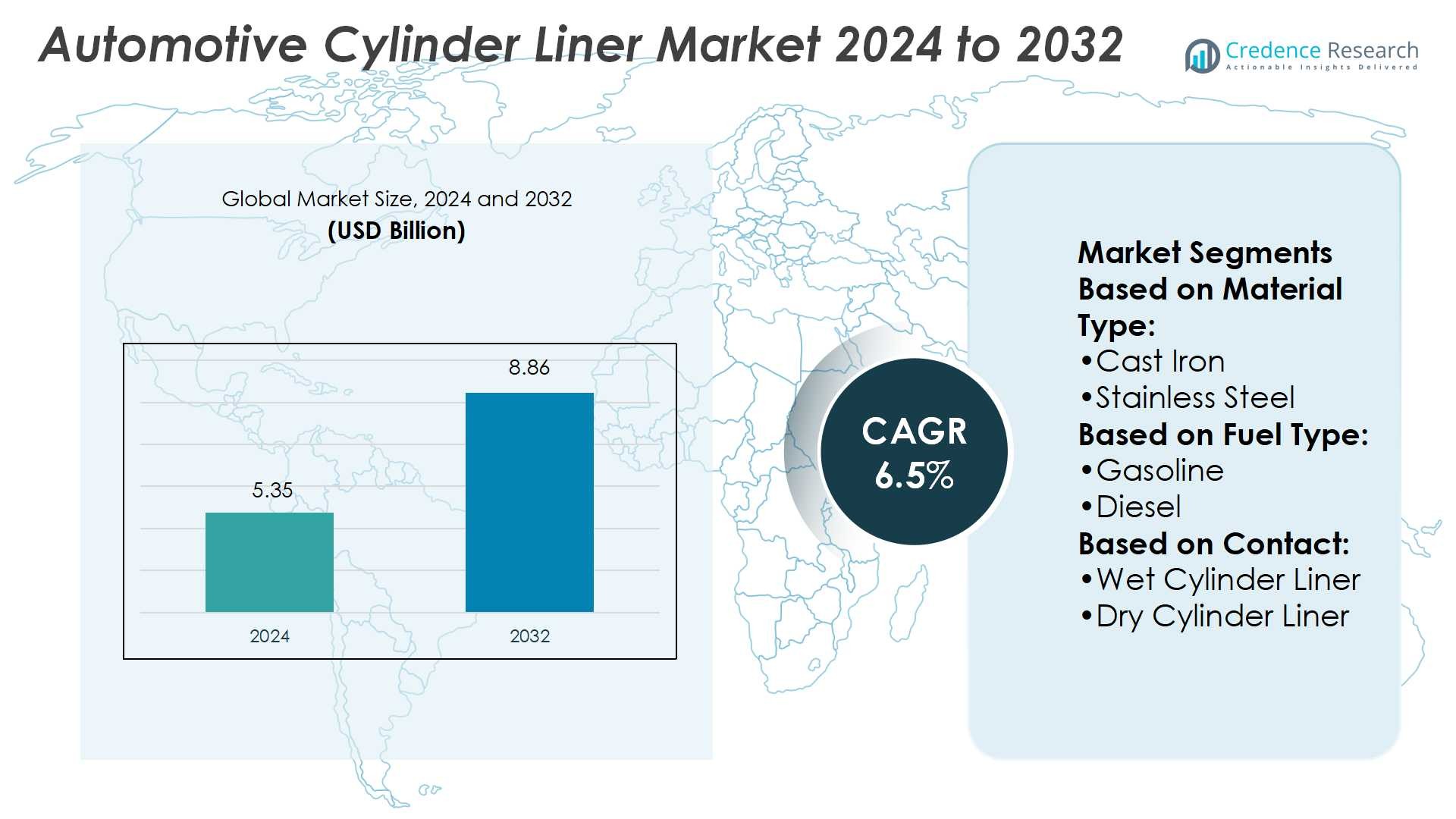

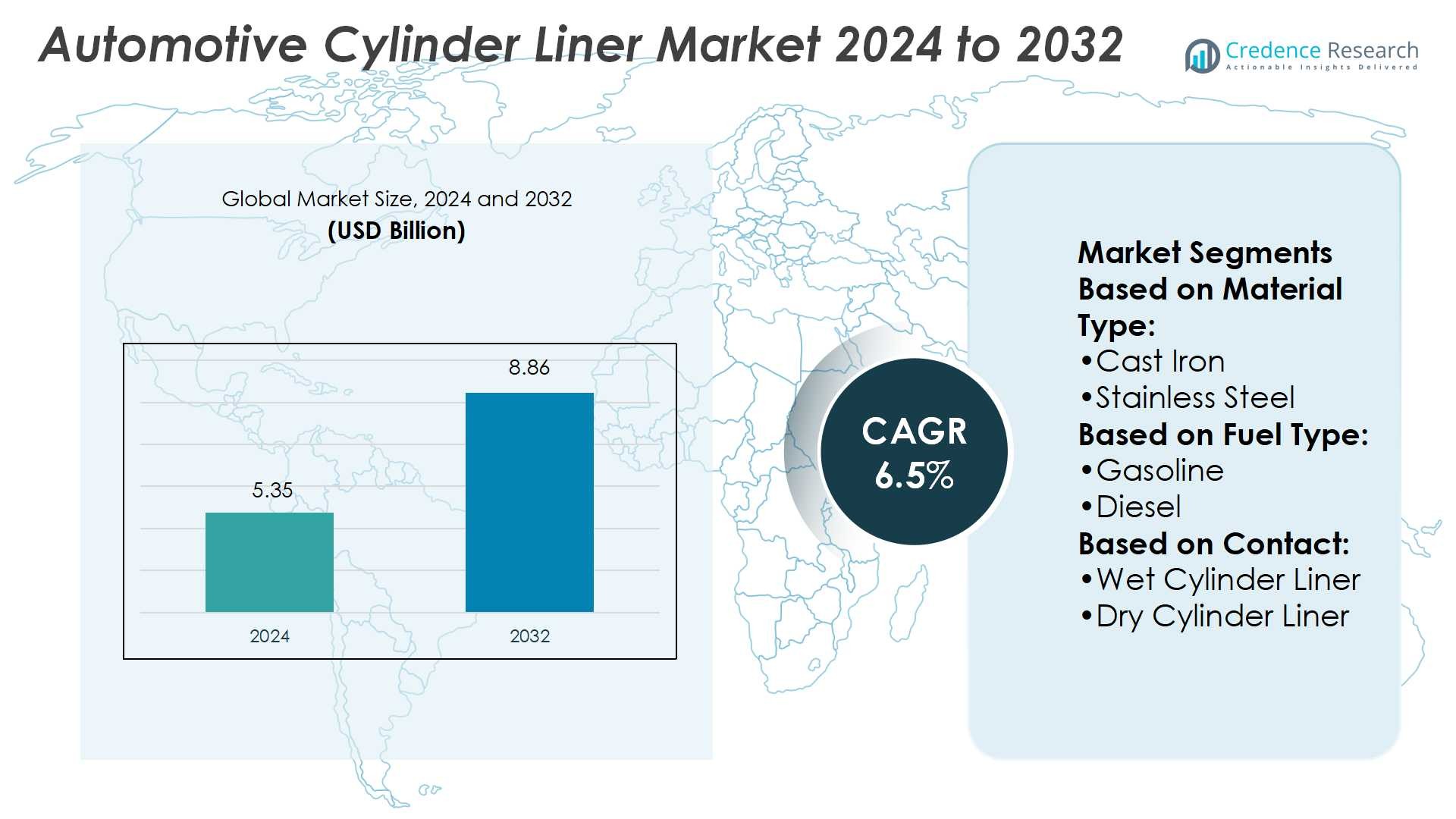

Automotive Cylinder Liner Market size was valued at USD 5.35 billion in 2024 and is anticipated to reach USD 8.86 billion by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Cylinder Liner Market Size 2024 |

USD 5.35 Billion |

| Automotive Cylinder Liner Market, CAGR |

6.5% |

| Automotive Cylinder Liner Market Size 2032 |

USD 8.86 Billion |

The Automotive Cylinder Liner Market grows with rising vehicle production, stricter emission standards, and demand for fuel-efficient engines. Manufacturers focus on advanced materials such as aluminum alloys, stainless steel, and composites to reduce weight while maintaining durability. It benefits from strong aftermarket demand driven by aging vehicle fleets and frequent replacements. Trends include adoption of advanced coatings, precision manufacturing, and integration with hybrid powertrains to enhance performance. Lightweight designs and digital manufacturing accelerate product innovation, while regional hubs in Asia Pacific expand global supply capabilities. The market evolves through sustainability initiatives, regulatory compliance, and continuous technological advancements.

The Automotive Cylinder Liner Market shows strong geographical presence, with Asia Pacific leading due to large-scale vehicle production, North America and Europe maintaining steady demand through advanced technologies and stringent emission norms, and Latin America along with the Middle East & Africa contributing through aftermarket growth. Key players focus on innovation, durability, and lightweight designs to strengthen competitiveness. It highlights the roles of global leaders investing in advanced materials, coatings, and partnerships with OEMs to expand market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive Cylinder Liner Market size was USD 5.35 billion in 2024 and will reach USD 8.86 billion by 2032, at a CAGR of 6.5%.

- Rising vehicle production and stricter emission standards drive demand for durable and fuel-efficient liners.

- Adoption of aluminum alloys, stainless steel, and composites supports lightweight designs and better engine performance.

- Advanced coatings, precision manufacturing, and hybrid powertrain integration shape major market trends.

- Competitive landscape features innovation in materials, partnerships with OEMs, and global aftermarket presence.

- Raw material cost fluctuations and rising EV adoption restrain long-term growth prospects.

- Asia Pacific leads in production, North America and Europe sustain demand through technology, while Latin America and the Middle East & Africa expand via aftermarket growth.

Market Drivers

Rising Vehicle Production and Expansion of the Global Automotive Industry

The Automotive Cylinder Liner Market benefits from increasing vehicle production across major economies. Growing consumer demand for passenger and commercial vehicles pushes automakers to scale production capacity. It strengthens the requirement for reliable engine components that improve efficiency and durability. Cylinder liners remain central to engine performance by reducing friction and withstanding thermal stress. Automakers emphasize high-quality liners to meet stricter emission and efficiency targets. Expanding automotive manufacturing hubs in Asia Pacific further accelerate adoption of advanced cylinder liner technologies.

- For instance, Chevron reports that its next-generation oil and natural gas facility designs in Colorado reduce greenhouse gas emissions by more than 90% compared with older designs, while reducing surface area by over 95%.

Stringent Emission Norms and Rising Focus on Fuel Efficiency

The Automotive Cylinder Liner Market experiences strong growth from global emission regulations. Governments enforce strict standards that require automakers to enhance engine efficiency and reduce fuel consumption. It raises the demand for lightweight and durable cylinder liners designed to optimize combustion. Improved designs help lower carbon output while maintaining power delivery. Automakers invest in advanced liner materials such as high-strength alloys and composites. These innovations ensure compliance while delivering reliable long-term engine performance.

- For instance, ENEOS constructed its first integrated synthetic fuel production plant at its Central Technical Research Laboratory in Yokohama, The plant is capable of producing one barrel of synthetic fuel per day, which is approximately 160 litres.

Increasing Demand for Lightweight and High-Performance Materials

The Automotive Cylinder Liner Market sees higher demand for lightweight solutions supporting better fuel economy. Automakers adopt aluminum alloys and advanced coatings to replace traditional heavy materials. It reduces overall engine weight and enhances thermal conductivity. Lightweight liners also improve acceleration and handling by reducing vehicle mass. Strong adoption in passenger cars and performance vehicles supports wider implementation. Material innovation continues to drive differentiation among suppliers competing for OEM partnerships.

Growing Aftermarket Demand and Maintenance Requirements

The Automotive Cylinder Liner Market gains momentum from the expanding aftermarket sector. Rising vehicle age worldwide drives frequent engine overhauls and part replacements. It creates consistent demand for liners offering durability and cost efficiency. Independent repair shops and authorized service centers contribute to steady sales. Cylinder liner replacements remain critical to extending vehicle lifecycle and maintaining performance. Growth in shared mobility fleets further increases service demand, reinforcing long-term market expansion.

Market Trends

Rising Use of Advanced Coatings and Surface Treatment Technologies

The Automotive Cylinder Liner Market is witnessing stronger adoption of advanced coatings that improve durability and performance. Manufacturers apply plasma spray coatings, diamond-like carbon layers, and thermal barrier materials to reduce wear. It enhances heat resistance and lowers friction during engine operation. These technologies support compliance with stricter emission and efficiency standards. Coatings also extend service intervals, creating cost savings for fleet operators. The trend aligns with growing demand for sustainable, long-lasting engine components.

- For instance, TotalEnergies’ Rubia EV3R lubricant range uses more than 50% re-refined base oils, meeting the same OEM approval standards as conventional oils, which helps maintain lubricant film integrity under high thermal stress.

Increasing Preference for Lightweight Alloys and Composite Materials

The Automotive Cylinder Liner Market shows a clear shift toward lightweight materials. Automakers replace traditional cast iron liners with aluminum alloys and hybrid composites. It reduces overall engine mass while maintaining strength and reliability. Lightweight designs improve vehicle fuel efficiency and enhance power-to-weight ratios. Growing use of composites also supports better heat dissipation and structural stability. This trend is reinforced by regulatory pushes for fuel savings and lower carbon emissions.

- For instance, ExxonMobil and Kingfa developed Exceed™ Tough PP8285E1, a high-flow, high-impact polypropylene resin. It delivers up to 35% higher impact strength compared to standard impact copolymers.

Integration of Cylinder Liners in Hybrid and Electric Vehicle Engines

The Automotive Cylinder Liner Market adapts to evolving hybrid and electric powertrain technologies. Hybrid vehicles still rely on efficient combustion engines, raising demand for compact and high-performance liners. It ensures smoother engine transitions and reliable thermal management. Electric vehicle range extenders also integrate specialized liners designed for small, efficient engines. Suppliers focus on precision designs that meet unique requirements of new mobility platforms. The trend highlights diversification of liner applications beyond conventional powertrains.

Expansion of Digital Manufacturing and Customization Capabilities

The Automotive Cylinder Liner Market benefits from digital manufacturing innovations. 3D printing, CNC machining, and advanced simulation tools enable precise, customized liner designs. It allows faster prototyping and supports low-volume, specialized applications for performance vehicles. Automation in production reduces defects and enhances consistency across product batches. Customized liners improve compatibility with next-generation engines designed for tighter tolerances. Digital manufacturing also shortens development cycles, giving suppliers a competitive edge. The trend strengthens partnerships between OEMs and component manufacturers.

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Instability

The Automotive Cylinder Liner Market faces challenges from volatile raw material prices and disrupted supply chains. Steel, aluminum, and alloy costs fluctuate due to global demand shifts and geopolitical tensions. It increases production expenses for manufacturers and reduces profit margins. Supply chain disruptions delay timely availability of essential inputs, affecting order fulfillment. OEMs and suppliers struggle to balance quality, cost, and delivery expectations. Growing reliance on imported materials in some regions further exposes manufacturers to risks. These factors force companies to seek alternative sourcing strategies and material innovations.

Technological Shifts and Increasing Pressure from Electrification

The Automotive Cylinder Liner Market encounters difficulties from the growing penetration of electric vehicles. EV adoption reduces long-term demand for combustion engine components, pressuring liner manufacturers to diversify. It creates uncertainty in future production volumes and investment planning. Hybrid vehicles sustain partial demand but require specialized liners that add development costs. Meeting evolving emission norms further complicates design and material selection. Smaller players with limited R&D budgets find it harder to remain competitive. These challenges push manufacturers to innovate while preparing for an industry in transition.

Market Opportunities

Expanding Demand for High-Performance and Lightweight Engine Components

The Automotive Cylinder Liner Market presents strong opportunities through rising demand for advanced engine components. Automakers prioritize lightweight and durable liners to improve fuel efficiency and meet emission standards. It creates growth prospects for suppliers offering innovative alloys, coatings, and composites. Increasing consumer interest in performance vehicles also strengthens the need for precision-engineered liners. Demand extends to both passenger and commercial vehicles, where durability and efficiency are critical. Suppliers focusing on R&D can secure partnerships with leading OEMs by providing differentiated solutions.

Growth Potential in Hybrid Powertrains and Aftermarket Services

The Automotive Cylinder Liner Market benefits from the expansion of hybrid vehicle adoption and aftermarket services. Hybrid engines continue to rely on efficient combustion systems, driving demand for compact and optimized liners. It supports opportunities for manufacturers that design specialized products for evolving powertrain needs. The global rise in vehicle age fuels aftermarket demand for replacement liners, creating a steady revenue stream. Fleet operators and mobility service providers further contribute by requiring frequent maintenance and part replacement. Companies that expand distribution networks and offer cost-effective, high-quality products can capture significant market share.

Market Segmentation Analysis:

By Material Type

The Automotive Cylinder Liner Market demonstrates strong segmentation by material type, with cast iron maintaining a dominant share due to its strength, cost-effectiveness, and wear resistance. Cast iron liners continue to be widely used in heavy-duty engines and commercial vehicles. Stainless steel gains traction for its corrosion resistance and durability in high-performance engines. It offers longer service life and enhanced thermal stability under demanding conditions. Aluminum shows rapid growth driven by the automotive industry’s focus on lightweight engines and improved fuel efficiency. Titanium, though costlier, emerges in niche applications requiring superior strength-to-weight ratios and advanced performance standards. Material choice strongly depends on engine design, cost targets, and regulatory compliance requirements.

- For instance, research on Ni-P plated + heat-treated gray cast iron cylinder liners found microhardness of 895 HV at 600 °C after treatment. Weight loss under cavitation was 0.0376 g.

By Fuel Type

The Automotive Cylinder Liner Market divides into gasoline and diesel engine applications, each with distinct demand dynamics. Gasoline engines dominate passenger vehicles, supported by global consumer preference for fuel efficiency and lower emissions. Cylinder liners for gasoline engines focus on reducing friction, improving heat transfer, and ensuring smoother performance. Diesel engines remain critical in commercial vehicles, agricultural machinery, and heavy-duty trucks, where durability and torque are priorities. It drives the demand for liners that can withstand high compression and thermal stress. Rising regulatory pressure on diesel emissions challenges demand but sustains innovation in material design and coating technologies. The segment balance reflects regional fuel preferences and evolving regulatory frameworks.

- For instance, surface roughness (Sa) of cylinder liners increased by 58.43% when temperature rose from 80 °C to 190 °C in a piston ring–cylinder liner test, while piston ring roughness increased by 96.5% over same temp span.

By Contact

The Automotive Cylinder Liner Market is segmented into wet and dry cylinder liners, each offering distinct advantages. Wet liners, which come in direct contact with coolant, dominate heavy-duty and high-performance applications due to superior cooling efficiency and ease of replacement. It allows better thermal management and extends engine life in demanding environments. Dry liners, fitted without direct coolant contact, find wider use in passenger vehicles for cost savings and simpler designs. They reduce engine block size and weight while maintaining durability. Selection between wet and dry liners often depends on the intended vehicle application, service requirements, and cost considerations. Both segments maintain steady demand across global markets, ensuring growth opportunities for manufacturers offering tailored solutions.

Segments:

Based on Material Type:

- Cast Iron

- Stainless Steel

Based on Fuel Type:

Based on Contact:

- Wet Cylinder Liner

- Dry Cylinder Liner

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 27% in the Automotive Cylinder Liner Market, driven by the strong presence of established automotive OEMs and consistent demand for passenger and commercial vehicles. The region’s focus on advanced engine technologies and regulatory compliance with strict emission norms boosts the adoption of lightweight and durable cylinder liners. It has a robust aftermarket network that further supports steady replacement demand, especially in aging vehicle fleets. The United States leads the region with high investments in R&D, while Canada and Mexico contribute through growing manufacturing bases and supply chain integration. Diesel engine applications remain important in commercial fleets, supporting demand for heavy-duty liners. The push toward hybrid and performance vehicles also drives interest in advanced materials and coatings across North American markets.

Europe

Europe accounts for 25% of the Automotive Cylinder Liner Market, supported by a strong manufacturing base, premium vehicle production, and strict emission regulations. Germany, France, and the United Kingdom lead the region, hosting some of the world’s top automotive brands. It benefits from increasing demand for high-performance liners that enhance engine efficiency and durability. European automakers focus heavily on sustainability, encouraging the use of lightweight alloys and advanced composites in liner design. The aftermarket is significant, with older vehicles requiring frequent liner replacements to maintain performance standards. Hybrid powertrains also sustain demand as automakers bridge the gap between combustion and electric vehicles. The regional market continues to expand through advanced production techniques and collaborations between OEMs and component suppliers.

Asia Pacific

Asia Pacific holds the largest share of 32% in the Automotive Cylinder Liner Market, fueled by rapid industrialization, rising disposable incomes, and a strong automotive manufacturing ecosystem. China, India, and Japan dominate production and consumption, supported by large-scale passenger car demand and expanding commercial fleets. It benefits from cost-effective manufacturing capabilities and a growing focus on fuel-efficient vehicle designs. Rising vehicle ownership in emerging economies creates a steady aftermarket for cylinder liners. Hybrid and small-engine vehicles gain traction in Japan and South Korea, further diversifying product requirements. The region also experiences high exports of cylinder liners to global markets, reinforcing its role as a critical hub in the supply chain. Investments in advanced materials and automation strengthen Asia Pacific’s competitive position.

Latin America

Latin America represents a 9% share of the Automotive Cylinder Liner Market, with Brazil and Mexico leading regional growth. The demand is driven by increasing vehicle production, rising middle-class incomes, and the need for durable liners in both passenger and commercial segments. It benefits from aftermarket growth, as vehicle aging rates are higher compared to developed markets. Diesel engines remain popular in commercial transport and agricultural machinery, supporting specialized liner demand. Regional manufacturers face challenges from fluctuating raw material costs but continue to adapt through localized sourcing. Hybrid vehicle adoption is still limited, but future opportunities are emerging as governments promote cleaner transportation. The region’s long-term growth potential relies on economic stability and industrial expansion.

Middle East & Africa

The Middle East & Africa holds a 7% share of the Automotive Cylinder Liner Market, driven by demand for commercial vehicles, off-road equipment, and a growing passenger vehicle base. Gulf countries lead adoption due to higher purchasing power and strong infrastructure development activities. It has a sizable aftermarket segment, where durability and cost-effectiveness are key purchase factors. South Africa serves as a regional hub for automotive manufacturing and distribution. Diesel engines dominate, particularly in commercial fleets and construction equipment, creating consistent liner demand. Hybrid adoption remains low but presents future opportunities as governments pursue sustainability targets. Expanding distribution channels and partnerships with global suppliers help strengthen the region’s position in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuchs Petrolub SE (Germany)

- Chevron Corporation (U.S.)

- ENEOS Corporation (Japan)

- Sinopec Group (China)

- TotalEnergies SE (France)

- Exxon Mobil Corporation (U.S.)

- Valvoline Inc. (U.S.)

- BP plc (U.K.)

- China National Petroleum Corporation (China)

- Idemitsu Kosan (Japan)

Competitive Analysis

The Automotive Cylinder Liner Market players include Fuchs Petrolub SE (Germany), Chevron Corporation (U.S.), ENEOS Corporation (Japan), Sinopec Group (China), TotalEnergies SE (France), Exxon Mobil Corporation (U.S.), Valvoline Inc. (U.S.), BP plc (U.K.), China National Petroleum Corporation (China), and Idemitsu Kosan (Japan). The Automotive Cylinder Liner Market is highly competitive, shaped by continuous innovation in material science, precision engineering, and coating technologies. Companies focus on developing lightweight, durable, and heat-resistant liners that meet stricter emission standards and enhance fuel efficiency. It emphasizes advancements such as plasma spray coatings, high-strength alloys, and hybrid composites that improve engine performance and reduce maintenance needs. The market also benefits from strong demand in both OEM supply and the aftermarket, with manufacturers expanding their global reach through strategic partnerships and localized production facilities. Digital manufacturing, automation, and rapid prototyping further strengthen competitiveness by improving efficiency and reducing time-to-market. Sustainability, cost optimization, and adaptability to hybrid powertrains remain central to securing long-term growth opportunities.

Recent Developments

- In April 2025, Daewoo entered the Indian automotive lubricant market through a licensing collaboration with Mangali Industries Limited, announced at a launch event in New Delhi. The partnership will introduce Daewoo’s range of lubricants for two-wheelers, passenger cars, commercial and agricultural vehicles across the country.

- In April 2025, MSB Global Group Bhd is boosting its diversification efforts, with plans to launch an in-house electric vehicle (EV) charger brand by the second quarter of 2025, while also preparing to transition from a trading-based business to a lubricant manufacturer.

- In January 2025, Advik Hi-Tech Pvt. Ltd. unveiled a pioneering portfolio of products at the Auto Component Expo during Bharat Mobility Global Expo 2025 in New Delhi. The company featured cutting-edge innovations in electric pumps, advanced braking systems, and scalable battery packs for mobility and energy storage sectors.

- In September 2024, J.Juan, a Barcelona-based company specializing in brake systems, introduced a new racing brake kit designed for the Can-Am Maverick R. Unveiled at the Sand Sports Super Show in Los Angeles, the kit features advanced components aimed at enhancing braking performance and driver control.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Fuel Type, Contact and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady demand from growing global vehicle production.

- Lightweight materials will gain wider adoption to improve fuel efficiency.

- Hybrid vehicles will continue to drive demand for specialized liners.

- Advanced coatings will play a larger role in reducing wear and friction.

- Digital manufacturing will speed up design and customization processes.

- The aftermarket will expand with aging vehicle fleets worldwide.

- Sustainability goals will push innovation in recyclable and eco-friendly materials.

- Regional manufacturing hubs will strengthen supply chain resilience.

- Partnerships with OEMs will remain critical for long-term competitiveness.

- Technological adaptation will shape opportunities despite rising EV adoption.