Market Overview

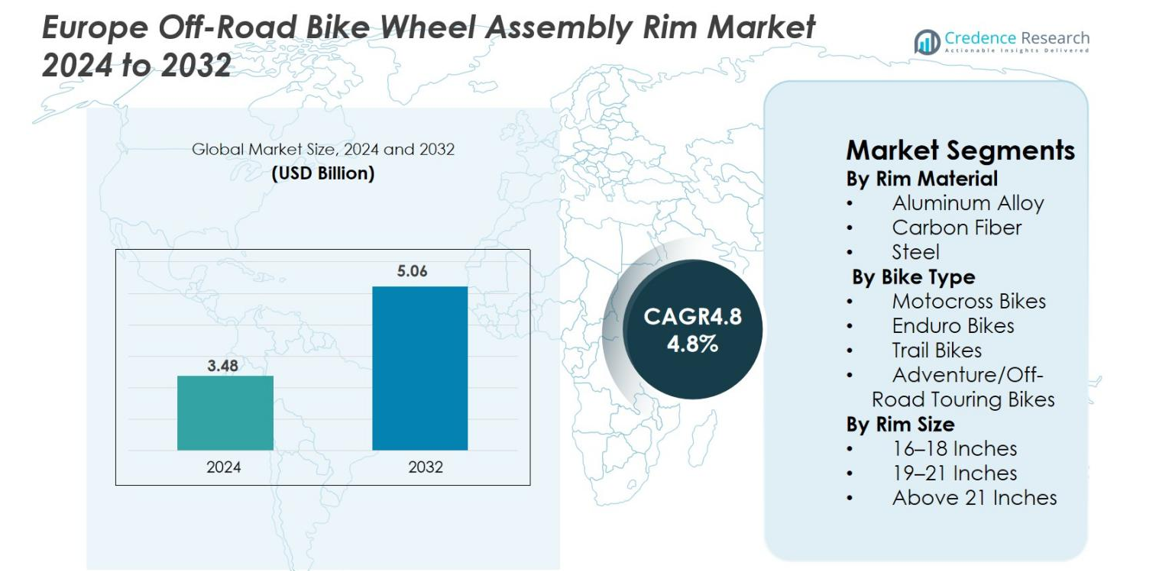

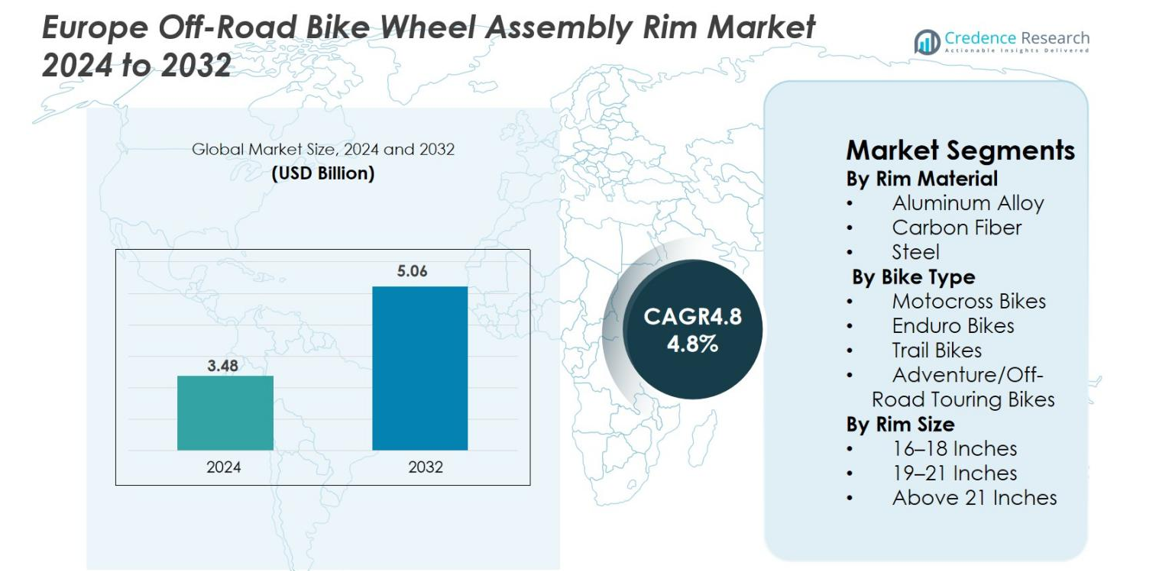

Europe Off-Road Bike Wheel Assembly Rim Market size was valued at USD 3.48 Billion in 2024 and is anticipated to reach USD 5.06 Billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Off-Road Bike Wheel Assembly Rim Market Size 2024 |

USD 3.48 Billion |

| Europe Off-Road Bike Wheel Assembly Rim Market, CAGR |

4.8% |

| Europe Off-Road Bike Wheel Assembly Rim Market Size 2032 |

USD 5.06 Billion |

Europe Off-Road Bike Wheel Assembly Rim Market is driven by leading manufacturers such as DID Europe, Excel Rim Company, Haan Wheels, Talon Engineering, SM Pro Wheels, Warp 9 Racing, OZ Motorbike, Kite Parts Europe, Z-Wheel, and RK Excel Europe, all focusing on high-strength materials and precision-engineered rim technologies. Western Europe leads the market with a 41.6% share in 2024, supported by a strong motocross and enduro racing ecosystem across Germany, France, and the UK. Northern Europe follows with 23.4% share driven by rugged terrains and high demand for durable, performance-oriented wheel assemblies among recreational and professional riders

Market Insights

- Europe Off-Road Bike Wheel Assembly Rim Market was valued at USD 3.48 Billion in 2024 and is projected to reach USD 5.06 Billion by 2032, registering a CAGR of 4.8%.

- The market grows as rising motocross, enduro, and trail riding activities increase demand for lightweight, durable rims, with aluminum alloy dominating the material segment with a 62.4% share in 2024.

- Key trends include rapid adoption of carbon fiber rims, CNC-engineered components, and customization-driven aftermarket expansion, supporting performance upgrades across professional and recreational segments.

- Leading players such as DID Europe, Excel Rim Company, Haan Wheels, and Talon Engineering strengthen market presence through advanced rim technologies, modular wheel systems, and racing partnerships, enhancing product differentiation.

- Western Europe leads with a 41.6% share, followed by Northern Europe at 23.4%, while 19–21-inch rims remain the dominant rim size segment with a 54.1% share, supported by stability and compatibility with high-performance off-road bikes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Rim Material

The Europe Off-Road Bike Wheel Assembly Rim Market is primarily driven by the rising demand for lightweight and high-performance components, with aluminum alloy rims dominating the segment with a 62.4% market share in 2024. Their balance of durability, affordability, and weight efficiency makes them highly preferred across motocross and enduro applications. Carbon fiber rims continue to gain traction due to superior strength-to-weight ratios, supporting premium bike categories, while steel rims maintain relevance in budget and recreational segments. Increasing rider preference for responsive handling and improved shock absorption further accelerates aluminum alloy adoption.

- For instance, the alloy rim produced by Excel (the “Takasago” off-road rim) uses a 7000-series aluminium alloy. This provides roughly 50% higher yield strength than standard 6000-series aluminium rims

By Bike Type

Within the bike type segment, motocross bikes lead the Europe market with a 47.9% share in 2024, supported by strong participation in competitive racing events and frequent component replacement cycles due to high structural impact. Enduro bikes follow with rising demand from long-distance off-road enthusiasts seeking durable wheel assemblies with superior traction. Trail and adventure touring bikes experience steady growth as recreational off-roading expands across Europe. Increased motorsport engagement, improved track infrastructure, and higher demand for performance-oriented wheel systems continue to reinforce motocross dominance.

- For instance, Husqvarna’s FC‑series motocross bikes feature reinforced aluminium rims designed to withstand repeated jumps and rough terrain, demonstrating the importance of durability in motocross applications.

By Rim Size

The rim size segment is dominated by 19–21-inch rims, accounting for 54.1% share in 2024, as these sizes offer optimal stability, shock absorption, and maneuverability essential for motocross and enduro terrains. Their widespread compatibility with professional racing bikes strengthens adoption across OEM and aftermarket channels. The 16–18-inch category maintains moderate demand among youth and mid-segment bikes, while rims above 21 inches cater to specialized adventure and touring models. The shift toward high-performance off-road riding and increasing demand for enhanced front-wheel control continue to propel the dominance of 19–21-inch rims.

Key Growth Drivers

Rising Off-Road Sports Participation and Competitive Racing Activities

The Europe Off-Road Bike Wheel Assembly Rim Market benefits significantly from the growing popularity of motocross, enduro racing, and trail riding across countries such as Germany, France, and the UK. Increasing participation in organized championships and weekend recreational riding drives higher demand for durable and high-performance wheel assemblies that withstand aggressive terrains and high-impact maneuvers. Frequent wheel replacement cycles among professional riders further accelerate market growth. OEMs rapidly introduce lightweight and reinforced rim technologies to enhance maneuverability, stability, and acceleration. Additionally, the expansion of off-road training academies and motorsport clubs continues to increase the adoption of premium wheel systems, reinforcing steady demand across the aftermarket and OEM channels.

- For instance, Europe Dirt Bikes” market is expected to rise driven by rising interest in motocross racing and recreational riding culture.

Strong Demand for Lightweight and High-Strength Rim Materials

A major growth driver for the Europe Off-Road Bike Wheel Assembly Rim Market is the strong shift toward lightweight, high-strength materials such as aluminum alloys and carbon fiber. Riders increasingly prioritize agility, improved suspension response, and reduced rotational mass, making advanced material rims essential for performance enhancement. Aluminum alloy rims remain dominant due to their balance of strength, affordability, and shock absorption, while carbon fiber rims gain traction within premium and racing segments for their superior stiffness-to-weight ratio. Manufacturers invest heavily in improved forging, heat treatment, and composite technologies, enabling better durability under extreme riding conditions. This focus on advanced materials not only boosts product differentiation but also supports long-term market expansion across performance-oriented applications.

- For instance, Excel Rim Company’s “Takasago 7000-series” aluminium rims undergo advanced forging and heat treatment, delivering roughly 50% higher yield strength than standard rims, enhancing durability for motocross and enduro use.

Growing Aftermarket Expansion and Customization Preferences

The rapid expansion of the aftermarket sector is driving sustained growth in the Europe Off-Road Bike Wheel Assembly Rim Market. Riders increasingly seek customized wheel assemblies with enhanced aesthetics, weight reduction, and optimized traction for specific terrains. This trend fuels demand for specialized rims, reinforced hubs, anodized components, and spoke upgrades. Frequent replacements due to wear and tear in competitive riding further strengthen aftermarket sales. Custom fitting services, online retailing, and the availability of brand-specific wheel kits are also boosting market penetration. Moreover, rising consumer preference for tailored riding experiences encourages companies to offer modular wheel components and performance-tuned assemblies, creating significant long-term revenue opportunities.

Key Trends & Opportunities

Advancements in Rim Manufacturing and Digital Engineering Techniques

A key trend shaping the Europe Off-Road Bike Wheel Assembly Rim Market is the increasing adoption of advanced manufacturing technologies such as CNC machining, hydroforming, and robotic spoke lacing. These processes enable superior precision, weight optimization, and enhanced rim integrity. Digital simulation tools allow manufacturers to analyze stress distribution and optimize rim geometry for extreme terrains, improving safety and longevity. Additive manufacturing also emerges as an opportunity for producing custom components and lightweight prototypes. As producers integrate sensor-enabled hubs and smart components, the market moves toward intelligent wheel systems capable of monitoring strain, vibration, and riding conditions, offering new value propositions for competitive and recreational riders.

- For instance, Husqvarna utilizes modern engineering practices, including digital stress simulation (Finite Element Analysis or CAE), in the design of components like wheel rims to optimize their performance and durability.

Rising Transition Toward Premium and Performance-Oriented Wheel Systems

A strong opportunity arises from Europe’s accelerating shift toward premium off-road bikes and high-performance wheel assemblies. Riders increasingly prioritize advanced handling, faster acceleration, and higher durability, pushing demand for carbon fiber rims, reinforced hubs, and precision-spoked systems. Brands are expanding their product portfolios with racing-certified rim technologies and limited-edition performance kits that appeal to professional riders. The trend is supported by the growth of adventure tourism and long-distance off-road expeditions across Europe, where riders prefer lightweight, impact-resistant rims capable of enduring diverse terrains. As consumer expectations elevate, manufacturers offering premium, high-strength solutions capture substantial growth prospects.

- For instance, Husqvarna’s FE 450 and TE 300 models feature reinforced aluminium rims and precision-spoked assemblies designed for professional enduro riders, enhancing handling and durability on long off-road tracks.

Key Challenges

High Cost of Advanced Rim Materials and Manufacturing Technologies

One of the major challenges in the Europe Off-Road Bike Wheel Assembly Rim Market is the high cost associated with advanced materials such as carbon fiber and precision-machined aluminum alloys. The manufacturing processes involved including forging, composite layering, and automated lacing significantly raise production expenses, limiting adoption among cost-sensitive consumers. While high-performance riders readily invest in premium rims, recreational users often opt for budget options, creating a market gap. Additionally, supply chain fluctuations and rising metal prices elevate overall costs, affecting OEM pricing strategies. These cost barriers hinder widespread penetration of advanced rim technologies across mid-range segments.

Frequent Wear, Damage Risk, and Maintenance Requirements

Off-road wheel rims are highly susceptible to damage due to rocks, jumps, uneven terrain, and aggressive riding styles, creating a persistent challenge for both users and manufacturers. Frequent dents, spoke loosening, and rim distortion result in increased maintenance demands and replacement cycles, raising ownership costs for riders. Even advanced materials cannot fully eliminate the impact-related wear associated with intense off-road conditions. This challenge also pressures manufacturers to continually innovate in durability and impact resistance while balancing weight optimization. The need for regular inspections and service appointments further affects user experience, especially for long-distance and competitive riders.

Regional Analysis

Western Europe

Western Europe dominates the Europe Off-Road Bike Wheel Assembly Rim Market with a 41.6% share in 2024, driven by strong motocross and enduro racing cultures in Germany, France, the UK, and the Netherlands. High consumer spending on premium performance bikes and frequent participation in organized motorsport events support substantial adoption of lightweight aluminum and carbon fiber rims. OEM presence, advanced manufacturing facilities, and robust aftermarket distribution channels further strengthen regional demand. Continuous investment in off-road parks, training academies, and racing infrastructure fuels recurring rim replacement cycles and encourages the uptake of premium wheel assemblies among professional and recreational riders.

Northern Europe

Northern Europe holds a 23.4% market share in 2024, driven by active off-road communities in Sweden, Finland, and Norway, where rugged terrains and outdoor sports culture stimulate high demand for durable wheel assemblies. Riders prioritize reinforced aluminum and carbon fiber rims capable of handling rocky trails, harsh weather, and demanding off-road conditions. Strong adventure tourism, particularly long-distance wilderness trail riding, boosts adoption of larger rim sizes and premium wheel systems. Government-backed motorsport initiatives and an affinity for high-performance recreational vehicles further contribute to steady expansion across both OEM and aftermarket segments.

Southern Europe

Southern Europe accounts for a 19.7% market share in 2024, supported by growing off-road biking activity in Italy, Spain, and Portugal. The region’s favorable climate, varied landscapes, and expanding motocross and enduro events drive higher usage of performance-oriented rims. Demand is strong among recreational riders investing in lightweight, shock-absorbing wheel assemblies to improve handling on mountainous and sandy terrains. The aftermarket sector is expanding due to rising customization trends, while local manufacturers and dealerships improve accessibility to advanced rim technologies. Tourism-driven trail riding also plays a key role in supporting continuous market growth.

Eastern Europe

Eastern Europe represents a 15.3% market share in 2024, with strong growth potential driven by increasing affordability of off-road bikes and developing motorsport infrastructure in Poland, Czech Republic, Hungary, and Romania. Riders in this region prioritize durable and cost-effective aluminum rims, though adoption of carbon fiber options is gradually rising within competitive segments. Growing participation in regional motocross leagues and increased penetration of international bike brands fuel demand for replacement wheel assemblies. Expanding adventure touring and recreational trail riding also support market expansion, while improving distribution networks enhance availability of OEM and aftermarket components.

Market Segmentations

By Rim Material

- Aluminum Alloy

- Carbon Fiber

- Steel

By Bike Type

- Motocross Bikes

- Enduro Bikes

- Trail Bikes

- Adventure/Off-Road Touring Bikes

By Rim Size

- 16–18 Inches

- 19–21 Inches

- Above 21 Inches

By Geography

- Western Europe

- Northern Europe

- Southern Europe

- Eastern Europe

Competitive Landscape

The competitive landscape of the Europe Off-Road Bike Wheel Assembly Rim Market is characterized by the strong presence of established manufacturers focusing on advanced material technologies, precision engineering, and performance enhancement. Key players such as DID Europe, Excel Rim Company, Haan Wheels, Talon Engineering, SM Pro Wheels, Warp 9 Racing, Kite Parts Europe, OZ Motorbike, Z-Wheel, and RK Excel Europe continually introduce lightweight and impact-resistant rims tailored for motocross, enduro, trail, and adventure applications. These companies invest in CNC machining, heat-treated aluminum alloys, and carbon composite processes to deliver superior durability and handling. The aftermarket segment remains highly active, driven by consumer demand for customization and frequent rim replacements in competitive sports. Strategic partnerships with racing teams, expansion of distribution networks, and the development of modular wheel kits further strengthen the market positions of leading players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DID Europe

- Excel Rim Company

- Haan Wheels

- Talon Engineering Ltd

- Warp 9 Racing

- SM Pro Wheels

- Kite Parts Europe

- Z-Wheel (Dirt Freak)

- OZ Motorbike

- RK Excel Europe

Recent Developments

- In 2025, Haan Wheels began offering custom wheels for the Ducati Desmo450 MX (combining Haan’s hubs with rims from Excel Rim Co. Ltd.).

- In 2025, Talon Engineering launched its “Talon Wheel Builder” an online tool for designing custom off-road motorcycle wheels.

- In June 2025, GW launched a completely new wheelset series including alloy MTB XC, carbon gravel, and road wheelsets along with a full new rim line (both carbon and alloy) to support OEM and aftermarket rim/wheel needs

Report Coverage

The research report offers an in-depth analysis based on Rim Material, Bike Type, Rim Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as off-road sports participation increases across Europe.

- Adoption of lightweight aluminum and carbon fiber rims will rise due to performance-oriented preferences.

- OEMs will expand product portfolios with advanced rim geometries and reinforced spoke systems.

- Aftermarket sales will grow as riders demand customized wheel assemblies for varied terrains.

- Digital engineering and CNC machining will enhance rim precision and durability.

- Adventure and long-distance trail riding will fuel demand for larger and impact-resistant rim sizes.

- Western Europe will maintain dominance, supported by strong motorsport ecosystems.

- Manufacturers will emphasize modular wheel designs to support easy upgrades and replacements.

- Partnerships with racing teams will accelerate adoption of premium rim technologies.

- Increasing focus on sustainability will drive innovation in recyclable and eco-friendly rim materials.