Market Overview

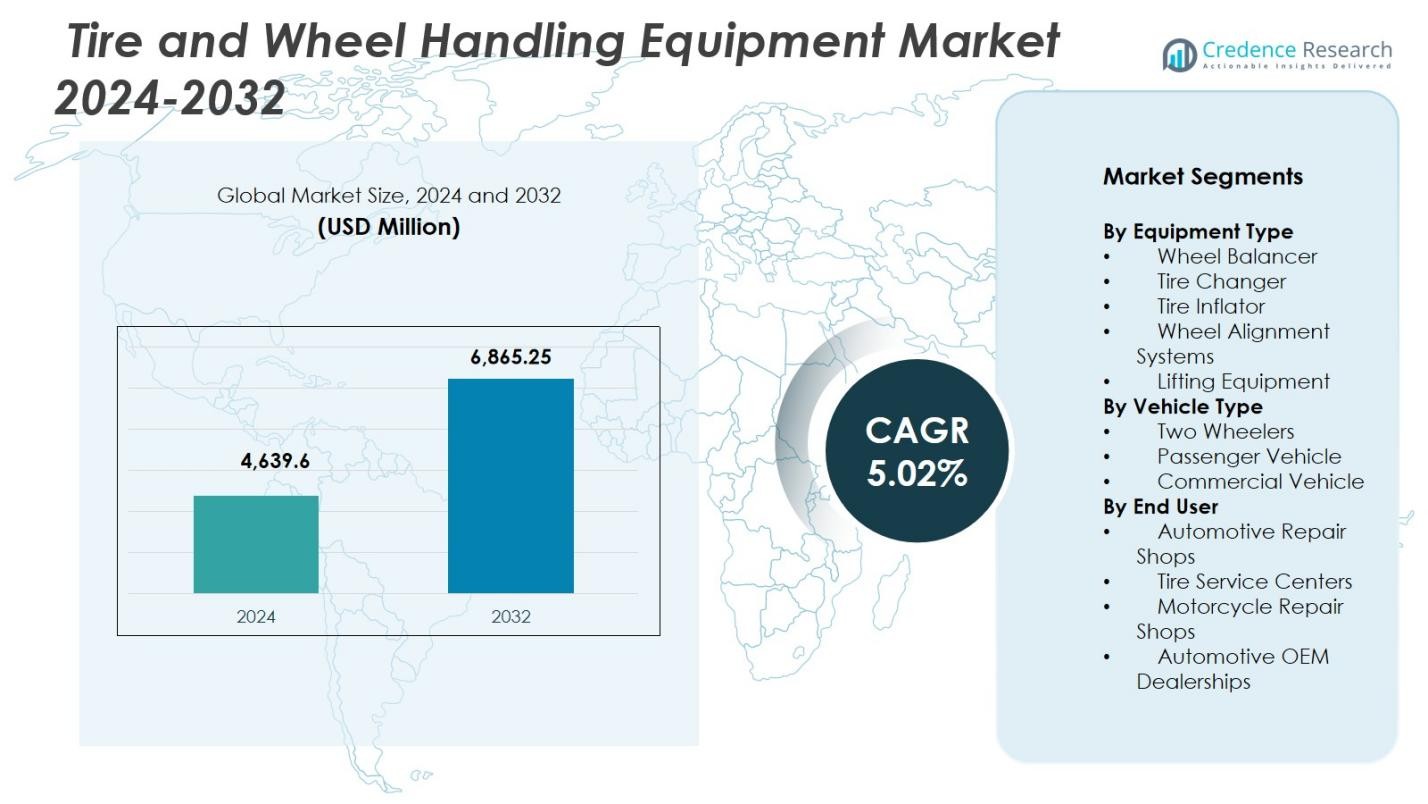

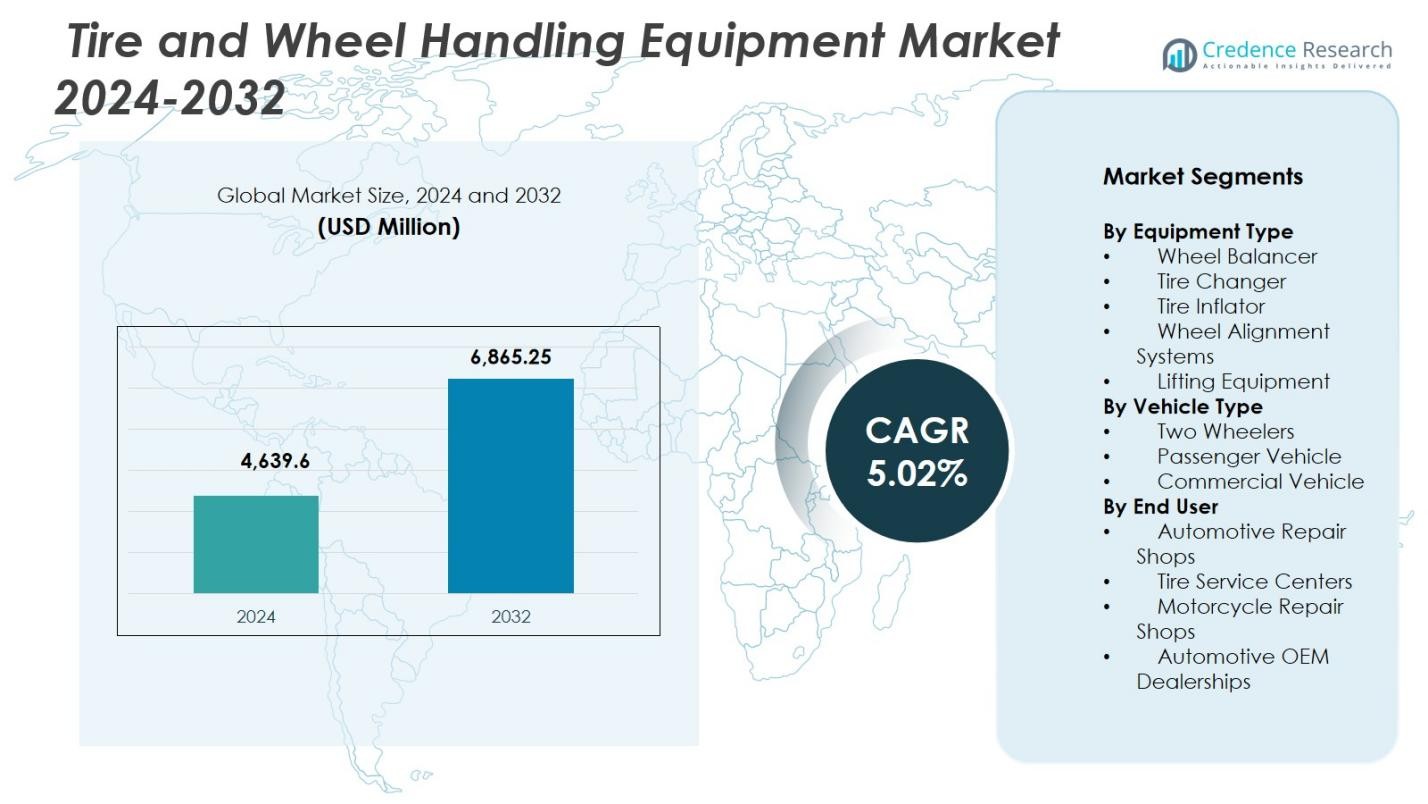

Tire and Wheel Handling Equipment Market size was valued at USD 4,639.6 million in 2024 and is anticipated to reach USD 6,865.25 million by 2032, at a CAGR of 5.02% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tire and Wheel Handling Equipment Market Size 2024 |

USD 4,639.6 Million |

| Tire and Wheel Handling Equipment Market, CAGR |

5.02% |

| Tire and Wheel Handling Equipment Market Size 2032 |

USD 6,865.25 Million |

Tire and Wheel Handling Equipment Market features leading players such as Hunter Engineering, Bosch Automotive Service Solutions, Corghi, Ravaglioli, Rotary Lift, Hofmann Megaplan, Coats, Snap-on, JLG Industries, and Camso, all driving advancements in alignment, balancing, lifting, and tire-changing technologies. These companies focus on automation, ADAS compatibility, and EV-ready equipment to meet rising service demands across modern workshops. Asia-Pacific led the global market in 2024 with 33.7% share, supported by expanding automotive production, high two-wheeler density, and rapid workshop modernization. North America and Europe followed, driven by strong service networks, regulatory standards, and high adoption of advanced wheel-handling systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tire and Wheel Handling Equipment Market was valued at USD 4,639.6 million in 2024 and is projected to grow at a CAGR of 5.02% through 2032.

- Rising vehicle parc and increased maintenance frequency drive demand for wheel alignment systems, which held the largest segment share of 32.4% in 2024 due to their essential role in precision and ADAS-related servicing.

- Digitalization, touchless alignment, IoT-enabled diagnostics, and EV-oriented workshop upgrades are key trends reshaping equipment adoption across global service centers.

- Major players such as Hunter Engineering, Bosch, Corghi, Ravaglioli, Rotary Lift, and Coats strengthen market position through automated, software-integrated, and high-efficiency equipment portfolios targeting modern workshops.

- Asia-Pacific led the market with 33.7% share in 2024, followed by North America at 31.2% and Europe at 29.8%, while Latin America and Middle East & Africa contributed smaller shares due to slower modernization and cost constraints.

Market Segmentation Analysis:

By Equipment Type

The Tire and Wheel Handling Equipment Market is dominated by wheel alignment systems, capturing 32.4% share in 2024 due to their essential role in ensuring precision, safety, and efficiency in modern workshops. Increasing vehicle parc, rising tire replacement frequency, and growing adoption of advanced ADAS-compatible alignment technologies strongly support this dominance. Tire changers follow, driven by the shift toward low-profile and high-performance tires that require specialized equipment. Demand for lifting equipment and wheel balancers is also increasing as service centers modernize operations and prioritize workflow automation and operator safety.

- For instance, John Bean’s Tru-Point ADAS calibration system verifies vehicle alignment and monitors each step of the setup process against OEM safety specifications before and after ADAS calibration, helping workshops ensure accurate thrust angles and sensor positioning.

By Vehicle Type

Passenger vehicles accounted for the largest share of the Tire and Wheel Handling Equipment Market, holding 56.8% share in 2024, supported by rising private vehicle ownership, frequent maintenance cycles, and the rapid expansion of urban mobility. Increased adoption of radial and performance tires further boosts equipment demand across alignment, balancing, and tire-changing systems. Commercial vehicles held a growing share due to fleet expansion and stricter regulations for tire safety and fuel efficiency. Two-wheelers continue to contribute steadily, driven by high vehicle density in emerging economies and increasing service requirements in motorcycle repair workshops.

- For instance, Coats Company’s CHD 6330 heavy duty tire changer uses hydraulic power to manage tubeless truck tires up to 63 inches in diameter and 30 inches wide, supporting fleet tire replacement with ergonomic pendant controls.

By End User

Automotive repair shops led the Tire and Wheel Handling Equipment Market with 41.6% share in 2024, driven by rising multi-brand workshop networks, higher vehicle service frequency, and the need for advanced alignment, balancing, and lifting solutions. Tire service centers follow closely as demand for precision tire-related services accelerates, supported by growth in electric and high-performance vehicles. Automotive OEM dealerships maintain a strong presence due to high investment in premium diagnostic tools and customer-centric service models. Motorcycle repair shops contribute consistently, supported by expanding two-wheeler service demand in densely populated markets.

Key Growth Drivers

Rising Vehicle Parc and Increased Maintenance Frequency

Global expansion of vehicle ownership, especially in urban and developing regions, is significantly driving demand for tire and wheel handling equipment. Higher annual mileage, frequent tire replacements, and growing awareness of preventive maintenance push service centers to adopt advanced alignment, balancing, and lifting systems. As passenger and commercial fleets expand, workshops require more efficient, accurate, and automated solutions to handle rising service volumes. This trend directly accelerates equipment investments, strengthening long-term market growth across OEM dealerships, repair shops, and tire service facilities.

- For instance, John Bean introduced the V3300 Wheel Alignment System, which combines fast imaging technology with intelligent software to guide technicians through alignments.

Shift Toward Advanced and Automated Workshop Technologies

Automotive service environments are rapidly transitioning toward automation to improve operational efficiency, reduce human error, and support modern vehicle technologies. ADAS-enabled vehicles, performance tires, and electric vehicle architectures require highly precise alignment, balancing, and diagnostic systems. This shift encourages service centers to replace outdated tools with digital, sensor-based, and software-integrated equipment. Automated lifting platforms, touchless alignment systems, and intelligent tire changers enhance throughput while ensuring consistent service quality. This technological evolution strongly elevates equipment demand and reinforces modernization across tire service infrastructure.

- For instance, Robert Bosch GmbH provides the ADAS One Solution software with DAS 3000 equipment for guided, vehicle-specific calibrations of radar, lidar, and camera sensors. It halves setup time compared to manual methods and generates compliance reports for OEM standards.

Stringent Safety and Efficiency Regulations

Regulatory emphasis on vehicle safety, tire performance, and fuel efficiency is compelling workshops to adopt compliant, technically advanced tire-handling solutions. Mandatory alignment checks, tire pressure monitoring standards, and safety inspections increase the adoption of calibrated inflators, alignment systems, and wheel balancers. Fleet operators, in particular, face stricter compliance obligations for minimizing downtime and ensuring roadworthiness, driving higher investments in precision equipment. These regulatory pressures not only expand the replacement cycle for older machinery but also accelerate new equipment adoption, ensuring sustained market growth.

Key Trends & Opportunities

Integration of Digital, Connected, and Smart Workshop Solutions

A growing trend in the Tire and Wheel Handling Equipment Market is the integration of connected technologies, including IoT-enabled sensors, cloud-based diagnostics, and real-time equipment monitoring. These smart systems offer predictive maintenance, automated calibration, and enhanced accuracy, enabling service centers to optimize workflow and reduce downtime. Touchless wheel alignment, digital measurement tools, and AI-driven balancing systems are rapidly emerging as value-added solutions. This digital transformation presents major opportunities for manufacturers to differentiate through software-driven features and long-term service contracts.

- For instance, Hofmann’s geoliner 609 imaging wheel aligner is tablet‑controlled and cloud‑connected, combining advanced imaging software with smart notification functions that flag issues such as suspension stress and environmental errors to streamline alignment flow in compact workshops.

Expansion of EV-Oriented Tire and Wheel Service Solutions

The accelerating transition to electric vehicles opens a strong opportunity for specialized tire-handling equipment. EVs require precise wheel alignment, advanced lifting systems suited for heavy battery packs, and specialized tire changers capable of handling high-torque wheels. Service centers upgrading to EV-certified infrastructure increasingly invest in premium and automated systems to meet OEM standards. As global EV adoption grows, the need for EV-specific workshop equipment becomes a major opportunity for manufacturers to develop tailored tools, training modules, and integrated service platforms.

- For instance, INDEVA’s Liftronic Easy manipulator handles tire rims with instant load weight detection via its automatic balancing system, enabling ergonomic movement across varying wheel weights in automotive assembly.

Key Challenges

High Initial Investment and Maintenance Costs

The high upfront cost of automated alignment systems, advanced balancers, and hydraulic or electronic lifting equipment remains a significant barrier for small and independent workshops. These systems also require routine calibration, software updates, and trained operators, adding to long-term ownership expenses. Budget constraints often delay modernization, limiting equipment adoption in cost-sensitive markets. This challenge particularly affects emerging economies where service centers prioritize affordable solutions, potentially slowing the penetration of advanced technologies across the broader aftermarket ecosystem.

Skill Gaps and Limited Technical Expertise in Workshops

The increasing sophistication of tire-handling and alignment equipment demands skilled technicians capable of operating digital, software-driven, and automated systems. Many workshops face shortages of trained personnel, resulting in underutilization of advanced tools and inconsistent service quality. Lack of structured training programs, especially in developing markets, further widens the skills gap. As vehicles integrate ADAS, complex suspension systems, and EV platforms, the need for specialized technician expertise intensifies making workforce capability a critical challenge for market-wide technology adoption and operational efficiency.

Regional Analysis

North America

North America held 31.2% share of the Tire and Wheel Handling Equipment Market in 2024, driven by a well-established automotive service infrastructure, high vehicle ownership, and strong adoption of advanced workshop technologies. The region benefits from widespread use of automated alignment systems, premium lifting solutions, and ADAS-compatible diagnostic tools across dealership networks and independent repair shops. Growing EV penetration in the U.S. and Canada further stimulates demand for specialized tire-handling systems suited for heavier battery platforms. Continuous investment in service modernization and strict vehicle safety regulations reinforce the region’s leadership position.

Europe

Europe accounted for 29.8% share of the Tire and Wheel Handling Equipment Market in 2024, supported by stringent regulatory standards for vehicle safety, emissions, and tire performance. The region’s dense network of OEM-authorized workshops and the strong presence of premium vehicle manufacturers drive adoption of advanced alignment and balancing solutions. Growing winter tire replacement cycles and high adoption of performance tires further boost equipment demand. Rising EV sales in Germany, the UK, and Nordic countries accelerate investment in specialized lifting systems and EV-compatible tire-changing technologies, strengthening the region’s focus on precision and automation.

Asia-Pacific

Asia-Pacific dominated with 33.7% share in 2024, emerging as the fastest-growing region due to expanding automotive production, increasing vehicle parc, and rapid urbanization. High two-wheeler density, especially in India and Southeast Asia, fuels demand for specialized motorcycle repair equipment. China’s large aftermarket ecosystem and acceleration of EV adoption drive investments in automated balancing, alignment, and lifting tools. Growing multi-brand workshop chains and rising awareness of preventive maintenance further enhance equipment penetration. Government regulations promoting vehicle safety inspections and periodic servicing contribute to the region’s strong market scaling and technological modernization.

Latin America

Latin America captured 3.6% share in 2024, driven by a gradual expansion of automotive repair networks and steady growth in passenger and commercial vehicle fleets. Brazil and Mexico lead regional demand as service centers invest in modern tire-changing and wheel-balancing equipment to improve operational efficiency. Rising emphasis on road safety standards and increasing adoption of mid-range and premium workshop tools support market progression. However, budget constraints among smaller repair shops and economic fluctuations slow large-scale modernization. Growing aftermarket consolidation presents opportunities for equipment suppliers targeting professionalized service environments.

Middle East & Africa

Middle East & Africa held 1.7% share of the market in 2024, supported by expanding vehicle ownership, rising commercial fleets, and growth in organized service centers across Gulf countries and South Africa. Investment in high-end workshop infrastructure, particularly in the UAE and Saudi Arabia, drives demand for advanced lifting systems and alignment solutions. Increasing adoption of premium passenger cars and SUVs further supports specialized tire-handling equipment usage. Despite promising growth potential, limited technical expertise and uneven service ecosystem development in several African markets constrain rapid equipment penetration.

Market Segmentations:

By Equipment Type

- Wheel Balancer

- Tire Changer

- Tire Inflator

- Wheel Alignment Systems

- Lifting Equipment

By Vehicle Type

- Two Wheelers

- Passenger Vehicle

- Commercial Vehicle

By End User

- Automotive Repair Shops

- Tire Service Centers

- Motorcycle Repair Shops

- Automotive OEM Dealerships

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Tire and Wheel Handling Equipment Market is defined by the presence of major players such as Hunter Engineering, Bosch Automotive Service Solutions, Corghi, Ravaglioli, Rotary Lift, Hofmann Megaplan, Coats, Snap-on, JLG Industries, and Camso, all of which collectively shape innovation, pricing, and global distribution strategies. These companies focus on expanding automated and ADAS-compatible solutions to meet the rising demand for precision wheel alignment, balancing, and lifting systems across modern service centers. Manufacturers increasingly invest in software-integrated platforms, touchless alignment technologies, and EV-ready equipment to strengthen their product portfolios and address evolving workshop requirements. Strategic partnerships with OEM dealerships, expansion into high-growth markets in Asia-Pacific, and enhanced after-sales service capabilities further reinforce their competitive positioning. Continuous R&D investment, strong dealer networks, and emphasis on workflow automation enable leading companies to differentiate in a market driven by regulatory compliance, technology upgrades, and increasing aftermarket service volumes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hunter Engineering Company

- Bosch Automotive Service Solutions

- Corghi S.p.A.

- Ravaglioli S.p.A.

- Rotary Lift

- Hofmann Megaplan

- Coats (Fortive)

- Snap-on Incorporated

- JLG Industries, Inc.

- Camso Inc.

Recent Developments

- In November 2025, Hunter Engineering released updated 2026 alignment and ADAS coverage, adding nearly 3,000 new vehicle records to its calibration database.

- In December 2025, Fastco Canada (a subsidiary of Groupe Touchette) announced the acquisition of the ENVY Wheel Brand, strengthening its portfolio in wheels and aftermarket services.

Report Coverage

The research report offers an in-depth analysis based on Equipment Type, Vehicle Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as vehicle ownership rises and service frequency increases across all regions.

- Adoption of automated and digital workshop equipment will accelerate as service centers modernize operations.

- EV expansion will drive demand for specialized lifting, alignment, and tire-handling systems designed for heavier vehicle platforms.

- ADAS-equipped vehicles will push workshops to invest in advanced, high-precision wheel alignment technologies.

- Organized multi-brand service networks will expand rapidly, increasing equipment standardization and automation.

- Manufacturers will integrate IoT, AI, and cloud analytics into equipment to enable predictive maintenance and real-time diagnostics.

- Increasing regulatory pressure on vehicle safety and inspection standards will boost demand for certified and calibrated tools.

- Growth in fleet management and logistics sectors will enhance adoption of high-capacity and efficiency-driven handling systems.

- Replacement demand for outdated mechanical equipment will strengthen as workshops shift toward digital and touchless solutions.

- Emerging markets will offer strong expansion opportunities driven by urbanization and rising investments in modern service infrastructure.