Market Overview

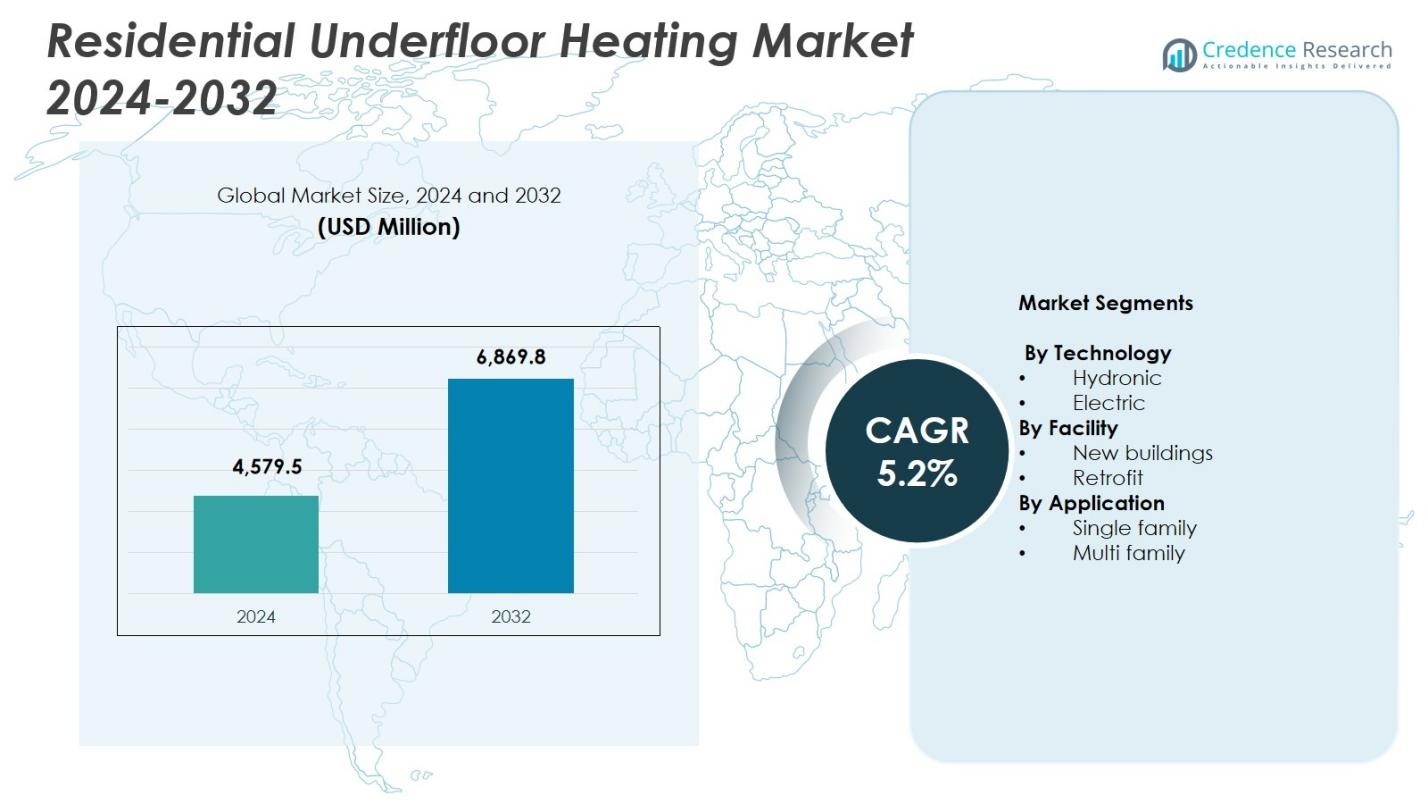

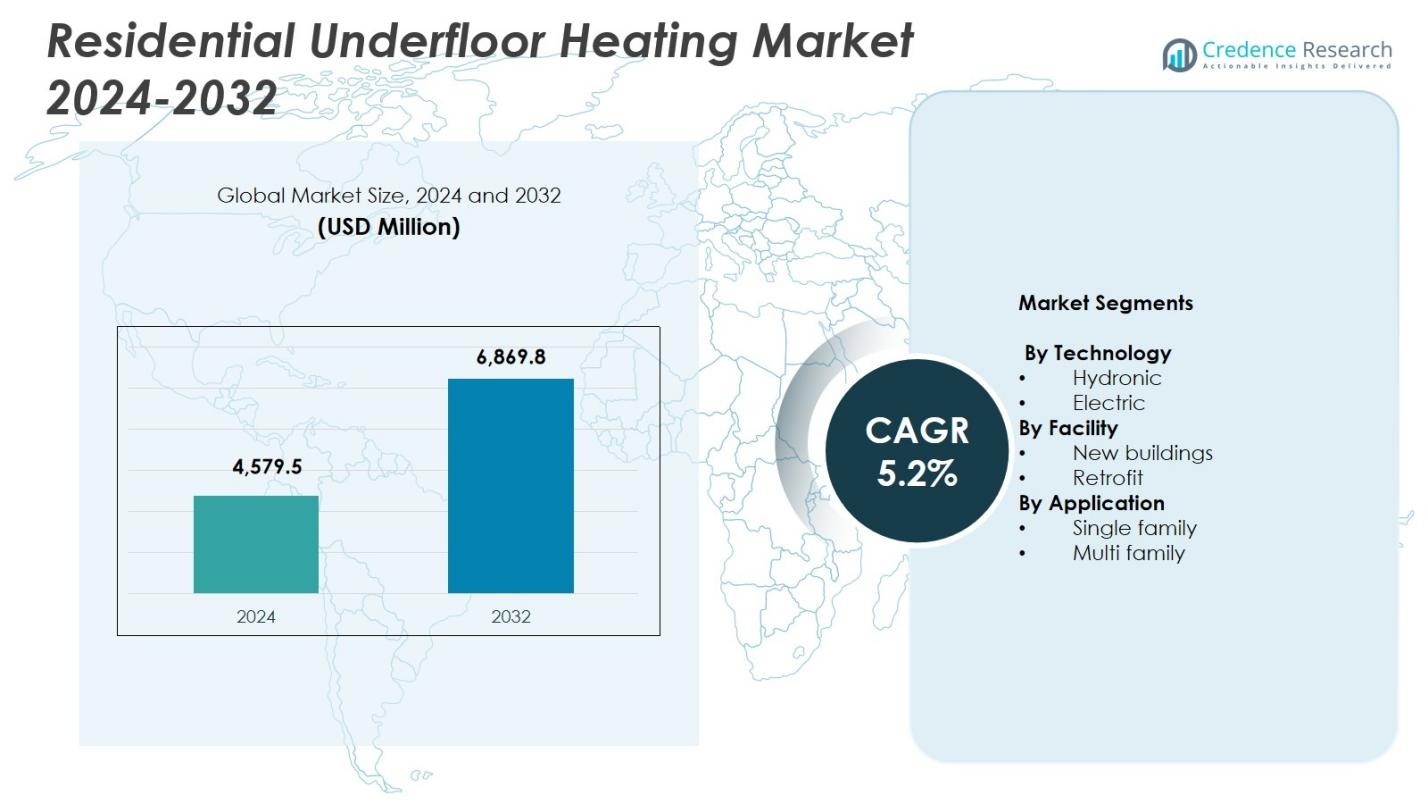

Residential Underfloor Heating Market size was valued at USD 4,579.5 Million in 2024 and is anticipated to reach USD 6,869.8 Million by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Underfloor Heating Market Size 2024 |

USD 4,579.5 Million |

| Residential Underfloor Heating Market, CAGR |

5.2% |

| Residential Underfloor Heating Market Size 2032 |

USD 6,869.8 Million |

Residential Underfloor Heating Market is shaped by leading players such as Amuheat, Asiastar, Danfoss, Devex Systems, Elektra, Heat Mat, Hemstedt, Hurlcon Hydronic Heating, Magnum Heating, and Mysa Smart Thermostats, all of which continue to expand product innovation and smart heating integration. These companies focus on energy-efficient hydronic and electric systems, advanced digital controls, and installation-friendly designs to meet rising residential demand. Europe dominated the market in 2024 with 42.3% market share, supported by stringent energy-efficiency standards, high renewable heating adoption, and strong construction activity across key countries including Germany, the U.K., and the Nordic region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Residential Underfloor Heating Market reached USD 4,579.5 Million in 2024 and will grow at a CAGR of 5.2% through 2032.

- Market growth is driven by rising demand for energy-efficient heating, strong adoption of hydronic systems holding 58.4% share, and increasing new-build installations accounting for 63.7% share.

- Key trends include adoption of smart thermostats, IoT-enabled controls, and rising installation of eco-efficient radiant systems aligned with sustainability goals.

- Leading players such as Amuheat, Danfoss, Heat Mat, Magnum Heating, and Mysa Smart Thermostats focus on advanced heating technologies, renewable-ready systems, and expanded distribution networks.

- Europe leads with 42.3% share, followed by North America at 27.6% and Asia-Pacific at 19.4%, driven by strong construction activity and expanding demand for comfort-focused and energy-saving heating solutions.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Technology:

The Residential Underfloor Heating Market is segmented into Hydronic and Electric systems, with the Hydronic segment dominating in 2024 by holding 58.4% market share. Its leadership is driven by high energy efficiency, lower long-term operating costs, and strong adoption in regions with colder climates. Hydronic systems offer uniform heat distribution and compatibility with renewable energy sources such as heat pumps, which accelerates their deployment in modern residential projects. Increasing regulations promoting energy-efficient home heating solutions and growing demand for sustainable temperature control further reinforce the dominance of hydronic underfloor heating systems.

- For instance, Danfoss Icon™ controls manage hydronic underfloor heating via thermal actuators and room thermostats, enabling demand-based supply temperatures that save approximately 5% energy per degree lowered without sacrificing comfort.

By Facility:

Within the facility segment, New Buildings accounted for 63.7% market share in 2024, emerging as the dominant category in the Residential Underfloor Heating Market. The segment benefits from rising construction of energy-efficient homes, integration of smart heating infrastructure, and supportive building codes mandating low-emission heating systems. Developers increasingly prefer underfloor solutions for their space-saving design, enhanced comfort, and compatibility with modern insulation standards. New residential projects also enable easier installation of hydronic systems compared to retrofit applications, driving higher adoption and reinforcing the segment’s leading position.

- For instance, Danfoss DEVI electric underfloor heating supports near-zero energy housing complexes, enabling lighter floor construction with no annual maintenance unlike hydronic systems, ideal for well-insulated new builds paired with photovoltaics.

By Application:

The Application segment of the Residential Underfloor Heating Market is led by Single-family homes, which captured 67.1% market share in 2024. This dominance stems from strong consumer preference for premium comfort, improved indoor air quality, and energy-efficient heating in standalone residential units. Growing investments in home renovation, rising disposable incomes, and expanding adoption of smart thermostats further elevate demand within this category. Single-family homes also allow more flexibility in integrating underfloor systems during construction or upgrades, making them the preferred environment for both hydronic and electric underfloor heating installations.

Key Growth Drivers

Rising Adoption of Energy-Efficient Home Heating

The Residential Underfloor Heating Market is experiencing strong growth as homeowners increasingly prefer energy-efficient heating systems that reduce utility costs and carbon emissions. Underfloor heating delivers consistent heat distribution at lower operating temperatures, improving overall efficiency compared to traditional radiators. Governments worldwide are implementing stricter building energy codes and offering incentives for low-emission heating technologies, further accelerating adoption. The integration of renewable energy sources, such as heat pumps, with hydronic underfloor systems strengthens the market’s momentum, driven by the shift toward sustainable residential infrastructure.

- For instance, Warmup’s smart underfloor heating systems operate at around 29°C to achieve comfort levels that traditional systems require at 60–70°C water temperatures.

Expansion of New Residential Construction

Growth in new housing development significantly drives the Residential Underfloor Heating Market, as modern building designs allow seamless integration of hydronic and electric systems. Builders increasingly select underfloor heating to enhance property value, improve space utilization by eliminating radiators, and comply with evolving construction standards. Energy-efficient and smart-home-ready heating infrastructure is becoming a priority for developers and homeowners alike. Rising urbanization, increased demand for premium housing, and government-backed green building initiatives continue to bolster installations in new residential projects, strengthening long-term market demand.

- For instance, Nu-Heat’s LoPro®Max system was installed in architect Dan Rowland’s multi-story carbon-neutral new build in Chichester, delivering rapid heat-up times comparable to radiators while integrating with heat pumps for optimal performance in sustainable designs.

Increasing Consumer Preference for Comfort and Smart Home Integration

Consumers are prioritizing elevated comfort and advanced climate control solutions, driving demand for underfloor heating in residential spaces. The market benefits from growing adoption of smart thermostats, remote-controlled heating systems, and zoned temperature management, which enhance convenience and energy savings. The silent operation, improved indoor air quality, and uniform warmth delivered by underfloor systems make them highly attractive for modern living environments. As smart-home penetration expands across regions, integration of intelligent heating controls further accelerates uptake, positioning underfloor heating as a preferred premium home heating solution.

Key Trends & Opportunities

Growing Penetration of Smart Heating and IoT Integration

A major trend reshaping the Residential Underfloor Heating Market is the increasing use of IoT-enabled devices and intelligent heating solutions. Smart thermostats, occupancy sensors, and energy-monitoring platforms optimize performance by adjusting temperature based on user habits, weather conditions, and room usage patterns. These systems reduce energy consumption and enhance user experience, driving wider adoption in both new and retrofit projects. As consumer interest in connected homes strengthens, manufacturers have opportunities to develop advanced control interfaces, AI-driven automation tools, and seamless multi-zone management technologies.

- For instance, Danfoss’s ECtemp™ Smart thermostat connects via Wi-Fi to the ECtemp™ Smart App, enabling remote control of electrical underfloor heating from anywhere. It features adaptive PWM regulation and supports up to 10 mobile devices per unit, with open window detection to cut unnecessary heating.

Rising Demand for Sustainable and Low-Carbon Heating Solutions

The transition toward environmentally conscious construction and low-carbon heating technologies presents significant opportunities for market expansion. Underfloor heating aligns with global sustainability goals by supporting low-temperature heating and pairing effectively with renewable energy systems, including solar thermal and geothermal heat pumps. Growing awareness of indoor environmental quality and rising demand for systems that reduce reliance on fossil fuels are accelerating investments in eco-friendly heating technologies. Manufacturers offering recyclable materials, energy-efficient system components, and green installation methods are positioned to capture greater market share.

- For instance, Resideo Technologies’ HCC100 multi-zone controller manages up to eight zones for underfloor heating and cooling, integrating with renewable sources like heat pumps to meet tightened energy efficiency standards aimed at reducing CO2 emissions.

Key Challenges

High Initial Installation Costs

One of the major challenges restraining the Residential Underfloor Heating Market is the high upfront cost compared to traditional heating systems. Expenses related to subfloor preparation, insulation, system components, and professional installation can limit adoption, especially in cost-sensitive regions. While long-term energy savings offset some of the investment, many homeowners remain hesitant due to the substantial initial outlay. The challenge is more pronounced in retrofit applications, where structural modifications increase installation complexity. Market growth will depend on cost reductions, improved materials, and streamlined installation processes.

Installation Complexity in Retrofit Projects

Retrofit installations pose a significant challenge due to structural constraints, floor height adjustments, and the need for specialized labor. Older homes often require extensive subfloor modifications to accommodate hydronic or electric heating systems, increasing installation time and cost. These technical complications limit adoption in renovation projects despite growing consumer interest. Ensuring compatibility with existing flooring, plumbing, and electrical systems adds further difficulty. Manufacturers and installers must innovate low-profile systems and simplified retrofit solutions to address these barriers and expand market penetration in older residential properties.

Regional Analysis

North America

North America accounted for 27.6% market share in 2024, driven by growing adoption of energy-efficient heating solutions and rising demand for premium residential comfort systems. The region benefits from widespread integration of smart thermostats, strong renovation activity, and increasing preference for radiant heating in colder states such as Canada and the northern U.S. Supportive energy regulations and incentives for low-emission home heating further strengthen market growth. Expanding construction of single-family homes, coupled with rising awareness of indoor air quality and uniform heating benefits, continues to enhance the deployment of underfloor heating systems across the region.

Europe

Europe dominated the Residential Underfloor Heating Market with 42.3% market share in 2024, supported by stringent energy-efficiency regulations, high adoption of hydronic heating systems, and strong penetration of renewable-energy-integrated home heating technologies. Countries such as Germany, the U.K., the Netherlands, and the Nordic region lead installation volumes due to cold climatic conditions and well-developed green building standards. Government initiatives promoting low-carbon and sustainable residential infrastructure further boost adoption. Rising consumer preference for enhanced home comfort and increasing construction of modern, smart-home-ready dwellings reinforce Europe’s position as the leading regional market.

Asia-Pacific

Asia-Pacific held 19.4% market share in 2024, driven by rapid urbanization, expanding middle-class housing, and increasing investment in premium residential infrastructure across China, Japan, South Korea, and Australia. Growing awareness of energy-efficient heating technologies and rising adoption of electric underfloor systems in high-rise developments contribute to market momentum. Government emphasis on sustainable construction and green building certifications further supports regional uptake. As smart home adoption accelerates and construction activities expand, Asia-Pacific is emerging as a high-growth region, with rising demand for underfloor heating in both new residential projects and selective retrofit applications.

Latin America

Latin America captured 5.8% market share in 2024, influenced by increasing adoption of energy-efficient home heating systems in countries with cooler climates such as Chile, Argentina, and southern Brazil. Growing consumer interest in premium home comfort solutions and improving economic conditions drive gradual market expansion. Urban development and rising construction of modern residential buildings support increased installation of electric underfloor systems, which are easier to integrate in urban housing layouts. Although market growth is moderate compared to other regions, expanding awareness of efficient heating technologies and strengthening real estate development offer new opportunities.

Middle East & Africa

The Middle East & Africa region accounted for 4.9% market share in 2024, with demand primarily driven by premium residential developments in the UAE, Saudi Arabia, and South Africa. While overall heating requirements are lower due to warmer climates, underfloor heating is increasingly adopted in luxury villas, smart homes, and high-end apartment projects for comfort and aesthetic appeal. Improved construction activity, rising expatriate housing investments, and growing emphasis on smart building technologies support market growth. Manufacturers offering energy-efficient, low-temperature systems are gaining traction as residential infrastructure modernizes across select urban centers in the region.

Market Segmentations:

By Technology

By Facility

By Application

- Single family

- Multi family

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Residential Underfloor Heating Market features leading players such as Amuheat, Asiastar, Danfoss, Devex Systems, Elektra, Heat Mat, Hemstedt, Hurlcon Hydronic Heating, Magnum Heating, and Mysa Smart Thermostats. The market is characterized by strong product innovation, expanding smart heating integration, and continuous advancements in hydronic and electric system technologies. Companies are focusing on developing energy-efficient, low-profile heating solutions that support modern construction requirements and retrofit compatibility. Strategic partnerships with homebuilders, HVAC contractors, and smart-home ecosystem providers are strengthening market presence. Manufacturers are also investing in digital thermostats, IoT-enabled controls, and zoned heating technologies to enhance performance and user convenience. Growing emphasis on sustainability and renewable-energy-ready heating systems is driving firms to introduce eco-efficient materials and optimized installation methods. Furthermore, key players are expanding geographically through distribution networks, product line diversification, and targeted marketing aimed at premium residential segments.

Key Player Analysis

- Heat Mat

- Amuheat

- Danfoss

- Magnum Heating

- Mysa Smart Thermostats

- Asiastar

- Devex Systems

- Hemstedt

- Elektra

- Hurlcon Hydronic Heating

Recent Developments

- In March 2025, Danfoss showcased its new Danfoss Icon2™ hydronic floor heating solution at ISH 2025, offering flexible thermostat control and easy installation.

- In April 2025, Purmo Group acquired UFHN Ltd., expanding its portfolio of electric and hydronic underfloor heating systems for residential applications.

- In October 2025, Warmup launched the 7iE Smart Matter Wi-Fi Thermostat the first underfloor heating controller compatible with the Matter smart-home standard.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Technology, Facility, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Residential Underfloor Heating Market will grow steadily as homeowners prioritize energy-efficient and low-carbon heating solutions.

- Adoption of hydronic systems will rise due to strong compatibility with heat pumps and renewable energy sources.

- Smart thermostats and IoT-enabled heating controls will increasingly shape system design and user experience.

- New residential construction will continue to drive substantial installation volumes across major regions.

- Retrofit-friendly, low-profile underfloor heating solutions will gain momentum in older housing markets.

- Sustainable building regulations will accelerate demand for radiant heating technologies.

- Manufacturers will expand investment in eco-efficient materials and advanced installation methods.

- Electric underfloor heating will see growing adoption in high-rise and urban residential projects.

- Luxury housing developments will remain strong adopters of smart radiant heating systems.

- Global market expansion will benefit from rising consumer preference for enhanced comfort and indoor air quality.

Market Segmentation Analysis:

Market Segmentation Analysis: