Market Overview

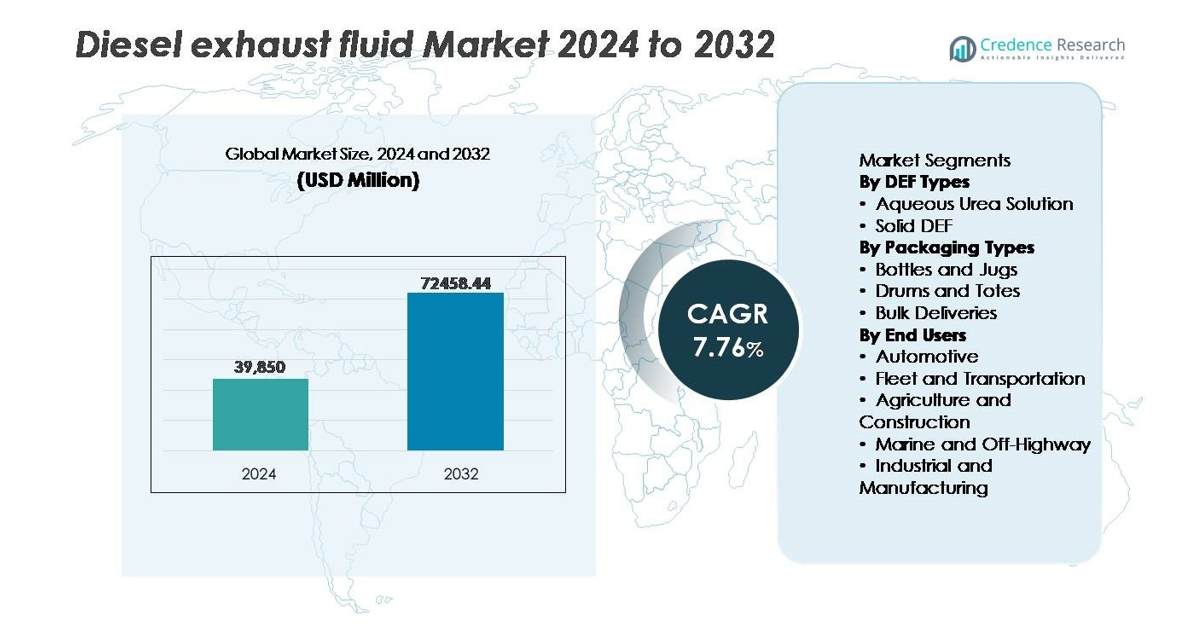

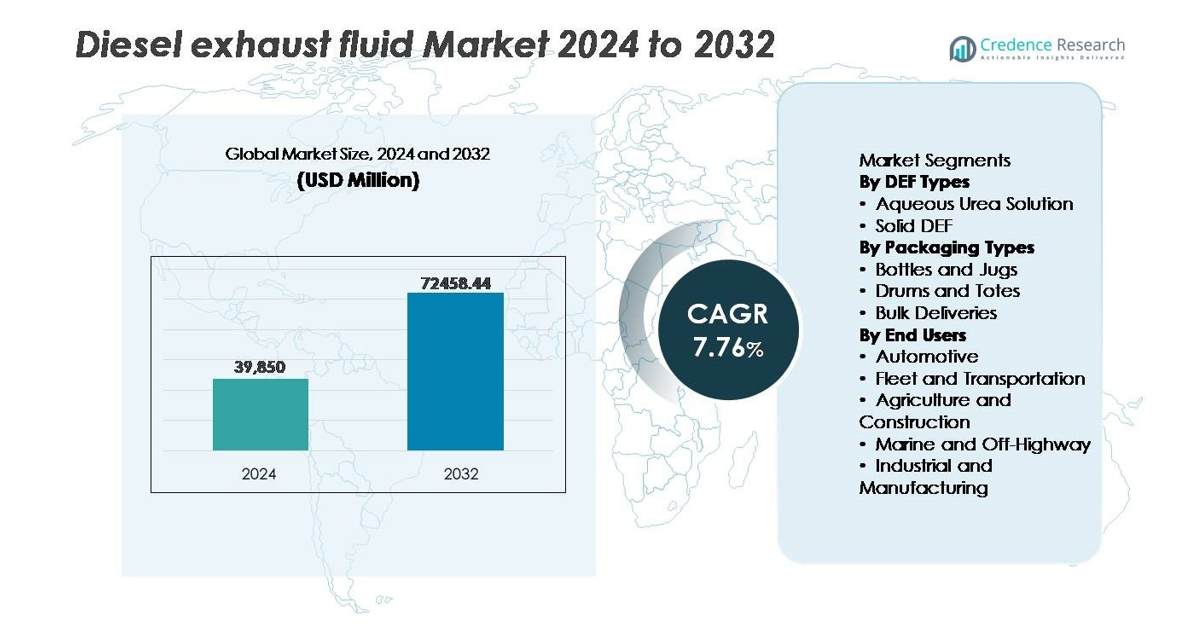

The global Diesel Exhaust Fluid (DEF) market was valued at USD 39,850 million in 2024 and is projected to reach USD 72,458.44 million by 2032, expanding at a CAGR of 7.76% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Diesel Exhaust Fluid Market Size 2024 |

USD 39,850 million |

| Diesel Exhaust Fluid Market, CAGR |

7.76% |

| Diesel Exhaust Fluid Market Size 2032 |

USD 72,458.44 million |

The Diesel Exhaust Fluid market is shaped by a competitive group of established producers and distribution-focused specialists, including Blue Sky Diesel Exhaust Fluid, CF Industries Holdings, Inc., Old World Industries, LLC, Yara International ASA, Certified DEF, Cummins Filtration, The Potash Corporation of Saskatchewan, STOCKMEIER Group, Dyno Nobel, and KOST USA, Inc. These companies focus on supply chain resilience, high-purity DEF formulations, and expanding bulk delivery networks to serve large fleet operators and industrial users. North America leads the global market with an estimated 30–35% share, driven by widespread adoption of SCR-equipped vehicles, strong regulatory enforcement, and extensive at-pump retail and bulk dispensing infrastructure.

Market Insights

- The global Diesel Exhaust Fluid market was valued at USD 39,850 million in 2024 and is expected to reach USD 72,458.44 million by 2032, growing at a CAGR of 7.76% during the forecast period.

- Growth is driven by stringent emission regulations, particularly for NOx reduction, and the rising adoption of SCR-equipped diesel vehicles across commercial transportation and industrial machinery segments.

- Key market trends include the rapid expansion of bulk DEF delivery models, increasing adoption of high-purity ISO-compliant DEF solutions, and growing demand from off-highway, marine, and construction equipment applications.

- The competitive landscape features global chemical producers and DEF specialists focusing on capacity expansion, digital monitoring, and distribution partnerships; however, price volatility in urea and alternatives such as electric mobility pose restraints.

- Regionally, North America leads with 30–35% share, followed by Europe at 25–30% and Asia Pacific at 20–25%, while aqueous urea solution accounts for the dominant segment share among DEF types.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By DEF Types (Aqueous Urea Solution, Solid DEF)

The Diesel Exhaust Fluid market is primarily driven by the dominance of aqueous urea solution, which holds the largest market share due to its compatibility with SCR-equipped commercial vehicles and broad regulatory acceptance for Euro VI and EPA Tier 4 engines. Its cost efficiency, easy availability, and proven performance in NOx reduction support widespread adoption. Solid DEF remains a niche option, gaining preliminary interest in extreme-climate operations and remote logistics applications; however, its higher conversion system cost limits mainstream deployment compared to established liquid formulations.

- For instance, Yara International operates one of the world’s largest ammonia and urea production hubs in Pilbara, Western Australia, producing approximately 850,000 tonnes of ammonia annually, enabling scalable global supply for aqueous DEF manufacturing.

By Packaging Types (Bottles and Jugs, Drums and Totes, Bulk Deliveries)

Within packaging, bulk deliveries account for the dominant share, primarily driven by large fleet operators, highway logistics hubs, and industrial customers that consume DEF at high volumes and require continuous supply efficiency. Centralized storage solutions, automated dispensing, and reduced per-liter handling costs reinforce adoption. Drums and totes serve mid-scale users such as construction sites or seasonal agricultural operations, while bottles and jugs remain relevant in retail and aftermarket channels. However, growing fleet consolidation and refueling infrastructure expansion continue to accelerate the transition toward bulk DEF procurement.

- For instance, Old World Industries expanded its BlueDEF® bulk distribution capabilities by deploying storage and dispensing infrastructure supporting fleet customers at more than 4,500 locations across North America, including large-capacity tanks compatible with high-throughput commercial fueling stations.

By End Users (Automotive, Fleet and Transportation, Agriculture and Construction, Marine and Off-Highway, Industrial and Manufacturing)

The fleet and transportation segment leads the DEF market, supported by the expanding population of SCR-equipped heavy-duty trucks and long-haul freight carriers subject to stringent NOx emission norms. Continuous vehicle utilization and high DEF burn rates drive recurring demand. Agriculture and construction follow, influenced by compliance requirements for off-road machinery and engine upgrades. Marine, industrial, and manufacturing segments show gradual adoption as emission standards extend beyond on-road vehicles. The shift toward logistics electrification remains gradual, preserving near-term reliance on DEF-enabled diesel fleets.

Key Growth Drivers

Stringent Emission Standards for NOx Reduction

Stringent environmental regulations targeting nitrogen oxide emissions stand as the most influential driver for Diesel Exhaust Fluid adoption across commercial, industrial, marine, and off-highway equipment. Global emission frameworks, including Euro VI, EPA Tier 4, China VI, and Bharat Stage VI, mandate selective catalytic reduction integration in diesel vehicles, compelling consistent DEF consumption. Government-imposed compliance monitoring, higher penalties for non-adherence, and mandatory onboard diagnostics significantly accelerate market penetration. In addition, national policies promoting low-emission freight mobility and green industrial operations push OEMs to standardize SCR-compatible engines, increasing DEF demand across vehicle fleets and stationary engines. As regulatory enforcement intensifies and expands across developing economies, the fluid’s role transitions from compliance-based procurement to operational necessity, securing long-term revenue visibility for DEF suppliers and distributors worldwide.

- For instance, Cummins demonstrated that its SCR technology can achieve up to 90% NOx reduction and improve fuel efficiency by reducing exhaust gas recirculation load, with system optimization validated across engine platforms exceeding 400 horsepower in heavy-duty applications.

Expansion of Fleet Operations and Long-Haul Transportation

Growth in commercial freight movement, e-commerce logistics networks, highway distribution, and industrial supply chains substantially elevates DEF consumption. High-mileage vehicles utilize DEF at predictable burn rates proportional to operational hours and engine performance, making fleet operators consistent, bulk-volume buyers. The increasing registration of light commercial vans for last-mile deliveries and heavy-duty trucks for cross-border transportation strengthens recurring demand. Investments in public and private fleet modernization programs, combined with government incentives supporting fuel-efficient diesel assets in emerging markets, further support market expansion. Fleet telematics and fluid monitoring technologies improve inventory management and reduce wastage, enabling suppliers to adopt automated bulk replenishment models, strengthening supply continuity. These dynamics collectively position long-haul freight fleets as the fastest-expanding user group in the DEF landscape.

- For instance, UPS operates a fleet of more than 125,000 vehicles, including over 13,000 heavy-duty trucks equipped with diesel SCR technology, consuming DEF consistently across long-haul service routes covering more than 3.4 billion miles annually.

Infrastructure Development in DEF Retailing and Bulk Distribution

The rapid development of retail DEF dispensing infrastructure at fuel stations, service centers, and highway corridors increases end-user accessibility and supports consumption acceleration. Bulk storage solutions integrated with metered refilling systems benefit large vehicle depots, construction hubs, and agricultural sites, reducing per-liter cost and enhancing operational reliability. Partnerships between fuel retailers, lubricant suppliers, and DEF distributors enable network scale-up and long-term contract models. Furthermore, smart dispensing systems with digital tracking, order automation, and fleet billing integration create transparency in consumption patterns and simplify procurement authorization. As more markets transition from packaged DEF to bulk supply, economies of scale improve, margins strengthen, and suppliers gain leverage to service high-volume industrial and transportation clients.

Key Trends & Opportunities

Increasing Adoption of High-Purity DEF and Quality Monitoring Technologies

Emerging opportunities stem from the rising importance of high-purity DEF formulation aligned with ISO 22241 standards required to protect SCR systems from catalyst degradation. Fleet operators are adopting onboard quality sensors, IoT fluid monitoring, and handheld testing devices to prevent contamination-related warranty disputes. The trend also opens opportunities for premium-grade DEF, filtration solutions, and storage contamination prevention systems. Suppliers offering certified, tightly controlled manufacturing and logistics processes gain differentiation and pricing power, particularly when servicing mission-critical fleets and heavy-equipment users. Technology integration further supports predictive maintenance and streamlines procurement cycles, positioning quality assurance as a revenue-enhancing opportunity.

- For instance, Bosch’s DEF and NOx monitoring technology utilizes an onboard NOx sensor capable of measuring emissions in real time at exhaust temperatures up to 850°C, enabling precise SCR dosing and reducing DEF overconsumption, while supporting compliance across heavy-duty engine platforms.

Growth of DEF in Off-Highway, Marine, and Industrial Engines

As emission norms extend to non-road diesel engines, new opportunities arise in segments historically less regulated marine vessels, construction machinery, agricultural tractors, mining equipment, and industrial generators. Increasing replacement of legacy engines with SCR-enabled systems and growth of remote power generation markets support new DEF demand patterns. Port authorities, mining operators, and industrial parks are transitioning toward cleaner operations to meet environmental reporting and ESG commitments. The diffusion of DEF beyond the automotive domain diversifies revenue streams for manufacturers and opens regional distribution opportunities in remote project-based locations, where bulk delivery and portable dispensing infrastructure present incremental business potential.

- For instance, Wärtsilä’s marine SCR system enables NOx reduction of up to 90% and is compatible with engines ranging from 1,200 kW to over 20,000 kW, allowing ocean-going vessels to meet IMO Tier III compliance in emission control areas.

Key Challenges

Volatility in Urea Prices and Supply Chain Dependencies

The DEF market faces notable challenges due to fluctuations in urea pricing, driven by fertilizer demand, natural gas cost volatility, and geopolitical disruptions affecting ammonia and urea exports. Sudden supply constraints increase manufacturing costs and reduce distributor margins, especially in fixed-contract agreements. Import-dependent markets remain highly exposed to shipping delays and currency fluctuations, creating procurement uncertainty for fleet operators. Supply disruptions risk forcing users toward unauthorized or diluted DEF alternatives, which can damage SCR systems, void warranties, and elevate emissions. Managing cost stability while ensuring product availability is a persistent challenge for industry stakeholders.

Growth of Electric and Alternative-Fuel Transportation

The long-term expansion of battery-electric vehicles, hydrogen fuel-cell fleets, and natural gas-powered engines represents a structural challenge for DEF demand. Although diesel power remains dominant in heavy-load and long-distance freight applications, policy-driven electrification programs and subsidies could reduce diesel engine sales over time. Municipal bus fleets, urban delivery vehicles, and port handling equipment are transitioning toward zero-emission platforms at increasing rates. While full replacement remains gradual, technological advancement and declining battery cost curves pose a future competitive threat, compelling DEF stakeholders to diversify service portfolios and strengthen non-automotive supply channels.

Regional Analysis

North America

North America remains the largest region in the DEF market, accounting for approximately 30–35% of global revenues in 2024. This leading share is underpinned by widespread use of SCR-equipped heavy-duty commercial vehicles and strict emission regulations enforced across the U.S. and Canada. Extensive DEF distribution infrastructure including bulk supply to fleet operators and station-based retail availability ensures reliable fluid supply for high-mileage road freight. Robust highway freight networks and ongoing demand from construction, agriculture and industrial equipment also contribute significantly. As a result, North America continues to anchor global DEF demand and sets a benchmark for regulatory-driven consumption.

Europe

Europe contributes an estimated 25–30% share of the global DEF market, buoyed by early adoption of stringent emission standards such as Euro VI across major countries. The requirement for NOₓ reduction in heavy-duty trucks, construction machinery, and off-road equipment ensures consistent demand for DEF. High fleet density, rigorous environmental enforcement, and widespread retrofitting of SCR systems foster sustained consumption. Moreover, growth in infrastructure investments and cross-border freight transport across the European Union further supports DEF uptake. As regulations deepen and older diesel fleets are replaced, Europe sustains a strong, stable DEF base and remains a key mature market globally.

Asia Pacific

The Asia Pacific region is rapidly expanding and currently holds roughly 20–25% of global DEF demand, with growth rates surpassing most other regions. Accelerating industrialization, rising commercial vehicle sales, large-scale infrastructure development, and growing agricultural mechanization across countries like China, India, and South Korea drive DEF adoption. Additionally, emerging emission standards and growing awareness of air quality push fleet operators to shift toward SCR-equipped diesel engines. Rapid expansion of logistics, mining, and construction sectors ensures diversified demand from on-road freight to off-highway machinery positioning Asia Pacific as the fastest-growing DEF market globally.

Latin America

Latin America holds a moderate share, roughly 8–10%, of the global DEF market. The region’s growth is driven by gradual adoption of emission regulations, increasing imports of SCR-compliant diesel vehicles, and expansion of freight and construction infrastructure in key markets such as Brazil and Mexico. Given infrastructural and retail limitations in rural areas, many buyers rely on packaged DEF (bottles, drums) rather than bulk supply systems. Nonetheless, expanding logistics networks and growing demand for public- and private-sector commercial fleets support steady volume increase. Continued investment in distribution channels and regulatory alignment could further accelerate DEF demand in Latin America.

Middle East & Africa

The Middle East & Africa region contributes an approximate 5–7% of global DEF market revenue, reflecting its emerging market status. Diesel-powered heavy equipment, mining operations, oil-field logistics, and construction projects drive baseline DEF demand. As international OEMs introduce SCR-compliant engines and regional regulators begin to consider tighter emissions norms, uptake is slowly rising. However, fragmented supply chains, limited DEF infrastructure, and logistical challenges hinder rapid growth. Large infrastructure and industrial projects especially in Gulf Cooperation Council (GCC) states offer key opportunities; successful expansion of bulk supply networks and regulatory enforcement could significantly boost DEF adoption over the coming years.

Market Segmentations:

By DEF Types

- Aqueous Urea Solution

- Solid DEF

By Packaging Types

- Bottles and Jugs

- Drums and Totes

- Bulk Deliveries

By End Users

- Automotive

- Fleet and Transportation

- Agriculture and Construction

- Marine and Off-Highway

- Industrial and Manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Diesel Exhaust Fluid (DEF) market is characterized by a mix of global chemical producers, fuel distributors, automotive service providers, and specialized DEF manufacturers competing to expand capacity, enhance distribution networks, and maintain product purity standards. Companies focus on securing urea supply chains, developing ISO-compliant high-purity formulations, and deploying bulk dispensing systems across transportation corridors and fleet depots. Strategic priorities include long-term contracts with logistics operators, co-location of production facilities near agricultural and industrial hubs, and collaborations with retail fuel networks for DEF-at-pump availability. Private label offerings are growing in the aftermarket, intensifying price-based competition. Meanwhile, digital delivery tracking, IoT-enabled tank monitoring, and quality testing technologies emerge as differentiation factors, strengthening service models. As emission regulations broaden geographically and across off-road sectors, competitive positioning increasingly depends on supply reliability, cost management, and the ability to serve high-volume fleet and industrial customers at scale.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Blue Sky Diesel Exhaust Fluid

- CF Industries Holdings, Inc.

- Old World Industries, LLC

- Yara International ASA

- Certified DEF

- Cummins Filtration

- The Potash Corporation of Saskatchewan

- STOCKMEIER Group

- Dyno Nobel

- KOST USA, Inc.

Recent Developments

- In November 2024, Old World Industries, LLC / Blue DEF the company announced a new triple-filtration process for its PEAK® BlueDEF® line to further elevate DEF purity standards. They also revealed a refreshed packaging design for both BlueDEF® and BlueDEF® Platinum® slated for Q1 2025.

Report Coverage

The research report offers an in-depth analysis based on DEF types, Packaging types, End users and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- DEF demand will remain stable as SCR technology continues to dominate diesel emission control systems globally.

- Expansion of long-haul logistics and freight transportation will sustain bulk fluid consumption.

- Developing countries adopting stricter emission norms will accelerate new market penetration.

- Integration of IoT-enabled storage and dispensing systems will enhance supply visibility and inventory control.

- Off-highway machinery in mining, agriculture, and construction will contribute increasingly to DEF volumes.

- Manufacturers will focus on high-purity formulations to protect SCR systems and reduce maintenance risk.

- Retail DEF dispensing at fuel stations will expand to improve accessibility across regions.

- Strategic partnerships between fuel distributors and DEF suppliers will strengthen distribution efficiency.

- Electrification of light commercial fleets may gradually reduce long-term DEF reliance in specific segments.

- Sustainability initiatives will drive recycling, optimized logistics, and reduced carbon footprint across the DEF supply chain.