Market Overview

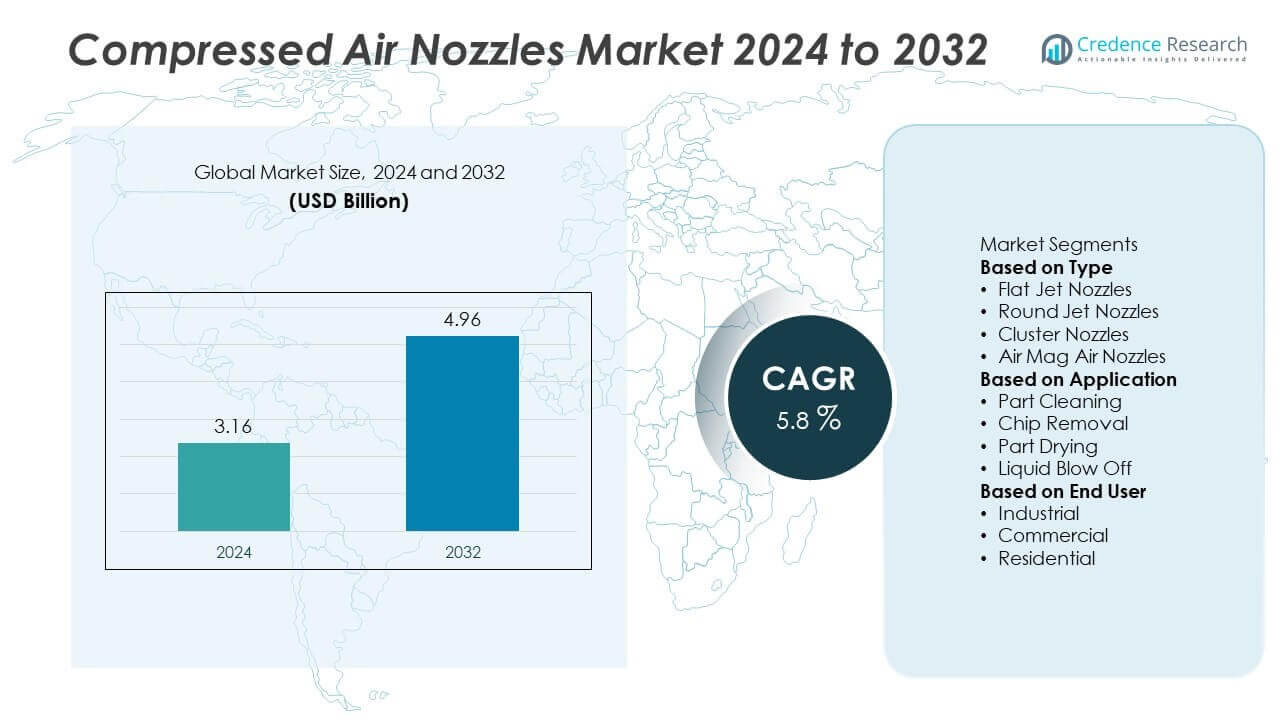

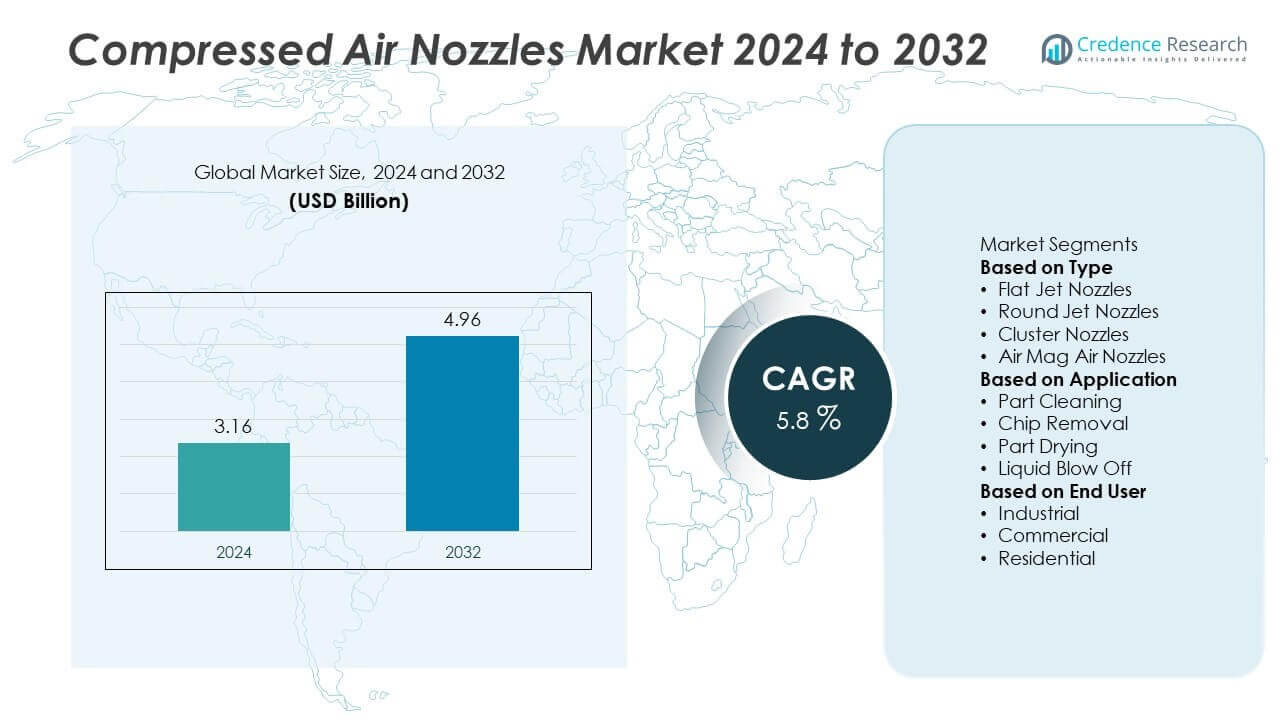

Compressed Air Nozzles Market size was valued at USD 3.16 billion in 2024 and is projected to reach USD 4.96 billion by 2032, growing at a CAGR of 5.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compressed Air Nozzles Market Size 2024 |

USD 3.16 Billion |

| Compressed Air Nozzles Market, CAGR |

5.8% |

| Compressed Air Nozzles Market Size 2032 |

USD 4.96 Billion |

Top players in the Compressed Air Nozzles market include EXAIR Corporation, AiRTX International, Pneumadyne Inc., Euspray Srl, BEX Spray Nozzles Ltd., Delavan Spray Technologies, Schlick GmbH, H. Ikeuchi Co., Ltd., Ikeuchi Taiwan Co., Ltd., and KJN Enterprises. These companies focus on energy-efficient designs, noise reduction, and precision airflow solutions to meet industrial needs. Asia-Pacific leads the market with 32% share, driven by rapid industrialization and automation in China, India, and Japan. Europe follows with 30% share, supported by strict energy efficiency regulations and strong manufacturing output, while North America accounts for 28% share, led by technological adoption and compliance with OSHA safety standards.

Market Insights

- Compressed Air Nozzles market was valued at USD 3.16 billion in 2024 and is projected to reach USD 4.96 billion by 2032, growing at a CAGR of 5.8% during the forecast period.

- Rising demand for energy-efficient air systems and noise-reducing solutions drives adoption, with flat jet nozzles holding over 40% share and industrial end users contributing more than 70% of demand.

- Trends include growing use of air amplification technology, automation-driven precision cleaning, and adoption of low-noise engineered nozzles to meet global safety standards.

- The market is moderately fragmented with key players such as EXAIR Corporation, AiRTX International, and Schlick GmbH focusing on R&D, product innovation, and expanding global distribution networks.

- Asia-Pacific leads with 32% share, followed by Europe at 30% and North America at 28%, driven by manufacturing growth, regulatory compliance, and rising investment in smart factory solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Flat jet nozzles dominate the market, holding over 40% share due to their versatility and efficient air distribution. These nozzles are widely used for surface cleaning, drying, and cooling applications, delivering uniform airflow with reduced energy consumption. Round jet nozzles follow closely, favored for targeted cleaning and chip removal in industrial machinery. Cluster nozzles serve heavy-duty operations that require high impact force, while air mag air nozzles are gaining traction for their superior air amplification and noise reduction benefits. The growing emphasis on energy-efficient compressed air systems continues to strengthen demand for flat jet nozzles.

- For instance, EXAIR’s 2″ High Power Flat Super Air Nozzle produces a flat 2-inch (51 mm) airstream with a blowing force of 2.2 pounds (998 grams). This force is measured at a distance of 12 inches (305 mm) from the target.

By Application

Part cleaning leads the application segment with more than 30% share, driven by the growing need for precision cleaning in automotive, aerospace, and electronics industries. Compressed air nozzles ensure effective removal of dust, debris, and contaminants without damaging delicate surfaces. Chip removal and part drying applications are also significant, supporting metalworking and manufacturing lines. Liquid blow-off nozzles are increasingly used in food processing and packaging to maintain hygiene. Rising adoption of automated cleaning systems and compliance with industry cleanliness standards are boosting demand across all application areas.

- For instance, EXAIR’s standard force air nozzles deliver focused blowoff force from 2 ounces (56.7 grams) up to 22 ounces (624 grams) ideal for removing fine dust and debris from small surfaces.

By End User

The industrial segment accounts for over 70% of market share, driven by widespread use in manufacturing, automotive, and heavy equipment sectors. These nozzles support high-efficiency operations, reduce air consumption, and improve safety by lowering noise levels. Commercial users, including food processors and packaging facilities, contribute a smaller yet growing share as hygiene regulations become stricter. Residential usage remains niche, mainly in small workshops and home-based fabrication setups. Growth in industrial automation, along with rising demand for energy savings and process optimization, continues to reinforce the dominance of the industrial end-user segment.

Key Growth Drivers

Rising Demand for Energy-Efficient Air Systems

The market grows with the increasing need for energy-efficient compressed air systems across industries. Compressed air nozzles with optimized designs reduce air consumption and operational costs, aligning with sustainability targets. Manufacturers focus on producing low-noise, high-efficiency nozzles to meet workplace safety and energy regulations. Industries such as automotive, food processing, and electronics adopt these solutions to improve productivity while lowering carbon emissions. Government initiatives promoting energy conservation further accelerate the shift toward advanced nozzle systems with higher performance and reduced energy wastage.

- For instance, Lechler’s flat fan Whisperblast nozzle Series 600.493.1Y, at a pressure of 2 bar (approximately 29 psi), consumes 30 m³/h (equivalent to about 17.65 SCFM), produces a blowing force of 4.2 N (or 0.94 LBF), and has a noise level of 78 dB(A).

Growth in Industrial Automation and Manufacturing

Industrial automation drives demand for compressed air nozzles by requiring precise cleaning, cooling, and drying solutions in production lines. Nozzles are widely used in chip removal and part cleaning during CNC machining, metalworking, and assembly processes. Automation increases the need for consistent airflow, noise control, and reduced downtime, which efficient nozzles provide. Expansion of manufacturing facilities in Asia-Pacific and Latin America fuels adoption. The rise of Industry 4.0 and smart factories further boosts integration of air nozzles with automated systems for improved control and monitoring.

- For instance, the Lechler intensive multi-channel flat jet nozzle Series 600.383.35 operates at a pressure of 29 psi, where it delivers an air consumption of 18 SCFM. The nozzle has a maximum pressure rating of 145 psi and a maximum operating temperature of 50°C.

Stringent Workplace Safety and Noise Regulations

Compliance with occupational health and safety standards drives adoption of engineered air nozzles designed to reduce noise levels below OSHA and EU-OSHA limits. Low-noise nozzles improve worker comfort and productivity while reducing the risk of hearing damage. Manufacturers develop nozzles that maintain high thrust while keeping sound levels safe, ensuring regulatory compliance. Industries prioritize safe compressed air usage to avoid workplace hazards like airborne debris and accidental injuries. This regulatory push fuels investments in advanced nozzle technology that combines performance, safety, and energy efficiency.

Key Trends & Opportunities

Key Trends & Opportunities

Adoption of Advanced Air Amplification Technology

Air amplification technology is becoming a key trend as it delivers higher thrust with lower air consumption. These nozzles use the Coandă effect to draw in surrounding air, multiplying output while saving energy. Industries adopt these solutions to achieve cost savings and meet sustainability goals. This trend creates opportunities for manufacturers to offer innovative designs for high-impact applications like cooling and blow-off in packaging and automotive plants. Air amplification also supports quieter operation, aligning with global noise-reduction standards and enhancing workplace safety.

- For instance, Vortec’s Maximum Thrust Nozzle Model 1220 delivers thrust of 72 oz-force at a distance of 12 inches with air consumption of 120 SCFM.

Expansion in Emerging Manufacturing Hubs

Rapid industrialization in Asia-Pacific, Latin America, and parts of Africa creates significant growth opportunities. New manufacturing facilities in sectors like electronics, automotive, and food processing require efficient air management systems. Local governments support industrial growth through infrastructure investments, attracting global players to set up production units. This expansion increases demand for cost-effective compressed air nozzles that offer durability and energy efficiency. Manufacturers are targeting these regions with affordable, high-performance products to capture market share and build long-term customer relationships.

- For instance, Ultra Clean Technologies’ Launcher Kits require a ½-inch internal diameter hose delivering 38 SCFM at 80 PSI for cleaning of hose assemblies ranging from ¼-inch (6 mm) up to 2-inch (50 mm) internal diameter.

Key Challenges

High Operating Costs of Compressed Air Systems

Compressed air is one of the most expensive utilities in industrial facilities, accounting for a large share of energy consumption. Inefficient nozzles lead to significant air losses, driving up electricity costs. Small and medium enterprises often struggle to justify investments in premium engineered nozzles despite potential long-term savings. This cost barrier slows widespread adoption of advanced nozzle technologies in cost-sensitive markets. Manufacturers are addressing this challenge by offering ROI-driven solutions and energy audits to demonstrate measurable cost reductions.

Maintenance and Air Leak Issues

Air leaks in compressed air systems remain a major challenge, leading to energy waste and operational inefficiencies. Damaged or clogged nozzles can cause pressure drops and uneven airflow, affecting production quality. Regular maintenance and inspection are necessary but can be resource-intensive for large facilities. Neglecting maintenance leads to increased downtime and higher operational costs. Market players are developing durable, clog-resistant nozzles and providing predictive maintenance solutions to help industries minimize leaks and maintain consistent performance.

Regional Analysis

North America

North America holds about 28% market share, driven by strong demand from automotive, aerospace, and food processing industries. The U.S. leads the region with extensive adoption of energy-efficient compressed air systems to meet OSHA safety and noise standards. Manufacturers invest in advanced nozzles with low air consumption to reduce operational costs. Growth in industrial automation and maintenance practices fuels recurring demand for replacement nozzles. Canada contributes through investments in manufacturing upgrades and process optimization. The focus on workplace safety and sustainability continues to encourage adoption of engineered air nozzles across key industrial sectors.

Europe

Europe accounts for nearly 30% of the market share, supported by well-established manufacturing bases in Germany, Italy, and the U.K. Strict EU regulations on noise and energy efficiency drive demand for high-performance engineered nozzles. Automotive, packaging, and electronics industries dominate usage, with an emphasis on precision cleaning and chip removal applications. Government-backed energy efficiency programs accelerate retrofitting of older plants with optimized air systems. Eastern Europe sees growing demand as new industrial hubs emerge. Manufacturers focus on compliance with CE marking and ISO standards, ensuring product reliability and regulatory alignment across the region.

Asia-Pacific

Asia-Pacific dominates with around 32% market share, making it the fastest-growing regional market. China, India, and Japan lead demand due to rapid industrialization and expansion of automotive and electronics manufacturing. The region benefits from increasing adoption of automated production lines that rely heavily on compressed air nozzles for cleaning, drying, and cooling. Government initiatives supporting smart factories and energy conservation further fuel growth. Rising focus on reducing production costs encourages use of air amplification technology. Local and global players expand production capacity to meet strong demand from emerging manufacturing clusters.

Latin America

Latin America holds about 6% market share, with Brazil and Mexico as major contributors. Industrial development and foreign investments in automotive and food processing sectors drive demand for compressed air nozzles. The region increasingly adopts energy-efficient nozzles to reduce electricity costs, which remain high. Manufacturing plants focus on chip removal and part cleaning applications to maintain product quality and meet export standards. Expansion of industrial parks and government incentives for modernizing facilities support steady market growth. Manufacturers are targeting this region with cost-effective, durable nozzle solutions to strengthen penetration.

Middle East & Africa

Middle East & Africa represents around 4% of market share, showing gradual but steady growth. GCC countries drive demand with investments in oil & gas, construction, and industrial automation projects. Compressed air nozzles are used for maintenance, cleaning, and material handling operations in these sectors. South Africa and Egypt see rising adoption in manufacturing and packaging industries. Harsh environmental conditions push demand for durable, corrosion-resistant nozzles. Increasing focus on workplace safety, noise reduction, and energy efficiency encourages adoption of engineered air nozzles, supported by growing awareness and supplier partnerships in the region.

Market Segmentations:

By Type

- Flat Jet Nozzles

- Round Jet Nozzles

- Cluster Nozzles

- Air Mag Air Nozzles

By Application

- Part Cleaning

- Chip Removal

- Part Drying

- Liquid Blow Off

By End User

- Industrial

- Commercial

- Residential

By Geography

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Compressed Air Nozzles market is shaped by key players such as EXAIR Corporation, AiRTX International, Pneumadyne Inc., Euspray Srl, BEX Spray Nozzles Ltd., Delavan Spray Technologies, Schlick GmbH, H. Ikeuchi Co., Ltd., Ikeuchi Taiwan Co., Ltd., and KJN Enterprises. These companies focus on developing energy-efficient and low-noise nozzles that meet global safety and efficiency standards. Leading manufacturers invest heavily in R&D to introduce air amplification technologies, reduce air consumption, and improve durability. Strategic partnerships and distribution networks expand their global presence, particularly in Asia-Pacific and Europe where demand is surging. Competitors also emphasize customization to meet sector-specific needs in automotive, packaging, and food processing industries. Capacity expansion and localized manufacturing strengthen supply chain reliability and cost competitiveness. Sustainability initiatives and compliance with regulations such as OSHA and CE standards remain critical factors shaping the strategies of top market participants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schlick GmbH

- Ikeuchi Taiwan Co., Ltd.

- AiRTX International

- EXAIR Corporation

- BEX Spray Nozzles Ltd.

- Euspray Srl

- KJN Enterprises

- Pneumadyne Inc.

- Delavan Spray Technologies

- Ikeuchi Co., Ltd.

Recent Developments

- In June 2025, EXAIR Corporation launched the HydroClaw nozzle, designed for hygienic cleaning, engineered to allow particles up to 1/4-inch in diameter, which is three times the free passage of comparable spray balls.

- In 2025, Schlick GmbH (Düsen-Schlick) replaced the traditional flat jet nozzle geometry with what it calls its “ABC nozzle orifice” design: this rounded orifice reduces turbulence and helps prevent dust build-up (“anti-bearding”) on the nozzle.

- In May 2024, EXAIR Corporation introduced the PowerStream Liquid Atomizing Nozzle, offered in 1/8 NPT with 5 flow rates, for applications like cooling, rinsing, washing, and dust control.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient nozzles will rise as industries focus on reducing air consumption.

- Adoption of air amplification technology will expand to improve thrust with lower operating costs.

- Growth in industrial automation will drive consistent demand for precision cleaning and drying nozzles.

- Manufacturers will invest in low-noise designs to meet global workplace safety regulations.

- Asia-Pacific will remain the fastest-growing region, supported by rapid industrialization and manufacturing expansion.

- Europe will see steady demand driven by strict energy efficiency and noise compliance standards.

- Product customization for sector-specific needs like food processing and electronics will gain momentum.

- Predictive maintenance and smart monitoring features will be integrated into advanced nozzle systems.

- Competitive focus will shift toward sustainable production and recyclable materials.

- Strategic partnerships and global distribution expansion will strengthen supply chains and market reach.

Key Trends & Opportunities

Key Trends & Opportunities