Market Overview

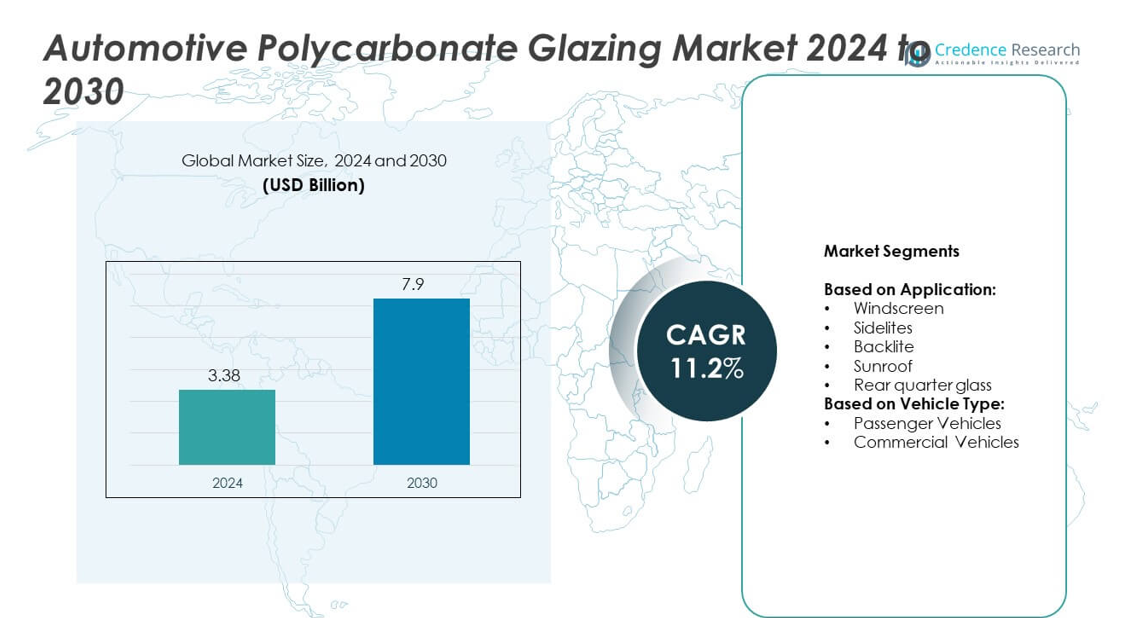

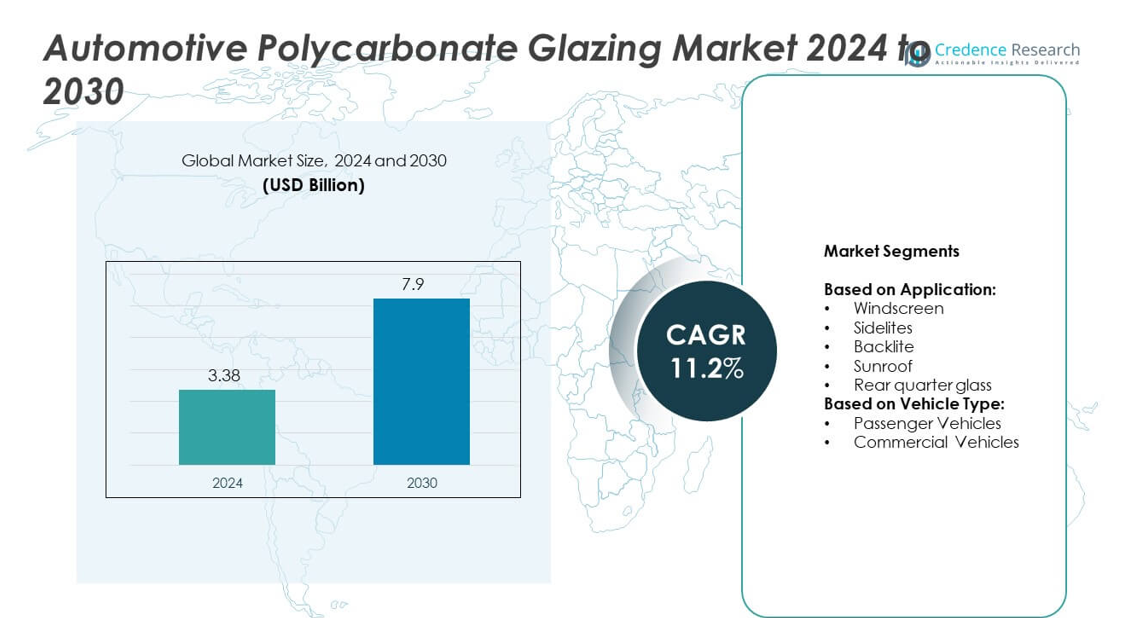

The automotive polycarbonate glazing market size was valued at USD 3.38 billion in 2024 and is projected to reach USD 7.9 billion by 2032, growing at a CAGR of 11.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Polycarbonate Glazing Market Size 2024 |

USD 3.38 billion |

| Automotive Polycarbonate Glazing Market, CAGR |

11.2% |

| Automotive Polycarbonate Glazing Market Size 2032 |

USD 7.9 billion |

The automotive polycarbonate glazing market grows with rising demand for lightweight, impact-resistant, and design-flexible materials in modern vehicles. Automakers adopt polycarbonate to improve fuel efficiency, electric vehicle range, and aesthetic appeal. It supports advanced styling features such as panoramic roofs, curved windows, and integrated displays. Infrared-blocking coatings, sensor compatibility, and recyclability enhance its value. Market expansion aligns with emission regulations, electric mobility, and smart vehicle technologies, making polycarbonate a preferred glazing material across multiple automotive applications.

Asia Pacific leads the automotive polycarbonate glazing market due to strong electric vehicle production and material innovation in China, Japan, and South Korea. Europe follows with high adoption in premium vehicles and strong regulatory support for lightweight materials. North America sees steady growth from electric SUV and luxury car demand. Key players such as Covestro AG, SABIC, Teijin Limited, and LG Chem focus on advanced formulations, regional expansion, and OEM partnerships to strengthen their market position across diverse automotive applications.

Market Insights

- The automotive polycarbonate glazing market was valued at USD 3.38 billion in 2024 and is projected to reach USD 7.9 billion by 2032, growing at a CAGR of 11.2%.

- Lightweight materials and emission regulations drive OEMs to adopt polycarbonate for better fuel economy and electric vehicle efficiency.

- Design flexibility, panoramic roofs, and infrared-blocking coatings are major trends influencing product development and consumer appeal.

- Leading players such as SABIC, Covestro AG, LG Chem, and Teijin Limited invest in advanced coatings, sensor-compatible glazing, and recyclable formulations.

- High production costs, complex coating processes, and regulatory barriers in windscreen applications limit faster adoption across mass vehicle segments.

- Asia Pacific leads in volume due to high EV manufacturing, while Europe and North America show strong premium segment demand.

- The market aligns with rising demand for smart, sustainable mobility solutions and continues to expand with support from electric and autonomous vehicle growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Lightweight Materials to Improve Fuel Efficiency and EV Range

The automotive polycarbonate glazing market benefits from the global shift toward lightweight vehicles. Polycarbonate is nearly 50% lighter than traditional glass, allowing automakers to reduce vehicle weight. Lower vehicle weight directly enhances fuel efficiency and extends the driving range of electric vehicles. Car manufacturers face strict CO₂ emission rules, which push adoption of lightweight alternatives. Polycarbonate glazing helps achieve better aerodynamics by supporting advanced shapes and complex designs. It is increasingly favored in electric mobility, where range optimization is a top priority.

- For instance, Palram reports that its polycarbonate sheets are more than 50% lighter than equivalent glass panels, while maintaining similar visible light transmission.

Increasing Focus on Safety and Durability Standards in Modern Vehicles

The automotive polycarbonate glazing market grows with demand for safety features and durable vehicle structures. Polycarbonate offers high impact resistance, making it less prone to shattering compared to conventional glass. It enhances passenger protection in accidents while ensuring longer product life cycles. Regulators encourage safer materials that comply with global safety benchmarks. Automakers integrate glazing solutions to balance strength, weight, and clarity. It supports industry needs for safety without compromising aesthetics or performance.

- For instance, Riot Glass offers its ArmorPlast AP50BR, a 0.522-inch thick (nominally ½-inch), 3-ply polycarbonate laminate sheet with 83% light transmission. This material is a light-ballistic and forced-entry product, meaning it does not offer protection against all ballistic threats

Rising Adoption of Advanced Design Flexibility and Innovative Applications

The automotive polycarbonate glazing market gains momentum through design advantages and application versatility. Polycarbonate allows seamless integration of panoramic roofs, side windows, and rear windshields. Designers use the material to create aerodynamic curves and complex shapes. It improves vehicle styling, enhancing consumer appeal in premium and mid-range segments. Automakers adopt polycarbonate to enable thinner structures without sacrificing strength. It also supports integration of embedded sensors, coatings, and displays.

Strong Alignment with Sustainability and Energy Efficiency Goals

The automotive polycarbonate glazing market aligns with global sustainability targets and energy-efficient production practices. Polycarbonate requires less energy in processing compared to glass, reducing environmental impact. Manufacturers emphasize recyclable grades to support circular economy initiatives. The material lowers overall energy consumption across the vehicle lifecycle. Automakers meet rising consumer demand for eco-friendly mobility solutions by using polycarbonate glazing. It ensures compliance with sustainability standards while delivering performance and efficiency benefits.

Market Trends

Wider Integration of Panoramic Roof Systems and Large Transparent Surfaces

The demand for panoramic roofs and extended glass surfaces drives innovation in automotive glazing. Consumers prefer vehicles with open, spacious interiors that maximize natural light. Polycarbonate enables lightweight, curved roof panels without compromising structural integrity. It offers better formability compared to glass, supporting modern panoramic designs. Automakers use it to reduce load while improving aesthetics and thermal insulation. The Automotive Polycarbonate Glazing market grows in response to this styling trend across luxury and mainstream vehicles.

- For instance, Palram describes its solid polycarbonate sheets achieving >90% light transmission in transparent variants, enabling clear panoramic surfaces.

Growing Adoption of Infrared-Blocking and UV-Resistant Coating Technologies

Automotive glazing must balance light transmission with heat and UV protection. Manufacturers apply advanced coatings on polycarbonate to reflect infrared radiation and block harmful UV rays. It helps maintain cabin comfort, lowers air conditioning load, and protects interior materials. Consumers expect enhanced thermal management without sacrificing clarity or transparency. These coatings also improve durability and scratch resistance of polycarbonate parts. The Automotive Polycarbonate Glazing market benefits from increased demand for comfort-enhancing smart surfaces.

- For instance, Riot Glass’s ArmorPlast AP50BR includes hard coats on both interior and exterior surfaces that resist yellowing and hazing for 7 years, while maintaining high optical clarity

Shift Toward Electrification and Smart Mobility Infrastructure

Electric and autonomous vehicles need advanced materials for weight reduction and sensor compatibility. Polycarbonate glazing supports this shift by allowing radar and lidar transmission without distortion. It integrates smart sensors, displays, and heads-up projection surfaces seamlessly. Manufacturers focus on functional integration while reducing weight and energy consumption. This dual role in design and digital performance increases its appeal across EV and autonomous platforms. The Automotive Polycarbonate Glazing market aligns with these mobility transformations.

Expansion of Multi-Layer Laminated Structures for Safety and Noise Control

Polycarbonate’s adaptability enables multilayer configurations that enhance sound insulation and impact resistance. Laminated glazing blocks external noise, improving passenger comfort in urban and highway environments. It also boosts safety by preventing shatter or intrusion during collisions. OEMs use advanced lamination techniques to combine strength, clarity, and acoustic performance. It becomes a preferred solution in high-end vehicles and EVs where cabin quietness is critical. The Automotive Polycarbonate Glazing market advances with this trend toward performance-based innovation.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limit Mass Adoption

Polycarbonate glazing requires advanced processing techniques such as injection molding, lamination, and hard coating. These steps increase production complexity and raise costs compared to conventional glass. Smaller automotive suppliers find it difficult to invest in the required infrastructure and expertise. Hard coatings, essential for scratch resistance, demand strict environmental control and precision. Any defect during coating leads to rejection, affecting yield and profit margins. The Automotive Polycarbonate Glazing market faces barriers in scaling due to these production challenges. It limits broad adoption across entry-level vehicle segments.

Regulatory Limitations and Optical Performance Constraints Pose Hurdles

Global automotive regulations still favor traditional glass for several safety and optical performance standards. Polycarbonate must meet strict transparency, scratch resistance, and UV durability requirements to gain wider regulatory acceptance. Inconsistent compliance across regions creates certification hurdles for multinational OEMs. Optical clarity in curved or large-surface applications sometimes falls short of expectations. It requires continuous investment in material science to bridge these gaps. The Automotive Polycarbonate Glazing market must overcome these regulatory and technical limitations to unlock its full potential.

Market Opportunities

Expansion of Electric and Autonomous Vehicle Platforms Drives New Material Demand

Automotive OEMs invest heavily in electric and autonomous vehicle development. These platforms require materials that combine weight savings, durability, and sensor compatibility. Polycarbonate glazing meets these needs through radar-transparency, impact resistance, and thermal insulation. It supports integration of lidar sensors, HUD displays, and embedded antennas in roof and window systems. Vehicle designers value its flexibility for non-traditional shapes and functional surfaces. The Automotive Polycarbonate Glazing market sees strong growth potential from this shift toward next-generation mobility platforms.

Rising Demand for Sustainable and Energy-Efficient Materials in Global Markets

Environmental regulations and consumer preference accelerate demand for recyclable and energy-saving materials. Polycarbonate production emits less CO₂ than traditional glass and supports lightweight vehicle construction. It lowers energy use across the vehicle lifecycle by improving thermal efficiency and reducing load. Automakers seek glazing solutions that align with sustainability targets and circular design principles. Recyclable polycarbonate grades and bio-based variants present new commercialization paths. The Automotive Polycarbonate Glazing market can expand by meeting green mobility and regulatory goals worldwide.

Market Segmentation Analysis:

By Application

Windscreen applications represent a critical segment, though regulatory limitations restrict full-scale polycarbonate usage in this area. Most developments focus on hybrid or multi-layered systems to meet visibility and safety norms. Sidelites dominate usage due to easier approval and lower performance constraints compared to windscreens. These panels benefit from reduced weight and better impact resistance, especially in electric and high-performance vehicles. Backlites see growing use in SUVs and hatchbacks, where larger surface areas and styling demands align with polycarbonate capabilities. The Automotive Polycarbonate Glazing market continues to expand across sunroof applications, driven by consumer demand for panoramic and lightweight roof systems. Rear quarter glass provides another high-growth area, offering design flexibility in both coupe-style and crossover vehicles.

- For instance, For quarter windows / rear quarter glazing: SAIC‑GM used a polycarbonate rear quarter window on the Buick GL8 MPVs. It is moulded from SABIC’s Lexan resin, and is 3 kg lighter (~40% weight saving) compared to the comparable glass window.

By Vehicle Type

Passenger vehicles account for the largest share of demand due to high production volumes and rapid design innovation. Automakers use polycarbonate glazing in premium sedans, SUVs, and electric cars to meet styling, weight, and energy targets. It enables seamless transitions in body panels and supports advanced interior features. Commercial vehicles adopt glazing materials more slowly, mainly for sunroofs, side panels, or rear windows in buses, vans, and light-duty trucks. Durability and thermal performance remain key in fleet and long-distance transport applications. The Automotive Polycarbonate Glazing market sees new opportunities in electric vans and delivery vehicles, where lower weight directly affects operational cost and efficiency. It supports vehicle manufacturers in aligning with clean transportation policies and urban fleet modernization.

- For instance, Exolon Group supplied solid polycarbonate sheets of 12 mm thickness for the cab glazing on John Deere’s E-Series forestry vehicles. The material is specifically engineered for high-impact resistance, a critical requirement for forestry machinery that must withstand heavy debris. Exolon sheets used in such applications have passed the FOPS test (falling object protective structures) and resist impacts up to 11,600 joules.

Segments:

Based on Application:

- Windscreen

- Sidelites

- Backlite

- Sunroof

- Rear quarter glass

Based on Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 23.6% of the global automotive polycarbonate glazing market. Automakers across the U.S. and Canada adopt polycarbonate in sunroofs, sidelites, and backlites to improve fuel economy and meet strict emission rules. The region sees steady demand from electric vehicle producers integrating lightweight materials to enhance battery range and reduce overall vehicle mass. Polycarbonate finds use in luxury SUVs and high-performance vehicles manufactured by brands such as Tesla, General Motors, and Ford. Most manufacturers emphasize UV-resistant coatings and scratch-proof finishes that align with extreme temperature variations across North America. Investments in smart mobility and autonomous vehicle technologies also encourage use of sensor-compatible materials. The market grows steadily as OEMs shift toward next-generation vehicle platforms and eco-friendly materials.

Europe

Europe holds a significant share of 28.9% in the automotive polycarbonate glazing market, making it the largest regional market. Regulatory support for CO₂ reduction, combined with stringent vehicle safety norms, drives polycarbonate adoption. Leading automakers including BMW, Mercedes-Benz, and Volkswagen integrate polycarbonate panels in panoramic roofs and advanced lighting assemblies. The region also supports research into recyclable polycarbonate formulations to meet EU sustainability targets. Germany, France, and the UK lead development in this segment, supported by government incentives for lightweight, low-emission vehicles. High adoption of electric and plug-in hybrid vehicles further accelerates demand. It provides strong momentum for polycarbonate glazing in both luxury and mid-range passenger car segments across European markets.

Asia Pacific

Asia Pacific captures 34.7% share, making it the most rapidly growing region in the automotive polycarbonate glazing market. China, Japan, South Korea, and India show high manufacturing activity, especially for electric vehicles and compact urban cars. Chinese manufacturers like BYD and NIO utilize polycarbonate extensively to lower vehicle weight and boost performance. Japan and South Korea lead in integrating polycarbonate into hybrid and fuel-efficient models. The presence of large polycarbonate producers such as Mitsubishi Chemical and Teijin strengthens the regional supply chain. Rising middle-class income and demand for feature-rich vehicles in India also support long-term adoption. Governments push for EV adoption and domestic innovation, fueling new opportunities for smart glazing systems. It makes Asia Pacific a key contributor to future volume growth in the market.

Latin America

Latin America holds a smaller but emerging market share of 6.4% in the automotive polycarbonate glazing segment. Brazil and Mexico lead vehicle production in the region and serve export markets in North America and Europe. Automakers in the region adopt polycarbonate mainly in sunroofs and rear-quarter panels for light vehicles. Growth remains moderate due to price sensitivity and limited regulatory pressure on emissions. However, rising urbanization and fleet modernization programs gradually increase interest in lightweight materials. It creates space for mid-term expansion, especially in passenger cars designed for exports.

Middle East and Africa

The Middle East and Africa account for 6.4% share of the global market. Vehicle demand remains steady in Gulf countries and South Africa, though market maturity is low. Luxury vehicles and imported EVs create limited demand for advanced glazing solutions. Climate conditions drive interest in UV-blocking, heat-resistant polycarbonate systems, particularly for sunroofs. Limited domestic vehicle production and regulatory frameworks slow faster adoption. It opens potential for niche applications where thermal control and durability are prioritized.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LG Chem (South Korea)

- Mitsubishi Chemical Group (Japan)

- Covestro AG (Germany)

- Chi Mei Corporation (Taiwan)

- Trinseo S.A. (USA)

- Teijin Limited (Japan)

- Formosa Chemicals & Fibre Corp. (Taiwan)

- Idemitsu Kosan Co., Ltd. (Japan)

- SABIC (Saudi Arabia)

- Lotte Chemical Corporation (South Korea)

Competitive Analysis

The automotive polycarbonate glazing market features strong competition among key players including LG Chem, Mitsubishi Chemical Group, Covestro AG, Chi Mei Corporation, Trinseo S.A., Teijin Limited, Formosa Chemicals & Fibre Corp., Idemitsu Kosan Co., Ltd., SABIC, and Lotte Chemical Corporation. These companies focus on advanced polycarbonate formulations tailored for thermal stability, impact resistance, and UV protection in automotive glazing systems. Most players maintain backward integration across resin production and glazing-grade compounding, ensuring material consistency and cost control. Strategic partnerships with OEMs and Tier 1 suppliers help strengthen their global presence. Companies invest in scratch-resistant hard-coating technologies that meet evolving safety and clarity standards. Product differentiation focuses on recyclability, radar-transparency, and compatibility with embedded electronics. Regional production hubs in Asia, Europe, and North America support reliable supply for growing electric and hybrid vehicle platforms. Players also compete on sustainable manufacturing by reducing emissions and energy usage in polycarbonate production. Demand from panoramic sunroofs, rear quarter windows, and curved glazing segments drives further innovation. R&D efforts target lightweight, multi-functional glazing solutions that align with automotive design and performance trends. Competitive dynamics will intensify as regulatory approvals expand and EV production scales across major regions.

Recent Developments

- In 2025, Teijin announced that its biomass-derived polycarbonate resin got adopted by Sigma Corporation for camera lens barrels.

- In 2024, LG Chem developed a PFAS‑free flame‑retardant polycarbonate/ABS material made from recycled plastics.

- In 2023, Covestro AG Developed “Makrolon PCR” grade polycarbonate resin with ~90% post‑consumer recycled content; plans to offer it in Asia‑Pacific and build a compounding plant in Shanghai

Report Coverage

The research report offers an in-depth analysis based on Application, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising demand for lightweight materials in electric and fuel-efficient vehicles.

- Polycarbonate glazing will see increased use in panoramic roofs, rear windows, and sunroofs.

- Adoption will rise in autonomous and connected vehicles for sensor-transparent surfaces.

- Regulatory updates may support broader use in windscreen applications after safety validations.

- Advanced coating technologies will improve scratch resistance and UV stability for long-term use.

- OEMs will invest in recyclable polycarbonate materials to align with sustainability goals.

- Asia Pacific will remain the fastest-growing region driven by EV production and urban vehicle sales.

- Partnerships between material suppliers and automakers will drive product innovation and faster rollout.

- Increased focus on noise reduction and comfort will push demand for multi-layer laminated glazing.

- Integration of smart features like HUDs and embedded displays will expand polycarbonate applications.