Market Overview

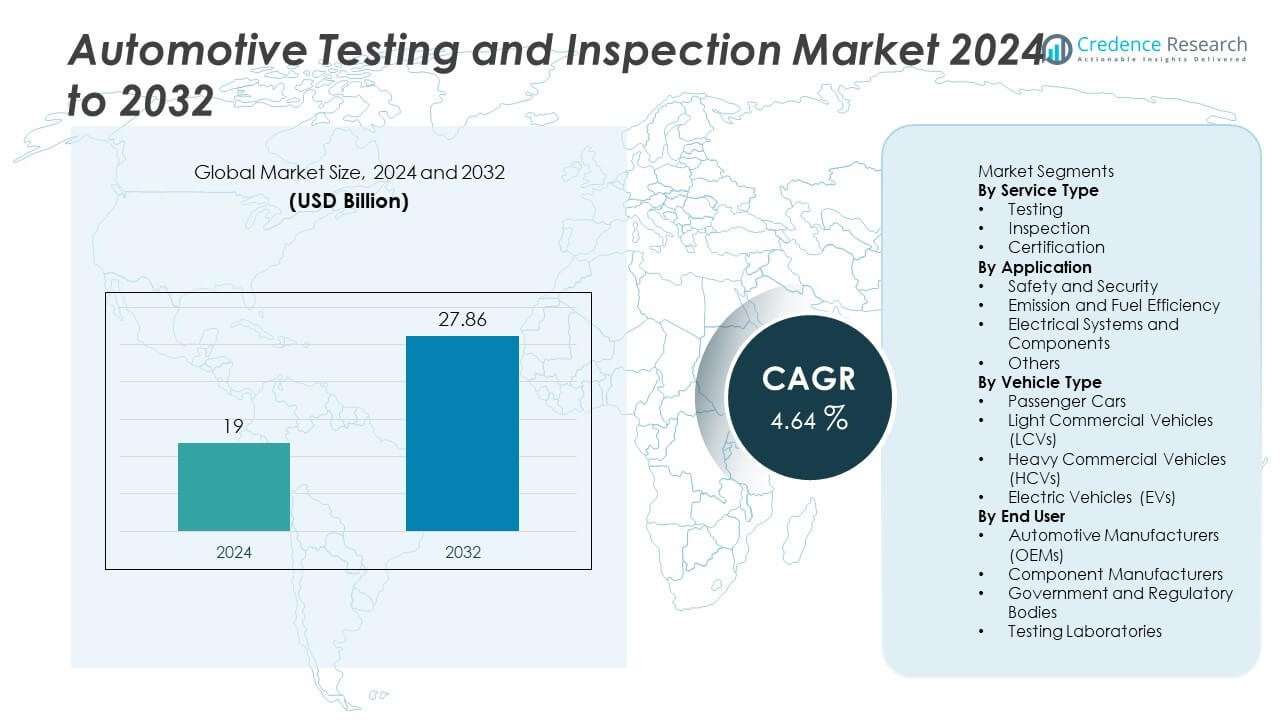

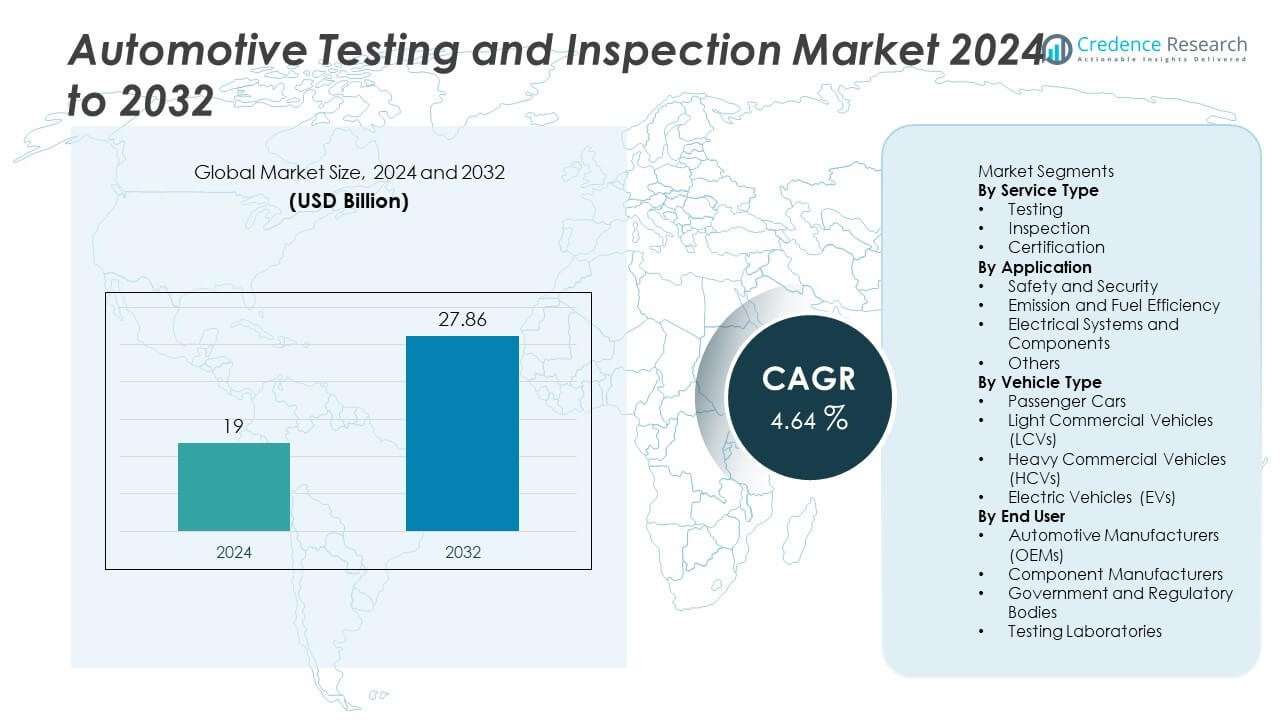

The global Automotive Testing And Inspection Market was valued at USD 19 billion in 2024 and is projected to reach USD 27.86 billion by 2032, expanding at a CAGR of 4.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Testing And Inspection Market Size 2024 |

USD 19 Billion |

| Automotive Testing And Inspection Market, CAGR |

4.64% |

| Antipsoriatics Market Size 2032 |

USD 27.86 Billion |

The automotive testing and inspection market is led by major companies such as TÜV SÜD Group, SGS SA, Bureau Veritas, Applus+, Intertek Group plc, DEKRA SE, Element Materials Technology, UL Solutions Inc., TÜV Rheinland Group, and MTS Systems Corporation. These organizations dominate through comprehensive service portfolios, advanced testing facilities, and adherence to international regulatory standards. North America leads the market with a 37.6% share in 2024, driven by strong regulatory frameworks and rapid adoption of electric vehicle testing. Europe follows with a 30.2% share, supported by stringent emission and safety norms, while Asia-Pacific holds a 24.8% share, emerging as the fastest-growing region due to large-scale automotive production and increasing investments in testing infrastructure.

Market Insights

- The automotive testing and inspection market was valued at USD 19 billion in 2024 and is projected to reach USD 27.86 billion by 2032, growing at a CAGR of 4.64%.

- Rising implementation of strict vehicle safety and emission regulations across major economies is driving demand for advanced testing, inspection, and certification services.

- The market is witnessing trends toward digital testing platforms, simulation-based analysis, and AI-driven inspection systems that improve accuracy and reduce validation time.

- Leading companies such as TÜV SÜD Group, SGS SA, and Bureau Veritas focus on expanding global testing networks, partnerships, and investments in electric and autonomous vehicle testing capabilities.

- North America leads with a 37.6% share, followed by Europe at 30.2%, while Asia-Pacific holds 24.8% share; the testing segment dominates by service type with 52.6% share, driven by high compliance and safety validation needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Testing dominates the automotive testing and inspection market, accounting for 52.6% share in 2024. This dominance is driven by stringent global regulations for vehicle safety, performance, and emissions that require extensive pre-production and post-production testing. The increasing complexity of modern vehicles, including electric and autonomous models, fuels demand for advanced testing facilities and simulation tools. Inspection services follow, supported by the need for regular maintenance and quality assurance, while certification plays a vital role in ensuring compliance with international standards and homologation requirements.

- For instance, SGS SA’s Chakan automotive lab in India conducts more than 10,000 component validation and durability tests per year, including advanced EV battery and thermal management assessments to meet UN ECE and AIS standards.

By Application

Safety and security lead the market with 38.4% share in 2024. The segment’s dominance is attributed to rising government mandates for occupant protection, crashworthiness, and active safety systems such as ADAS and autonomous features. Growing focus on electronic stability, airbag systems, and braking performance further drives segment growth. Emission and fuel efficiency testing hold significant importance due to tightening environmental norms, while electrical systems and component testing gain traction with the increasing penetration of hybrid and electric vehicles.

- For instance, TÜV SÜD Group’s dynamic crash testing center in Germany conducts numerous safety tests annually, including advanced sled tests with technology like the High G catapult and Active Lateral Intrusion Simulator (ALIS), supporting major OEMs in airbag and seatbelt validation.

By Vehicle Type

Passenger cars hold the largest market share of 46.9% in 2024. The strong demand stems from the high production volume of passenger vehicles and the integration of advanced safety, emission, and connectivity technologies. Manufacturers prioritize rigorous testing to meet international standards and enhance reliability. Electric vehicles are the fastest-growing segment, driven by regulatory pushes toward carbon neutrality and the need for battery, software, and system durability testing. Light and heavy commercial vehicles also contribute significantly as fleet operators focus on fuel efficiency and operational safety validation.

Key Growth Drivers

Stringent Vehicle Safety and Emission Regulations

Increasingly strict global standards for vehicle safety, performance, and emissions are driving demand for automotive testing and inspection services. Governments across regions are enforcing compliance with Euro 6, Bharat Stage VI, and U.S. EPA norms. These regulations require rigorous testing of vehicles and components for crashworthiness, fuel efficiency, and pollutant control. Automakers rely on advanced testing systems to ensure certification readiness, enhance product reliability, and avoid costly recalls, strengthening growth across OEM and supplier networks.

- For instance, DEKRA SE carried out 31.6 million vehicle-related tests in 2023, reinforcing its global leadership in vehicle testing and inspection services.

Rapid Growth of Electric and Autonomous Vehicles

The rising adoption of electric and autonomous vehicles is transforming the automotive testing and inspection market. EVs require specialized testing for battery safety, thermal management, and electronic systems. Similarly, autonomous vehicles demand precision validation of sensors, AI software, and communication networks. This technological shift has increased investment in simulation-based testing and digital validation tools, encouraging service providers to expand capabilities and meet evolving regulatory and performance standards globally.

- For instance, Applus+ IDIADA operates comprehensive proving grounds in Spain and China, featuring multiple specialized test tracks, including an ADAS and Connected Automated Vehicle (CAV) platform in Spain and 18 tracks in China.

Expansion of Connected and Smart Vehicle Technologies

Increasing integration of connected technologies such as ADAS, V2X communication, and infotainment systems is driving demand for advanced automotive testing solutions. These systems require validation for software reliability, cybersecurity, and interoperability. Testing providers are developing digital and hardware-in-the-loop platforms to ensure real-time data accuracy and compliance with cybersecurity frameworks. As vehicles become more connected and intelligent, testing and inspection services play a crucial role in ensuring safety, functionality, and seamless connectivity.

Key Trends and Opportunities

Adoption of Simulation and Virtual Testing

Virtual testing using digital twins and computer-aided engineering is becoming a major trend in the automotive testing industry. It reduces time and cost associated with physical testing by enabling early-stage performance evaluation and component optimization. Automakers are adopting simulation for EV battery performance, crash simulations, and ADAS functionality. The trend supports faster development cycles and compliance readiness, creating new opportunities for service providers specializing in virtual and hybrid testing environments.

- For instance, Siemens Digital Industries Software’s Simcenter platform offers advanced crash simulation capabilities, including occupant safety system development and battery pack crash analysis, using validated multi-body and finite element models.

Integration of AI and IoT in Testing Processes

Artificial intelligence and IoT technologies are enhancing automation and accuracy in testing and inspection systems. AI enables predictive analysis and defect detection, while IoT facilitates real-time monitoring and data-driven insights from test equipment. This integration improves efficiency, minimizes errors, and enhances system traceability. As automotive manufacturers transition to smart factories, AI- and IoT-enabled testing platforms are expected to become a core element of end-to-end quality assurance systems.

- For instance, Intertek Group plc leverages AI-based anomaly detection and IoT telemetry across its operations, including its automotive labs, to improve efficiency, provide predictive maintenance insights, and enhance the validation process for advanced systems such as EV and autonomous vehicle technologies.

Key Challenges

High Cost of Advanced Testing Infrastructure

The implementation of modern testing facilities, especially for electric and autonomous vehicles, requires significant capital investment. Specialized equipment, simulation tools, and compliance systems increase operational costs, limiting accessibility for small and mid-sized manufacturers. Moreover, the continuous need for equipment upgrades to meet evolving regulations further adds to financial pressure. Cost-effective modular testing solutions and shared infrastructure models are emerging as key approaches to overcome this challenge.

Complexity of Global Compliance and Standardization

Automotive testing and inspection processes vary widely across regions due to differing regulatory frameworks and certification requirements. Meeting multiple standards such as ISO, NHTSA, and UNECE adds complexity for global manufacturers. The lack of uniform testing parameters also delays product approvals and increases costs. Harmonizing international testing regulations and expanding cross-border certification recognition are essential to streamline processes and reduce compliance burdens for automakers.

Regional Analysis

North America

North America leads the automotive testing and inspection market with a 37.6% share in 2024. The region’s dominance is driven by stringent safety and emission regulations enforced by agencies such as the National Highway Traffic Safety Administration (NHTSA) and the Environmental Protection Agency (EPA). The United States plays a major role due to advanced R&D centers, widespread adoption of electric vehicles, and high investment in autonomous vehicle testing. Continuous technological innovation, coupled with collaboration between automakers and testing service providers, strengthens the region’s leadership in vehicle validation and compliance services.

Europe

Europe holds a 30.2% share in the automotive testing and inspection market in 2024. The region’s growth is supported by strict Euro 6 emission standards and robust government policies promoting sustainable mobility. Germany, the United Kingdom, and France are key contributors due to strong automotive manufacturing bases and advanced testing infrastructure. The shift toward electric mobility and connected vehicles has increased demand for software validation and component durability testing. Ongoing investments in digital testing laboratories and safety compliance initiatives further reinforce Europe’s position as a major testing hub.

Asia-Pacific

Asia-Pacific accounts for 24.8% of the global automotive testing and inspection market in 2024 and represents the fastest-growing region. Rapid industrialization, expanding automotive production, and government initiatives for emission control drive strong demand. China, Japan, South Korea, and India dominate regional growth, supported by the rising adoption of EVs and smart vehicles. Increasing investments in autonomous driving research, along with stringent safety and efficiency regulations, are accelerating testing demand. The emergence of local testing facilities and partnerships with international certification bodies continue to enhance regional market capacity.

Latin America

Latin America captures a 4.3% share in the automotive testing and inspection market in 2024. The region’s growth is influenced by rising automotive exports, stricter emission norms, and expanding vehicle production in Brazil and Mexico. Growing awareness of safety standards and the need for regulatory compliance are boosting demand for third-party testing and inspection services. However, limited infrastructure and high testing costs challenge widespread adoption. Despite this, increasing foreign investments and collaborations with global testing organizations are expected to drive steady progress in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 3.1% share in the automotive testing and inspection market in 2024. Market growth is driven by growing vehicle imports, infrastructure development, and rising government focus on road safety and emission control. The United Arab Emirates, Saudi Arabia, and South Africa are key markets adopting international testing and certification standards. Expansion of electric and hybrid vehicle segments is encouraging the establishment of local testing facilities. While the region remains in an early development stage, modernization initiatives are expected to create new opportunities for testing service providers.

Market Segmentations:

By Service Type

- Testing

- Inspection

- Certification

By Application

- Safety and Security

- Emission and Fuel Efficiency

- Electrical Systems and Components

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

By End User

- Automotive Manufacturers (OEMs)

- Component Manufacturers

- Government and Regulatory Bodies

- Testing Laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the automotive testing and inspection market is shaped by leading players such as TÜV SÜD Group, SGS SA, Bureau Veritas, Applus+, Intertek Group plc, DEKRA SE, Element Materials Technology, UL Solutions Inc., TÜV Rheinland Group, and MTS Systems Corporation. These companies maintain strong global positions through extensive service networks, technical expertise, and continuous investments in advanced testing infrastructure. They offer comprehensive solutions covering vehicle safety, emissions, durability, and component certification to ensure compliance with international standards. Strategic collaborations with automotive manufacturers, government bodies, and technology developers enable expansion into electric and autonomous vehicle testing domains. The increasing adoption of digital testing tools, simulation platforms, and AI-driven inspection systems is enhancing efficiency and precision. Competition remains focused on innovation, service diversification, and regional expansion, with companies aiming to strengthen their foothold in high-growth markets across Asia-Pacific and North America.

Key Player Analysis

- TÜV SÜD Group

- SGS SA

- Bureau Veritas

- Applus+

- Intertek Group plc

- DEKRA SE

- Element Materials Technology

- UL Solutions Inc.

- TÜV Rheinland Group

- MTS Systems Corporation

Recent Developments

- In September 2025, TÜV SÜD highlighted that its operations in India became a centre of competence for automotive cybersecurity and functional safety, supporting its global mobility portfolio.

- In March 2025, TÜV SÜD AG expanded its test laboratory in Frankfurt am Main to include crash testing for charging plugs and performance testing for small batteries..

- In March 2024, SGS expanded flammability-testing services for automotive, aviation and maritime sectors at its US laboratory in Farmingdale, New York.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, Vehicle Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for testing services will increase as electric and autonomous vehicles become mainstream.

- Advanced simulation and digital twin technologies will reduce testing time and costs.

- AI and machine learning will improve inspection accuracy and predictive maintenance capabilities.

- Adoption of remote and automated inspection solutions will rise across global facilities.

- Integration of cybersecurity testing will expand with growing vehicle connectivity.

- Governments will enforce stricter safety and emission norms, boosting certification demand.

- Asia-Pacific will emerge as the fastest-growing region due to rapid automotive production.

- Collaboration between OEMs and testing agencies will enhance compliance efficiency.

- Investments in battery, software, and electronic component testing will accelerate.

- Expansion of global testing networks will strengthen market reach and competitiveness.