Market Overview

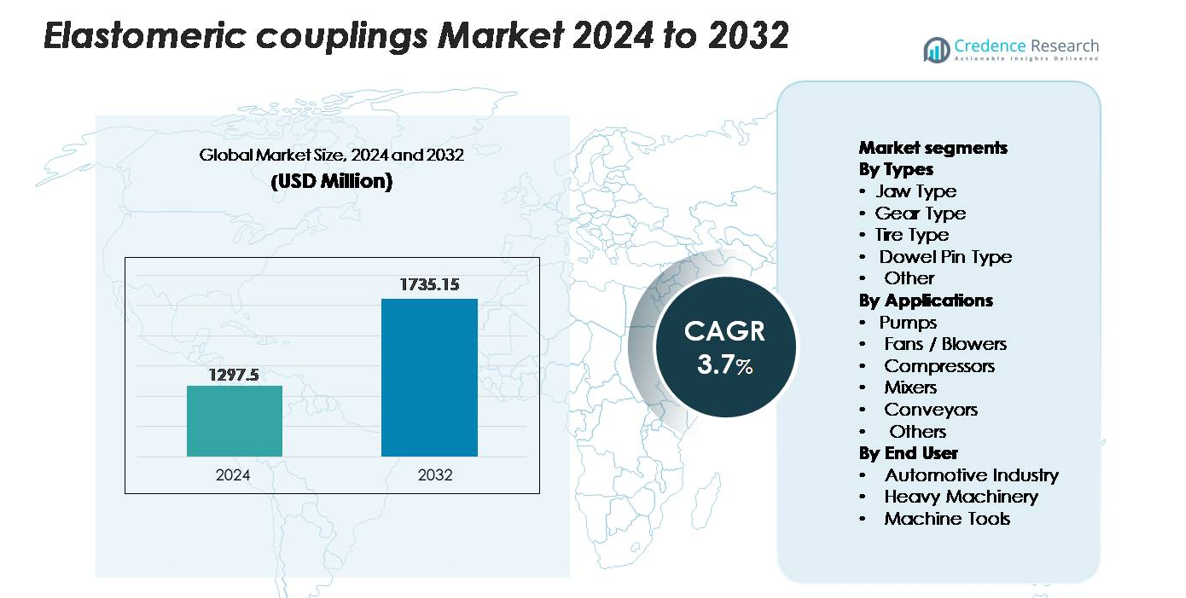

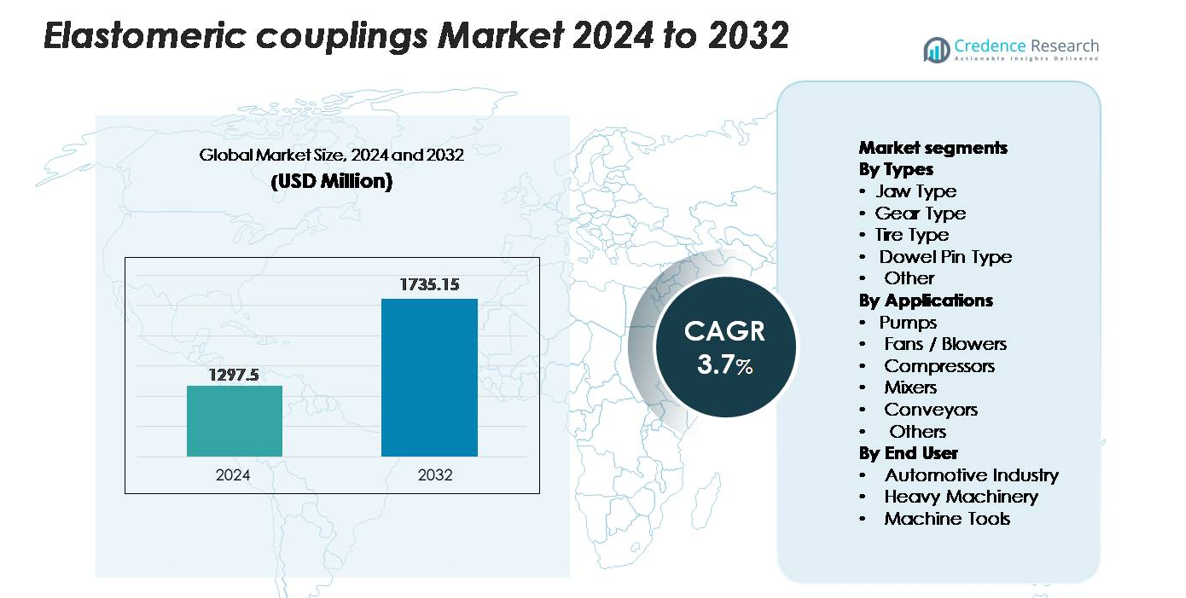

The global Elastomeric Couplings Market was valued at USD 1,297.5 million in 2024 and is projected to reach USD 1,735.15 million by 2032, advancing at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Elastomeric Couplings Market Size 2024 |

USD 1,297.5 million |

| Elastomeric Couplings Market, CAGR |

3.7% |

| Elastomeric Couplings Market Size 2032 |

USD 1,735.15 million |

The elastomeric couplings market is shaped by a mix of global and regional leaders, including Siemens, Regal Rexnord, Dodge, Altra Industrial Motion, SKF, Voith, REICH, Renold, John Crane, Tsubakimoto Chain, R+W Coupling, LORD, KWD, KTR, and VULKAN. These companies compete through advanced elastomer formulations, high-precision machining, and application-specific coupling designs for pumps, compressors, conveyors, and automation systems. Asia Pacific stands out as the leading region with a 34–36% market share, driven by rapid industrialization and large-scale manufacturing activity. North America and Europe follow, supported by strong adoption in automotive, oil & gas, and high-precision machinery applications.

Market Insights

- The global elastomeric couplings market was valued at USD 1,297.5 million in 2024 and is expected to reach USD 1,735.15 million by 2032, registering a CAGR of 3.7% during the forecast period.

- Strong demand from pumps, compressors, and conveyors drives market expansion, with pumps accounting for the largest application share, supported by industrial fluid-handling growth across utilities and processing plants.

- Market trends focus on maintenance-free couplings, high-durability elastomers, and precision-engineered designs suited for automation, robotics, and high-speed machinery, especially in modern manufacturing facilities.

- Competitive intensity increases as players like Siemens, Regal Rexnord, SKF, Voith, REICH, and Altra Industrial Motion invest in advanced materials, modular hub designs, and global distribution networks while facing restraints such as limited suitability in high-torque and high-temperature environments.

- Asia Pacific leads with 34–36% market share, followed by North America (28–30%) and Europe (24–26%), reflecting strong industrialization, pump deployment, and modernization of rotating equipment across key sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Types:

Jaw-type elastomeric couplings represent the dominant sub-segment, accounting for the largest market share due to their compact structure, ease of installation, and ability to accommodate angular and parallel misalignment in industrial drives. Their replaceable elastomeric spiders reduce maintenance downtime, making them preferred in general-purpose machinery and OEM equipment. Gear-type couplings follow closely in applications requiring higher torque transmission, while tire-type and dowel-pin variants serve vibration-sensitive and heavy-duty rotating systems. Growing demand for flexible, shock-absorbing power-transmission components across manufacturing plants continues to reinforce jaw-type adoption.

- For instance, KTR’s ROTEX® jaw coupling range supports nominal torques up to 35,000 Nm and compensates for angular misalignment up to 1°, providing robust damping in pump and compressor drives.

By Applications:

Pumps hold the highest market share among applications, driven by their widespread use in water treatment facilities, chemical plants, HVAC systems, and oil & gas installations. Elastomeric couplings are favored in pump assemblies for their torsional flexibility, vibration damping, and ability to protect connected equipment from overload. Fans and blowers form the next major segment, particularly in ventilation and industrial air-handling systems that rely on misalignment-tolerant drivetrains. Compressors, mixers, and conveyor systems further contribute to market expansion as industries modernize rotating equipment to reduce noise, optimize alignment, and extend service life.

- For instance, the John Crane Powerstream® A-Series elastomeric coupling line offers models with maximum continuous torques up to 20,936 Nm (185,300 lb.in.) and are rated for speeds up to 9,600 rpm (for the smallest size, the A00C), enabling reliable performance in demanding pump and blower systems

By End User:

The automotive industry emerges as the leading end-user segment, securing the largest market share due to high integration of elastomeric couplings in engine test rigs, assembly systems, paint-shop conveyors, and robotic handling units. Their ability to reduce backlash, absorb shock loads, and enhance drivetrain reliability makes them essential across automotive manufacturing lines. Heavy machinery follows closely, driven by construction, mining, and processing equipment requiring robust torque-handling capability. Machine tool manufacturers also deploy elastomeric couplings for precise rotational control and vibration suppression in CNC systems, milling machines, and cutting tools, supporting consistent operational accuracy.

Key Growth Drivers

Rising Demand for Vibration-Damping Solutions in Rotating Equipment

Industrial facilities increasingly prioritize equipment reliability, reduced noise levels, and vibration control, which strengthens adoption of elastomeric couplings. Their inherent flexibility allows them to absorb torsional shocks, dampen dynamic loads, and maintain alignment across pumps, compressors, mixers, and conveyors. As industries digitize and deploy more sensitive automation systems, the need for couplings that protect motors and driven shafts becomes essential. Manufacturers also benefit from elastomeric couplings’ low maintenance requirements and simple installation, reducing operational downtime. Upgrades in water treatment, HVAC modernization, and growth in mid-sized industrial plants further accelerate replacement cycles, reinforcing long-term demand for flexible, damping-capable coupling solutions.

- For instance, REICH’s ARCUSAFLEX® rubber-disc coupling offers nominal torque capacities up to 72,000 Nm and torsional damping levels optimized for fluctuating load profiles, enabling measurable reductions in vibratory stress on connected machinery.

Expansion of Automation, Robotics, and High-Speed Machinery

The accelerated deployment of automated production lines, robotics, and CNC systems boosts the need for highly reliable couplings capable of operating at higher speeds with minimal backlash. Elastomeric couplings are increasingly used in servo-driven systems and precision machinery because they accommodate parallel and angular misalignment while ensuring smooth torque transmission. Their ability to maintain dynamic stability without frequent lubrication makes them suitable for fast-paced industrial processes. Growth in electronics assembly, packaging, automotive manufacturing, and semiconductor equipment strengthens this demand. As factories transition toward intelligent, high-throughput operations, elastomeric couplings become integral components supporting continuous, precision-intensive performance.

- For instance, R+W’s EKH elastomer coupling series is designed for applications in high-speed servo axes and robotic joints that require precise torsional behavior. The series features a broad torque range from 4 Nm up to 25,000 Nm and can accommodate standard operating speeds up to 13,000 rpm for smaller models, with finely balanced versions capable of reaching even higher speeds, depending on the specific model and elastomer insert used.

Growth in Fluid Handling Systems Across Industrial and Utility Sectors

Infrastructure development and industrial expansion continue to boost investment in pumps, blowers, and compressors equipment that relies heavily on elastomeric couplings. Utilities upgrading wastewater and desalination plants, chemical processors expanding fluid-transfer lines, and oil & gas operators enhancing midstream facilities all require reliable coupling systems. Elastomeric couplings’ ability to handle misalignment caused by thermal variations and mounting inconsistencies makes them ideal for pump-driven installations. In addition, their resistance to corrosive environments and operational flexibility promotes adoption in demanding processes such as slurry transport, ventilation, and chemical dosing. As global fluid-handling capacities scale, coupling demand increases proportionally.

Key Trends & Opportunities

Shift Toward Maintenance-Free and High-Durability Coupling Designs

A major trend shaping the market is the growing preference for maintenance-free designs using advanced elastomers that resist wear, fatigue, and chemical degradation. Manufacturers are developing couplings with higher torsional stiffness, improved thermal resistance, and extended service life to meet modern machinery requirements. This evolution opens opportunities for premium-grade elastomeric products tailored for harsh-duty pumps, compressors, and heavy industrial drives. The expansion of predictive maintenance and condition monitoring systems also encourages the adoption of couplings engineered for consistent performance under fluctuating loads. As industries pursue longer operating cycles and reduced maintenance budgets, demand for next-generation durable elastomeric couplings rises sharply.

- For instance, Siemens’ FLENDER N-Eupex DK elastomer coupling variant uses thermally optimized polymer elements tested for continuous operation at 90°C and rated for torques up to 70,000 Nm, enabling substantially longer service intervals in heavy-duty pump and compressor systems.

Increasing Customization for High-Precision and Sector-Specific Applications

Industries increasingly request customized couplings optimized for their operating conditions, creating meaningful opportunities for specialized manufacturers. Sectors such as packaging, semiconductor fabrication, pharmaceuticals, and food processing demand precision-aligned rotating components with controlled torsional behavior. This trend encourages development of application-specific elastomeric compounds, modular hub designs, and lightweight geometries suited for confined equipment spaces. Opportunities also emerge from renewable energy applications such as wind turbines and small hydropower units, where flexible misalignment compensation is critical. Customization enhances performance and reliability, enabling suppliers to differentiate their offerings in niche, high-performance industrial environments.

- For instance, Voith’s K series of highly flexible elastomer couplings incorporates customized elastomer packs engineered to withstand dynamic torques up to 1,300,000 Nm (1,300 kNm) and accommodate axial, radial, and angular displacements, meeting stringent requirements in precision-driven drive systems.

Adoption of Eco-Friendly and Energy-Efficient Industrial Components

Sustainability-oriented procurement policies are driving adoption of elastomeric couplings made from recyclable materials and energy-efficient designs that reduce mechanical losses. Industries aiming to comply with carbon-reduction mandates increasingly prefer components that support low-noise, low-vibration operation and extend equipment lifespan, thereby lowering total energy consumption. Manufacturers exploring bio-based elastomers and environmentally benign additives are well-positioned to gain traction. As industrial sustainability certifications and ESG reporting become mainstream, opportunities widen for suppliers offering eco-focused coupling technologies with reduced environmental impact

Key Challenges

Performance Limitations in High-Torque and High-Temperature Environments

Despite their advantages, elastomeric couplings face operational limitations in applications requiring extremely high torque, elevated temperatures, or exposure to aggressive chemicals. The elastomer elements may degrade, harden, or crack under continuous thermal stress, impacting coupling lifespan and performance stability. Heavy industrial systems such as large compressors, metal processing lines, and marine propulsion often require metallic gear or disc couplings instead. This restricts elastomeric couplings from penetrating ultra-heavy-duty markets. Overcoming these constraints requires advanced materials engineering and costlier formulations, which may hinder adoption in price-sensitive industries.

Intense Competition from Alternative Coupling Technologies

The market faces strong competition from gear, disc, grid, and fluid couplings, which offer superior performance in certain high-power or precision-heavy applications. These alternatives often deliver higher torque capacity, better thermal tolerance, and more predictable torsional stiffness, making them suitable for critical machinery. As industries pursue higher power densities and faster operating speeds, metallic and composite couplings could increasingly replace elastomeric types in specialized machinery. This competitive pressure forces elastomeric coupling manufacturers to invest in R&D, develop higher-performance elastomers, and offer improved lifecycle benefits raising overall production costs and squeezing margins.

Regional Analysis

North America

North America holds an estimated 28–30% share of the elastomeric couplings market, driven by strong adoption across automated manufacturing, oil & gas operations, and water treatment infrastructure. The United States leads regional demand due to extensive industrial retrofitting, high pump and compressor deployment, and rapid modernization of factory automation systems. Growth is also supported by expanding robotics applications in automotive and aerospace facilities. Canadian demand increases through investments in power generation, mining, and municipal utilities. The region’s emphasis on reducing maintenance downtime and improving equipment efficiency continues to reinforce steady uptake of elastomeric coupling solutions.

Europe

Europe accounts for approximately 24–26% of global market share, supported by well-established manufacturing clusters in Germany, Italy, and France. The region’s stringent operational safety norms and long-standing focus on vibration control enhance adoption in pumps, conveyors, and precision machinery. Growth in renewable energy plants, wastewater treatment facilities, and environmental compliance upgrades further expands demand. The automotive sector remains a major consumer, particularly in powertrain testing, machining systems, and assembly-line automation. Ongoing investment in Industry 4.0 and high-efficiency rotating equipment enables European industries to prioritize flexible couplings that reduce energy losses and extend machinery life.

Asia Pacific

Asia Pacific dominates the global landscape with the largest market share of 34–36%, driven by large-scale industrialization across China, India, Japan, and Southeast Asia. Rapid expansion of manufacturing plants, chemical processing units, and fluid-handling infrastructure fuels strong coupling consumption. China leads regional demand due to its vast pump, compressor, and automotive production base, while India’s growth is propelled by investments in heavy machinery, power generation, and smart manufacturing. Market penetration is also accelerated by rising adoption of precision equipment in electronics and semiconductor assembly. The region’s competitive manufacturing ecosystem drives high-volume procurement of elastomeric couplings.

Latin America

Latin America holds a moderate share of 7–8%, driven by demand from mining, oil & gas, food processing, and cement manufacturing sectors. Countries such as Brazil, Mexico, and Chile are expanding fluid-handling and material-processing capacity, supporting higher utilization of pumps, mixers, and conveyors equipped with elastomeric couplings. Industrial modernization efforts particularly in automotive assembly and agribusiness contribute to growing adoption of flexible, maintenance-friendly coupling types. Despite economic fluctuations, rising investment in water treatment facilities and infrastructure rehabilitation provides consistent demand. The region continues to benefit from increasing focus on equipment reliability and reduced downtime.

Middle East & Africa (MEA)

The Middle East & Africa region represents roughly 6–7% of the global market, supported by strong deployment of pumps, compressors, and blowers in oil & gas, petrochemical, and desalination operations. GCC countries lead demand with large-scale industrial projects and heavy investment in fluid-handling systems used in refining and wastewater management. In Africa, growing mining activity and electricity infrastructure upgrades stimulate additional coupling consumption. The region’s harsh operating environments characterized by heat, dust, and corrosive conditions drive preference for elastomeric couplings that offer misalignment tolerance and vibration damping while minimizing maintenance needs in remote industrial locations.

Market Segmentations:

By Types

- Jaw Type

- Gear Type

- Tire Type

- Dowel Pin Type

- Other

By Applications

- Pumps

- Fans / Blowers

- Compressors

- Mixers

- Conveyors

- Others

By End User

- Automotive Industry

- Heavy Machinery

- Machine Tools

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The elastomeric couplings market features a moderately consolidated competitive landscape, with global manufacturers competing on product durability, torsional performance, material innovation, and customization capabilities. Leading players focus on engineering advanced elastomer compounds that offer improved fatigue resistance, higher torque capacity, and better temperature stability to meet diverse industrial requirements. Competition is further shaped by the expansion of product portfolios targeting pumps, compressors, blowers, and precision machinery. Companies increasingly invest in automated manufacturing, precision machining, and modular hub designs to enhance consistency and reduce lead times. Strategic priorities also include strengthening distributor networks, improving aftermarket support, and expanding into high-growth regions such as Asia Pacific. As end users demand maintenance-free, vibration-damping solutions compatible with modern automated systems, manufacturers differentiate through application-specific designs, digital configuration tools, and performance-tested elastomer elements. Ongoing R&D efforts and selective mergers or partnerships continue to define competitive positioning in this evolving industrial components market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- VULKAN (India)

- Renold (UK)

- LORD (U.S.)

- KTR (India)

- Voith (Germany)

- John Crane (U.S.)

- R+W Coupling (U.S.)

- REICH (Germany)

- Siemens (Germany)

- Dodge (U.S

Recent Developments

- In June 2024, John Crane exhibited its coupling solutions at ACHEMA 2024 in Frankfurt. At the event, the company highlighted its Powerstream® elastomeric coupling series featuring urethane inserts with unrestricted shelf life, designed for pump, conveyor, and blower applications.

- In February 2024, REICH launched its “Hybrid drive for track construction machines” solution, combining the ARCUSAFLEX® rubber disc coupling with a switchable electromagnetic coupling, tailored for heavy-duty van/rail applications.

Report Coverage

The research report offers an in-depth analysis based on Types, Applications, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook

- Demand for elastomeric couplings will rise as industries modernize pumps, compressors, and mixers to improve reliability and reduce downtime.

- Automation and robotics expansion will increase adoption of flexible, low-maintenance coupling designs with improved torsional performance.

- Advancements in high-durability elastomer materials will extend coupling lifespan and support broader use in harsh operating environments.

- Precision machinery growth will drive demand for low-backlash couplings suited for CNC, packaging, and semiconductor applications.

- Manufacturers will invest in customized coupling solutions tailored to industry-specific torque, misalignment, and vibration requirements.

- Digital configuration tools and performance modeling will streamline coupling selection and enhance engineering accuracy.

- Energy-efficient industrial operations will favor couplings that reduce vibration-induced losses and enhance motor efficiency.

- Regional manufacturing expansion in Asia Pacific will continue to strengthen global production and consumption.

- Aftermarket demand will grow as plants prioritize predictive maintenance and regular elastomer replacement cycles.

- Competitive differentiation will focus on material innovation, modular designs, and expanded global distribution networks.