Market Overview

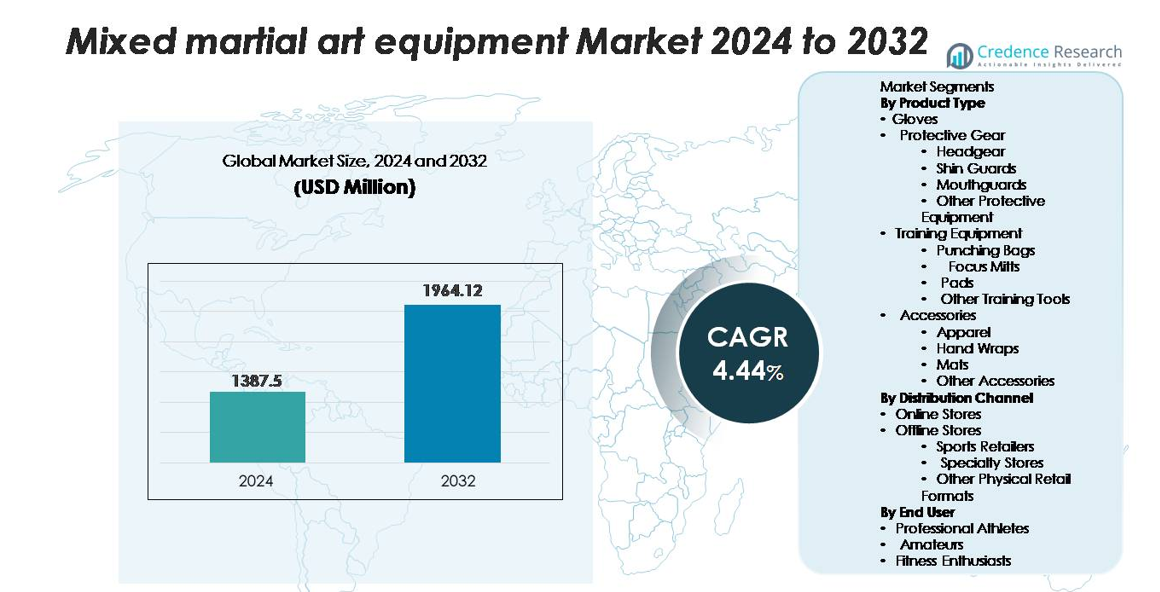

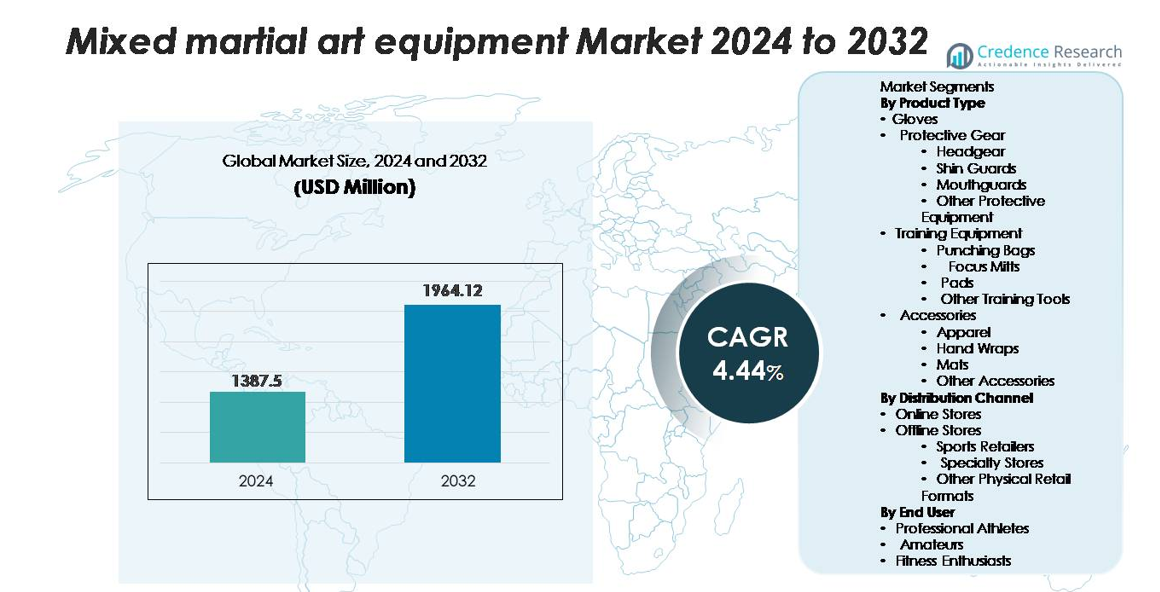

The global Mixed Martial Arts (MMA) Equipment Market was valued at USD 1,387.5 million in 2024 and is projected to reach USD 1,964.12 million by 2032, reflecting a CAGR of 4.44% over the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mixed Martial Art Equipment Market Size 2024 |

USD 1,387.5 million |

| Mixed Martial Art Equipment Market, CAGR |

4.44% |

| Mixed Martial Art Equipment Market Size 2032 |

USD 1,964.12 million |

Leading players in the Mixed Martial Arts (MMA) equipment market include RDX Sports Ltd., Fairtex Equipment Co. Ltd., Venum, Combat Sports International, Twins Special Co. Ltd., Adidas AG, Century Martial Arts, Revgear Sports Co., Hayabusa Fightwear Inc., and Everlast Worldwide Inc. These companies compete through advanced material engineering, athlete partnerships, and strong omnichannel distribution. Product portfolios emphasize high-performance gloves, protective gear, and training equipment tailored for both professional fighters and fitness-driven users. North America leads the global market with a 35–38% share, supported by a mature combat-sports culture, premium product adoption, and dense gym networks, while Europe and Asia-Pacific follow as key high-growth regions.

Market Insights

- The global Mixed Martial Arts (MMA) equipment market was valued at USD 1,387.5 million in 2024 and is projected to reach USD 1,964.12 million by 2032, registering a CAGR of 4.44% during the forecast period.

- Growing participation in MMA training, fitness-based striking programs, and rising demand for premium gloves—the dominant product segment with 35–38% share—continue to drive purchasing activity across professional and recreational users.

- Material innovation, including lightweight composites, moisture-resistant padding, and ergonomic protective gear, shapes current market trends, while brands strengthen digital presence through D2C models and omnichannel expansion.

- Competitive intensity rises as global players such as Venum, RDX Sports, Adidas, Hayabusa, and Fairtex focus on durability improvements, while market restraints include high equipment replacement rates and counterfeit product penetration across online channels.

- Regionally, North America leads with 35–38% share, followed by Europe at 25–27%, while Asia-Pacific (23–25%) emerges as the fastest-growing region due to expanding MMA gyms and youth participation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Gloves remain the dominant product type, holding an estimated 35–38% market share, driven by their mandatory use in both training and competitive settings. Their frequent replacement cycle due to wear, sweat absorption, and hygiene requirements sustains recurring demand. Protective gear such as headgear, shin guards, and mouth guards continues to expand as safety regulations tighten across gyms and federations. Training equipment, including punching bags, pads, and focus mitts, supports gym-scale procurement, while accessories like apparel, hand wraps, and mats benefit from lifestyle-driven adoption. Overall, gloves continue to lead due to consistent usage intensity across all skill levels.

- For instance, RDX Sports offers headgear such as the T1 head guard series, which is crafted from durable Maya Hide leather and features multi-layered padding, including EVA-Lution and other foams, to absorb impacts. The headgear is CE-certified and complies with the EN 13277-4 standard, which limits the maximum transmitted force during testing to less than 2 kN.

By Distribution Channel

Online stores represent the leading distribution channel with an approximate 55–58% market share, supported by growing e-commerce penetration, wider product availability, and competitive pricing. Digital platforms benefit from strong brand visibility, consumer reviews, and frequent discount cycles, which influence purchasing decisions for both beginners and professionals. Offline stores comprising sports retailers, specialty stores, and other physical outlets retain relevance by offering product testing and expert consultation, particularly for premium gloves and customized protective gear. Specialty stores perform well in urban training clusters but online platforms maintain dominance due to convenience and extensive assortments.

- For instance, Dick’s Sporting Goods operates over 885 stores in the US and utilizes a comprehensive, store-wide RFID tagged inventory system to support efficient inventory management and omnichannel order fulfillment.

By End User

Fitness enthusiasts form the largest end-user segment, capturing roughly 48–52% market share, propelled by rising participation in MMA-inspired fitness programs and the integration of striking workouts in mainstream gyms. This group drives substantial demand for gloves, pads, and basic protective gear. Amateur practitioners also contribute significantly as they scale up equipment usage while progressing through training levels. Professional athletes, though smaller in volume, create high-value demand for premium-grade gloves and advanced protective equipment. The dominance of fitness enthusiasts reflects MMA’s transition from a competitive sport to a widely embraced training and conditioning discipline.

Key Growth Drivers

Expanding Global Participation in Combat Sports and Fitness Conditioning

The rapid rise of MMA as both a competitive sport and fitness discipline significantly accelerates equipment demand. Participation has grown across North America, Europe, and Asia-Pacific, fueled by the expansion of MMA gyms, youth academies, and cross-training programs in conventional fitness centers. As consumers increasingly incorporate striking-based workouts, gloves, pads, and protective gear remain essential purchase categories. Major MMA promotions, athlete endorsements, and streaming platforms amplify global visibility, encouraging more users to adopt structured training routines. Fitness chains integrating MMA cardio classes further widen the user base, prompting recurring equipment replacement due to intense usage cycles. This broadening participation from recreational fitness seekers to amateur fighters creates sustained, multi-tier equipment demand across price points.

- For instance, the UFC Apex facility uses a professional broadcast setup that includes 4K and HD camera systems, robotic camera control rooms, and remote-operated heads to support live fight production. The venue also features Shure wireless microphone systems integrated into its production chain, as listed in its official equipment roster. This setup ensures consistent audio-visual quality during global UFC broadcasts.

Rising Safety Awareness and Strengthening Regulatory Requirements

Advocacy for safer combat sports fuels higher adoption of certified protective gear. Sports federations, gym operators, and event organizers enforce stricter safety norms, mandating verified headgear, shin guards, mouthguards, and groin protection. Heightened awareness of impact-related injuries drives consumers to prefer high-quality, shock-absorbing equipment. Protective innovations such as multi-layer foam systems, moisture-resistant padding, reinforced stitching, and ergonomic headgear design help reduce injury risk, encouraging premium upgrades. Pediatric and youth MMA programs where safety regulations are more stringent contribute strongly to protective gear purchases. As MMA evolves into a structured discipline with organized leagues and tournaments, adherence to safety standards expands rapidly, positioning protective equipment as one of the fastest-growing categories.

- For instance, Twins Special’s SGL-10 shin guards use high-density multi-layer foam padding and 100% genuine Thai leather to deliver strong shock absorption during training. The design includes double hook-and-loop straps and a pre-curved ergonomic profile for a stable, secure fit. Each pair is handmade in Thailand, reflecting the brand’s established craftsmanship in combat sports gear.

Growth of E-Commerce and Direct-to-Consumer (D2C) Brand Strategies

Digitization continues to transform purchasing behavior, making online platforms a primary demand driver for MMA equipment. Brands leverage e-commerce marketplaces, D2C channels, and social-commercial integrations to reach broader audiences with lower distribution overhead. Digital storefronts allow extensive product assortment, influencer-led marketing, and AI-driven product recommendations that enhance consumer engagement. Subscription-based purchase cycles for hand wraps, apparel, and replacement gloves also gain traction. Online channels support product comparison, user reviews, and convenient returns—particularly beneficial for first-time users choosing sizing or material specifications. As brands deploy faster delivery, omnichannel strategies, and customized digital campaigns, online retail continues expanding its share, fueling consistent equipment sales across demographics.

Key Trends & Opportunities

Integration of Advanced Materials and Performance-Enhancing Designs

Material innovation emerges as a defining trend, as manufacturers engineer equipment that delivers improved durability, shock absorption, ventilation, and ergonomic comfort. High-density foam composites, microfiber leather, breathable mesh linings, and moisture-wicking fabrics are increasingly integrated into gloves and protective gear. Lightweight punching bags with enhanced filling technologies reduce floor strain while maintaining realistic impact response. Custom-fit mouthguards and anatomically shaped shin guards offer higher protection and training comfort. As consumers seek equipment optimized for performance and longevity, brands investing in technical material upgrades gain a competitive edge. This creates opportunities for premium product lines targeting advanced users and professionals demanding superior feel, resilience, and precision support.

- For instance, Budo Nord’s WKF-approved headgear is CE-certified and tested under the EN 13277-4 standard, which requires transmitted impact forces to remain below 2 kN. The model includes a transparent protective mask used in youth competition categories and meets the safety criteria defined by the World Karate Federation

Expanding Fitness Hybridization and Cross-Training Applications

MMA-inspired training continues to expand beyond combat gyms into mainstream fitness environments. Hybrid workout formats combining striking drills, conditioning circuits, agility routines, and strength exercises create new opportunities for equipment manufacturers. Punching bags, mitts, and mats are now commonly integrated into boot camps, high-intensity interval training (HIIT) sessions, and functional fitness programs. This shift broadens demand beyond competitive fighters to everyday gym users seeking high-calorie, full-body training experiences. The trend encourages production of beginner-friendly, lightweight equipment and modular kits designed for home gyms. Manufacturers benefit from appealing to a wider fitness ecosystem seeking versatile tools for dynamic cross-training applications.

- For instance, Everlast’s HydroStrike heavy bags are designed to be water-filled and use HydroStrike technology to enhance strike absorption for a more natural impact feel. The water core helps reduce stress on the wrists and elbows compared to traditional fiber-filled bags. This design makes the bags popular among fitness users seeking lower-impact training equipment.

Growing Popularity of Home Training and Compact MMA Equipment

Home-based fitness continues to present strong opportunities, especially as consumers seek flexible training solutions outside traditional gyms. Compact punching bags, portable pads, foldable mats, and beginner glove sets are increasingly purchased by individuals building home workout spaces. Social media tutorials, virtual coaching programs, and online MMA classes accelerate this trend by offering structured training pathways. Manufacturers respond with space-saving designs, easy storage features, and multipurpose equipment that suits smaller living environments. The market benefits from rising consumer willingness to invest in high-quality, at-home fitness setups, creating sustained demand for user-friendly MMA training essentials.

Key Challenges

Prevalence of Low-Quality Counterfeit Products in the Market

The MMA equipment industry faces persistent challenges from counterfeit and substandard products that flood online marketplaces. These items often mimic leading brands but use inferior materials that compromise durability, safety, and performance. Counterfeits can cause injuries, degrade customer trust, and undermine the credibility of established manufacturers. The problem intensifies with unregulated third-party sellers and globalized e-commerce networks, making enforcement difficult. Premium brands are forced to increase investments in anti-counterfeiting technologies, authentication systems, and awareness campaigns. The presence of unsafe counterfeit gear also pressures regulatory agencies and gyms to tighten quality checks, raising operational overhead across the value chain.

High Wear-and-Tear Rates Leading to Elevated Replacement Costs

MMA equipment undergoes significant wear due to high-impact usage, sweat exposure, and repetitive training cycles. Gloves lose padding integrity, wraps fray, mouthguards degrade, and protective gear deteriorates over time, creating frequent replacement needs. While this generates recurring revenue, it also raises cost barriers for beginners and fitness users who may find premium equipment expensive to maintain. Gyms face elevated costs as they replace shared equipment frequently to maintain hygiene and safety standards. Price-sensitive consumers may shift toward cheaper alternatives, intensifying brand competition and squeezing margins. This challenge reinforces the need for manufacturers to balance durability, affordability, and material innovation.

Regional Analysis

North America

North America holds the largest market share of 35–38%, driven by strong participation in organized MMA, well-established training facilities, and high adoption of premium protective gear. The region benefits from the influence of major MMA promotions, which significantly boost equipment demand among both athletes and fitness users. Expanding youth programs and continuous investments by commercial gyms further support category growth. Consumers show strong preferences for branded gloves, performance apparel, and certified safety equipment. The presence of leading manufacturers and advanced retail networks reinforces North America’s dominant position in the global market.

Europe

Europe accounts for around 25–27% of global demand, supported by rising interest in combat sports, increasing gym memberships, and the expansion of MMA academies in the U.K., Germany, France, and Eastern Europe. Strong regulatory emphasis on safety encourages higher adoption of certified protective gear. The sport’s growing visibility through televised events and regional tournaments fuels equipment upgrades across amateur and semi-professional categories. E-commerce growth has improved access to international brands, while specialty retailers continue to cater to advanced users. Europe’s diverse consumer base strengthens demand across gloves, apparel, and training equipment.

Asia-Pacific

Asia-Pacific represents 23–25% of the global market, emerging as the fastest-growing region due to rapid expansion of MMA organizations, increased youth participation, and rising urban fitness engagement. Countries such as China, Japan, South Korea, and Australia are witnessing strong adoption of MMA-inspired fitness programs. Affordable manufacturing boosts the availability of competitively priced equipment, particularly gloves, pads, and apparel. The region also benefits from government-supported sports development initiatives and a surge in boutique combat gyms. Asia-Pacific’s growing middle-class consumer base and digital retail penetration continue to accelerate equipment demand across all skill levels.

Latin America

Latin America captures 6–8% of the market, supported by strong cultural affinity for combat sports, rising popularity of regional MMA leagues, and increasing fitness-center expansions in Brazil, Mexico, and Argentina. Growth is driven by demand for entry-level gloves, protective gear, and home-training equipment, especially among younger consumers. While affordability remains a key purchasing factor, premium segments are slowly expanding as urban gyms introduce structured MMA programs. E-commerce adoption provides broader access to branded products, helping the region overcome earlier supply limitations. Latin America shows stable growth momentum driven by community-based training culture.

Middle East & Africa

The Middle East & Africa region holds 4–5% market share, supported by rising interest in combat sports, particularly in the UAE, Saudi Arabia, and South Africa. Government-backed sports initiatives and major MMA events hosted in the Gulf region elevate equipment demand. Growth is concentrated in urban centers where fitness clubs integrate striking and functional training modules. Consumers increasingly purchase gloves, wraps, and basic protective equipment as MMA becomes a mainstream fitness activity. Limited local manufacturing keeps the market dependent on imports, but expanding specialty retail and online channels continue to improve product availability.

Market Segmentations:

By Product Type

- Gloves

- Protective Gear

- Headgear

- Shin Guards

- Mouthguards

- Other Protective Equipment

- Training Equipment

- Punching Bags

- Focus Mitts

- Pads

- Other Training Tools

- Accessories

- Apparel

- Hand Wraps

- Mats

- Other Accessories

By Distribution Channel

- Online Stores

- Offline Stores

- Sports Retailers

- Specialty Stores

- Other Physical Retail Formats

By End User

- Professional Athletes

- Amateurs

- Fitness Enthusiasts

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mixed Martial Arts (MMA) equipment market is characterized by a blend of global sporting goods brands, specialty combat sports manufacturers, and emerging direct-to-consumer players. Leading companies focus on material innovation, ergonomic design, and durability improvements to differentiate gloves, protective gear, and training equipment. Established brands leverage strong distribution networks, athlete endorsements, and partnerships with MMA promotions to strengthen market visibility. Meanwhile, D2C brands compete through aggressive digital marketing, customizable product offerings, and competitive pricing. E-commerce dominance has intensified competition, enabling smaller manufacturers to reach broader audiences. Companies increasingly invest in advanced foam composites, reinforced stitching technologies, breathable synthetic fabrics, and lightweight training tools to meet performance expectations. With rising counterfeiting concerns, premium brands deploy authentication tags and quality-certification programs to protect product credibility. Overall, competition continues to escalate as brands target both professional athletes and the rapidly expanding fitness-driven consumer segment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Adidas AG (via its combat sports division) secured an official equipment-manufacturer agreement with World Boxing, thereby authorizing the “adidas Combat Sports” brand to deliver certified competition gear into international multi-sport events under global sanctioning.

- In February 2025, Fairtex Equipment Co. Ltd. launched its 2025 product lineup, showcasing technological upgrades and refinements in gloves, shin guards and protective gear for MMA and Muay Thai training.

Report Coverage

The research report offers an in-depth analysis based on Product type, Distribution channel, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption of premium gloves and protective gear as users prioritize durability and impact safety.

- MMA-inspired fitness programs will expand in mainstream gyms, increasing demand for beginner-friendly equipment.

- E-commerce and direct-to-consumer channels will strengthen, offering wider product access and faster delivery.

- Material innovation will accelerate, introducing lighter, stronger, and more breathable composites for gloves and pads.

- Home training setups will grow, driving sales of compact punching bags, mats, and portable striking tools.

- Professional athlete endorsements and global MMA events will continue to influence consumer purchasing behavior.

- Asia-Pacific will emerge as a key growth engine, supported by expanding gym networks and youth participation.

- Brands will invest more in anti-counterfeit technologies to protect product authenticity and consumer safety.

- Smart training equipment incorporating sensors and performance tracking features will gain traction.

- Sustainability-driven product lines using eco-friendly materials will gradually reshape manufacturing practices.