Market Overview

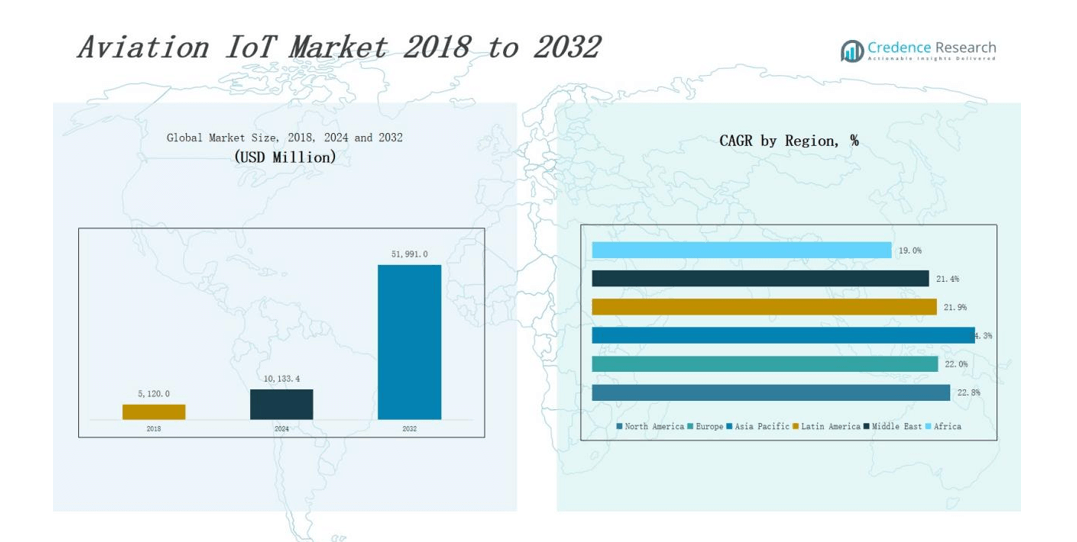

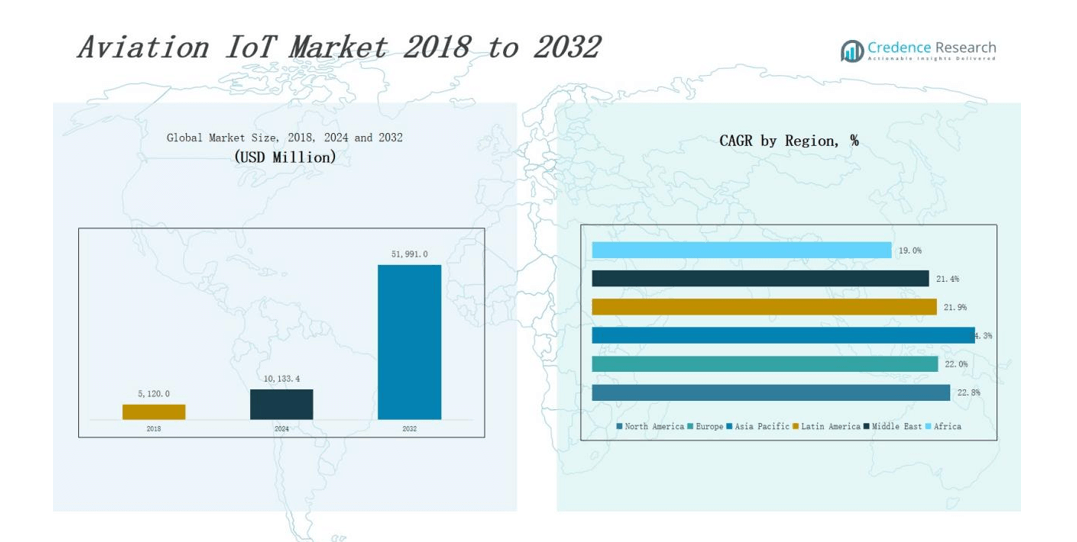

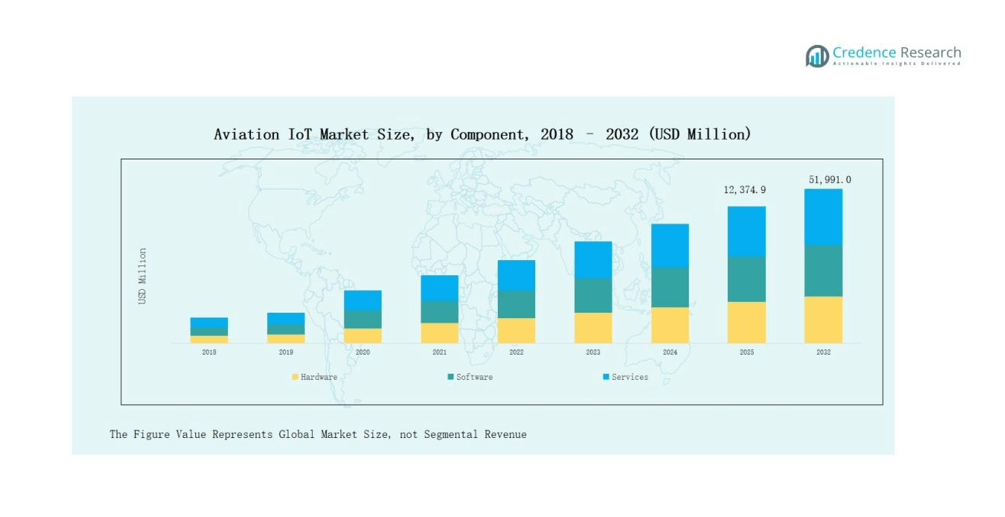

Aviation IoT Market size was valued at USD 5,120.0 million in 2018 to USD 10,133.4 million in 2024 and is anticipated to reach USD 51,991.0 million by 2032, at a CAGR of 22.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aviation IoT Market Size 2024 |

USD 10,133.4 million |

| Aviation IoT Market, CAGR |

22.8% |

| Aviation IoT Market Size 2032 |

USD 51,991.0 million |

The Aviation IoT Market is shaped by leading players such as Honeywell International, Collins Aerospace, Thales Group, GE Aviation, SITA, IBM Corporation, Cisco Systems, Lufthansa Technik, and Airbus. These companies drive competitiveness through connected aircraft systems, predictive maintenance solutions, real-time flight monitoring, and enhanced passenger experience technologies. Their strategies emphasize partnerships with airlines, integration of advanced analytics, and cloud-based platforms to optimize aviation operations. Regionally, North America holds the leading position in the Aviation IoT Market with a 38 percent share, supported by strong adoption of smart aviation technologies, established aerospace infrastructure, and regulatory support for digital transformation in the aviation sector.

Market Insights

- The Aviation IoT Market grew from USD 5,120.0 million in 2018 to USD 10,133.4 million in 2024 and is projected to reach USD 51,991.0 million by 2032, supported by a CAGR of 8%.

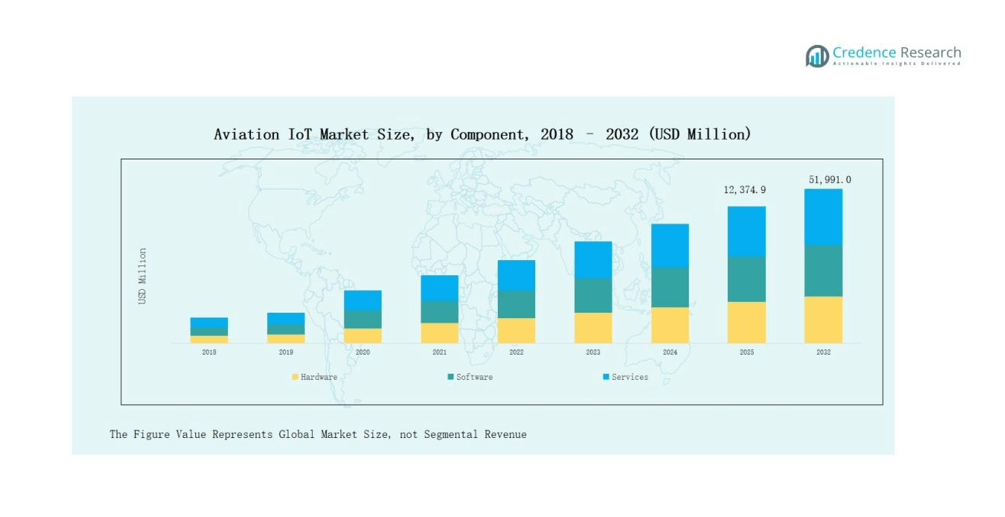

- Hardware dominates with 48% share in 2024, fueled by adoption of sensors, avionics, and communication modules, while software and services expand through analytics, cloud integration, and cybersecurity demand.

- Aircraft operations lead with 40% share in 2024, driven by predictive maintenance, fuel efficiency optimization, and flight monitoring, followed by ground operations, passenger experience, and asset management.

- Airline operators account for 42% share, leveraging IoT for fleet efficiency, predictive analytics, and real-time crew management, while airports, MRO providers, and OEMs increasingly deploy connected solutions.

- North America leads with 38% share in 2024, followed by Europe at 27% and Asia Pacific at 25%, with Latin America, Middle East, and Africa showing steady long-term growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

By Component

Hardware dominates the Aviation IoT market with a 48% share, driven by the extensive adoption of connected sensors, communication modules, and advanced avionics that enable real-time monitoring of aircraft systems. Strong demand for IoT-enabled devices in predictive maintenance and asset tracking supports this growth, as airlines and airports invest in robust infrastructure to improve operational safety and efficiency. Software holds a significant position by enabling data analytics, integration, and automation across operations, while services continue to expand through demand for cloud hosting, cybersecurity, and managed IoT platforms.

- For instance, Airbus introduced its “Skywise Health Monitoring” platform using onboard sensors and communication modules to provide predictive alerts, helping airlines like easyJet streamline aircraft maintenance.

By Application

Aircraft operations lead the market with a 40% share, supported by the increasing deployment of IoT solutions for predictive maintenance, fuel efficiency optimization, and flight performance monitoring. Airlines prioritize connected aircraft systems to minimize downtime and reduce operational costs, strengthening the dominance of this segment. Ground operations benefit from digital baggage handling and logistics tracking, while passenger experience applications grow through in-flight connectivity and personalized services. Asset management continues to gain traction as IoT adoption improves resource utilization and reduces maintenance inefficiencies.

- For instance, Lufthansa Group deployed an IoT-powered baggage tracking solution via RFID tags across multiple hubs, improving bag traceability to 99.5%.

By End-Use

Airline operators represent the dominant end-use segment with a 42% share, reflecting their large-scale integration of IoT platforms to streamline fleet operations, reduce delays, and enhance passenger safety. Investments in predictive maintenance, digital flight operations, and real-time crew management are key factors fueling their leadership. Airports remain important adopters with IoT-enabled solutions for traffic management, security, and passenger flow optimization. MRO providers are leveraging IoT for predictive analytics and lifecycle management of critical aircraft components, while aircraft OEMs integrate IoT into new-generation aircraft designs to strengthen long-term operational performance.

Market Overview

Rising Demand for Predictive Maintenance

The adoption of IoT in aviation is strongly driven by the growing emphasis on predictive maintenance, which enables early detection of mechanical failures and minimizes costly downtime. Airlines are deploying IoT-enabled sensors across engines, landing gear, and avionics systems to collect real-time performance data, reducing unexpected failures and improving fleet availability. This proactive maintenance strategy not only enhances operational efficiency but also lowers long-term repair costs, making predictive maintenance a key driver for sustained IoT adoption in the aviation industry.

- For instance, Airbus, through its Skywise platform, provides advanced predictive maintenance tools that integrate sensor data from over 10,000 connected aircraft, helping airlines like Korean Air anticipate engine component failures and optimize maintenance schedules.

Expansion of Connected Aircraft Systems

The demand for connected aircraft solutions represents a major growth driver in the Aviation IoT market. Aircraft are increasingly equipped with IoT-based communication, navigation, and monitoring systems that enable real-time data exchange between cockpit, cabin, and ground stations. Such integration ensures efficient flight operations, improved situational awareness, and enhanced passenger services. Airlines benefit from greater fuel efficiency, reduced turnaround times, and optimized air traffic management, positioning connected aircraft technology as a critical enabler of digital transformation across the aviation ecosystem.

- For instance, Boeing’s 787 Dreamliner transmits up to half a terabyte of flight data per flight through advanced sensors, enabling real-time monitoring of engines, hydraulics, and cabin conditions.

Enhancing Passenger Experience

Improving passenger experience continues to be a central growth driver in the Aviation IoT market. IoT-powered solutions such as smart seating, personalized in-flight entertainment, and real-time luggage tracking enhance service quality and build customer loyalty. Airlines are integrating IoT applications to deliver seamless travel, from check-in through boarding to post-flight services, while airports use connected systems for efficient crowd management and reduced waiting times. The increasing focus on customer-centric innovations makes enhanced passenger experience a vital factor fueling IoT investments in aviation.

Key Trends & Opportunities

Integration of AI and Big Data Analytics

The convergence of IoT with AI and big data analytics is a defining trend in the Aviation IoT market. Airlines and airports are leveraging advanced analytics to process massive datasets collected from connected aircraft, ground equipment, and passenger interactions. This integration enables accurate forecasting of demand, route optimization, and enhanced safety protocols. Opportunities arise from AI-driven decision-making platforms, which deliver actionable insights for operational excellence and customer engagement, positioning data-driven intelligence as a transformative force in aviation digitalization.

- For instance, Delta Air Lines uses its “Flight Weather Viewer” system powered by AI and IoT sensors to help pilots anticipate turbulence, reducing weather-related delays and improving passenger safety.

Growth of Smart Airports

The emergence of smart airports presents significant opportunities for IoT adoption in aviation. Airport authorities are deploying connected infrastructure for automated baggage handling, biometric-enabled security systems, and real-time passenger flow management. These solutions enhance safety, efficiency, and convenience, aligning with global initiatives for modernized aviation hubs. Investments in smart airport projects worldwide, particularly in Asia-Pacific and the Middle East, accelerate the adoption of IoT technologies, opening new revenue streams for service providers and reinforcing IoT’s role in future-ready airport ecosystems.

- For instance, Hong Kong International Airport introduced a fully automated baggage handling system using RFID tags, enabling 100% baggage tracking accuracy and quicker transfers.

Key Challenges

High Implementation and Maintenance Costs

One of the key challenges for the Aviation IoT market is the high capital investment required for IoT infrastructure and ongoing maintenance. Airlines and airports must invest in advanced sensors, communication systems, and cybersecurity frameworks, which can be prohibitively expensive, especially for smaller operators. Integration with legacy systems further raises costs and complexity, making large-scale adoption difficult. These financial barriers can slow down IoT deployment, particularly in emerging markets, where budget constraints and limited access to advanced technologies remain prevalent.

Data Security and Privacy Concerns

Data security challenges pose significant risks to the Aviation IoT market. The continuous exchange of real-time data between aircraft, airports, and ground systems makes aviation networks vulnerable to cyberattacks. Breaches can compromise passenger safety, disrupt operations, and erode trust in connected aviation solutions. Ensuring robust cybersecurity protocols, compliance with regulatory standards, and secure cloud integration is critical. Addressing privacy concerns over passenger data and building resilient protection mechanisms remain essential hurdles for sustaining long-term IoT adoption in the aviation industry.

Integration with Legacy Systems

Seamless integration of IoT with legacy aviation systems presents a complex challenge. Many airlines and airports still rely on outdated infrastructure that lacks compatibility with modern IoT platforms. Bridging this gap requires significant customization, extended implementation timelines, and additional costs, which hinder rapid adoption. The lack of standardization across IoT protocols and interoperability issues between different vendors further complicate deployment. Overcoming integration barriers is crucial for ensuring that IoT solutions can deliver optimal performance and scalability in diverse aviation environments.

Regional Analysis

North America

North America leads the Aviation IoT market with a 38% share in 2024, supported by its strong aerospace ecosystem, early adoption of digital aviation solutions, and significant investments from airlines and airports. The market grew from USD 1,836.5 million in 2018 to USD 3,590.2 million in 2024 and is projected to reach USD 18,390.7 million by 2032, reflecting a robust CAGR of 22.8%. The United States dominates with widespread deployment of connected aircraft systems, predictive maintenance platforms, and smart airport initiatives, making the region a global leader in aviation digitalization.

Europe

Europe accounts for a 27% share of the Aviation IoT market in 2024, driven by stringent aviation safety regulations, rapid development of smart airports, and strong presence of leading aerospace companies. The market expanded from USD 1,450.0 million in 2018 to USD 2,766.1 million in 2024 and is expected to reach USD 13,463.2 million by 2032, recording a CAGR of 22.0%. Germany, France, and the UK are at the forefront of adoption, supported by large-scale investments in passenger experience technologies, real-time monitoring, and airport modernization projects across the European aviation sector.

Asia Pacific

Asia Pacific holds a 25% share of the Aviation IoT market in 2024 and is the fastest-growing region with a CAGR of 24.3%. The market rose from USD 1,146.9 million in 2018 to USD 2,379.8 million in 2024 and is projected to reach USD 13,540.1 million by 2032. Growth is fueled by rapid air passenger expansion, government investments in smart airport infrastructure, and increasing fleet modernization across China, Japan, India, and Southeast Asia. Rising demand for in-flight connectivity and operational efficiency further strengthens Asia Pacific’s position as a high-growth hub for aviation IoT adoption.

Latin America

Latin America represents an 8% share of the Aviation IoT market in 2024, supported by growing airline modernization initiatives and the expansion of regional air travel. The market increased from USD 414.7 million in 2018 to USD 814.6 million in 2024 and is forecast to reach USD 3,945.1 million by 2032, advancing at a CAGR of 21.9%. Brazil and Mexico dominate the region’s adoption, investing in connected aircraft systems and airport digitalization projects. Rising passenger traffic and the need for cost-efficient operations drive opportunities for IoT deployment in fleet management and passenger service improvement.

Middle East

The Middle East accounts for a 6% share of the Aviation IoT market in 2024, growing steadily due to investments in world-class smart airports and modern fleets by Gulf carriers. The market expanded from USD 221.2 million in 2018 to USD 413.4 million in 2024 and is set to reach USD 1,939.6 million by 2032, registering a CAGR of 21.4%. Countries like the UAE, Qatar, and Saudi Arabia lead regional adoption, focusing on enhancing passenger experience and operational efficiency. Strategic government investments in aviation infrastructure position the Middle East as a growing hub for IoT-enabled aviation solutions.

Africa

Africa contributes a 4% share of the Aviation IoT market in 2024, with growth driven by increasing modernization of airports and gradual adoption of IoT solutions across airlines. The market grew from USD 50.7 million in 2018 to USD 169.3 million in 2024 and is projected to reach USD 712.4 million by 2032, advancing at a CAGR of 19.0%. South Africa and Egypt lead adoption with infrastructure upgrades, while other nations in Sub-Saharan Africa show potential through investments in aviation digitalization. Limited funding and infrastructure gaps remain challenges, but rising air traffic creates long-term opportunities.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Application

- Ground Operations

- Passenger Experience

- Aircraft Operations

- Asset Management

By End-Use

- Airport

- Airline Operators

- MRO (Maintenance, Repair, and Overhaul)

- Aircraft OEM

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The Aviation IoT market is characterized by strong competition among global technology providers, aerospace companies, and specialized IoT solution vendors, each driving innovation to capture greater market share. Leading players such as Honeywell International, Cisco Systems, Huawei Technologies, IBM Corporation, Microsoft, and SAP SE dominate through comprehensive IoT portfolios that integrate hardware, software, and cloud-based services. These companies focus on predictive maintenance, connected aircraft systems, and smart airport infrastructure, catering to both airlines and airport operators. Regional players and niche solution providers, including Aeris Communication, Tech Mahindra, and Wind River Systems, strengthen competition by offering customized IoT platforms and cost-effective deployment models. Partnerships and collaborations between airlines, OEMs, and IoT vendors remain central strategies for expanding adoption. The competitive environment emphasizes technological differentiation, cybersecurity capabilities, and scalability, with Asia Pacific emerging as a key battleground due to rapid fleet modernization and airport digitalization projects across China, India, and Southeast Asia.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

l In January 2025, Honeywell and NXP Semiconductors expanded their aviation partnership by integrating Honeywell’s Anthem cloud-connected avionics with NXP’s advanced computing architecture. The collaboration aims to enhance flight planning, operational efficiency, and AI-driven autonomy.

- In May 2025, Vertical Aerospace and Honeywell expanded their partnership to bring the VX4 electric vertical take-off and landing (eVTOL) aircraft to market. Honeywell will continue certification and production work for key flight control and aircraft management systems on the VX4.

- In February 2025, Rocket Lab successfully launched five IoT satellites for French operator Kinéis under the “IOT 4 You and Me” mission. The deployment advanced Kinéis’ satellite constellation toward completion, boosting IoT connectivity for aviation tracking and global asset monitoring.

- In August 2025, Geespace, the aerospace arm of Geely, launched 11 satellites to expand its IoT constellation to 41 in orbit, with plans to reach 72 by year-end. This deployment extends near-global coverage, enabling stronger IoT connectivity for aviation, automotive, and smart mobility systems.

Market Concentration & Characteristics

The Aviation IoT Market reflects a moderately concentrated structure, with dominance by a few multinational corporations that possess strong technological capabilities, extensive product portfolios, and established client bases. It is characterized by the integration of advanced sensors, connectivity platforms, and data analytics tools that support predictive maintenance, real-time monitoring, and passenger-centric services. Large players such as Honeywell, Cisco, Huawei, IBM, and Microsoft maintain leadership through continuous innovation and strategic partnerships with airlines, airports, and OEMs. Smaller firms and regional vendors contribute by offering specialized or cost-effective solutions, creating a competitive yet collaborative ecosystem. The market demonstrates high entry barriers due to significant capital requirements, strict aviation safety regulations, and the need for proven reliability in mission-critical operations. It shows strong growth potential in emerging economies, where rising investments in smart airports and digital aviation systems create opportunities for broader adoption. Scalability, cybersecurity, and interoperability remain defining characteristics of this market.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Aviation IoT will expand through stronger integration of predictive maintenance across global fleets.

- Airlines will adopt more connected aircraft systems to optimize operations and fuel efficiency.

- Smart airport development will drive large-scale IoT infrastructure investments.

- Passenger experience will improve with IoT-enabled personalization and seamless travel solutions.

- Cybersecurity solutions will become a priority to secure aviation IoT networks.

- AI and big data analytics will enhance decision-making in aviation operations.

- Regional growth will accelerate in Asia Pacific due to rapid fleet modernization.

- Partnerships between OEMs, airlines, and IoT vendors will intensify for innovation.

- Adoption of IoT in MRO will expand to reduce downtime and improve safety.

- Cloud-based aviation IoT platforms will gain prominence for scalability and real-time monitoring.