Market Overview

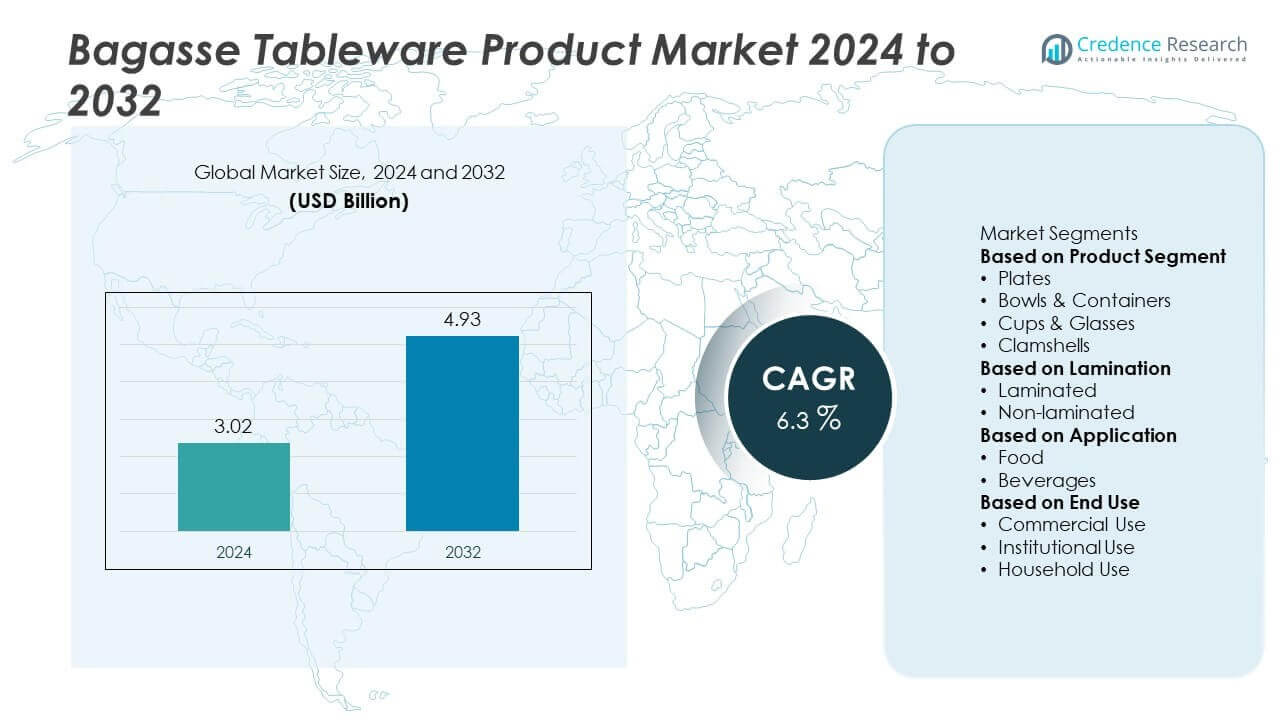

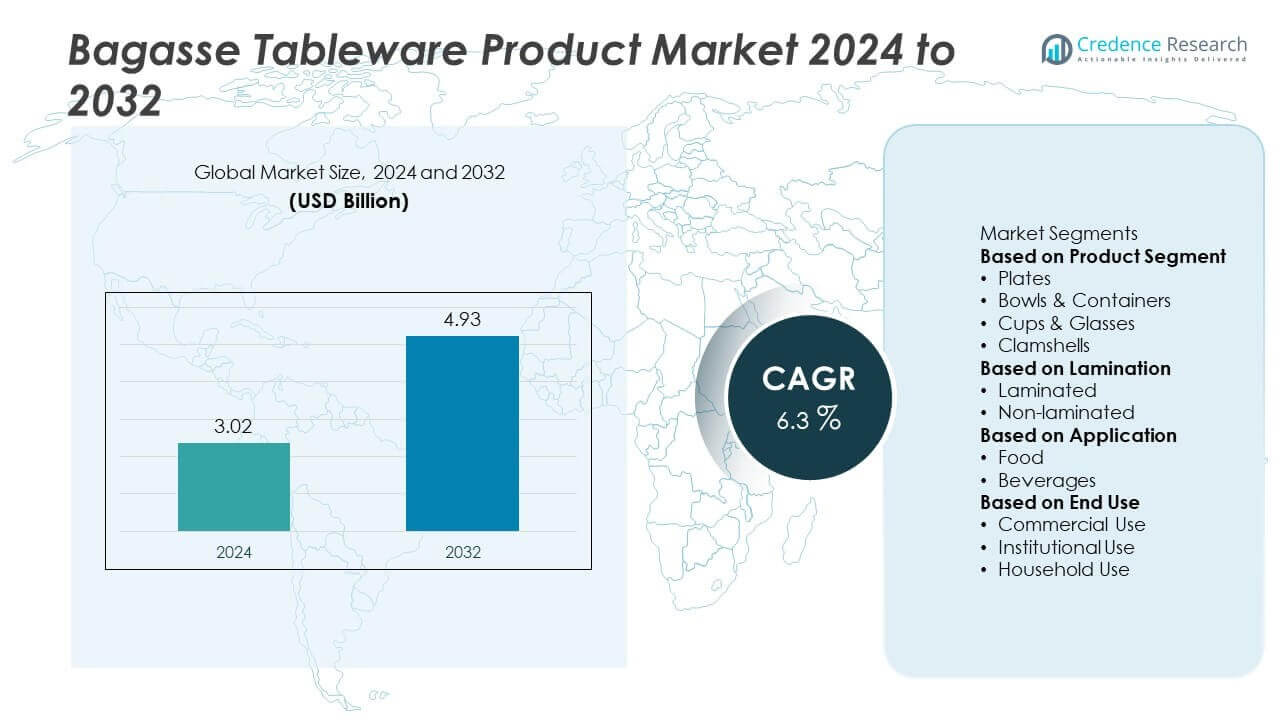

Bagasse Tableware Product Market size was valued at USD 3.02 billion in 2024 and is projected to reach USD 4.93 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bagasse Tableware Product Market Size 2024 |

USD 3.02 Billion |

| Bagasse Tableware Product Market, CAGR |

6.3% |

| Bagasse Tableware Product Market Size 2032 |

USD 4.93 Billion |

Top players in the Bagasse Tableware Product market include Genpak, Ecoware, CPM Industries, World Centric, Albea, Biotrem, Huhtamaki, Dart Container Corporation, Biopac, and International Paper. These companies focus on developing durable, compostable, and cost-effective bagasse plates, bowls, clamshells, and trays to meet rising demand from foodservice and retail sectors. They invest in product innovation, coating technology, and regional manufacturing to ensure compliance with global sustainability standards. Asia-Pacific leads the market with 33% share, driven by plastic bans and rapid growth of food delivery services. Europe follows with 29% share, supported by strong regulatory frameworks, while North America accounts for 27% share, driven by increasing adoption in quick-service restaurants and institutional catering.

Market Insights

- Bagasse Tableware Product market was valued at USD 3.02 billion in 2024 and is projected to reach USD 4.93 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising bans on single-use plastics and growing consumer preference for eco-friendly products drive demand, with plates holding over 35% share and food applications contributing more than 70% of total usage.

- Trends include innovations in bio-based coatings, moisture-resistant finishes, and increasing adoption in retail and household segments through e-commerce and supermarkets.

- The market is moderately competitive with key players such as Huhtamaki, Dart Container Corporation, World Centric, and Genpak investing in product development, capacity expansion, and partnerships with foodservice providers.

- Asia-Pacific leads with 33% share, followed by Europe at 29% and North America at 27%, supported by strong regulations, urbanization, and rapid growth of food delivery and takeaway services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Segment

Plates dominate the bagasse tableware product market with over 35% market share, driven by strong demand from quick-service restaurants, catering services, and institutional dining. Plates made from bagasse offer durability, heat resistance, and compostability, aligning with global sustainability goals and single-use plastic bans. Bowls & containers and cups & glasses follow closely, supported by rising takeout and beverage service trends. Clamshells see increasing adoption in food delivery and meal packaging, particularly in urban areas. Expanding foodservice infrastructure and the shift toward eco-friendly packaging materials continue to fuel growth across all product categories.

- For instance, Bioleader® supplies single-use, compostable bagasse tableware plates that can withstand hot food at 95 °C without deformation. These products are durable and microwave-safe, but they are not designed for repeated use in a commercial dishwasher.

By Lamination

Non-laminated bagasse tableware holds the largest share, accounting for more than 60% of the market due to its complete biodegradability and cost efficiency. These products are preferred by environmentally conscious consumers and organizations aiming to reduce their plastic footprint. Laminated variants, which use bio-based or thin polyethylene coatings, serve niche applications requiring moisture and grease resistance. Growing demand from quick-service restaurants and takeaway chains supports laminated product adoption. However, increasing regulations favoring fully compostable products are expected to strengthen the market position of non-laminated bagasse tableware in the coming years.

- For instance, Gracz (formerly BPE, Thailand) produces 100% natural, non-laminated plates and cups from plant fibers like bagasse and bamboo. These products are certified to be fully compostable, with industrial decomposition typically occurring within 45 to 60 days under optimal conditions.

By Application

Food applications lead the market with more than 70% share, as bagasse plates, clamshells, and trays are widely used for serving and packaging meals. Rising adoption by restaurants, cloud kitchens, and catering services fuels demand in this segment. Beverages contribute a smaller but growing share, driven by the use of cups, glasses, and drink carriers for hot and cold drinks. The growth in takeaway culture, on-the-go consumption, and sustainability-driven procurement policies further boost both segments. Increasing preference for compostable alternatives over plastic packaging continues to expand the market for bagasse tableware products.

Key Growth Drivers

Bans on Single-Use Plastics and Regulatory Support

The market is expanding due to strict government bans on single-use plastics and supportive regulations for sustainable packaging. Many countries have introduced policies encouraging adoption of biodegradable alternatives, driving demand for bagasse-based plates, bowls, and clamshells. Foodservice operators and institutional buyers are shifting to bagasse tableware to meet compliance and corporate sustainability goals. This regulatory push strengthens market penetration across quick-service restaurants, catering services, and retail. Growing consumer preference for eco-friendly packaging further accelerates adoption, positioning bagasse products as a mainstream solution for disposable tableware.

- For instance, Aaryadi International LLP in India offers bagasse plates rated for temperature usage from -20 °C to 120 °C, and their bagasse cups and containers fully compost in 90 days in commercial composting facilities.

Growth of Food Delivery and Takeaway Services

Rising food delivery and takeaway demand is a major driver for bagasse tableware. E-commerce food platforms, cloud kitchens, and quick-service restaurants increasingly use compostable containers, trays, and clamshells for packaging. These products offer strength, temperature resistance, and leak-proof properties suitable for transporting meals. Urbanization and busy lifestyles further fuel the growth of on-the-go consumption, boosting demand for disposable, sustainable packaging. Partnerships between food aggregators and packaging manufacturers are increasing, creating consistent demand and expanding the customer base for bagasse tableware products globally.

- For instance, Sumkoka Technology manufactures a bagasse burger clamshell container (approximately 153×153×43 mm) that is freezer-safe and commonly used in takeaway and food delivery applications. This size is a standard offering within the eco-friendly food service packaging market.

Increasing Consumer Focus on Sustainability

Consumers are increasingly aware of the environmental impact of packaging waste and prefer products that are biodegradable and compostable. Bagasse tableware provides a sustainable option that supports circular economy initiatives by utilizing sugarcane waste. Retailers and brands highlight eco-friendly packaging to attract environmentally conscious buyers. Rising awareness campaigns and eco-label certifications strengthen consumer confidence in these products. This shift in consumer behavior is driving consistent market growth and motivating manufacturers to expand production capacity and innovate product designs for better performance and cost efficiency.

Key Trends & Opportunities

Key Trends & Opportunities

Innovation in Coatings and Barrier Solutions

Manufacturers are developing bio-based coatings and water-resistant finishes to enhance performance of bagasse products. These innovations expand applications in greasy, moist, or liquid-heavy foods where conventional uncoated products may fail. Advancements in microwave-safe and heat-resistant properties are improving adoption in restaurants and catering services. The opportunity lies in replacing PE-laminated items with fully compostable barrier-coated alternatives that meet global sustainability standards. Such innovation supports compliance with regulations and strengthens the market appeal of bagasse tableware for both hot and cold food packaging.

- For instance, InNature Pack produces compostable tableware from sugarcane fibres using a high-pressure thermoforming process to create a dense, sturdy product. The high heat and pressure create strong natural bonds between the cellulose fibres, forming a low-porosity structure that resists water and oil without the need for synthetic liners or additives like AKD.

Expansion into Retail and Household Segments

Retail adoption is increasing as supermarkets, e-commerce platforms, and specialty stores offer bagasse plates, bowls, and cutlery for home use. Rising popularity of sustainable party supplies and disposable dinnerware for events boosts household consumption. Packaging in smaller, convenient packs is making these products more attractive to residential buyers. Manufacturers are leveraging online sales channels and branding initiatives to reach eco-conscious consumers. This trend is creating new revenue streams beyond the commercial and institutional segments, expanding overall market potential and strengthening brand presence.

- For instance, Bioleader, lists bagasse tableware items (plates, trays, cups) that fully compost in industrial composting conditions between 60 and 90 days, while being certified for microwave and freezer safety.

Key Challenges

Higher Production and Procurement Costs

Bagasse tableware generally costs more than conventional plastic alternatives, which can hinder adoption in price-sensitive markets. The production process involves specialized equipment, molding technology, and sometimes bio-coatings, driving up costs. Small food vendors and low-margin businesses may hesitate to shift to bagasse due to these price differences. Manufacturers are working to optimize processes and achieve economies of scale to bring prices down. Wider regulatory enforcement and subsidies will be critical to overcome cost barriers and encourage broader market penetration.

Limited Awareness and Supply Chain Gaps

In several developing regions, awareness about bagasse products and their benefits remains low. Inconsistent availability and limited distribution networks also restrict adoption. Small-scale suppliers face challenges in meeting large volume requirements from institutional buyers. This creates reliance on imports, which may raise costs and delay procurement. Strengthening local production capacity, building efficient logistics, and conducting awareness campaigns will be essential to overcome these challenges and ensure steady growth of the bagasse tableware product market globally.

Regional Analysis

North America

North America holds 27% market share, driven by strict single-use plastic bans and rising adoption of eco-friendly tableware in the U.S. and Canada. Quick-service restaurants, institutional caterers, and retail chains are major consumers of bagasse plates, clamshells, and trays. Government regulations and corporate sustainability programs encourage the switch to biodegradable packaging. Growing popularity of online food delivery platforms further boosts demand for durable and compostable containers. Manufacturers invest in local production facilities and distribution networks to meet increasing consumption. The region’s strong regulatory framework and consumer awareness support steady and long-term market growth.

Europe

Europe accounts for 29% market share, supported by stringent EU directives on plastic waste reduction and high consumer preference for sustainable packaging. Countries like Germany, France, and the U.K. lead in adopting bagasse tableware across foodservice and retail sectors. Institutional buyers, including schools and corporate cafeterias, are key demand drivers due to compliance with green procurement policies. Innovation in barrier coatings and compostable laminations is advancing adoption in moisture-heavy applications. Expansion of retail channels and private label offerings is fueling residential consumption. Europe’s emphasis on circular economy principles continues to drive investment in biodegradable packaging solutions.

Asia-Pacific

Asia-Pacific leads with 33% market share, making it the largest and fastest-growing regional market. China and India dominate consumption due to government-led plastic bans, rapid urbanization, and rising disposable incomes. Food delivery and quick-service restaurant growth create consistent demand for bagasse-based plates, cups, and clamshells. Local manufacturers are scaling production capacity to serve both domestic and export markets. Japan and South Korea show strong adoption in retail and institutional sectors, favoring high-quality compostable tableware. Expansion of organized retail and e-commerce further drives penetration, making Asia-Pacific the key growth engine for global bagasse tableware products.

Latin America

Latin America captures 6% market share, led by Brazil and Mexico, where regulatory actions are encouraging the transition away from plastics. The foodservice industry and catering businesses are adopting bagasse plates and containers to meet sustainability goals and consumer demand. Local sugarcane production ensures abundant raw material availability, supporting cost-effective manufacturing. The rise of casual dining chains and event catering also contributes to market expansion. Increasing export opportunities for eco-friendly products and government awareness campaigns are expected to accelerate adoption. However, price sensitivity remains a challenge, driving demand for competitively priced solutions.

Middle East & Africa

Middle East & Africa represents 5% market share, showing steady growth as governments promote sustainable packaging initiatives. GCC countries are early adopters due to rising hospitality sector demand and events catering. Bagasse trays and clamshells are gaining traction in quick-service restaurants and institutional catering services. South Africa leads in Africa with expanding retail availability and consumer awareness campaigns. Harsh climate conditions encourage the use of sturdy, heat-resistant tableware, giving bagasse products a competitive edge. Ongoing infrastructure development and growing preference for eco-friendly solutions are expected to create long-term opportunities for market players.

Market Segmentations:

By Product Segment

- Plates

- Bowls & Containers

- Cups & Glasses

- Clamshells

By Lamination

By Application

By End Use

- Commercial Use

- Institutional Use

- Household Use

By Geography

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Bagasse Tableware Product market features leading players such as Genpak, Ecoware, CPM Industries, World Centric, Albea, Biotrem, Huhtamaki, Dart Container Corporation, Biopac, and International Paper. These companies focus on expanding their product portfolios with biodegradable plates, bowls, clamshells, and cutlery to address rising demand for sustainable tableware. Major players invest in advanced molding technologies, bio-based coatings, and compostable laminations to improve durability and performance in both hot and cold food applications. Strategic partnerships with quick-service restaurants, food delivery platforms, and institutional buyers are strengthening market reach. Manufacturers also focus on scaling local production facilities to reduce logistics costs and ensure consistent supply. Competitive differentiation is increasingly based on innovation, price competitiveness, and compliance with global plastic ban regulations. Sustainability certifications, such as BPI and EN13432, are becoming critical to brand positioning, driving companies to enhance product quality and align with circular economy initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Genpak

- Ecoware

- CPM Industries

- World Centric

- Albea

- Biotrem

- Huhtamaki

- Dart Container Corporation

- Biopac

- International Paper

Recent Developments

- In July 2025, Huhtamaki launched new compostable ice cream cups that combine home and industrial compostability.

- In June 2025, Albea announced new eco-friendly packaging solutions for the cosmetics and foodservice sectors, spotlighting bagasse tableware and coated bagasse trays within its “Responsible Packaging” commitment to make 100% of packaging reusable, recyclable, or compostable by end-2025.

- In February 2025, World Centric earned NSF Compostability Claim verification for its disposable foodservice products, confirming compliance with rigorous compostability standards.

Report Coverage

The research report offers an in-depth analysis based on Product Segment, Lamination, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biodegradable and compostable tableware will continue to grow with stricter plastic bans.

- Plates and clamshells will remain the top-selling products due to high use in foodservice.

- Innovation in moisture and grease-resistant coatings will expand applications in hot and oily foods.

- Retail and household consumption will rise as sustainable party and home-use tableware gains popularity.

- Manufacturers will invest in automation and capacity expansion to meet rising global demand.

- Partnerships with quick-service restaurants and food delivery platforms will strengthen product adoption.

- Asia-Pacific will remain the fastest-growing region, driven by rapid urbanization and regulatory support.

- Europe will see growth fueled by strong circular economy policies and green procurement initiatives.

- Price competitiveness and economies of scale will make bagasse products more accessible in emerging markets.

- Sustainability certifications and eco-labeling will become key differentiators for market players.

Key Trends & Opportunities

Key Trends & Opportunities