Market Overview:

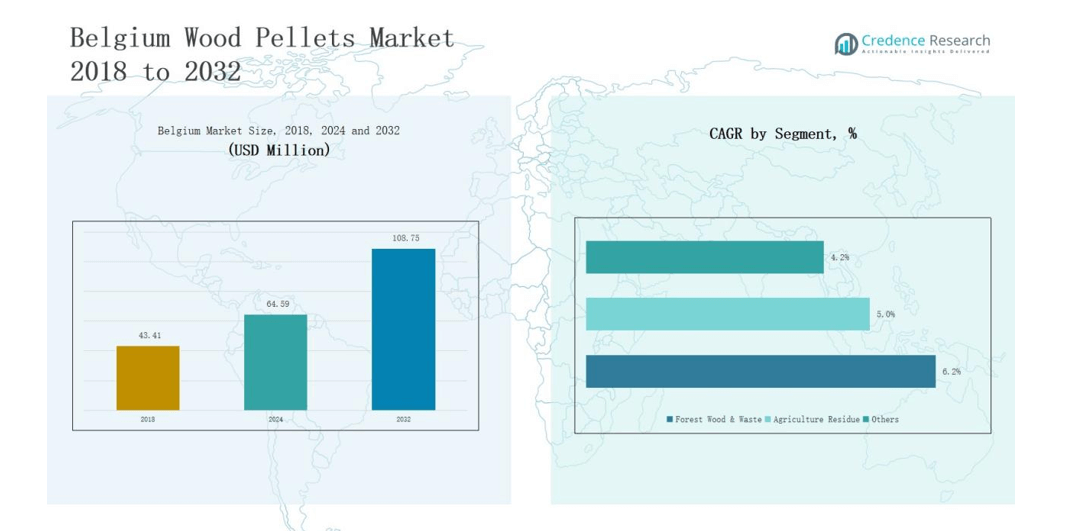

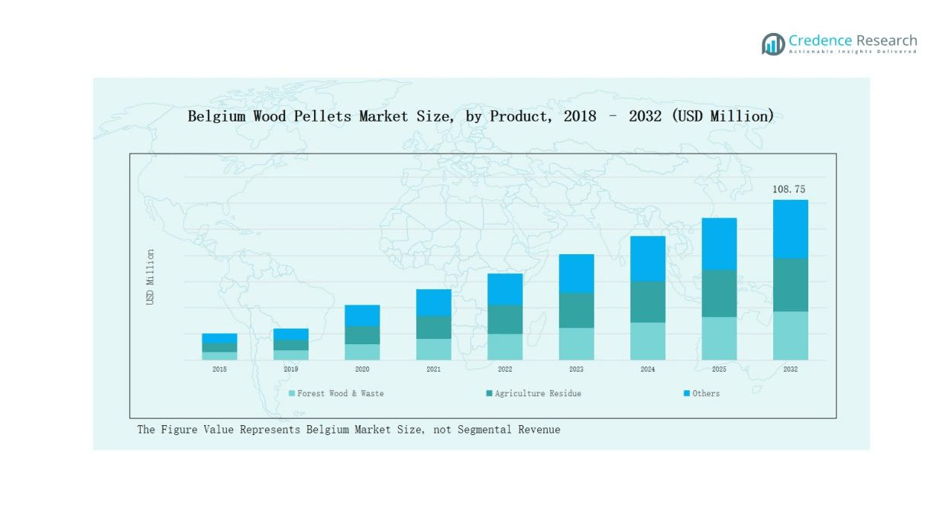

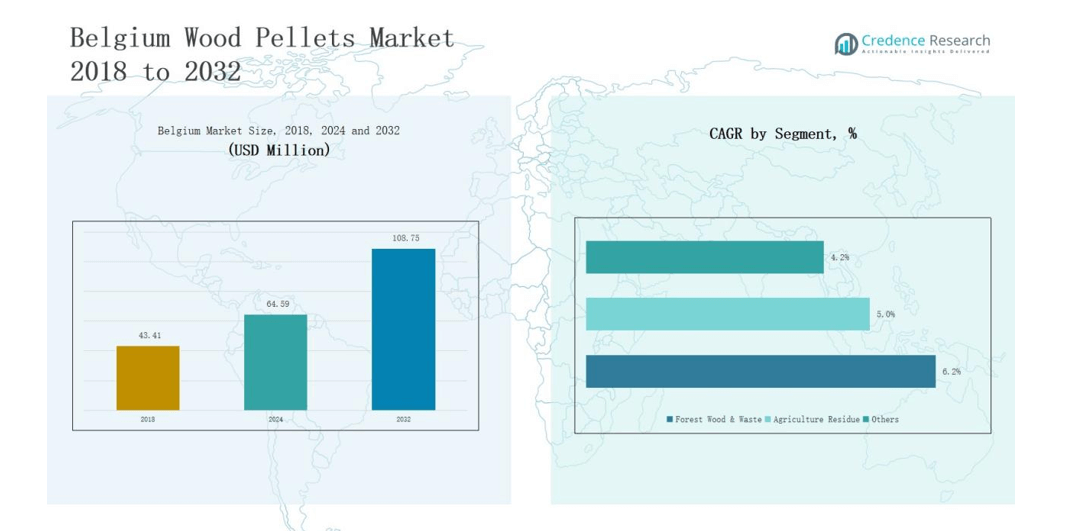

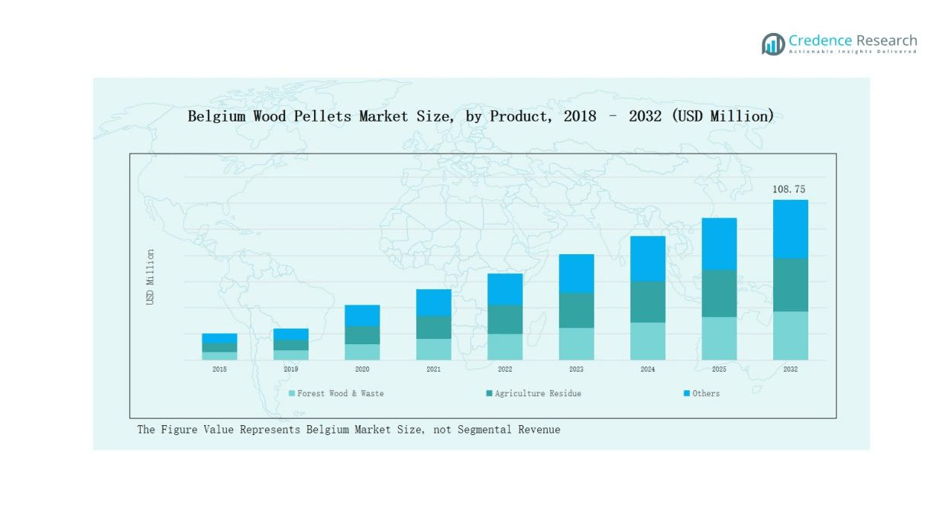

Belgium Wood Pellets Market size was valued at USD 43.41 million in 2018 to USD 64.59 million in 2024 and is anticipated to reach USD 108.75 million by 2032, at a CAGR of 6.26 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Belgium Wood Pellets Market Size 2024 |

USD 64.59 million |

| Belgium Wood Pellets Market, CAGR |

6.26% |

| Belgium Wood Pellets Market Size 2032 |

USD 108.75 million |

The Belgium Wood Pellets Market is shaped by key players including Pellets de Belgique, DPI – Division Pellets, Pellet Centrale, Eco Pellets Belgium, Renewable Pellet Manufacture, Euro Pellets BVBA, Biomass Pellets Group, and Greenway Group. These companies strengthen their positions through ENplus-certified products, efficient distribution networks, and long-term supply contracts with industrial and residential consumers. Imports remain vital, but domestic producers focus on quality, sustainability, and reliable delivery to maintain competitiveness. Among regions, Flanders leads with a 45% market share in 2024, driven by strong industrial demand, well-established district heating networks, and efficient import channels through the Port of Antwerp. This dominance underlines the region’s strategic importance in both production and consumption within the national market.

Market Insights

- The Belgium Wood Pellets Market grew from USD 43.41 million in 2018 to USD 64.59 million in 2024 and is projected to reach USD 108.75 million by 2032.

- Key players include Pellets de Belgique, DPI – Division Pellets, Pellet Centrale, Eco Pellets Belgium, Renewable Pellet Manufacture, Euro Pellets BVBA, Biomass Pellets Group, and Greenway Group.

- By product, Forest Wood & Waste dominates with 70% share in 2024, followed by Agriculture Residue at 20% and Others at 10%.

- By application, Industrial Pellet for CHP/District Heating leads with 50% share, followed by Residential/Commercial Heating at 30%, Co-Firing at 15%, and Others at 5%.

- Regionally, Flanders holds 45% share, Wallonia 35%, and Brussels-Capital Region 20%, reflecting strong demand drivers across industrial, residential, and urban heating networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Belgium Wood Pellets Market is dominated by the Forest Wood & Waste segment, holding nearly 70% share in 2024. Its leadership is driven by abundant forestry resources, well-established supply chains, and compliance with EU sustainability standards. Agriculture residue accounts for around 20% share, supported by growing use of crop waste for energy diversification, particularly in rural regions. The Others segment, including blended biomass materials, captures the remaining 10% share, driven by niche applications and local experimentation with alternative raw materials.

- For instance, the Belgian utility Engie Electrabel has converted several coal-fired units to biomass using certified wood pellets, reinforcing demand from forestry-based sources.

By Application

The Industrial Pellet for CHP/District Heating segment leads with about 50% share in 2024, supported by Belgium’s strong district heating networks, renewable energy targets, and reliance on large-scale pellet imports to meet industrial demand. The Pellet for Heating Residential/Commercial segment follows with roughly 30% share, driven by rising adoption of pellet stoves and boilers for sustainable home heating. Industrial Pellet for Co-Firing holds close to 15% share, reflecting the push for biomass integration in coal power plants to reduce carbon intensity. The Others segment, including small-scale niche uses, accounts for nearly 5% share, showing limited but steady growth in specialized energy applications.

- For instance, MCZ Group supplies pellet boilers and stoves across Europe, reporting strong sales growth in household pellet heating units.

Market Overview

Rising Demand for Renewable Heating Solutions

Belgium’s energy sector is shifting strongly toward renewable heating, with wood pellets playing a vital role. District heating networks and combined heat and power plants increasingly integrate pellets to replace fossil fuels. Government incentives and EU directives strengthen adoption across industrial sectors. Residential households are also turning to pellet stoves as cost-effective and sustainable alternatives. This growing demand for low-carbon heating underpins long-term market expansion and enhances the position of pellets as a reliable renewable energy source.

- For instance, Electrabel (Engie Belgium) has converted units of the Rodenhuize power station in Ghent to run entirely on wood pellets, demonstrating large-scale industrial reliance on biomass for renewable heat and electricity generation.

Supportive Government Policies and EU Regulations

The policy landscape continues to favor wood pellet adoption in Belgium. The European Union’s Renewable Energy Directive (RED II) enforces binding renewable energy targets that drive biomass utilization. National subsidies, tax benefits, and feed-in tariffs encourage both industrial and residential pellet investments. Belgium benefits from its location within Europe’s biomass trade network, which ensures access to imported supply. These supportive frameworks create a favorable business environment, sustaining demand while encouraging further investments in pellet-based energy systems.

- For instance, the Sustainable Biomass Partnership (SBP) has successfully verified operations like Holzkontor und Pelletierwerk Schwedt GmbH to comply with the EU RED II sustainability criteria, ensuring that pellet suppliers meet rigorous environmental standards.

Technological Advancements in Pellet Production and Distribution

Advancements in pelletizing technologies and logistics are boosting efficiency across Belgium’s wood pellet market. Producers deploy modern pellet mills and quality control systems to ensure ENplus-certified output that meets sustainability standards. Enhanced transport and storage infrastructure improve supply reliability, reinforcing Belgium’s role as a hub for biomass distribution in Europe. These innovations help reduce operational costs and carbon footprints, while ensuring stable energy performance for industrial buyers and residential consumers relying on pellet-based heating systems.

Key Trends & Opportunities

Expansion of District Heating Infrastructure

District heating expansion in Belgium is creating new opportunities for wood pellets. Municipalities are investing in biomass-powered CHP systems to supply urban heating while reducing emissions. Utilities increasingly sign long-term pellet supply contracts, ensuring stability for producers and importers. This growth supports consistent demand for high-volume industrial pellets and strengthens the market’s integration with renewable heating policies. As district heating projects grow, pellet suppliers benefit from a steady and scalable demand channel in urban regions.

- For instance, the city of Leuven has expanded its district heating network with a biomass CHP plant developed by EBE NV, supplying renewable heat to universities and residential buildings since 2018.

Growing Focus on Circular Economy and Agricultural Residues

Belgium is embracing agricultural residues as a complementary feedstock for pellet production. Farmers and energy firms are repurposing crop waste to create biomass pellets, supporting circular economy principles. This diversification reduces dependence on forest wood while enhancing rural economic opportunities. Policies promoting waste-to-energy adoption further support this segment. Agricultural residue pellets appeal to industries and households seeking low-cost alternatives, and their use aligns with broader sustainability goals, creating new opportunities in Belgium’s biomass energy landscape.

- For instance, ArcelorMittal Belgium commissioned a plant in Ghent that converts waste wood and agricultural residues into bio-coal pellets for use in their steel production process, aiming to reduce carbon emissions significantly.

Key Challenges

Dependence on Pellet Imports

Belgium relies heavily on imports from countries such as Latvia, Russia, and Canada, exposing the market to supply risks. Fluctuations in international trade, geopolitical disruptions, or rising transport costs directly affect pellet availability and pricing. Limited domestic production capacity prevents full supply chain independence. This dependency creates long-term vulnerabilities for industrial utilities and households, particularly during peak winter demand periods when consistent and affordable pellet supply is critical.

Competition from Alternative Renewable Sources

The wood pellet market in Belgium competes with other renewable options such as solar, wind, and heat pumps. Government subsidies increasingly favor electrification, particularly in residential heating. The falling costs of solar panels and high efficiency of modern heat pumps attract consumers away from biomass heating solutions. Industrial sectors are also diversifying their renewable energy mix, often prioritizing technologies with lower operating costs. This competition places pressure on pellet suppliers to maintain affordability and sustainability credentials.

Price Volatility and Supply Chain Constraints

Pellet prices in Belgium face volatility from fluctuating raw material costs, transport expenses, and global demand. Seasonal spikes in winter further strain supply and lead to price surges. Import reliance adds exposure to shipping rate changes and currency fluctuations. Domestic storage and logistics infrastructure also face capacity challenges, limiting the ability to stabilize supply. This volatility complicates long-term contracts and reduces confidence among consumers and businesses, making price stability a persistent challenge for market growth.

Regional Analysis

Flanders

Flanders leads the Belgium Wood Pellets Market with a 45% share in 2024. Strong industrial activity and widespread adoption of combined heat and power plants drive demand in this region. District heating networks are well established, supported by municipal policies encouraging renewable energy use. Imports of wood pellets are routed efficiently through the Port of Antwerp, which strengthens supply security and cost efficiency. Residential consumers in Flanders also contribute to demand through pellet stoves and boilers, reflecting a strong preference for sustainable heating solutions. It maintains its leadership due to advanced infrastructure and policy-driven adoption.

Wallonia

Wallonia accounts for 35% share in 2024, supported by its vast forest resources and strong biomass utilization practices. Local pellet production facilities benefit from access to forestry waste, which reduces reliance on imports compared to other regions. Industrial heating applications in Wallonia continue to grow as factories integrate pellet-based systems to align with renewable energy targets. Rural households rely heavily on pellet stoves, creating steady residential demand. Investments in supply chains and sustainable forestry practices help maintain regional competitiveness. It remains a vital contributor to Belgium’s biomass supply base and consumption.

Brussels-Capital Region

The Brussels-Capital Region holds a 20% share in 2024, driven by rising urban demand for clean energy solutions. District heating projects and municipal commitments to sustainability boost pellet usage in commercial and public buildings. Space constraints limit large-scale production facilities, making the region dependent on pellet imports from Flanders and international suppliers. Government incentives for low-emission heating systems stimulate adoption among households and businesses. Logistics infrastructure ensures steady inflows of pellets, supporting consistent supply to urban consumers. It plays an important role as a consumption hub, despite limited raw material availability within the region.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Country

- Flanders

- Wallonia

- Brussels-Capital Region

Competitive Landscape

The Belgium Wood Pellets Market features a moderately consolidated structure, with competition led by both domestic producers and regional distributors. Key players such as Pellets de Belgique, DPI – Division Pellets, Pellet Centrale, Eco Pellets Belgium, and Renewable Pellet Manufacture strengthen their positions through reliable sourcing, ENplus-certified products, and established contracts with industrial and residential customers. Companies like Euro Pellets BVBA, Biomass Pellets Group, and Greenway Group expand their market reach by leveraging efficient distribution channels and long-term partnerships with heating utilities. Imports remain essential to balance demand, with Belgian firms securing supply from European and global producers. Competition centers on price stability, sustainability compliance, and product quality, as consumers and industries demand consistent performance. Strategic initiatives include investments in production facilities, technological upgrades, and expanded logistics networks. It reflects a market where scale, sustainability, and reliable delivery play crucial roles in defining competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Pellets de Belgique

- DPI – Division Pellets

- Pellet Centrale

- Eco Pellets Belgium

- Renewable Pellet Manufacture

- Euro Pellets BVBA

- Biomass Pellets Group

- Greenway Group

- Others

Recent Developments

- In early 2023, Industrie du Bois Vielsalm (IBV), part of the Wood & Energy Group, completed the third phase of its pellet plant expansion, adding 180,000 tonnes of capacity and raising its total output to 450,000 tpa, making it Europe’s largest pellet site.

- In 2023, Belgium reached nearly 600,000 tonnes of ENplus®-certified pellet output, ranking fifth in Europe for certified production and reinforcing its role in maintaining high product quality standards.

- In 2024, ENplus® certified 13.3 million tonnes of pellets across Europe and launched a mobile application to help users verify certified suppliers and report fraud, enhancing trust and transparency in the Belgium market as part of the wider EU system.

- In May 2024, IBV (part of the Wood & Energy Group) completed a third expansion phase.

This raised its pellet production capacity to 450,000 tpa—Europe’s largest single-site pellet plant.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for pellets will grow as Belgium expands district heating networks.

- Imports will continue to play a major role in securing pellet supply.

- Residential pellet stove adoption will increase due to sustainable heating demand.

- Industrial use of pellets in CHP plants will strengthen with renewable energy targets.

- Agricultural residue pellets will gain traction as part of circular economy initiatives.

- Competition from solar and heat pumps will challenge pellet demand in urban areas.

- ENplus-certified pellets will dominate sales as consumers prioritize quality and sustainability.

- Investments in logistics and storage facilities will improve supply chain efficiency.

- Local producers will explore capacity expansion to reduce reliance on foreign suppliers.

- Policy incentives will remain critical in driving growth and supporting long-term stability.