Market Overview:

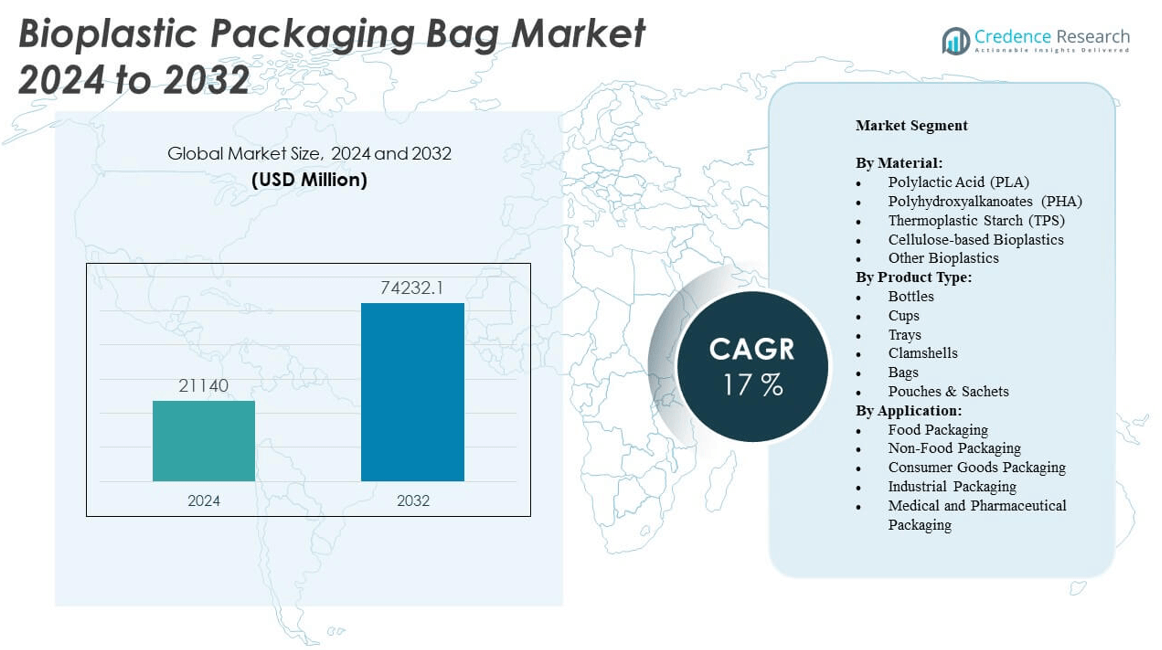

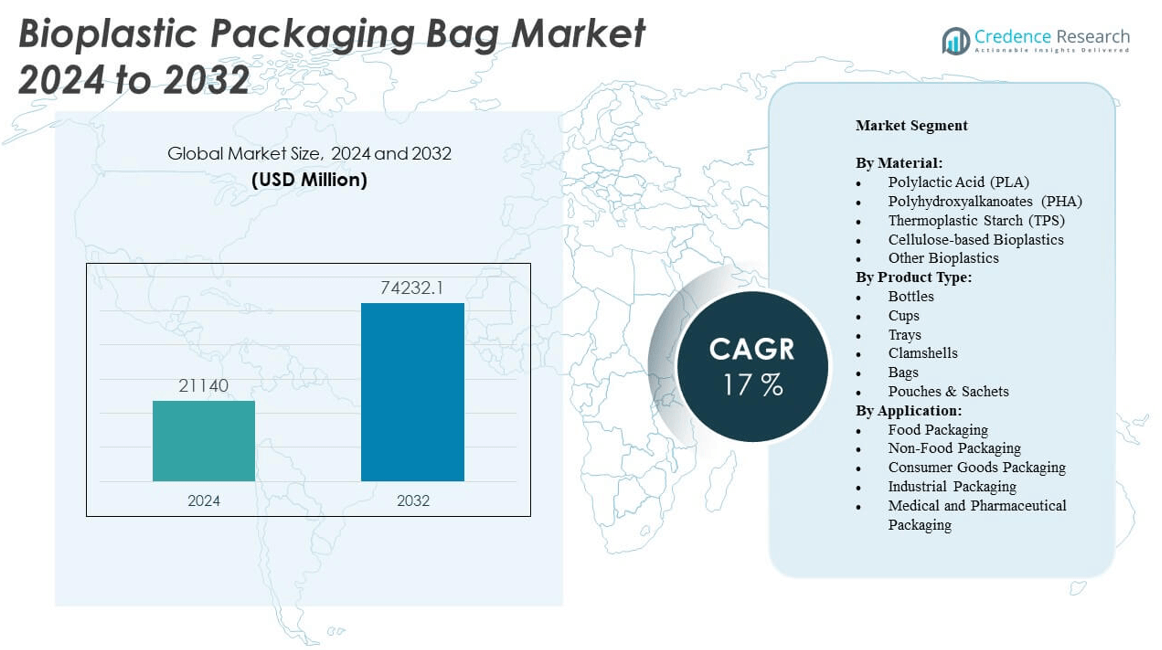

The Bioplastic Packaging Bag Market is projected to grow from USD 21,140 million in 2024 to an estimated USD 74,232.1 million by 2032, with a compound annual growth rate (CAGR) of 17% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bioplastic Packaging Bag Market Size 2024 |

USD 21,140 million |

| Bioplastic Packaging Bag Market, CAGR |

17% |

| Bioplastic Packaging Bag Market Size 2032 |

USD 74,232.1 million |

The market is gaining momentum as global industries transition toward sustainable and eco-friendly packaging solutions. Rising consumer awareness of plastic pollution, combined with stringent government regulations on single-use plastics, is driving demand for biodegradable and compostable packaging bags. Leading retailers and food companies are adopting bioplastic packaging to meet environmental targets and appeal to eco-conscious customers. Innovations in bio-based polymers, including PLA, PHA, and starch blends, are further enhancing product functionality and expanding application across diverse sectors.

Regionally, Europe leads the Bioplastic Packaging Bag Market due to strong policy support for sustainable packaging, especially in countries like Germany, France, and the Netherlands. North America is also witnessing substantial growth, driven by corporate sustainability initiatives and increasing consumer preference for green products. Meanwhile, the Asia Pacific region is emerging rapidly, fueled by rising environmental concerns, expanding urban populations, and government incentives for bioplastics production in countries like China, India, and Japan. Latin America and the Middle East & Africa are gradually adopting bioplastic solutions as awareness and infrastructure improve.

Market Insights:

- The Bioplastic Packaging Bag Market is valued at USD 21,140 million in 2024 and is projected to reach USD 74,232.1 million by 2032, growing at a CAGR of 17%.

- Regulatory bans on single-use plastics and rising sustainability mandates are accelerating the shift toward bioplastic packaging solutions.

- Strong consumer demand for biodegradable and compostable bags is influencing packaging choices across food, retail, and e-commerce sectors.

- High production costs and limited scalability of advanced biopolymers are restricting adoption in price-sensitive markets.

- Inadequate composting and recycling infrastructure in many regions hampers the full environmental potential of bioplastic bags.

- Europe holds a 36% market share, driven by robust legislation and infrastructure, while Asia Pacific is emerging rapidly due to growing domestic production and plastic reduction policies.

- North America accounts for 28% of global revenue, supported by brand-led sustainability initiatives and regional biopolymer manufacturing investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government Regulations and Environmental Mandates Are Accelerating Bioplastic Adoption

Governments across the globe are enforcing stringent regulations to minimize plastic waste and promote sustainable packaging practices. Bans on single-use plastics in countries such as Germany, Canada, and India are driving the demand for alternatives. Public policy support for compostable and biodegradable materials is pushing manufacturers to invest in eco-friendly solutions. These mandates are creating a robust foundation for bioplastic innovation and supply chain development. The Bioplastic Packaging Bag Market is gaining momentum due to this regulatory shift, which creates strong commercial incentives for adoption. Brands must comply with emerging waste management frameworks, fueling the shift away from conventional plastics. Companies are leveraging these rules to reposition themselves as environmentally responsible. Regulatory clarity is strengthening investor confidence in bioplastics infrastructure and R&D projects.

- For example, China’s ban on single-use plastics specifically exempts biodegradable alternatives, catalyzing a surge in PLA (polylactic acid) production capacity that is projected to reach approximately 30% market share of global bioplastics installed capacity between 2025 and 2035.

Rising Consumer Preference for Sustainable and Eco-Friendly Packaging Materials

Consumers are becoming more conscious of their environmental impact, prompting a clear preference for biodegradable alternatives. Social media and environmental campaigns have raised awareness about plastic pollution, influencing purchase behavior. Retailers and brands are responding by introducing biodegradable and compostable bags in their product portfolios. This shift is not limited to premium segments but is expanding into mass-market categories. The Bioplastic Packaging Bag Market is benefiting from this surge in demand for greener choices across food, fashion, and e-commerce. Packaging has become a key brand differentiator, and eco-labeling is influencing customer loyalty. Businesses that offer sustainable packaging solutions are earning stronger brand equity. Consumers are willing to pay a premium for packaging that aligns with their values, reinforcing long-term market growth.

Corporate Sustainability Goals Are Reshaping Packaging Procurement Practices

Leading companies across industries are committing to aggressive sustainability targets that include plastic reduction and carbon footprint minimization. These goals are directly influencing procurement strategies, encouraging partnerships with suppliers offering bio-based alternatives. Major brands in food, cosmetics, and consumer goods are launching products in bioplastic packaging to meet ESG benchmarks. The Bioplastic Packaging Bag Market is gaining from these shifts, supported by long-term supplier agreements and material innovation. Businesses are overhauling supply chains to integrate sustainable packaging at scale. It is accelerating investments in compostable and recyclable solutions with traceable raw material sources. Life-cycle assessments are now embedded in packaging decisions, with bioplastics offering favorable results. Companies view sustainable packaging not just as compliance but as a driver of competitive advantage.

Advancements in Biopolymer Technologies Enhancing Material Performance

R&D investments are enabling bioplastics to meet or exceed conventional plastic performance standards. Modern biopolymers now offer high tensile strength, barrier properties, and heat resistance suitable for diverse applications. Innovations in polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch blends are extending the utility of bioplastic bags. These advances are reducing concerns around durability, moisture retention, and shelf life. The Bioplastic Packaging Bag Market is gaining technical validation, enabling entry into pharmaceutical, frozen food, and industrial packaging segments. It is encouraging broader market acceptance across sectors previously reliant on petroleum-based films. Emerging technologies are also cutting production costs, making bioplastics more price-competitive. Enhanced processability is helping manufacturers scale production efficiently while meeting quality requirements.

- For example, in May 2024, CJ Biomaterials introduced PHACT S1000P, a semi-crystalline polyhydroxyalkanoate (PHA) biopolymer designed for packaging requiring heat stability and enhanced rigidity, certified for both home and industrial composting as well as marine and soil degradation.

Market Trends:

Expansion of Compostable Packaging Infrastructure in Urban and Retail Ecosystems

Cities and municipalities are investing in composting facilities to support biodegradable packaging waste. This infrastructure expansion is encouraging businesses to shift to compostable bags with greater confidence. Retail chains are introducing in-store collection systems for compostable packaging materials. The Bioplastic Packaging Bag Market is witnessing improved end-of-life management, which supports its environmental credentials. It is also enhancing brand trust among consumers concerned with waste disposal. Composting capacity growth is aligning with packaging legislation, particularly in Europe and North America. New certification systems are ensuring compatibility with local waste streams. Urban infrastructure integration is creating a more circular economy for packaging disposal.

Growing Demand from Quick-Service Restaurants and Delivery-Based Food Chains

The rise in takeout and delivery orders has increased demand for sustainable packaging solutions. Food service providers are adopting bioplastic bags to align with corporate responsibility goals and consumer expectations. Regulatory pressures on single-use food packaging are reinforcing this trend. The Bioplastic Packaging Bag Market is witnessing expanded adoption across fast-casual and QSR brands. It is gaining share from traditional plastic in both primary and secondary food packaging. Brands are using biodegradable bags to highlight environmental messaging on menus and digital platforms. Consumer feedback loops are accelerating the shift through mobile app preferences. Food delivery aggregators are also partnering with green packaging providers to build eco-conscious brand identities.

Shift Toward High-Barrier Bioplastic Films for Enhanced Shelf Life

Demand is rising for bioplastic bags with enhanced functional properties such as oxygen and moisture resistance. High-barrier solutions are being used in food, pharmaceuticals, and electronics packaging to maintain product integrity. Manufacturers are developing multilayered biodegradable films that offer both protection and sustainability. The Bioplastic Packaging Bag Market is evolving with a focus on quality and compliance across high-value segments. It is creating new opportunities for advanced biopolymer formulations and additive innovations. These high-performance bags are enabling more widespread usage in refrigerated and frozen storage applications. The shift is expanding use cases that previously relied on multi-laminate petroleum-based plastics. Market players are differentiating based on technical capabilities rather than just eco-labels.

- For example, Amcor’s 2024 launch achieved both high-barrier properties and compatibility with European curbside composting streams, verified by proprietary and third-party laboratory testing on shelf-life retention for perishable foods

Proliferation of Private Labels and Sustainable Packaging SKUs in Retail

Retailers are expanding their private label offerings with a strong emphasis on sustainable packaging. Supermarket chains and department stores are launching dedicated eco-friendly bag lines. The Bioplastic Packaging Bag Market is benefiting from this shift in merchandising strategies and in-store branding. It is gaining traction among retailers aiming to reduce plastic use across supply chains. New product launches featuring bioplastics are supported by point-of-sale education and digital storytelling. Shelf-ready packaging with compostable certifications is improving consumer recognition and shelf impact. Retailers are leveraging sustainability claims to compete with national brands and attract loyalty-driven buyers. Sustainability has moved from the niche to the mainstream across multiple product categories.

- For example, Natural Grocers (NGVC) reported launching 22 new eco-conscious private label SKUs in Q2 2025, with 800+ products now using sugar-cane based or recycled-content packaging. This accounts for 8.6% of total company sales and reduces packaging plastic content by 20% compared to conventional lines.

Market Challenges Analysis:

Cost Competitiveness and Price Sensitivity in Mass Adoption Remain Key Barriers

Despite the environmental benefits, bioplastic bags remain costlier than conventional plastics, limiting broader market penetration. The high cost of raw materials such as PLA and PHA drives up production expenses. Economies of scale are not yet fully achieved, especially among small and medium manufacturers. The Bioplastic Packaging Bag Market is facing pricing pressure from both consumers and retailers, particularly in price-sensitive regions. It is challenging to balance sustainability with affordability, especially in developing economies. End-users often hesitate to adopt higher-cost packaging unless mandated or incentivized. Manufacturers are seeking ways to streamline production and optimize supply chains to reduce costs. Without widespread price parity, adoption will remain slower in cost-driven markets.

Limited Composting Infrastructure and Consumer Awareness Impede Circularity

Many regions lack adequate infrastructure to process bioplastic waste effectively, undermining its sustainability advantage. Industrial composting facilities are sparse in parts of Asia, Latin America, and Africa. Even in developed markets, confusion persists regarding correct disposal methods for bioplastics. The Bioplastic Packaging Bag Market struggles with misconceptions that all bioplastics are home compostable or recyclable. It is critical to ensure proper labeling and public education to drive responsible usage. Inadequate waste segregation often leads to contamination in recycling or composting streams. Brands are investing in awareness campaigns, but systemic change requires government and municipal support. Without infrastructure alignment, bioplastic bags may not deliver their full environmental potential.

Market Opportunities:

Rising Investments in Bioplastic Manufacturing and Supply Chain Localization

Governments and private investors are funding bioplastic production facilities to reduce reliance on fossil-derived materials. These investments are creating regional hubs for sustainable packaging innovation. The Bioplastic Packaging Bag Market is poised to benefit from localized supply chains that cut transportation emissions and improve responsiveness. It is unlocking opportunities for partnerships between polymer developers, packaging converters, and FMCG brands. Manufacturers are exploring renewable feedstocks such as algae, agricultural waste, and seaweed to diversify sources.

Integration of Smart Features and Digital Printing in Bioplastic Bags

Advances in printing and tracking technologies are enabling smart bioplastic bags with QR codes, tamper-evidence, and brand interactivity. These features are enhancing traceability and consumer engagement, especially in premium and health-focused segments. The Bioplastic Packaging Bag Market is leveraging these technologies to elevate packaging beyond protection and disposal. It is positioning bioplastics as a medium for storytelling, authenticity verification, and user education.

Market Segmentation Analysis:

The Bioplastic Packaging Bag Market is segmented by material, product type, and application, each contributing to its growing diversity and scope.

By material, Polylactic Acid (PLA) leads the material segment due to its cost-effectiveness, ease of processing, and wide adoption in food and retail packaging. Polyhydroxyalkanoates (PHA) are gaining traction in medical and pharmaceutical applications due to their biodegradability and biocompatibility. Thermoplastic Starch (TPS) and cellulose-based bioplastics also hold significant shares, supported by abundant feedstock and favorable compostability characteristics. Other bioplastics continue to support niche applications through tailored formulations.

- For example, NatureWorks is the world’s leading supplier of PLA biopolymer. In 2024, the company announced commercial-scale supply agreements with Huhtamaki for foodservice packaging in the EU and US, delivering over 150,000 metric tons of Ingeo™ PLA annually.

By product type, bags represent the dominant segment, driven by demand from food service, grocery retail, and e-commerce sectors. Bottles, cups, trays, and clamshells are also growing steadily, supported by the food and beverage industry’s shift toward sustainable alternatives. Pouches and sachets are gaining visibility in personal care and pharmaceutical packaging due to their lightweight structure and functional properties.

- For instance, Eco Products’ PLA cold drink cups, made in North America from Ingeo™ PLA, are certified compostable and supplied to Starbucks for regional store trials in California, with initial deployment of over 8 million units in 2024.

By application, food packaging remains the largest revenue contributor, supported by strict regulations on plastic use and rising consumer preference for eco-friendly materials. Non-food packaging and consumer goods packaging are expanding as brand owners invest in sustainable presentation and delivery formats. Industrial and pharmaceutical packaging segments are adopting bioplastic materials to comply with environmental policies and meet performance standards. The Bioplastic Packaging Bag Market continues to diversify through innovation across all application verticals.

Segmentation:

By Material:

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Thermoplastic Starch (TPS)

- Cellulose-based Bioplastics

- Other Bioplastics

By Product Type:

- Bottles

- Cups

- Trays

- Clamshells

- Bags

- Pouches & Sachets

By Application:

- Food Packaging

- Non-Food Packaging

- Consumer Goods Packaging

- Industrial Packaging

- Medical and Pharmaceutical Packaging

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Europe holds the largest share in the Bioplastic Packaging Bag Market, accounting for 36% of the global revenue in 2024. Strong regulatory frameworks, including the EU’s Single-Use Plastics Directive and waste management policies, are driving demand for compostable and bio-based bags. Countries such as Germany, France, and the Netherlands are leading in adoption due to well-established recycling and composting infrastructure. Government subsidies and corporate sustainability targets are supporting continuous R&D in biopolymers. The market benefits from high consumer awareness and retailer initiatives favoring biodegradable packaging solutions. Manufacturers are focusing on enhancing local production capabilities to reduce imports and improve responsiveness to regional demand. Europe continues to be the innovation center for bioplastic applications in packaging.

North America captures 28% of the global Bioplastic Packaging Bag Market, driven by growing investments in sustainable materials and consumer demand for eco-friendly products. The United States leads the region, supported by state-level bans on single-use plastics and retail partnerships promoting compostable alternatives. Large-scale food and beverage companies are actively transitioning to bioplastic bags in response to ESG targets and brand image considerations. Canada is showing steady growth through public education initiatives and waste reduction strategies. The region has witnessed expansion in domestic bioplastic production, especially PLA and starch-based materials. It is also experiencing increased collaborations between packaging firms and biopolymer technology providers. Brand-led initiatives are shaping packaging norms across fast-moving consumer goods.

Asia Pacific holds a 24% market share and represents the fastest-growing region in the Bioplastic Packaging Bag Market. Rising urbanization, supportive government policies, and strong manufacturing capacity in China, India, and Japan are accelerating growth. Local governments in China and India are implementing plastic bans, which are prompting demand for biodegradable alternatives. The region benefits from abundant agricultural feedstocks for bioplastic production, enabling cost-effective material sourcing. Rapid development of retail and e-commerce sectors is generating large-scale demand for sustainable packaging. It is witnessing increasing foreign direct investments in bioplastic plants and R&D centers. Asia Pacific’s position in global supply chains enhances its role in meeting international bioplastic bag demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- NatureWorks LLC

- Novamont S.p.A.

- Biome Bioplastics

- TotalEnergies Corbion (also known as Total Corbion PLA)

- BioBag International

- Braskem S.A.

Competitive Analysis

The Bioplastic Packaging Bag Market features a competitive landscape with a mix of established players and emerging innovators. Key companies include Novamont S.p.A., BASF SE, NatureWorks LLC, BioBag International AS, and Futamura Group. These players focus on bio-based polymer development, strategic collaborations, and sustainable packaging innovation. It is characterized by continuous product launches, licensing agreements, and capacity expansions to meet rising demand. Companies are investing in R&D to enhance barrier properties and reduce production costs. Regional players are entering the market with customized, locally sourced solutions. Market leaders maintain strong distribution networks across Europe, North America, and Asia Pacific. Competitive positioning depends on technical performance, regulatory compliance, and supply chain agility.

Recent Developments:

- In June 2025, BASF SE announced innovative developments in sustainable plastics at the K 2025 event, highlighting new biopolymer packaging materials that utilize renewable feedstocks instead of fossil resources. These advancements, including certified compostable solutions from BASF’s ecoflex® and biomass-balanced PBAT, are directly designed for the bioplastic packaging bag market.

- In April 2025, Braskem S.A. expanded its “I’m green™” bio-based polyethylene production, growing its global capacity and reinforcing its leadership in the field. The “I’m green™” biopolymer is widely used in bioplastic packaging, including bags, and this expansion supports broader adoption of sustainable packaging solutions worldwide.

Market Concentration & Characteristics

The Bioplastic Packaging Bag Market remains moderately concentrated, with top companies accounting for a significant portion of global revenue. It is marked by steady innovation cycles, regulatory-driven adoption, and price-sensitive consumer behavior. The market supports both global players and niche manufacturers targeting regional sustainability goals. Vertical integration and raw material access provide competitive advantage. Demand volatility and feedstock availability influence pricing strategies. Firms operate in a dynamic environment shaped by environmental mandates and shifting end-user preferences. Product differentiation hinges on compostability, printability, and functional performance across applications.

Report Coverage:

The research report offers an in-depth analysis based on material, product type, and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness sustained growth driven by increasing environmental regulations and global anti-plastic initiatives.

- Biopolymer innovations will improve material durability, expanding application in food, pharmaceutical, and industrial packaging.

- Integration of automation in bioplastic bag manufacturing will enhance production efficiency and reduce operational costs.

- Growing consumer demand for sustainable packaging will influence brand strategies across retail and FMCG sectors.

- Investments in localized bioplastic production facilities will strengthen supply chains and reduce dependence on imports.

- Expansion of composting and recycling infrastructure will support broader end-of-life solutions for bioplastic bags.

- Strategic partnerships between raw material suppliers and packaging converters will accelerate market penetration.

- Emerging economies will contribute significantly to demand due to urbanization and regulatory support.

- Digital printing and smart packaging features will differentiate bioplastic bags in competitive retail environments.

- Global sustainability benchmarks will push companies to adopt certified and traceable bioplastic solutions at scale.