| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Gasket And Seals Market Size 2024 |

USD 1,714.23 Million |

| Brazil Gasket And Seals Market, CAGR |

5.31% |

| Brazil Gasket And Seals Market Size 2032 |

USD 2,593.55 Million |

Market Overview

The Brazil Gasket And Seals Market is projected to grow from USD 1,714.23 million in 2024 to an estimated USD 2,593.55 million by 2032, with a compound annual growth rate (CAGR) of 5.31% from 2025 to 2032. This steady growth is driven by increasing industrial applications and the demand for durable sealing solutions across various sectors, such as automotive, oil & gas, and manufacturing.

Key drivers of the Brazil Gasket and Seals Market include the expansion of the automotive sector, rising industrialization, and the growing need for effective sealing solutions to improve operational efficiency and safety. Additionally, trends such as the development of environmentally friendly sealing materials, customization of seals for specific applications, and increased awareness about maintenance and repair of equipment further contribute to market growth.

Geographically, Brazil holds a significant share of the gasket and seals market in the Latin American region. The country’s strong industrial base, coupled with key sectors like oil & gas, automotive, and construction, continues to drive demand for high-quality sealing products. Major players in the market include global and regional manufacturers such as Trelleborg, SKF, Freudenberg, and Dana Incorporated, who are focusing on product innovation and expanding their regional presence to capitalize on growth opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Brazil Gasket and Seals Market is projected to grow from USD 1,714.23 million in 2024 to USD 2,593.55 million by 2032, with a CAGR of 5.31% from 2025 to 2032.

- The market is driven by the expansion of the automotive sector, rising industrialization, and increased demand for sealing solutions in oil & gas, manufacturing, and construction.

- Innovations in material technology are contributing to the growth of high-performance sealing products that offer durability and resistance to extreme conditions.

- Growing demand for eco-friendly sealing materials and sustainable manufacturing practices is shaping the market landscape.

- Volatility in raw material prices and supply chain disruptions can hinder market growth, affecting production costs and availability of sealing solutions.

- The Southeast region dominates the market, accounting for nearly 45-50% of the market share, due to its strong industrial and automotive presence.

- Major players like Trelleborg, SKF, Freudenberg, and Dana are focusing on innovation and expanding their regional presence to capture market opportunities.

Market Drivers

Growing Demand from the Automotive Industry

The automotive industry is a significant contributor to the growth of the Brazil Gasket and Seals Market. As Brazil is one of the largest automotive markets in Latin America, the demand for gaskets and seals in automotive applications is steadily increasing. Gaskets and seals are essential components in vehicles, serving as sealing solutions for engines, exhaust systems, transmissions, and various other mechanical parts. They help to prevent leaks, control fluid flow, and ensure the integrity of the vehicle’s components under extreme conditions. For instance, companies are investing in R&D to develop specialized gaskets and seals for electric vehicles, which require unique sealing solutions for battery systems and cooling systems. The growing adoption of electric vehicles further boosts the demand for these specialized components. Additionally, the need for aftermarket replacement parts as vehicle fleets increase, as well as growing concerns regarding vehicle performance, fuel efficiency, and emissions, are pushing for higher-quality sealing solutions in the automotive sector.

Expanding Industrial Sector and Infrastructure Development

Brazil’s industrial sector, including manufacturing, energy, and construction, is a key driver of the gasket and seals market. The expansion of industrial activities, fueled by increased investments in infrastructure and industrialization, is raising the demand for sealing solutions that can withstand harsh operational environments. The oil and gas industry, in particular, requires high-performance gaskets and seals due to the rigorous demands of offshore and onshore operations. For instance, government initiatives to support infrastructure development projects, such as the construction of new factories and large-scale infrastructure, require a vast number of sealing products. These gaskets and seals are used in a variety of applications, including pumps, valves, pipelines, HVAC systems, and machinery, ensuring their proper functioning and reducing the risk of system failures. As Brazil continues to focus on modernizing its infrastructure, the market for sealing solutions in industrial applications is set to grow. Moreover, advancements in material technology are enabling the creation of seals that can endure extreme temperatures, pressure, and chemical exposure.

Rise in Oil & Gas Production and Demand for Sealing Solutions

Brazil is one of the largest oil producers in Latin America, and the oil and gas sector plays a critical role in the country’s economic development. The country has been focusing on expanding its oil and gas exploration and production activities, particularly in offshore fields like the pre-salt reservoirs, which are located deep under the ocean. This expansion has significantly boosted the demand for high-quality gaskets and seals that can withstand the harsh environments and extreme pressures typical in these operations.Seals and gaskets are vital in ensuring the reliability and safety of equipment used in the oil and gas industry, including pipelines, drilling rigs, pressure vessels, and valves. As production in these fields increases, so does the demand for durable and high-performance sealing solutions to prevent leaks, ensure the safety of workers, and maintain system integrity. Furthermore, Brazil’s commitment to increasing its oil exports and establishing itself as a leader in global energy markets is expected to further drive the need for advanced sealing solutions. With the growth of the oil and gas industry, manufacturers in the gasket and seals market are focusing on offering solutions that meet the unique challenges of the energy sector, such as resistance to high pressure, chemicals, and temperature extremes.

Technological Advancements in Sealing Materials and Product Innovation

Technological advancements in sealing materials and product innovation are key drivers in the Brazil Gasket and Seals Market. The constant demand for more durable and efficient sealing solutions has led to the development of new materials, such as expanded PTFE, composites, and specialty elastomers, that offer enhanced performance in extreme conditions. These innovations have enabled manufacturers to produce seals that offer improved resistance to heat, pressure, chemicals, and wear, making them ideal for use in a variety of industries, including automotive, oil & gas, and industrial manufacturing.Moreover, there is a growing trend toward customized sealing solutions that cater to specific industry needs. As industrial processes become more complex and the demand for precision increases, gasket and seal manufacturers are working closely with end-users to design bespoke sealing products that meet exact specifications. This trend toward product customization is expected to continue, driving the need for specialized seals that improve operational efficiency, reduce downtime, and lower maintenance costs. Additionally, the increasing focus on sustainability and the environment has led to the development of eco-friendly sealing materials that reduce the environmental impact of gaskets and seals, further driving market growth.

Market Trends

Sustainability and Environmentally Friendly Solutions

The focus on sustainability is a key trend in the Brazil Gasket and Seals Market, driven by increasing environmental awareness and the regulatory push for more eco-friendly products. Manufacturers are increasingly exploring materials and production processes that reduce environmental impact. For instance, there is a growing interest in biodegradable seals and gaskets made from sustainable materials, such as natural rubber, bio-based polymers, and recyclable compounds. These materials not only address the environmental concerns but also help companies meet stringent environmental regulations, which is especially important in industries like automotive and construction, where sustainability initiatives are becoming a priority.Additionally, the increasing adoption of eco-friendly seals is supported by growing consumer demand for greener products and the need for businesses to comply with environmental regulations that limit waste and pollution. This shift towards sustainability in the gasket and seals market aligns with broader trends in industrial manufacturing, where circular economy principles are being adopted to reduce waste and promote the reuse of materials. In Brazil, industries such as automotive and construction, which are major consumers of gaskets and seals, are under pressure to innovate and implement sustainable practices, further pushing the demand for environmentally friendly sealing solutions. Manufacturers are also focusing on reducing the carbon footprint of their production processes, which includes optimizing energy consumption and minimizing emissions during the manufacturing of seals and gaskets.

Growing Demand for Sealing Solutions in the Energy and Renewable Energy Sectors

The energy sector, particularly the renewable energy industry, is contributing significantly to the demand for gaskets and seals in Brazil. As the country focuses on diversifying its energy mix and increasing the share of renewable energy sources, such as wind, solar, and bioenergy, there is a corresponding rise in the need for sealing solutions to maintain the performance and efficiency of renewable energy infrastructure. In wind turbine applications, for instance, specialized seals are required to protect critical components, such as bearings and gearboxes, from dust, moisture, and contaminants. Similarly, solar power systems and bioenergy plants rely on gaskets and seals to prevent leakage in piping systems and enhance energy transfer efficiency.The energy sector is undergoing significant transformation in Brazil, as the government and private companies invest in cleaner energy solutions to meet sustainability targets. This shift is expected to increase the demand for sealing products used in renewable energy systems and equipment. Additionally, the ongoing development of Brazil’s pre-salt oil fields, which are located offshore, continues to drive the need for high-performance sealing solutions in the oil and gas industry. As Brazil’s energy landscape evolves, manufacturers of gaskets and seals are focusing on developing specialized sealing solutions that cater to the specific needs of these growing energy sectors, offering enhanced reliability, longer service life, and better resistance to environmental factors.

Adoption of Advanced Materials for Enhanced Performance

A major trend in the Brazil Gasket and Seals Market is the increasing adoption of advanced materials that offer superior performance characteristics. The demand for seals and gaskets that can withstand extreme conditions—such as high pressure, temperature fluctuations, and chemical exposure—has led manufacturers to focus on developing and utilizing innovative materials. For instance, surveys by industry leaders indicate a growing preference for materials like expanded PTFE (polytetrafluoroethylene) gaskets and fluorocarbon elastomers due to their ability to endure harsh operational environments. These advanced materials are particularly valuable in industries such as automotive, oil & gas, and chemicals, where sealing solutions must provide reliable performance over extended periods. As companies in Brazil and around the world continue to face evolving industrial challenges, the need for high-performance sealing solutions has driven ongoing research and development in materials technology.

Customization of Seals and Gaskets for Specific Applications

The trend towards greater customization in gasket and seal manufacturing is rapidly growing in Brazil. Industries like automotive, energy, and manufacturing are looking for more tailored solutions that meet the unique needs of their applications. Custom seals and gaskets are increasingly in demand because they offer better performance and efficiency for specific machinery, systems, and processes. For instance, government surveys highlight the automotive sector’s need for gaskets and seals that are not only suited to the engine’s operating conditions but are also optimized for fuel efficiency and emissions control. Similarly, in the oil and gas industry, seals are being customized to withstand the specific pressures and temperatures encountered in offshore drilling rigs or deep-water exploration. This trend towards tailored sealing solutions is also visible in the industrial manufacturing sector, where companies seek gaskets and seals that can handle high-performance machinery. As businesses in Brazil continue to modernize their production facilities and improve operational efficiency, the demand for custom gaskets and seals is expected to grow.

Market Challenges

Fluctuating Raw Material Costs and Supply Chain Disruptions

One of the major challenges faced by the Brazil Gasket and Seals Market is the volatility in raw material costs and disruptions in the supply chain. The production of gaskets and seals relies heavily on materials like rubber, metal, and advanced polymers, which are subject to price fluctuations due to factors such as global demand, geopolitical tensions, and supply chain inefficiencies. For instance, the price of rubber and synthetic elastomers can be impacted by agricultural trends, climate events, and the availability of oil and gas. These fluctuations often lead to increased production costs for manufacturers, which can, in turn, affect the pricing and competitiveness of gaskets and seals in the market. Furthermore, supply chain disruptions, particularly those related to international trade, have become more common due to the ongoing effects of the COVID-19 pandemic, global trade uncertainties, and logistical challenges. In Brazil, where a significant portion of raw materials and finished products are imported, these disruptions can cause delays in production schedules and shortages of key materials. This presents a significant challenge for gasket and seal manufacturers, as they must find ways to mitigate the impact of these disruptions, such as by securing alternative supply sources or adopting more localized production strategies.

Intense Competition and Price Pressure

The Brazil Gasket and Seals Market is also grappling with intense competition and price pressure, which poses a challenge for manufacturers aiming to maintain profitability. The market is characterized by the presence of both local and international players, each vying for a share of the growing demand for sealing solutions. This has led to increased competition, particularly in the low-cost segment, where manufacturers are forced to reduce prices to remain competitive. While cost reduction strategies are crucial to securing market share, they can also compromise product quality, which in turn affects customer satisfaction and brand loyalty. Additionally, the increasing focus on cost efficiency among end-users in industries such as automotive, oil and gas, and manufacturing has heightened price sensitivity, further intensifying the competitive pressures faced by gasket and seal manufacturers. Companies are forced to balance the need for competitive pricing with the demand for high-quality, durable products. This often results in the challenge of maintaining profit margins while meeting the expectations of price-conscious consumers. Manufacturers must continuously innovate, streamline operations, and optimize production processes to stay competitive while ensuring the quality of their products.

Market Opportunities

Expansion in Renewable Energy Sector

One of the most promising opportunities in the Brazil Gasket and Seals Market lies in the growing renewable energy sector. As Brazil continues to invest in cleaner and more sustainable energy sources, including wind, solar, and bioenergy, there is a rising demand for specialized sealing solutions. Seals and gaskets play a crucial role in maintaining the efficiency and reliability of renewable energy infrastructure. For example, in wind turbines, gaskets are essential to protecting critical components from environmental contaminants, ensuring longevity and performance. Similarly, in solar power systems, gaskets are used in sealing modules and electrical connections to prevent moisture ingress. This burgeoning sector offers manufacturers the opportunity to develop innovative sealing products tailored to the unique needs of renewable energy applications, positioning themselves as key suppliers in a rapidly expanding market.

Growth in Automotive and Electric Vehicle (EV) Market

The automotive sector, particularly the electric vehicle (EV) market, represents a significant growth opportunity for gasket and seal manufacturers in Brazil. With the increasing adoption of electric vehicles and a shift toward cleaner transportation options, the demand for high-quality sealing solutions is set to rise. Gaskets and seals are crucial components in EVs, ensuring proper sealing in the battery systems, cooling systems, and high-voltage components. As the Brazilian automotive industry continues to transition towards more sustainable and efficient technologies, manufacturers have the chance to develop specialized seals that meet the unique demands of EVs, further diversifying their product offerings and capturing a growing share of this emerging market. This trend is expected to drive substantial long-term growth opportunities in the gasket and seals market.

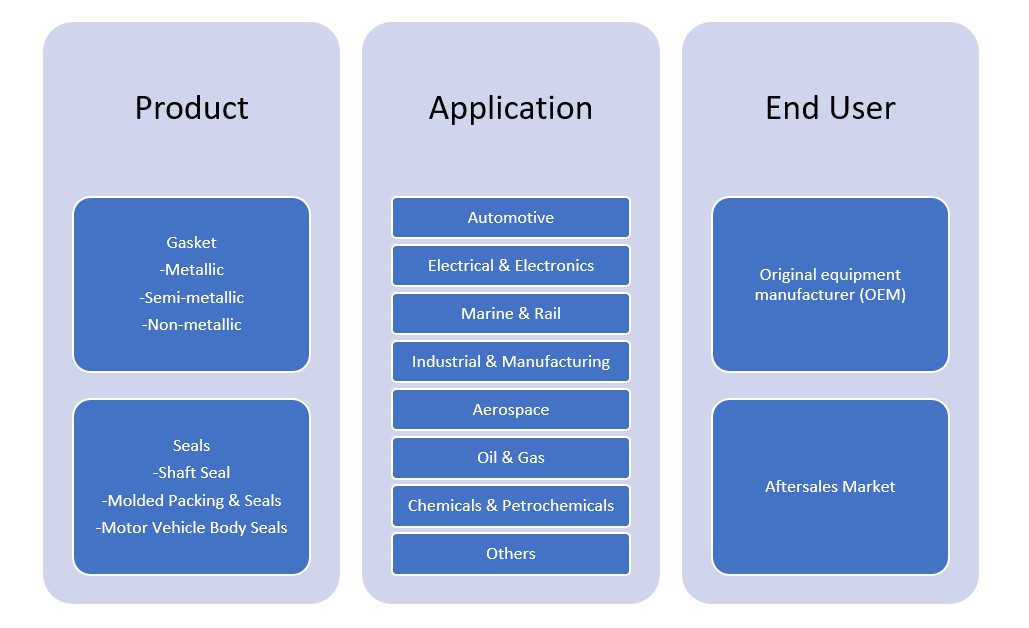

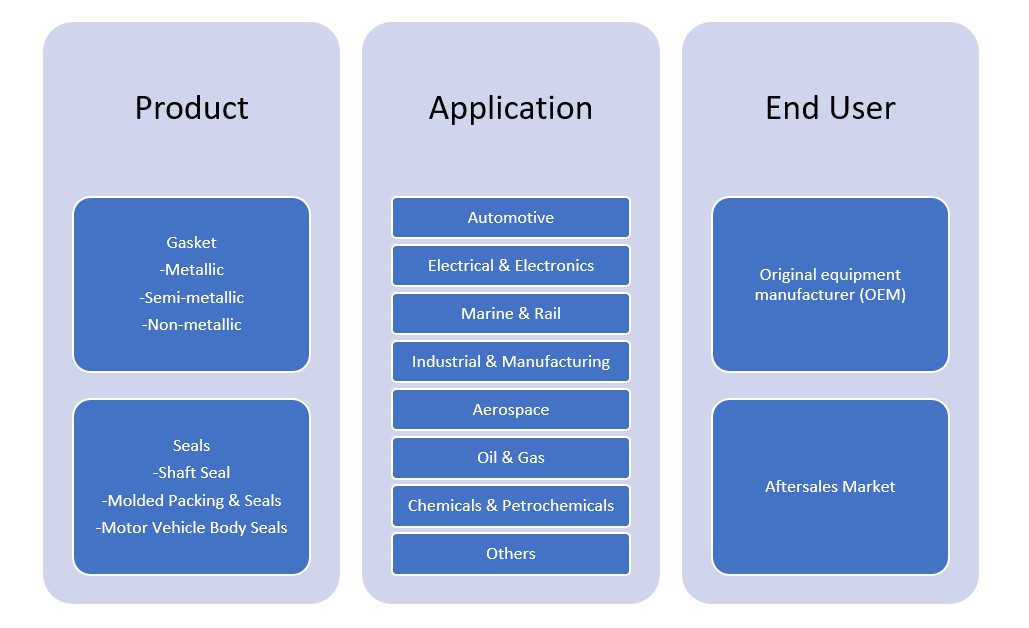

Market Segmentation Analysis

By Product

The market is broadly categorized into gaskets and seals. The gasket segment is further divided into metallic, semi-metallic, and non-metallic gaskets. Metallic gaskets are widely used in high-pressure and high-temperature environments, especially in industrial and petrochemical applications. Semi-metallic gaskets, offering a balance between strength and flexibility, are preferred in various mechanical systems. Non-metallic gaskets, often made from materials like rubber, PTFE, or graphite, dominate applications requiring chemical resistance and low compressive force.The seals segment includes shaft seals, molded packing and seals, and motor vehicle body seals. Shaft seals are extensively utilized in rotating equipment across automotive and manufacturing industries. Molded packing and seals are popular due to their adaptability in complex geometries, while motor vehicle body seals are crucial in enhancing vehicle durability and noise insulation, especially in passenger and commercial vehicles.

By Application

The market is segmented into automotive, electrical & electronics, marine & rail, industrial & manufacturing, aerospace, oil & gas, chemicals & petrochemicals, and others. The automotive sector holds a significant share, driven by the production and maintenance of conventional and electric vehicles. The oil & gas and chemicals & petrochemicals segments also generate high demand due to the need for high-performance sealing solutions in extreme operating conditions. Industrial and manufacturing applications remain a steady demand base due to continuous production processes requiring reliable sealing components.

Segments

Based on Product

- Gasket

- Metallic

- Semi-metallic

- Non-metallic

- Seals

- Shaft Seal

- Molded Packing & Seals

- Motor Vehicle Body Seals

Based on Application

- Automotive

- Electrical & Electronics

- Marine & Rail

- Industrial & Manufacturing

- Aerospace

- Oil & Gas

- Chemicals & Petrochemicals

- Others

Based on End User

- Original equipment manufacturer (OEM)

- Aftersales Market

Based on Region

- Southeast

- South

- Northeast

- North

- Central-West

Regional Analysis

Southeast Brazil (45-50%)

The Southeast region holds the largest market share in the Brazil Gasket and Seals Market, contributing approximately 45-50% of the total market. This region is the industrial powerhouse of the country, home to major automotive manufacturers, industrial plants, and energy companies. São Paulo, in particular, is a key hub for the automotive industry, driving significant demand for gaskets and seals used in vehicle production and aftermarket services. Additionally, the region is pivotal for oil & gas operations, especially in the offshore pre-salt fields, making it a critical area for high-performance sealing solutions. The diverse industrial base across this region supports the demand for a variety of gasket and seal types, including metallic and non-metallic gaskets, as well as shaft seals and molded packing.

South Brazil (25-30%)

The South region accounts for approximately 25-30% of the total market share. This region is known for its strong manufacturing sector, including automotive, machinery, and agricultural equipment production. The automotive industry is particularly significant here, with several domestic and international companies having production facilities in the region. The demand for gaskets and seals in this area is driven by both OEMs and the aftermarket sector. Additionally, the South region’s growing focus on clean energy, particularly in wind power and bioenergy, is contributing to an increased need for specialized sealing solutions.

Key players

- VMI Sealing Solutions

- Sodecis

- Tecnoseal

- Dichtungstechnik

- Sealing Technology Brazil

Competitive Analysis

The Brazil Gasket and Seals Market is characterized by a diverse set of players offering a wide range of sealing solutions to meet the varied needs of industries such as automotive, oil & gas, and manufacturing. VMI Sealing Solutions stands out for its strong product portfolio and innovative sealing technologies, focusing on high-quality and high-performance seals and gaskets. Sodecis, known for its robust presence in the local market, offers competitive pricing and is focused on expanding its regional footprint. Tecnoseal is recognized for its custom-engineered sealing products and has built a reputation for reliability and precision, catering to both OEMs and the aftermarket segment. Dichtungstechnik offers specialized sealing solutions with a focus on high-end applications in industries like aerospace and automotive, while Sealing Technology Brazil focuses on delivering tailored solutions to meet the specific demands of the oil & gas and energy sectors. Together, these players form a highly competitive landscape where innovation, product quality, and customer service are key differentiators.

Recent Developments

- On February 12, 2025, SKF India Limited’s Board of Directors approved the appointment of Ms. Surbhi Srivastava, Head of People Experience, to the Senior Management Team. Ms. Srivastava holds a Bachelor of Science from Fergusson College and an MBA from Symbiosis Institute of Business Management, Pune, with over 20 years of experience across various industries.

- In May 2024, Trelleborg announced plans to invest in a new production facility in Casablanca, Morocco, dedicated to aerospace sealing solutions. Construction commenced prior to January 2025, with operations expected to begin by the end of 2025.

- In November 2023, Freudenberg Sealing Technologies reported that sales of its Simriz perfluoroelastomeric (FFKM) compounds had more than doubled in North America over the preceding 24 months. This surge was attributed to the compounds’ quality, performance, and availability during supply chain disruptions.

- On May 2, 2023, The Yokohama Rubber Co., Ltd. completed the acquisition of all outstanding shares of Trelleborg Wheel Systems Holding AB, expanding its presence in the off-highway tire sector.

Market Concentration and Characteristics

The Brazil Gasket and Seals Market exhibits a moderate to high level of concentration, with a mix of both local and international players competing for market share. Major global players such as VMI Sealing Solutions, Sodecis, and Tecnoseal dominate the market with their extensive product portfolios and strong distribution networks. However, the market also includes numerous regional and small-to-medium-sized enterprises that cater to specific niches and regional needs. The competitive landscape is characterized by innovation in sealing materials, customization of solutions for specialized applications, and a growing emphasis on sustainability. The market’s dynamics are also influenced by the increasing demand for high-performance gaskets and seals, particularly in industries such as automotive, oil & gas, and renewable energy. Despite competition, there remains ample opportunity for new entrants and regional players to expand, particularly through technological advancements and product differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The automotive sector will continue to drive demand for gaskets and seals, particularly with the rise of electric vehicles. As vehicle production grows, the need for high-quality sealing solutions will increase.

- Brazil’s expanding oil and gas exploration, especially in offshore pre-salt fields, will increase the demand for specialized, high-performance sealing solutions. Seals will be essential in ensuring operational efficiency and safety in extreme conditions.

- The renewable energy sector, particularly wind and solar energy, will provide significant opportunities for gasket and seal manufacturers. Sealing solutions for energy infrastructure, including turbines and solar panels, will see a rise in demand.

- Advancements in material technology will lead to the development of more durable, heat-resistant, and chemical-resistant sealing products. These innovations will cater to industries requiring high-performance sealing solutions.

- There will be a growing demand for customized gaskets and seals tailored to specific applications in industries like automotive and aerospace. Manufacturers will focus on offering bespoke solutions to enhance product performance.

- Environmental considerations will drive the adoption of eco-friendly materials in gasket and seal production. Sustainable materials like biodegradable polymers and recycled compounds will become increasingly common.

- As Brazil continues to invest in infrastructure, the demand for sealing solutions in construction and industrial equipment will rise. Gaskets and seals will be needed to ensure the efficiency of machinery and systems.

- The aftersales market will continue to expand due to the growing number of vehicles and machinery requiring replacement seals and gaskets. This will create sustained demand for aftermarket sealing products.

- The gasket and seals market in Brazil will see increased competition as both global and regional players vie for market share. This could lead to market consolidation as companies seek to expand their regional presence.

- With industries demanding more reliable and long-lasting products, the market will see a shift towards seals that offer enhanced durability and longevity. Manufacturers will focus on delivering seals with better performance in extreme conditions, reducing maintenance costs.