Market Overview

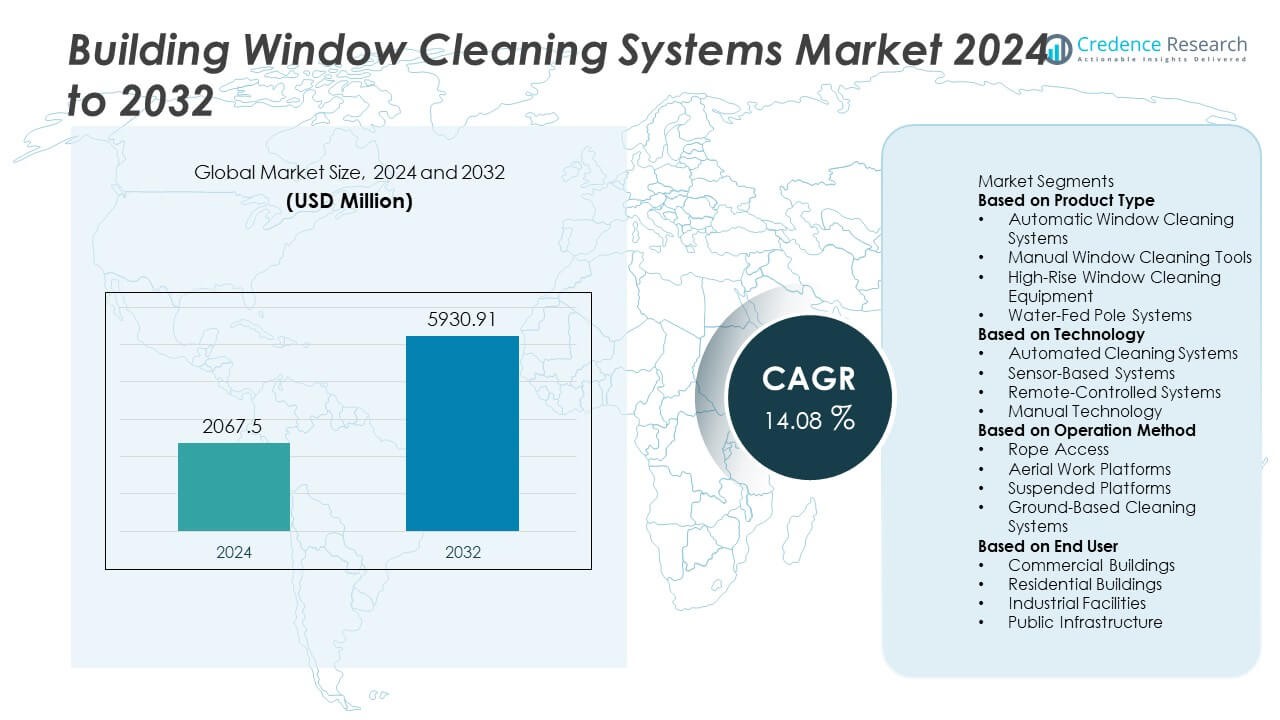

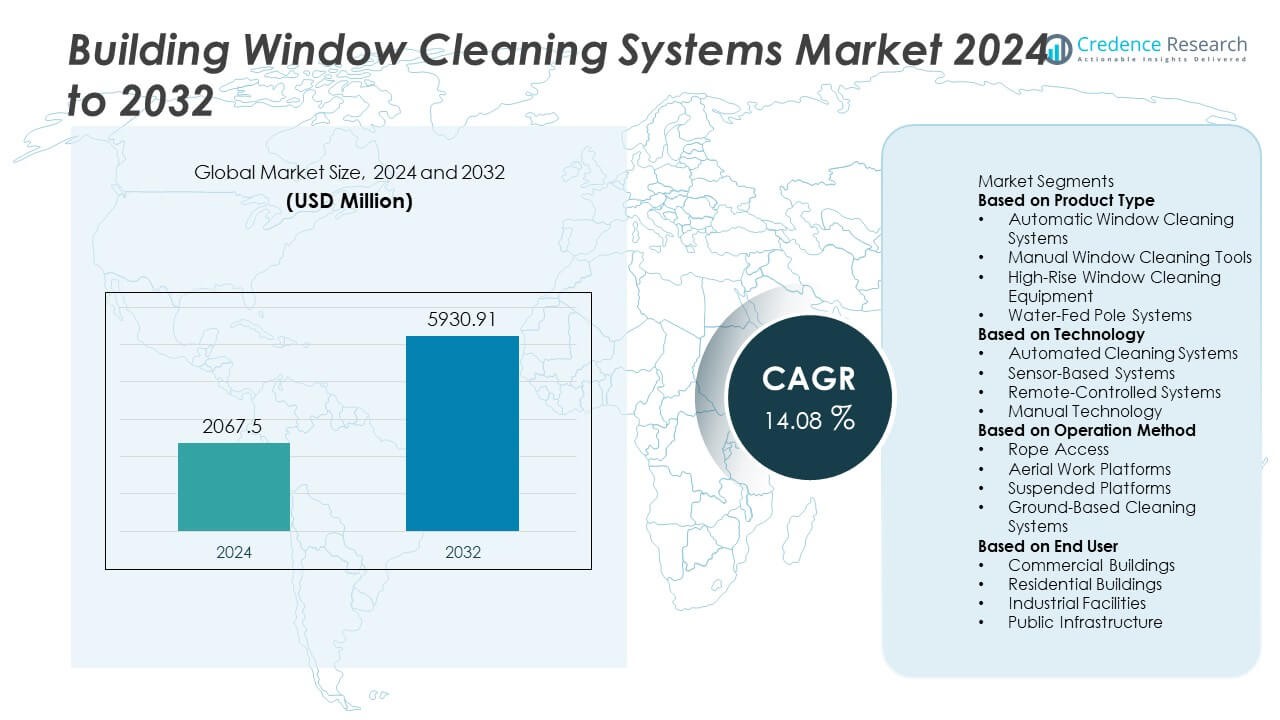

The Building Window Cleaning Systems Market reached USD 2,067.5 million in 2024 and is projected to reach USD 5,930.91 million by 2032, supported by a CAGR of 14.08% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Building Window Cleaning Systems Market Size 2024 |

USD 2,067.5 Million |

| Building Window Cleaning Systems Market, CAGR |

14.08% |

| Building Window Cleaning Systems Market Size 2032 |

USD 5,930.91 Million |

The Building Window Cleaning Systems market is led by key players such as Kärcher, Unger Enterprises, IPC Eagle, Hailo, Ettore Products Company, Fimap, XERO Manufacturing, Cleanfix Reinigungssysteme, Facade Access Group (FAG), and Sky Pro Window Cleaning Systems. These companies expand their portfolios with automated cleaners, high-rise access systems, and water-fed pole technologies to meet rising demand for safe and efficient façade maintenance. North America leads the global market with a 33% share, driven by high-rise commercial infrastructure and strong adoption of robotic systems. Asia Pacific follows with a 31% share, supported by rapid urban development and expanding skylines, while Europe accounts for a 29% share due to strict safety regulations and strong demand for sustainable cleaning solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Building Window Cleaning Systems market reached USD 2,067.5 million in 2024 and will reach USD 5,930.91 million by 2032 at a CAGR of 14.08%.

- Demand grows as automatic window cleaning systems lead the product segment with a 41% share, driven by safer, faster, and more efficient cleaning needs across commercial and high-rise buildings.

- Key trends include rapid adoption of robotic, AI-enabled, and water-efficient cleaning systems, supported by rising smart building development and increased focus on sustainable maintenance technologies.

- Competitive activity intensifies as Kärcher, Unger Enterprises, IPC Eagle, Hailo, and other players expand portfolios with automated platforms, sensor-based navigation, and lightweight high-rise equipment, while high installation and maintenance costs remain major restraints.

- Regionally, North America holds a 33% share, Asia Pacific captures 31%, and Europe accounts for 29%, reflecting strong adoption of automated systems, expanding skylines, and strict safety standards across commercial and residential buildings.

Market Segmentation Analysis:

By Product Type

Automatic Window Cleaning Systems lead this segment with a 41% share, driven by rising adoption across commercial towers, smart buildings, and large glass façades that demand efficient and consistent cleaning. These systems reduce labor risks, enhance safety, and deliver faster cleaning cycles compared to traditional tools. High-rise window cleaning equipment continues to gain traction as urban skylines expand, while water-fed pole systems see strong use in mid-rise structures due to their reach and water efficiency. Manual tools remain relevant for small-scale or low-budget applications but hold a smaller share as automation adoption accelerates globally.

- For instance, Kärcher introduced robotic floor cleaners for professional use, such as the KIRA B 50 scrubber dryer robot, which can cover a potential area performance of up to 2,300 square meters per hour in medium to large indoor areas.

By Technology

Automated Cleaning Systems dominate the technology segment with a 44% share, supported by increasing integration of robotics, AI navigation, and advanced suction technologies that ensure precise and safe cleaning on multi-story buildings. Sensor-based systems grow steadily as high-end buildings invest in smart maintenance solutions capable of obstacle detection and real-time positioning. Remote-controlled systems expand as facility managers seek safer alternatives to manual high-rise operations. Manual technology maintains use in low-rise or residential cleaning but continues to decline as automation reduces operational risks and long-term costs.

- For instance, Skyline Robotics developed an AI-guided robot named Ozmo using a KUKA robotic arm, an array of sensors including lidar and force sensors, and a sophisticated software-based AI system to map façades and maintain stability with high accuracy.

By Operation Method

Rope Access leads this segment with a 39% share, driven by its flexibility, cost-efficiency, and ability to access complex architectural structures where machines may struggle. It remains widely used in high-rise commercial buildings and mixed-use towers. Suspended platforms follow closely as large building owners adopt motorized gondola systems for safer and faster façade cleaning. Aerial work platforms support cleaning for mid-rise structures and industrial sites that require mobility and stability. Ground-based cleaning systems continue to expand due to water-fed pole innovation and suitability for low- to mid-height buildings.

Key Growth Drivers

Rising Demand for Automated and Safe Cleaning Solutions

Automation drives strong growth as buildings adopt safer and faster cleaning systems. High-rise structures need solutions that reduce worker risk and improve cleaning efficiency. Automatic and robotic systems support consistent cleaning and cut labor costs. Facility managers prefer machines that deliver stable performance in complex façades. Growing smart building adoption also increases demand for intelligent cleaning systems. These factors strengthen the shift toward automation across commercial and residential sectors.

- For instance, Cleanfix Reinigungssysteme produces autonomous robotic systems, such as the scrubber-dryer RA660 Navi XL and the vacuum robot S170 Navi, which use advanced navigation systems like LiDAR and BlueBotics ANT® for professional cleaning of large areas.

Expansion of High-Rise and Glass-Heavy Infrastructure

Urban development increases the number of towers with large glass surfaces. These structures require reliable and frequent façade cleaning. Modern architecture uses more glass, increasing cleaning volume and complexity. High-rise window cleaning equipment supports safe access and large-area coverage. The rising construction of commercial towers strengthens market demand. New city development projects further boost adoption of advanced cleaning systems.

- For instance, IPC Eagle offers various solutions, such as the Cleano system which uses a microfiber pad and pure water for efficient cleaning of vertical surfaces, and high-pressure washers with pressure outputs like 120 bar for industrial applications.

Growing Focus on Efficiency and Cost Reduction

Building owners seek solutions that cut long-term cleaning costs. Automated systems reduce manual labor, downtime, and safety-related expenses. Machines offer faster cycles that lower operational hours and improve building upkeep. Water-fed poles and suspended platforms enhance cleaning accuracy with less waste. Facility managers choose systems that support regular cleaning with minimal disruption. This shift drives adoption of efficient and scalable cleaning technologies.

Key Trends & Opportunities

Rapid Adoption of Robotic and AI-Enabled Cleaning Systems

Robotic cleaners gain momentum as buildings adopt smart maintenance tools. AI navigation improves coverage, safety, and precision on high façades. Sensors help detect obstacles and control movement across complex structures. These systems reduce dependency on skilled labor and improve safety compliance. Rising investment in building automation expands opportunities for smart cleaning technologies.

- For instance, the Fraunhofer Institute for Factory Operation and Automation (IFF) developed a facade-cleaning robot system called SIRIUSc, a modular climbing robot designed for skyscrapers and large glass structures.

Growth of Eco-Friendly and Water-Efficient Cleaning Methods

Sustainable cleaning becomes a major opportunity as buildings reduce water usage. Water-fed pole systems use purified water that lowers chemical demand. Eco-friendly cleaning supports green building certifications and reduces operational costs. Manufacturers develop systems that minimize waste and energy use. Growing environmental regulations push adoption of efficient and sustainable technologies.

- For instance, Unger Enterprises launched a water-fed pole system equipped with a 3-stage DI–RO filtration unit delivering 0 ppm output and reducing detergent use by up to 100 liters per month in large facilities.

Key Challenges

High Initial Investment and Maintenance Costs

Advanced cleaning systems require significant upfront investment. Automated and robotic systems also need regular servicing. Many small contractors face budget limits that slow adoption. High-rise equipment demands safety checks and certified operators. These factors raise total ownership costs and limit faster market penetration.

Complex Building Designs and Access Limitations

Modern buildings have curved, angled, or irregular façades. These structures challenge cleaning access and machine stability. Rope access and platforms may not reach all surfaces. Robotic systems struggle with uneven edges and frames. These complexities require customized solutions, increasing project costs and operational difficulty.

Regional Analysis

North America

North America holds a 33% share of the Building Window Cleaning Systems market, driven by widespread adoption of automated and robotic cleaners across commercial towers. The region benefits from a strong presence of high-rise buildings, strict safety regulations, and rising investment in smart building maintenance technologies. Facility managers prioritize solutions that reduce labor risk and improve cleaning efficiency, supporting demand for water-fed poles, suspended platforms, and advanced automated systems. Growing focus on operational cost reduction and sustainability also fuels the shift toward eco-friendly cleaning technologies across urban centers.

Europe

Europe accounts for a 29% share, supported by dense urban infrastructure, advanced building safety standards, and a strong preference for sustainable cleaning practices. Countries such as Germany, the U.K., and France adopt innovative rope access and automated systems to maintain modern glass façades. Increasing use of energy-efficient building materials and a growing emphasis on green maintenance accelerate adoption of water-fed pole systems. Regulatory norms promoting worker safety drive the replacement of manual tools with mechanized and automated equipment, strengthening overall market growth across commercial and residential sectors.

Asia Pacific

Asia Pacific leads with a 31% share, driven by rapid urbanization, expanding skylines, and large-scale construction of high-rise commercial and residential towers across China, India, South Korea, and Southeast Asia. The region embraces advanced cleaning technologies to manage rising demand for façade maintenance on glass-intensive structures. Growing labor shortages and higher safety concerns boost adoption of automated and remote-controlled cleaning systems. Additionally, smart city initiatives and modern infrastructure projects accelerate investments in high-rise window cleaning equipment, making Asia Pacific one of the fastest-growing markets.

Latin America

Latin America holds a 4% share, supported by growing commercial infrastructure in Brazil, Mexico, and Colombia. Urban expansion and increasing construction of mid-rise and high-rise buildings drive demand for efficient window cleaning solutions. The market sees rising adoption of rope access and water-fed pole systems as building owners focus on cost-effective maintenance methods. Although automation adoption remains slower than in developed regions, growing interest in workplace safety and modern cleaning practices contributes to gradual market expansion across major cities.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by large-scale development of modern commercial towers and luxury residential structures in the UAE, Saudi Arabia, and Qatar. The region’s glass-heavy architecture requires frequent maintenance, boosting demand for advanced cleaning systems. High temperatures and environmental conditions create additional cleaning needs, increasing reliance on water-fed poles and suspended platform systems. While automation adoption is emerging, rising investments in iconic high-rise projects and smart city developments support future demand for robotic cleaning technologies.

Market Segmentations:

By Product Type

- Automatic Window Cleaning Systems

- Manual Window Cleaning Tools

- High-Rise Window Cleaning Equipment

- Water-Fed Pole Systems

By Technology

- Automated Cleaning Systems

- Sensor-Based Systems

- Remote-Controlled Systems

- Manual Technology

By Operation Method

- Rope Access

- Aerial Work Platforms

- Suspended Platforms

- Ground-Based Cleaning Systems

By End User

- Commercial Buildings

- Residential Buildings

- Industrial Facilities

- Public Infrastructure

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape is shaped by major players such as Kärcher, Unger Enterprises, IPC Eagle, Hailo, Ettore Products Company, Fimap, XERO Manufacturing, Cleanfix Reinigungssysteme, Facade Access Group (FAG), and Sky Pro Window Cleaning Systems. These companies strengthen market presence by offering advanced cleaning solutions that support automated, high-rise, and eco-efficient operations. Key manufacturers invest in robotic window cleaners, water-fed pole innovations, and lightweight high-rise platforms to enhance safety and reduce manual labor dependency. Product portfolios expand with sensor-based navigation, AI-enabled movement control, and improved suction technologies designed for complex building façades. Strategic collaborations with facility management firms and commercial building developers help companies meet rising demand for scalable and reliable cleaning systems. Many players also focus on sustainable cleaning technologies, including purified-water systems and low-energy robotic units, to align with global green building standards. Continuous R&D investment and regional distribution expansion further intensify competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kärcher

- Unger Enterprises

- IPC Eagle

- Hailo

- Ettore Products Company

- Fimap

- XERO Manufacturing

- Cleanfix Reinigungssysteme

- Facade Access Group (FAG)

- Sky Pro Window Cleaning Systems

Recent Developments

- In 2025, Unger Enterprises launched the HydroPower® Nano Pure Water System, featuring a triple-stage filtration system, nano-membrane plus DI resin, producing up to 1.5 gallons of streak-free cleaning water per minute, using about 10% less water than traditional RO systems.

- In 2024, Unger Enterprises published a blog post explaining that demand for pure-water window-cleaning equipment is rising and that their systems address chemical- and labour-reduction trends.

- In 2023, Fimap SpA unveiled its “EMx Super-Green” scrubbing machine, which uses its AQUÆ® technology to clean without detergents.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Operation Method, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for automated and robotic cleaning systems will rise as high-rise construction expands.

- Safety regulations will push building owners to replace manual cleaning with advanced systems.

- AI-enabled navigation and smart sensors will improve cleaning accuracy on complex façades.

- Water-efficient and eco-friendly cleaning technologies will gain wider adoption.

- Remote-controlled and autonomous systems will reduce dependence on skilled labor.

- High-rise access platforms and rope-assisted equipment will evolve with better safety features.

- Smart city projects will create strong demand for intelligent façade maintenance solutions.

- Integration of predictive maintenance tools will enhance equipment lifespan and reliability.

- Commercial real estate growth will drive large-scale deployment of automated cleaning units.

- Asia Pacific and the Middle East will emerge as major growth hubs due to rapid urbanization.