Market Overview

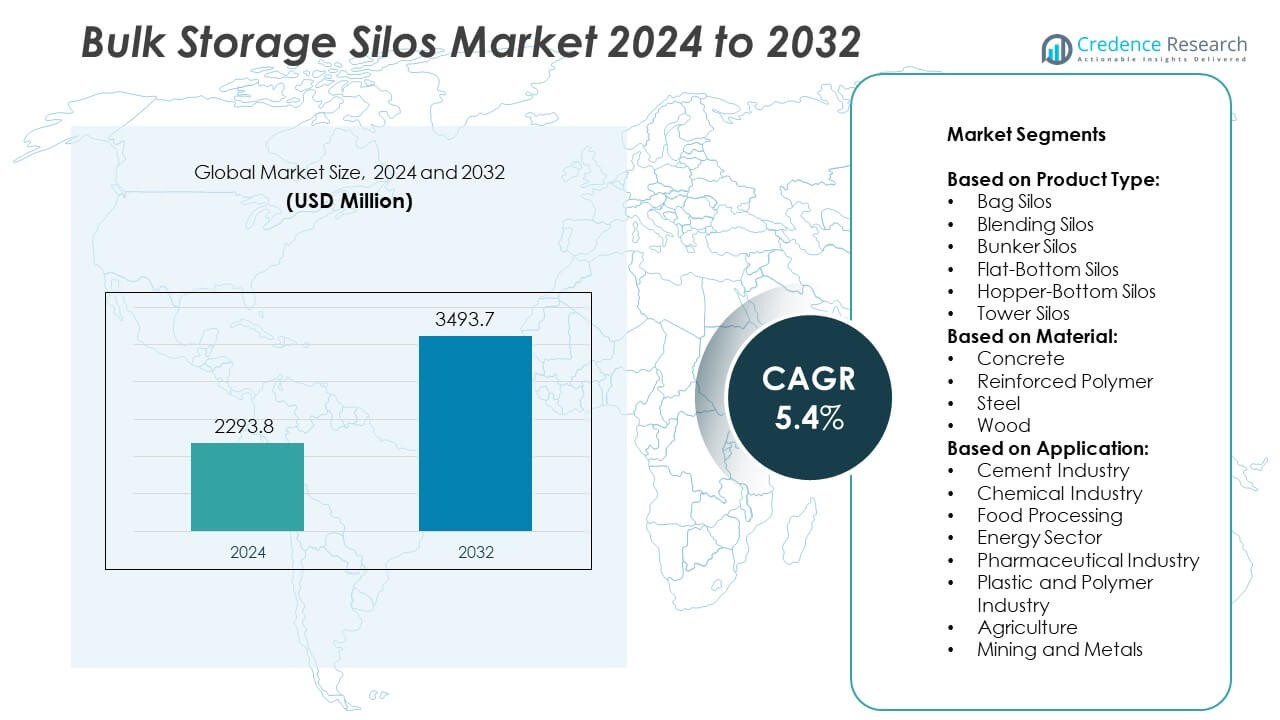

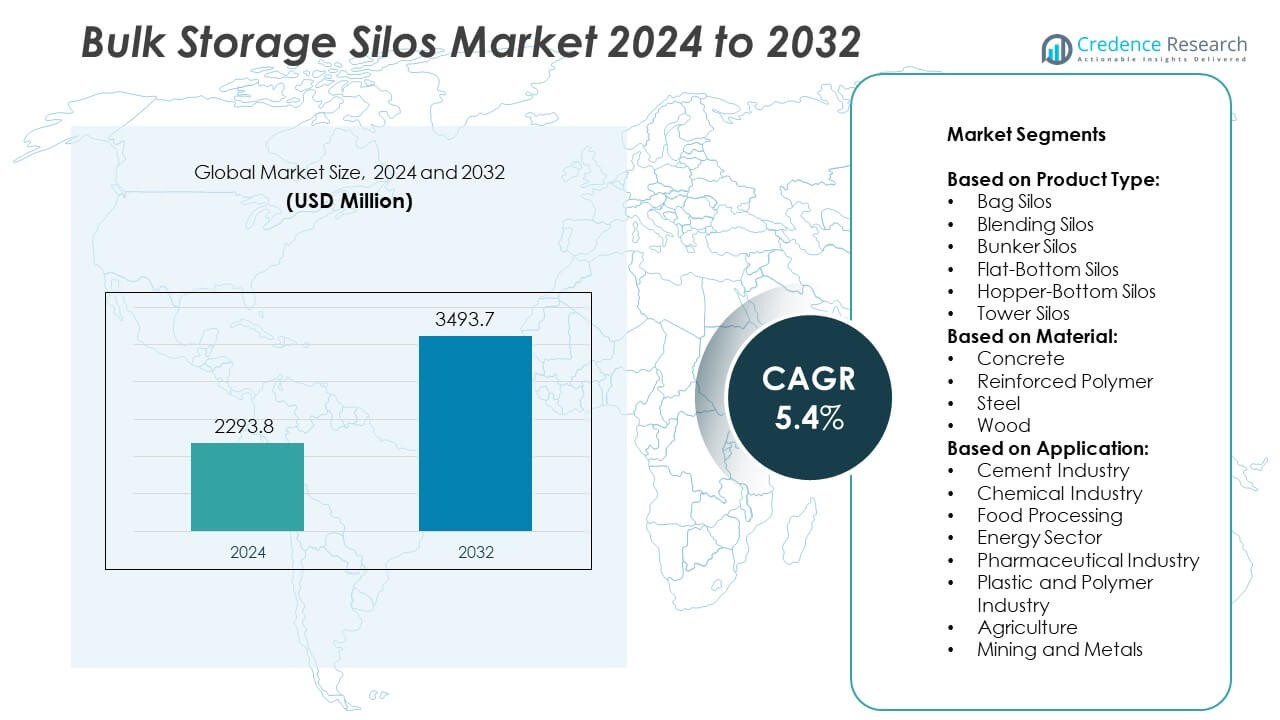

The Bulk Storage Silos Market size was valued at USD 2293.8 million in 2024 and is anticipated to reach USD 3493.7 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bulk Storage Silos Market Size 2024 |

USD 2293.8 Million |

| Bulk Storage Silos Market, CAGR |

5.4% |

| Bulk Storage Silos Market Size 2032 |

USD 3493.7 Million |

The Bulk Storage Silos market grows driven by rising demand for efficient and large-capacity storage solutions across agriculture, food processing, and industrial sectors. Increasing production volumes and the need to reduce post-harvest losses push adoption of durable silos with advanced material handling capabilities. Integration of automation and IoT technologies enhances operational efficiency, real-time monitoring, and inventory management. Sustainability trends encourage use of eco-friendly materials and energy-efficient designs.

The Bulk Storage Silos market demonstrates robust growth across key regions including North America, Europe, and Asia Pacific, driven by expanding agricultural and industrial activities. Emerging economies in Asia and Latin America show increasing demand for efficient storage solutions to support food processing and manufacturing sectors. Key players such as Ahrens Silos, Bentall Rowlands, CST Industries, and Sioux Steel lead the industry by offering advanced, durable, and customizable silo products. These companies focus on incorporating smart technologies and sustainable materials to meet diverse regional requirements. Their strong global presence enables them to capitalize on regional infrastructure development and modernization trends effectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Bulk Storage Silos market was valued at USD 2293.8 million in 2024 and is projected to reach USD 3493.7 million by 2032, growing at a CAGR of 5.4% during the forecast period.

- Rising demand for efficient storage solutions in agriculture, food processing, and industrial sectors drives market growth by reducing post-harvest losses and improving inventory management.

- Integration of automation and IoT-enabled smart technologies enhances operational efficiency, real-time monitoring, and predictive maintenance, fueling adoption of advanced silo systems.

- Leading players such as Ahrens Silos, Bentall Rowlands, CST Industries, and Sioux Steel focus on innovation, sustainability, and expanding their global footprint to maintain competitive advantage.

- High initial investment costs and complex installation processes restrain market growth, limiting adoption among small and medium enterprises with budget constraints.

- Regional markets vary, with North America leading due to established infrastructure, Asia Pacific growing rapidly from industrialization and agricultural modernization, and Europe focusing on technological integration and regulatory compliance.

- Sustainability trends and government initiatives supporting infrastructure development in emerging economies create new opportunities for eco-friendly and modular bulk storage silo solutions.

Market Drivers

Increasing Demand for Efficient Storage Solutions in Agriculture and Industry

The Bulk Storage Silos market experiences strong growth driven by increasing demand for efficient storage solutions across agriculture, food processing, and industrial sectors. Rising production of grains, cereals, and feed materials compels businesses to adopt large-capacity silos to manage bulk inventory safely and reduce post-harvest losses. Automation integration in silo operations enhances monitoring and control, improving inventory management accuracy and operational efficiency. It supports seamless material handling and reduces manual labor costs, appealing to large-scale storage operators. Growing emphasis on preserving product quality during storage motivates investment in advanced silo technologies with temperature and moisture control systems. The market benefits from expanding infrastructure projects and modernization of existing storage facilities worldwide.

- For instance, CST Industries installed automated monitoring systems in over 1,200 silos globally, improving material flow management and reducing downtime.

Industrialization and Urbanization Driving Demand for Robust Storage Infrastructure

Rapid industrialization and urbanization drive the need for robust storage infrastructure in chemical, mining, and manufacturing industries. Bulk Storage Silos offer reliable containment for raw materials and finished products, supporting continuous production workflows. It accommodates a variety of bulk solids, powders, and granular materials, making it versatile across multiple sectors. Regulatory compliance concerning safety and environmental standards increases demand for silos with corrosion-resistant materials and fire prevention features. Market players innovate to design silos that meet stringent industry norms while optimizing space utilization. The growth in construction activities further fuels demand for cement and aggregate storage silos to streamline material logistics.

- For instance, Ahrens Silos engineered more than 750 large-capacity silos for cement storage, incorporating advanced discharge systems that improve unloading efficiency and reduce material waste.

Expansion of Food and Beverage Industry Boosting Adoption of Hygienic Storage Solutions

The Bulk Storage Silos market adapts to strict food safety regulations requiring clean and inert storage environments. It offers specialized designs for storing edible oils, grains, and powdered ingredients, maintaining product integrity and traceability. Rising consumer awareness regarding product quality influences manufacturers to invest in advanced silo systems equipped with real-time data monitoring. The trend of customizing silo capacity and features according to client needs drives technological advancements. Enhanced supply chain efficiency achieved through centralized storage systems encourages businesses to scale silo installations.

Sustainability and Resource Optimization Supporting Market Growth

Increasing focus on sustainability and resource optimization supports the market’s growth trajectory. The Bulk Storage Silos market caters to eco-friendly storage practices by reducing material waste and energy consumption. Silo designs incorporating recyclable materials and energy-efficient systems align with corporate environmental goals. It enables better inventory forecasting and reduces overstocking, minimizing resource loss. Industry players adopt smart sensor technologies to optimize storage conditions and facilitate preventive maintenance. Growing government initiatives promoting agricultural and industrial infrastructure development create favorable market conditions for bulk storage silo investments.

Market Trends

Increasing Integration of Automation and Smart Technologies in Storage Systems

The Bulk Storage Silos market adopts automation and smart technologies to enhance operational efficiency and reduce human error. It incorporates sensors and IoT devices to monitor temperature, humidity, and fill levels in real-time, enabling proactive maintenance and better inventory control. Automation reduces downtime and improves accuracy in material handling processes. Companies invest in software solutions that integrate silo data with enterprise resource planning systems for streamlined operations. Remote monitoring capabilities support decision-making and minimize onsite labor requirements. The trend reflects a shift toward digital transformation across storage infrastructure to meet evolving industry demands.

- For instance, Sioux Steel developed over 700 modular silo units with interchangeable components, enabling clients to expand storage capacity by up to 35% without full system replacement.

Shift Towards Sustainable and Environmentally Friendly Storage Solutions

Sustainability trends influence the Bulk Storage Silos market by driving demand for eco-friendly materials and energy-efficient designs. It encourages the use of recyclable metals and coatings that extend silo lifespan while reducing environmental impact. Energy-saving technologies, including solar-powered monitoring systems and insulation improvements, reduce operational costs and carbon footprint. Market participants focus on minimizing material waste during storage and transportation. The increasing regulatory emphasis on environmental protection compels manufacturers to innovate greener storage options. Sustainable practices in silo design and maintenance gain traction across agricultural and industrial sectors.

- For instance, Bentall Rowlands completed the installation of 650 large-capacity silos in Asia Pacific regions over the last five years.

Customization and Modular Design Enhancing Market Flexibility

The Bulk Storage Silos market shifts towards offering highly customizable and modular storage solutions to meet diverse client requirements. It provides adaptable designs that cater to various materials, capacities, and site constraints. Modular silos allow easy expansion and relocation, reducing installation time and costs. Customers benefit from tailored features like specialized coatings, aeration systems, and discharge mechanisms. The ability to configure silos for specific applications strengthens their appeal across industries including agriculture, chemicals, and construction. Market players prioritize flexibility to support clients’ evolving storage needs and optimize space utilization.

Expansion of Emerging Markets Driving Infrastructure Development

Emerging economies propel the Bulk Storage Silos market by increasing investments in agricultural and industrial infrastructure. It supports growing demand for efficient bulk material storage amid rising production volumes. Expanding food processing industries and industrial manufacturing sectors fuel requirements for large-capacity silos. Government initiatives focusing on rural development and supply chain modernization enhance market opportunities. The market experiences higher adoption of technologically advanced storage solutions to improve product preservation and operational efficiency. Regional growth stimulates innovation and competitive strategies among key industry players.

Market Challenges Analysis

High Initial Investment and Complex Installation Procedures Limit Market Adoption

The Bulk Storage Silos market faces challenges due to the substantial capital expenditure required for purchasing and installing advanced silo systems. It demands skilled labor and specialized equipment for site preparation, assembly, and commissioning, which can increase project timelines and costs. Small and medium-sized enterprises often hesitate to invest in large-scale storage infrastructure due to budget constraints. Complex installation processes may disrupt ongoing operations, leading to productivity losses during transition periods. The need for compliance with stringent safety and engineering standards further complicates deployment. Market players must focus on developing cost-effective solutions and simplified installation techniques to overcome these barriers.

Maintenance Requirements and Risks Related to Material Handling Affect Market Growth

Maintaining Bulk Storage Silos presents operational challenges, including regular inspections, cleaning, and repair to prevent contamination, corrosion, and structural damage. It requires dedicated maintenance protocols to ensure optimal performance and longevity, increasing operational expenses. Handling bulk materials such as powders, grains, and chemicals involves risks like clogging, segregation, and dust generation, which can compromise product quality and safety. The market contends with the need to balance robust silo designs with ease of maintenance. Fluctuating raw material characteristics and environmental conditions demand adaptive storage solutions. Manufacturers must innovate maintenance-friendly designs and protective technologies to mitigate risks and enhance reliability.

Market Opportunities

Advancements in Smart Storage Technologies Present Significant Growth Potential

The Bulk Storage Silos market holds opportunities in adopting advanced smart technologies that enhance storage management and operational efficiency. It can leverage IoT-enabled sensors, automated monitoring systems, and data analytics to provide real-time insights into inventory levels, environmental conditions, and maintenance needs. These technologies reduce downtime, minimize material loss, and improve decision-making accuracy. Integration with cloud-based platforms enables remote management and predictive maintenance, offering added value to end-users. Market players that innovate smart and connected silo solutions can capture new customers seeking digital transformation in storage infrastructure. Growing interest in Industry 4.0 adoption across agriculture and manufacturing sectors fuels demand for intelligent silo systems.

Expansion into Emerging Economies and Infrastructure Development Boosts Market Reach

Emerging economies offer substantial opportunities for the Bulk Storage Silos market due to rapid industrialization and agricultural modernization. It can address growing needs for efficient bulk material storage driven by expanding food processing, chemical, and construction industries in these regions. Government initiatives focused on improving rural infrastructure and supply chain logistics further support market expansion. Increasing investments in large-scale storage facilities provide scope for introducing advanced silo designs tailored to local requirements. Collaborations with regional players and customized solutions can strengthen market presence and competitiveness. The market benefits from tapping into untapped geographic segments with rising demand for durable and scalable storage solutions.

Market Segmentation Analysis:

By Product Type:

Bag silos, blending silos, bunker silos, flat-bottom silos, hopper-bottom silos, and tower silos, each serving specific storage needs. Bag silos offer flexible and cost-effective solutions for temporary storage of bulk materials, commonly used in agricultural and feed applications. Blending silos facilitate the mixing of different materials before processing, enhancing product uniformity and quality. Bunker silos provide large-scale outdoor storage, ideal for feed and biomass in agricultural operations. Flat-bottom silos deliver versatility and ease of maintenance, suitable for storing granular and powdered materials. Hopper-bottom silos improve discharge efficiency by enabling gravity-fed unloading, favored in industries requiring fast material flow. Tower silos maximize vertical space utilization, often preferred in industrial settings with limited ground area.

- For instance, Sioux Steel has manufactured bag silos globally, providing seasonal storage for feed and grain with capacities ranging from 500 to 3,000 tons.

By Material:

The Bulk Storage Silos market includes concrete, reinforced polymer, steel, and wood constructions, each offering distinct benefits. Concrete silos provide durability, fire resistance, and long service life, making them popular in heavy industrial applications such as cement and mining. Reinforced polymer silos combine lightweight properties with corrosion resistance, appealing to sectors requiring chemical stability and ease of installation. Steel silos deliver high strength and adaptability, widely used in food processing, chemical, and agricultural industries due to their robustness and maintenance-friendly characteristics. Wood silos, though less common, find application in niche agricultural settings due to their natural insulation and cost-effectiveness.

- For example, Rowlands Woodhouse has constructed over 300 wood silos primarily for livestock feed storage, leveraging their thermal insulation properties.

By Application:

The Bulk Storage Silos market caters to diverse industries including cement, chemical, food processing, energy, pharmaceutical, plastic and polymer, agriculture, and mining and metals. The cement industry demands large-capacity silos for storing clinker, cement powder, and additives, emphasizing durability and dust control. Chemical industries require silos with corrosion-resistant materials and safety features to handle reactive substances safely. Food processing applications focus on hygienic designs that maintain product quality for grains, powders, and edible oils. The energy sector utilizes silos for biomass and coal storage to support efficient fuel handling. Pharmaceutical and plastic industries seek precise environmental control within silos to preserve raw material integrity. Agriculture depends heavily on silos for grain, feed, and silage storage, requiring flexible and weather-resistant solutions. Mining and metals benefit from silos that withstand abrasive materials and harsh environmental conditions.

Segments:

Based on Product Type:

- Bag Silos

- Blending Silos

- Bunker Silos

- Flat-Bottom Silos

- Hopper-Bottom Silos

- Tower Silos

Based on Material:

- Concrete

- Reinforced Polymer

- Steel

- Wood

Based on Application:

- Cement Industry

- Chemical Industry

- Food Processing

- Energy Sector

- Pharmaceutical Industry

- Plastic and Polymer Industry

- Agriculture

- Mining and Metals

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a commanding share in the Bulk Storage Silos market, accounting for approximately 37.6% of the global revenue in 2024. The United States drives this dominance due to its extensive agricultural production, developed industrial base, and advanced infrastructure. Investments in silo technology and modernization projects support steady market growth. Automation and smart silo integration enhance operational efficiency, attracting large-scale agricultural and industrial users. Demand for high-capacity, durable storage solutions remains strong to accommodate expanding grain and bulk material inventories. The region’s regulatory environment also promotes the adoption of safe and environmentally compliant storage systems.

Asia Pacific

Asia Pacific accounts for roughly 28.1% of the Bulk Storage Silos market share in 2024 and is the fastest-growing region. Countries like China and India lead in infrastructure expansion and agricultural modernization, driving demand for efficient bulk storage systems. Rapid urbanization and increasing food production volumes create opportunities for large-scale silo installations. The region also experiences rising industrial activity, requiring specialized silos for chemicals, plastics, and minerals. Technological adoption in monitoring and automation supports better inventory management and reduces material loss. Government initiatives focused on rural development further propel market growth.

Europe

Europe represents a significant 22.0% portion of the Bulk Storage Silos market, supported by strong agricultural and industrial sectors. The region emphasizes advanced technology integration, including IoT-enabled smart silos and automated controls, enhancing storage safety and efficiency. Western and Eastern Europe invest in upgrading existing facilities to meet stringent environmental and quality standards. Demand spans multiple industries such as food processing, chemicals, and pharmaceuticals, requiring diverse silo types and materials. The focus on sustainability also influences the choice of corrosion-resistant and energy-efficient silo designs. Market growth maintains a steady pace due to regulatory compliance and modernization efforts.

Latin America

Latin America holds a smaller but growing share of the Bulk Storage Silos market, accounting for approximately 6.5% of the global market in 2024. Increasing agricultural output and the need to minimize post-harvest losses drive demand for reliable storage infrastructure. Countries in this region invest in silo systems that offer scalability and adaptability to local conditions. Expansion in food processing and mining sectors also contributes to market opportunities. Despite slower infrastructure development compared to other regions, government programs supporting rural development enhance growth prospects. Customized solutions tailored to regional requirements gain preference among market players.

Middle East and Africa

The Middle East and Africa region accounts for nearly 5.8% of the Bulk Storage Silos market share in 2024 and is emerging steadily. Investments in agriculture and industrial infrastructure modernization drive market growth. Efforts to improve food security and streamline material storage fuel demand for advanced silo solutions. The market focuses on robust silos capable of withstanding harsh environmental conditions and accommodating various bulk materials. Growing industrialization and mining activities further increase storage requirements. Market penetration remains moderate but shows promising growth aligned with regional development initiatives. Providers emphasize durable, corrosion-resistant designs suitable for this region’s operational challenges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hanson

- Symaga

- Rowlands Woodhouse

- P+W Metallbau

- Superior Grain Equipment

- SCUTTI

- Silos Córdoba

- Kotzur

- Nelsons

- Ahrens Silos

- Sioux Steel

- TSC

- Bentall Rowlands

- CST Industries

- Zibo Boda

- E. Silos

- Silo Warehouse

Competitive Analysis

Key players in the Bulk Storage Silos market include Ahrens Silos, Bentall Rowlands, CST Industries, G.E. Silos, Hanson, Kotzur, Nelsons, P+W Metallbau, Rowlands Woodhouse, SCUTTI, Silo Warehouse, Silos Córdoba, Sioux Steel, Superior Grain Equipment, Symaga, TSC, and Zibo Boda. These companies compete by focusing on product innovation, customization, and expanding their geographical presence to capture diverse industry demands. They invest heavily in research and development to integrate automation, IoT-enabled monitoring, and sustainable materials into their silo solutions, enhancing operational efficiency and environmental compliance. Leading players emphasize building strong client relationships through tailored service offerings and after-sales support. Strategic collaborations and acquisitions enable them to broaden product portfolios and enter new regional markets. Pricing strategies balance cost-effectiveness with quality to appeal to various customer segments, from large industrial operations to smaller agricultural enterprises. With increasing competition, these companies continuously improve manufacturing processes to reduce lead times and improve delivery reliability. Their ability to adapt to evolving industry standards and regulatory requirements positions them to maintain market leadership amid growing demand for advanced storage infrastructure worldwide.

Recent Developments

- In 2025, Symaga experienced a record year with 696 new projects completed, resulting in the production of 1,750 silos and other storage tanks.

- In 2024, XBL(Xcel Bulk Logistics) Storage Solutions further enhanced its positioning strategy, which is based on important geo locations, by penetrating the Savannah market in the silos and bulk storage segment.

- In 2024, Nelson continues to be a key player in the grain storage silo market, recognized for its transportable silos and custom-built storage solutions delivered with minimal lead time.

Market Concentration & Characteristics

The Bulk Storage Silos market exhibits a moderately concentrated structure with a mix of established global manufacturers and regional players competing to meet diverse industry needs. It is characterized by strong competition among key players who emphasize product innovation, quality, and customization to differentiate themselves. Market leaders focus on integrating advanced technologies such as automation, IoT-based monitoring, and sustainable materials to enhance operational efficiency and environmental compliance. The market serves various sectors including agriculture, food processing, chemicals, and construction, each demanding specialized silo designs and materials. Customer requirements for durability, ease of maintenance, and regulatory adherence shape product development trends. Regional variations influence manufacturing approaches, with companies tailoring solutions to local climatic, operational, and economic conditions. The market’s moderate entry barriers stem from the need for technical expertise, capital investment, and compliance with safety standards. Collaboration between manufacturers and end-users fosters continuous innovation and service improvement. Overall, the Bulk Storage Silos market maintains a dynamic competitive environment driven by evolving industry standards and expanding applications worldwide.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Bulk Storage Silos market will continue expanding due to rising agricultural production worldwide.

- Increasing adoption of automation and smart monitoring technologies will enhance silo management.

- Demand for sustainable and energy-efficient silo designs will grow steadily.

- Emerging economies will offer significant growth opportunities through infrastructure development.

- Manufacturers will focus on modular and customizable silo solutions to meet diverse client needs.

- Integration of IoT and predictive maintenance will reduce operational downtime and costs.

- Market players will invest in advanced materials to improve silo durability and corrosion resistance.

- Regulatory emphasis on safety and environmental compliance will drive innovation in silo design.

- Expansion in food processing, chemical, and pharmaceutical sectors will boost storage silo demand.

- Collaborations and strategic partnerships will increase to strengthen global market presence.