| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Cardiovascular Devices Market Size 2024 |

USD 2,443.49 Million |

| Canada Cardiovascular Devices Market, CAGR |

6.4% |

| Canada Cardiovascular Devices Market Size 2032 |

USD 4,278.73 Million |

Market Overview

The Canada Cardiovascular Devices Market is projected to grow from USD 2,443.49 million in 2024 to an estimated USD 4,278.73 million based on 2032, with a compound annual growth rate (CAGR) of 6.4% from 2025 to 2032. This growth is driven by the rising prevalence of cardiovascular diseases (CVDs), increasing geriatric population, and technological advancements in diagnostic and therapeutic cardiac devices.

Key drivers influencing market expansion include a surge in lifestyle-related heart conditions, growing awareness of early diagnosis, and supportive government initiatives aimed at enhancing cardiac care services. There is a notable trend toward integrating AI and digital health technologies in cardiovascular diagnostics and management. Additionally, patients and healthcare providers are increasingly favoring implantable devices, wearable monitors, and catheter-based interventions due to their improved efficiency, reduced recovery time, and enhanced monitoring capabilities. These trends collectively strengthen the growth trajectory of the cardiovascular devices market in Canada.

Geographically, major provinces such as Ontario, Quebec, and British Columbia are leading the market due to their well-developed healthcare facilities, high healthcare spending, and concentration of medical device manufacturers. Prominent players operating in the Canada Cardiovascular Devices Market include Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Edwards Lifesciences Corporation, and GE HealthCare. These companies focus on continuous innovation, strategic partnerships, and regulatory approvals to expand their footprint in the Canadian market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada Cardiovascular Devices Market is projected to grow from USD2,443.49 million in 2024 to USD4,278.73 million by 2032, registering a CAGR of 6.4% from 2025 to 2032.

- The global cardiovascular devices market is projected to grow from USD 72,115.60 million in 2024 to USD 133,700.94 million by 2032, with a CAGR of 7.1% from 2025 to 2032, driven by increasing cardiovascular diseases and advancements in medical technology.

- A steadily aging population in Canada is increasing the prevalence of heart diseases, driving demand for implantable devices, monitoring systems, and surgical interventions.

- Rapid innovation in minimally invasive technologies, wearable monitoring devices, and AI-integrated diagnostics is transforming cardiovascular care and fueling market growth.

- Modernization of hospitals, increased funding for digital health, and government-backed cardiac care programs are supporting widespread adoption of advanced cardiovascular devices.

- The high cost of advanced cardiovascular devices and inconsistent reimbursement policies across provinces limit adoption, particularly in mid-sized and rural healthcare facilities.

- Lengthy Health Canada approval timelines and stringent clinical evidence requirements pose entry barriers for new and innovative cardiovascular technologies.

- Ontario leads with 38% market share, followed by Quebec (24%) and British Columbia (18%), supported by advanced healthcare infrastructure and concentration of key players.

Report Scope

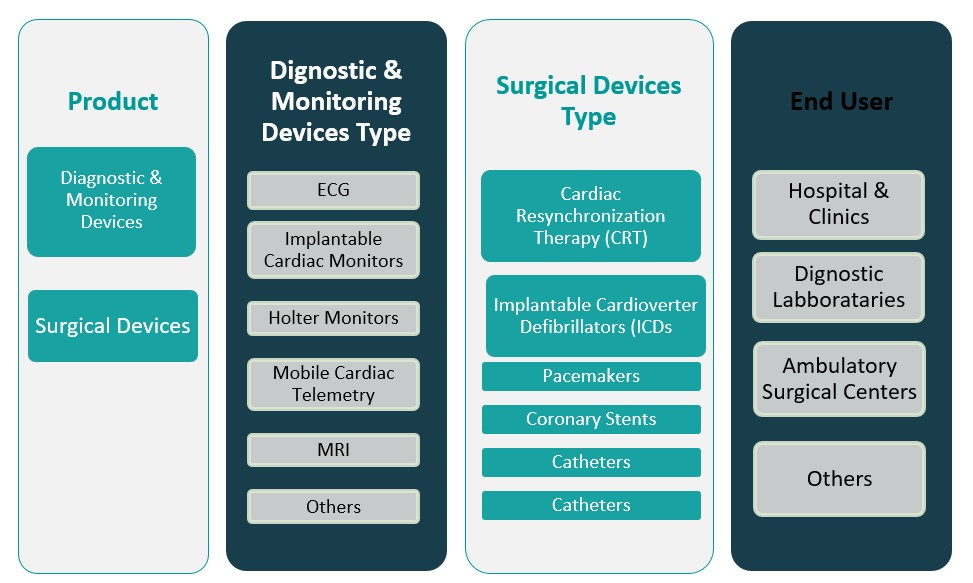

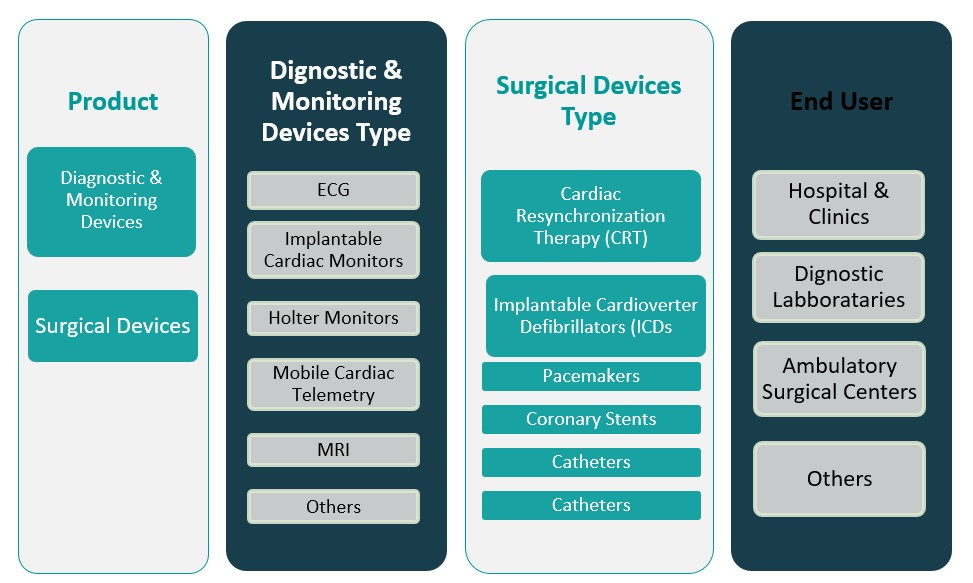

This report segments the Canada Cardiovascular Devices Market as follows:

Market Drivers

Rising Prevalence of Cardiovascular Diseases and Aging Population

One of the primary drivers of the Canada Cardiovascular Devices Market is the increasing prevalence of cardiovascular diseases (CVDs), including coronary artery disease, heart failure, arrhythmias, and congenital heart defects. Cardiovascular disease remains the second leading cause of death in Canada, accounting for a significant number of total mortalities each year. For instance, according to the Public Health Agency of Canada, approximately 2.6 million Canadian adults aged 20 and over live with diagnosed heart disease. Additionally, cardiovascular diseases accounted for 76,639 deaths in Canada in 2022, making them one of the leading causes of mortality. Factors such as sedentary lifestyles, high rates of obesity, poor dietary habits, excessive alcohol consumption, and smoking have significantly contributed to the rising burden of heart-related ailments. Additionally, hypertension and diabetes—both major risk factors for CVD—are also on the rise, further increasing the need for advanced cardiovascular diagnostics and treatment devices. Moreover, Canada’s aging population plays a crucial role in boosting the demand for cardiovascular healthcare. By 2030, seniors (aged 65 and older) are expected to make up over 23% of the national population, increasing the need for implantable devices such as pacemakers and defibrillators, as well as non-invasive diagnostic tools like echocardiograms and CT angiography.

Technological Advancements and Innovation in Cardiovascular Devices

The rapid pace of technological innovation is another significant driver propelling the Canada Cardiovascular Devices Market forward. The industry is witnessing a steady influx of next-generation devices designed to improve accuracy, enhance patient safety, and streamline cardiovascular care. For instance, Canada has seen advancements in AI-driven cardiac imaging, wearable ECG monitors, and remote patient monitoring devices, which are improving early detection and personalized treatment strategies. The adoption of minimally invasive cardiovascular procedures, including transcatheter heart valves and advanced stents, is reducing recovery times and improving patient outcomes. Minimally invasive procedures, in particular, have gained strong traction across Canadian hospitals and clinics. Devices used in catheter-based interventions—such as transcatheter aortic valve replacement (TAVR), percutaneous coronary intervention (PCI), and electrophysiology catheters—are being adopted widely due to their shorter hospital stays, faster recovery times, and reduced post-operative complications. Moreover, wearable technologies such as smartwatches and remote ECG monitors are facilitating continuous monitoring of heart rhythms and enabling real-time data sharing between patients and physicians. These innovations are not only improving clinical outcomes but are also empowering patients to manage their heart health proactively. The ongoing investments in R&D by medical device manufacturers and favorable regulatory approvals for advanced technologies are expected to keep driving this trend over the coming years.

Expanding Government Initiatives and Healthcare Infrastructure Modernization

Supportive government policies and ongoing investments in healthcare infrastructure significantly bolster the growth of the cardiovascular devices market in Canada. The Canadian government, in collaboration with provincial health departments, has prioritized early diagnosis, prevention, and effective management of chronic diseases, particularly cardiovascular disorders. Programs such as the Canadian Chronic Disease Surveillance System (CCDSS) and initiatives under the Public Health Agency of Canada aim to improve health outcomes by funding research, enhancing disease surveillance, and promoting access to advanced healthcare technologies. Furthermore, substantial public investments are being made to upgrade hospital infrastructure, digitize health records, and incorporate advanced diagnostic and treatment equipment into public healthcare facilities. The increased availability of funding for medical device procurement and healthcare digitization has encouraged hospitals and clinics to invest in high-quality cardiovascular devices, thereby expanding the accessibility of cardiac care to a broader population base. In addition, regulatory support in the form of faster Health Canada approvals for innovative cardiovascular products contributes to smoother and more rapid market entry, encouraging both domestic innovation and international investment in the Canadian cardiovascular device industry.

Increasing Patient Awareness and Shift Toward Preventive Cardiology

Another pivotal driver of the Canadian cardiovascular devices market is the growing awareness among the public regarding cardiovascular health and the importance of early diagnosis and disease prevention. Public health campaigns, educational programs, and non-profit organization efforts—such as those led by the Heart and Stroke Foundation of Canada—have significantly contributed to raising awareness about the signs, symptoms, and risk factors associated with heart disease. As a result, there is an increased demand for diagnostic tools like ECG machines, portable Holter monitors, and stress testing systems. Simultaneously, the shift toward preventive cardiology has led patients to seek regular screenings, lifestyle adjustments, and continuous heart monitoring, even before the onset of symptoms. This preventive approach is driving demand for wearable heart rate monitors, home-use blood pressure monitors, and digital health platforms that integrate with smartphones and cloud storage for better tracking of cardiovascular metrics. As consumers become more health-conscious and data-savvy, their willingness to adopt technologically advanced monitoring solutions is rising, thus creating new growth opportunities for manufacturers offering user-friendly and connected cardiovascular devices.

Market Trends

Surge in Demand for Minimally Invasive Cardiovascular Procedures

Minimally invasive cardiovascular interventions are becoming a standard of care in Canada due to their clinical efficiency and lower patient recovery times. Increasing patient preference for less traumatic procedures, combined with the growing capability of hospitals and cardiac centers to support catheter-based technologies, has accelerated the adoption of devices such as balloon angioplasty catheters, stents, and transcatheter heart valves. Procedures like Transcatheter Aortic Valve Replacement (TAVR) and Percutaneous Coronary Intervention (PCI) are being widely implemented across Canadian institutions due to their reduced procedural complications and hospitalization periods. For instance, the Canadian Institute for Health Information (CIHI) reports that over 2.4 million Canadians have heart disease, making it the second leading cause of death in the country. These techniques are especially beneficial for the country’s expanding elderly population and patients with comorbidities who are poor candidates for open-heart surgery. Additionally, the Canadian healthcare system is focusing on cost-effectiveness and operational efficiency, both of which are enhanced by the widespread implementation of minimally invasive devices. Manufacturers are responding to this demand by introducing advanced materials and designs that ensure better device flexibility, biocompatibility, and precision. With strong support from clinical guidelines and favorable reimbursement structures for certain interventional cardiology procedures, this trend is expected to gain further momentum, reinforcing the shift from conventional surgical approaches to minimally invasive cardiac care.

Integration of Digital Health and AI Technologies in Cardiology

The integration of digital health and artificial intelligence (AI) into cardiovascular care is transforming clinical decision-making and patient monitoring across Canada. Smart algorithms, predictive analytics, and machine learning models are increasingly being used to analyze large volumes of cardiovascular data, including ECGs, imaging scans, and vital signs, to enhance diagnosis and treatment precision. AI-enabled platforms now support clinicians by identifying patterns linked to arrhythmias, ischemia, or structural heart anomalies with greater speed and accuracy than traditional methods. Simultaneously, digital health tools such as wearable ECG monitors, mobile-based heart rate trackers, and remote monitoring systems allow patients to track their cardiovascular health in real time and share continuous data with providers, facilitating proactive intervention and reducing emergency episodes. The Canadian healthcare system is progressively adopting telecardiology services and cloud-based cardiovascular information systems (CVIS), driven by the need to improve access to specialist care in rural and underserved regions. As digital infrastructure improves and patient acceptance grows, the use of digital therapeutics, remote diagnostics, and AI-powered triage systems is expected to become more mainstream. This trend aligns with Canada’s broader digital health strategy and reflects the healthcare industry’s pivot toward personalized and technology-driven cardiac care.

Rise in Home-Based and Ambulatory Cardiac Monitoring Solutions

There is a growing trend toward the adoption of home-based and ambulatory cardiac monitoring devices in Canada, fueled by patient demand for convenience, better disease management, and early diagnosis of arrhythmias and heart failure. Wearable devices such as Holter monitors, patch-based ECG systems, and smartwatches with integrated heart health features are increasingly replacing traditional in-clinic testing methods. These solutions enable real-time, continuous monitoring of cardiovascular parameters without disrupting daily life, thereby improving patient compliance and facilitating early clinical intervention. The COVID-19 pandemic further accelerated this trend by underscoring the importance of decentralized care and minimizing hospital visits for non-emergency conditions. Canadian regulatory bodies and payers are beginning to recognize the value of remote monitoring in chronic disease management, and reimbursement frameworks are evolving to support these technologies. Healthcare providers are also incorporating cloud-based data platforms and AI tools to efficiently analyze the vast datasets generated by ambulatory monitors. As a result, the Canadian cardiovascular ecosystem is shifting toward proactive, at-home health management, reducing the burden on tertiary care facilities while improving long-term cardiac outcomes. The growth of telemedicine and digital health literacy among the aging population is expected to sustain and expand this trend in the coming years.

Emphasis on Personalized and Precision Cardiovascular Medicine

Canada’s cardiovascular device market is witnessing a pronounced shift toward personalized and precision medicine, where treatment strategies and technologies are tailored based on individual patient characteristics, genetic markers, and specific disease profiles. Advancements in genomics, biomarker research, and diagnostic imaging have made it possible to stratify cardiovascular risks more accurately and customize interventions accordingly. For instance, precision stents and bioresorbable scaffolds are now being designed to match patient-specific arterial anatomy, improving clinical outcomes and reducing restenosis rates. Additionally, implantable devices such as defibrillators and pacemakers are increasingly equipped with programmable settings and adaptive algorithms that adjust based on patient physiology, enhancing performance and comfort. The integration of electronic health records (EHRs), AI analytics, and wearable device data is further enabling cardiologists to build comprehensive patient profiles and predict adverse events before they occur. Academic institutions and research centers across Canada are collaborating with med-tech companies to develop next-generation precision cardiology tools. This personalized approach is gaining traction across both public and private healthcare settings, promoting better patient satisfaction, fewer hospital readmissions, and optimized use of resources. As research and clinical validation expand, personalized cardiovascular solutions are set to play a central role in shaping the future of heart care in Canada.

Market Challenges

High Cost of Advanced Cardiovascular Devices and Limited Reimbursement Coverage

One of the most significant challenges facing the Canada Cardiovascular Devices Market is the high cost associated with advanced medical devices and the variability in reimbursement policies across provinces. While modern cardiovascular technologies—such as drug-eluting stents, implantable cardioverter-defibrillators (ICDs), and transcatheter heart valves—offer superior clinical outcomes, they also come with substantial price tags. These high costs strain hospital budgets and can limit access, particularly in smaller healthcare facilities or underfunded regions. Additionally, many of these devices require specialized infrastructure and skilled personnel, further increasing the overall cost of treatment. Canada’s publicly funded healthcare system, though comprehensive, does not always provide consistent or timely reimbursement for every cardiovascular device or procedure. Reimbursement policies vary between provinces, often leading to disparities in access to care. Devices not listed on provincial formularies or those awaiting health technology assessments may experience delays in adoption, even if they are clinically validated. For instance, the Canadian Cardiovascular Society (CCS) received USD 1.6 million from the Canadian government to study the clinical and functional outcomes of adults and children who experienced myocarditis and/or pericarditis after receiving an mRNA COVID-19 vaccination. Private insurance coverage may bridge some gaps, but it is not universally available or sufficient. These financial barriers discourage some healthcare providers from investing in newer technologies and can delay patient access to life-saving treatments. Until there is broader reimbursement alignment and more cost-effective procurement strategies, the market growth of cardiovascular devices in Canada may be hindered, especially in rural and economically constrained areas.

Regulatory Hurdles and Lengthy Approval Timelines

The regulatory landscape in Canada poses another substantial challenge to the cardiovascular devices market. Health Canada, the country’s primary medical device regulatory body, maintains stringent requirements for device approval to ensure safety and efficacy. While these regulations are essential for protecting public health, they often result in long approval timelines and complex documentation processes. For manufacturers—particularly small and mid-sized enterprises—navigating the regulatory environment can be resource-intensive and time-consuming. Delays in market entry due to prolonged clinical trial requirements, safety evaluations, and dossier reviews can impede innovation and limit early adoption of novel cardiovascular technologies. Moreover, the Canadian regulatory framework frequently requires additional evidence even if a device is already approved in major markets such as the United States or the European Union. This can discourage multinational firms from launching new products in Canada simultaneously with other global markets. In some cases, companies prioritize larger or less regulated markets first, delaying Canadian market access for critical devices. The lack of a streamlined regulatory fast-track pathway for high-priority or breakthrough cardiovascular technologies further compounds the issue. While Health Canada has introduced some initiatives to modernize the approval process, more reforms are needed to balance safety with timely innovation adoption. Without regulatory agility, Canada risks lagging behind in global cardiovascular advancements, limiting both patient outcomes and market competitiveness.

Market Opportunities

Expansion of Remote Monitoring and Telecardiology Solutions

Canada presents a significant market opportunity for remote cardiovascular monitoring and telecardiology solutions, particularly in response to the growing need for accessible healthcare in rural and underserved regions. With a vast geography and population clusters spread across remote areas, Canada’s healthcare system is increasingly prioritizing decentralized models of care. The integration of wearable cardiac monitors, mobile health applications, and cloud-based diagnostic platforms allows for continuous patient monitoring, real-time data sharing, and earlier intervention, all while minimizing the burden on hospital infrastructure. As public and private healthcare providers seek to improve outcomes and reduce hospital readmissions, investment in remote cardiac care infrastructure is poised to grow. This creates substantial opportunity for device manufacturers and digital health companies offering scalable, user-friendly, and interoperable monitoring solutions.

Personalized Cardiovascular Care through AI and Genomics Integration

The rise of precision medicine and the integration of AI and genomics into cardiovascular care offer a promising growth avenue in the Canadian market. Increasing collaboration between research institutions, healthcare providers, and med-tech companies is paving the way for patient-specific cardiovascular therapies and devices tailored to genetic profiles, lifestyle factors, and clinical history. Predictive algorithms and advanced analytics can support early detection of cardiovascular risk, optimize treatment strategies, and reduce adverse events. As Canada strengthens its digital health infrastructure and genomic research initiatives, there is a clear opportunity for companies to introduce AI-powered diagnostic tools, smart implants, and individualized treatment platforms that align with the future of personalized cardiac care.

Market Segmentation Analysis

By Product

The Canada Cardiovascular Devices Market is segmented into diagnostic & monitoring devices and surgical devices. Diagnostic and monitoring devices, including ECG systems, Holter monitors, event recorders, and cardiac imaging systems, represent a significant portion of the market owing to the rising emphasis on early detection and routine cardiovascular screening. The growing prevalence of arrhythmias, hypertension, and other chronic heart conditions is propelling the demand for accurate, real-time monitoring technologies. Additionally, advancements in AI-driven diagnostic platforms and portable monitoring systems are making cardiac assessments more accessible, particularly in outpatient and home-care settings. Surgical devices, such as stents, pacemakers, defibrillators, and heart valves, are also gaining traction as minimally invasive procedures and implantable technologies become more prevalent. The adoption of transcatheter and catheter-based interventions continues to rise, driven by patient preference for reduced recovery times and the increasing capabilities of Canadian surgical centers to support complex cardiac procedures.

By End User

By end user, the market is categorized into hospitals & clinics, diagnostic laboratories, ambulatory surgical centers, and others. Hospitals and clinics dominate the market, as they remain the primary points of care for complex cardiovascular diagnostics, surgical interventions, and post-operative management. Equipped with advanced infrastructure and specialized cardiology units, these facilities are driving the demand for both surgical and monitoring devices. Diagnostic laboratories also contribute significantly, particularly in providing non-invasive and pre-surgical cardiovascular assessments. Meanwhile, ambulatory surgical centers are witnessing rising utilization of cardiovascular devices due to their cost-effective and efficient care delivery for minor and minimally invasive procedures. The “others” category, including long-term care centers and home healthcare settings, is expanding as the market increasingly embraces decentralized and patient-centric cardiac monitoring solutions.

Segments

Based on Product

- Diagnostic & Monitoring Devices

- Surgical Devices

Based on End User

- Hospitals & Clinics

- Diagnostic Laboratories

- Ambulatory Surgical Centers

- Others

Based on Diagnostic & Monitoring Devices Type

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- MRI

- Others

Based on Surgical Devices Type

- Cardiac Resynchronization Therapy (CRT)

- Implantable Cardioverter Defibrillators (ICDs

- Pacemakers

- Coronary Stents

- Catheters

Based on Region

- Ontario

- Quebec

- British Columbia

- Alberta

- others

Regional Analysis

Ontario (38%)

Ontario holds the largest share of the market, accounting for approximately 38% of the national cardiovascular devices market revenue. This dominance is attributed to the presence of leading hospitals, cardiac care centers, and medical device companies headquartered in the province. Institutions like Toronto General Hospital and Sunnybrook Health Sciences Centre are at the forefront of adopting advanced cardiovascular technologies. Additionally, Ontario benefits from strong government support for research and development, as well as widespread availability of minimally invasive surgical procedures and diagnostic tools.

Quebec (24%)

Quebec follows, representing around 24% of the market share. The province is home to several high-performing healthcare institutions, such as the Montreal Heart Institute, which specialize in cardiovascular research and innovation. Quebec’s emphasis on early diagnosis and chronic disease management is driving the uptake of diagnostic and monitoring devices, particularly for hypertension and heart rhythm disorders. Moreover, Quebec’s bilingual healthcare environment supports outreach to diverse patient populations, enhancing healthcare access and awareness.

Key players

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- L. Gore & Associates, Inc.

- Siemens Healthcare GmbH

- BIOTRONIK SE & Co. KG

- Canon Medical Systems Asia Pte. Ltd.

- Braun SE

- LivaNova PLC

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Johnson & Johnson Services, Inc.

- Baxter International Inc.

Competitive Analysis

The Canada Cardiovascular Devices Market is highly competitive, characterized by the presence of both global leaders and specialized manufacturers. Companies such as Medtronic, Abbott, and Boston Scientific dominate the market with broad product portfolios, strong R\&D pipelines, and strategic partnerships that enhance innovation and market penetration. Edwards Lifesciences and BIOTRONIK focus on technologically advanced implants and electrophysiology devices, catering to niche demands in surgical cardiology. GE HealthCare, Siemens Healthineers, and Philips N.V. lead in diagnostic imaging, supporting the growing trend toward early detection and non-invasive monitoring. Emerging players and regional distributors also contribute by offering cost-effective solutions for mid-tier healthcare providers. The competition is driven by continuous product innovation, regulatory approvals, and a growing emphasis on digital integration and minimally invasive technologies, which push companies to maintain a robust presence and adaptive strategies in Canada’s evolving cardiovascular landscape.

Recent Developments

- In February 2025, Abbott issued a safety notification for certain Assurity and Endurity pacemakers due to potential epoxy mixing issues during manufacturing, which could lead to device malfunction.

- In April 2025, GE HealthCare launched the Revolution™ Vibe CT system featuring Unlimited One-Beat Cardiac imaging and AI solutions, enhancing cardiac imaging capabilities.

- In April 2025, Medtronic reported promising evidence for its Affera™ pulsed field ablation technologies in treating atrial fibrillation patients.

- In May 2024, Siemens Healthineers announced new cardiology applications with artificial intelligence for the Acuson Sequoia ultrasound system, including a new 4D transesophageal (TEE) transducer for cardiology exams.

- In February 2025, Philips developed a miniaturized intracardiac transducer, enabling higher-resolution views of cardiac structures and functions, benefiting structural heart disease and electrophysiology procedures.

- In March 2025, Boston Scientific announced the acquisition of SoniVie Ltd. to expand its interventional cardiology therapies offerings with ultrasound-based renal denervation technology.

- In June 2024, Biovac Institute entered a partnership with Sanofi to locally manufacture inactivated polio vaccines in Africa, aiming to serve the potential needs of over 40 African countries.

Market Concentration and Characteristics

The Canada Cardiovascular Devices Market exhibits a moderate to high level of market concentration, with a few global players such as Medtronic, Abbott, Boston Scientific, and Edwards Lifesciences holding a significant share due to their comprehensive product portfolios, strong brand recognition, and continuous technological innovation. The market is characterized by high entry barriers stemming from stringent regulatory requirements, the need for clinical validation, and substantial capital investment in R&D and manufacturing. It is also technology-intensive, with rapid advancements in minimally invasive procedures, remote monitoring, and AI-integrated diagnostic tools shaping competitive dynamics. Furthermore, the market demonstrates a strong focus on quality, safety, and patient outcomes, leading to a preference for well-established brands among healthcare providers. While public healthcare infrastructure dominates procurement, growing interest in telehealth, decentralized care, and digital health platforms is opening opportunities for niche players and regional suppliers offering specialized or cost-effective cardiovascular solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, End User, Diagnostic & Monitoring Devices Type, Surgical Devices Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for minimally invasive cardiovascular procedures will continue to rise, driven by patient preference for faster recovery and reduced hospital stays. Healthcare facilities across Canada are expected to increase investments in catheter-based and image-guided interventions.

- The integration of AI and machine learning in diagnostic and monitoring devices will reshape clinical decision-making. Predictive analytics will help physicians detect cardiovascular risks earlier and tailor more effective treatment plans.

- Remote patient monitoring will expand rapidly, supported by advancements in wearable technologies and telecardiology. This trend will improve access to cardiovascular care in rural and underserved regions across Canada.

- Personalized cardiovascular care will gain momentum, with genomic data and patient-specific device customization enhancing outcomes. Precision medicine initiatives will support the development of targeted interventions and adaptive implantable devices.

- Public-private partnerships will accelerate innovation in the cardiovascular space through research funding and infrastructure upgrades. These collaborations will help bridge gaps in device access and foster local manufacturing capabilities.

- Canada’s aging population will significantly increase the demand for cardiovascular implants, pacemakers, and defibrillators. This demographic shift will drive sustained market growth, particularly in long-term and chronic care settings.

- Regulatory frameworks are expected to evolve to support faster approvals for breakthrough cardiovascular technologies. Streamlined Health Canada processes will enhance the market entry of innovative products and reduce commercialization delays.

- Environmental sustainability will become a strategic focus, encouraging manufacturers to develop eco-friendly cardiovascular devices. Hospitals and procurement bodies will prioritize suppliers with green manufacturing practices and recyclable device components.

- Increased healthcare digitization will support data-driven cardiac care through interoperable systems and electronic health records. Integration of cardiovascular devices with digital health platforms will enable seamless monitoring and longitudinal care.

- Market competition will intensify as global and regional players introduce differentiated solutions tailored to Canadian healthcare needs. Product innovation, pricing strategies, and localization efforts will define competitive advantage in the evolving landscape.