| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Cyber Physical Systems Market Size 2024 |

USD 4218.25 Million |

| Canada Cyber Physical Systems Market, CAGR |

9.46% |

| Canada Cyber Physical Systems Market Size 2032 |

USD 8693.99 Million |

Market Overview

The Canada Cyber Physical Systems Market is projected to grow from USD 4218.25 million in 2024 to an estimated USD 8693.99 million by 2032, with a compound annual growth rate (CAGR) of 9.46% from 2024 to 2032.

Several factors are propelling the growth of the CPS market in Canada. The rising adoption of Industry 4.0 practices has led to a surge in smart manufacturing initiatives, necessitating the implementation of CPS for enhanced efficiency and productivity. Additionally, advancements in the Internet of Things (IoT) and artificial intelligence (AI) have facilitated the development of more sophisticated CPS solutions, enabling real-time data processing and decision-making. Furthermore, the increasing focus on energy efficiency and sustainability has driven the adoption of CPS in smart grid applications, optimizing energy distribution and consumption. The growing demand for autonomous vehicles and connected transportation infrastructure is also contributing to market momentum. Moreover, government support in the form of research funding and innovation grants is accelerating the development and deployment of CPS technologies across the country.

In the North American context, Canada is emerging as a significant player in the CPS market. The country’s commitment to technological advancement is evident in initiatives such as the establishment of the Canadian Centre for Cyber Security, which underscores the emphasis on cybersecurity—a critical component of CPS. Moreover, Canada’s focus on smart infrastructure projects, including smart cities and intelligent transportation systems, further bolsters the demand for CPS technologies. Educational institutions in Canada are also contributing to the growth of this sector by offering specialized programs in CPS and IoT, thereby cultivating a skilled workforce to support the expanding market. Major urban centers such as Toronto, Vancouver, and Montreal are leading the adoption of CPS technologies, creating innovation clusters that foster collaboration between academia, industry, and government. Additionally, the presence of global tech firms and startups investing in CPS solutions enhances regional competitiveness and drives sustained market development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Canada Cyber-Physical Systems market is expected to grow significantly, reaching USD 8,693.99 million by 2032, driven by digital transformation and technological advancements.

- The Global Cyber Physical Systems is projected to grow from USD 1,25,271.30 million in 2024 to an estimated USD 2,71,668.59 million by 2032, with a compound annual growth rate (CAGR) of 10.16% from 2024 to 2032.

- Industry 4.0 adoption is a key driver, particularly in the manufacturing sector, where CPS enhances automation, predictive maintenance, and supply chain optimization.

- Advancements in IoT, AI, and machine learning are accelerating the deployment of CPS, enabling real-time data processing and improved decision-making across sectors like energy and healthcare.

- Sustainability and energy efficiency initiatives are promoting CPS adoption, particularly in smart grid technologies that optimize energy distribution and consumption.

- The Canadian government’s strategic funding and innovation initiatives are creating a supportive environment for the growth of CPS, with a strong focus on cybersecurity and smart infrastructure.

- Cybersecurity and data privacy concerns remain a challenge, as CPS systems become more integrated into critical infrastructure, requiring robust protection measures.

- The shortage of skilled professionals in CPS technologies poses a barrier, making it difficult for companies to deploy and scale CPS solutions effectively across industries.

Market Drivers:

Adoption of Industry 4.0 and Smart Manufacturing

The growing adoption of Industry 4.0 practices is a major driver for the expansion of Cyber-Physical Systems in Canada. As industries modernize their operations, there is a pressing need to integrate advanced automation and intelligent control mechanisms. CPS technologies facilitate real-time communication between machines and systems, enabling manufacturers to optimize processes, improve productivity, and reduce operational costs. Canadian manufacturing sectors are increasingly implementing smart factories that leverage CPS for predictive maintenance, quality control, and supply chain management. This digital transformation is not only enhancing efficiency but also making Canadian industries more competitive on a global scale.

Advancements in IoT, AI, and Machine Learning

Rapid developments in enabling technologies such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning are significantly contributing to CPS adoption. These technologies form the backbone of modern CPS, supporting the seamless interaction between the cyber and physical environments. In Canada, the growing ecosystem of AI research, along with public and private investments in IoT infrastructure, is accelerating CPS deployment across various sectors including energy, healthcare, and transportation. The ability of AI to analyze vast volumes of real-time data generated by physical systems enhances decision-making capabilities and improves operational agility. This synergy between CPS and AI-driven technologies is unlocking new levels of automation and intelligence in Canadian enterprises.

Emphasis on Sustainability and Energy Efficiency

Canada’s strong commitment to sustainability and environmental stewardship is another key driver promoting CPS integration. As energy costs rise and climate change mitigation becomes a national priority, organizations are adopting CPS solutions to optimize resource consumption and reduce emissions. Smart grids, powered by CPS, enable utilities to monitor and manage energy distribution more efficiently, thus supporting the country’s transition to renewable energy sources. For example, advanced grid technologies are enabling utilities to reduce energy losses by more than 25%, as estimated by the International Energy Agency (IEA). Additionally, smart building systems and intelligent transportation networks use CPS to minimize waste and enhance sustainability outcomes. This alignment with national sustainability goals is expected to further fuel the demand for CPS technologies across public and private sectors.

Supportive Government Initiatives and Research Ecosystem

The Canadian government plays an instrumental role in advancing the CPS landscape through strategic funding, policy frameworks, and research initiatives. National programs that support digital innovation, smart infrastructure development, and cybersecurity have created a conducive environment for CPS growth. Moreover, Canadian universities and research institutions are actively contributing to the development of next-generation CPS technologies through collaborative projects and specialized academic programs. These efforts are building a skilled workforce and fostering a culture of innovation, positioning Canada as a competitive player in the global CPS market. The convergence of supportive policies and a robust R&D ecosystem is expected to sustain long-term market expansion. For example, over 75% of industry-sponsored R&D in Canada is conducted at leading research universities, which play a pivotal role in advancing CPS innovations.

Market Trends:

Integration of CPS in Smart Cities Development

One of the most prominent trends in the Canadian Cyber-Physical Systems market is the increasing integration of CPS technologies in smart city initiatives. Municipal governments across Canada are investing in intelligent infrastructure to enhance urban living, reduce traffic congestion, and improve public safety. For instance, real-time traffic management systems like PTV Optima use advanced sensor data and analytics to optimize traffic flow and reduce congestion without requiring new infrastructure. Cities such as Toronto, Vancouver, and Montreal are deploying CPS-enabled systems for real-time traffic management, smart lighting, and environmental monitoring. These systems rely on the real-time coordination of physical sensors and digital analytics to manage urban challenges efficiently. As urban populations grow and sustainability targets become more ambitious, the reliance on CPS to support data-driven governance and responsive infrastructure is gaining momentum.

Expansion of CPS in Healthcare and Remote Monitoring

The healthcare sector in Canada is witnessing a significant shift with the adoption of CPS for enhanced patient care and remote health monitoring. CPS-enabled medical devices are being increasingly utilized to collect real-time patient data, monitor vital signs, and enable timely interventions. For example, companies like CareSimple provide remote patient monitoring (RPM) solutions that integrate seamlessly with electronic health records, allowing healthcare providers to track patient data in real time. This trend has gained traction particularly in rural and underserved regions, where access to traditional healthcare services is limited. Canadian healthcare institutions are leveraging CPS to bridge gaps in service delivery, improve diagnostic accuracy, and enhance chronic disease management. As healthcare digitization accelerates, the role of CPS in delivering personalized and responsive care is expected to expand further.

Application of CPS in Critical Infrastructure and Defense

Another growing trend is the deployment of Cyber-Physical Systems in critical infrastructure sectors, including energy, transportation, and defense. In response to evolving cybersecurity threats and the need for operational resilience, Canadian agencies are investing in secure CPS frameworks. For instance, smart grid systems are integrating CPS to manage electricity distribution, detect faults, and prevent outages. Similarly, intelligent rail and air traffic control systems rely on CPS for synchronized operations and risk mitigation. In the defense sector, CPS is being adopted for autonomous surveillance, robotics, and secure communication networks. This strategic shift toward intelligent infrastructure highlights the increasing dependence on CPS to protect national interests and ensure service continuity.

Rise of Academic-Industry Collaborations in CPS Innovation

Canada is also witnessing a notable rise in academic-industry partnerships aimed at accelerating CPS research and commercialization. Universities and research centers are working closely with technology firms to develop next-generation CPS solutions across multiple domains. Collaborative initiatives such as the National Cybersecurity Consortium and Canada’s Digital Technology Supercluster are fostering innovation by funding projects that integrate CPS with emerging technologies like 5G, edge computing, and digital twins. These collaborations not only drive technological breakthroughs but also contribute to talent development and workforce readiness. This trend reflects Canada’s proactive approach to fostering a globally competitive CPS ecosystem.

Market Challenges Analysis:

Cybersecurity and Data Privacy Concerns

One of the foremost challenges in the adoption of Cyber-Physical Systems in Canada is the heightened concern over cybersecurity and data privacy. As CPS solutions integrate physical operations with digital networks, they become vulnerable to cyber threats such as data breaches, ransomware, and system manipulation. Given that CPS often supports critical infrastructure, any compromise can lead to serious consequences for public safety and national security. Despite Canada’s robust regulatory framework and growing emphasis on cybersecurity, ensuring real-time protection across distributed and complex CPS networks remains a major hurdle for both private and public sector stakeholders.

High Implementation Costs and Infrastructure Gaps

The high cost of implementing CPS technologies poses a significant restraint, particularly for small and medium-sized enterprises (SMEs). For example, many Canadian manufacturing firms report difficulty upgrading their infrastructure to support CPS due to high costs associated with advanced sensors and analytical platforms. The integration of advanced sensors, real-time control systems, and analytical platforms requires substantial capital investment. Additionally, existing infrastructure may lack the technical readiness to support such integration, necessitating costly upgrades. While large organizations may have the resources to absorb these costs, SMEs often face barriers in accessing funding or technical expertise. This limits the broader adoption of CPS across sectors and slows down overall market growth.

Shortage of Skilled Workforce

A persistent challenge in the Canadian CPS market is the shortage of skilled professionals capable of designing, deploying, and maintaining complex cyber-physical environments. The interdisciplinary nature of CPS—requiring knowledge in software engineering, systems design, cybersecurity, and domain-specific expertise—makes it difficult to find qualified talent. Although academic institutions are introducing specialized programs to address this gap, the demand for skilled CPS professionals continues to outpace supply. This talent shortage could hinder innovation and delay the scaling of CPS solutions across industries in Canada.

Market Opportunities:

Canada’s Cyber-Physical Systems market presents significant opportunities driven by the country’s digital transformation agenda and its strong emphasis on innovation-led growth. The expanding adoption of CPS in sectors such as transportation, healthcare, manufacturing, and energy is opening new avenues for technological advancement and economic development. As smart city projects and sustainable infrastructure initiatives gain traction, there is a growing demand for integrated systems that enable real-time monitoring, automation, and decision-making. The government’s strategic focus on developing intelligent transportation systems and enhancing public safety through technology offers a fertile ground for CPS applications. Additionally, Canada’s energy sector, with its ongoing shift toward clean and smart energy solutions, presents opportunities for CPS deployment in grid management, fault detection, and renewable energy integration.

Moreover, the emergence of 5G networks, edge computing, and digital twin technologies further amplifies the potential of CPS across Canada. These technologies enable faster data processing, lower latency, and more efficient system control, allowing for scalable and responsive CPS infrastructures. Academic-industry collaborations, supported by federal innovation programs, are fostering a vibrant ecosystem for research, development, and commercialization of CPS solutions. Startups and established firms alike can leverage this environment to co-develop next-generation products and services tailored to both domestic and international markets. As the need for resilient, intelligent, and secure systems grows across industries, the CPS market in Canada is well-positioned to become a key driver of technological leadership and economic competitiveness in the coming years.

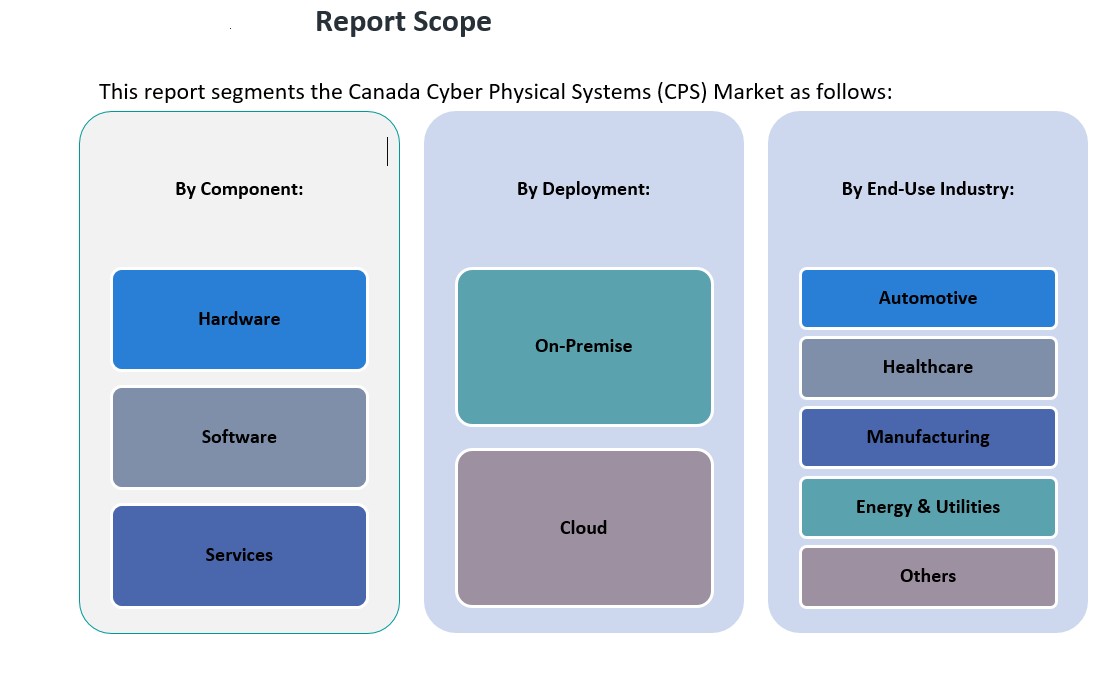

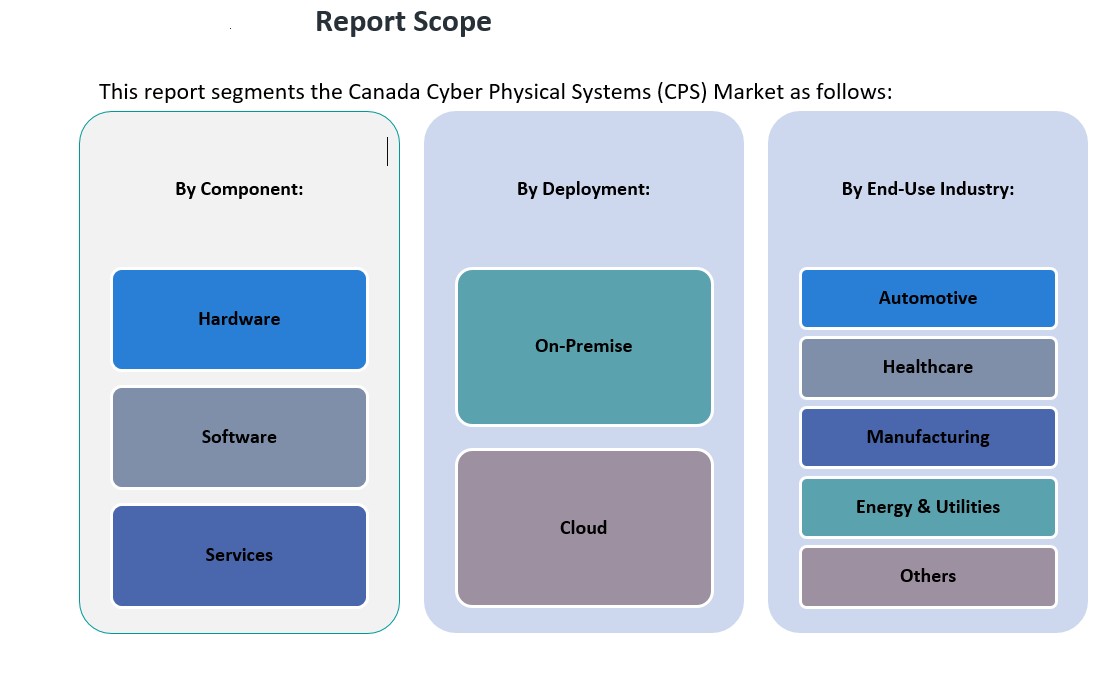

Market Segmentation Analysis:

The Canada Cyber-Physical Systems (CPS) market is segmented by component, deployment, and end-use industry, each contributing uniquely to the market’s evolution and growth.

By component, the hardware segment holds a significant share due to the widespread integration of sensors, actuators, embedded systems, and control devices essential for real-time operations. However, the software segment is witnessing rapid growth, driven by the increasing demand for intelligent analytics, simulation platforms, and system optimization tools. Services, including consulting, integration, and maintenance, play a vital role in ensuring the successful deployment and lifecycle management of CPS solutions across diverse industries.

By deployment, the market is categorized into on-premise and cloud-based solutions. On-premise deployments remain relevant, especially in industries requiring stringent data control and security, such as defense and healthcare. However, cloud-based CPS solutions are gaining considerable momentum, supported by the expansion of Canada’s cloud infrastructure and the growing preference for scalable, cost-efficient platforms. Cloud deployments enhance system agility and allow for seamless updates, making them ideal for industries undergoing digital transformation.

By end-use industry, manufacturing continues to lead CPS adoption due to the rise of smart factories and Industry 4.0 practices. The healthcare sector is rapidly adopting CPS technologies for remote monitoring, diagnostics, and patient care. The automotive industry leverages CPS for advanced driver-assistance systems and autonomous vehicle research. Energy and utilities are utilizing CPS to modernize grids and optimize resource usage. Other sectors, including aerospace and public infrastructure, are also exploring CPS for enhanced system control and efficiency.

Segmentation:

By Component:

- Hardware

- Software

- Services

By Deployment:

By End-Use Industry:

- Automotive

- Healthcare

- Manufacturing

- Energy & Utilities

- Others

Regional Analysis:

The Cyber-Physical Systems (CPS) market in Canada exhibits distinct regional dynamics, with provinces such as Ontario, Quebec, British Columbia, and Alberta playing pivotal roles in its development and expansion.

Ontario

Ontario stands as the most significant contributor to Canada’s CPS market, accounting for approximately 40% of the market share. This dominance is largely due to the province’s robust industrial base, particularly in manufacturing and automotive sectors, which are increasingly integrating CPS technologies to enhance automation and efficiency. The presence of major urban centers like Toronto fosters a conducive environment for technological innovation and adoption. Furthermore, Ontario’s strong regulatory framework around data protection drives the need for advanced CPS solutions to ensure compliance and operational security.

Quebec

Quebec follows with a substantial share of the CPS market, driven by its emphasis on aerospace and energy industries. Montreal, as a hub for aerospace engineering, sees significant adoption of CPS in the development of advanced avionics and autonomous systems. Additionally, Quebec’s investment in renewable energy projects, particularly hydroelectric power, leverages CPS for efficient grid management and integration of diverse energy sources. The province’s commitment to research and development further accelerates the implementation of CPS technologies across various sectors.

British Columbia

British Columbia contributes notably to the CPS market, with a focus on technology and clean energy sectors. Vancouver’s burgeoning tech industry drives the development and deployment of CPS in areas such as smart city initiatives and environmental monitoring. The province’s dedication to sustainability aligns with the adoption of CPS in managing renewable energy resources and optimizing urban infrastructure. Collaborations between academic institutions and industry players in British Columbia further stimulate innovation in CPS applications.

Alberta

Alberta’s engagement with the CPS market is primarily influenced by its oil and gas industry. The province utilizes CPS to enhance operational efficiency, safety, and environmental compliance in resource extraction and processing. Calgary’s role as an energy sector hub facilitates the integration of CPS for real-time monitoring and automation of complex industrial processes. Despite the traditional reliance on fossil fuels, Alberta is exploring CPS applications in renewable energy projects, reflecting a diversification of its energy portfolio.

Key Player Analysis:

- IBM Corporation

- Honeywell International Inc.

- Rockwell Automation, Inc.

- General Electric Company

- Microsoft Corporation

- Intel Corporation

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Cisco Systems, Inc.

- 3M Company

Competitive Analysis:

The Canada Cyber-Physical Systems (CPS) market is moderately competitive, with a blend of global technology providers and domestic innovators driving market growth. Leading international companies such as Siemens AG, IBM Corporation, and Schneider Electric offer comprehensive CPS solutions across key sectors including manufacturing, energy, and healthcare. These firms leverage their global expertise and advanced technologies to meet Canada’s growing demand for integrated, intelligent systems. In parallel, Canadian companies and research institutions are making notable contributions by focusing on localized solutions, cybersecurity, and niche applications. Collaboration between industry and academia plays a pivotal role in fostering innovation and commercialization of CPS technologies. Furthermore, government-backed initiatives and funding programs support startups and SMEs entering the CPS space. As the market evolves, competitive differentiation increasingly hinges on innovation, scalability, and the ability to deliver secure, real-time, and sector-specific solutions tailored to Canada’s digital transformation goals.

Recent Developments:

- On March 31, 2025, Siemens AG announced the formation of the Accenture Siemens Business Group at Hannover Messe 2025. This partnership aims to transform engineering and manufacturing by combining Siemens’ industrial AI and automation technologies with Accenture’s data and AI expertise. The group will employ 7,000 professionals globally to develop software-defined products and factories, leveraging Siemens Xcelerator portfolio and Accenture’s AI capabilities.

- On January 1, 2025, Honeywell introduced “Cyber Insights,” an OT-focused solution designed to provide real-time visibility into operational technology systems. This initiative addresses emerging cybersecurity challenges in critical infrastructure environments while leveraging AI for improved monitoring and incident response.

- On April 4, 2025, Bosch Rexroth partnered with Trackunit to integrate BODAS Connect OTA technology into Trackunit’s ecosystem. This collaboration enables remote diagnostics and software updates for construction machinery while ensuring compliance with cybersecurity regulations like the Cyber Resilience Act.

Market Concentration & Characteristics:

The Cyber-Physical Systems (CPS) market in Canada is characterized by a moderate level of concentration, with a mix of global technology leaders and domestic firms contributing to its landscape. International corporations such as IBM Corporation, Microsoft Corporation, and Schneider Electric have established a significant presence, offering advanced CPS solutions across various sectors. These companies leverage their extensive research and development capabilities to introduce innovative products tailored to the Canadian market. Domestic enterprises and startups are also playing a crucial role, particularly in niche applications and localized solutions. Collaborations between Canadian universities and industry players have fostered a conducive environment for innovation, leading to the development of specialized CPS technologies. The market is further characterized by rapid technological advancements, especially in the integration of the Internet of Things (IoT), artificial intelligence (AI), and real-time data analytics. These innovations are enhancing the functionality and applicability of CPS across industries such as manufacturing, healthcare, and energy. As the market evolves, companies that can effectively integrate these technologies while addressing cybersecurity and data privacy concerns are likely to gain a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Component, Deployment and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The CPS market in Canada is expected to witness steady expansion, supported by digital transformation across public and private sectors.

- Manufacturing will continue to be a dominant application area, driven by the adoption of smart factory practices and advanced automation technologies.

- Technological advancements in IoT and AI will enhance CPS functionality, enabling more intelligent and responsive systems.

- Energy and utilities will increasingly rely on CPS to support the transition to smart grids and sustainable energy infrastructure.

- Government investments and innovation programs will play a crucial role in accelerating CPS development and deployment nationwide.

- Industry-academic collaborations will strengthen the research ecosystem and contribute to a skilled talent pipeline for CPS-related roles.

- Increased adoption of Industry 4.0 will drive CPS implementation in operational workflows, improving efficiency and decision-making.

- The transportation sector will adopt CPS to advance intelligent mobility solutions and autonomous vehicle technologies.

- Cybersecurity will become a top priority as CPS systems handle more critical operations and sensitive data.

- Healthcare applications of CPS will grow, supporting remote monitoring, diagnostics, and enhanced patient outcomes through connected systems.