Market Overview

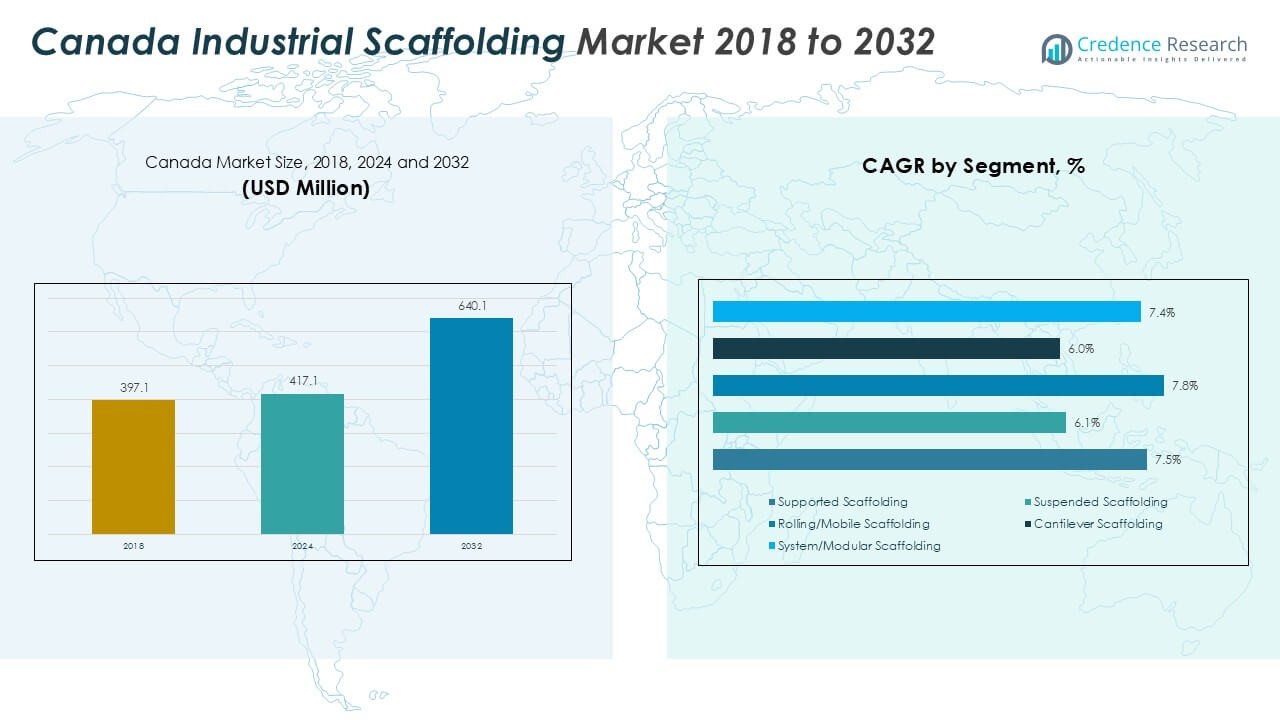

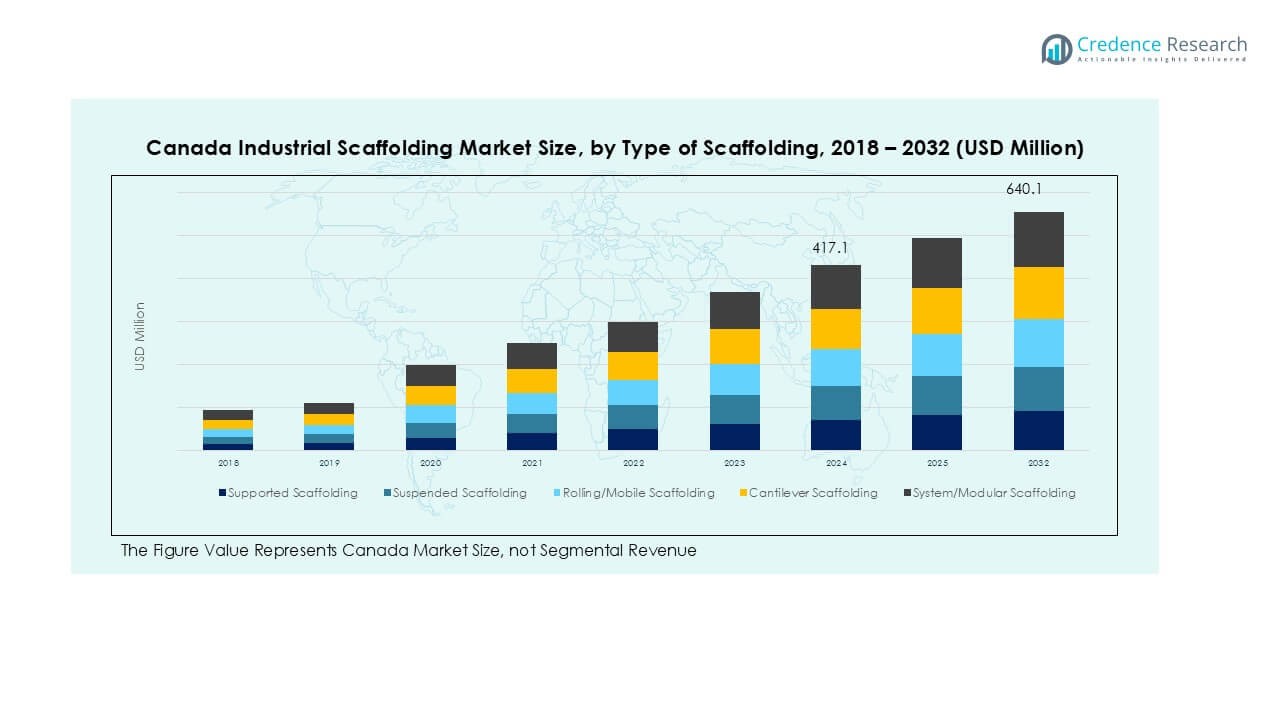

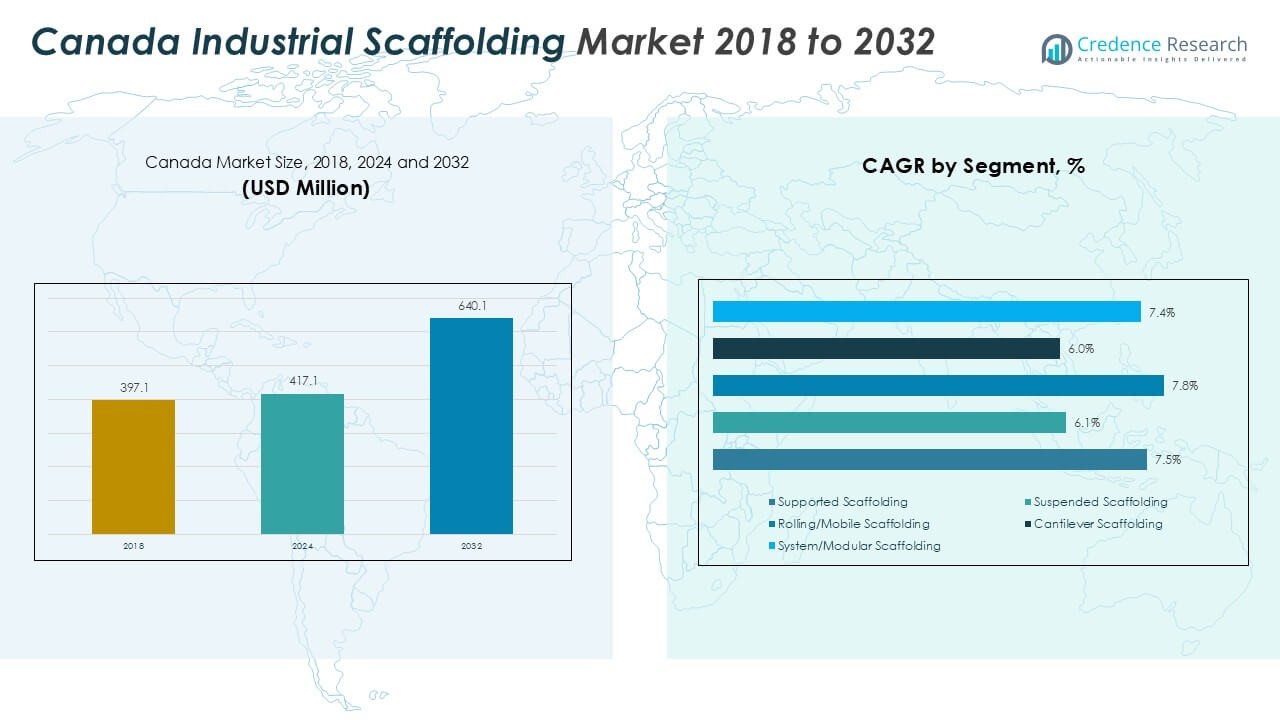

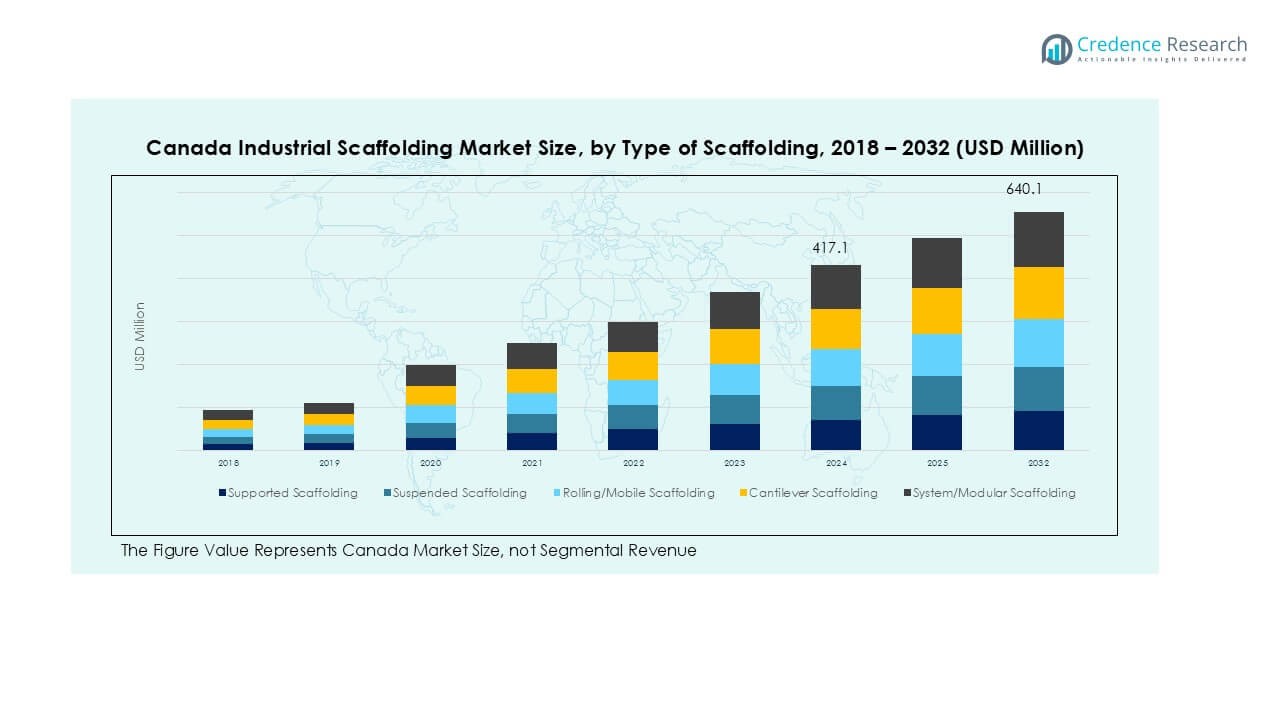

Canada Industrial Scaffolding market size was valued at USD 397.1 million in 2018 to USD 417.1 million in 2024 and is anticipated to reach USD 640.1 million by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Canada Industrial Scaffolding Market Size 2024 |

USD 417.1 Million |

| Canada Industrial Scaffolding Market, CAGR |

5.4% |

| Canada Industrial Scaffolding Market Size 2032 |

USD 640.1 Million |

The Canada industrial scaffolding market is led by major players such as Skyway Canada, WestCan Scaffolding, Industrial Scaffold Services L.P., Layher North America, BrandSafway, PERI, and AECOM. These companies dominate through strong rental networks, turnkey solutions, and compliance with strict Canadian safety standards. Western Canada is the leading region, accounting for over 40% market share in 2024, driven by oil sands projects, LNG terminals, and mining expansions. Central Canada follows with nearly 30% share, supported by nuclear refurbishments and manufacturing activity. Together, these regions create the highest demand for supported and modular scaffolding solutions across energy, power, and mining sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Canada industrial scaffolding market was valued at USD 417.1 million in 2024 and is projected to reach USD 640.1 million by 2032, growing at a CAGR of 4%.

- Growth is driven by expanding oil sands, LNG terminals, and power generation projects, alongside rising industrial maintenance and turnaround activities.

- Modular and prefabricated scaffolding systems are trending due to faster assembly, improved safety, and reduced project timelines, supporting higher adoption across industries.

- The market is moderately fragmented with key players like Skyway Canada, WestCan Scaffolding, Layher North America, and BrandSafway competing through turnkey solutions, rentals, and digital planning tools.

- Western Canada leads with over 40% share, followed by Central Canada at nearly 30%; by type, supported scaffolding holds the largest share at 45%, while steel accounts for over 60% of material usage, reflecting strong demand for durable, load-bearing solutions in industrial applications.

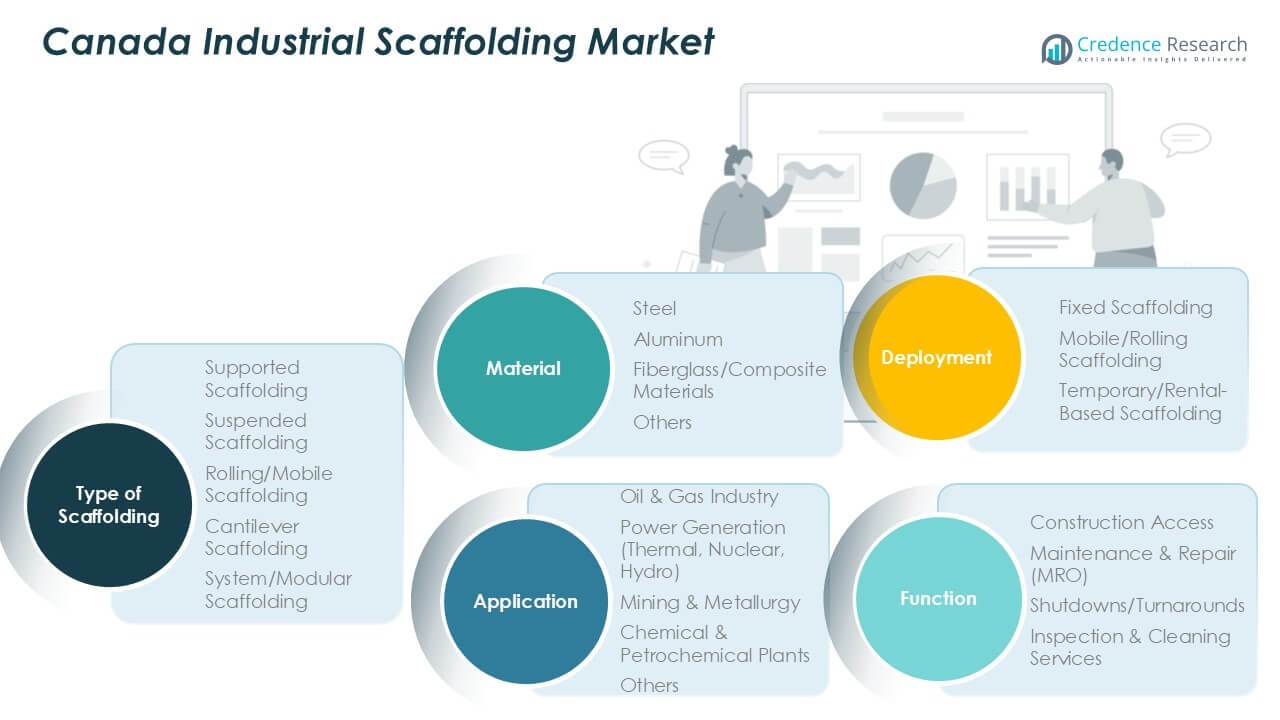

Market Segmentation Analysis:

By Type of Scaffolding

Supported scaffolding holds the largest share of the Canada industrial scaffolding market, accounting for over 45% in 2024. Its dominance is driven by its versatility, stability, and cost-effectiveness for large-scale industrial projects. Supported scaffolding is widely used in power plants, refineries, and mining facilities where heavy-duty structures are required. Rolling/mobile scaffolding is gaining traction in maintenance and inspection activities due to easy mobility. System/modular scaffolding is also expanding steadily, supported by rising demand for quick assembly and worker safety compliance in high-value projects across energy and process industries.

- For instance, in 2023, Suncor Energy Inc. undertook planned turnaround activities at its Oil Sands Base Plant in Alberta. Large-scale turnarounds like this require extensive maintenance and involve thousands of workers from Suncor and various contractor partners.

By Application

The oil & gas industry dominates the market, representing nearly 40% share in 2024. Extensive use in refinery turnarounds, maintenance shutdowns, and new facility construction fuels demand for scaffolding solutions. Power generation follows closely, driven by thermal and nuclear plant upgrades and hydro facility maintenance programs. Mining and metallurgy projects also contribute significantly due to ongoing expansions in Canada’s resource-rich provinces. Increasing maintenance schedules in chemical and petrochemical plants further boost market adoption, ensuring safe worker access to complex structures during inspection, repair, and construction activities.

- For instance, Imperial Oil, which operates the Strathcona Refinery near Edmonton, Alberta, completed a turnaround at the facility in the third quarter of 2024.

By Material

Steel scaffolding is the leading material segment with more than 60% market share in 2024, owing to its strength, durability, and suitability for heavy industrial applications. Steel structures are preferred for large refineries, power stations, and mining sites where load-bearing capacity is critical. Aluminum scaffolding is growing steadily due to its lightweight nature, which allows faster installation and mobility. Fiberglass and composite scaffolding are seeing niche adoption in chemical and petrochemical environments where corrosion resistance and electrical insulation are required, ensuring worker safety and compliance with safety standards.

Key Growth Drivers

Expansion of Oil & Gas and Power Generation Projects

Canada’s growing investment in oil sands, LNG terminals, and power generation facilities drives scaffolding demand. Refinery maintenance shutdowns, nuclear plant refurbishments, and hydroelectric expansion projects require large-scale scaffolding installations for safe worker access. The focus on energy security and infrastructure upgrades supports recurring demand for supported and modular scaffolding systems. This consistent project pipeline ensures strong utilization rates and sustains market growth.

- For instance, BrandSafway is a supplier for Syncrude’s Mildred Lake facility in Alberta, providing scaffolding and industrial access solutions for turnarounds and maintenance work. Syncrude regularly conducts these large-scale, planned maintenance events, which can involve thousands of on-site contract workers.

Stringent Workplace Safety Regulations

Compliance with strict safety standards under Canadian labor and occupational health regulations boosts demand for advanced scaffolding solutions. Employers prioritize safe, stable, and easy-to-assemble scaffolding to minimize accident risks. Adoption of modular systems with integrated safety features, guardrails, and fall protection solutions has risen sharply. Increasing enforcement and penalties for non-compliance encourage investment in high-quality scaffolding equipment, supporting steady market expansion.

- For instance, Layher Canada offers its Allround Lightweight system, which features lighter components due to the use of higher-tensile steel. Some individual components, such as certain ledgers and standards, have seen weight reductions of up to 10% to 25%, contributing to improved ergonomics and handling for contractors.

Industrial Maintenance and Turnaround Activities

Frequent maintenance and turnaround operations in refineries, power plants, and chemical facilities are major growth contributors. Scaffolding is essential for inspections, equipment overhauls, and structural repairs. Industrial operators allocate significant budgets to planned shutdowns, fueling recurring demand. The push for operational efficiency and minimized downtime leads to growing use of modular and mobile scaffolding systems that enable faster installation and dismantling.

Key Trends & Opportunities

Rising Adoption of Modular and Prefabricated Scaffolding

System and modular scaffolding are gaining momentum due to faster setup times and superior safety performance. Industrial contractors prefer prefabricated components that reduce labor hours and improve project timelines. Digital design tools and 3D modeling are being integrated to optimize scaffolding layouts, reducing material waste. This trend supports increased productivity and cost savings for complex industrial projects.

- For instance, Layher’s Allround modular scaffolding is known for its efficiency and is widely used in demanding industrial environments like oil refineries. Irving Oil’s refinery in Saint John is a major industrial site that requires extensive scaffolding for its regular maintenance “turnarounds”. The use of advanced scaffolding systems often leads to demonstrable productivity gains.

Growing Use of Lightweight and Corrosion-Resistant Materials

Demand for aluminum and fiberglass scaffolding is increasing in industries such as petrochemicals and mining, where corrosion and weight are major concerns. Lightweight scaffolding improves mobility and reduces worker fatigue, leading to higher efficiency. The adoption of advanced composite materials presents an opportunity for suppliers to differentiate offerings, targeting specialized applications like offshore facilities and chemical plants where safety and durability are critical.

- For instance, at a Fort McMurray SAGD facility expansion, Aluma Systems likely used aluminum scaffold frames to reduce the overall scaffolding weight compared to steel alternatives.

Key Challenges

High Labor Costs and Skilled Workforce Shortage

Canada’s industrial scaffolding market continues to struggle with a persistent shortage of trained scaffolders, which significantly drives up labor costs and contributes to frequent project delays. The construction and maintenance of complex industrial facilities, such as oil refineries, power plants, and mining operations, demand a highly skilled workforce to ensure compliance with strict safety standards. Insufficient availability of certified personnel leads to increased competition for talent, escalating wages and overall project costs. Many companies are investing in in-house training programs, certification initiatives, and apprenticeship schemes to bridge the skills gap. Despite these efforts, the pace of workforce development lags behind market demand, creating capacity constraints.

Volatility in Raw Material Prices

Fluctuating prices of key raw materials, particularly steel and aluminum, pose a significant challenge to the Canada industrial scaffolding market. These metals account for the majority of scaffolding system costs, making price swings highly impactful on project budgets and supplier margins. Global supply chain disruptions, tariffs, and fluctuating demand from construction and infrastructure sectors contribute to unpredictable cost patterns. Contractors and rental providers struggle to accurately forecast expenses for long-duration projects, leading to budgeting uncertainty. This volatility also affects purchasing decisions, as end-users weigh the benefits of renting versus buying scaffolding equipment.

Regional Analysis

Western Canada

Western Canada dominates the Canada industrial scaffolding market with over 40% share in 2024, driven by large oil sands projects, LNG terminals, and mining operations in Alberta and British Columbia. Frequent refinery turnarounds and construction of new energy facilities create consistent demand for supported and modular scaffolding. The region also benefits from infrastructure upgrades and pipeline expansions, which require extensive access solutions. High capital spending from oil and gas operators and mining companies ensures recurring opportunities, making Western Canada the largest revenue contributor and a critical hub for scaffolding rental and installation services.

Central Canada

Central Canada, led by Ontario, holds nearly 30% market share in 2024, supported by strong manufacturing, automotive, and power generation sectors. Industrial scaffolding demand is driven by ongoing nuclear refurbishments, power plant maintenance programs, and industrial construction projects. The region’s dense population and concentration of chemical and petrochemical facilities create steady requirements for scaffolding in maintenance and safety inspections. Growth is also supported by urban infrastructure projects, which generate demand for mobile and modular scaffolding systems. Strategic location and skilled labor availability make Central Canada a competitive market for equipment suppliers and service providers.

Atlantic Canada

Atlantic Canada accounts for approximately 15% market share in 2024, with demand concentrated in offshore oil, gas, and shipbuilding industries. The presence of key facilities in Newfoundland and Labrador and Nova Scotia drives recurring scaffolding needs for maintenance and repairs. Investment in offshore platform upgrades and port infrastructure projects further supports growth. Though smaller in scale, the region benefits from steady industrial activity and government-backed projects. Use of corrosion-resistant materials, such as aluminum and fiberglass scaffolding, is common due to harsh marine environments, creating niche opportunities for specialized scaffolding providers in the area.

Northern Canada

Northern Canada represents about 10–12% market share in 2024, driven mainly by mining and energy projects in remote locations. Harsh climate conditions and logistical challenges increase reliance on durable and quick-assembly scaffolding systems. Mining expansions in Yukon, Nunavut, and Northwest Territories are key growth drivers, as they require extensive scaffolding during facility construction and maintenance. Demand is largely project-based and seasonal, peaking during warmer months. Opportunities exist for companies offering modular and mobile scaffolding solutions that reduce setup time and improve safety in extreme conditions. Government investment in northern infrastructure supports long-term market prospects.

Market Segmentations:

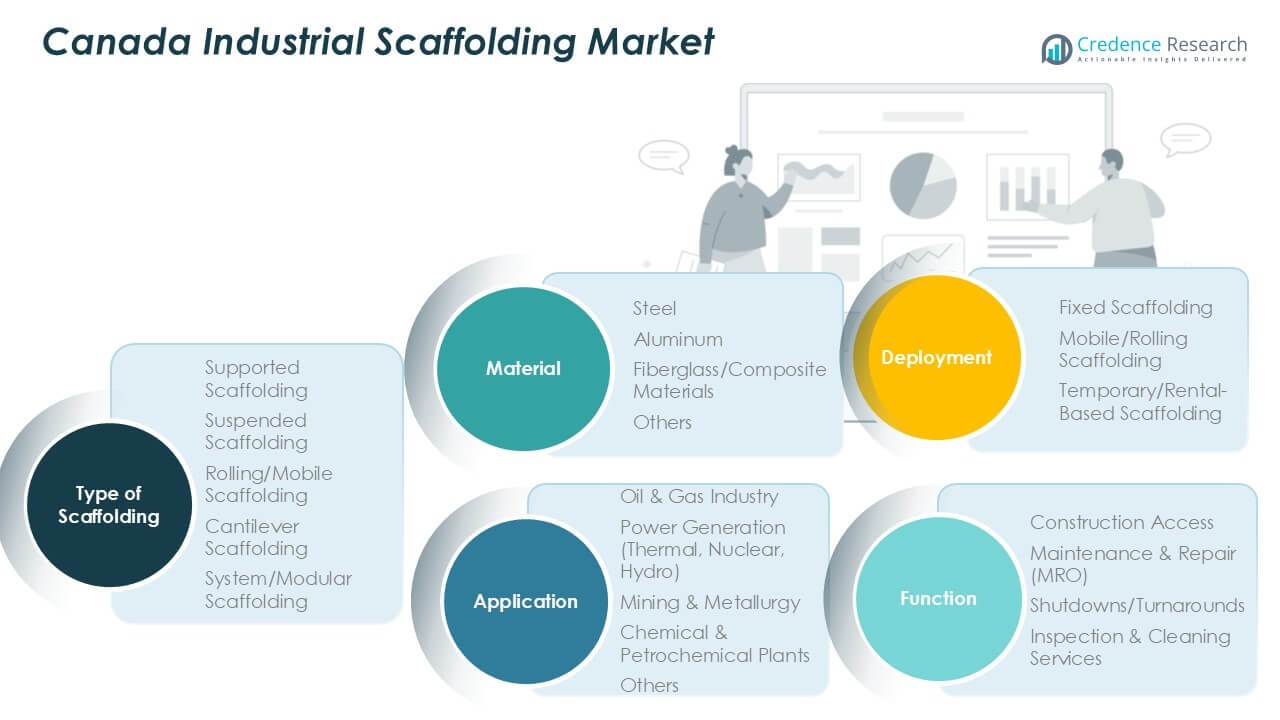

By Type of Scaffolding

- Supported Scaffolding

- Suspended Scaffolding

- Rolling/Mobile Scaffolding

- Cantilever Scaffolding

- System/Modular Scaffolding

By Application

- Oil & Gas Industry

- Power Generation (Thermal, Nuclear, Hydro)

- Mining & Metallurgy

- Chemical & Petrochemical Plants

- Others

By Material

- Steel

- Aluminum

- Fiberglass/Composite Materials

- Others

By Deployment

- Fixed Scaffolding

- Mobile/Rolling Scaffolding

- Temporary/Rental-Based Scaffolding

By Function

- Construction Access

- Maintenance & Repair (MRO)

- Shutdowns/Turnarounds

- Inspection & Cleaning Services

By Geography

- Western Canada

- Central Canada

- Atlantic Canada

- Northern Canada

Competitive Landscape

The Canada industrial scaffolding market is moderately fragmented, with a mix of regional service providers and global manufacturers competing for market share. Key players such as Skyway Canada, WestCan Scaffolding, Industrial Scaffold Services L.P., Layher North America, and BrandSafway dominate the market by offering integrated scaffolding solutions, rental services, and safety-compliant systems. These companies focus on large industrial projects, including oil sands, power generation, and mining operations, where reliability and quick deployment are critical. Strategic partnerships, acquisitions, and investment in modular and prefabricated scaffolding systems are common to enhance efficiency and safety. Local companies compete on service quality, cost-effectiveness, and rapid mobilization, while international players leverage technological innovation and strong product portfolios. Continuous training programs, digital project planning tools, and adherence to strict Canadian safety regulations remain key differentiators. The market sees intense competition, with players prioritizing long-term contracts, maintenance projects, and turnaround services to ensure steady revenue streams.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skyway Canada

- Western Canada’s WestCan Scaffolding Inc. (WestCan)

- Industrial Scaffold Services L.P.

- Layher North America

- BrandSafway

- PERI

- Scaffold Services

- Mason’s Scaffolding

- AECOM (scaffolding offerings via infrastructure services)

- Scaffold Solutions

- North Scaffold Products

Recent Developments

- In July 2022, A major developer and provider of formwork and scaffolding systems, PERI Formwork Systems, Inc., has developed what would become a new industry standard for bridge construction. VPS ensures a safety and efficiency gap through a highly versatile system that is adjustable, rentable, and productive in forming bridge columns and caps.

- In July 2022, Doka, a key player in formwork solutions and services to the construction industry has taken its collaboration with the well-known American scaffolding company AT-PAC to the next level by making a significant investment in the US-based firm. The two companies first teamed up in 2020 to offer comprehensive solutions for building sites, and their partnership has only grown stronger since then.

- In July 2022, A Glasgow subsidiary named StepUp Scaffold UK from StepUp Scaffold Group in Memphis has completed the purchase of MP House ApS located near Copenhagen during July 2022. The company MP House stands as the dominant supplier of tools and equipment along with accessories to scaffolding operators based in Denmark.

- In April 2022, Layher Holding GmbH Co KG has introduced the Allround Scaffold, a name that reflects the company and perhaps represents the pinnacle of modular scaffolding solutions. The Modular Scaffolding System is essentially the Layher Allround Scaffolding. This system is comparable to Allround Performance, as it serves multiple purposes within a single framework. No matter how complex the designs, architectural styles, or strict safety standards may be, Allround Scaffolding consistently proves to be the quicker, safer, and more economical choice.

Report Coverage

The research report offers an in-depth analysis based on Type of Scaffolding, Application, Material, Deployment, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising industrial maintenance and turnaround projects.

- Demand for modular and prefabricated scaffolding systems will increase due to faster assembly needs.

- Oil and gas projects will remain the largest demand driver, supported by ongoing refinery expansions.

- Power generation facility upgrades will create recurring scaffolding requirements for inspection and repair.

- Adoption of digital design and 3D planning tools will optimize project efficiency and reduce delays.

- Lightweight and corrosion-resistant materials like aluminum and fiberglass will see wider adoption.

- Safety regulations will continue to push investment in advanced scaffolding systems with integrated protection.

- Rental services will expand as contractors prefer cost-effective, short-term access solutions.

- Skilled workforce development will remain a focus, with training programs reducing labor shortages.

- Western Canada will maintain its lead, while Central Canada will show steady growth with infrastructure projects.