Market Overview:

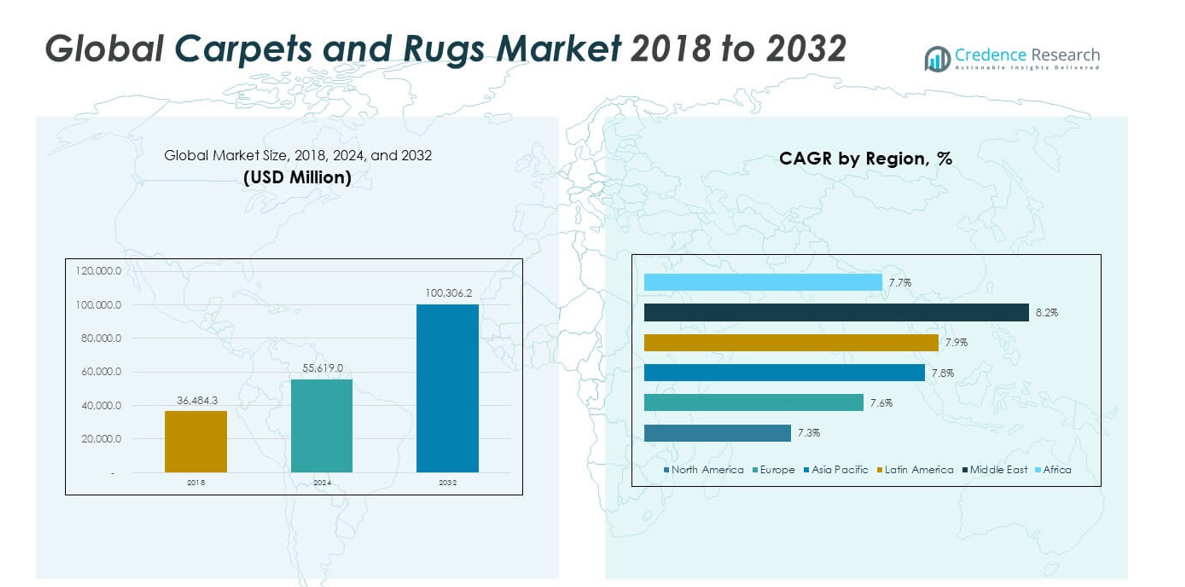

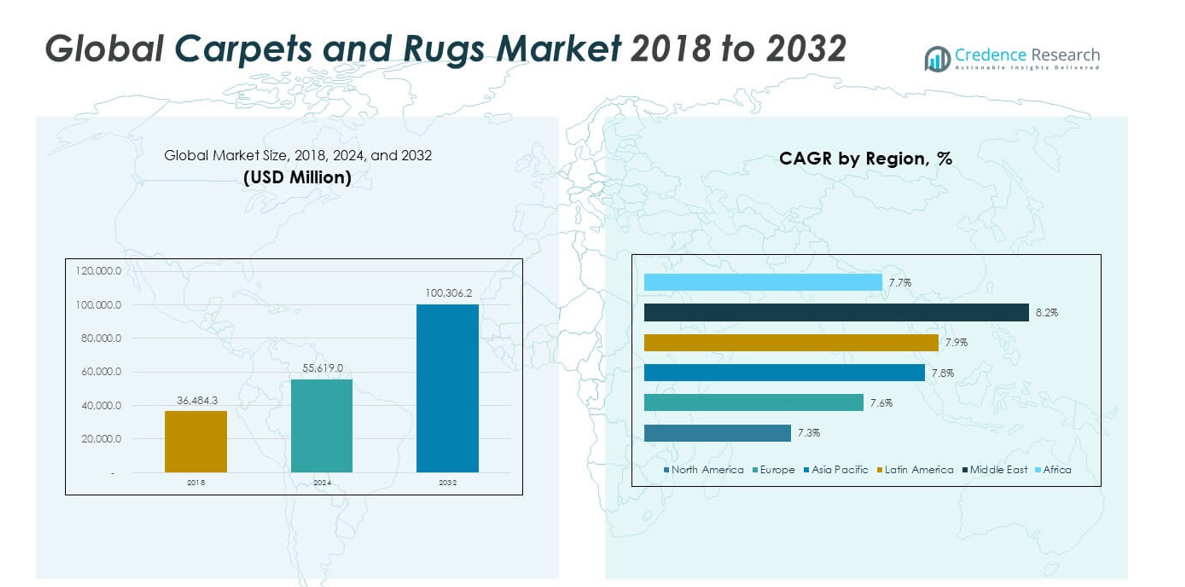

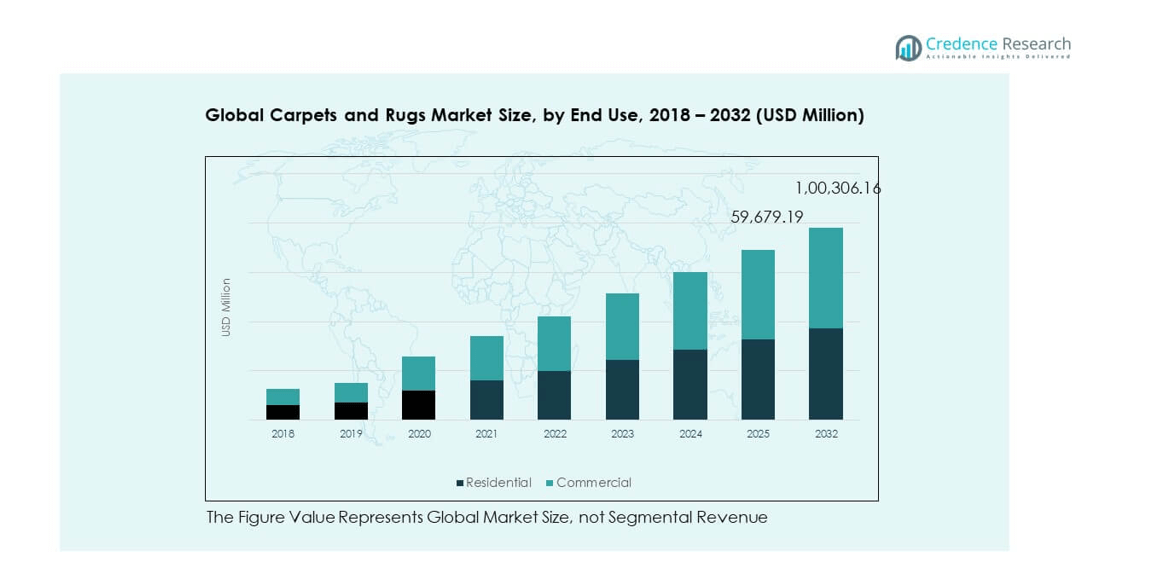

The Global Carpets and Rugs Market size was valued at USD 36,484.3 million in 2018, increased to USD 55,619.0 million in 2024, and is anticipated to reach USD 1,00,306.2 million by 2032, at a CAGR of 7.70% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Carpets and Rugs Market Size 2024 |

USD 55,619.0 million |

| Carpets and Rugs Market, CAGR |

7.70% |

| Carpets and Rugs Market Size 2032 |

USD 1,00,306.2 million |

Rising demand for home décor and interior renovations drives the market growth. Consumers increasingly prefer carpets and rugs that enhance aesthetics, comfort, and functionality in residential and commercial spaces. Urbanization, growing disposable incomes, and premium housing projects support higher adoption. It benefits from innovations in sustainable materials and eco-friendly manufacturing, attracting environmentally conscious buyers. The hospitality sector’s need for luxury, durable, and sound-absorbing flooring also strengthens market expansion.

North America and Europe lead the market due to strong residential and commercial adoption, with emphasis on design and sustainability. Asia-Pacific is an emerging region, driven by rapid urbanization, infrastructure development, and increasing consumer spending. It benefits from cost-effective manufacturing and growing demand for modern and luxury flooring solutions. Latin America and the Middle East show moderate growth, supported by housing and hospitality projects, while Africa presents nascent opportunities for future expansion.

Market Insights:

- The Global Carpets and Rugs Market was valued at USD 36,484.3 million in 2018, increased to USD 55,619.0 million in 2024, and is projected to reach USD 1,00,306.2 million by 2032, growing at a CAGR of 7.70% during the forecast period.

- Asia-Pacific leads with 37.8% share, followed by Europe at 23.9% and North America at 18.5%, driven by urbanization, infrastructure expansion, premium residential demand, and advanced manufacturing capabilities.

- Latin America is the fastest-growing region with a 10.9% share, supported by rising housing projects, hospitality expansion, and increasing disposable income.

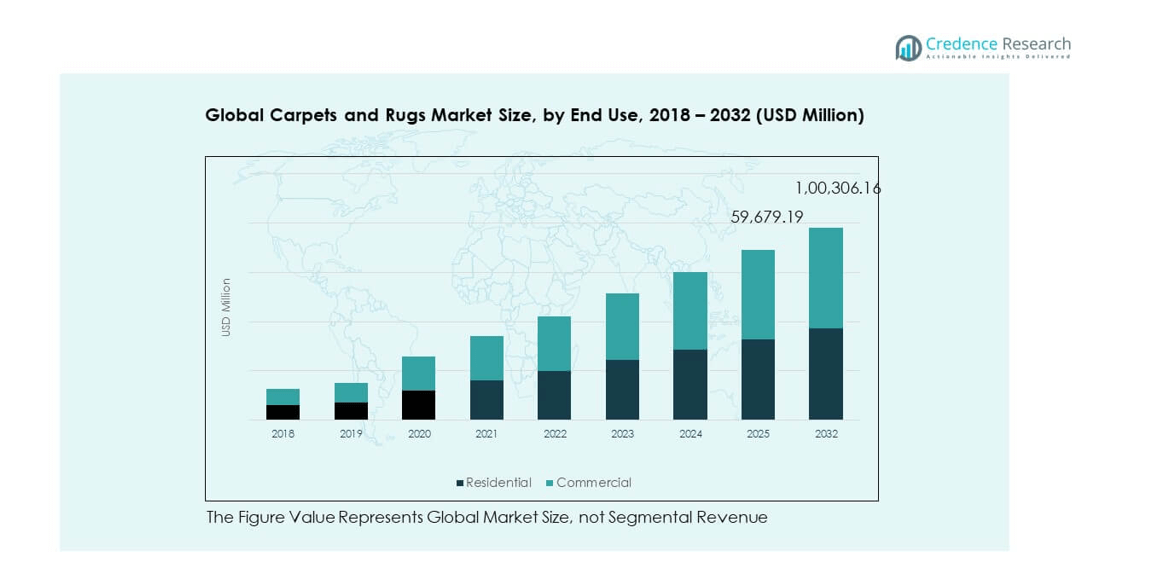

- Residential end use dominates with roughly 59.5% of the market, reflecting strong demand for home renovation, interior aesthetics, and comfort-enhancing carpets.

- Commercial applications account for around 40.5% of the market, driven by corporate offices, hotels, and retail infrastructure requiring durable, design-oriented, and high-performance flooring solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Home Renovation and Interior Aesthetics

The growing emphasis on home renovation and interior design is fueling the Global Carpets and Rugs Market. Consumers now prefer products that add visual appeal and comfort while reflecting personal style. The influence of home décor media and online retail platforms has made premium flooring options more accessible. Urban housing projects are expanding, driving installations in apartments and modern homes. The demand for noise reduction and insulation also supports carpet use. Residential buyers are investing in patterned and textured designs for living spaces. It is gaining traction in both developed and developing economies. Interior designers increasingly recommend sustainable materials that combine style and utility.

- For example, Interface Inc. reported an increase of 4.3% in full-year net sales for 2024, driven largely by new sales strategies and product differentiation in the Americas flooring market. Premium carpet tiles and enhanced retail offerings contributed to the company’s growth.

Expansion of Commercial Construction and Hospitality Sectors

Commercial expansion in hotels, offices, and retail spaces strengthens market demand. The Global Carpets and Rugs Market benefits from projects seeking durable and stylish flooring. The hospitality sector prioritizes carpets for comfort, noise control, and branding aesthetics. Corporate facilities choose modular carpet tiles for easy maintenance and replacement. Growing urban commercial centers create consistent procurement needs. Renovation in luxury hotels increases orders for custom-designed rugs. It supports manufacturers offering design flexibility and enhanced durability. Continuous innovation in fiber technology enhances longevity in heavy-traffic zones.

- For example, Mohawk Group’s carpet tiles were central to the 2025 conversion of the Kooperativa office complex in Brno, Czech Republic a project directly referenced on Mohawk’s site which demonstrates modular solutions deployed in a high-profile commercial office setting with direct product attribution.

Adoption of Sustainable and Eco-Friendly Materials

Sustainability awareness is transforming the industry. The Global Carpets and Rugs Market witnesses demand for recycled and natural fibers such as wool, jute, and PET. Governments promote green construction policies encouraging eco-friendly flooring adoption. Manufacturers invest in low-emission adhesives and dyes to reduce carbon footprint. Buyers prefer certifications like LEED and Green Label Plus for product assurance. It reflects the growing environmental consciousness among consumers. Companies integrating circular economy principles gain market credibility. This shift encourages suppliers to innovate in biodegradable carpet production.

Technological Advancements in Design and Manufacturing Processes

Innovations in 3D printing, dyeing, and tufting technologies enhance carpet design precision. The Global Carpets and Rugs Market benefits from automation improving quality consistency and reducing costs. Smart production systems help customize colors, patterns, and textures efficiently. Manufacturers employ digital design tools to meet changing customer preferences. It enables faster delivery cycles and better material utilization. Machine-made carpets are becoming superior in finish and durability. The integration of sustainable fibers with digital printing expands product appeal. Continuous technology upgrades strengthen competitiveness among global brands.

Market Trends

Growing Preference for Customized and Luxury Carpets

Personalization defines modern consumer choices in the Global Carpets and Rugs Market. Buyers seek unique textures, colors, and patterns matching interior themes. Luxury segments gain momentum through handwoven and designer pieces. The integration of artistic designs attracts premium customers in residential and hospitality sectors. It aligns with lifestyle shifts toward distinctive décor aesthetics. Technology enables intricate weaving and digital printing for personalization. E-commerce platforms provide visualization tools for buyers to preview custom designs. The trend supports high-margin sales across major distribution networks.

- For instance, Tarkett achieved the use of 157,000 tons of recycled materials in its 2024 carpet and flooring production, representing 19% of its total raw materials, and expanded its ReStart® collection program to 29 countries, supporting high-end, sustainable custom carpet solutions that are independently verified by EcoVadis .

Increased Penetration of E-Commerce and Digital Retail Channels

Online retail platforms redefine carpet and rug purchasing behavior globally. The Global Carpets and Rugs Market experiences strong digital transformation in sales. E-commerce simplifies access to diverse collections and price comparisons. Manufacturers and brands now launch exclusive online stores to expand outreach. It enhances customer engagement through virtual room visualization tools. Competitive pricing, quick delivery, and easy returns increase online adoption. Social media advertising influences buyers’ aesthetic decisions. Digital platforms strengthen global connectivity between producers and consumers.

Shift Toward Multifunctional and Smart Flooring Solutions

Modern consumers favor multifunctional flooring options that combine beauty and utility. The Global Carpets and Rugs Market witnesses innovation in anti-bacterial, anti-slip, and temperature-regulating carpets. Research efforts focus on integrating smart fibers for air purification and static control. It attracts health-conscious customers and corporate facility managers. Products offering sound absorption and comfort underfoot gain traction in offices and hotels. Multifunctionality drives preference for versatile designs across diverse settings. This technological evolution enhances safety, comfort, and performance standards. Manufacturers focusing on smart carpet solutions gain a competitive advantage.

Emphasis on Artisanal Craftsmanship and Cultural Heritage

Cultural and handmade products are regaining popularity among global consumers. The Global Carpets and Rugs Market is seeing renewed interest in ethnic, traditional, and artisanal weaving styles. Handcrafted designs reflect regional identities and craftsmanship excellence. It creates differentiation for luxury and boutique brands in international markets. Heritage-based motifs from regions like Persia, Turkey, and India appeal to collectors. Fair-trade initiatives support artisans and strengthen local economies. Buyers value authenticity and cultural storytelling in product offerings. This trend supports sustainable employment and preserves cultural legacy.

- For instance, Jaipur Rugs’ “Artisan Originals” program has trained over 7,000 rural artisans in India as of 2024, resulting in measurable export growth for hand-knotted rugs rooted in local craftsmanship and cultural motifs, verified by the company’s press releases and news reports from that year.

Market Challenges Analysis

High Raw Material Costs and Fluctuating Supply Chain Dynamics

The Global Carpets and Rugs Market faces pressure from rising raw material costs and complex logistics. Wool, nylon, and polyester prices often fluctuate due to global commodity trends. Supply chain disruptions affect timely deliveries and inventory planning. It forces manufacturers to manage cost efficiencies without compromising quality. Transport delays increase operational expenses, especially in cross-border trade. Smaller producers struggle with procurement stability and limited bargaining power. Currency fluctuations further impact international pricing strategies. Addressing these challenges requires supply diversification and technological upgrades in sourcing management.

Intense Competition and Market Fragmentation Among Global Players

Competition among established and regional manufacturers remains intense. The Global Carpets and Rugs Market includes diverse participants across price and quality segments. Low-cost imports challenge premium producers in developed markets. It increases pressure to differentiate through innovation and brand reputation. Counterfeit and low-grade products harm consumer trust. Market fragmentation complicates standardization in design and performance. Sustaining profit margins becomes difficult amid pricing wars. Companies must strengthen quality assurance and customer engagement to remain competitive.

Market Opportunities

Rising Demand in Emerging Economies and Expanding Infrastructure Projects

Urban development in Asia-Pacific, the Middle East, and Latin America creates strong opportunities for carpet adoption. The Global Carpets and Rugs Market benefits from commercial infrastructure investments in offices, hotels, and public facilities. Economic growth supports lifestyle upgrades and rising décor spending. It encourages brands to expand production and retail networks in high-potential regions. Increasing housing projects and tourism infrastructure boost sales channels. Local manufacturing partnerships improve cost competitiveness and supply responsiveness. Global players exploring these markets gain long-term strategic benefits.

Innovation in Sustainable and Smart Material Development

Innovation in recyclable and performance-enhancing materials creates major growth potential. The Global Carpets and Rugs Market advances through research in bio-based fibers and low-impact dyes. Manufacturers focusing on energy-efficient processes gain environmental certification advantages. It strengthens market positioning among eco-conscious consumers and institutional buyers. Smart carpet technology integrated with sensors opens new commercial applications. Companies investing in design sustainability and digital production see improved brand loyalty. Continuous innovation ensures relevance in both residential and commercial markets.

Market Segmentation Analysis:

The Global Carpets and Rugs Market is segmented by type, material, and end use.

By type, tufted carpets hold the dominant share due to their durability, affordability, and ease of installation across residential and commercial interiors. Woven carpets follow closely, valued for intricate designs and premium aesthetics favored in luxury spaces. Knotted and needle-punched segments serve niche markets, offering handmade craftsmanship and industrial utility. It shows growing demand for custom and design-oriented patterns, especially in high-end architectural projects and hospitality environments.

- For instance, Shaw Industries, a major market leader and subsidiary of Berkshire Hathaway, reported generating over $5 billion in annual revenue from tufted carpet sales and has established industry leadership in innovation in modular design and technology, as confirmed by public business news and company filings. Woven carpets follow closely, valued for intricate designs and premium aesthetics favored in luxury spaces.

By material, nylon leads the market owing to its high resilience, stain resistance, and long service life. Polyester ranks second, supported by demand for soft textures and cost efficiency. Polypropylene is preferred for moisture resistance in high-traffic and outdoor applications, while cotton remains popular in handcrafted and decorative products. It is shifting toward sustainable fiber blends and recycled materials to meet eco-friendly preferences and regulatory standards.

- For instance, nylon 6,6 fibers (as used by leading brands like Universal Fibers) endure abrasion tests of about 40,000 cycles before wear, far outperforming alternative fibers and confirming their leadership in durability metrics documented in technical guides and fiber manufacturer releases.

By end use, the residential segment dominates due to rising home renovation and urban housing projects. Consumers prefer carpets for warmth, comfort, and interior appeal. The commercial segment records steady growth, driven by demand from hotels, offices, and retail environments prioritizing design and acoustic performance. It continues to benefit from global construction expansion, architectural innovation, and increasing emphasis on premium flooring experiences.

Segmentation:

By Type

- Tufted

- Needle Punched

- Knotted

- Woven

- Others

By Material

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Carpets and Rugs Market size was valued at USD 6,895.52 million in 2018, increased to USD 10,302.23 million in 2024, and is anticipated to reach USD 18,075.17 million by 2032, at a CAGR of 7.3% during the forecast period. North America holds a 18.5% market share, driven by rising renovation projects and modern flooring trends. The U.S. dominates due to strong residential demand, advanced production technologies, and sustainable carpet initiatives. Canada shows growing adoption of eco-friendly materials in commercial settings. It benefits from government programs promoting green building standards. Rising investments in luxury homes and premium interior design support steady expansion. The presence of leading brands ensures product innovation and higher quality standards.

Europe

The Europe Global Carpets and Rugs Market size was valued at USD 8,800.00 million in 2018, reached USD 13,334.26 million in 2024, and is anticipated to reach USD 23,852.81 million by 2032, at a CAGR of 7.6%. Europe accounts for a 23.9% market share, supported by robust demand from architectural and hospitality sectors. The UK, Germany, and France lead adoption of design-oriented, sustainable carpets. It reflects growing awareness toward environmental certifications and indoor air quality standards. Technological advancements in tufting and weaving enhance regional competitiveness. European manufacturers emphasize low-emission and recyclable materials. The commercial real estate sector continues to integrate stylish and acoustic flooring solutions.

Asia Pacific

The Asia Pacific Global Carpets and Rugs Market size was valued at USD 13,699.84 million in 2018, expanded to USD 21,016.04 million in 2024, and is anticipated to reach USD 38,216.65 million by 2032, at a CAGR of 7.8%. Asia Pacific leads with a 37.8% share, supported by rapid urbanization and infrastructure development. China and India drive consumption through expanding residential and commercial construction. Japan and South Korea contribute with technological and design advancements. It benefits from cost-effective manufacturing and strong export capabilities. Rising disposable incomes increase spending on home décor and luxury furnishings. The region attracts international investments from flooring companies establishing regional production hubs. Growing awareness of sustainable materials fosters innovation in eco-friendly carpet production.

Latin America

The Latin America Global Carpets and Rugs Market size was valued at USD 3,933.00 million in 2018, rose to USD 6,050.55 million in 2024, and is anticipated to reach USD 11,043.71 million by 2032, at a CAGR of 7.9%. Latin America captures a 10.9% market share, driven by growing urban housing and commercial development. Brazil leads adoption, followed by Mexico and Argentina with rising middle-class demand for aesthetic interiors. It experiences steady expansion in hospitality and retail infrastructure projects. Imported carpets gain popularity among premium buyers. Local manufacturers focus on affordable products to meet price-sensitive markets. Government-backed housing programs stimulate residential renovation. The region continues to show long-term potential for modern flooring materials.

Middle East

The Middle East Global Carpets and Rugs Market size was valued at USD 2,473.63 million in 2018, increased to USD 3,878.23 million in 2024, and is anticipated to reach USD 7,252.14 million by 2032, at a CAGR of 8.2%. The Middle East holds a 7.2% share, supported by robust construction in commercial and hospitality sectors. GCC countries dominate due to large-scale hotel and residential projects. The market benefits from cultural preference for handwoven rugs and luxury interiors. It sees growing interest in customized carpets blending traditional designs with modern materials. Regional investments in tourism and retail real estate boost demand. Manufacturers adopt advanced weaving technology to serve premium clients. Sustainability trends promote natural fiber usage in upscale developments.

Africa

The Africa Global Carpets and Rugs Market size was valued at USD 682.26 million in 2018, reached USD 1,037.69 million in 2024, and is anticipated to reach USD 1,865.69 million by 2032, at a CAGR of 7.7%. Africa accounts for a 1.7% share, with rising demand from urban infrastructure and institutional projects. South Africa leads due to improving construction activity and consumer interest in decorative interiors. Egypt and Nigeria show emerging potential with expanding retail and hospitality sectors. It benefits from affordable imports from Asian manufacturers. Limited local production creates opportunities for regional investment. Awareness of modern flooring and sustainable materials grows among urban consumers. The region is expected to witness steady growth supported by rising economic development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Global Carpets and Rugs Market features a mix of established global brands and regional manufacturers competing across product innovation, design, and sustainability. Key players such as Mohawk Industries, Shaw Industries Group, and The Dixie Group maintain strong market positions through advanced manufacturing and diverse product portfolios. It emphasizes continuous development of eco-friendly materials and smart production technologies to align with green building standards. Companies like Ruggable LLC and Kaleen focus on modular and customizable designs catering to evolving consumer tastes. Retail giants such as Lowe’s Companies, Inc. support extensive distribution networks, strengthening accessibility and brand presence. Strategic alliances, mergers, and regional expansions drive competitive differentiation. The growing influence of digital retail platforms further intensifies rivalry among global and local brands striving to capture consumer loyalty through design innovation and material performance.

Recent Developments:

- In May 2025, Oriental Weavers, a leading Egyptian manufacturer in the global carpets and rugs market, launched a new polyester yarn dyeing unit in Egypt’s 10th of Ramadan City, aiming to reinforce its internal yarn capacity and further support innovation in sustainable carpet production.

- In January 2025, global manufacturer Tarkett unveiled its new carpet collection Preserved Treasures™, designed with a focus on life-plan sustainability and high performance, underlining the growing trend towards eco-friendly and wellness-focused product launches in the carpets and rugs industry.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material and End Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Carpets and Rugs Market will experience strong growth driven by urban housing and commercial construction expansion.

- Rising consumer preference for premium and customizable designs will shape market demand across regions.

- Adoption of sustainable and eco-friendly fibers will gain traction, influencing production and product development strategies.

- Technological advancements in tufting, weaving, and digital printing will improve product quality and design precision.

- Expansion of e-commerce platforms will enhance accessibility and facilitate global market penetration.

- The residential segment will continue to dominate, fueled by renovation trends and lifestyle upgrades.

- Commercial applications in hospitality and corporate offices will sustain demand for high-performance carpets.

- Emerging economies in Asia-Pacific and Latin America will present long-term growth opportunities.

- Companies will focus on strategic partnerships, mergers, and regional expansions to strengthen competitive positioning.

- Innovation in smart and multifunctional carpets will create new applications in acoustics, comfort, and safety solutions.