Market Overview

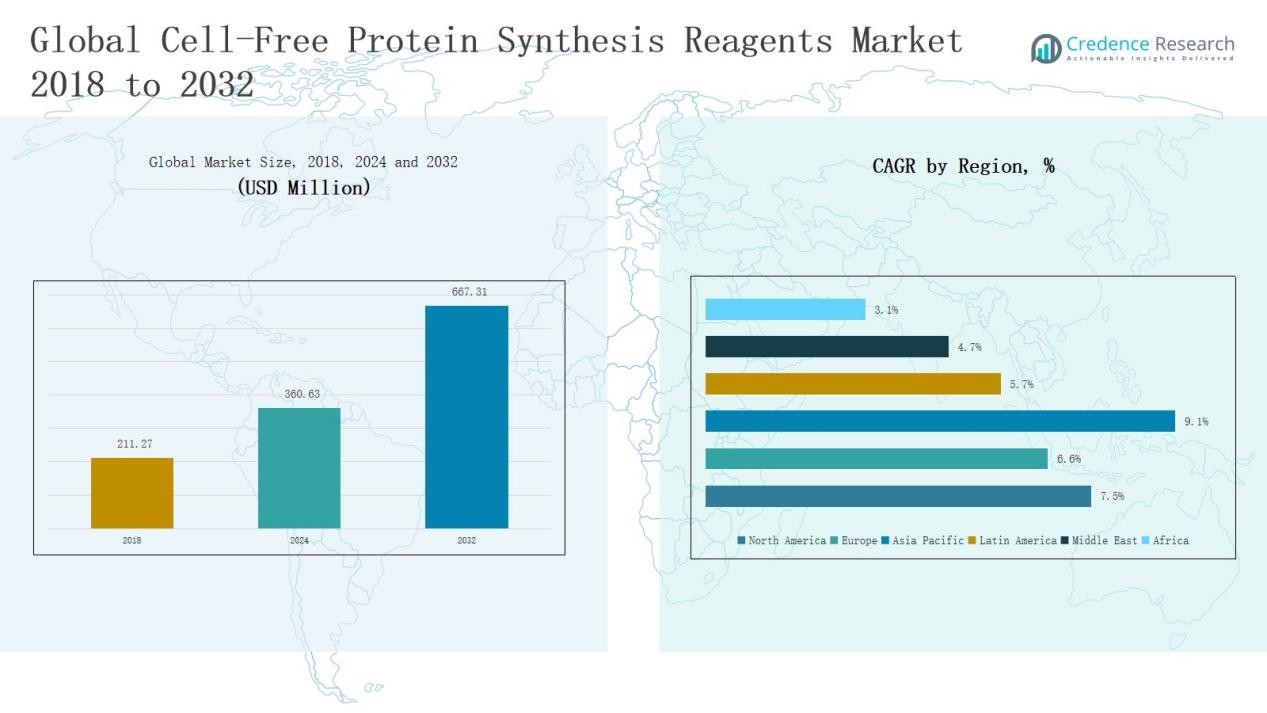

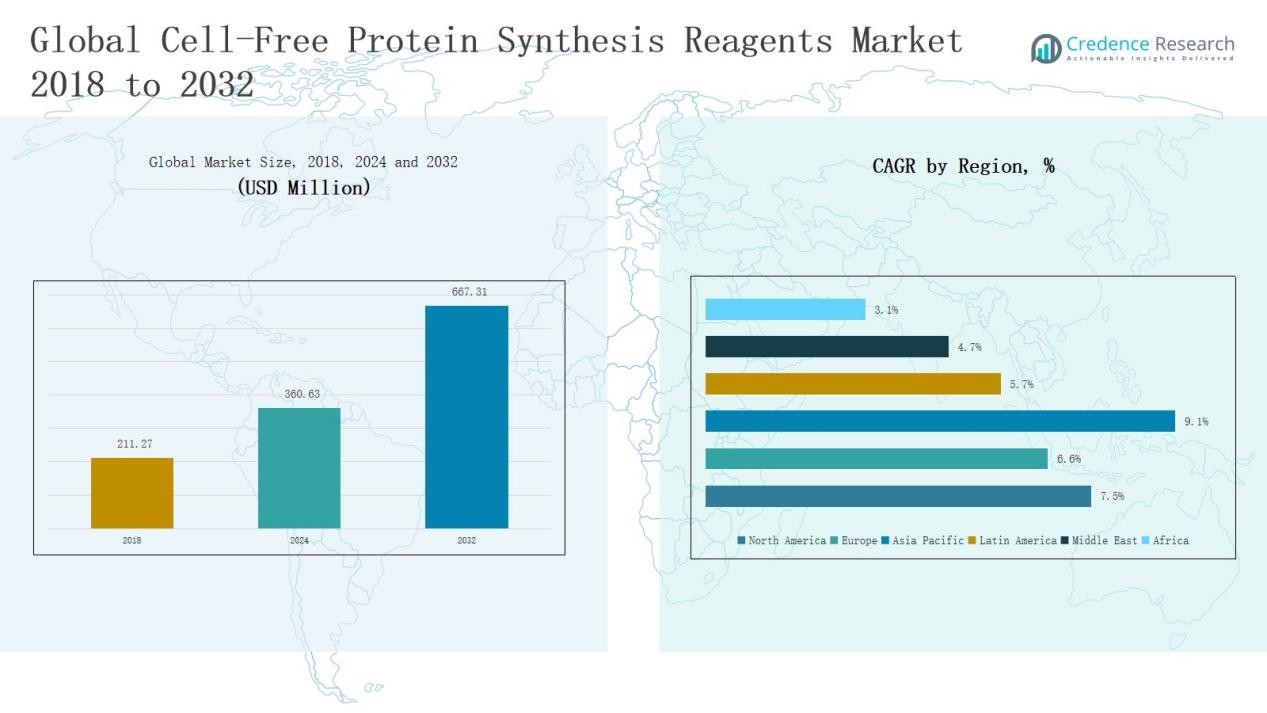

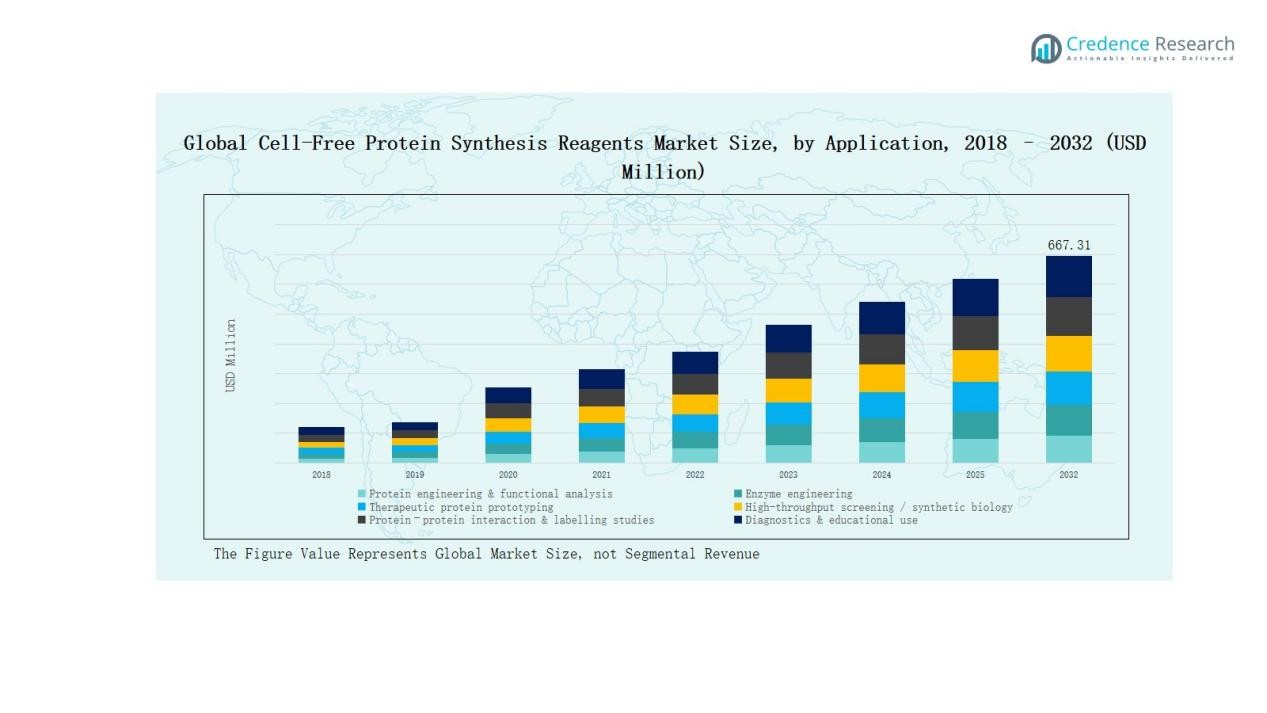

Cell-Free Protein Synthesis Reagents Market size was valued at USD 211.27 million in 2018 to USD 360.63 million in 2024 and is anticipated to reach USD 667.31 million by 2032, at a CAGR of 7.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cell-Free Protein Synthesis Reagents Market Size 2024 |

USD 360.63 Million |

| Cell-Free Protein Synthesis Reagents Market, CAGR |

7.45% |

| Cell-Free Protein Synthesis Reagents Market Size 2032 |

USD 667.31 Million |

The Cell-Free Protein Synthesis Reagents Market is driven by a mix of global leaders and specialized biotechnology firms. Key players include Thermo Fisher Scientific, Merck KGaA/Sigma-Aldrich, Promega Corporation, Takara Bio, New England Biolabs, CellFree Sciences, Biotechrabbit, Cube Biotech, GeneCopoeia, Bioneer Corporation, Jena Bioscience, Creative Biolabs, and Sutro Biopharma, each competing through advanced reagent portfolios, innovation in lysates, and strategic collaborations with pharmaceutical and research institutes. Among regions, North America leads the market with a 38% share in 2024, supported by strong R&D investment, advanced infrastructure, and the presence of major biotechnology companies driving large-scale adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cell-Free Protein Synthesis Reagents Market grew from USD 211.27 million in 2018 to USD 360.63 million in 2024, projected to reach USD 667.31 million by 2032 at a 45% CAGR.

- Cell extracts and lysates lead with a 38% share in 2024, while extract-based systems dominate methods with 71% share, supported by versatility, scalability, and cost-effectiveness.

- Protein engineering and functional analysis remain the largest application with 30% share, followed by enzyme engineering (18%) and therapeutic protein prototyping (16%), driven by pharma and biotech adoption.

- North America holds the largest regional share at 38% in 2024, supported by strong R&D, advanced infrastructure, and leading reagent manufacturers, reinforcing its global market dominance.

- Key players include Thermo Fisher Scientific, Merck KGaA/Sigma-Aldrich, Promega, Takara Bio, New England Biolabs, CellFree Sciences, Biotechrabbit, Cube Biotech, GeneCopoeia, Bioneer, Jena Bioscience, Creative Biolabs, and Sutro Biopharma.

Market Segment Insights

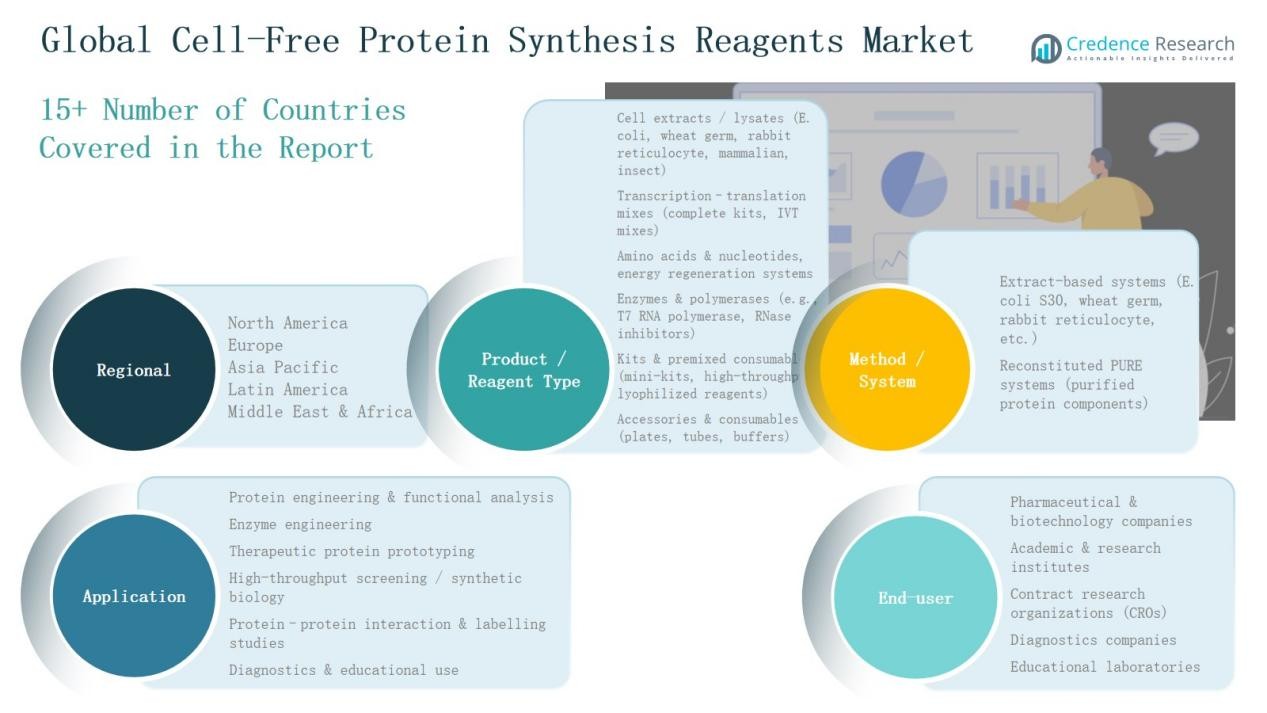

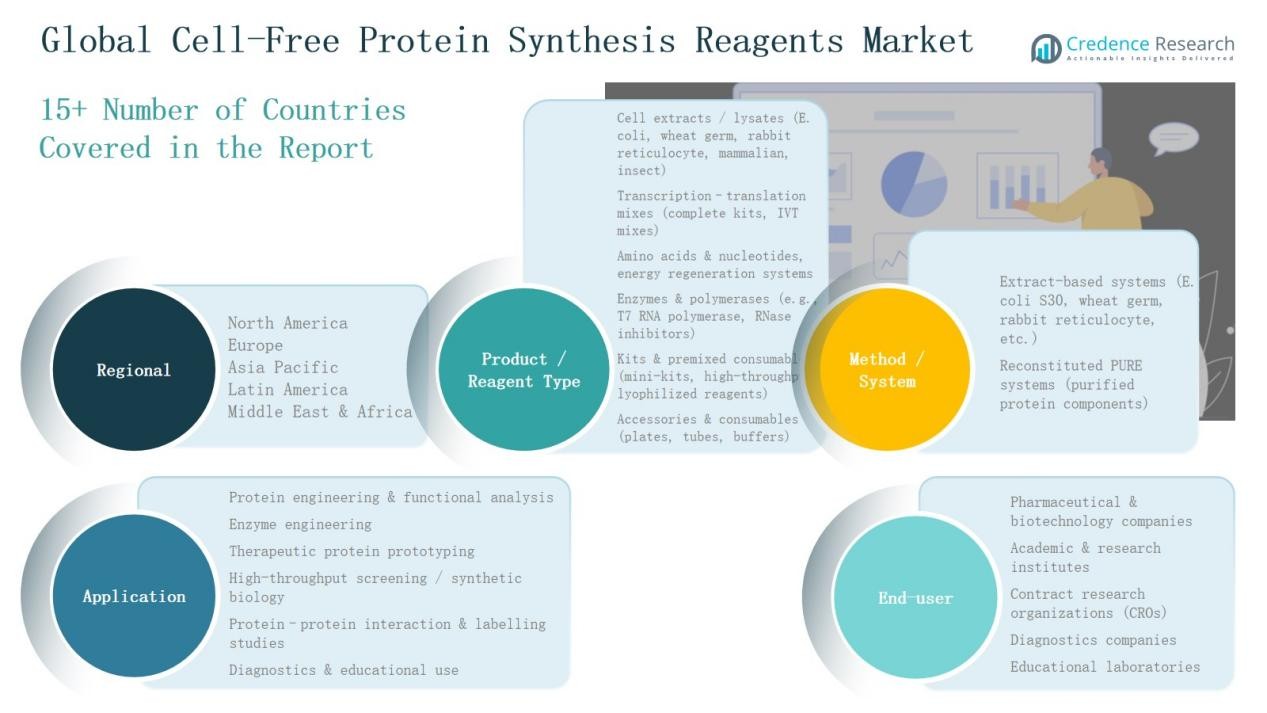

By Product / Reagent Type

Cell extracts and lysates dominate with 38% share in 2024, driven by cost-effective E. coli and wheat germ systems. Transcription–translation mixes hold 22%, reflecting demand for ready-to-use IVT kits. Amino acids, nucleotides, and energy regeneration systems account for 14%, supporting synthesis yield. Enzymes and polymerases contribute 11%, led by T7 RNA polymerase use. Kits and premixed consumables capture 9%, expanding through high-throughput and lyophilized reagent solutions.

- For instance, Canvax released ultra-high yield IVT enzyme kits featuring T7 RNA polymerase and pyrophosphatase, designed for mRNA synthesis and enhanced nucleotide incorporation, streamlining reagent demand for RNA therapeutic development.

By Method / System

Extract-based systems dominate with 71% market share in 2024, primarily due to their versatility, scalability, and strong performance in protein expression using E. coli S30 and wheat germ extracts. They are widely used in pharmaceutical R&D and industrial applications because of their cost advantage and adaptability to diverse protein types. Reconstituted PURE systems hold the remaining 29% share, growing steadily as demand rises for high-purity protein synthesis, particularly in synthetic biology and structural biology studies. Their precise control over components supports advanced applications despite higher costs.

- For instance, CellFree Sciences launched the WEPRO7240 wheat germ extract system, enabling large-scale cell-free protein synthesis with enhanced yields for antibody and membrane protein production.

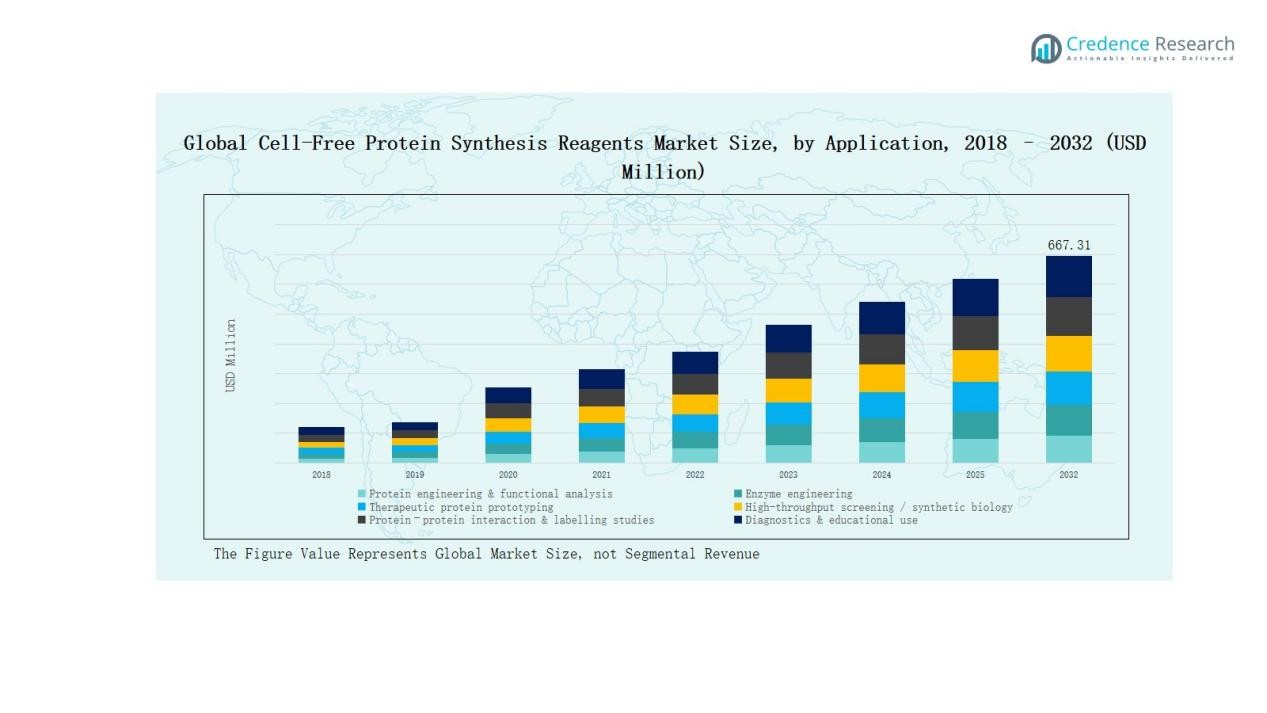

By Application

Protein engineering and functional analysis lead applications with 30% share, supported by investments in protein design. Enzyme engineering holds 18%, while therapeutic protein prototyping accounts for 16%, driven by biologics development. High-throughput screening and synthetic biology capture 14%, followed by protein–protein interaction studies at 12%. Diagnostics and educational use represent 10%, reflecting demand for simplified kits. Together, these segments highlight broad adoption across research, biotechnology, pharmaceuticals, and academic applications.

Key Growth Drivers

Rising Demand for Therapeutic Protein Prototyping

The market is strongly driven by increasing demand for rapid therapeutic protein prototyping. Pharmaceutical and biotechnology companies use cell-free systems to accelerate drug discovery, antibody engineering, and biologics development. Unlike conventional cell-based methods, these reagents allow faster expression of complex proteins without cell culture constraints. This speed shortens development timelines, reduces costs, and enables quick testing of multiple protein variants. The growing biologics pipeline and rising prevalence of chronic diseases further amplify demand, positioning therapeutic prototyping as a central driver of market expansion.

- For instance, Researchers at University College London (UCL) used E. coli cell-free protein synthesis (CFPS) systems to quickly screen and stabilize hepatitis B core (HBc) protein variants, enabling artificial disulfide bridge engineering for nanoparticle therapeutics.

Expansion of Synthetic Biology and High-Throughput Screening

Synthetic biology advancements and high-throughput screening adoption are key growth drivers. Researchers leverage cell-free systems to design genetic circuits, study protein–protein interactions, and screen large compound libraries with efficiency. Reagents that support scalable, automated processes are in high demand, particularly in academic and industrial R&D. Their flexibility and compatibility with robotics accelerate innovation in enzyme discovery, drug screening, and metabolic engineering. The increasing role of automation and integration with digital platforms enhances throughput, fueling market growth across biotechnology, pharmaceutical, and academic research sectors.

- For instance, Ginkgo Bioworks announced it screened over 17 million genetic designs through its automated high-throughput cell engineering foundry, highlighting the scale achievable with synthetic biology platforms.

Technological Advancements in Cell-Free Systems

Continuous innovation in lysates, transcription–translation mixes, and energy regeneration systems drives strong adoption. Advanced reagents deliver improved protein yields, longer reaction stability, and broader expression capabilities for complex proteins. Enzyme engineering and recombinant polymerases such as T7 RNA polymerase enhance efficiency in transcription and translation processes. Lyophilized kits and miniaturized formats further simplify workflows, making these systems more user-friendly and accessible. These technological improvements lower barriers for entry in educational and research institutes, while enabling precision-driven applications in drug discovery and structural biology.

Key Trends & Opportunities

Growing Integration of Cell-Free Systems in Diagnostics

An emerging trend is the use of cell-free protein synthesis reagents in point-of-care diagnostics. Researchers are developing biosensors and diagnostic assays that rely on rapid protein expression outside of living cells. This approach offers faster detection, cost efficiency, and portability compared to traditional lab methods. As demand for decentralized and personalized testing rises, cell-free platforms provide opportunities to expand into clinical diagnostics. The trend creates pathways for new product launches targeting infectious diseases, cancer biomarkers, and resource-limited healthcare settings worldwide.

- For instance, Daicel Arbor Biosciences introduced next-generation myTXTL® kits designed to accelerate antibody discovery and protein engineering, facilitating rapid diagnostic reagent production.

Adoption in Academic and Educational Programs

Educational laboratories and academic institutions increasingly adopt simplified reagent kits for training and learning. Lyophilized and miniaturized consumables allow students to replicate protein expression experiments without advanced lab infrastructure. This trend supports skill development in synthetic biology and molecular biology education, building a pipeline of future researchers. Opportunities exist for suppliers to expand product portfolios catering specifically to educational markets. The rising global emphasis on STEM education and funding for life sciences training further enhances adoption, positioning the segment as a growth opportunity.

- For instance, MEDOX Biotech India offers a broad portfolio of molecular biology teaching kits and reagents, widely used in educational laboratories. Their products, including micropipettes and gel electrophoresis kits, are designed to provide hands-on biotech learning experiences aligned with academic curricula across India.

Key Challenges

High Costs of Reagents and Kits

One of the major challenges is the high cost of cell-free protein synthesis reagents, particularly PURE systems and lyophilized kits. Advanced mixes and specialized enzymes require complex production, leading to premium pricing. While pharmaceutical and biotech firms can absorb these costs, smaller academic and educational institutions often face budgetary constraints. This restricts widespread adoption, especially in developing regions. Cost reduction strategies and scalable production methods will be essential to address this barrier and make the technology more accessible to a broader user base.

Limited Protein Yield and Scalability Issues

Despite technological progress, protein yield limitations remain a challenge for large-scale applications. Extract-based systems often struggle with complex proteins requiring post-translational modifications, while PURE systems are expensive at scale. These factors hinder commercial use in therapeutic manufacturing, restricting adoption primarily to research and prototyping stages. Companies must focus on enhancing yield stability, reaction longevity, and scalability to support industrial use. Addressing these gaps is crucial to unlock broader commercialization and compete with established cell-based expression methods in protein production.

Regulatory and Standardization Barriers

The market faces challenges related to regulatory acceptance and standardization of reagents for clinical and diagnostic use. Lack of harmonized protocols and validation frameworks creates uncertainty for pharmaceutical companies considering scale-up. Regulatory agencies require consistent performance, reproducibility, and safety assurance, which current systems may not fully deliver. Without clear standards, adoption in therapeutic and diagnostic pipelines can be delayed. Strengthening quality benchmarks, conducting clinical validations, and building consensus across industry stakeholders will be key to overcoming these regulatory hurdles.

Regional Analysis

North America

North America holds the largest share of the Cell-Free Protein Synthesis Reagents Market, accounting for 38% in 2024 with revenues reaching USD 157.49 million. The region is projected to grow at a 7.5% CAGR, reaching USD 292.22 million by 2032. Growth is supported by strong pharmaceutical R&D investments, high adoption in biotechnology firms, and presence of leading reagent manufacturers. Academic institutes and CROs in the U.S. and Canada further fuel demand through protein engineering and therapeutic prototyping projects. Regulatory support for biologics research and advanced laboratory infrastructure strengthen the region’s dominance.

Europe

Europe contributes 24% share in 2024, valued at USD 99.54 million, and is projected to reach USD 173.51 million by 2032 at a 6.6% CAGR. Countries like Germany, France, and the UK are central to market growth due to their strong biotechnology clusters and synthetic biology programs. The region benefits from EU-funded life sciences projects and collaborations between research institutes and biotech firms. Demand is particularly high for enzyme engineering and high-throughput screening applications. The presence of established reagent suppliers and a growing focus on precision medicine reinforce Europe’s position as the second-largest market.

Asia Pacific

Asia Pacific emerges as the fastest-growing region, holding 18% market share in 2024 with USD 75.19 million and expected to reach USD 157.57 million by 2032 at a 9.1% CAGR. China, Japan, and India drive growth with rapid investments in biotechnology research, academic collaborations, and synthetic biology startups. The region’s expanding pharmaceutical industry leverages cell-free systems for therapeutic protein prototyping and high-throughput screening. Government funding in R&D, particularly in China and South Korea, accelerates adoption. Growing educational initiatives and demand for affordable kits also contribute, positioning Asia Pacific as a critical growth hub in the forecast period.

Latin America

Latin America holds 4% share in 2024, generating USD 16.06 million, and is expected to reach USD 26.14 million by 2032, growing at a 5.7% CAGR. Brazil and Argentina lead the market due to increasing adoption of biotechnology research and diagnostic applications. Universities and research centers are gradually integrating cell-free reagents into protein engineering and educational training. Although adoption is slower than developed regions, rising interest in biosimilars and biopharmaceuticals supports growth. The market is also shaped by collaborations with international suppliers that introduce advanced reagent kits, expanding accessibility in emerging research environments.

Middle East

The Middle East accounts for 2% share in 2024, valued at USD 7.83 million, and is forecasted to reach USD 11.82 million by 2032 at a 4.7% CAGR. Growth is primarily driven by GCC countries and Israel, where investments in healthcare innovation and life sciences research are expanding. Universities and biotechnology startups are gradually adopting cell-free systems for enzyme engineering and diagnostics. Limited infrastructure and high reagent costs slow large-scale adoption, but rising government focus on diversifying healthcare and research ecosystems provides long-term opportunities for suppliers targeting niche applications.

Africa

Africa represents the smallest share, contributing 1% in 2024 with USD 4.53 million, projected to reach USD 6.06 million by 2032 at a 3.1% CAGR. South Africa leads adoption, supported by academic research initiatives and diagnostic development programs. Other countries remain in early stages of adoption due to budgetary constraints and limited laboratory infrastructure. Growth opportunities lie in educational kits and low-cost consumables, particularly as STEM programs expand across universities. International partnerships with reagent suppliers are expected to play a critical role in market expansion, enabling access to advanced technologies in resource-limited settings.

Market Segmentations:

By Product / Reagent Type

- Cell extracts / lysates (E. coli, wheat germ, rabbit reticulocyte, mammalian, insect)

- Transcription–translation mixes (complete kits, IVT mixes)

- Amino acids & nucleotides, energy regeneration systems

- Enzymes & polymerases (e.g., T7 RNA polymerase, RNase inhibitors)

- Kits & premixed consumables (mini-kits, high-throughput, lyophilized reagents)

- Accessories & consumables (plates, tubes, buffers)

By Method / System

- Extract-based systems (E. coli S30, wheat germ, rabbit reticulocyte, etc.)

- Reconstituted PURE systems (purified protein components)

By Application

- Protein engineering & functional analysis

- Enzyme engineering

- Therapeutic protein prototyping

- High-throughput screening / synthetic biology

- Protein–protein interaction & labelling studies

- Diagnostics & educational use

By End-User

- Pharmaceutical & biotechnology companies

- Academic & research institutes

- Contract research organizations (CROs)

- Diagnostics companies

- Educational laboratories

By Region

- North America (U.S., Canada, Mexico)

- Europe (UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Australia, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East (GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa (South Africa, Egypt, Rest of Africa)

Competitive Landscape

The competitive landscape of the Cell-Free Protein Synthesis Reagents Market is characterized by a mix of global life science leaders, specialized biotechnology firms, and emerging regional players. Companies such as Thermo Fisher Scientific, Merck KGaA/Sigma-Aldrich, Promega Corporation, Takara Bio, and New England Biolabs dominate the market with broad reagent portfolios, strong global distribution networks, and sustained investments in R&D. Niche players including CellFree Sciences, Biotechrabbit, Cube Biotech, and GeneCopoeia strengthen competition by offering specialized lysates, transcription–translation kits, and lyophilized solutions tailored for academic and industrial use. Sutro Biopharma and Creative Biolabs leverage proprietary technologies to target therapeutic prototyping and drug discovery, expanding the market scope. Partnerships with pharmaceutical companies, CROs, and academic institutions remain central strategies, alongside innovation in high-throughput and automated reagent systems. Growing demand from synthetic biology, enzyme engineering, and diagnostics drives continuous product innovation, making technological differentiation and scalability the key competitive levers in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Thermo Fisher Scientific

- Merck KGaA / Sigma-Aldrich

- Promega Corporation

- Takara Bio

- New England Biolabs (NEB)

- CellFree Sciences Co., Ltd.

- Biotechrabbit GmbH

- Cube Biotech GmbH

- GeneCopoeia, Inc.

- Bioneer Corporation

- Jena Bioscience GmbH

- Creative Biolabs

- Sutro Biopharma

Recent Developments

- In June 2024, LenioBio and Labscoop formed a strategic partnership to enhance access to LenioBio’s cell-free protein synthesis technology across North America, enabling broad availability of their ALiCE platform products and services via Labscoop’s e-commerce marketplace.

- In January 2025, Sutro Biopharma and Boehringer Ingelheim BioXcellence established a collaboration to develop first-in-class cell-free protein synthesis capabilities at commercial scale, marking a significant development in the market.

- In Junessss 2024, Daicel Arbor Biosciences launched its upgraded myTXTL® Pro and Antibody/DS Kits to enhance protein expression efficiency and streamline workflows.

- In August 2025, AIChE hosted the 3rd Cell-Free Systems Conference at Northwestern University, highlighting advances in diagnostics, synthetic cells, and high-throughput CFPS applications.

Report Coverage

The research report offers an in-depth analysis based on Product / Reagent Type, Method / System, Application, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for rapid therapeutic protein prototyping will strengthen adoption across pharmaceutical pipelines.

- Expansion of synthetic biology applications will drive wider use of advanced reagent systems.

- Academic and research institutes will increase uptake of simplified kits for education and training.

- High-throughput screening platforms will rely more on cell-free reagents for efficiency.

- Growth in enzyme engineering will boost demand for specialized lysates and polymerases.

- Diagnostic assay development will increasingly integrate cell-free systems for faster results.

- Technological advances will enhance protein yield and stability, broadening application scope.

- Strategic collaborations between biotech firms and reagent suppliers will intensify competition.

- Emerging markets will adopt cost-effective kits and consumables to expand accessibility.

- Regulatory clarity and standardization will improve acceptance in clinical and industrial use.