| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Industrial Fasteners Market Size 2024 |

USD 12235.02 Million |

| China Industrial Fasteners Market, CAGR |

8.08% |

| China Industrial Fasteners Market Size 2032 |

USD 22785.14 Million |

Market Overview:

The China Industrial Fasteners Market is projected to grow from USD 12235.02 million in 2024 to an estimated USD 22785.14 million by 2032, with a compound annual growth rate (CAGR) of 8.08% from 2024 to 2032.

Several factors are propelling the growth of China’s industrial fasteners market. Foremost is the country’s extensive infrastructure development initiatives, including the Belt and Road Initiative, which have spurred demand for fasteners in construction and transportation projects. Additionally, China’s status as the world’s largest automotive manufacturing hub has led to increased consumption of automotive fasteners, essential for assembling engines, suspensions, and braking systems. The manufacturing sector’s expansion, supported by favorable government policies and investments, further amplifies the demand for industrial fasteners across various applications. The growing emphasis on renewable energy projects and the push towards greener construction practices are also contributing to the expanding demand for specialized fasteners.

Within the Asia-Pacific region, China stands out as the leading market for industrial fasteners, both in production and consumption. The country’s well-established manufacturing infrastructure and export capabilities enable it to meet domestic needs and supply international markets effectively. China benefits from a deep supply chain ecosystem and strong logistical networks, which enhance its position as a critical supplier to global industries. The dominance is further reinforced by the presence of numerous fastener manufacturers and a robust supply network that caters to various industries, including automotive, construction, and electronics. As urbanization and industrial activities continue to accelerate, China’s regional leadership in the industrial fasteners market is expected to persist, contributing significantly to the global market’s growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China Industrial Fasteners Market is projected to grow from USD 12,235.02 million in 2024 to USD 22,785.14 million by 2032, registering a strong CAGR of 8.08% during the forecast period.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Extensive infrastructure development projects, including the Belt and Road Initiative and smart city expansions, are significantly increasing the demand for high-performance industrial fasteners across construction and transportation sectors.

- China’s dominance in global automotive manufacturing is fueling the consumption of advanced fasteners, with growing emphasis on lightweight, high-strength products suited for electric vehicles and fuel-efficient designs.

- The rapid adoption of automation, smart manufacturing, and Industry 4.0 technologies across China’s manufacturing sector is driving the demand for precision-engineered, customized fastening solutions.

- Rising investments in renewable energy projects, particularly in solar and wind energy, are creating new growth opportunities for specialized fasteners capable of withstanding harsh environmental and mechanical stresses.

- Challenges such as fluctuating raw material prices, intense market competition, and the presence of substandard low-cost fasteners are putting pressure on manufacturers to innovate and maintain profitability.

- Regionally, Eastern China leads the market due to its strong industrial base, while Northern, Central, and Southern regions are also contributing significantly, supported by expanding infrastructure, automotive, and manufacturing activities.

Market Drivers:

Infrastructure Development and Construction Boom

China’s continuous investment in large-scale infrastructure projects significantly drives the industrial fasteners market. Government initiatives such as the Belt and Road Initiative and urbanization efforts across emerging cities are increasing the need for durable, high-performance fastening solutions. Infrastructure sectors like bridges, highways, railways, and airports require a diverse range of fasteners to ensure structural integrity and long-term resilience. For instance, companies like Ningbo Fastenwell Metal Technology Co., Ltd. are recognized for producing high-strength hex and structural bolts, which are widely used in heavy-duty infrastructure applications such as bridges and highways. Additionally, the expansion of smart cities and public utility projects continues to boost demand for specialized fasteners tailored to withstand dynamic environmental conditions and stress factors. The emphasis on sustainable construction practices is further pushing manufacturers to innovate and supply advanced fastening technologies suited for modern infrastructure requirements.

Automotive Industry Expansion

China’s position as the world’s largest automotive manufacturing hub plays a crucial role in fueling fastener demand. With millions of vehicles produced annually, the automotive sector requires a vast volume of high-strength, lightweight fasteners essential for assembling engines, chassis, suspensions, and body structures. The rapid adoption of electric vehicles (EVs) further stimulates the market, as EVs demand specialized fasteners designed for battery enclosures, lightweight frames, and safety-critical applications. Moreover, continuous advancements in automotive design and the pursuit of vehicle weight reduction to enhance fuel efficiency are driving innovations in fastener materials and engineering. Collaborations between automotive manufacturers and fastener suppliers are becoming more prominent to meet evolving industry specifications.

Manufacturing Sector Growth and Technological Advancements

The broad expansion of China’s manufacturing sector across industries such as electronics, machinery, aerospace, and consumer goods is creating substantial opportunities for the industrial fasteners market. Manufacturers are increasingly adopting automation, precision engineering, and smart manufacturing techniques, which demand highly customized and precision-engineered fastening solutions. The implementation of Industry 4.0 technologies, including robotics and AI-based production systems, requires fasteners that deliver exceptional performance, reliability, and ease of assembly. For instance, a Hunan-based new energy technology company reported a 70% reduction in processing time and a 72% increase in production capacity for embedded screw sleeves after implementing robotic arms and smart manufacturing systems. This growing complexity in manufacturing applications is encouraging innovation in fastening systems, including the development of corrosion-resistant, vibration-proof, and tamper-proof fasteners, supporting the long-term growth trajectory of the market.

Focus on Renewable Energy and Green Initiatives

The surge in renewable energy projects, particularly in solar and wind energy sectors, is opening new avenues for the industrial fasteners market in China. Renewable energy installations require specialized fasteners capable of withstanding extreme weather conditions, thermal expansion, and mechanical stresses. The government’s commitment to achieving carbon neutrality goals by 2060 has accelerated the pace of investments in green infrastructure, further amplifying the need for high-performance fastening solutions. In addition, sustainable manufacturing practices are encouraging fastener producers to develop eco-friendly materials and production techniques, aligning with national and global environmental standards. These factors collectively reinforce the importance of industrial fasteners as a critical component in China’s evolving energy landscape.

Market Trends:

Rising Demand for Lightweight and High-Performance Fasteners

A notable trend shaping the China industrial fasteners market is the increasing preference for lightweight and high-performance fasteners. For instance, Qifeng Precision Technology Co., Ltd., a high-tech enterprise in China, has significantly expanded its R&D efforts to develop aerospace and military fasteners with enhanced tensile strength, corrosion resistance, and thermal stability. With industries such as aerospace, automotive, and electronics focusing heavily on weight reduction without compromising strength, the demand for advanced fastener materials such as titanium alloys, high-grade aluminum, and composites is accelerating. Companies are investing in research and development to produce fasteners that offer enhanced tensile strength, corrosion resistance, and thermal stability. This shift is particularly significant in the aviation and electric vehicle sectors, where lightweight construction is critical to improving energy efficiency and performance. The adoption of high-performance fastening solutions is gradually redefining product development standards across multiple manufacturing verticals.

Technological Integration in Fastener Production

The integration of cutting-edge technologies into fastener production processes is becoming increasingly prominent in China. Advanced manufacturing techniques such as additive manufacturing (3D printing), cold forming, and automated assembly are reshaping the industrial fasteners landscape. These technologies allow for greater precision, reduced production time, and cost efficiencies, leading to faster market responsiveness. Smart manufacturing systems embedded with sensors are also gaining traction, enabling real-time quality monitoring and predictive maintenance of fastening tools. Furthermore, the incorporation of surface treatment innovations, such as advanced coatings for improved wear and chemical resistance, is enhancing the durability and lifecycle of fasteners used in critical industrial applications.

Growing Popularity of Customized and Application-Specific Fasteners

Customization is emerging as a crucial trend in the China industrial fasteners market, driven by the diverse needs of specialized industries. Sectors such as medical devices, telecommunications, and renewable energy are demanding fasteners tailored to their specific operational and regulatory requirements. Manufacturers are increasingly offering product variations in terms of size, coating, threading, and material composition to address unique application challenges. This movement toward highly specialized, application-specific fastening solutions is encouraging collaboration between OEMs and fastener producers during the early design phases of projects. The focus on custom engineering ensures optimal compatibility, performance reliability, and compliance with stringent quality standards across varied industrial segments.

Sustainability and Environmental Compliance Influencing Product Innovation

Environmental regulations and a heightened emphasis on sustainability are driving innovation in China’s industrial fasteners market. Manufacturers are actively working to minimize the environmental impact of their production processes by using recyclable materials, adopting low-emission coating technologies, and optimizing energy usage. For example, Zhejiang Haili Co., Ltd. has implemented ISO14001 environmental management system certification and energy-efficient manufacturing methods to minimize environmental impact. There is a noticeable increase in the production of eco-friendly fasteners designed for sustainable construction, renewable energy systems, and green transportation projects. Additionally, end-users are prioritizing suppliers that demonstrate a commitment to environmental stewardship and carbon footprint reduction. As China intensifies its focus on environmental responsibility, the trend toward sustainable fastener solutions is expected to gain even greater momentum, influencing market dynamics in the coming years.

Market Challenges Analysis:

Fluctuating Raw Material Prices

Volatility in the prices of raw materials such as steel, aluminum, and titanium is a major restraint for the China industrial fasteners market. For instance, the Iron Ore Spot Price reached $137.05/MT in December 2023, marking a 22.54% year-on-year increase, which directly raised steel production costs for fastener manufacturers. The cost of these materials is highly sensitive to global supply chain disruptions, trade policies, and geopolitical tensions. Manufacturers face challenges in maintaining stable profit margins due to sudden price spikes, leading to increased production costs and reduced competitiveness. This unpredictability forces many companies to either absorb the costs, impacting profitability, or pass them onto customers, which can weaken demand in price-sensitive sectors. The dependency on imported specialty materials further exacerbates the issue, creating additional pressure on manufacturers to seek alternative sourcing strategies.

Intense Market Competition and Pricing Pressure

The industrial fasteners market in China is highly fragmented, with numerous domestic and international players competing aggressively on price. This intense competition often results in significant pricing pressure, forcing manufacturers to reduce costs without compromising product quality. Smaller companies, in particular, struggle to maintain profitability while meeting the increasingly sophisticated demands of industries such as automotive, aerospace, and electronics. In addition to price wars, the influx of low-cost, substandard fasteners from unregulated sources poses a challenge to market integrity, undermining the value proposition of quality-driven suppliers. Maintaining differentiation through innovation, certifications, and value-added services has become critical for survival in such a competitive environment.

Stringent Regulatory and Quality Compliance Requirements

Compliance with stringent quality standards and evolving regulatory frameworks presents another significant challenge for industrial fastener manufacturers in China. Industries such as aerospace, automotive, and construction demand adherence to international certifications, including ISO, ASTM, and DIN standards. Achieving and maintaining these certifications requires significant investments in advanced manufacturing technologies, rigorous testing protocols, and quality assurance processes. For many small and medium-sized enterprises (SMEs), the cost and complexity of compliance create barriers to entry into high-value markets. Failure to meet these regulatory requirements not only limits market access but also exposes companies to potential legal liabilities and reputational damage.

Market Opportunities:

The China industrial fasteners market presents significant growth opportunities fueled by the rapid expansion of emerging industries such as renewable energy, electric vehicles, and smart infrastructure. As China accelerates its transition toward clean energy and sustainable urbanization, the demand for specialized fastening solutions tailored to solar farms, wind turbines, and energy-efficient construction is surging. The increasing adoption of electric vehicles, supported by strong government incentives and consumer demand for greener alternatives, is creating new requirements for lightweight, high-strength fasteners designed for battery systems, lightweight body structures, and advanced drivetrain assemblies. These developments offer fastener manufacturers substantial avenues to innovate and diversify their product portfolios in alignment with next-generation industry standards.

Moreover, the growing focus on automation, artificial intelligence, and advanced manufacturing technologies in China’s industrial sector offers new opportunities for fastener companies to supply precision-engineered, application-specific solutions. The ongoing digital transformation across industries requires components that can meet high-performance, durability, and safety standards under more complex operational conditions. Fastener producers that invest in smart production capabilities, enhanced quality assurance systems, and customized offerings are well-positioned to capture a larger share of the evolving market. Additionally, opportunities exist in expanding export capabilities to emerging economies, where demand for high-quality, certified fasteners is steadily rising. Strategic collaborations with OEMs and infrastructure developers, coupled with an emphasis on sustainability and compliance, will further unlock long-term growth prospects for players in the China industrial fasteners market.

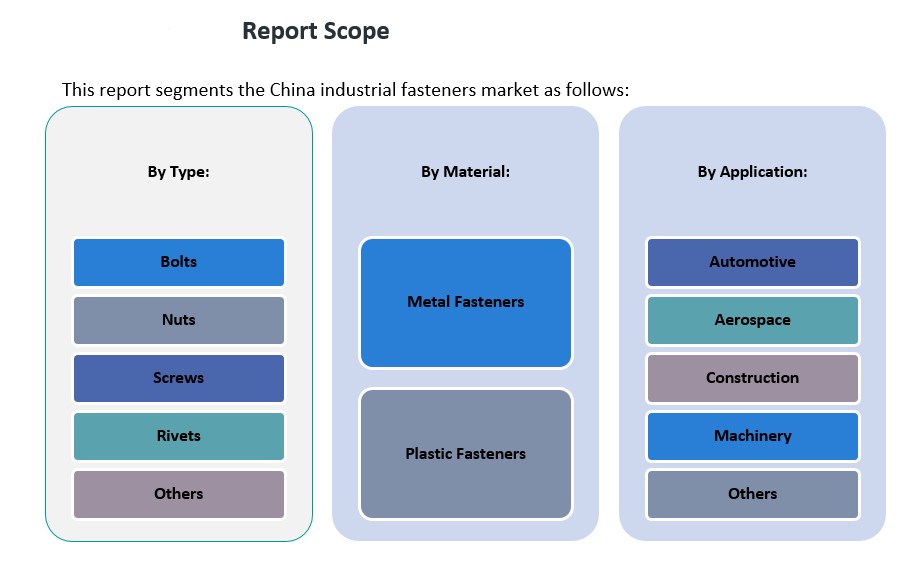

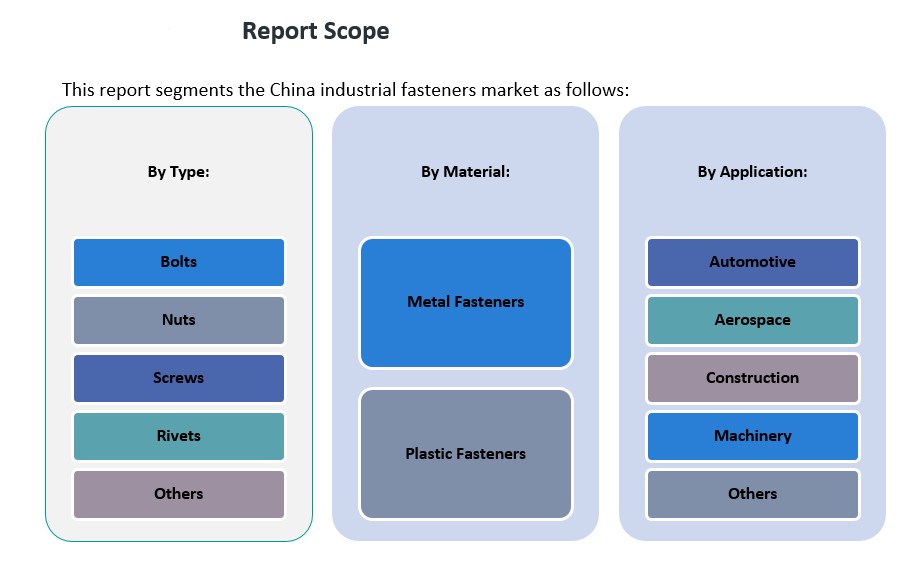

Market Segmentation Analysis:

The China industrial fasteners market is segmented by type, application, and material, each playing a vital role in shaping the market dynamics.

By type, bolts represent the largest share, owing to their widespread use across construction, automotive, and heavy machinery industries for secure and load-bearing applications. Nuts and screws also hold significant shares, driven by their essential role in assembly and manufacturing processes across diverse sectors. Rivets, favored for their reliability in aerospace and construction applications, are witnessing growing demand. The “others” segment, which includes washers, pins, and anchors, continues to provide steady support to niche markets requiring specialized fastening solutions.

By application, the automotive sector dominates the market due to China’s strong vehicle production capabilities and the rising trend toward electric vehicles. Construction follows closely, supported by rapid urban development and infrastructure projects that require robust fastening solutions for safety and durability. Machinery manufacturing also remains a critical segment, with rising automation and industrialization boosting demand for high-performance fasteners. The aerospace sector, though smaller in volume, is expanding steadily, fueled by China’s increasing investments in aviation and space exploration. Other applications, including electronics and energy, are creating additional growth avenues for specialized fasteners.

By material, metal fasteners command the majority share, as steel, titanium, and aluminum fasteners are preferred for their strength, durability, and versatility across industries. However, plastic fasteners are gaining popularity, particularly in automotive and electronics applications where lightweight, corrosion-resistant components are required. The shift toward specialized materials reflect the broader trend of material innovation in response to evolving industrial needs.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The China industrial fasteners market demonstrates varied regional dynamics, with Eastern China holding the dominant share due to its strong industrial base and advanced infrastructure development. In 2024, Eastern China accounted for approximately 45% of the total market share, driven by the concentration of major manufacturing hubs such as Shanghai, Jiangsu, and Zhejiang. These provinces serve as critical centers for automotive, machinery, and electronics production, which generate substantial demand for high-quality fasteners. The presence of export-driven manufacturing facilities and significant foreign direct investment also reinforces the region’s leadership position in the domestic market.

Northern China represents the second-largest regional market, contributing around 25% of the total market share. Provinces such as Beijing, Tianjin, and Hebei are witnessing increased investments in automotive, aerospace, and construction industries, stimulating the need for advanced fastening solutions. The government’s focus on promoting green building standards and expanding smart city initiatives across the Beijing-Tianjin-Hebei economic corridor is further driving demand for innovative fastener products tailored to sustainable infrastructure projects.

Central China accounts for roughly 18% of the industrial fasteners market, with regions like Hubei, Henan, and Hunan emerging as key growth centers. Central China’s strategic location and improved transportation networks have attracted several manufacturing and logistics companies, boosting industrial activity and, consequently, the need for durable and cost-efficient fasteners. Infrastructure expansion projects, industrial park developments, and the rise of new energy vehicle manufacturing plants are contributing to the market’s steady growth across this region.

Southern and Western China together make up the remaining 12% of the market share. Although relatively smaller compared to other regions, these areas are rapidly evolving, supported by infrastructure modernization, urbanization, and government initiatives to enhance regional economic balance. Provinces such as Guangdong in the south, with its strong electronics and construction industries, are important contributors. Meanwhile, western provinces like Sichuan and Chongqing are gaining prominence through investments in high-speed railways, renewable energy projects, and industrial base expansion. As these regions continue to develop their manufacturing and construction capabilities, the demand for specialized fasteners is expected to rise steadily, offering manufacturers new opportunities to expand their footprint across the broader Chinese market landscape.

Key Player Analysis:

- Nifco Inc.

- Shanghai Prime Machinery Co. Ltd.

- Meidoh Co. Ltd.

- Sundram Fasteners Limited

- Agrati Group

- HIL Ltd.

- Bhansali Fasteners

- Zhejiang Huantai Fastener Co., Ltd.

- Kyocera Corporation

- Nippon Industrial Fasteners Company (Nifco)

Competitive Analysis:

The China industrial fasteners market is highly competitive, characterized by the presence of numerous domestic and international players vying for market share. Leading companies such as Shanghai Prime Machinery Company, Gem-Year Industrial Co., Ltd., and Bulten AB have established strong positions through extensive product portfolios, technological innovation, and strategic partnerships. Local manufacturers focus heavily on competitive pricing and customization to cater to the diverse needs of automotive, construction, and manufacturing sectors. International players leverage advanced technologies and quality certifications to target high-end applications, particularly in aerospace and renewable energy industries. The market is witnessing increased consolidation activities, with companies investing in mergers, acquisitions, and expansions to strengthen their regional presence and technological capabilities. Continuous investment in R&D, product differentiation, and adherence to international quality standards remain critical strategies for gaining a competitive edge in this dynamic and evolving market landscape.

Recent Developments:

- In August 2024, at the International Fastener Show China, AFT/AFMC introduced a new manufacturing machine tool specifically designed for aerospace fasteners. This launch showcased advanced techniques and technology, drawing significant attention from industry professionals and highlighting the company’s commitment to innovation in high-performance fastener production.

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing.

Market Concentration & Characteristics:

The China industrial fasteners market exhibits moderate to high market concentration, with a mix of large established players and a broad base of small to medium-sized manufacturers. Major companies dominate the premium and export-driven segments by offering high-quality, certified fasteners for automotive, aerospace, and construction applications. Meanwhile, numerous local players cater to cost-sensitive markets, creating a highly competitive landscape in the mid and low-end product categories. The market is characterized by rapid technological advancements, growing demand for customized solutions, and increasing emphasis on sustainable manufacturing practices. Product innovation, supply chain integration, and adherence to international quality standards are becoming defining features of leading companies. Additionally, government support for industrial modernization and export incentives is encouraging manufacturers to invest in automation and smart manufacturing technologies. As customer expectations evolve, the market is gradually shifting toward greater specialization, quality assurance, and environmental compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of renewable energy projects will drive demand for specialized fasteners resistant to extreme environmental conditions.

- Rising electric vehicle production will boost the need for lightweight, high-strength fasteners tailored to battery and chassis applications.

- Advancements in smart manufacturing and automation will encourage the adoption of precision-engineered fastening solutions.

- Increased investment in aerospace and defense sectors will create opportunities for high-performance, certified fasteners.

- Growing emphasis on green building standards will stimulate innovation in eco-friendly fastening materials and coatings.

- Regional development initiatives in Central and Western China will open new growth avenues for fastener manufacturers.

- Strategic collaborations between OEMs and fastener suppliers will become more prominent to meet evolving industrial needs.

- Rising export opportunities to Southeast Asia and Africa will strengthen China’s position in the global fasteners market.

- Development of corrosion-resistant and vibration-proof fasteners will gain momentum across infrastructure and machinery sectors.

- Enhanced regulatory standards will push manufacturers to prioritize quality certifications and advanced testing technologies.