| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Industrial Hemp Market Size 2023 |

USD 970.12 Million |

| China Industrial Hemp Market, CAGR |

23.9% |

| China Industrial Hemp Market Size 2032 |

USD 6,703.50 Million |

Market Overview

China Industrial Hemp Market size was valued at USD 970.12 million in 2023 and is anticipated to reach USD 6,703.50 million by 2032, at a CAGR of 23.9% during the forecast period (2023-2032).

The China Industrial Hemp market is driven by rising demand for sustainable and eco-friendly products across various industries. Growing awareness of hemp’s versatility in applications such as textiles, construction, automotive, food, and pharmaceuticals is a key factor propelling market growth. Additionally, the increasing adoption of hemp-based materials for their environmental benefits, including reduced carbon footprint and biodegradability, is contributing to the market’s expansion. Regulatory changes supporting hemp cultivation and production, along with technological advancements in processing and product innovation, further enhance market dynamics. The trend toward natural and organic products, coupled with the increasing use of hemp in health and wellness products, is also driving demand. As China continues to embrace green initiatives and sustainability, the industrial hemp market is poised for substantial growth, with a strong outlook through 2032.

The geographical landscape of China’s industrial hemp market is diverse, with key regions such as Beijing, Shanghai, Guangzhou, and Shenzhen driving growth. Beijing leads with strong governmental support and a focus on sustainability, while Shanghai benefits from its economic infrastructure and technological advancements. Guangzhou serves as a major hub for hemp cultivation, particularly for CBD products, and Shenzhen thrives due to its innovation-driven economy. Key players in the market include Liaoning Qiaopai Biotech Co., Ltd., Hemp Inc, HMI Group, and Medical Marijuana Inc., among others. These companies contribute to the growth of the sector through their extensive product portfolios, innovative technologies, and strategic business approaches. They are involved in various aspects of the industrial hemp value chain, from cultivation to processing and product development, supporting China’s position as a leading player in the global hemp market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The China Industrial Hemp market was valued at USD 970.12 million in 2023 and is projected to reach USD 6,703.50 million by 2032, growing at a CAGR of 23.9% during the forecast period.

- The global industrial hemp market was valued at USD 7,987.24 million in 2023 and is expected to reach USD 46,774.80 million by 2032, growing at a CAGR of 21.7% from 2023 to 2032.

- Increasing demand for eco-friendly and sustainable products is a key market driver, especially in textiles, construction, and automotive industries.

- Technological advancements in hemp processing, including extraction methods, are expanding product applications and improving product quality.

- The rising health and wellness trend in China is boosting demand for hemp-based CBD products, health supplements, and personal care items.

- Market restraints include regulatory uncertainties and supply chain challenges, such as limited infrastructure and raw material consistency.

- Major players like Liaoning Qiaopai Biotech, Hemp Inc, and HMI Group are leading the market with their innovative product offerings and strategic business models.

- Regions like Beijing, Shanghai, and Guangzhou are central to China’s industrial hemp market, contributing significantly to production and commercialization.

Report Scope

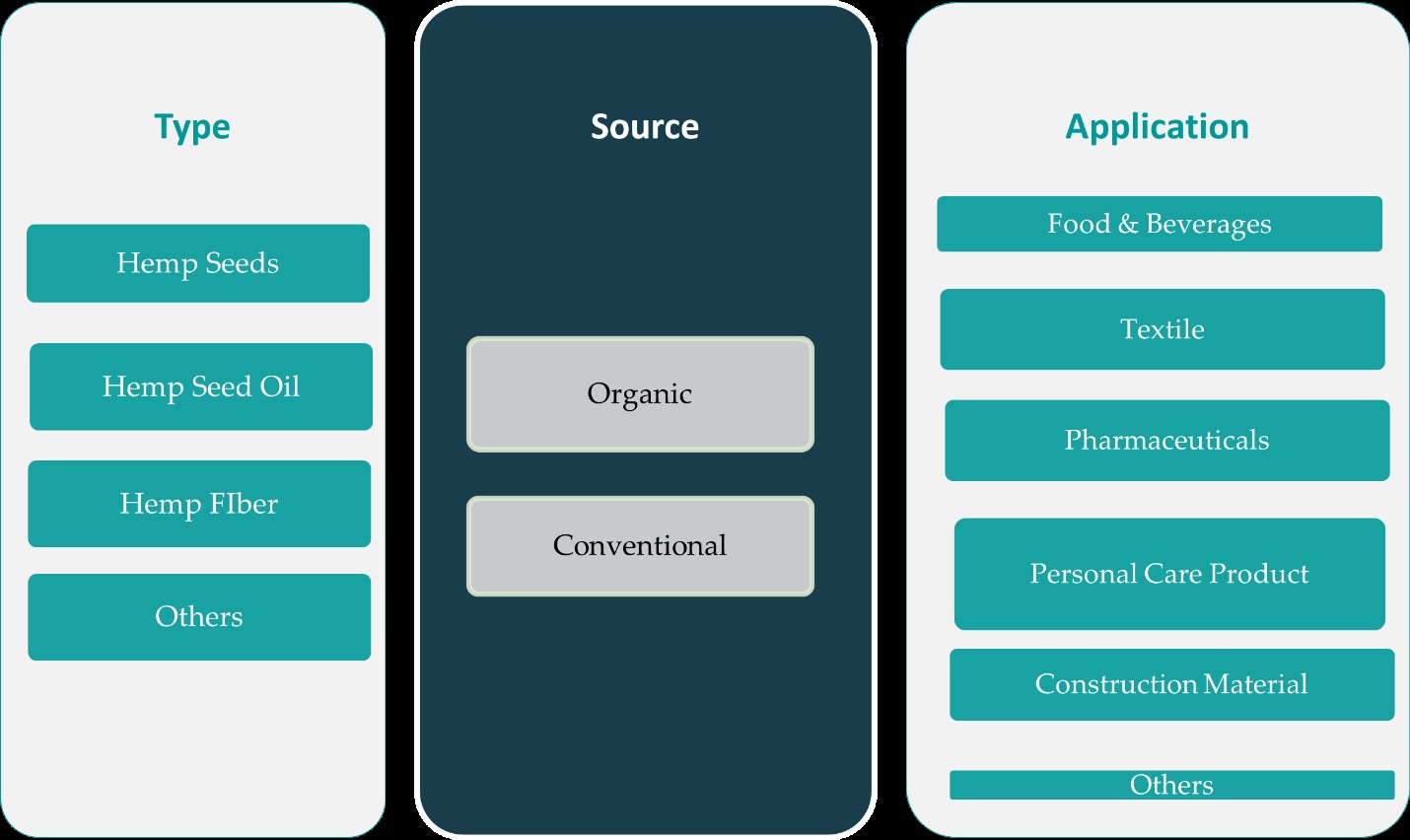

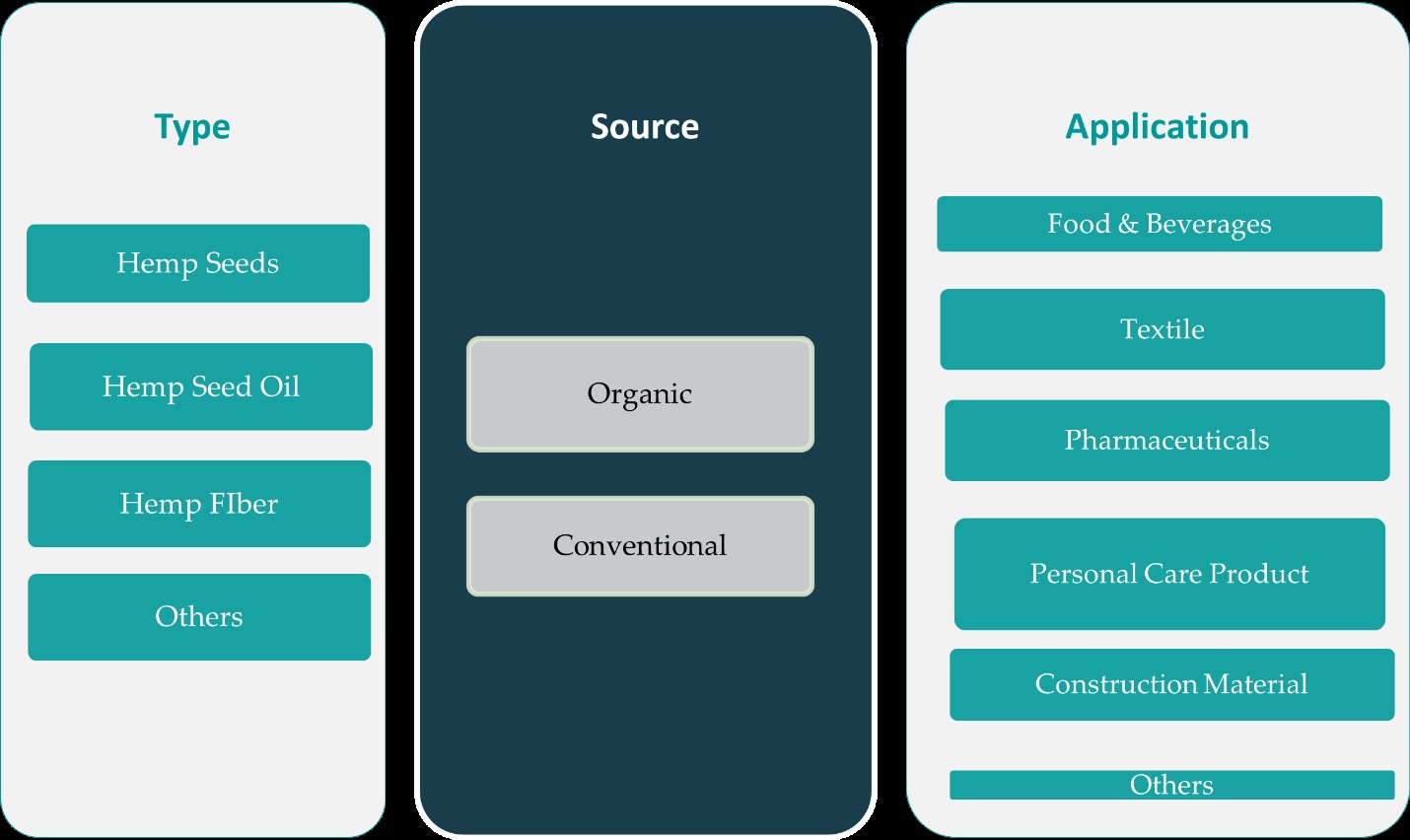

This report segments the China Industrial Hemp Market as follows:

Market Drivers

Rising Demand for Sustainable Products

One of the primary drivers of the China Industrial Hemp market is the increasing demand for sustainable and eco-friendly products. Industrial hemp is recognized for its minimal environmental impact, as it requires fewer pesticides and fertilizers compared to traditional crops, and it grows quickly with minimal water consumption. This makes it an attractive alternative to other materials in industries such as textiles, automotive, and construction, which are increasingly seeking sustainable options. The shift toward eco-friendly manufacturing practices and the need for biodegradable materials are significantly contributing to the rise in hemp-based products, further supporting market growth in China.

Supportive Government Regulations

The Chinese government has implemented favorable regulations that promote the cultivation and commercialization of industrial hemp. For instance, a report by the USDA Foreign Agricultural Service emphasized that China has eased restrictions on hemp production as part of its broader strategy to develop a green economy. The government is providing incentives for hemp farmers and businesses involved in hemp-based industries, including funding for research and development, which helps accelerate the commercialization of hemp-derived products. The ongoing support from regulatory bodies is expected to continue playing a crucial role in fostering the growth of the industrial hemp market in China, making it an attractive investment destination.

Technological Advancements and Product Innovation

Technological advancements in hemp cultivation, processing, and product development are another key driver of the market. In recent years, innovations in extraction technologies and the development of advanced processing techniques have significantly improved the efficiency and quality of hemp-derived products. These advancements have expanded the range of applications for hemp, from traditional uses in textiles to novel applications in the food, pharmaceutical, and cosmetic industries. As businesses in China continue to invest in technology to enhance production capabilities, the market is seeing a wider array of hemp-based products that cater to evolving consumer preferences, which in turn drives demand and market growth.

Growing Health and Wellness Trends

The rising awareness of the health benefits associated with hemp products is a significant market driver, particularly in the food, pharmaceutical, and wellness sectors. For instance, a report by Medical News Today emphasized that hemp is rich in nutrients such as omega-3 fatty acids, proteins, and antioxidants, which are driving its incorporation into health supplements, functional foods, and skincare products. In addition, hemp-derived CBD (cannabidiol) products are gaining popularity due to their potential therapeutic benefits, such as pain relief, anxiety reduction, and anti-inflammatory effects. As Chinese consumers become more health-conscious and demand natural wellness solutions, the adoption of hemp-based products is accelerating, providing further momentum for the market’s expansion.

Market Trends

Expansion of Industrial Hemp Applications

The industrial hemp market in China is experiencing a significant diversification of applications, extending beyond traditional uses in textiles to include sectors such as automotive, construction, and bioplastics. For instance, a report by the National Hemp Industry Technology System (NHITS) highlighted that hemp-based composites are gaining traction in the automotive industry due to their lightweight properties, which enhance fuel efficiency and reduce carbon emissions. Similarly, the construction sector is exploring hempcrete a sustainable building material made from hemp to improve energy efficiency in buildings. This broadening of applications is a key trend contributing to the market’s growth.

Technological Innovations in Processing

Advancements in processing technologies are playing a crucial role in enhancing the quality and variety of hemp products in China. Innovations in extraction methods, particularly for cannabidiol (CBD), have led to higher purity levels and more efficient production processes. These improvements are expanding the use of CBD in personal care products, health supplements, and food and beverage items. The continuous development of processing technologies is expected to drive further growth and diversification of hemp-based products in the market.

Regional Disparities and Specialized Production

China’s industrial hemp production exhibits notable regional disparities, with provinces specializing in different aspects of hemp utilization. For instance, Yunnan province focuses on extracting metabolites for medical and cosmetic uses, while Shanxi emphasizes harvesting seeds and fiber for food and textile applications. This specialization is a result of regional policies, climatic conditions, and market demand, leading to a diversified and regionally tailored hemp industry across the country.

Integration with Sustainable Development Goals

The Chinese government’s commitment to sustainable development is influencing the growth of the industrial hemp market. Hemp cultivation aligns with environmental objectives due to its low water usage, minimal need for pesticides, and ability to sequester carbon. These environmental benefits are attracting investment and policy support, further bolstering the market. As global interest in sustainable and eco-friendly materials intensifies, China’s hemp industry is well-positioned to meet this demand, contributing to both economic growth and environmental sustainability.

Market Challenges Analysis

Regulatory and Legal Constraints

Despite the favorable regulatory shifts in China, challenges persist in the legal and regulatory landscape of the industrial hemp market. For instance, a report by the USDA Foreign Agricultural Service highlighted that variations in local government policies and restrictions on hemp-based product commercialization create uncertainty for businesses. The regulatory framework is still evolving, and the lack of clear, uniform guidelines across regions can hinder investment and slow down industry growth. As the market matures, stakeholders may face challenges in navigating these complex and occasionally ambiguous regulatory requirements, which could delay the widespread adoption of hemp-based products.

Supply Chain and Production Barriers

The industrial hemp market in China faces challenges related to supply chain inefficiencies and production barriers. While hemp is a hardy crop, the lack of sufficient infrastructure for large-scale processing and distribution remains a critical issue. The need for specialized equipment and facilities for extracting and refining hemp-based products can limit production capacity and increase operational costs. Additionally, fluctuations in raw material availability and quality may affect consistency in production. These supply chain challenges, combined with the relatively new nature of the hemp industry in China, pose significant hurdles in scaling up production to meet the increasing demand for hemp-derived products.

Market Opportunities

The China Industrial Hemp market presents numerous opportunities driven by growing demand for sustainable materials across various industries. As the global focus shifts toward environmental sustainability, industrial hemp’s eco-friendly properties make it an attractive alternative in sectors like textiles, construction, automotive, and packaging. The growing trend toward reducing carbon footprints and utilizing biodegradable materials is expected to fuel the demand for hemp-based products in China. Additionally, the increasing adoption of hemp in emerging sectors, such as bioplastics and bio-composites, offers significant market potential. With China’s commitment to green initiatives and sustainable development, hemp presents a key opportunity for businesses seeking to align with the country’s long-term environmental goals.

The rapid growth of the health and wellness sector in China also opens up significant opportunities for the industrial hemp market. Hemp-based products such as CBD oils, health supplements, and cosmetics are gaining popularity among consumers who are increasingly prioritizing natural, plant-based solutions. As Chinese consumers become more health-conscious, there is growing demand for hemp-derived products with therapeutic properties, including pain relief and stress reduction. Moreover, the government’s ongoing support for hemp cultivation and research, coupled with advancements in extraction and processing technologies, further enhances market opportunities. These factors, combined with a growing acceptance of hemp as a versatile and sustainable material, create an environment ripe for investment and expansion in China’s industrial hemp market.

Market Segmentation Analysis:

By Type:

The China Industrial Hemp market is segmented based on product types, including hemp seed, hemp seed oil, hemp fiber, and other hemp derivatives. Hemp seed dominates the market due to its rich nutritional value, containing essential fatty acids, proteins, and antioxidants. Hemp seed oil, known for its health benefits, is gaining significant traction in the food, cosmetic, and pharmaceutical sectors. This oil is rich in omega-3 fatty acids and is widely used in wellness products, including supplements, skincare, and personal care items. Hemp fiber is another prominent segment, largely used in textiles, automotive, and construction materials due to its strength, durability, and eco-friendly nature. The “others” category includes products such as hemp-based bioplastics, CBD products, and other emerging applications. The demand for these segments is driven by the growing trend for sustainable and eco-conscious solutions across various industries in China.

By Source:

The market is also segmented based on the source of hemp, with two primary categories: organic and conventional. Organic hemp is seeing a surge in demand, primarily driven by consumer preferences for natural and chemical-free products. Organic hemp cultivation, free from synthetic pesticides and fertilizers, aligns with the growing trend toward health-conscious and eco-friendly products. This segment is gaining momentum in sectors like food, cosmetics, and wellness, where purity and sustainability are critical selling points. On the other hand, conventional hemp, which includes hemp grown with the use of pesticides and fertilizers, remains a cost-effective option for large-scale industrial applications such as textiles and construction. The balance between organic and conventional hemp will depend on factors like consumer demand for organic products, government regulations, and production costs. The increasing shift toward organic offerings is expected to fuel growth in this segment, especially in health and wellness markets.

Segments:

Based on Type:

- Hemp Seed

- Hemp Seed Oil

- Hemp Fiber

- Others

Based on Source:

Based on Application:

- Food & Beverages

- Textile

- Pharmaceuticals

- Construction Material

- Others

Based on the Geography:

- Beijing

- Shanghai

- Guangzhou

- Shenzhen

Regional Analysis

Beijing

Beijing, with its strategic location and strong governmental support for sustainable industries, holds a leading market share of approximately 25%. The capital’s focus on environmental sustainability, coupled with its advanced infrastructure and research capabilities, makes it a hub for industrial hemp cultivation and processing. The region benefits from its proximity to policy-making bodies and its emphasis on green initiatives, which continue to drive the growth of the industrial hemp market.

Shanghai

Shanghai, a global financial and business center, follows closely with a market share of 22%. The city’s robust manufacturing base, coupled with its leadership in innovation and technology, positions it as a critical player in the industrial hemp sector. Shanghai’s strong economic infrastructure supports the scaling of hemp production and the commercialization of hemp-based products, particularly in textiles, automotive, and bioplastics. Additionally, Shanghai’s strategic position as a trade and logistics hub further enhances its role in the growth of the industrial hemp market.

Guangzhou

Guangzhou, located in southern China, holds a market share of around 20%, benefiting from its proximity to major agricultural and processing areas. The region has emerged as a key center for hemp cultivation, particularly for CBD production and its related derivatives. Guangzhou’s focus on technological advancements and the rapid expansion of the health and wellness sector contribute to the region’s growing market share. Its well-established agricultural infrastructure supports the large-scale cultivation of industrial hemp, positioning it as a key supplier for both domestic and international markets.

Shenzhen

Shenzhen, with its advanced technology and innovation-driven economy, accounts for a market share of approximately 18%. Known for its leading position in electronics and biotechnology, Shenzhen has leveraged its technological expertise to develop advanced processing methods for hemp-derived products. The region’s emphasis on sustainable materials, coupled with the rise in consumer demand for natural products, has driven the growth of the industrial hemp market. Shenzhen’s strategic location in Guangdong province, an area known for its manufacturing strength, further solidifies its importance in the overall market. These factors make Shenzhen a key player in the industrial hemp industry.

Key Player Analysis

- Liaoning Qiaopai Biotech Co., Ltd.

- Hemp Inc

- HMI Group

- Medical Marijuana Inc

- Fresh Hemp Foods Ltd.

- Harbin Jinyang Linen Products Factory

- Guangxi Nanning China-europe Trading Co., Ltd.

- Liu’an Huanglong Hemp Spinning Crafts Co., Ltd.

Competitive Analysis

The competitive landscape of the China Industrial Hemp market is shaped by key players such as Liaoning Qiaopai Biotech Co., Ltd., Hemp Inc, HMI Group, Medical Marijuana Inc, Fresh Hemp Foods Ltd., Harbin Jinyang Linen Products Factory, Guangxi Nanning China-europe Trading Co., Ltd., and Liu’an Huanglong Hemp Spinning Crafts Co., Ltd. These companies are crucial in driving innovation, product development, and market expansion across various segments. Leading players are investing heavily in research and development to improve the quality of hemp-derived products, particularly in sectors such as food, wellness, textiles, and bioplastics. The market is highly competitive, with companies striving to differentiate themselves by offering a diverse range of products, including hemp seed oil, hemp fiber, and CBD-infused products. Innovation in hemp processing technology, such as more efficient extraction methods and product refinement, plays a critical role in maintaining a competitive edge. Additionally, companies are increasingly focusing on sustainability, with eco-friendly and organic hemp products gaining popularity among consumers. The rise in demand for natural and chemical-free products has led to a surge in the organic hemp segment, further intensifying competition. Furthermore, the development of new applications for hemp in emerging industries, such as construction materials and automotive components, is expanding market opportunities. As competition grows, players are also strengthening their global reach by forming strategic partnerships and expanding their supply chains, ensuring they meet both domestic and international demand. The market is expected to continue evolving as companies adapt to changing consumer preferences and regulatory landscapes.

Recent Developments

- In October 2024, Canopy Growth Corporation acquired Wana, which includes Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. With this acquisition, Canopy USA holds 100% of Wana’s equity interests. The acquisition will help the company to build a leading brand-focused cannabis company in the US.

- In October 2024, AURORA CANNABIS INC. launched an expanded range of premium medical cannabis oils in Australia in partnership with MedReleaf Australia. Designed to meet diverse patient needs, the new offerings include Aurora THC 25 (Sativa), Aurora THC 25 (Indica), Aurora 12.5:12.5 oil, Aurora 50:50 oil, and Aurora 10:100 oil, all available in 30 ml bottles for physician prescription.

- In June 2024, Curaleaf Holdings, Inc. launched new lines of hemp-derived THC products under its Select and Zero Proof brands. These products will be available across 25 states and the District of Columbia through direct-to-consumer delivery and Curaleaf’s national distribution network.

- In May 2024, The Cronos Group partnered with GROW Pharma, a leading distributor of medicinal cannabis in the UK, to expand its PEACE NATURALS brand into the UK. Through this collaboration, Cronos will supply high-quality, premium cannabis products, ensuring patients in the UK have access to the globally recognized brand PEACE NATURALS.

- In February 2024, RISE Dispensaries, the cannabis retail chain owned by Green Thumb Industries Inc., expanded its presence with the opening of its 15th retail location in Florida and 92nd nationwide. The new store will feature special promotions and complimentary merchandise for its first customers. It opens the company to a much larger reach of its products like chocolate, mints, gummies, and tarts made by its Incredibles brand.

- In January 2023, HempMeds Brasil launched two new full-spectrum products. These new products were created to suit the new requirements of Brazilian doctors who intend to suggest it to their patients.

Market Concentration & Characteristics

The China Industrial Hemp market exhibits moderate concentration, with a few large players dominating key segments such as hemp seed production, hemp oil extraction, and hemp fiber processing. However, the market remains fragmented, with numerous smaller companies focusing on niche areas such as CBD products, hemp-based textiles, and bioplastics. The increasing demand for sustainable and eco-friendly products is driving market growth, attracting new entrants and fostering innovation. Companies are leveraging technological advancements in hemp processing to differentiate themselves in a competitive landscape. Additionally, the market is characterized by a growing trend toward organic and high-quality hemp products, with consumers becoming more health-conscious and environmentally aware. The regulatory environment also plays a critical role in shaping market dynamics, as companies must navigate evolving rules and guidelines related to hemp cultivation, production, and product commercialization. As the market matures, consolidation may occur, leading to increased concentration in key areas.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- China’s industrial hemp market is expected to grow steadily due to increasing demand for hemp-based products across various industries, including textiles, construction, and food.

- The country’s favorable regulatory environment is likely to encourage further investment in the industrial hemp sector, with relaxed policies aiding production and research.

- The expansion of the global hemp market will provide China with opportunities for increased exports of hemp-based products and raw materials.

- Advancements in hemp cultivation techniques are expected to improve yield efficiency, positioning China as a leading producer in the global market.

- China’s strong manufacturing base will enable the production of a wide range of hemp-based products, boosting both domestic and international demand.

- Increased adoption of hemp-derived CBD products is anticipated, with growing consumer interest in health and wellness trends.

- China’s strategic investment in research and development of hemp-based technologies will enhance product quality and introduce innovative solutions in various sectors.

- The rise of sustainable and eco-friendly materials will drive demand for hemp in construction, automotive, and packaging industries.

- The government’s support for green agriculture and environmental sustainability is expected to further propel the hemp industry’s growth.

- As global awareness around the benefits of industrial hemp increases, China is likely to strengthen its position as a major player in the hemp supply chain.