| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Loitering Munition Market Size 2023 |

USD 239.02 Million |

| China Loitering Munition Market, CAGR |

12.8% |

| China Loitering Munition Market Size 2032 |

USD 709.82 Million |

Market Overview:

China Loitering Munition Market size was valued at USD 239.02 million in 2023 and is anticipated to reach USD 709.82 million by 2032, at a CAGR of 12.8% during the forecast period (2023-2032).

The growth of China’s loitering munition market is primarily driven by several factors. Technological advancements in autonomous systems, artificial intelligence, and precision targeting capabilities are enhancing the performance and versatility of loitering munitions. These advancements allow for greater accuracy, real-time decision-making, and improved operational effectiveness on the battlefield. Additionally, loitering munitions offer a cost-effective alternative to traditional guided missiles, providing significant savings without compromising the quality of defense capabilities. China’s military strategy also emphasizes asymmetric warfare, where loitering munitions play a crucial role in providing precise strikes while minimizing collateral damage, particularly in regions with complex geopolitical tensions such as Taiwan and the South China Sea. Furthermore, China’s position as a key player in the global defense industry enables it to export these systems, tapping into the growing international demand for loitering munitions, strengthening both its domestic military capabilities and its global defense market presence.

China’s loitering munition market is heavily influenced by its strategic objectives in the Indo-Pacific region, particularly in the context of rising tensions with Taiwan and other neighboring countries. The country has made significant investments in loitering munitions to enhance its military capabilities, particularly for rapid and precise strikes in contested environments. The development of systems like the Feilong-60A (Flying Dragon-60) showcases China’s ability to innovate in this sector. The Chinese market is also bolstered by a strong domestic defense industry, with state-owned enterprises and defense contractors leading the research, development, and production of loitering munitions. These companies are playing an essential role in meeting the needs of China’s military branches Army, Navy, and Air Force while also securing export opportunities in the global defense market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China loitering munition market was valued at USD 239.02 million in 2023 and is expected to reach USD 709.82 million by 2032, growing at a CAGR of 12.8% during the forecast period.

- The global loitering munition market is valued at USD 1,967.89 million in 2023 and is expected to grow significantly, reaching USD 4,952.89 million at a CAGR of 10.8% by 2032, driven by increasing demand for precision strike systems.

- Technological advancements in autonomous systems, AI, and precision targeting are driving the market by enhancing loitering munitions’ performance and operational flexibility.

- Cost-effectiveness is a key driver, as loitering munitions offer a more affordable alternative to traditional missile systems, allowing for precise strikes at a lower cost.

- China’s strategic military objectives in the Indo-Pacific region, particularly regarding Taiwan and the South China Sea, are intensifying the demand for loitering munitions for asymmetric warfare.

- China’s position as a global defense exporter presents significant growth opportunities, with increasing demand for cost-effective loitering munitions from international markets.

- Regulatory and export control challenges restrict market expansion, as international arms embargoes and regulations limit the export of loitering munitions to certain regions.

- Despite technological advancements, integrating loitering munitions into China’s military infrastructure presents challenges, requiring specialized training and continuous upgrades to maintain effectiveness.

Market Drivers:

Technological Advancements

The rapid advancements in technology are a major driver of growth in the China loitering munition market. Loitering munitions have become increasingly sophisticated, thanks to breakthroughs in autonomous systems, artificial intelligence (AI), and precision guidance technologies. For example, Aerospace CH UAV Co Ltd, a subsidiary of China Aerospace Science and Technology Corporation (CASC), is developing a new long-range loitering munition based on its AR-series of air-to-ground missiles, which already includes the AR-3a micro-turbojet-powered anti-radar loitering missile with a 100 km range and 30 minutes of flight endurance. These innovations allow loitering munitions to operate with greater accuracy, autonomy, and efficiency, enabling them to engage targets with minimal human intervention. AI-powered systems improve real-time decision-making capabilities, optimizing target acquisition and strike execution. Additionally, improvements in miniaturization and sensor technology are making loitering munitions more versatile and effective across a range of military applications, further driving their adoption in modern defense strategies.

Cost-Effectiveness

Loitering munitions provide a cost-effective alternative to traditional guided missiles and other high-cost precision strike systems. In light of the increasing pressure on defense budgets worldwide, loitering munitions present a viable solution for countries like China, which are focused on modernizing their military arsenal while maintaining cost efficiency. These systems offer substantial savings by reducing the need for expensive, conventional missile systems and providing flexible strike capabilities at a fraction of the cost. As defense budgets remain constrained, the demand for cost-effective, yet highly efficient, weapon systems is expected to continue driving the growth of the loitering munition market.

Strategic Military Objectives

China’s growing emphasis on modernizing its military forces, especially in the context of regional tensions, is another key driver of the loitering munition market. With the rising threats in the Indo-Pacific region, particularly related to Taiwan and the South China Sea, China seeks to bolster its asymmetric warfare capabilities. For instance, the People’s Liberation Army (PLA) has showcased systems such as the FH901 and ASN-301, which are designed for rapid deployment and use in contested environments, including the Indo-Pacific region and scenarios involving Taiwan. Loitering munitions provide China with the ability to deliver precision strikes in contested environments, enhancing its strategic advantages in military operations. These systems offer significant operational flexibility, enabling the Chinese military to carry out targeted strikes against high-value assets, without incurring the high risks associated with traditional missile systems. The integration of loitering munitions into China’s broader defense strategy is essential to its plans for modernizing its military and asserting its geopolitical influence.

Global Export Potential

China’s loitering munition market is also driven by its growing role as a major exporter of defense technologies. The country’s defense industry has increasingly shifted its focus towards producing advanced military systems, including loitering munitions, for export to various global markets. As other nations look for cost-effective and cutting-edge defense solutions, the demand for loitering munitions has been on the rise. China, with its well-established defense manufacturing base, is positioned to capitalize on this trend. Its loitering munition systems, which offer high performance at competitive prices, are particularly attractive to countries looking to modernize their defense capabilities without overspending. The combination of technological advancements, cost-effectiveness, and export potential has firmly positioned China as a leading player in the global loitering munition market.

Market Trends:

Integration of AI and Autonomous Systems

A prominent trend in the China loitering munition market is the increasing integration of artificial intelligence (AI) and autonomous systems into loitering munitions. This trend is driven by the growing need for precision and real-time decision-making in modern warfare. For example, Norinco’s Intelligent Precision Strike System, demonstrated at the 2024 Zhuhai Air Show, can autonomously dispatch drones, track targets, devise strike plans, and distribute firing information, with almost all processes automated except for the final command to fire. By incorporating AI, loitering munitions can operate more efficiently, improving their ability to identify, track, and engage targets autonomously. Additionally, AI-powered systems can adapt to dynamic battlefield conditions, ensuring that the munitions can operate in complex environments. This integration enhances the operational effectiveness of loitering munitions, making them a key asset in modern military arsenals.

Shift Toward Multi-Role and Modular Systems

The trend toward multi-role and modular loitering munitions is becoming increasingly evident in the Chinese defense sector. Manufacturers are focusing on developing systems that can perform a variety of tasks, such as surveillance, reconnaissance, and direct strikes, all with a single platform. This shift allows for greater operational flexibility, as a single system can be adapted to meet different mission requirements. Modular designs also allow for easier upgrades and maintenance, improving the lifespan and versatility of loitering munitions. The Chinese military, with its evolving defense strategies, is keen on adopting these adaptable systems to strengthen its capabilities in asymmetric warfare.

Increased Focus on Countermeasures and Electronic Warfare

As loitering munitions become more widely adopted, there is a growing trend in China toward incorporating advanced countermeasures and electronic warfare capabilities into these systems. These enhancements are aimed at countering the increasing threats posed by adversary defense systems. Electronic warfare capabilities, such as jamming and spoofing, are being integrated into loitering munitions to ensure that they can operate effectively even in contested airspace. This trend reflects China’s broader efforts to develop sophisticated defense technologies that can neutralize enemy countermeasures and secure superiority in modern combat scenarios.

Growth in Export Markets

China’s loitering munition market is experiencing a noticeable increase in demand from international markets. As more countries seek cost-effective and high-performance weapon systems, China’s loitering munitions are being increasingly recognized for their technological capabilities and affordability. This trend is part of China’s broader strategy to expand its presence in the global defense market. For instance, at the Africa Aerospace and Defence 2024 exhibition, Centaur Defense Systems LLC showcased the DFX-50 loitering munition, which has a maximum takeoff weight of 16.5 kg and can carry a payload of up to 5 kg, demonstrating China’s export-oriented approach to new product development. Several regions, particularly in the Middle East and Asia-Pacific, have shown a growing interest in acquiring loitering munitions from China due to their relatively lower cost compared to Western alternatives. This export-driven growth is contributing to the expansion of China’s market share in the global loitering munition segment.

Market Challenges Analysis:

Regulatory and Export Control Challenges

One of the key restraints impacting the China loitering munition market is the stringent international regulations and export controls on defense technologies. As loitering munitions fall under advanced weaponry, they are subject to export restrictions in many regions. Several countries, particularly in the Western hemisphere, have stringent arms embargoes and controls over the sale of military technologies like loitering munitions. These regulations limit China’s ability to fully capitalize on the growing global demand for such systems, restricting market access to specific regions. Furthermore, geopolitical tensions and the complex nature of international relations can delay or hinder export agreements and sales of these advanced weapon systems.

Technological and Integration Challenges

Despite significant advancements in loitering munition technologies, there are still challenges related to integration and technological maturity. For instance, the development of systems like the ASN-301 loitering munition has highlighted the need for specialized vehicles and rapid deployment capabilities, as seen in the adaptation of the FAW MV3 6×6 truck to carry and launch six ASN-301 units per vehicle. For China, the ability to integrate loitering munitions seamlessly into existing military infrastructure and operational strategies remains a challenge. As these systems become more complex, they require specialized training, maintenance, and support systems to ensure effectiveness in diverse combat scenarios. Additionally, continuous technological upgrades are necessary to maintain a competitive edge. While China has made notable progress in autonomous systems and AI integration, ensuring the reliability and robustness of these technologies in real-world combat remains an ongoing challenge.

Public and Global Perception Issues

The use of loitering munitions, which often involves precision strikes and autonomous operations, can raise ethical and moral concerns regarding their impact on civilian areas and the risks of collateral damage. Globally, there is growing scrutiny around the use of unmanned systems, particularly in regions where military operations intersect with civilian infrastructure. This perception can lead to resistance from other nations, both politically and diplomatically, in engaging with Chinese loitering munition systems. Additionally, the potential for misuse or overuse of such advanced systems in conflict zones may fuel concerns about the escalation of warfare.

Cost of Development and Production

Although loitering munitions offer a cost-effective alternative to traditional missiles, the development and production of advanced loitering munition systems remain capital intensive. For China, maintaining an efficient production pipeline for these advanced technologies while keeping costs competitive can be challenging. Investment in research and development, as well as ensuring the quality and operational efficiency of loitering munitions, requires significant financial resources. Balancing the need for high-performance systems with cost constraints is a continuous challenge in this market.

Market Opportunities:

The China loitering munition market presents significant opportunities driven by the country’s strategic military objectives and growing defense budget. As China continues to modernize its military, loitering munitions have become a critical component in its defense strategy, offering capabilities such as precision strikes and enhanced operational flexibility. The increasing emphasis on asymmetric warfare, particularly in the Indo-Pacific region, provides a substantial opportunity for the development and deployment of loitering munitions. With tensions rising in areas like the South China Sea and Taiwan, China’s military is seeking low-cost, high-impact weapons that can deliver precision targeting with minimal collateral damage, making loitering munitions an attractive solution. The demand for these systems will continue to grow as they prove invaluable in various combat scenarios, offering a significant opportunity for expansion within the domestic defense sector.

Furthermore, the growing global interest in loitering munitions presents an additional market opportunity for China. As defense spending increases worldwide, particularly in emerging economies and regions seeking modern military technologies, China is well-positioned to capitalize on the demand for cost-effective, high-performance loitering munition systems. China’s ability to produce advanced systems at competitive prices provides it with a unique advantage in the global defense market, particularly in countries looking for affordable alternatives to expensive Western defense systems. By strengthening its position as a leading exporter of loitering munitions, China can further expand its market reach and establish itself as a dominant player in the global defense technology market.

Market Segmentation Analysis:

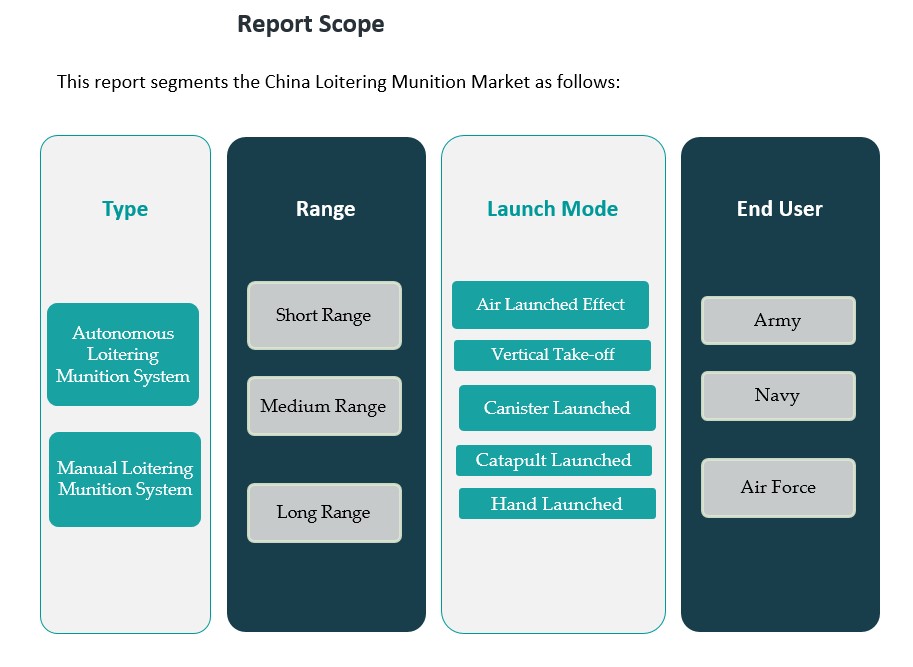

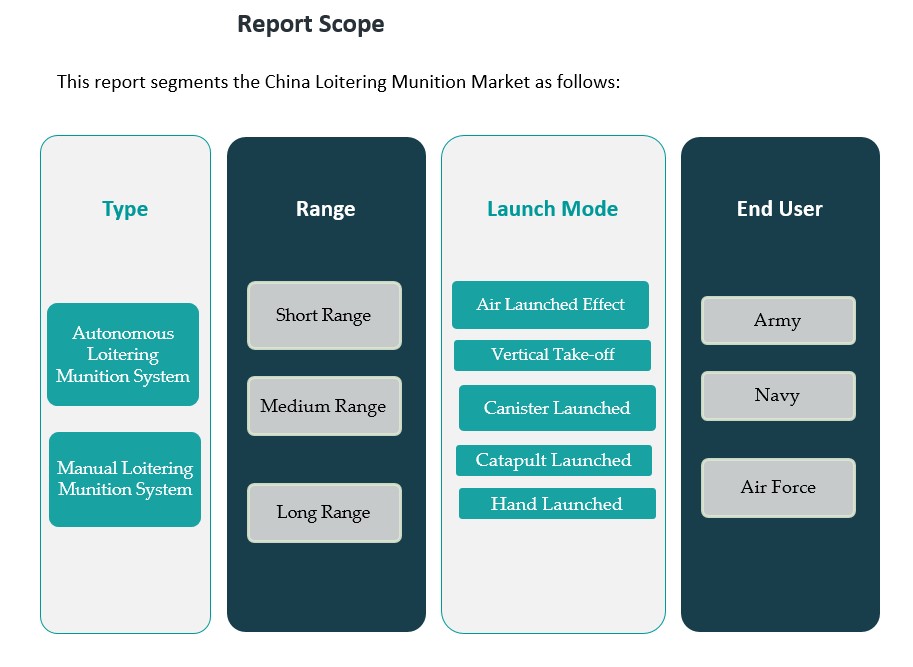

The China loitering munition market can be segmented based on type, range, launch mode, and end user.

By Type, the market is divided into autonomous and manual loitering munition systems. Autonomous loitering munitions are gaining traction due to advancements in artificial intelligence and autonomous navigation, enabling these systems to operate independently in dynamic combat environments. On the other hand, manual loitering munition systems, though less advanced, are still relevant in scenarios where human control is preferred, offering a more flexible approach in tactical operations.

By Range, loitering munitions are categorized into short, medium, and long-range systems. Short-range systems are typically employed for close-quarters strikes, ideal for localized engagements. Medium-range systems offer a balance between operational reach and payload capacity, making them versatile for a variety of missions. Long-range loitering munitions, designed for extended operations, are becoming increasingly important for strategic strikes in contested regions.

By Launch Mode, the market includes air-launched, vertical take-off, canister-launched, catapult-launched, and hand-launched systems. Air-launched loitering munitions are deployed from aircraft, allowing for rapid strikes from a distance. Vertical take-off systems, suitable for confined spaces, are gaining popularity for their flexibility in deployment. Canister, catapult, and hand-launched systems offer versatility in different operational contexts, allowing troops to deploy loitering munitions from various platforms.

By End User, the market serves the land, air, and naval forces. The land-based systems are commonly used for tactical ground operations, air systems provide support for aerial strikes, and naval forces are adopting loitering munitions for maritime defense and surveillance. Each segment plays a pivotal role in modernizing China’s military capabilities, addressing specific operational needs across different military branches.

Segmentation:

By Type:

- Autonomous Loitering Munition System

- Manual Loitering Munition System

By Range:

- Short Range

- Medium Range

- Long Range

By Launch Mode:

- Air Launched Effect

- Vertical Take-off

- Canister Launched

- Catapult Launched

- Hand Launched

By End User:

Regional Analysis:

The China loitering munition market is shaped by the country’s strategic military objectives, technological advancements, and regional security dynamics. While the domestic market is the primary driver, regional developments also play a significant role in shaping the market’s trajectory. The integration of loitering munition systems into China’s military arsenal is essential for strengthening its position in the Indo-Pacific region, particularly in the context of tensions in areas like Taiwan and the South China Sea.

East China is the largest region for loitering munition deployment, accounting for a significant market share due to its proximity to key military bases and strategic locations. This region benefits from the concentration of advanced defense industries and research facilities, such as those in Shanghai and Zhejiang, where leading defense contractors and manufacturers are located. East China’s dominance is further supported by the central government’s focus on advancing its military modernization plans, with investments in autonomous systems and loitering munition development.

South China is also an important region in the loitering munition market, particularly due to the presence of military and aerospace industries in Guangdong and Hong Kong. The region is strategically important for China’s defense posture in the South China Sea, where loitering munitions can be employed for maritime surveillance and precision strikes. As tensions continue to rise in this region, the demand for advanced loitering munitions is expected to grow, driven by the need for flexible, cost-effective weaponry capable of addressing asymmetric threats.

North China, home to Beijing, the nation’s political and military hub, plays a critical role in the development and strategic deployment of loitering munitions. The government’s defense initiatives, such as the “Made in China 2025” plan, which focuses on enhancing self-sufficiency in defense technologies, has led to a strong presence of research and development centers in this region. Loitering munition systems developed in North China are intended to support China’s broader military objectives, particularly in countering external threats and asserting dominance in its region.

Central and Western China, although not as heavily involved in loitering munition production, are becoming increasingly important as the government seeks to expand defense capabilities across the country. This includes strengthening the military presence in these regions to support broader defense strategies and enhance the operational reach of China’s military forces.

Key Player Analysis:

- Northrop Grumman

- Thales

- Paramount Group

- AVIC (Aviation Industry Corporation of China)

- Norinco (China North Industries Group Corporation)

- CASC (China Aerospace Corporation)

Competitive Analysis:

The China loitering munition market is highly competitive, with several key players driving innovation and growth. Leading defense contractors, including state-owned enterprises such as Norinco and AVIC, dominate the development and production of loitering munitions in China. These companies leverage advanced technologies, including AI, autonomous navigation, and precision guidance systems, to develop high-performance loitering munitions for various military branches. Additionally, China Aerospace Corporation (CASC) plays a significant role in the market, focusing on enhancing loitering munition capabilities for both defense and export purposes. The Chinese government’s strategic investments in defense technology also facilitate market expansion by supporting domestic production and export initiatives. With the increasing demand for precision strike capabilities and advanced unmanned systems, these players are continuously improving loitering munitions’ performance, versatility, and affordability, which enhances China’s competitive advantage in both domestic and international markets.

Recent Developments:

- In October 2024, Northrop Grumman revealed the development of a new loitering munition designed for the U.S. Army’s Air Launch Effects (ALE) program. This hybrid system, called the Hero ALE, combines Northrop Grumman’s technology with components from Israel’s UVision Hero 120 and Hero 400 drones. The Hero ALE is being built in the United States by UVision USA, a wholly owned subsidiary, and is intended to provide advanced swarming and precision strike capabilities for future helicopters under the Army’s Future Vertical Lift (FVL) initiative.

- In March 2025, Norinco completed the development of the Feilong-60A (Flying Dragon-60), China’s first modular rocket-based loitering munition. The FL-60A is paired with the SR-5 multiple launch rocket system, with each unit carrying two six-tube canisters, significantly enhancing China’s precision strike capabilities. This development marks a major step in modular, rocket-launched loitering munitions for the Chinese military.

Market Concentration & Characteristics:

The China loitering munition market exhibits moderate concentration, primarily dominated by a few large state-owned defense companies, including Norinco, AVIC, and CASC. These companies control the majority of the market share, given their significant resources, advanced technological capabilities, and strong government backing. The market is characterized by a high level of technological innovation, with continuous advancements in autonomous systems, artificial intelligence, and precision targeting capabilities. While these major players dominate production and development, the market is also witnessing an increase in collaboration between defense contractors and research institutions to enhance loitering munition performance. The focus is on improving the operational flexibility and cost-effectiveness of these systems to meet diverse military needs. Additionally, the Chinese government’s commitment to modernizing its military forces and expanding export opportunities continues to shape market dynamics, fostering a competitive environment for both domestic and global defense markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type. Range, Launch Mode and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- China’s loitering munition market will continue to grow due to increasing defense budgets and military modernization efforts.

- Technological advancements in AI and autonomous systems will enhance loitering munition capabilities, driving higher demand.

- The demand for loitering munitions in asymmetrical warfare scenarios, particularly in the Indo-Pacific, will grow.

- Cost-effective alternatives to traditional missiles will make loitering munitions attractive to both domestic and international buyers.

- China’s focus on expanding its export market will increase global demand for affordable, advanced loitering munitions.

- New strategic military initiatives will integrate loitering munitions across various military branches, enhancing operational efficiency.

- Increased collaboration between state-owned enterprises and private defense firms will drive innovation in loitering munition systems.

- The shift toward modular, multi-role loitering munitions will cater to diverse military needs across multiple sectors.

- Loitering munitions will play a central role in China’s evolving defense posture, particularly in response to regional security challenges.

- Continued investment in R&D will ensure China remains competitive in the global loitering munition market.