| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Pea Proteins Market Size 2024 |

USD 275.98 Million |

| China Pea Proteins Market, CAGR |

14.32% |

| China Pea Proteins Market Size 2032 |

USD 805.27 Million |

Market Overview:

The China Pea Proteins Market is projected to grow from USD 275.98 million in 2024 to an estimated USD 805.27 million by 2032, with a compound annual growth rate (CAGR) of 14.32% from 2024 to 2032.

The growth of the China pea protein market is primarily driven by shifting consumer preferences towards plant-based and sustainable food options. Health-conscious consumers are increasingly seeking alternatives to animal-based proteins due to concerns over lactose intolerance and the desire for clean-label, non-GMO products. The Chinese government’s initiatives, such as the “clean plate campaign” aiming to reduce meat consumption by 50% by 2030, have also supported this shift towards plant-based proteins. In addition, environmental factors such as reducing carbon emissions and minimizing animal agriculture’s ecological footprint are encouraging the adoption of plant-based products like pea protein. Ethical considerations surrounding animal welfare further bolster the market as consumers seek cruelty-free, eco-friendly alternatives. These factors combined are significantly boosting demand for pea protein in China, driving the market’s growth trajectory.

China leads the Asia Pacific pea protein market, capturing a significant share of the region’s revenue. This dominance is attributed to rapid urbanization, a growing middle class, and a strong consumer demand for healthier and more sustainable dietary options. The country’s vast population and evolving dietary preferences, influenced by a rising awareness of health and environmental concerns, make it a key market for plant-based protein products. Moreover, China’s increasing focus on food security and the push towards self-sufficiency in plant-based ingredients have prompted domestic manufacturers to ramp up production, with both local and international players investing in the market. These efforts are further accelerated by the growing popularity of pea protein in various applications, including meat substitutes, beverages, and dietary supplements, as consumers move towards more ethical and environmentally friendly food choices. This regional strength positions China as a central hub for the expansion of the pea protein market in Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The China Pea Proteins Market is projected to grow from USD 275.98 million in 2024 to an estimated USD 805.27 million by 2032, with a CAGR of 14.32% from 2024 to 2032. driven by the increasing demand for plant-based, non-GMO, and clean-label protein alternatives.

- The global pea proteins market is projected to grow from USD 2,229.15 million in 2024 to USD 5,618.92 million by 2032, at a CAGR of 12.25%.

- The government’s initiatives, such as the “clean plate campaign” and efforts to reduce meat consumption by 50% by 2030, are fueling the market’s shift towards plant-based proteins.

- Rising awareness of health and wellness concerns, such as obesity and heart disease, is encouraging Chinese consumers to adopt plant-based diets, further supporting the demand for pea protein.

- Environmental considerations, including the desire to reduce carbon emissions and minimize animal agriculture’s ecological footprint, are pushing consumers towards eco-friendly alternatives like pea protein.

- The growing popularity of flexitarianism is driving the demand for meat substitutes, positioning pea protein as a key ingredient in plant-based meat alternatives.

- High production costs and sourcing limitations present challenges, as specialized extraction methods and a limited supply of peas can impact the affordability and scalability of pea protein production.

- China leads the Asia Pacific pea protein market, driven by rapid urbanization, a rising middle class, and increasing demand for healthier, sustainable food options.

Market Drivers:

Health and Wellness Trends

The increasing awareness of health and wellness among consumers is one of the primary drivers fueling the growth of the China pea protein market. With rising concerns over diet-related health issues such as obesity, heart disease, and diabetes, there is a shift towards plant-based foods that offer a healthier alternative to traditional animal proteins. For instance, companies like Yantai Shuangta Food Co., Ltd. have responded to this trend by expanding their pea protein product lines to include a variety of meat substitutes and dietary supplements, directly addressing the needs of health-conscious consumers. Pea protein is particularly attractive due to its high nutritional value, being a rich source of essential amino acids, fiber, and minerals. The growing trend of reducing meat consumption, driven by health-conscious individuals, is steering consumers toward plant-based proteins as part of a balanced, nutrient-rich diet.

Government Support and Policies

Government initiatives play a crucial role in accelerating the adoption of plant-based proteins in China. The Chinese government’s commitment to sustainability and environmental protection has led to policies aimed at reducing the country’s carbon footprint, with a specific focus on the food industry. For example, in 2024, the Ministry of Agriculture and Rural Affairs released a document identifying alternative proteins as a key area for national agricultural science and technology innovation, specifically prioritizing research into novel foods to “create a new generation of food to meet new scenarios and special needs. Additionally, the government’s push to decrease meat consumption by 50% by 2030 is further incentivizing the adoption of plant-based alternatives like pea protein. These policy shifts are driving demand for sustainable food options and creating a conducive environment for the growth of the pea protein market.

Environmental and Ethical Considerations

Concerns about the environmental impact of animal agriculture have further fueled the demand for pea protein in China. Animal farming is a significant contributor to greenhouse gas emissions, deforestation, and water pollution, which has led many consumers to explore more sustainable food options. Pea protein, being plant-based, offers a lower environmental footprint compared to animal-derived proteins. As Chinese consumers become more aware of these environmental issues, there is a rising preference for products that align with ethical and sustainability values. This growing awareness is driving the demand for pea protein as an eco-friendly and ethical alternative to traditional animal proteins.

Growing Demand for Meat Substitutes

The rise in flexitarianism, where consumers choose plant-based diets without fully eliminating animal products, has further contributed to the increasing demand for pea protein in China. As more people seek to reduce their meat consumption, the demand for meat substitutes and plant-based proteins has surged. Pea protein, with its ability to mimic the texture and nutritional profile of meat, is increasingly used in products like plant-based burgers, sausages, and other meat analogs. This growing market for meat substitutes is driving innovation in pea protein-based food products, contributing to the overall growth of the pea protein market in China.

Market Trends:

Rising Popularity of Plant-Based Foods

The China pea protein market is experiencing a notable shift toward plant-based foods as more consumers adopt healthier eating habits. This trend is fueled by the increasing awareness of the benefits of plant-based diets, such as better heart health, weight management, and reduced risk of chronic diseases. As health-conscious individuals seek alternative protein sources, pea protein has become a favored option due to its nutritional profile and versatility in various food products. The growing popularity of plant-based foods is evident in the rise of pea protein being incorporated into meat substitutes, snacks, beverages, and dairy alternatives, with consumers becoming more open to replacing animal-based proteins with plant-based ones.

Technological Innovations in Product Development

Technological advancements are playing a key role in the development of the pea protein market in China. Innovations in food processing, such as enhanced extraction methods and improved formulations, have made pea protein more refined and adaptable to different product applications. For instance, Shandong Hua-Thai Food Products operates a centralized, automatic production facility with an annual output of 25,000 tons of peas, 3,800 tons of isolated pea protein, 12,000 tons of pea starch, supported by an independent R&D center focused on overcoming taste and mouthfeel challenges. Advances in protein extraction technology have led to pea protein concentrates and isolates that offer better taste, texture, and nutritional value. These improvements have expanded the potential uses of pea protein, particularly in plant-based meat alternatives, where texture and flavor are crucial. As manufacturers continue to invest in research and development, new product formulations are being introduced to meet evolving consumer demands for more palatable and nutrient-dense plant-based foods.

Expansion of the Vegan and Flexitarian Consumer Base

The growing consumer base of vegans and flexitarians in China is further driving the demand for pea protein. Veganism and plant-based diets are gaining mainstream acceptance, particularly among younger generations and urban populations. Flexitarianism, where individuals primarily follow plant-based diets but occasionally consume animal-based products, is also becoming more prevalent. This expanding demographic is increasingly turning to plant-based proteins like pea protein to meet their dietary needs. As more people adopt flexitarian diets, the demand for plant-based alternatives in traditional animal protein categories, such as meat and dairy, is rising. This shift in consumer behavior is contributing to the broader acceptance and incorporation of pea protein into everyday diets.

Investment in Sustainable Sourcing

Sustainability has become a significant focus in the China pea protein market, with both consumers and companies placing greater importance on eco-friendly production practices. Pea protein, as a plant-based ingredient, offers a more sustainable alternative to animal-derived proteins, with a smaller environmental footprint in terms of water use, greenhouse gas emissions, and land requirements. For example, Shandong Hua-Thai Food Products sources high-quality, non-GMO peas from Canada and the USA, and their production processes emphasize environmental responsibility and product traceability. As consumers become more environmentally conscious, they are increasingly seeking out products made from sustainably sourced ingredients. In response, manufacturers are prioritizing sustainable sourcing, adopting greener production methods, and emphasizing environmental responsibility in their marketing strategies. This growing focus on sustainability is further driving the demand for pea protein, which aligns with the values of eco-conscious consumers.

Market Challenges Analysis:

High Production Costs

One of the key challenges facing the China pea protein market is the relatively high production cost compared to other plant-based proteins. For instance, industry analysis highlights that high production costs are a primary restraint, as the specialized equipment and technology needed for pea protein production drive up expenses for manufacturers. While the demand for pea protein is increasing, the higher production costs pose a significant barrier to widespread adoption, particularly for manufacturers aiming to offer affordable products in price-sensitive markets. This issue is further exacerbated by fluctuations in raw material costs, which can make it difficult for producers to maintain stable pricing.

Supply Chain and Sourcing Limitations

The supply chain for pea protein in China is still developing, which can create challenges for ensuring a steady supply of raw materials. Pea cultivation is more concentrated in specific regions, and while China is a major producer of peas, the country faces challenges in scaling up production to meet the growing demand for pea protein. This limited availability of peas can lead to supply shortages, impacting the production of pea protein and potentially causing price volatility. Additionally, the relatively small scale of domestic pea protein production facilities limits the overall capacity to meet the rising demand in the food industry.

Consumer Perception and Taste Preferences

Despite the growing popularity of plant-based diets, pea protein still faces resistance from some consumers due to taste and texture preferences. While advancements in product development have improved the flavor and texture of pea protein, it may still not appeal to all consumers, particularly those accustomed to traditional animal proteins. The challenge lies in overcoming these taste barriers and convincing consumers to incorporate pea protein into their regular diets. This restraint may limit the expansion of pea protein-based products in certain segments of the market, especially in more traditional or conservative consumer groups.

Regulatory and Labeling Issues

In China, regulatory frameworks for plant-based proteins are still evolving. Manufacturers may face challenges in navigating the country’s food safety and labeling regulations, particularly when it comes to ensuring compliance with standards for new or novel food products. Uncertainty in regulatory policies can slow down the pace of innovation and product introduction in the market, as companies must wait for approvals before launching new pea protein-based items. This can hinder the ability of businesses to quickly respond to market demands and capitalize on emerging trends.

Market Opportunities:

The China pea protein market presents significant opportunities driven by the rising demand for plant-based protein alternatives. As consumers become increasingly health-conscious and environmentally aware, the shift towards plant-based diets is expected to continue expanding. This provides a unique opportunity for manufacturers to capitalize on the growing preference for sustainable and nutritious protein sources. Pea protein, with its rich nutritional profile, offers a competitive advantage in meeting the needs of health-focused consumers seeking alternatives to animal-based proteins. Furthermore, as the Chinese government encourages sustainable food practices and reduces meat consumption, there is substantial potential for growth in the plant-based food sector, particularly for products featuring pea protein.

In addition to health and sustainability factors, the growing trend of flexitarianism in China represents a significant market opportunity for pea protein. Flexitarians, who incorporate plant-based foods into their diets while still consuming meat occasionally, are a large and expanding demographic. This group seeks high-quality, plant-based protein options that mimic the taste and texture of traditional animal proteins. As a result, there is ample room for innovation in developing pea protein-based products that cater to the preferences of flexitarians, including meat substitutes, snacks, and dairy alternatives. By meeting the demands of this evolving consumer segment, companies in the pea protein market can position themselves for long-term success and establish a strong presence in the growing Chinese market.

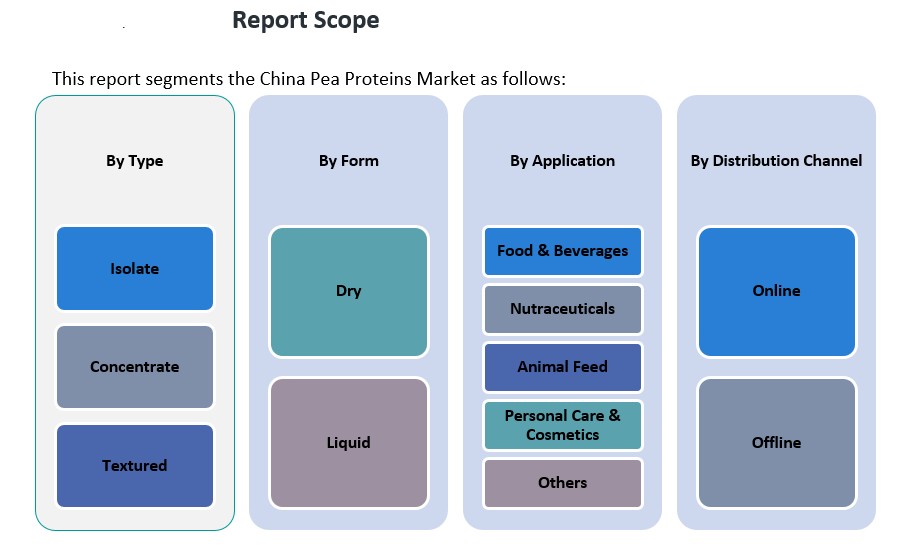

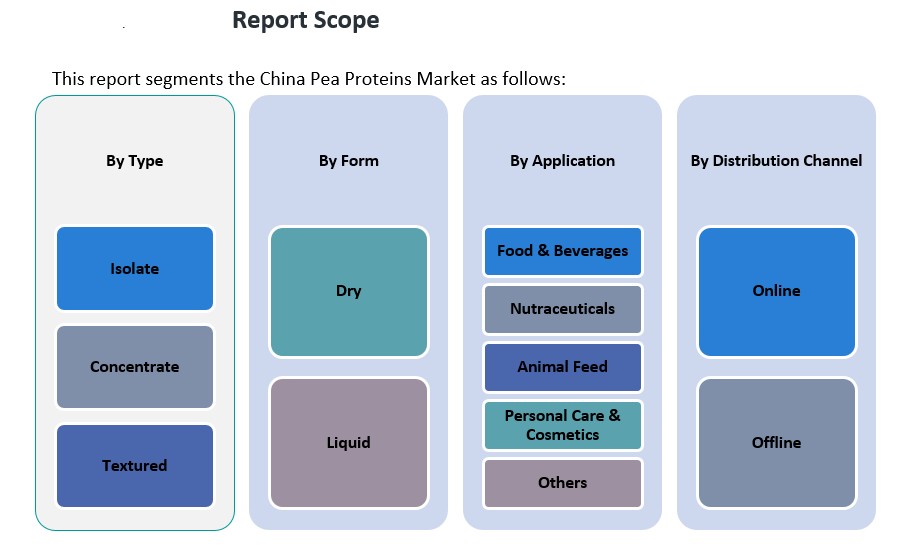

Market Segmentation Analysis:

The China pea protein market is segmented based on type, application, form, and distribution channel, each of which contributes to the market’s dynamic growth.

By Type

Pea protein is primarily available in three forms: isolate, concentrate, and textured. Among these, pea protein isolate holds the largest market share due to its high protein content and versatility in various applications, particularly in food and beverages. Pea protein concentrate, which retains more of the fiber and nutrients, is also gaining popularity in the nutraceutical and animal feed sectors. Textured pea protein, used mainly in meat alternatives, is experiencing strong growth due to the rising demand for plant-based meat products.

By Application

In terms of application, the food and beverage sector dominates the China pea protein market, driven by the increasing consumption of plant-based protein products such as meat substitutes, dairy alternatives, and snacks. The nutraceutical segment is also expanding, with pea protein being used in dietary supplements due to its high amino acid profile and health benefits. Animal feed is another key application, as pea protein offers a sustainable protein source for livestock. Additionally, the personal care and cosmetics sector is utilizing pea protein for its skin and hair benefits, contributing to the overall market growth.

By Form

Pea protein is available in both dry and liquid forms, with dry forms being more commonly used due to ease of storage and transport. Liquid forms are gaining traction in ready-to-drink beverages and food products.

By Distribution Channel

Online distribution channels are experiencing rapid growth, particularly as consumers turn to e-commerce for plant-based products. However, offline channels, including supermarkets and health food stores, continue to play a crucial role in product availability and consumer access to pea protein-based products.

Segmentation:

By Type

- Isolate

- Concentrate

- Textured

By Application

- Food & Beverages

- Nutraceuticals

- Animal Feed

- Personal Care & Cosmetics

- Others

By Form

By Distribution Channel

Regional Analysis:

The China pea protein market is experiencing significant growth, driven by increasing consumer demand for plant-based proteins, health-conscious dietary trends, and supportive government policies. China’s dominance in the Asia-Pacific region is evident, with the country accounting for approximately 25.1% of the region’s pea protein market share in 2023.

Eastern China: Industry Hub and Innovation Center

Eastern China, encompassing major economic zones such as Shanghai, Jiangsu, Zhejiang, and Anhui provinces, serves as the epicenter for pea protein production and innovation. This region hosts numerous processing facilities and research centers dedicated to developing advanced pea protein technologies. The proximity to key ports facilitates efficient importation of raw materials and exportation of finished products, enhancing the region’s competitiveness in the global market.

Northern China: Strategic Sourcing and Export Gateway

Northern China, particularly Inner Mongolia and Heilongjiang provinces, plays a crucial role in sourcing raw peas for protein extraction. These areas benefit from extensive agricultural land dedicated to pea cultivation, ensuring a steady supply of raw materials. The region’s logistical infrastructure supports the transportation of peas to processing centers in the east and serves as a gateway for exports to international markets.

Southern China: Emerging Market with Growing Demand

Southern China, including Guangdong and Fujian provinces, is witnessing a surge in demand for plant-based products, including pea protein. The region’s urban population is increasingly adopting health-conscious diets, driving the need for alternative protein sources. While local production is limited, the growing consumer base presents opportunities for market expansion and product diversification.

Southwestern China: Developmental Potential and Market Expansion

Southwestern China, comprising Sichuan, Chongqing, and Yunnan provinces, is an emerging market with significant potential for pea protein development. The region’s agricultural sector is diversifying, and there is a growing interest in sustainable farming practices. Investments in infrastructure and technology are paving the way for increased pea protein production to meet local and national demand.

Key Player Analysis:

- Shandong Jianyuan Group

- Fenchem Biotek Ltd.

- Ingredion Incorporated

- Roquette Frères

- Yantai Shuangta Food Co., Ltd.

- ET Chem

- Cargill, Inc.

- DuPont (IFF)

- Nutraonly (Xi’an) Nutritions Inc.

- Burcon NutraScience Corporation

Competitive Analysis:

The China pea protein market is competitive, with several domestic and international players vying for market share. Key companies such as Roquette Frères, NutriPea, and Ingredion are leading the market, leveraging their advanced technologies and extensive product portfolios. Local producers like Yunnan Tin Company and Jiangsu Sinoglory Health Food are also expanding their presence by enhancing product offerings and investing in innovative processing methods. These companies focus on producing high-quality pea protein isolates, concentrates, and textured variants, catering to the growing demand for plant-based proteins in food, beverages, and nutraceuticals. The competition is intensifying as companies strive to develop cost-effective, high-quality products to meet the increasing consumer demand for plant-based alternatives. Additionally, strategic partnerships, research and development investments, and expanding distribution networks are key strategies employed by market leaders to strengthen their positions. Innovation and sustainability are also becoming crucial differentiators in this evolving market.

Recent Developments:

- In March 2025, Daily Harvest introduced its Organic Pea Protein Powder, designed to offer a clean, allergen-friendly protein boost for smoothies and breakfast bowls. This new product contains only USDA-certified organic pea protein, free from additives, fillers, artificial sweeteners, seed oils, and preservatives, and provides 24 grams of plant-based protein per serving. The powder is tested for heavy metals, is highly digestible, and is suitable for those with common allergies, continuing Daily Harvest’s commitment to clean, simple ingredients and meeting customer demand for high-quality, convenient protein options.

- In February 2024, Roquette expanded its NUTRALYS® plant protein range by launching four new multifunctional pea protein ingredients: NUTRALYS® Pea F853M (isolate), NUTRALYS® H85 (hydrolysate), NUTRALYS® T Pea 700FL (textured), and NUTRALYS® T Pea 700M (textured). These ingredients are designed to improve taste, texture, and application versatility in plant-based foods and high-protein nutritional products, enabling food manufacturers to develop innovative meat alternatives, nutritional bars, protein drinks, and dairy alternatives. This launch reflects Roquette’s ongoing investment in plant protein innovation and its mission to support food manufacturers in creating appealing plant-based products.

- In January 2024, Ingredion and Lantmännen announced a long-term partnership to develop and commercialize a portfolio of pea protein isolates for the European market. This collaboration aims to leverage Ingredion’s expertise in process engineering and product development alongside Lantmännen’s vertically integrated production capabilities, with the goal of delivering high-quality, sustainably sourced pea protein isolates that meet the evolving needs of the global market.

Market Concentration & Characteristics:

The China pea protein market exhibits a low concentration, characterized by the presence of numerous domestic and international players. Major global companies such as Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group PLC, and International Flavours & Fragrances Inc. operate within the market, alongside prominent Chinese firms like Yantai Shuangta Food Co. Ltd. Despite the involvement of these key players, no single company commands a dominant market share, indicating a fragmented competitive landscape. This fragmentation allows for a diverse range of products and innovations, catering to the varying demands of consumers and industries. The China pea protein market is characterized by its rapid growth, driven by increasing consumer demand for plant-based protein alternatives. Factors such as rising health consciousness, dietary preferences favoring plant-based foods, and the environmental benefits of pea cultivation contribute to this expansion. The market offers a variety of pea protein forms, including isolates, concentrates, and textured variants, catering to applications in food and beverages, nutraceuticals, animal feed, and personal care products. Additionally, the market is witnessing innovations in product development, with companies focusing on improving taste, texture, and nutritional profiles to meet consumer expectations. The presence of both established and emerging players fosters a competitive environment that encourages continuous improvement and adaptation to market trends.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The China pea protein market is expected to continue its rapid expansion as consumers increasingly shift towards plant-based diets.

- Health-conscious consumption trends will drive further demand for pea protein, particularly in food and beverage sectors.

- Government initiatives promoting sustainable agriculture will boost pea protein production and its adoption.

- Technological advancements in protein extraction methods will reduce production costs and improve product quality.

- The rise of flexitarianism in China will expand the customer base for pea protein-based meat alternatives.

- Growing awareness of environmental sustainability will further position pea protein as a key eco-friendly protein source.

- The demand for pea protein will rise in nutraceuticals and dietary supplements, driven by its high nutritional profile.

- Innovation in product development, including improved taste and texture, will attract a broader range of consumers.

- The expansion of e-commerce platforms will provide wider access to pea protein products across urban and rural markets.

- Stronger regional supply chains will mitigate raw material sourcing challenges, supporting market growth.