Market Overview

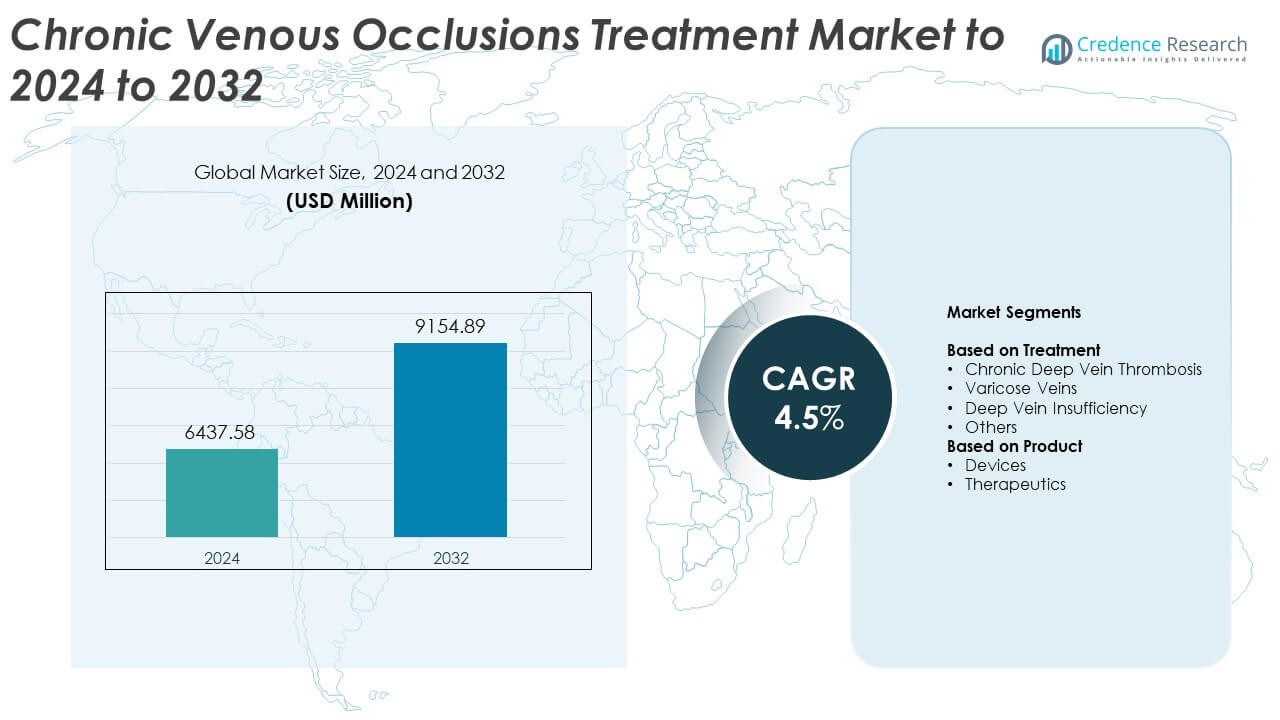

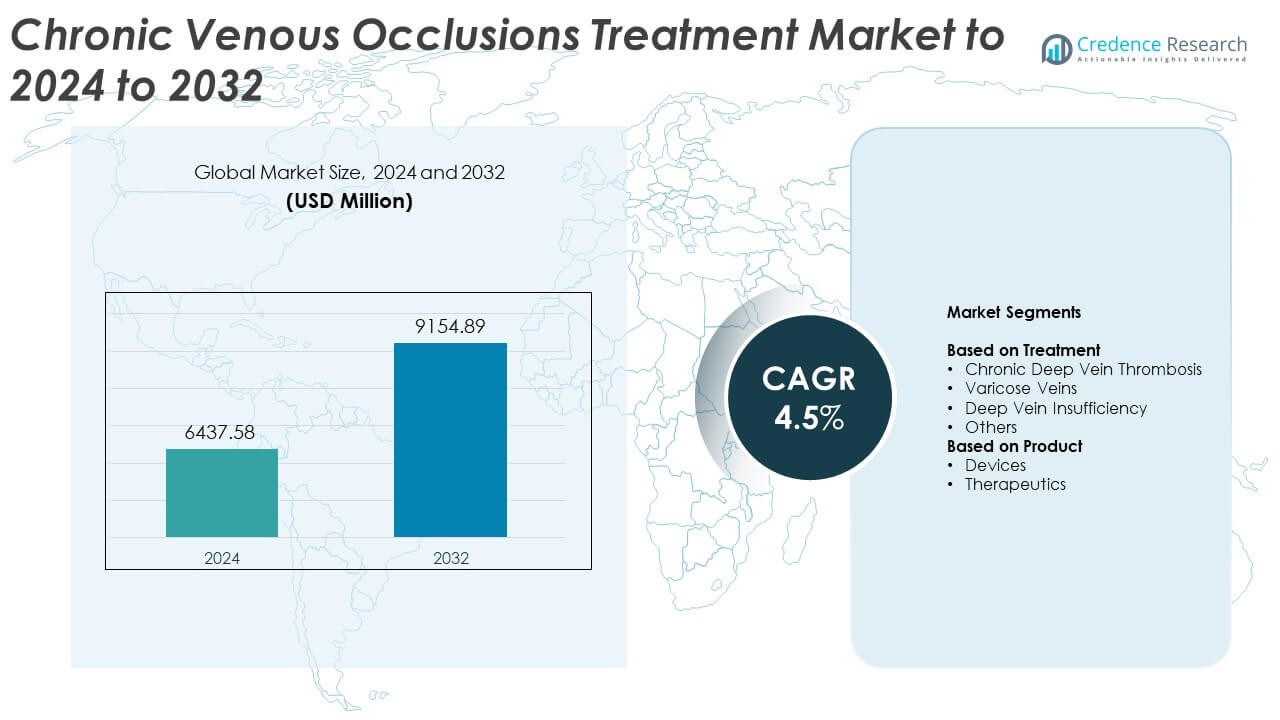

The Chronic Venous Occlusions Treatment Market size was valued at USD 6437.58 million in 2024 and is anticipated to reach USD 9154.89 million by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chronic Venous Occlusions Treatment Market Size 2024 |

USD 6437.58 Million |

| Chronic Venous Occlusions Treatment Market, CAGR |

4.5% |

| Chronic Venous Occlusions Treatment Market Size 2032 |

USD 9154.89 Million |

The Chronic Venous Occlusions Treatment Market is led by major players including Medtronic plc, Pfizer Inc., Smith & Nephew PLC, Bayer AG, Boston Scientific Corporation, Stryker Corporation, Sanofi, and Bristol Myers Squibb. These companies focus on expanding advanced endovascular and pharmacological solutions to enhance patient outcomes and reduce recurrence rates. North America holds the dominant position in the global market, accounting for about 39% share in 2024, supported by advanced healthcare infrastructure and widespread adoption of minimally invasive treatments. Europe follows with around 28% share, while Asia Pacific shows the fastest growth due to improving healthcare access and rising awareness of venous disease management.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Chronic Venous Occlusions Treatment Market was valued at USD 6437.58 million in 2024 and is projected to reach USD 9154.89 million by 2032, growing at a CAGR of 4.5%.

• Market growth is driven by the increasing prevalence of chronic venous disorders, rising adoption of minimally invasive endovascular therapies, and growing awareness about early diagnosis and treatment.

• Technological advancements in imaging-guided interventions and drug-coated devices are shaping market trends, improving procedural precision and long-term outcomes.

• The market is moderately competitive, with global manufacturers focusing on innovation, product approvals, and strategic collaborations to expand geographic presence.

• Regionally, North America leads with 39% share due to strong healthcare infrastructure, followed by Europe at 28% and Asia Pacific at 22%, where rising healthcare access and awareness continue to drive future market expansion.

Market Segmentation Analysis:

By Treatment

The varicose veins segment dominates the chronic venous occlusions treatment market, accounting for around 42% share in 2024. This dominance is driven by the high prevalence of venous reflux disorders and the growing preference for minimally invasive treatment options such as endovenous laser therapy and sclerotherapy. Rising awareness of cosmetic and therapeutic interventions among patients also supports demand. Additionally, increasing adoption of ultrasound-guided procedures in clinical settings enhances treatment accuracy, contributing to the segment’s continued leadership in the overall market.

- For instance, Medtronic’s VenaSeal in the VeClose RCT achieved 24-month complete closure of 95.3% with cyanoacrylate versus 94.0% with radiofrequency ablation (n=171 at 24 months).

By Product

The devices segment leads the chronic venous occlusions treatment market with approximately 55% share in 2024. Its growth is attributed to the widespread use of angioplasty catheters, stents, and guidewires for effective venous recanalization. Technological advancements in imaging-guided and drug-coated devices have improved treatment outcomes and reduced recurrence rates. The increasing preference for endovascular over surgical approaches due to shorter recovery time and reduced complications further strengthens the dominance of this segment across global healthcare settings.

- For instance, Boston Scientific’s Venovo stent in VERNACULAR showed 12-month primary patency of 88.3% overall, including 96.9% in NIVL lesions, with 7.4% target-lesion revascularization.

Key Growth Drivers

Rising prevalence of venous diseases

The growing incidence of chronic venous disorders, including deep vein thrombosis and varicose veins, is a primary driver of the market. An aging global population, sedentary lifestyles, and increasing obesity rates are boosting the demand for effective treatment options. Hospitals and vascular clinics are reporting a steady rise in patients requiring endovascular or minimally invasive interventions. These factors collectively fuel the need for advanced medical devices and therapies targeting venous obstruction and related complications.

- For instance, Bayer’s EINSTEIN-DVT trial enrolled 3,449 acute DVT patients, highlighting substantial treatment need across a large, multicountry cohort.

Technological advancements in treatment devices

Continuous innovation in catheter-based and stent-assisted recanalization technologies has improved treatment efficacy and reduced recovery time. Advanced imaging systems enable better navigation through complex venous structures, enhancing procedural success. The integration of drug-coated devices further supports long-term vessel patency and lowers recurrence rates. These developments are pushing healthcare facilities to adopt modern solutions, strengthening the overall market demand for technologically advanced treatment options.

- For instance, Cook Medical’s Zilver Vena reported 12-month primary quantitative patency of 89.9% and 30-day freedom from major adverse events of 96.7% in the VIVO study.

Increasing healthcare spending and awareness

Rising healthcare expenditures and growing public awareness about early diagnosis of venous disorders drive treatment adoption. Governments and private insurers are expanding coverage for endovascular and pharmacological therapies, making advanced care more accessible. Public health campaigns and screening programs are encouraging patients to seek early medical intervention, particularly in developed economies. This trend is significantly boosting the market for chronic venous occlusions treatment worldwide.

Key Trends & Opportunities

Adoption of minimally invasive procedures

The shift toward minimally invasive endovascular treatments is a major trend shaping the market. These procedures reduce hospital stays, minimize post-operative pain, and improve patient recovery outcomes. Healthcare providers are increasingly favoring endovenous laser ablation, balloon angioplasty, and stent placement over traditional open surgeries. The growing preference for outpatient procedures is expected to expand market potential in both developed and emerging regions.

- For instance, biolitec’s 1470-nm endovenous laser ablation achieved 96% complete sonographic vein disappearance at 1 year, with one recanalization reported.

Integration of AI and imaging technologies

Artificial intelligence and advanced imaging are enhancing diagnostic accuracy and procedural planning in venous occlusion treatment. AI-assisted imaging helps in real-time visualization of complex venous networks, improving treatment precision. Automated image analysis supports clinicians in identifying blockages early, leading to faster and safer interventions. This integration is expected to create new opportunities for medical device manufacturers and diagnostic system developers.

- For instance, Viz.ai reduced time-to-consult for pulmonary embolism from 240 minutes to 7 minutes in a clinical workflow study.

Expansion into emerging healthcare markets

Growing investment in healthcare infrastructure across Asia-Pacific and Latin America presents major opportunities for market growth. Rising patient awareness and expanding vascular care facilities are encouraging the adoption of chronic venous occlusion treatments. Local manufacturing partnerships and supportive government policies are making advanced devices more affordable. This expansion is expected to diversify revenue sources for global market leaders.

Key Challenges

High cost of treatment and devices

The high price of endovascular devices, stents, and imaging systems poses a major restraint. Many patients, especially in low- and middle-income regions, cannot afford advanced interventions. Limited reimbursement coverage for new technologies further restricts access. These cost-related challenges slow market penetration despite technological progress, making affordability a persistent concern for healthcare providers and patients alike.

Shortage of skilled vascular specialists

A global shortage of interventional radiologists and vascular surgeons limits the availability of advanced venous occlusion treatments. Complex procedures like venous recanalization require specialized expertise and equipment that are not widely available in smaller hospitals. This gap in skilled professionals restricts the reach of high-quality care and hampers adoption rates, particularly in developing regions where training infrastructure is still evolving.

Regional Analysis

North America

North America dominates the chronic venous occlusions treatment market with around 39% share in 2024. The region’s leadership is driven by a strong presence of advanced healthcare infrastructure, high awareness about venous disorders, and early adoption of minimally invasive procedures. The United States leads regional growth due to extensive insurance coverage and widespread use of endovascular technologies. Increasing prevalence of chronic venous diseases among the elderly population and growing demand for outpatient-based vascular care continue to strengthen North America’s position in the global market.

Europe

Europe accounts for approximately 28% share of the chronic venous occlusions treatment market in 2024. The region benefits from favorable reimbursement policies, high diagnosis rates, and growing adoption of advanced treatment devices in countries such as Germany, France, and the United Kingdom. Rising healthcare investments and the presence of leading medical device manufacturers also contribute to market growth. Increasing preference for endovenous laser treatments and stenting procedures, supported by strong clinical research initiatives, continues to enhance Europe’s overall market share.

Asia Pacific

Asia Pacific holds about 22% share of the chronic venous occlusions treatment market in 2024 and is expected to record the fastest growth through 2032. Expanding healthcare infrastructure, rising awareness of vascular health, and increasing disposable incomes are key drivers in countries like China, Japan, and India. Government initiatives promoting access to advanced treatment technologies further support market expansion. Additionally, the region’s growing patient pool suffering from obesity and lifestyle-related disorders enhances demand for effective venous occlusion therapies.

Latin America

Latin America represents nearly 6% share of the chronic venous occlusions treatment market in 2024. The region is witnessing gradual adoption of modern endovascular techniques as healthcare accessibility improves. Brazil and Mexico lead growth due to public and private investment in vascular care infrastructure. Increasing awareness about chronic venous diseases and ongoing training programs for vascular specialists are supporting better clinical outcomes. However, high costs and limited reimbursement coverage remain key barriers to broader treatment adoption across the region.

Middle East & Africa

The Middle East & Africa account for around 5% share of the chronic venous occlusions treatment market in 2024. Market growth is supported by expanding hospital networks and increasing focus on specialized vascular care in Gulf countries such as the UAE and Saudi Arabia. Rising prevalence of diabetes and obesity has elevated the incidence of venous disorders, boosting treatment demand. Despite these factors, limited healthcare infrastructure and low awareness levels in several African nations continue to constrain the region’s overall market potential.

Market Segmentations:

By Treatment

- Chronic Deep Vein Thrombosis

- Varicose Veins

- Deep Vein Insufficiency

- Others

By Product

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Chronic Venous Occlusions Treatment Market includes leading companies such as Medtronic plc, Pfizer Inc., Smith & Nephew PLC, Tactile Medical, Bayer AG, Boston Scientific Corporation, Julius Zorn GmbH, Merz Pharma, Stryker Corporation, Sanofi, InVera Medical, Viatris Inc., and Bristol Myers Squibb. The market is characterized by strong competition among established medical device and pharmaceutical manufacturers focusing on innovation in endovascular and pharmacological therapies. Companies are expanding product portfolios through strategic collaborations, R&D investments, and technology upgrades to improve procedural outcomes and patient recovery. Continuous development of minimally invasive and imaging-assisted treatments enhances clinical precision and efficiency. Additionally, regulatory approvals and market expansions in emerging economies support revenue diversification. Many players are also emphasizing physician training, digital integration, and sustainability in manufacturing to strengthen brand presence and patient trust. Overall, technological innovation and geographic expansion remain key competitive priorities shaping the market’s future dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Medtronic plc

- Pfizer Inc.

- Smith & Nephew PLC

- Tactile Medical

- Bayer AG

- Boston Scientific Corporation

- Julius Zorn GmbH

- Merz Pharma

- Stryker Corporation

- Sanofi

- InVera Medical

- Viatris Inc.

- Bristol Myers Squibb

Recent Developments

- In January 2025, Stryker agreed to acquire Inari Medical. The deal expands Stryker into venous thromboembolism care.

- In 2025, Pfizer and BMS launched a direct-to-patient Eliquis program. The program expanded access channels in the U.S.

- In 2023, InVera Medical Limited launched “InVera,” described as the world’s first effective non-thermal medical device for treating chronic venous disease.

Report Coverage

The research report offers an in-depth analysis based on Treatment, Product and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising cases of chronic venous diseases.

- Growing adoption of minimally invasive endovascular treatments will enhance patient outcomes.

- Technological advancements in imaging and stent design will improve procedural accuracy.

- Increasing awareness and early diagnosis will drive higher treatment rates globally.

- Expansion of healthcare infrastructure in emerging economies will boost market penetration.

- Integration of AI-assisted imaging and navigation systems will support precision therapy.

- Rising investment by medical device manufacturers will accelerate innovation.

- Government initiatives promoting vascular health will strengthen treatment accessibility.

- Collaboration between hospitals and research institutions will improve clinical success rates.

- Training programs for vascular specialists will help address workforce shortages and expand access.