Market Overview

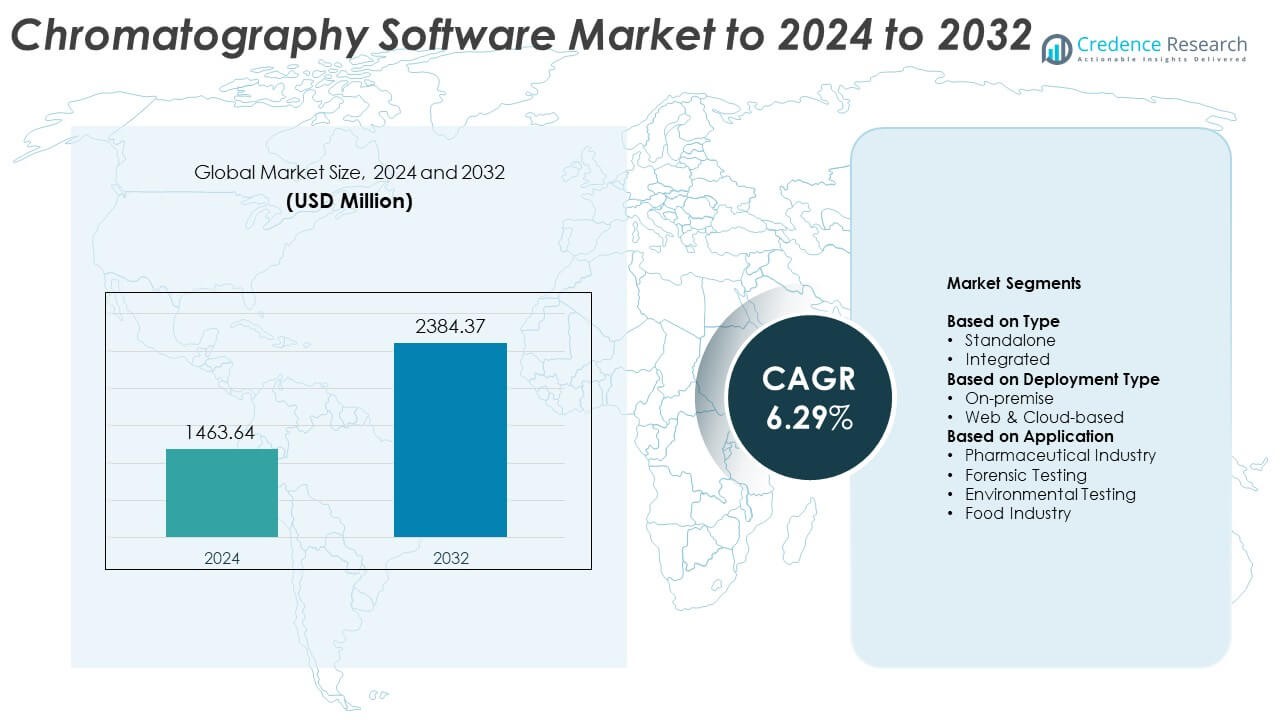

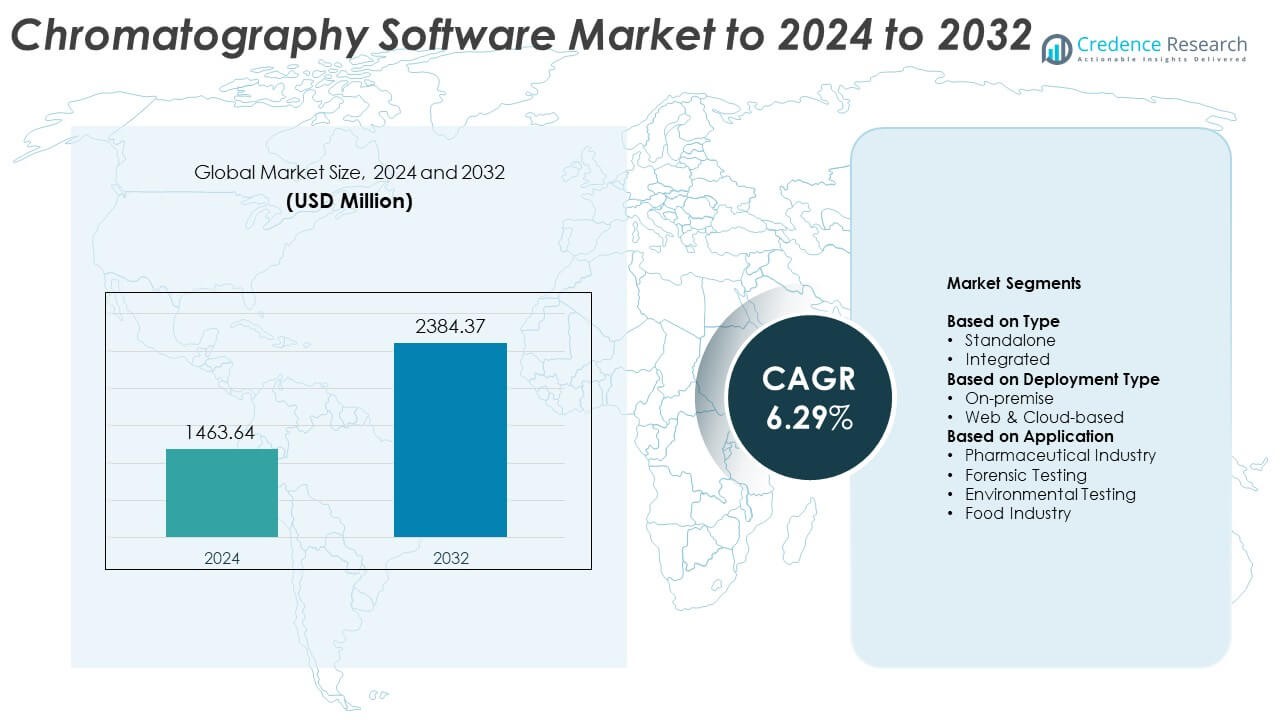

Chromatography Software Market size was valued at USD 1463.64 million in 2024 and is anticipated to reach USD 2384.37 million by 2032, at a CAGR of 6.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chromatography Software Market Size 2024 |

USD 1463.64 Million |

| Chromatography Software Market, CAGR |

6.29% |

| Chromatography Software Market Size 2032 |

USD 2384.37 Million |

The chromatography software market is dominated by leading companies such as Shimadzu Corporation, DataApex, Bruker Corporation, Waters Corporation, Restek Corporation, Cytiva, KNAUER, Agilent Technologies Inc., Scion Instruments, and Gilson Inc. These players focus on enhancing automation, data integrity, and regulatory compliance through advanced software integration and cloud-based solutions. North America leads the global market with approximately 39% share in 2024, supported by strong pharmaceutical R&D activity and established analytical infrastructure. Europe follows with around 27% share, driven by strict quality standards and digital transformation in laboratories, while Asia Pacific emerges as the fastest-growing region with expanding biopharmaceutical production and increasing investment in laboratory automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chromatography software market was valued at USD 1463.64 million in 2024 and is projected to reach USD 2384.37 million by 2032, growing at a CAGR of 6.29%.

- Rising automation in laboratories, growing pharmaceutical R&D, and increasing regulatory compliance requirements are driving market growth worldwide.

- Cloud-based deployment and integration of AI-driven data analytics represent key trends improving efficiency and accuracy in chromatographic analysis.

- The market is highly competitive, with major players focusing on digital transformation, strategic partnerships, and expansion of integrated and web-based solutions to strengthen global presence.

- North America leads with a 39% share, followed by Europe at 27% and Asia Pacific at 22%; the integrated software segment dominates with 64% share, while the pharmaceutical industry remains the largest application area at 46%, supported by expanding biopharmaceutical manufacturing and strict data integrity standards.

Market Segmentation Analysis:

By Type

The integrated segment dominates the chromatography software market with around 64% share in 2024. Its growth is driven by the increasing adoption of unified platforms that combine data acquisition, processing, and reporting within a single system. Integrated software enhances workflow efficiency, minimizes manual intervention, and ensures regulatory compliance across laboratories. Rising demand from biopharmaceutical and analytical testing facilities for seamless connectivity between chromatography instruments and laboratory information management systems continues to strengthen the dominance of this segment.

- For instance, PerkinElmer SimplicityChrom is the chromatography data system software designed for the GC 2400 Platform (controlling GC and GC/MS instruments) and the LC 300 Platform (controlling HPLC and UHPLC instruments).

By Deployment Type

The web and cloud-based segment leads the market, accounting for about 58% share in 2024. Growth is attributed to the shift toward remote data accessibility, real-time analytics, and scalable storage infrastructure. Cloud deployment enables centralized data management, improved collaboration among global teams, and lower operational costs. The rising preference for subscription-based software models and the need for flexible, secure, and compliant data handling in research environments further reinforce the segment’s leading position.

- For instance, Waters Empower Cloud centralized 13 global sites on AWS for one platform.

By Application

The pharmaceutical industry segment holds the largest share of approximately 46% in 2024. This dominance is supported by increasing demand for accurate quality assurance, drug formulation analysis, and validation processes. Chromatography software provides reliable data integrity and compliance, ensuring precision throughout drug discovery and manufacturing stages. Expanding biopharmaceutical production and strict regulatory frameworks, including those governing electronic records and audit trails, continue to fuel adoption in pharmaceutical laboratories worldwide.

Key Growth Drivers

Rising Adoption of Automation and Digital Workflows

Automation is driving major advancements in chromatography software by reducing manual errors and increasing data accuracy. Laboratories are embracing digital platforms that integrate data acquisition, processing, and reporting for faster turnaround. Automated workflows enhance productivity and regulatory compliance while minimizing human intervention. The growing focus on efficiency in pharmaceutical and research operations continues to accelerate adoption, making automation a vital growth catalyst in this market.

- For instance, Bruker TASQ quantifies 100s of compounds in a single run via batch workflows.

Expansion of Pharmaceutical and Biopharmaceutical R&D Activities

The increasing volume of drug discovery and biologics research significantly boosts the demand for chromatography software. These tools support complex analytical procedures required in quality control and validation processes. As regulatory scrutiny intensifies, companies rely on advanced data management solutions to ensure traceability and compliance. The global expansion of pharmaceutical R&D centers further enhances software utilization across production and testing facilities.

- For instance, Cytiva UNICORN 7 lets users control or monitor up to 3 instruments from one window and share methods via a database.

Shift Toward Cloud-Based Data Management Solutions

Cloud-based platforms are transforming laboratory data operations by enabling remote access, real-time monitoring, and centralized storage. Organizations benefit from lower infrastructure costs and flexible scalability for multi-user environments. The shift toward secure cloud deployment is improving collaboration among geographically dispersed teams. This trend is a key growth driver, supporting digital transformation across research institutions and contract testing laboratories.

Key Trends & Opportunities

Integration of Artificial Intelligence and Machine Learning

The inclusion of AI and machine learning is enabling predictive analytics and intelligent data interpretation in chromatography systems. These technologies enhance pattern recognition, optimize separation methods, and accelerate decision-making. Laboratories using AI-powered software can efficiently analyze large datasets and improve accuracy in molecular identification. This integration creates significant opportunities for improving operational precision and reducing analytical time.

- For instance, a deep-learning model applied to untargeted LC-HRMS data achieved 85.5% test set accuracy, 98.8% sensitivity, and 97.8% selectivity.

Growing Focus on Regulatory Compliance and Data Integrity

Compliance with stringent standards such as FDA 21 CFR Part 11 and Good Laboratory Practice (GLP) is driving upgrades in chromatography software. Vendors are developing secure audit trails, electronic signatures, and traceability features to meet evolving regulations. As global demand for validated data management systems rises, compliance-oriented solutions present a key opportunity for market expansion.

- For instance, Shimadzu LabSolutions supports 21 CFR Part 11 across 7 instrument categories, including HPLC, GC, GC-MS, LC-MS, UV, FTIR, and balances.

Key Challenges

High Implementation and Maintenance Costs

The initial investment required for advanced chromatography software and integration with legacy systems remains a barrier for small laboratories. Ongoing maintenance, periodic validation, and training add to operational costs. These financial constraints limit adoption in developing regions, restraining overall market growth despite rising technological innovations.

Data Security and Integration Complexities

With increasing reliance on cloud and network-based systems, data security concerns have intensified. Integrating chromatography software with multiple instruments and laboratory information systems often creates compatibility challenges. Ensuring secure data transfer and consistent performance across platforms remains a significant challenge for vendors and end-users alike.

Regional Analysis

North America

North America dominates the chromatography software market with around 39% share in 2024. The region’s leadership is driven by strong pharmaceutical R&D activities, advanced analytical infrastructure, and the presence of major industry players. High adoption of cloud-based laboratory solutions and stringent regulatory frameworks promote software upgrades for compliance and data integrity. The United States accounts for the majority of regional demand due to its established biopharmaceutical manufacturing and quality control facilities, while Canada’s growing investment in healthcare research further supports market expansion.

Europe

Europe holds approximately 27% share of the chromatography software market in 2024. Growth is supported by the rising adoption of automation in laboratories, strong emphasis on regulatory compliance, and expansion of biopharmaceutical production capacities. Countries such as Germany, the United Kingdom, and France lead adoption, focusing on quality control in pharmaceuticals and food testing. Increasing collaboration between academic research institutions and analytical technology providers enhances demand for integrated software solutions, making Europe a key contributor to global market development.

Asia Pacific

Asia Pacific accounts for about 22% share of the chromatography software market in 2024. Rapid industrialization, increasing pharmaceutical exports, and government initiatives promoting digital transformation in laboratories drive regional growth. China, Japan, and India are major markets, supported by expanding biopharmaceutical manufacturing and environmental testing activities. Growing investment in R&D infrastructure and the integration of automated systems in analytical laboratories are further boosting software adoption across industries, positioning Asia Pacific as the fastest-growing regional market.

Latin America

Latin America represents nearly 7% share of the chromatography software market in 2024. The region’s growth is fueled by increasing adoption of analytical testing tools in pharmaceutical, environmental, and food industries. Brazil and Mexico are the key contributors, driven by rising regulatory focus on product quality and data validation. Expanding laboratory infrastructure and growing awareness about automated chromatography systems support the gradual transition toward integrated and cloud-based software platforms across Latin American laboratories.

Middle East & Africa

The Middle East & Africa region holds around 5% share in the chromatography software market in 2024. Growth is influenced by expanding investments in healthcare infrastructure, rising pharmaceutical manufacturing, and an increasing number of environmental monitoring projects. Countries such as the United Arab Emirates and South Africa are adopting digital laboratory solutions to enhance efficiency and compliance. Limited access to advanced technology and high implementation costs, however, continue to restrain faster adoption in parts of the region.

Market Segmentations:

By Type

By Deployment Type

- On-premise

- Web & Cloud-based

By Application

- Pharmaceutical Industry

- Forensic Testing

- Environmental Testing

- Food Industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chromatography software market features strong competition among key players such as Shimadzu Corporation, DataApex, Bruker Corporation, Waters Corporation, Restek Corporation, Cytiva, KNAUER, Agilent Technologies Inc., Scion Instruments, and Gilson Inc. The competitive landscape is characterized by continuous innovation, software integration with advanced analytical instruments, and strategic collaborations with research institutions and pharmaceutical companies. Leading vendors focus on developing user-friendly, compliant, and cloud-enabled platforms to enhance laboratory automation and data integrity. Companies are expanding product portfolios to support multi-instrument compatibility, faster processing speeds, and AI-driven analytics. The emphasis on secure data management, scalable deployment, and regulatory adherence drives ongoing technological investments. Partnerships with biopharmaceutical manufacturers and academic laboratories are strengthening market reach, while mergers and acquisitions enhance global presence. Overall, competition remains intense, driven by the pursuit of software precision, compliance reliability, and enhanced analytical performance across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Shimadzu Corporation

- DataApex

- Bruker Corporation

- Waters Corporation

- Restek Corporation

- Cytiva

- KNAUER

- Agilent Technologies Inc.

- Scion Instruments

- Gilson Inc.

Recent Developments

- In 2025, Bruker Corporation announced Integration of RECIPE’s ClinMass® and ClinDART® assay kits with EVOQ® DART-TQ⁺ system, for high-throughput, chromatography-free data analysis in TDM and Drugs of Abuse workflows.

- In 2024, Agilent Technologies launched its Infinity III LC Series at major scientific events, including the 23rd Human Proteome Organization (HUPO) World Congress in Germany. The new series features InfinityLab Assist Technology, which provides real-time guidance and automated assistance to improve laboratory efficiency and troubleshoot issues.

- In 2023, Waters Corporation acquired Wyatt Technology, a company specializing in light scattering software. They also launched the Alliance iS HPLC System, which integrates with Empower Software to help reduce errors in QC labs.

Report Coverage

The research report offers an in-depth analysis based on Type, Deployment Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The chromatography software market will continue expanding due to automation and digital integration in laboratories.

- Cloud-based deployment models will gain stronger traction for scalable and secure data management.

- Artificial intelligence will enhance data analysis accuracy and method optimization across testing workflows.

- Pharmaceutical and biopharmaceutical sectors will remain the largest end users of chromatography software.

- Growing regulatory compliance requirements will drive adoption of validated and audit-ready software solutions.

- Integration with laboratory information management systems will become a key standard across industries.

- Increased demand for real-time monitoring will boost web-based and remote access solutions.

- Software vendors will focus on cybersecurity and advanced encryption to protect laboratory data.

- Emerging markets in Asia Pacific and Latin America will experience faster adoption due to expanding R&D facilities.

- Continuous product innovations and partnerships between analytical instrument manufacturers and software developers will shape long-term growth.