Market Overview

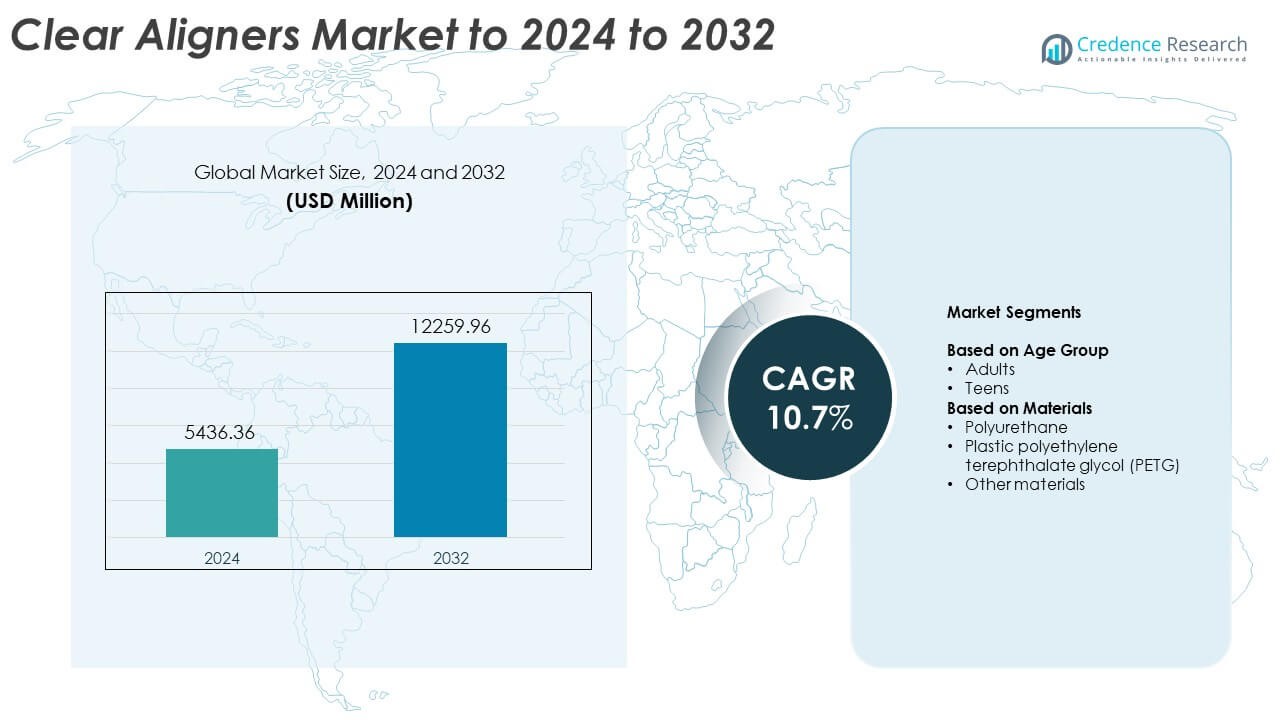

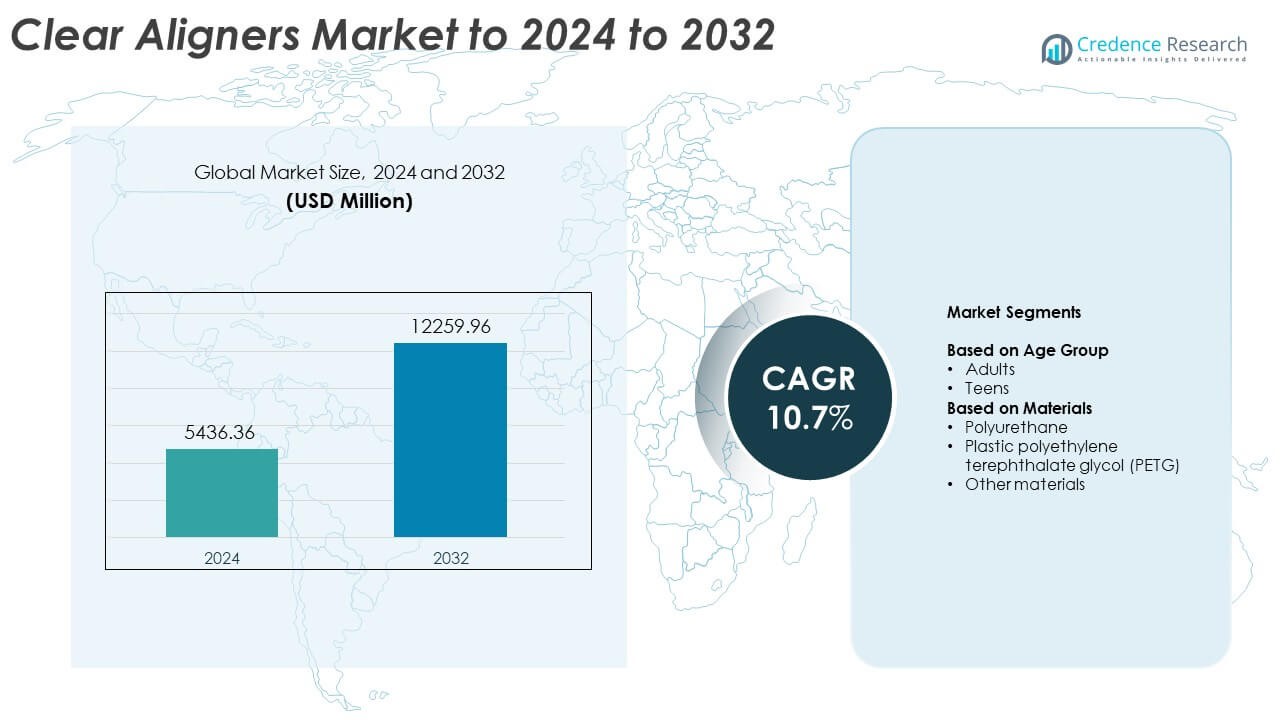

Clear Aligners Market size was valued at USD 5436.36 Million in 2024 and is anticipated to reach USD 12259.96 Million by 2032, at a CAGR of 10.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clear Aligners Market Size 2024 |

USD 5436.36 Million |

| Clear Aligners Market , CAGR |

10.7% |

| Clear Aligners Market Size 2032 |

USD 12259.96 Million |

The clear aligners market is led by major players including Align Technology, Angel Aligner, Henry Schein Inc, SmileDirect Club, Argen Corporation, 3M ESPE, Dentsply Sirona, TP Orthodontics Inc, Envista Corporation, and Institute Straumann. These companies dominate through advanced digital orthodontic technologies, AI-integrated treatment planning, and strong global distribution networks. North America remains the leading region, capturing around 54.3% of the total market share in 2024 due to high adoption of aesthetic dental solutions and well-developed healthcare infrastructure. Europe follows with 23.1% share, supported by strong dental service networks, while Asia Pacific is emerging as the fastest-growing regional market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The clear aligners market was valued at USD 5436.36 million in 2024 and is projected to reach USD 12259.96 million by 2032, growing at a CAGR of 10.7% during the forecast period.

- Rising preference for aesthetic and comfortable dental correction solutions among adults and teens is driving market growth, supported by increasing disposable incomes and digital orthodontic innovations.

- Technological advancements such as AI-assisted treatment planning, 3D printing, and tele-orthodontics are reshaping product development and clinical efficiency.

- The market is highly competitive, with major players investing in customized aligner systems, digital workflows, and sustainable materials to enhance brand positioning and expand global presence.

- North America held the largest regional share at 54.3% in 2024, followed by Europe with 23.1% and Asia Pacific at 13.7%, while adults dominated the age group segment with 65% share and polyurethane led materials with 56% share.

Market Segmentation Analysis:

By Age Group

The adults segment dominates the clear aligners market, accounting for around 65% share in 2024. The dominance is driven by rising demand for aesthetic dental treatments among working professionals and an increase in disposable income. Adults prefer aligners for their comfort, removability, and discreet appearance compared to traditional braces. Growing awareness about oral health and advancements in customized orthodontic solutions further support adoption, solidifying the adult category as the leading contributor to overall market revenue.

- For instance, Angelalign reported 359,400 cases in 2024, with 140,700 outside China.

By Materials

Polyurethane leads the market with approximately 56% share in 2024, owing to its superior flexibility, transparency, and durability. This material ensures better tooth movement control and patient comfort, making it preferred by major manufacturers. Polyurethane aligners also exhibit enhanced resistance to stains and deformation, improving long-term performance. The ongoing development of thermoplastic polyurethane blends tailored for orthodontic applications continues to strengthen this segment’s dominance in the clear aligners market.

- For instance, Straumann’s ClearCorrect states 10× force-retention and 4× tear-resistance versus single-layer polymers.

Key Growth Drivers

Rising Demand for Aesthetic and Convenient Orthodontic Solutions

Consumers increasingly prefer clear aligners over metal braces due to their discreet appearance and removable design. The rising focus on dental aesthetics among adults and teens fuels consistent adoption. Growing awareness about oral hygiene and comfort is further boosting market expansion. The availability of digital treatment planning and customized aligners has enhanced user experience and treatment precision, positioning clear aligners as a mainstream orthodontic solution across developed and emerging economies.

- For instance, makeO toothsi lists over 300,000 smiles designed and over 90,000 smiles transformed or corrected in India.

Technological Advancements in Digital Dentistry

Rapid integration of 3D printing, AI, and intraoral scanning technologies is transforming orthodontic treatment planning. These tools enable faster, more accurate aligner production with minimal errors and improved customization. Digital workflows have streamlined processes from diagnostics to final aligner delivery, reducing chair time for patients. Such innovations not only enhance clinical outcomes but also improve affordability and accessibility, strengthening the competitive positioning of key manufacturers in the global clear aligners market.

- For instance, Envista trained 120,000+ clinicians and launched Spark on Demand.

Rising Awareness and Access to Orthodontic Care

Growing access to dental services, coupled with increasing awareness campaigns, is expanding the consumer base for aligners. Urbanization and improved healthcare infrastructure in developing countries support higher adoption. A growing number of dental professionals are offering clear aligner services, increasing treatment availability. The influence of social media and celebrity endorsements also encourages younger consumers to seek aesthetic correction, driving demand across global markets.

Key Trends and Opportunities

Expansion of Direct-to-Consumer (DTC) Models

Direct-to-consumer aligner brands are reshaping distribution by offering online consultations and home impression kits. These models reduce dependency on traditional orthodontic clinics and make treatments more affordable. The convenience of at-home aligner delivery and virtual monitoring attracts tech-savvy and cost-conscious consumers. This approach also opens opportunities for subscription-based services, enabling consistent customer engagement and higher market penetration, particularly in urban and middle-income regions.

- For instance, Dentsply Sirona suspended Byte sales on October 24, 2024, in consultation with the FDA; its shares fell 6.8% in after-hours trading that day, but closed down 4.5% on the subsequent trading day (Friday).

Adoption of Sustainable and Biocompatible Materials

Manufacturers are increasingly focusing on developing eco-friendly and biocompatible thermoplastic materials for aligners. The trend aligns with global sustainability goals and growing consumer preference for non-toxic, recyclable options. Advances in medical-grade polymers enhance durability and transparency while reducing environmental impact. This shift not only meets regulatory expectations but also strengthens brand image and consumer trust, offering long-term opportunities for differentiation and market growth.

- For instance, Smartee cites over 108 million aligners produced worldwide, serves over 99,000 doctors across multiple continents, and holds over 1,015 patents across more than 57 countries.

Integration of AI in Treatment Customization

AI-driven treatment planning enhances precision by predicting tooth movement and optimizing aligner sequences. Integration of AI tools allows orthodontists to achieve faster results and minimize refinements. These systems improve communication between patients and practitioners through real-time tracking and predictive analytics. Growing AI adoption across digital dentistry presents strong opportunities for innovation and competitive advantage among leading aligner manufacturers.

Key Challenges

High Treatment Costs and Limited Insurance Coverage

The high price of customized aligner treatment remains a major barrier to widespread adoption. Many patients in developing regions still opt for traditional braces due to cost differences and lack of insurance support. The expenses associated with digital scanning, 3D printing, and orthodontic consultations add to the overall treatment cost. Limited reimbursement options further restrict accessibility, particularly in price-sensitive markets, slowing global penetration.

Complexity in Severe Orthodontic Cases

Clear aligners are highly effective for mild to moderate misalignments but face limitations in complex dental corrections. Severe malocclusions often require additional orthodontic interventions or hybrid treatments. This restricts aligner use among patients with advanced orthodontic conditions. Continuous R&D efforts are focused on improving aligner mechanics and material flexibility to expand their treatment scope, yet achieving comparable results to fixed braces remains a significant technical challenge.

Regional Analysis

North America

North America accounted for approximately 54.3% share of the global clear aligners market in 2024. This dominance stems from advanced dental infrastructure, strong consumer awareness of dental aesthetics, and well-established reimbursement policies. Major manufacturers and innovators are headquartered in the U.S., driving product launches and digital workflows. High disposable incomes and broad acceptance of cosmetic orthodontic treatments further support growth. The region continues to lead in clinical adoption and serves as a benchmark for emerging markets seeking to replicate its mature ecosystem.

Europe

Europe held around 23.1% of the global clear aligners market in 2024. The region’s growth is supported by increasing cosmetic dentistry demand, adoption of digital orthodontics, and high dental professional density in markets like Germany, the UK and France. Regulatory frameworks and reimbursement variability pose challenges, but the largely affluent population and rising aesthetic focus aid uptake. Manufacturers are expanding European operations and leveraging local partnerships to adapt solutions for regional preferences, strengthening Europe’s role as the second-largest regional market.

Asia Pacific

Asia Pacific contributed about 13.7% of the global clear aligners market in 2024. Growth in this region is driven by rising disposable incomes, expanding dental care infrastructure in China, India and Japan, and growing awareness of orthodontic aesthetics. Teledentistry and digital platforms are improving treatment access in rural and urban markets alike. Despite lower penetration than mature regions, the region delivers the highest growth potential, making it a strategic target for manufacturers and service providers looking to scale operations and capture emerging demand.

Latin America

Latin America represented roughly 5.1% share of the global clear aligners market in 2024. Growth is catalyzed by increasing demand for cosmetic dental treatments at more affordable cost structures, especially in Brazil and Mexico, and the rise of dental tourism. Limited infrastructure and lower insurance reimbursement hinder penetration, but expanding middle-class spending and rising aesthetic consciousness support potential. The region offers opportunity for manufacturers to introduce cost-effective offerings and digital distribution models tailored to local economic conditions.

Middle East & Africa

The Middle East & Africa region currently holds a modest share of the global clear aligners market, estimated below 5% in 2024. Adoption is driven by urbanisation, rising disposable incomes in Gulf countries, and growing cosmetic dentistry awareness. However, market expansion is constrained by limited specialist orthodontic services in many African markets, regulatory variances and price-sensitivity. Strategic partnerships, local manufacturing and tailored service models represent key avenues to unlock the region’s latent growth potential over the coming years.

Market Segmentations:

By Age Group

By Materials

- Polyurethane

- Plastic polyethylene terephthalate glycol (PETG)

- Other materials

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the clear aligners market features leading players such as Align Technology, Angel Aligner, Henry Schein Inc, SmileDirect Club, Argen Corporation, 3M ESPE, Dentsply Sirona, TP Orthodontics Inc, Envista Corporation, and Institute Straumann. These companies are driving innovation through advanced orthodontic technologies and digital treatment solutions. They are investing heavily in AI-powered design platforms, 3D printing, and remote monitoring tools to improve clinical precision and user experience. Strategic mergers, partnerships, and geographic expansions are strengthening their global reach. Competitive differentiation largely depends on product customization, treatment efficiency, and affordability. Increasing collaboration between dental professionals and technology providers is also enhancing patient engagement and satisfaction. Furthermore, companies are focusing on sustainability and biocompatible materials to meet regulatory and consumer expectations. As digitalization accelerates, competition is shifting toward integrated care models and personalized orthodontic solutions that combine technology, convenience, and clinical effectiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Align Technology launched the commercial availability of the Invisalign System with mandibular advancement featuring occlusal blocks in the U.S. and Canada

- In 2025, Dentsply Sirona showcased the integration of the SureSmile workflow with its cloud-based DS Core platform at the International Dental Show (IDS), demonstrating how digital impressions and AI-enhanced tools are used to create smarter workflows and customized treatment planning.

- In 2024, Straumann Group Launched the latest version of its app, ClearCorrect Sync 2.0, to digitize and streamline clinical operations.

Report Coverage

The research report offers an in-depth analysis based on Age Group, Materials and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The clear aligners market will continue to expand with growing demand for aesthetic dental solutions.

- Technological advancements such as AI and 3D printing will enhance treatment accuracy and efficiency.

- Increasing awareness of oral health will drive adoption among both adults and teens.

- Direct-to-consumer brands will gain traction through online consultations and home delivery models.

- Emerging markets in Asia Pacific and Latin America will offer strong growth opportunities.

- Sustainable and biocompatible materials will become a key focus for manufacturers.

- Integration of digital platforms will streamline diagnostics and treatment planning.

- Dental clinics will adopt hybrid models combining virtual and in-person consultations.

- Price reductions and installment-based plans will improve accessibility for middle-income consumers.

- Strategic partnerships between dental technology firms and healthcare providers will strengthen global market penetration.