Market Overview:

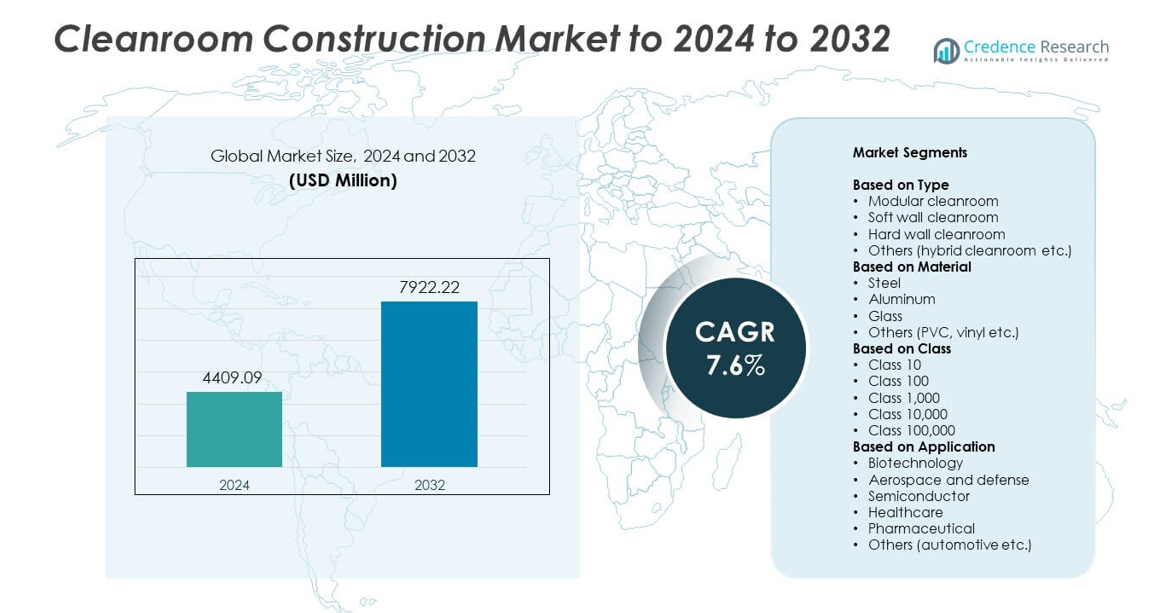

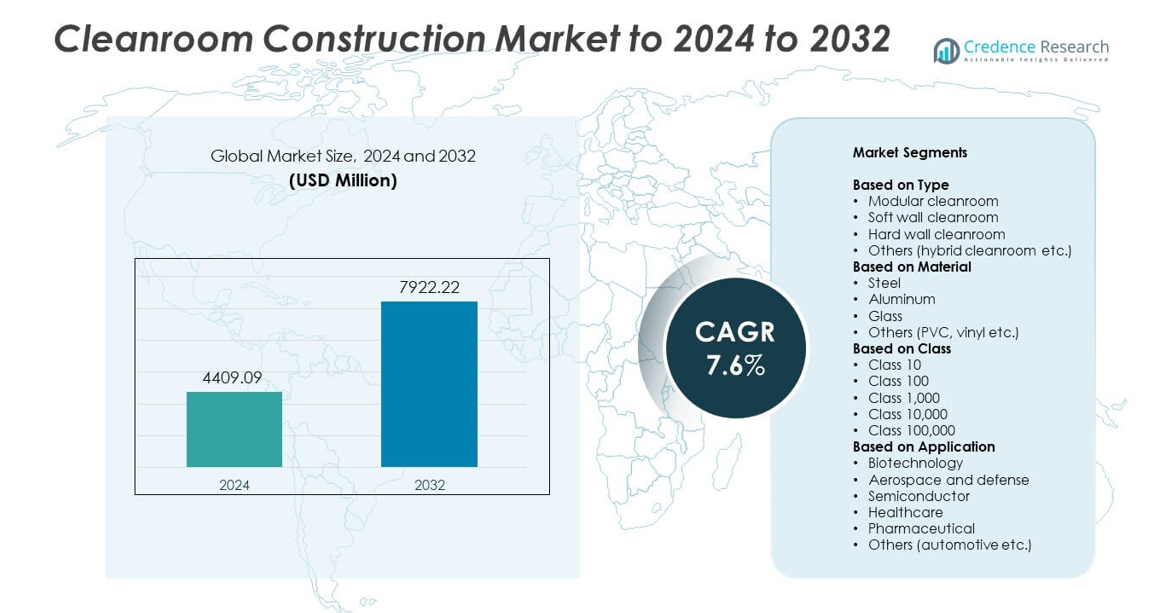

Cleanroom Construction Market size was valued USD 4409.09 Million in 2024 and is anticipated to reach USD 7922.22 Million by 2032, at a CAGR of 7.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cleanroom Construction Market Size 2024 |

USD 4409.09 Million |

| Cleanroom Construction Market, CAGR |

7.6% |

| Cleanroom Construction Market Size 2032 |

USD 7922.22 Million |

The cleanroom construction market features prominent players such as Exyte, Allied Cleanrooms, Angstrom Technology, Performance Contracting Group, Lindner, and American Cleanroom Systems. These companies lead through advanced engineering capabilities, modular construction expertise, and compliance with ISO and GMP standards. They focus on sustainable designs, energy-efficient HVAC integration, and digital monitoring to enhance operational performance. North America dominated the market with a 34.7% share in 2024, driven by robust semiconductor and pharmaceutical infrastructure investments. Asia Pacific followed with a 30.9% share, supported by rapid industrialization and large-scale cleanroom facility expansion in China, South Korea, and Japan.

Market Insights

- The cleanroom construction market was valued at USD 4409.09 million in 2024 and is projected to reach USD 7922.22 million by 2032, growing at a CAGR of 7.6% during the forecast period.

- Rising semiconductor manufacturing and expanding biopharmaceutical production are driving demand for contamination-controlled environments and advanced modular cleanroom solutions.

- Key trends include the adoption of prefabricated structures, energy-efficient HVAC systems, and automation technologies enhancing cleanroom performance and sustainability.

- The market is moderately fragmented, with major players focusing on ISO-compliant designs, technological innovation, and global partnerships to strengthen their competitive position.

- North America led the market with a 34.7% share, followed by Asia Pacific at 30.9% and Europe at 28.5%, while the semiconductor segment dominated with a 42.5% share in 2024 due to increasing chip fabrication projects across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Modular cleanrooms dominated the cleanroom construction market in 2024 with a 62.3% share. Their dominance is driven by faster installation, scalability, and cost-effective maintenance compared to traditional structures. Modular systems allow precise configuration and compliance with ISO standards, making them ideal for semiconductor and pharmaceutical production. The growing demand for flexible and energy-efficient cleanroom setups in new manufacturing facilities supports their expansion. Industries increasingly prefer modular solutions for quick upgrades, reduced downtime, and compatibility with advanced HVAC and filtration technologies.

- For instance, PortaFab installed a 20,000 ft² modular cleanroom for medical devices, integrating low-wall returns and meeting performance objectives.

By Material

Steel accounted for the largest share of 46.8% in the cleanroom construction market in 2024. Its high strength, corrosion resistance, and durability make it a preferred material for long-term cleanroom infrastructure. Steel panels offer excellent sealing properties that help maintain strict contamination control standards. Growing adoption in semiconductor and biotechnology cleanrooms further enhances its demand. The rising focus on sustainable and recyclable construction materials also benefits steel, as manufacturers increasingly use high-grade stainless and galvanized variants for structural integrity and hygiene.

- For instance, Kingspan UltraTech panels specify stainless steel 304/316L skins and standard panel widths 300–1200 mm, with systems approved to FM 4882 at 60 mm thickness.

By Class

Class 1,000 cleanrooms led the market in 2024, capturing a 38.6% share. These cleanrooms are widely adopted in semiconductor and pharmaceutical sectors, where maintaining ultra-low particulate concentration is crucial. They balance cost efficiency and contamination control, making them suitable for both R&D and high-precision manufacturing. Increasing production of microelectronics, vaccines, and medical devices fuels the need for advanced Class 1,000 environments. Demand is also supported by government investments in semiconductor fabs and biopharma facilities adhering to ISO 14644 standards for cleanroom classification.

Key Growth Drivers

Rising Semiconductor Manufacturing Expansion

The surge in semiconductor fabrication globally is a primary growth driver for the cleanroom construction market. Increasing investment in advanced chip manufacturing, driven by AI, 5G, and electric vehicles, is boosting demand for contamination-free production environments. Leading chipmakers are expanding facilities requiring precise air quality and temperature control. Governments are also supporting semiconductor self-sufficiency, further accelerating cleanroom adoption. This expansion strengthens infrastructure needs for ISO-compliant, modular, and energy-efficient cleanrooms tailored to microelectronics manufacturing.

- For instance, Intel’s D1X expansion (Mod 3) in Oregon, which opened in April 2022, added 270,000 ft² of cleanroom space for advanced process technology development.

Growing Biopharmaceutical Production Facilities

The rapid growth of biopharmaceutical manufacturing is fueling demand for cleanroom infrastructure. Strict regulatory standards for sterile production in vaccines, biologics, and cell therapy require advanced controlled environments. The industry’s shift toward modular and flexible cleanrooms ensures faster deployment and better contamination control. Increasing global investments in biologics R&D and contract manufacturing organizations are driving large-scale construction of cGMP-compliant facilities. This trend highlights the essential role of cleanroom construction in maintaining production integrity and safety.

- For instance, WuXi Biologics lifted a Hangzhou site from 8,000 L to 23,000 L by commissioning three 5,000 L single-use bioreactors.

Stringent Regulatory and Quality Standards

Rising global enforcement of quality and contamination control regulations boosts cleanroom construction activity. Industries such as pharmaceuticals, healthcare, and aerospace must comply with ISO 14644 and FDA cleanroom standards. This drives companies to upgrade or build new facilities with advanced air filtration, HVAC, and monitoring systems. The growing emphasis on maintaining product purity and safety standards across regulated sectors continues to strengthen the market’s expansion. Compliance-driven demand ensures consistent growth across multiple end-use industries.

Key Trends & Opportunities

Adoption of Modular and Prefabricated Cleanrooms

The shift toward modular construction is a major trend shaping the cleanroom industry. Modular cleanrooms offer faster installation, scalability, and reduced operational downtime. Manufacturers benefit from flexible configurations that support changing production requirements and regulatory updates. Increasing preference for prefabricated components also allows precise quality control during manufacturing. This trend is creating opportunities for suppliers offering turnkey modular cleanroom solutions across semiconductor, pharmaceutical, and biotechnology sectors.

- For instance, AES Clean Technology’s Faciliflex Express offers pre-designed, standardized cleanroom layouts in three models of approximately 5,000, 15,000, and 30,000 ft².

Integration of Energy-Efficient HVAC Systems

Sustainability is emerging as a key opportunity in cleanroom construction through energy-efficient HVAC design. Advanced airflow management and heat recovery technologies are reducing energy consumption while maintaining cleanroom integrity. Manufacturers are adopting variable airflow systems and smart monitoring to optimize resource usage. The focus on lowering carbon emissions and operational costs aligns with green manufacturing goals, driving adoption of energy-optimized cleanroom systems. This creates a competitive advantage for firms offering eco-efficient cleanroom infrastructure.

- For instance, EECO2’s dynamic control at Cambridge Pharma achieved ~50% fan-energy reduction versus a static 15 ACH baseline, while holding ISO 7 within 20–30% of limits.

Key Challenges

High Construction and Maintenance Costs

The high capital and operational expenses associated with cleanroom facilities pose a significant challenge. Advanced filtration systems, precision HVAC units, and stringent material standards elevate overall costs. Maintenance requirements for air purity, temperature control, and equipment calibration further add to expenses. Small and medium-sized enterprises often face barriers to entry due to these costs, limiting broader market penetration. The need for cost-effective yet compliant solutions remains a key industry concern.

Complex Design and Regulatory Compliance

Designing cleanrooms that meet diverse industry and regional standards is increasingly complex. Each application—semiconductor, pharmaceutical, or aerospace—demands unique environmental controls and layouts. Adhering to ISO and FDA guidelines requires specialized engineering expertise and high precision in system integration. Frequent updates to regulatory frameworks add further design and validation challenges. These complexities extend project timelines and increase risk for construction firms operating in regulated industries.

Regional Analysis

North America

North America held a 34.7% share of the cleanroom construction market in 2024. The region’s dominance is supported by strong demand from semiconductor, biotechnology, and

pharmaceutical manufacturing sectors. Government initiatives promoting domestic chip fabrication and pharmaceutical R&D investments are driving large-scale cleanroom installations. The presence of key players and advanced technology infrastructure further supports market expansion. Growing adoption of modular and energy-efficient cleanroom systems enhances operational flexibility and sustainability across manufacturing facilities in the United States and Canada.

Europe

Europe accounted for 28.5% of the global cleanroom construction market in 2024. Rising regulatory standards under the EU GMP framework and rapid growth in biopharmaceutical production are key factors driving demand. The region’s established aerospace and medical device industries also contribute significantly to cleanroom infrastructure development. Countries such as Germany, France, and the Netherlands are leading in modular and prefabricated cleanroom adoption. The increasing focus on energy-efficient designs and clean manufacturing practices supports continuous investments across pharmaceutical and microelectronics sectors.

Asia Pacific

Asia Pacific captured a 30.9% share of the cleanroom construction market in 2024, emerging as the fastest-growing region. Expansion in semiconductor manufacturing hubs such as China, South Korea, Taiwan, and Japan is fueling significant demand. Rapid industrialization, coupled with government incentives for local chip and biopharma production, accelerates cleanroom facility construction. The region also benefits from lower construction costs and growing pharmaceutical contract manufacturing activities. Increasing adoption of advanced filtration and contamination control technologies continues to enhance cleanroom standards across key Asian economies.

Latin America

Latin America represented a 3.6% share of the cleanroom construction market in 2024. The market growth is primarily driven by increasing pharmaceutical and healthcare infrastructure investments in countries such as Brazil and Mexico. Expanding vaccine manufacturing capacity and rising demand for sterile environments in medical facilities are supporting new cleanroom projects. Regional manufacturers are gradually adopting modular systems to ensure cost-efficient installations. Strengthening regulatory standards and international partnerships in life sciences are expected to boost further development of cleanroom construction capabilities across the region.

Middle East & Africa

The Middle East & Africa region accounted for 2.3% of the cleanroom construction market in 2024. Growing investments in pharmaceutical production, healthcare modernization, and research facilities are driving market growth. Countries such as the United Arab Emirates and Saudi Arabia are focusing on developing high-quality cleanroom spaces to support biotechnology and medical innovation. Rising demand for contamination-controlled environments in energy and aerospace sectors also contributes to regional expansion. Increasing government initiatives to diversify industrial output continue to support long-term cleanroom infrastructure growth.

Market Segmentations:

By Type

- Modular cleanroom

- Soft wall cleanroom

- Hard wall cleanroom

- Others (hybrid cleanroom etc.)

By Material

- Steel

- Aluminum

- Glass

- Others (PVC, vinyl etc.)

By Class

- Class 10

- Class 100

- Class 1,000

- Class 10,000

- Class 100,000

By Application

- Biotechnology

- Aerospace and defense

- Semiconductor

- Healthcare

- Pharmaceutical

- Others (automotive etc.)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cleanroom construction market is characterized by the presence of key players such as Exyte, Allied Cleanrooms, Cleanroom Construction Associates, Longden Company, Advanced Technology Group, Performance Contracting Group, Hodess, Total Clean Air, Angstrom Technology, Lindner, Ecos, American Cleanroom Systems, Grifols, Clean Air Technology, Nicos Group, and ACH Engineering. The market remains highly competitive, with companies focusing on turnkey solutions, modular cleanroom designs, and advanced contamination control systems. Leading firms emphasize technological innovation through energy-efficient HVAC integration, prefabricated modules, and compliance with global ISO and GMP standards. Strategic partnerships with semiconductor, biopharmaceutical, and healthcare firms are expanding project portfolios worldwide. Increasing demand for flexible, scalable, and cost-effective cleanroom solutions drives investment in automation and digital project management. Moreover, firms are strengthening their regional presence through acquisitions and collaborations to meet growing requirements for high-performance cleanroom facilities across emerging and developed markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Exyte

- Allied Cleanrooms

- Cleanroom Construction Associates

- Longden Company

- Advanced Technology Group

- Performance Contracting Group

- Hodess

- Total Clean Air

- Angstrom Technology

- Lindner

- Ecos

- American Cleanroom Systems

- Grifols

- Clean Air Technology

- Nicos Group

- ACH Engineering

Recent Developments

- In 2025, Angstrom Technology established “Angstrom Life Science Solutions” as a separate unit serving life-science clients. The rebrand formalized a dedicated cleanroom offering for regulated markets.

- In 2025, Exyte and JGC Corporation launched a new joint Engineering, Procurement, and Construction (EPC) brand named “Nixyte” to serve high-tech industries, including advanced cleanroom projects, across Southeast Asia.

- In 2024, Hodess Cleanrooms acquired Labworks International, expanding design-build and validation capabilities into Canada.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Class, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing semiconductor manufacturing will continue to drive large-scale cleanroom infrastructure investments.

- Modular and prefabricated cleanroom systems will see higher adoption due to flexibility and faster setup.

- Rising biopharmaceutical production will expand demand for cGMP-compliant cleanroom facilities.

- Energy-efficient HVAC and filtration technologies will shape future cleanroom designs.

- Increasing automation and smart monitoring systems will enhance operational efficiency.

- Stringent global regulatory standards will push industries toward advanced contamination control systems.

- Asia Pacific will remain the fastest-growing region with expanding electronics and pharma sectors.

- Sustainability goals will encourage the use of recyclable materials and low-energy systems.

- Collaboration between construction firms and technology providers will strengthen integrated cleanroom solutions.

- Continuous innovation in cleanroom materials and design will improve long-term cost efficiency and performance.