Market Overview:

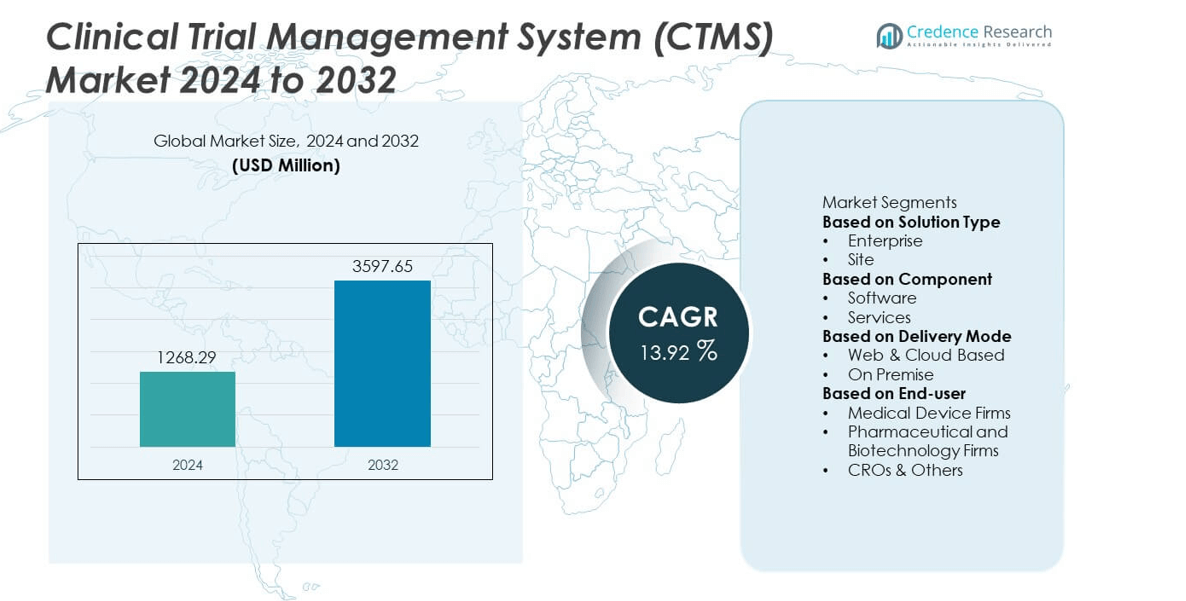

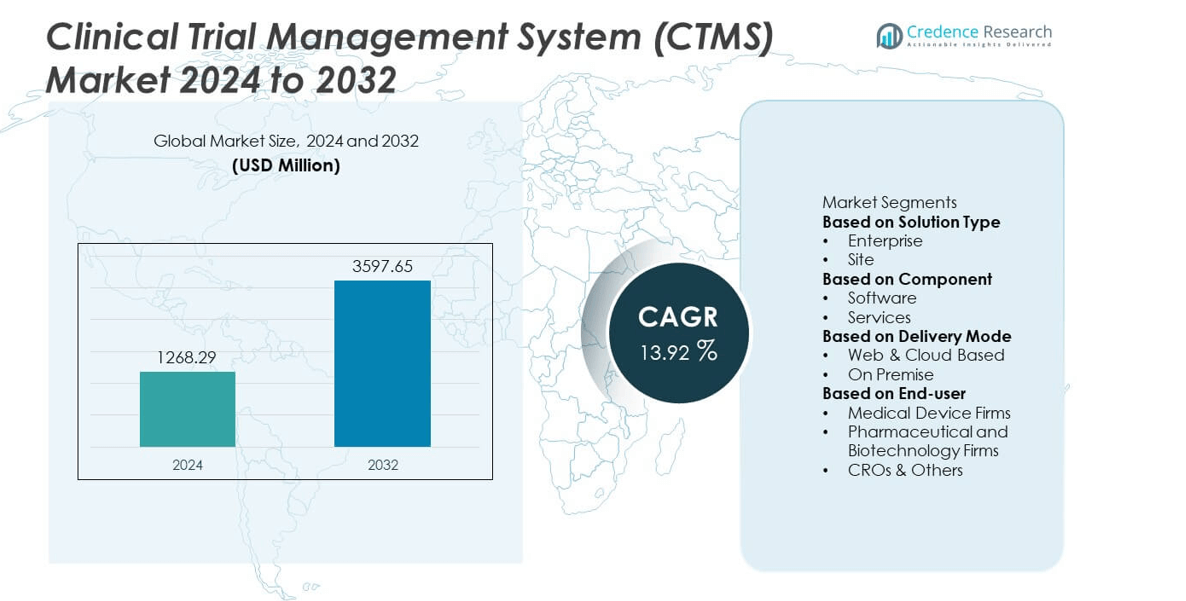

The Clinical Trial Management System (CTMS) market was valued at USD 1268.29 million in 2024 and is projected to reach USD 3597.65 million by 2032, growing at a CAGR of 13.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Trial Management System (CTMS) Market Size 2024 |

USD 1268.29 million |

| Clinical Trial Management System (CTMS) Market, CAGR |

13.92% |

| Clinical Trial Management System (CTMS) Market Size 2032 |

USD 3597.65 million |

The Clinical Trial Management System (CTMS) market is led by major players including Clario, RealTime Software Solutions, LLC, Medidata (Dassault Systèmes), Oracle, SimpleTrials, Laboratory Corporation of America Holdings, Calyx (formerly Parexel Informatics), Veeva Systems, IQVIA, Inc., and DATATRAK International, Inc. These companies dominate the market through advanced cloud-based CTMS platforms that enhance trial efficiency, regulatory compliance, and real-time analytics. North America led the global CTMS market with a 44.3% share in 2024, supported by a strong clinical research ecosystem and rapid adoption of AI-driven digital solutions. Europe followed with a 27.5% share, while Asia-Pacific emerged as the fastest-growing region due to expanding R&D investments and increasing clinical trial outsourcing.

Market Insights

- The Clinical Trial Management System (CTMS) market was valued at USD 1268.29 million in 2024 and is projected to reach USD 3597.65 million by 2032, growing at a CAGR of 13.92%.

- Increasing clinical trial volumes and rising demand for centralized data management are driving CTMS adoption among pharmaceutical, biotechnology, and contract research organizations.

- Cloud-based and AI-integrated CTMS platforms are gaining traction, supporting decentralized and hybrid trial models with enhanced automation and real-time monitoring.

- The market is highly competitive, with key players such as Oracle, Medidata (Dassault Systèmes), IQVIA, and Veeva Systems focusing on innovation, partnerships, and system interoperability.

- North America dominated the CTMS market with a 44.3% share in 2024, followed by Europe with 27.5%, while the web and cloud-based segment led by delivery mode with 66.8% share due to scalability and remote accessibility advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution Type

Enterprise solutions dominated the Clinical Trial Management System (CTMS) market in 2024, accounting for 63.4% of the total share. Their leadership is driven by large-scale adoption among pharmaceutical companies, contract research organizations (CROs), and academic research institutions conducting multi-site and complex clinical trials. Enterprise CTMS platforms enable centralized monitoring, advanced analytics, and seamless collaboration across global trial operations. The growing need for unified data management and compliance with regulatory standards such as FDA 21 CFR Part 11 further supports segment growth. Continuous integration of automation and AI tools enhances efficiency and decision-making across enterprise-level trials.

- For instance, Medidata, a Dassault Systèmes company, reported that over 33,000 clinical studies were managed on its enterprise CTMS platform globally. The system integrated 7 million trial participants across 140 countries, supporting both site-level and sponsor-level operations through automated compliance and analytics dashboards.

By Component

Software held the largest market share of 71.2% in 2024, reflecting the growing demand for integrated, user-friendly CTMS platforms that streamline study planning and data tracking. The segment’s growth is driven by advancements in cloud computing, data visualization, and workflow automation. Software solutions enable real-time trial monitoring, resource optimization, and effective site management, ensuring greater transparency and accuracy. Pharmaceutical and biotechnology companies are investing in configurable CTMS software to improve productivity and regulatory compliance. The increasing focus on remote trials and digital transformation further fuels the dominance of this segment.

- For instance, Veeva Systems reported that over 200 organizations used its Vault CTMS platform, helping manage more than 1 million patients across studies. The platform’s automated workflows and digital reporting tools have led to metrics such as a 50% decrease in average days from site selection to ready for enrollment.

By Delivery Mode

The web and cloud-based segment led the Clinical Trial Management System (CTMS) market in 2024 with a 66.8% share. Cloud deployment offers scalability, cost efficiency, and real-time access to trial data, making it the preferred choice for sponsors and CROs managing multiple trial sites. These solutions facilitate remote monitoring, secure data sharing, and simplified system upgrades without extensive IT infrastructure. The rising shift toward decentralized and hybrid clinical trials strengthens demand for flexible cloud-based CTMS models. Continuous investment in cybersecurity and compliance features ensures safe and reliable data handling, further driving segment expansion.

Key Growth Drivers

Increasing Number of Clinical Trials Globally

The rising volume of clinical trials across therapeutic areas such as oncology, cardiology, and neurology is a primary growth driver for the CTMS market. Pharmaceutical and biotechnology companies are expanding R&D investments, leading to higher demand for efficient trial management tools. CTMS platforms help streamline operations, improve patient recruitment, and ensure compliance with complex regulatory frameworks. The growing need for real-time data tracking and centralized control in multi-regional studies continues to accelerate adoption among sponsors and contract research organizations (CROs).

- For instance, IQVIA is a leading global provider of clinical research services and healthcare intelligence with approximately 91,000 employees in over 100 countries. The company leverages its Connected Intelligence platform, which includes advanced analytics and AI, to manage and analyze data on a large scale to support a wide variety of clinical studies and accelerate the development and commercialization of treatments.

Adoption of Cloud-Based and Integrated Solutions

Cloud-based CTMS solutions are gaining significant traction due to their scalability, cost-effectiveness, and ease of deployment. These systems enable remote accessibility, real-time collaboration, and integration with other clinical software such as electronic data capture (EDC) and electronic trial master file (eTMF). As hybrid and decentralized clinical trials expand, cloud-based platforms ensure secure data handling and operational transparency. The growing demand for flexible, interoperable solutions among CROs and sponsors further strengthens this segment’s growth trajectory.

- For instance, Oracle Life Sciences reported that its cloud-based CTMS platform managed data for over 250,000 global trials to date through the Oracle Health Sciences Clinical One environment. The platform integrates seamlessly with EDC and eTMF modules to provide unified, real-time oversight for sponsors and CROs.

Regulatory Emphasis on Data Transparency and Compliance

Stringent regulatory requirements from agencies like the FDA, EMA, and MHRA are driving the adoption of CTMS platforms to ensure compliance and data integrity. These systems offer audit trails, automated reporting, and standardized workflows that align with Good Clinical Practice (GCP) and 21 CFR Part 11 guidelines. The emphasis on traceability and documentation across global trials promotes the use of advanced CTMS for consistent quality assurance. Compliance-focused solutions also reduce manual errors and improve overall trial accountability.

Key Trends & Opportunities

Integration of Artificial Intelligence and Analytics

The integration of AI and predictive analytics into CTMS platforms is transforming trial management. These technologies enhance decision-making by identifying potential bottlenecks, optimizing site selection, and improving patient recruitment. Machine learning algorithms can analyze historical data to forecast trial outcomes and improve resource allocation. AI-enabled dashboards also enable real-time monitoring of performance metrics, enhancing trial visibility. The growing use of analytics-driven CTMS offers new opportunities for data-driven insights and operational efficiency across clinical research ecosystems.

- For instance, Clario uses AI-powered analytics to process clinical data points from imaging, ECG, and wearable devices integrated into its CTMS ecosystem. Its predictive analytics tools have been shown to improve the efficiency, accuracy, and speed of data quality assessment, allowing for rapid identification of problematic data.

Growing Demand for Decentralized and Hybrid Clinical Trials

Decentralized and hybrid clinical trial models are reshaping the demand for digital trial management solutions. CTMS platforms are evolving to support remote data capture, telemedicine integration, and virtual patient engagement. These models enhance participant convenience and improve recruitment rates, particularly in geographically diverse studies. Vendors offering flexible and interoperable CTMS architectures are well-positioned to capitalize on this trend. As regulatory bodies increasingly recognize decentralized trial data, the adoption of adaptive CTMS platforms will continue to expand.

- For instance, Labcorp Drug Development has conducted numerous decentralized and hybrid clinical trials using its technology ecosystem, which integrates various digital health technologies and platforms (including a partnership with Medable’s software platform). This system has supported significant digital recruitment and facilitated millions of patient interactions, enabling faster enrollment and improved data accuracy across geographically dispersed study sites.

Key Challenges

High Implementation and Maintenance Costs

The deployment of CTMS platforms involves substantial investment in software licensing, system customization, and user training. Smaller organizations and academic institutions often face budget constraints that limit adoption. Ongoing maintenance, data migration, and integration with legacy systems add to operational costs. The need for continuous software upgrades to comply with evolving regulations also increases financial pressure. Vendors are addressing these challenges through subscription-based pricing models and modular solutions, but cost remains a key restraint in broader market penetration.

Data Security and Integration Concerns

Ensuring data security and seamless integration across multiple clinical systems poses a persistent challenge. CTMS platforms handle sensitive patient and trial information, making them vulnerable to cyber threats and breaches. Variations in data standards and interoperability across EDC, LIMS, and eTMF systems further complicate integration. Maintaining regulatory compliance while managing multi-regional data transfers increases system complexity. To overcome these issues, companies are investing in advanced encryption, secure cloud infrastructure, and standardized APIs for better connectivity and data protection.

Regional Analysis

North America

North America dominated the Clinical Trial Management System (CTMS) market in 2024, accounting for 44.3% of the total share. The region’s leadership is driven by the presence of major pharmaceutical companies, high clinical trial activity, and advanced digital infrastructure. The United States remains the key contributor, supported by strong regulatory oversight and early adoption of cloud-based CTMS solutions. Growing investments in clinical research and increasing demand for AI-integrated platforms enhance market growth. The region’s emphasis on automation, data accuracy, and real-time monitoring continues to strengthen its dominance in global CTMS adoption.

Europe

Europe held a 27.5% share of the Clinical Trial Management System (CTMS) market in 2024, supported by robust clinical research networks and strong regulatory frameworks. The region’s growth is fueled by initiatives promoting trial transparency and cross-border collaboration under the European Medicines Agency (EMA). Countries such as Germany, the United Kingdom, and France are major adopters, driven by digital transformation in trial management. Increasing reliance on web-based CTMS solutions and rising clinical trial volumes in biotechnology further support expansion. Partnerships between CROs and software providers are boosting operational efficiency across regional research ecosystems.

Asia-Pacific

Asia-Pacific accounted for 19.2% of the Clinical Trial Management System (CTMS) market in 2024 and is projected to record the fastest growth through 2032. Rapid expansion of clinical research in China, India, Japan, and South Korea drives regional demand. Cost-effective trial operations, growing R&D investments, and supportive government policies encourage adoption of CTMS solutions. The rise of decentralized and hybrid clinical trials in the region further strengthens digital infrastructure. Expanding partnerships between global CROs and local research organizations also enhance scalability, positioning Asia-Pacific as a key growth hub in the global CTMS market.

Latin America

Latin America captured 5.6% of the Clinical Trial Management System (CTMS) market share in 2024, driven by increasing participation in multinational clinical trials and growing biopharmaceutical activity. Brazil and Mexico lead regional growth due to expanding healthcare infrastructure and favorable trial regulations. The adoption of cloud-based CTMS solutions is rising as sponsors seek cost-efficient trial management tools. Investments in local CRO partnerships and training initiatives are improving operational capabilities. Despite infrastructure limitations in smaller markets, Latin America’s strengthening role in global clinical research supports consistent market expansion.

Middle East & Africa

The Middle East & Africa held a 3.4% share of the Clinical Trial Management System (CTMS) market in 2024. Growth in the region is supported by expanding clinical trial operations in the Gulf Cooperation Council (GCC) countries and South Africa. Government initiatives encouraging R&D and healthcare digitization are driving adoption of CTMS platforms. The demand for cloud-based and scalable trial management systems is increasing among regional CROs and hospitals. However, limited research infrastructure and technical expertise continue to challenge broader market penetration, creating opportunities for partnerships with global CTMS providers.

Market Segmentations:

By Solution Type

By Component

By Delivery Mode

- Web & Cloud Based

- On Premise

By End-user

- Medical Device Firms

- Pharmaceutical and Biotechnology Firms

- CROs & Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Clinical Trial Management System (CTMS) market is highly competitive, featuring key players such as Clario, RealTime Software Solutions, LLC, Medidata (Dassault Systèmes), Oracle, SimpleTrials, Laboratory Corporation of America Holdings, Calyx (formerly Parexel Informatics), Veeva Systems, IQVIA, Inc., and DATATRAK International, Inc. These companies are focused on developing advanced CTMS platforms that integrate artificial intelligence, analytics, and cloud-based technologies to improve trial efficiency and data management. Strategic collaborations, product enhancements, and acquisitions are central to strengthening their global presence and technological capabilities. Leading vendors are expanding their service portfolios to support hybrid and decentralized clinical trials, enabling real-time tracking, automation, and regulatory compliance. The growing demand for interoperable systems that integrate seamlessly with electronic data capture (EDC) and electronic trial master file (eTMF) solutions continues to shape market competition. Overall, innovation, data security, and scalability remain the primary differentiating factors among CTMS providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clario

- RealTime Software Solutions, LLC

- Medidata (Dassault Systèmes)

- Oracle

- SimpleTrials

- Laboratory Corporation of America Holdings

- Calyx (formerly Parexel Informatics)

- Veeva Systems

- IQVIA, Inc.

- DATATRAK International, Inc.

Recent Developments

- In September 2025, IQVIA, Inc. introduced its Clinical Trial Financial Suite (CTFS), a next-generation platform integrating budgeting, contracting, forecasting and payments for clinical trials, with first commercial release slated for Q1 2026.

- In February 2025, Oracle Corporation’s Life Sciences unit was designated “Leader” in the Everest Group PEAK Matrix® assessment for CTMS products, underscoring its strong deployment and extensibility credentials.

- In February 2025, Medidata Solutions (a brand of Dassault Systèmes) announced it would highlight AI-powered, data-driven study design and execution capabilities—applicable to its CTMS offerings—at the annual SCOPE 2025 conference

Report Coverage

The research report offers an in-depth analysis based on Solution Type, Component, Delivery Mode, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The CTMS market will expand rapidly with the rising number of global clinical trials.

- Cloud-based CTMS platforms will dominate due to their scalability and remote accessibility.

- Integration of AI and machine learning will enhance data accuracy and trial forecasting.

- Decentralized and hybrid trial models will drive demand for flexible CTMS solutions.

- Vendors will focus on interoperability with EDC, eTMF, and patient engagement systems.

- Real-time analytics and predictive dashboards will improve decision-making in trial management.

- Data security and compliance technologies will become a top priority for CTMS providers.

- Emerging markets in Asia-Pacific and Latin America will see strong CTMS adoption.

- Strategic collaborations between CROs and software vendors will accelerate product innovation.

- Automation and digital monitoring will continue transforming clinical operations and efficiency.