Market overview

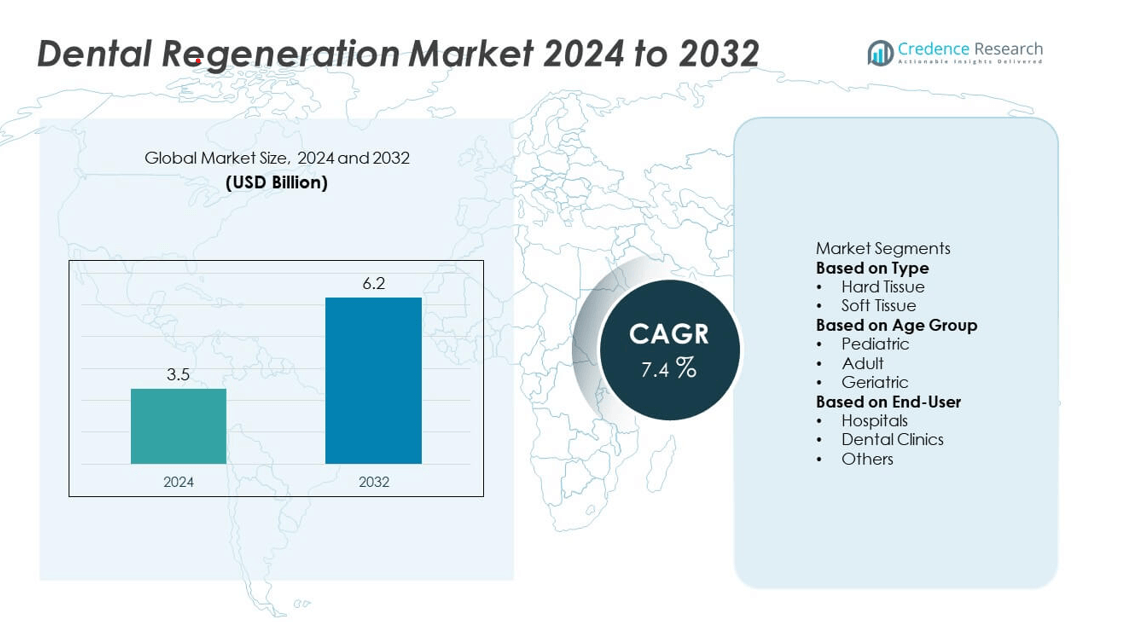

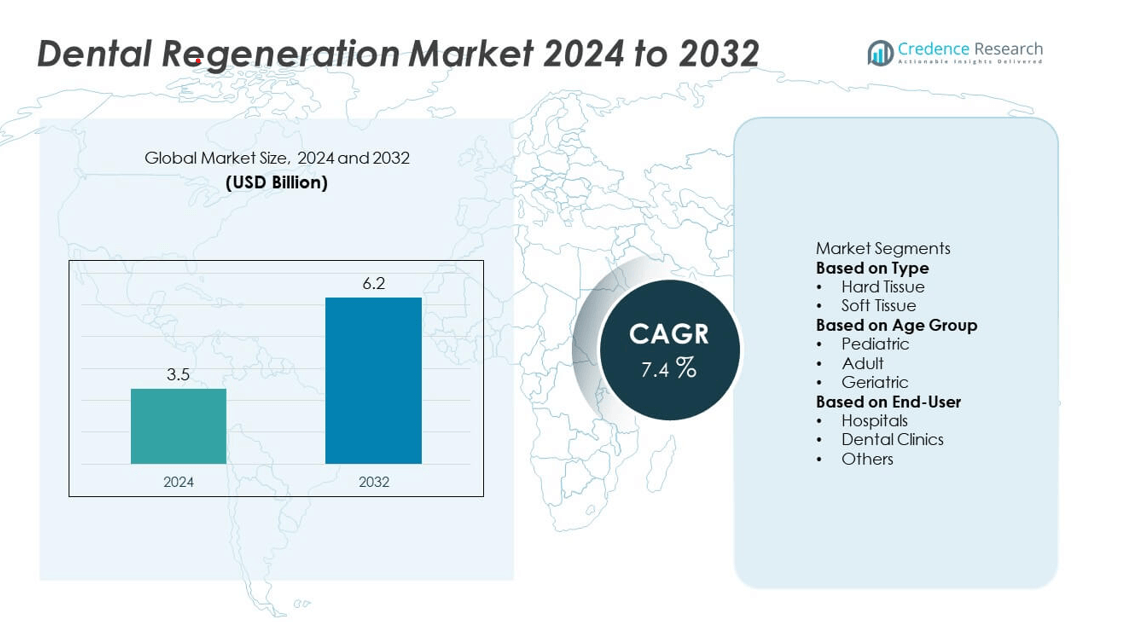

The dental regeneration market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.2 billion by 2032, expanding at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Regeneration Market Size 2024 |

USD 3.5 billion |

| Dental Regeneration Market, CAGR |

7.4% |

| Dental Regeneration Market Size 2032 |

USD 6.2 billion |

The dental regeneration market is led by major players including Aspen Dental Clinic, Delta Dental, Clove Dental, My Dentist, Axiss Dental, Heartland Dental, Apollo White Dental, Smile Dental Care, Floss Dental Clinic, and Integrated Dental Holdings. These companies dominate through extensive clinical networks, adoption of biomaterial-based therapies, and integration of regenerative treatments in restorative and cosmetic dentistry. North America leads the global market with a 38% share, supported by advanced dental infrastructure and high awareness of regenerative treatments. Europe follows with a 29% share, driven by strong R&D activity and increasing adoption of biomaterial-based grafts, while Asia-Pacific holds a 23% share, fueled by rising dental tourism and growing access to advanced dental care.

Market Insights

- The dental regeneration market was valued at USD 3.5 billion in 2024 and is projected to reach USD 6.2 billion by 2032, expanding at a CAGR of 7.4% during the forecast period.

- Growing prevalence of periodontal diseases and tooth loss is driving demand for hard and soft tissue regeneration procedures.

- Advancements in biomaterials, stem cell therapy, and 3D-printed scaffolds are shaping innovation in regenerative dentistry.

- Leading players such as Aspen Dental Clinic, Delta Dental, and Heartland Dental focus on expanding regenerative treatment portfolios and clinical integration.

- North America holds a 38% share, followed by Europe at 29% and Asia-Pacific at 23%, while the hard tissue segment leads with 59% share, driven by increasing adoption of bone graft substitutes and biomaterial-based restorative procedures across clinical and hospital settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The hard tissue segment dominated the dental regeneration market in 2024 with a 59% share, driven by the increasing prevalence of bone loss and periodontal diseases. Hard tissue regeneration is essential for restoring alveolar bone and supporting dental implants. Rising adoption of bone graft substitutes and stem cell-based biomaterials enhances regeneration outcomes. The growing popularity of bioactive ceramics and growth-factor-based scaffolds further supports this segment. Continuous advancements in guided bone regeneration and synthetic graft technologies are strengthening its dominance in both restorative and implant dentistry applications.

- For instance, Geistlich Pharma developed Bio-Oss Collagen, a bovine-derived bone substitute containing 90% cancellous granules and 10% porcine collagen matrix. The material has a porosity of 75–80% and particle size between 0.25–1 mm, supporting predictable bone regeneration. Clinical evaluations show average new bone formation of 45.6% after six months of healing, improving graft integration and implant stability.

By Age Group

The adult segment accounted for a 52% share of the dental regeneration market in 2024, supported by a high incidence of dental caries, trauma, and periodontal disorders. Adults increasingly seek regenerative solutions for tooth and bone restoration driven by rising awareness of advanced treatment options. The surge in cosmetic dentistry and implant procedures further fuels demand. Technological advancements such as platelet-rich plasma (PRP) and stem cell therapies enhance regenerative efficiency, promoting adoption among adults seeking minimally invasive and long-term restorative dental treatments across both developed and emerging economies.

- For instance, Straumann Group introduced the Emdogain gel, composed of enamel matrix derivative proteins at a concentration of 30 mg/mL in propylene glycol alginate. The formulation promotes periodontal ligament regeneration and cementum formation. Clinical studies demonstrate a mean clinical attachment gain of 2.9 mm within nine months of application, supporting improved soft and hard tissue healing in adult periodontal treatments.

By End-User

The dental clinics segment held the largest market share of 47% in 2024, attributed to the increasing availability of advanced dental regeneration procedures in clinical settings. Clinics are integrating biomaterial-based and cell-mediated therapies for faster tissue healing and restoration. Rising preference for personalized treatment and shorter recovery times has strengthened clinic-based adoption. The expansion of specialized regenerative dentistry centers, along with growing investment in digital diagnostics and 3D imaging, supports this segment’s leadership. Moreover, rising patient preference for cost-effective and accessible clinical care drives continuous growth in the dental clinics segment.

Key Growth Drivers

Increasing Prevalence of Periodontal and Dental Disorders

Rising cases of periodontal disease, tooth decay, and bone loss are major factors driving the dental regeneration market. Growing awareness of oral health and advancements in restorative dentistry are fueling the demand for tissue regeneration procedures. Aging populations and lifestyle-related dental problems are also increasing treatment needs. Clinicians are adopting bioactive materials and growth-factor-based therapies for faster healing and improved outcomes. This rising focus on preventive and regenerative oral care is propelling market expansion across hospitals and specialized dental clinics.

- For instance, Dentsply Sirona launched the OSSIX Plus membrane, made of cross-linked collagen with a resorption time of up to 26 weeks, designed for guided bone and tissue regeneration. The membrane maintains structural integrity for predictable bone healing, achieving up to 3.8 mm of new bone height in clinical studies. This innovation enhances post-surgical outcomes in periodontal and implant procedures.

Advancements in Biomaterials and Stem Cell Technologies

Innovations in biomaterials, stem cell therapy, and tissue engineering are significantly enhancing dental regeneration capabilities. Researchers are developing synthetic grafts, collagen membranes, and bioactive scaffolds that support natural tissue formation. Stem cell-based therapies, in particular, have shown strong potential in repairing damaged bone and soft tissues. These technological breakthroughs are enabling less invasive and more predictable results. Continuous investment in research and clinical trials is expanding the use of regenerative materials in implantology and reconstructive dental procedures.

- For instance, Institut Straumann AG developed the BoneCeramic graft, consisting of 60% hydroxyapatite and 40% beta-tricalcium phosphate, which offers controlled resorption and osteoconductivity. This biomaterial is suitable for bone repair applications in oral surgeries and can be used alone or in combination with autogenous bone.

Rising Demand for Cosmetic and Restorative Dentistry

The growing preference for aesthetic dental restoration is boosting demand for regenerative treatments. Patients are increasingly opting for advanced solutions to restore natural tooth structure and gum aesthetics. The rise in dental tourism and greater affordability of cosmetic procedures are strengthening this trend. Dental clinics and hospitals are expanding their service portfolios with regenerative solutions such as guided tissue regeneration and bone augmentation. Improved clinical outcomes and faster recovery times are driving adoption among both middle-aged and elderly populations seeking functional and aesthetic restoration.

Key Trends and Opportunities

Integration of 3D Printing and Digital Dentistry

The use of 3D printing and computer-aided design technologies is transforming dental regeneration procedures. Customized grafts, scaffolds, and membranes can now be fabricated with high precision, improving treatment success rates. Digital imaging and intraoral scanning further enhance diagnosis and surgical planning. The combination of regenerative materials with digital workflows reduces procedure time and improves patient outcomes. This technological convergence presents significant growth opportunities for manufacturers and dental service providers focusing on personalized, efficient regenerative treatment solutions.

- For instance, 3D Systems developed the NextDent 5100 printer, utilizing Figure 4 technology capable of producing biocompatible dental components with enhanced speed, precision, and efficiency.

Growing Adoption of Bioactive and Growth-Factor-Based Materials

Bioactive materials that stimulate tissue regeneration are gaining traction in dental practices worldwide. Products containing growth factors, calcium phosphates, and collagen are increasingly used for bone and soft tissue regeneration. These materials promote faster healing and stronger integration with existing tissue. Companies are investing in biocompatible and resorbable products that align with natural biological processes. As patient preference shifts toward safe and predictable treatments, the adoption of next-generation biomaterials is expected to accelerate, creating new opportunities for innovation and market expansion.

- For instance, Medtronic introduced the INFUSE Bone Graft, which contains recombinant human bone morphogenetic protein-2 (rhBMP-2) on an absorbable collagen sponge carrier. The product is approved for specific uses in certain spinal, oral, and orthopedic trauma surgeries in skeletally mature patients. It works by stimulating the body to generate its own new bone at the site of implantation.

Key Challenges

High Cost of Regenerative Dental Procedures

Dental regeneration treatments often involve advanced biomaterials and technologies, resulting in high procedure costs. Limited insurance coverage and the high expense of stem cell-based therapies restrict accessibility in developing economies. Small dental practices face challenges in adopting costly regenerative materials and digital tools. These financial barriers slow market penetration, particularly among middle-income patients. To overcome this challenge, manufacturers are focusing on developing cost-effective biomaterial alternatives and expanding distribution networks to increase affordability and accessibility.

Regulatory and Clinical Validation Barriers

Strict regulatory requirements for biomaterial safety and stem cell-based treatments pose significant hurdles for market growth. Long approval timelines and complex clinical validation processes delay product commercialization. Variations in global regulatory standards further complicate market entry for innovative regenerative solutions. Smaller companies struggle to meet these stringent requirements due to limited financial and technical resources. Enhancing clinical trial efficiency, standardizing safety guidelines, and improving regulatory harmonization are essential to accelerate the introduction of new dental regeneration products worldwide.

Regional Analysis

North America

North America dominated the dental regeneration market in 2024 with a 38% share, driven by advanced dental infrastructure and high adoption of regenerative procedures. The United States leads the region due to increasing cases of periodontal diseases and rising demand for implant-based restorations. Strong presence of leading biotechnology and dental material companies supports continuous innovation in biomaterials and stem cell applications. Favorable reimbursement policies, growing awareness of oral health, and higher expenditure on aesthetic and restorative dentistry further strengthen regional growth, positioning North America as a global hub for regenerative dental technologies.

Europe

Europe accounted for a 29% share of the dental regeneration market in 2024, supported by increasing government initiatives promoting oral health and technological innovation. Countries such as Germany, France, and the U.K. are leading in adopting biomaterial-based grafts and stem cell therapies. The region’s aging population and growing prevalence of periodontal and bone-loss conditions are driving demand for regenerative treatments. Favorable regulatory support for clinical research and widespread integration of 3D printing technologies in dental practices enhance treatment precision. These factors collectively position Europe as a major contributor to global dental regeneration advancements.

Asia-Pacific

Asia-Pacific held a 23% share of the global dental regeneration market in 2024, driven by rapid healthcare modernization and increasing awareness of advanced dental treatments. China, Japan, and India are major contributors, supported by a growing patient pool and rising dental tourism. Expanding investments in biotechnology and affordable access to regenerative products are fueling adoption. The rising middle-class population and government initiatives promoting oral healthcare further boost regional demand. Increasing collaborations between research institutes and global manufacturers are accelerating innovation, positioning Asia-Pacific as one of the fastest-growing regions in the dental regeneration industry.

Latin America

Latin America captured a 6% share of the dental regeneration market in 2024, driven by expanding dental tourism and growing awareness of restorative dental care. Brazil and Mexico are leading markets due to the increasing number of dental clinics offering regenerative treatments. The adoption of bone graft substitutes and soft tissue regeneration materials is steadily rising. Government investments in healthcare infrastructure and professional training programs are enhancing treatment accessibility. Although economic constraints limit market expansion, the rising availability of affordable biomaterials and improved clinical expertise continue to drive gradual regional growth.

Middle East & Africa

The Middle East & Africa region accounted for a 4% share of the dental regeneration market in 2024, supported by rising investments in dental care facilities and aesthetic dentistry. The UAE and Saudi Arabia are leading markets, driven by high-income populations and growing demand for advanced restorative procedures. Increased awareness of oral health and collaborations with global dental companies are boosting technology adoption. In Africa, expanding healthcare programs and training for dental professionals are improving treatment capacity. Despite cost challenges, ongoing investments in dental infrastructure and innovation are fostering steady regional market development.

Market Segmentations:

By Type

By Age Group

- Pediatric

- Adult

- Geriatric

By End-User

- Hospitals

- Dental Clinics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the dental regeneration market is defined by strong innovation, product diversification, and strategic expansion by key players such as Aspen Dental Clinic, Delta Dental, Clove Dental, My Dentist, Axiss Dental, Heartland Dental, Apollo White Dental, Smile Dental Care, Floss Dental Clinic, and Integrated Dental Holdings. These companies focus on expanding their regenerative dentistry services through advanced biomaterials, stem cell therapies, and tissue-engineered products. Strategic partnerships with biotechnology firms and research institutions are enhancing their clinical capabilities. Many players are investing in digital dental technologies such as 3D imaging and computer-guided implantology to improve treatment precision and patient outcomes. The market is becoming increasingly competitive, with companies emphasizing patient-centric care, cost efficiency, and faster healing solutions. Expansion of dental networks, integration of regenerative solutions in restorative and cosmetic treatments, and continuous R&D investments are key strategies driving leadership in this evolving global dental regeneration market.

[cr_cta type=”customize_now“]

Key Player Analysis

- Aspen Dental Clinic

- Delta Dental

- Clove Dental

- My Dentist

- Axiss Dental

- Heartland Dental

- Apollo White Dental

- Smile Dental Care

- Floss Dental Clinic

- Integrated Dental Holdings

Recent Developments

- In September 2025, Aspen Dental announced a partnership with Forward Science to deploy PerioStōm, a non-drug periodontal therapy, across more than 1,100 Aspen Dental practices.

- In February 2025, Aspen Dental formed a partnership with vVARDIS to introduce Curodont Repair Fluoride Plus and Curodont Protect products, aiming to treat early decay and prevent cavities using biomimetic regenerative techniques.

- In 2024, Delta Dental published new research via its Preventive Dental Care Study highlighting preventive diagnostics as foundational to reducing serious oral disease

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of stem cell-based and biomaterial regeneration therapies will continue to expand globally.

- Increasing investment in 3D printing and bioengineered scaffolds will enhance treatment precision.

- Dental clinics will remain the leading end-users due to growing patient preference for advanced regenerative care.

- Rising awareness of oral health will boost demand for restorative and preventive dental treatments.

- Integration of digital imaging and AI-driven diagnostics will improve treatment planning and outcomes.

- Hard tissue regeneration will dominate due to increasing use in implant and bone restoration procedures.

- North America and Europe will maintain leadership, supported by strong R&D and clinical innovation.

- Asia-Pacific will experience rapid growth driven by rising dental tourism and healthcare modernization.

- Collaborations between dental care providers and biotech firms will accelerate product development.

- Continuous focus on affordability and accessibility will support market expansion across emerging economies.