Market Overview

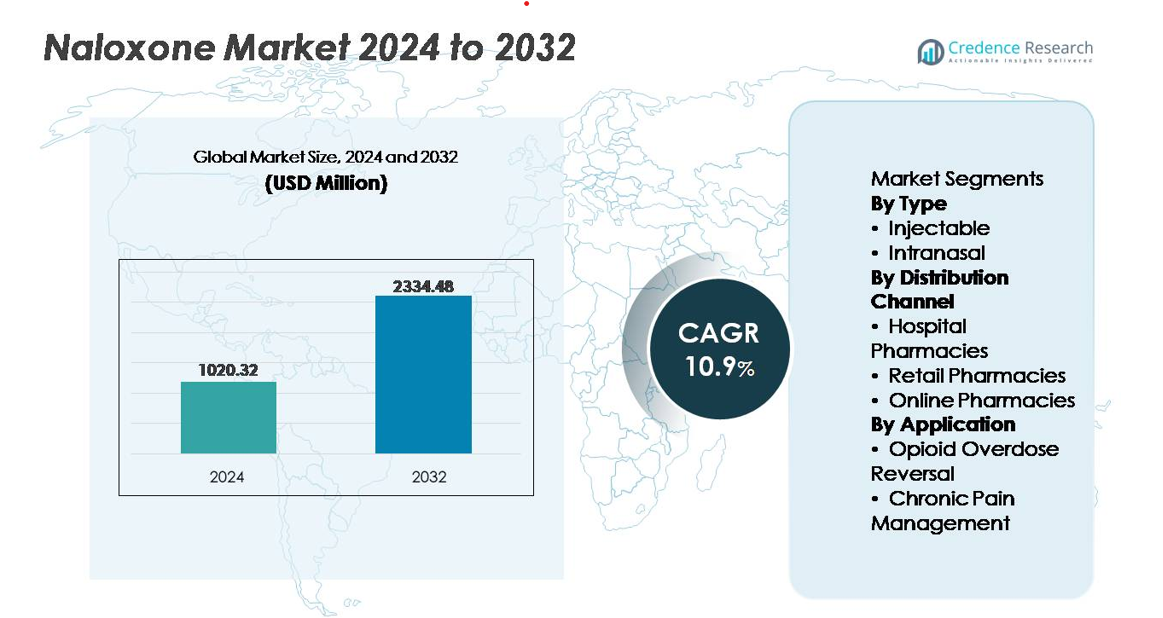

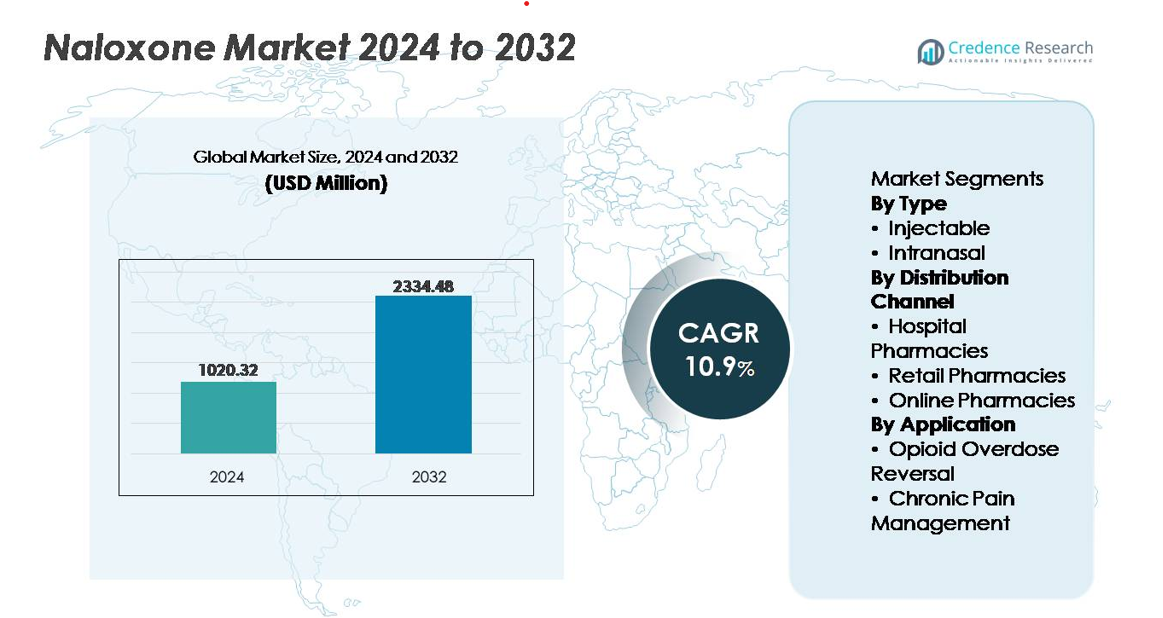

The global naloxone market was valued at USD 1,020.32 million in 2024 and is projected to reach USD 2,334.48 million by 2032, reflecting a compound annual growth rate (CAGR) of 10.9% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Naloxone Market Size 2024 |

USD 1,020.32 million |

| Naloxone Market, CAGR |

10.9% |

| Naloxone Market Size 2032 |

USD 2,334.48 million |

The naloxone market is led by established pharmaceutical manufacturers and specialized emergency drug developers, including Indivior PLC, Amphastar Pharmaceuticals Inc., Mundipharma International Limited, Hospira Inc. (Pfizer Inc.), Mylan N.V., Adapt Pharma Inc., Kaleo Inc., Kaléo Pharma LLC, and Opiant Pharmaceuticals Inc., each playing a strategic role in advancing formulation innovations and expanding global distribution. North America remains the leading region, commanding over 45% of the market share, supported by strong public health policies, extensive community access programs, and high adoption rates across clinical and non-clinical settings. Europe follows as a significant market participant, driven by increasing substance use treatment coverage and government-led overdose prevention initiatives.

Market Insights

- The global naloxone market was valued at USD 1,020.32 million in 2024 and is projected to reach USD 2,334.48 million by 2032, expanding at a CAGR of 10.9% during the forecast period.

- Market growth is driven by the increasing incidence of opioid overdose cases and supportive regulatory reforms enabling over-the-counter and community-based access to naloxone through hospitals, pharmacies, and public distribution frameworks.

- Intranasal formulations represent the fastest-growing segment, supported by ease of use, non-invasive delivery, and suitability for untrained responders in emergency events.

- Competitive expansion is defined by formulation advancements, strategic government supply contracts, and the entry of generic providers improving cost accessibility across developing markets.

- North America leads with over 45% market share, followed by Europe with around 25%, while Asia-Pacific emerges as the fastest-growing region; injectable naloxone continues to hold a dominant share across clinical and EMS applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The injectable segment holds the dominant share of the naloxone market, driven by its rapid onset of action and established clinical acceptance in emergency care settings. Injectable formulations remain the preferred option among paramedics, first responders, and hospital units due to their precise dosing, immediate bioavailability, and suitability for severe opioid overdose cases. Additionally, government-led naloxone distribution programs and training initiatives continue to prioritize injectable variants for community response kits, strengthening their market presence. Meanwhile, intranasal formulations experience steady uptake supported by ease of administration, non-invasive delivery, and increasing availability through retail and public access channels.

- “For instance, Emergent BioSolutions’ Narcan nasal spray delivers a precise 4 mg dose per actuationand is distributed through tens of thousands of U.S. retail pharmacies, grocery stores, and online retailers following its over-the-counter approval.”

By Distribution Channel

Hospital pharmacies account for the largest market share owing to the consistent demand from emergency departments, surgical units, and inpatient care settings that require immediate access to naloxone for opioid-related complications. Institutional protocols mandating naloxone availability have further reinforced procurement through hospital pharmacies. Retail pharmacies demonstrate significant growth as awareness campaigns and over-the-counter availability expand access for caregivers and individuals at risk. Online pharmacies are emerging players, supported by mail-order prescriptions, digital health platforms, and remote care models addressing underserved regions.

- For instance, Walgreens announced distribution of naloxone across all 9,000+ of its pharmacy locations in the U.S., including intranasal 4 mg sprays and injectable kits accessible without a prescription under standing order provisions.

By Application

Opioid overdose reversal dominates the application segment, supported by the escalating misuse of prescription opioids, synthetic opioids such as fentanyl, and rising public health emergencies. The effectiveness of naloxone as a life-saving intervention elevates its demand among emergency medical systems, community health providers, and law enforcement agencies. Mandatory co-prescription policies with high-risk opioid medications further contribute to segment expansion. Chronic pain management represents a secondary application, largely integrated within clinical settings where naloxone is co-formulated or co-prescribed to mitigate overdose risk during long-term opioid therapy, enhancing patient safety and regulatory compliance.

Key Growth Drivers

Increasing Prevalence of Opioid Overdose and Rising Public Health Burden

The escalating prevalence of opioid misuse, particularly involving synthetic opioids such as fentanyl, continues to drive global demand for naloxone as a life-saving overdose reversal medication. Emergency medical services, community organizations, and law enforcement agencies increasingly depend on naloxone as a frontline response. Public health authorities have classified opioid overdose as a critical epidemic, prompting substantial awareness campaigns, prevention programs, and response training. As opioid mortality affects younger populations and economically active demographics, governments allocate higher budgets for prevention and treatment. Mandatory stock requirements in schools, transport hubs, and public spaces further expand utilization. Additionally, co-prescription mandates for high-risk pain management patients and integration into harm reduction frameworks such as supervised consumption centers reinforce naloxone’s essential role. The combination of rising opioid overdose incidents, regulatory prioritization, and expanding access points significantly supports sustained market expansion.

- For instance, EMS agencies across the United States respond to hundreds of thousands of opioid-related overdose events annually, and the Drug Enforcement Administration (DEA) reported seizure of over 77 million counterfeit fentanyl tablets in 2023—indicating rapid proliferation of deadly synthetic supply chains.

Favorable Regulatory Policies and Community Access Initiatives

Supportive regulatory transformations including over-the-counter approval, expanded prescriptive authority, and community distribution serve as major catalysts for naloxone market growth. Many regions have simplified access by enabling pharmacists, nurses, and trained volunteers to dispense or administer naloxone without a physician’s direct order. Local authorities and NGOs have implemented low-cost or free naloxone distribution campaigns targeting populations with heightened risk exposure. Education programs on overdose recognition and intervention empower caregivers, family members, and social workers to carry naloxone kits. Government-funded harm reduction strategies now integrate naloxone into emergency boxes in libraries, shelters, and public restrooms. Multiple countries are adopting bulk purchasing models to reduce cost barriers, while updated clinical practice guidelines emphasize early availability. These policy and access reforms collectively strengthen naloxone adoption across institutional, retail, and community environments.

- For instance, “British Columbia’s public health Take-Home Naloxone (THN) program expanded to include more than 2,000diverse distribution sites across the province, contributing to the tens of thousands of overdose reversals recorded since the program’s inception in 2012”.

Increasing Healthcare Investments and Product Innovation

Growing investments in emergency care infrastructure, pharmaceutical manufacturing capacity, and training initiatives enhance the availability and usability of naloxone. Pharmaceutical advancements support improved delivery formats, including portable intranasal sprays, automatic injectors, and combination kits tailored for non-clinical users. Innovations targeting longer duration of effect address challenges associated with potent synthetic opioids, reducing the need for repeated dosing. Manufacturers are prioritizing user-friendly designs that require minimal training and integrate clear visual instructions. Strategic partnerships between public agencies, pharma companies, and nonprofit organizations expand global product reach through donation programs and subsidized procurement. In parallel, health technology systems are integrating overdose response protocols into care management platforms, improving tracking and follow-up. These advancements collectively elevate patient outcomes, operational efficiency, and wider adoption across professional and layperson settings.

Key Trends & Opportunities

Growing Commercial Opportunity in Non-Clinical and Public Access Markets

A notable trend reshaping the naloxone landscape is the rapid emergence of non-clinical end users including workplaces, educational institutions, hospitality venues, and public transportation centers creating new expansion channels beyond hospitals and pharmacies. Businesses are integrating naloxone into corporate safety compliance frameworks, driven by employee wellness regulations and rising workplace opioid risks. Retailers, gyms, malls, and event venues adopt naloxone kits to meet liability protection policies and risk mitigation strategies. Furthermore, philanthropic and corporate initiatives are funding community naloxone installations in automated emergency cabinets alongside defibrillators. This transition underscores a major commercial opportunity for manufacturers to introduce compact, intuitive, retail-ready formulations. As public access narrows response time and improves survival outcomes, suppliers catering to decentralized distribution and self-administered products stand to gain significant traction.

- For instance,”In response to the opioid crisis, the live events industry has increasingly adopted harm reduction measures. Non-profit organizations like End Overdose and This Must Be The Place partner with various venues and festivals to provide education and distribute naloxone kits, including intranasal units, for use in security and first aid stations.

Digital Health and Training Integration Expanding Education and Support

The integration of digital infrastructure into naloxone distribution opens new opportunities for training, awareness, and adherence. Mobile applications and online learning platforms now deliver real-time instructional videos for overdose intervention and device usage. QR-code linked guides embedded on packaging simplify first-time application for untrained responders. Telehealth providers incorporate naloxone education into virtual pain management, substance use disorder (SUD) care, and remote prescription programs. AI-enabled risk analytics support targeted outreach by identifying geographic hotspots for overdose surges. E-commerce and subscription-based replenishment models improve continuity of supply while enabling discreet home delivery. Collaboration between technology partners and healthcare authorities supports greater engagement, data insights, and outcome monitoring. This digital transformation expands naloxone literacy and increases readiness on a broader scale.

- For instance, Hikma Pharmaceuticals’ Kloxxado 8 mg nasal spray includes QR-embedded multilingual training modules accessible in over 10+ languages and logged more than 1.2 million scan accesses since rollout.

Key Challenges

Affordability Constraints and Uneven Global Access

Despite increasing policy support, price fluctuations and inconsistent insurance coverage continue to restrict access to naloxone in several regions. Many low-income populations disproportionately impacted by substance use face financial barriers, especially where government-funded programs are limited. Differences in reimbursement frameworks influence product choice favoring low-cost injectable formulations over advanced delivery options. Additionally, distribution inequalities persist between urban centers and remote areas lacking healthcare infrastructure or retail pharmacies. Supply chain disruptions, limited manufacturer presence, and logistical constraints hinder timely availability. Addressing affordability remains a core challenge as opioid overdose emergencies demand urgent and recurrent access.

Stigma, Limited Awareness, and Underreporting of Overdose Cases

Stigma surrounding substance use disorder hinders naloxone adoption and delays policy implementation. Misconceptions linking naloxone availability to increased drug misuse discourage community distribution. Many individuals at risk refrain from seeking help due to fear of criminalization or social judgement, resulting in underreporting of overdose incidents and missed intervention opportunities. Inconsistent knowledge of overdose symptoms among families and bystanders further reduces response effectiveness. Healthcare professionals may encounter stigma-driven resistance when recommending preventive naloxone. Overcoming these challenges requires targeted public education, destigmatization campaigns, and supportive legal protections aimed at shifting perception toward viewing naloxone as essential emergency care rather than an endorsement of drug use.

Regional Analysis

North America

North America accounts for the largest share of the naloxone market, representing over 45% of global revenue, driven by the high prevalence of opioid misuse, strong emergency healthcare infrastructure, and widespread community distribution initiatives. Regulatory approvals enabling over-the-counter access have accelerated product availability through pharmacies and non-clinical public access points. Government-funded harm reduction programs, mandatory co-prescription policies, and increased supply agreements with EMS agencies reinforce demand. The United States leads the region, supported by large-scale procurement for federal and state-run overdose prevention initiatives, expanding intranasal adoption, and heightened public awareness campaigns aimed at preventing synthetic opioid-related mortality.

Europe

Europe represents approximately 25% of the global naloxone market, supported by growing healthcare investments, substance use disorder treatment expansion, and national strategies addressing opioid dependency. Government-backed access programs and pilot initiatives deploying naloxone kits in public venues influence market growth. The United Kingdom, Italy, and Germany are at the forefront due to clearer prescribing frameworks and overdose response integration within community health services. Rising use of synthetic opioids and continued growth in chronic pain prescriptions increase preventive demand. However, adoption varies, as reimbursement inconsistencies and cautious regulatory interpretation delay uniform market penetration across Central and Eastern European countries.

Asia-Pacific

Asia-Pacific captures around 18% of the market, emerging as the fastest-growing regional segment owing to rising awareness of opioid misuse, increasing trauma and surgical interventions, and expanding emergency healthcare capacity. Australia and Japan lead the region with established harm reduction programs and supportive import and domestic production policies. Meanwhile, India and Southeast Asia are witnessing gradual uptake driven by non-profit initiatives and government-backed crisis response reforms. Market growth remains influenced by regulatory fragmentation and procurement limitations; however, rising urban demand, improving pharmaceutical manufacturing capability, and greater clinical adoption position the region for sustained expansion.

Latin America

Latin America accounts for nearly 7% of the global naloxone market, with growth driven by rising opioid dependency concerns, increasing availability through hospital pharmacies, and support from international aid programs. Brazil and Mexico lead consumption, supported by expanding emergency care networks and public health campaigns promoting overdose response readiness. However, barriers persist, including limited commercial distribution models, slower regulatory approvals, and affordability constraints impacting low-income populations. Community awareness and training programs are developing gradually, presenting opportunities for pharmaceutical partnerships and subsidized product channels, particularly in urban centers and cross-border traffic corridors impacted by illicit drug circulation.

Middle East & Africa

The Middle East & Africa region represents about 5% of market share, with adoption primarily driven by public health modernization, tourism-linked emergency coverage, and increasing recognition of opioid dependence as a treatable condition. The Gulf states demonstrate faster market penetration through imported formulations and hospital-centric distribution. African nations show incremental demand growth, supported by international health organizations facilitating naloxone access in trauma, surgery, and addiction treatment settings. Challenges include limited supply chains, low awareness outside major cities, and constrained reimbursement. As national overdose management programs evolve, opportunities for cost-effective injectable solutions are set to expand.

Market Segmentations:

By Type

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Application

- Opioid Overdose Reversal

- Chronic Pain Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the naloxone market is characterized by the presence of established pharmaceutical companies, emerging innovators, and regional manufacturers focused on expanding product accessibility through diversified formulations and strategic distribution channels. Leading players prioritize intranasal and auto-injector delivery systems designed for rapid, user-friendly administration suited to both clinical and public environments. Competitive strategies include government supply contracts, public health collaborations, and cost-effective bulk production to support community distribution programs. Partnerships with emergency medical services, non-profit organizations, and retail pharmacy chains strengthen brand presence and outreach. Companies are also investing in reformulations aimed at extended duration and higher dosing to address synthetic opioid potency. Meanwhile, generic manufacturers intensify price competition and broaden access in cost-sensitive markets, while regulatory approvals for over-the-counter availability reshape commercial positioning. Overall, the market reflects a baance between innovation-focused differentiation and affordability-driven expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Indivior PLC

- Kaleo Inc.

- Amphastar Pharmaceuticals Inc.

- Mundipharma International Limited

- Adapt Pharma Inc.

- Opiant Pharmaceuticals Inc.

- Hospira Inc. (Pfizer Inc.)

- Kaléo Pharma LLC

- Mylan N.V.

- Pfizer Inc.

Recent Developments

- In March 2023, Adapt Pharma, Inc. the U.S. FDA approved its 4 mg intranasal naloxone nasal spray for over-the-counter (OTC) sale.

- In May 2022, Opiant released clinical trial data showing its nasal formulation OPNT003 (nalmefene) produced a 5.745 L/min change in minute ventilation versus 3.011 L/min under naloxone after opioid-induced respiratory depression, a result that supports its planned New Drug Application.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for naloxone will continue rising as synthetic opioid potency intensifies and overdose events increase globally.

- Over-the-counter access will expand availability, driving greater adoption through pharmacies and non-clinical environments.

- New delivery systems will prioritize ease of use, longer duration of action, and minimal training requirements.

- Public and private sector partnerships will scale distribution through hospitals, schools, workplaces, and community centers.

- Affordability initiatives and generic competition will broaden access in cost-sensitive and emerging markets.

- Digital education platforms will support training for caregivers, first responders, and the general public.

- Co-prescription alongside opioid-based pain therapies will become standard in many healthcare systems.

- Government mandates will strengthen stock requirements in travel hubs, public venues, and emergency infrastructures.

- Manufacturing capacity will expand to support rapid deployment in overdose surge regions.

- Stigma reduction programs will improve community acceptance and encourage proactive naloxone adoption.