Market Overview

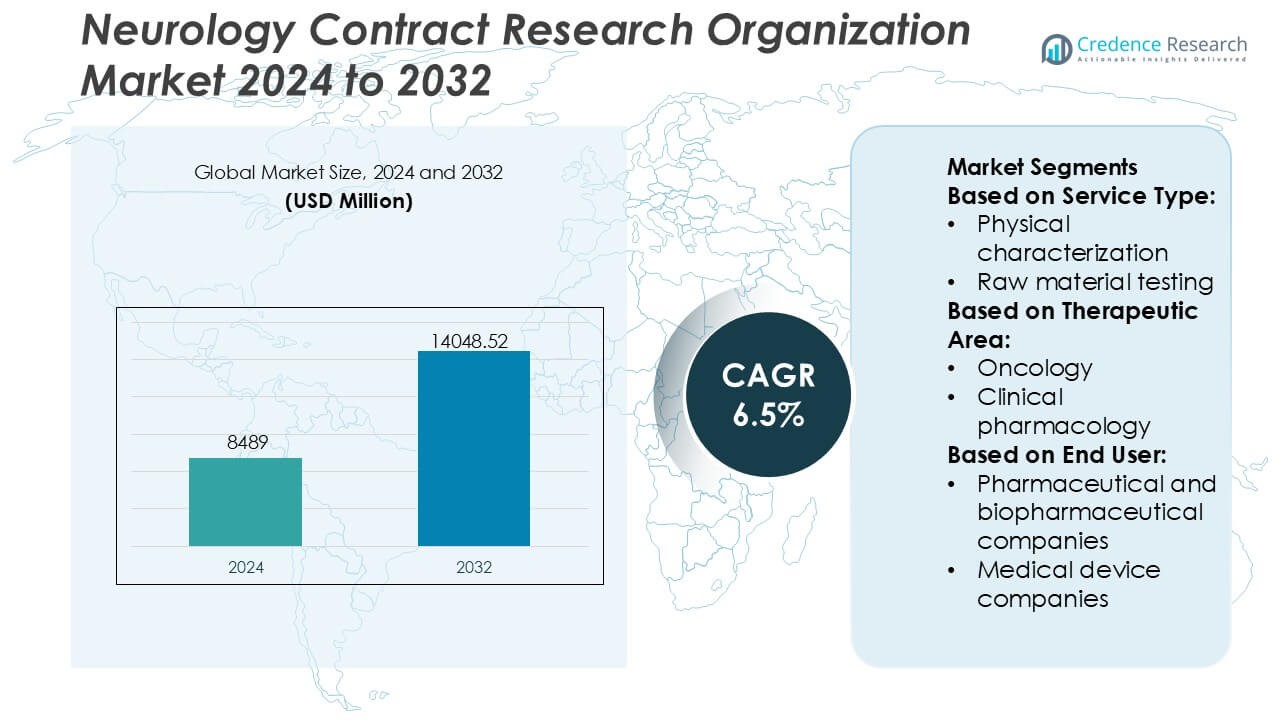

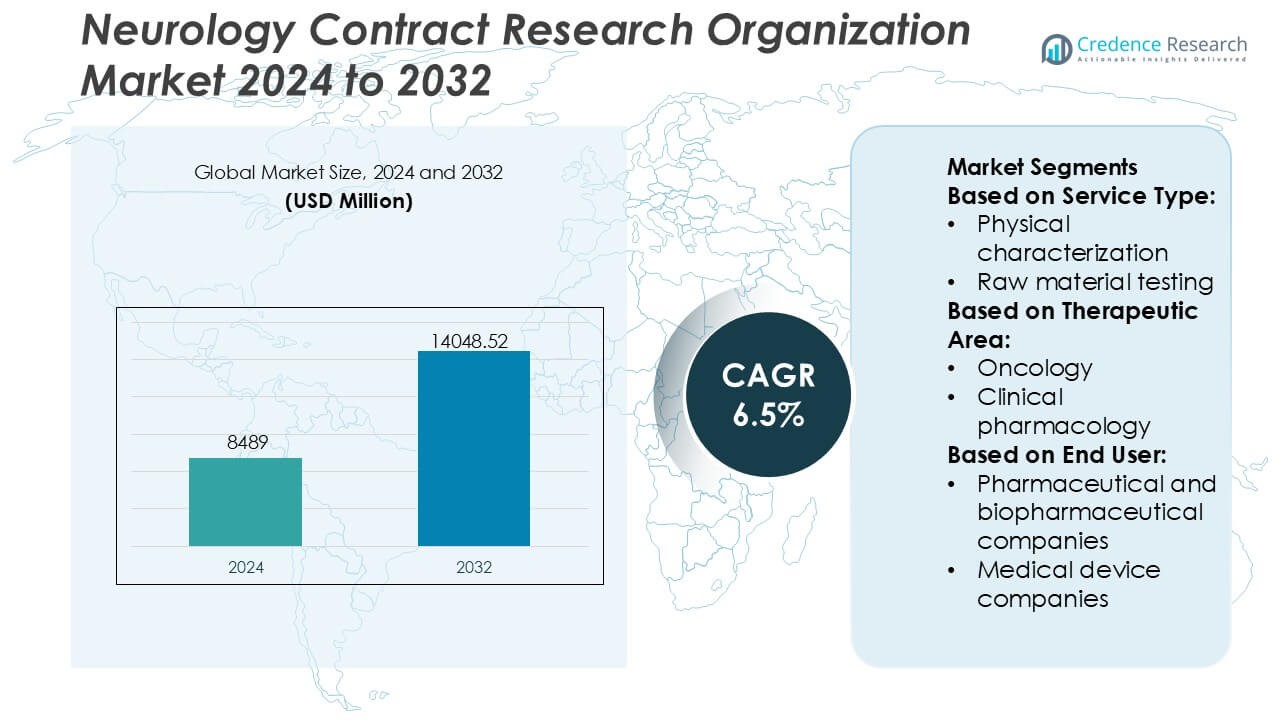

Neurology Contract Research Organization Market size was valued USD 8489 million in 2024 and is anticipated to reach USD 14048.52 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neurology Contract Research Organization Market Size 2024 |

USD 8489 Million |

| Neurology Contract Research Organization Market , CAGR |

6.5% |

| Neurology Contract Research Organization Market Size 2032 |

USD 14048.52 Million |

The Neurology Contract Research Organization market is led by a group of well-established global players that compete through deep neuroscience expertise, integrated service portfolios, and strong global trial execution capabilities. These organizations focus on managing complex neurology studies involving advanced imaging, biomarker-driven endpoints, and long-term follow-up requirements. Competitive positioning depends on scientific specialization, regulatory proficiency, patient recruitment efficiency, and adoption of digital and decentralized trial technologies. Strategic collaborations with pharmaceutical sponsors and academic research centers further strengthen market presence. North America emerges as the leading region with an exact 41% market share, supported by advanced clinical research infrastructure, high neurological disease prevalence, strong R&D investment, and early adoption of innovative trial methodologies, reinforcing its dominance in neurology-focused clinical research outsourcing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Neurology Contract Research Organization Market was valued at USD 8,489 million in 2024 and is projected to reach USD 14,048.52 million by 2032, expanding at a CAGR of 6.5%, driven by rising outsourcing of complex neurology trials.

- Market growth is supported by increasing neurological disease prevalence and demand for specialized services such as advanced neuroimaging, biomarker-based endpoints, and long-duration clinical studies.

- Key trends include growing adoption of decentralized and hybrid trial models, digital biomarkers, and data analytics to enhance patient recruitment, monitoring, and trial efficiency.

- Competitive dynamics center on scientific specialization, integrated service portfolios, regulatory expertise, and strategic collaborations with pharmaceutical sponsors and academic institutions.

- North America leads with an exact 41% market share, supported by advanced research infrastructure and high R&D investment, while service segments related to clinical development and biomarker-driven studies hold dominant shares due to trial complexity.

Market Segmentation Analysis:

By Service Type

By service type, early phase development services emerge as the dominant sub-segment, accounting for an estimated 34% market share in the neurology contract research organization market. This leadership reflects growing outsourcing of first-in-human studies, dose-escalation trials, and early safety assessments for complex neurological compounds. High protocol complexity, stringent regulatory requirements, and the need for specialized neuroimaging, biomarker analysis, and adaptive trial designs drive demand. Sponsors increasingly rely on CRO expertise to shorten development timelines, manage risk, and optimize early decision-making before advancing costly late-stage neurology programs.

- For instance, Boston Scientific Corporation advanced early-phase neuromodulation research through clinical programs supporting its Vercise Deep Brain Stimulation platform, which uses leads with 8 independent contacts and supports stimulation precision at sub-millimeter resolution, with early clinical studies enrolling more than 100 patients to validate safety, targeting accuracy, and device-controlled dose optimization during initial development phases.

By Therapeutic Area

By therapeutic area, neurology itself represents the dominant sub-segment with an estimated 38% market share, driven by rising prevalence of neurodegenerative and neuropsychiatric disorders such as Alzheimer’s disease, Parkinson’s disease, epilepsy, and multiple sclerosis. Drug development in neurology faces high failure rates and complex endpoints, increasing reliance on CROs with deep disease-area expertise. Demand is further supported by growth in gene therapies, biologics, and CNS-targeted small molecules requiring advanced clinical pharmacology, imaging endpoints, and long-duration trials. These factors sustain strong outsourcing across discovery, preclinical, and early clinical neurology programs.

- For instance, MicroVention Inc., a subsidiary of Terumo Corporation, has advanced neurovascular innovation through its LVIS EVO™ stent system. The device features a high-density, braided nitinol structure composed of 16 wires with Drawn Filled Tube (DFT) technology, which includes a platinum core for full-length radiopacity.

By End User

By end user, pharmaceutical and biopharmaceutical companies dominate the market, holding an estimated 69% share, reflecting their extensive pipelines in central nervous system therapeutics. These organizations outsource neurology research to control costs, access specialized scientific capabilities, and manage fluctuating R&D workloads. Increasing focus on rare neurological diseases, precision medicine, and accelerated development pathways strengthens CRO engagement across multiple development stages. While medical device companies and academic institutes contribute to demand through investigator-initiated studies and device trials, large biopharmaceutical sponsors remain the primary drivers of contract research spending in neurology.

Key Growth Drivers

Rising Neurological Disease Burden and Complex Trial Demand

The growing prevalence of neurological disorders such as Alzheimer’s disease, Parkinson’s disease, multiple sclerosis, epilepsy, and rare neurogenetic conditions significantly increases demand for specialized clinical research services. Neurology trials require complex protocols, long study durations, cognitive and functional endpoints, and advanced imaging and biomarker integration. Pharmaceutical and biotechnology companies increasingly rely on neurology-focused CROs to manage these complexities, ensure protocol compliance, and improve patient recruitment and retention. This rising clinical complexity directly drives outsourcing to CROs with dedicated neurological expertise and therapeutic depth.

- For instance, Abbott has demonstrated advanced neurological research capabilities through clinical programs supporting its Proclaim XR spinal cord stimulation system, which delivers targeted neuromodulation using a battery designed to last up to 10 years and supports stimulation waveforms with pulse widths as low as 30 microseconds, with multicenter studies enrolling more than 200 patients to evaluate long-term safety, functional improvement, and device performance in chronic neurological pain management.

Outsourcing Shift Among Pharma and Biotech Sponsors

Pharmaceutical and biopharmaceutical companies continue to expand outsourcing strategies to control costs, accelerate development timelines, and access specialized capabilities. Neurology drug development involves high failure rates and substantial regulatory scrutiny, prompting sponsors to partner with CROs that offer integrated preclinical, clinical, and regulatory services. CROs provide scalable infrastructure, global trial networks, and experienced neuroscience teams that reduce operational risk. This strategic shift toward full-service and functional outsourcing models strongly supports sustained demand growth in the neurology CRO market.

- For instance, Nexstim has strengthened outsourced neurology research through its Navigated Brain Stimulation (NBS) System, which delivers transcranial magnetic stimulation with targeting accuracy below 2 millimeters using individual MRI-based navigation, and has been validated across more than 6,000 patients in clinical and research settings, generating over 120 peer-reviewed publications that support its use in motor mapping, language mapping, and early-phase neurological therapy evaluation.

Advancements in Neuroimaging and Biomarker-Based Research

Rapid adoption of advanced neuroimaging techniques, digital biomarkers, and molecular diagnostics strengthens the role of specialized CROs. Modalities such as functional MRI, PET imaging, EEG analytics, and cerebrospinal fluid biomarkers improve disease stratification and endpoint sensitivity. Neurology CROs increasingly support protocol design, data interpretation, and centralized imaging analysis. These capabilities enhance trial precision and reduce variability, making CRO partnerships essential for sponsors developing disease-modifying neurological therapies and accelerating innovation across the research pipeline.

Key Trends & Opportunities

Expansion of Decentralized and Hybrid Neurology Trials

Decentralized and hybrid clinical trial models are gaining traction in neurology research due to mobility limitations among patients and long follow-up requirements. Remote cognitive assessments, wearable neurological monitoring devices, and tele-neurology visits improve patient participation and data continuity. CROs are investing in digital trial platforms and home-based data collection to support these models. This trend creates opportunities for CROs to differentiate through technology-enabled services while improving enrollment diversity and reducing trial disruption risks.

- For instance, Penumbra, Inc. has advanced technology-enabled neurovascular care through the Penumbra System®, a mechanical thrombectomy platform engineered for the rapid removal of blood clots in acute ischemic stroke. The system features high-performance aspiration catheters, such as the RED® 72, which can reach 132 cm in usable length to navigate complex intracranial anatomy.

Growing Focus on Rare and Orphan Neurological Disorders

Increased research activity in rare neurological and neurodevelopmental disorders presents significant opportunities for specialized CROs. Orphan drug incentives, accelerated regulatory pathways, and targeted therapies drive sponsor investment in niche indications. Neurology CROs with rare-disease expertise support small patient population trials, adaptive study designs, and global site coordination. This trend favors CROs capable of managing regulatory complexity and specialized endpoints, enabling sponsors to advance innovative therapies for underserved patient groups.

- For instance, Johnson & Johnson, through its Janssen Pharmaceutical Companies in collaboration with Legend Biotech, has advanced clinical research for CARVYKTI® (ciltacabtagene autoleucel), a CAR-T cell therapy for relapsed or refractory multiple myeloma. While primarily a hematologic treatment, the program has generated critical neurologic safety datasets from trials such as CARTITUDE-4, which enrolled more than 400 treated patients.

Key Challenges

High Trial Failure Rates and Scientific Uncertainty

Neurology drug development faces persistently high attrition rates due to incomplete disease understanding, heterogeneous patient populations, and limited predictive preclinical models. These challenges increase operational risk for CROs managing late-stage trials. Protocol amendments, extended timelines, and endpoint variability strain resources and margins. CROs must continuously invest in scientific expertise, adaptive trial design capabilities, and early risk mitigation strategies to manage uncertainty while maintaining sponsor confidence and operational efficiency.

Patient Recruitment and Retention Constraints

Recruiting and retaining neurological patients remains a major operational challenge due to cognitive impairment, disease progression, caregiver dependence, and geographic limitations. Lengthy trial durations and burdensome assessments further complicate participation. CROs must deploy targeted recruitment strategies, patient-centric trial designs, and digital engagement tools to address these barriers. Failure to manage enrollment timelines can delay development programs, increase costs, and reduce overall trial success rates in neurology research.

Regional Analysis

North America

North America dominates the Neurology Contract Research Organization market with an exact 41% market share, supported by a mature pharmaceutical ecosystem, high neurological disease prevalence, and strong clinical trial funding. The region benefits from advanced research infrastructure, early adoption of innovative trial methodologies, and widespread use of neuroimaging and biomarker-driven studies. The United States leads regional demand due to a high concentration of biopharmaceutical sponsors and specialized neurology CROs offering integrated preclinical and clinical services. Favorable regulatory pathways, strong patient registries, and robust academic–industry collaborations further strengthen North America’s leadership in neurology-focused clinical research outsourcing.

Europe

Europe holds an exact 28% market share, driven by strong government support for neuroscience research, well-established regulatory frameworks, and extensive cross-border clinical trial networks. Countries such as Germany, the United Kingdom, France, and the Nordic nations play a central role due to their advanced healthcare systems and high participation in multinational neurology trials. The region shows increasing focus on rare neurological disorders, aging-related diseases, and real-world evidence generation. European CROs benefit from harmonized clinical standards and access to diverse patient populations, making the region attractive for complex neurology studies and late-phase development programs.

Asia-Pacific

Asia-Pacific accounts for an exact 21% market share and represents the fastest-growing regional segment in the neurology CRO market. Growth is driven by expanding pharmaceutical manufacturing, rising neurological disease burden, and increasing clinical trial activity in China, Japan, South Korea, and India. Cost-effective trial execution, large patient pools, and improving regulatory transparency enhance the region’s appeal for global sponsors. Governments actively promote clinical research through infrastructure investment and policy reforms. CROs in Asia-Pacific increasingly support early-phase studies and global multicenter trials, strengthening the region’s strategic importance in neurology research.

Latin America

Latin America captures an exact 6% market share, supported by growing clinical research capabilities and increasing participation in international neurology trials. Countries such as Brazil, Mexico, and Argentina offer favorable patient recruitment conditions and lower operational costs compared to developed markets. The region benefits from improving regulatory frameworks and expanding investigator networks. Although infrastructure variability remains, CROs leverage Latin America for patient enrollment acceleration and diversity in neurology studies. Rising awareness of neurological disorders and expanding pharmaceutical investment continue to support gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa region holds an exact 4% market share, reflecting its emerging status in neurology-focused clinical research. Growth is driven by increasing healthcare investment, expansion of clinical trial regulations, and rising interest from global sponsors seeking new patient populations. Countries in the Gulf Cooperation Council lead regional activity due to improved research infrastructure and hospital modernization. In Africa, participation remains limited but gradually expands through international partnerships. While challenges persist, long-term opportunities exist as governments prioritize neurological disease management and clinical research capacity building.

Market Segmentations:

By Service Type:

- Physical characterization

- Raw material testing

By Therapeutic Area:

- Oncology

- Clinical pharmacology

By End User:

- Pharmaceutical and biopharmaceutical companies

- Medical device companies

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Neurology Contract Research Organization market players such as Boston Scientific Corporation, MicroVention Inc. (Terumo Corporation), Abbott, Nexstim, Penumbra, Inc., Johnson & Johnson Services Inc., Stryker, MicroPort Scientific Corporation, Codman Neuro (Integra LifeSciences), Medtronic. The Neurology Contract Research Organization market is highly competitive, driven by increasing outsourcing of complex neuroscience clinical trials and the growing demand for specialized therapeutic expertise. Competition centers on the ability to manage intricate study designs, long trial durations, and neurologically specific endpoints while maintaining regulatory compliance across regions. Market participants differentiate through advanced neuroimaging support, biomarker integration, digital and decentralized trial capabilities, and strong patient recruitment networks. Strategic collaborations with pharmaceutical sponsors and academic institutions strengthen scientific depth and execution quality. Ongoing investments in data analytics, artificial intelligence, and real-world evidence generation further intensify competition. Overall, success in this market depends on operational scalability, scientific specialization, and the ability to deliver high-quality, efficient neurology-focused research outcomes.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Questex’s Fierce Biotech announced finalists for the 2nd Annual Fierce CRO Awards, highlighting Contract Research Organizations’ vital role in drug development, trial management (like Phastar, MMS, CTI), and improving patient outcomes through better research, with winners like MMS celebrated in June for Client Service, emphasizing innovation in areas like data and global ops.

- In May 2025, Julius Clinical (Netherlands) and Peachtree BioResearch Solutions (US) merged to form a comprehensive, global Contract Research Organization (CRO) with enhanced capabilities, especially in Central Nervous System (CNS) research, combining their strengths in Phase I-III studies and expanding into cardio-metabolic, renal, and rare diseases for greater scientific and operational reach across North America and Europe.

- In May 2025, Everest Group recognized Fortrea as a “Leader” in their annual Pharmacovigilance (PV) Operations PEAK Matrix Assessment, highlighting their strong capabilities in managing drug safety and adverse event reporting for the life sciences industry. This placement on the PEAK Matrix signifies Fortrea’s significant market impact and vision in delivering robust pharmacovigilance services, alongside other major players like IQVIA and Accenture, noted in the Everest Group report.

- In February 2025, Medtronic has received U.S. FDA approval for the world’s first Adaptive Deep Brain Stimulation (DBS) system for individuals with Parkinson’s disease. This technology uses real-time brain signals to adjust stimulation levels based on the patient’s needs, offering a more personalized and responsive treatment approach.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Therapeutic Area, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Neurology-focused CRO demand will increase as sponsors advance complex and long-duration neuroscience clinical programs.

- Outsourcing partnerships will expand as pharmaceutical and biotechnology companies seek specialized neurological expertise.

- Adoption of decentralized and hybrid trial models will accelerate to improve patient access and retention.

- Advanced neuroimaging, digital biomarkers, and cognitive assessment tools will become standard components of neurology trials.

- Artificial intelligence and data analytics will play a larger role in patient stratification and endpoint optimization.

- Research activity in rare and orphan neurological disorders will continue to grow due to regulatory incentives.

- Global multicenter trials will increase, driving demand for CROs with strong cross-regional execution capabilities.

- Real-world evidence integration will support post-approval studies and long-term neurological outcome assessment.

- Regulatory complexity will encourage early CRO involvement in trial design and development strategy.

- Investment in patient-centric trial approaches will remain critical to improving enrollment efficiency and study success rates.