Market Overview

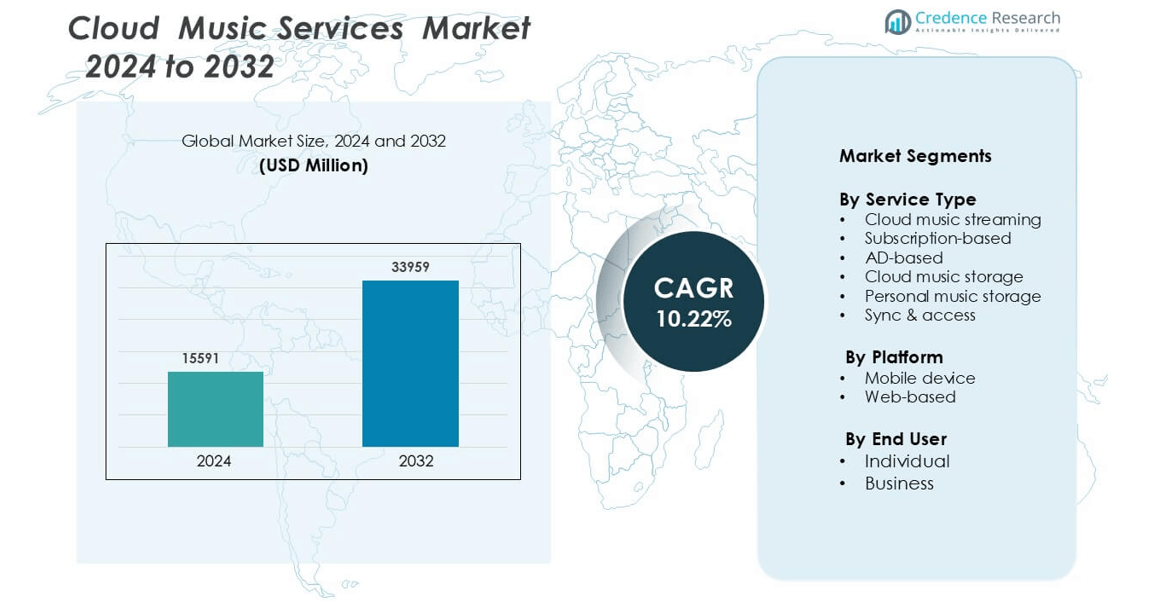

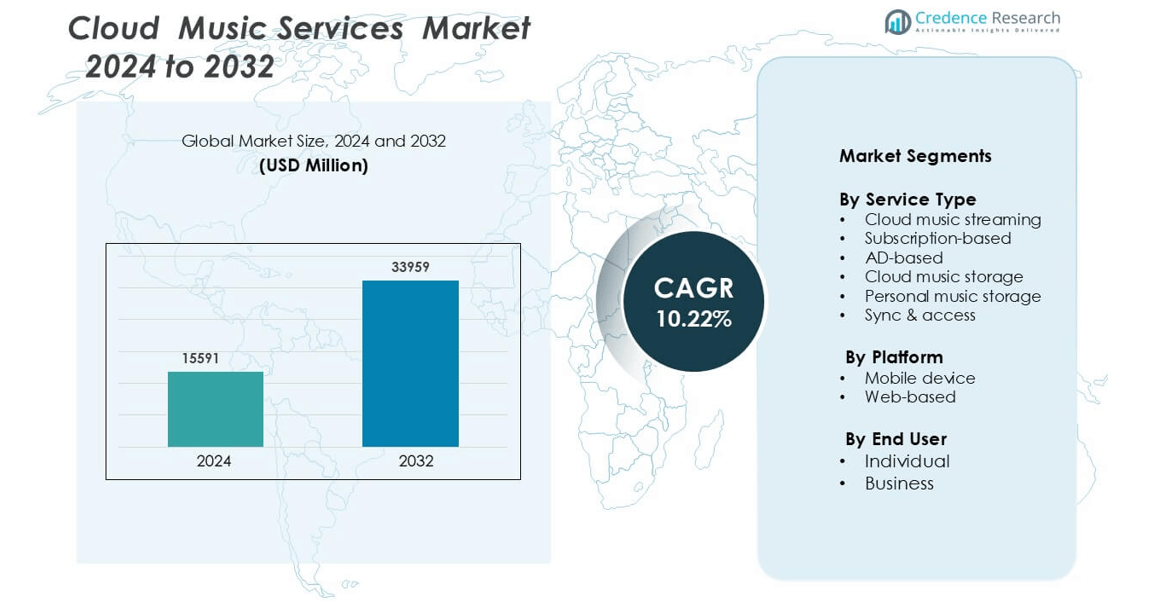

Cloud Music Service market was valued at USD 15591 million in 2024 and is anticipated to reach USD 33959 million by 2032, growing at a CAGR of 10.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Music Service Market Size 2024 |

USD 15591 million |

| Cloud Music Service Market, CAGR |

10.22% |

| Cloud Music Service Market Size 2032 |

USD 33959 million |

The cloud music service market is shaped by global leaders including Spotify AB, Apple Inc., Amazon.com Inc., YouTube Music, Pandora Media LLC, Deezer, NetEase Inc., Rhapsody International Inc., Saavn Media Pvt Ltd, and Gamma Gaana Ltd. These companies compete through large music libraries, personalized recommendations, premium audio formats, and bundled subscription plans with telecom and smart device ecosystems. North America leads the global market with a market share of 38%, supported by high smartphone penetration, strong digital infrastructure, and high spending on subscription-based entertainment services. Major players continue to invest in AI-driven curation, exclusive artist deals, and regional content to expand their global user base.

Market Insights

- The cloud music service market reached USD 15591 million in 2024 and is projected to hit USD 33959 million by 2032, registering a 10.22% CAGR.

- Strong market growth is driven by rising paid subscriptions, AI-based music recommendations, exclusive releases, and partnerships with telecom operators offering bundled data-plus-streaming packages.

- Key trends include regional language expansion, smart speaker integration, social playlist sharing, and demand for high-quality audio formats that improve user experience across devices.

- Spotify, Apple, Amazon, YouTube Music, Deezer, Pandora, and regional players such as Gaana and Saavn form a competitive landscape focused on content licensing, premium tiers, and personalized features; subscription-based streaming holds the largest segment share.

- North America leads the regional landscape with 38% share, followed by rapid growth in Asia Pacific due to affordable data plans and rising smartphone penetration, while Europe maintains steady adoption through high broadband coverage and strong interest in premium subscription services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

Cloud music streaming remains the dominant sub-segment, accounting for the largest market share. Users prefer on-demand access to large music catalogs, personalized playlists, and AI-based recommendations. Subscription-based services drive most revenue, helped by premium tiers, offline access, and high-quality audio. AD-based streaming expands reach among price-sensitive listeners, while cloud music storage and personal music lockers serve niche users who want to keep personal libraries online. Sync and access features help users move music across multiple devices. The rise of 4G and 5G networks strengthens the streaming ecosystem, boosting paid user adoption worldwide.

- For instance, Spotify has repeatedly stated in recent years (e.g., in 2023 and 2025 newsroom updates) that nearly 2 billion music discoveries happen on the platform every day through various personalized features, including Discover Weekly, AI-powered DJ, and Niche Mixes.

By Platform

Mobile devices hold the dominant share due to rising smartphone use, easy app access, and affordable data plans. Users prefer streaming apps for convenience, push notifications, and curated playlists. Music platforms invest in app optimization, voice search, and integration with smart wearables. Web-based platforms maintain steady adoption among desktop users who prefer larger screens and workplace access. However, mobile continues to expand faster because of better personalization, location-based playlists, and integration with social media. In-app purchases, bundled telecom subscriptions, and mobile advertising further strengthen the mobile-first ecosystem.

- For instance, Spotify has indicated that mobile devices are the primary access channel for its users, historically accounting for the majority of listening hours. In early 2015, reports noted that phones (42%) and tablets (10%) combined made up 52% of total listening.

By End User

Individuals form the dominant end-user segment and hold the highest market share. Millions of consumers use streaming apps for on-demand playback, offline downloads, and curated mixes. Social sharing features and user-generated playlists boost engagement. Businesses adopt cloud music services for commercial spaces, gyms, cafés, and retail stores, but represent a smaller share. Brands use licensed music to enhance ambiance and improve customer experience. The individual segment grows quickly due to digital payment adoption, cross-platform device syncing, smart assistants, and the availability of localized regional music catalogs.

Key Growth Drivers

Rising Adoption of Subscription-Based Streaming Models

Subscription-based streaming models act as a major driver in the cloud music service market. Users prefer paid plans for ad-free listening, offline downloads, premium audio formats, and cross-device syncing. Music platforms offer personalized playlists, AI-based song discovery, and multilingual libraries to improve retention. Partnerships with telecom operators, OTT platforms, and smartphone brands help companies add bundled plans at low entry costs. This strategy boosts subscriber counts across emerging and developed markets. Flexible monthly pricing, student packs, and family plans further accelerate paid user growth. As global mobile internet penetration rises and payment gateways expand, subscription models continue to gain traction, enabling stable recurring revenue streams for providers.

- For instance, Apple Music confirmed providing lossless audio encoded at 24-bit up to 192 kHz for paying subscribers, boosting premium conversions.

Increased Smartphone Penetration and Mobile Data Affordability

Smartphone adoption and low-cost mobile data contribute strongly to market expansion. Consumers enjoy anytime access to large music catalogs through dedicated apps with intuitive interfaces. Telecom providers support growth through free trial access and data-inclusive music packs. High-speed 4G and 5G networks reduce buffering and enable rich audio formats like lossless and spatial sound. Music labels and streaming platforms focus on exclusive content drops, regional language music, and social integration features, encouraging higher daily usage. The ability to download songs for offline listening supports areas with limited connectivity. Affordable prepaid data plans, rising digital literacy, and increasing youth populations create a favorable environment for cloud music adoption, especially across Asia, Latin America, and Africa.

- For instance, Amazon announced that over 500 million Alexa-enabled devices had been sold globally.

Shifting Consumer Preference Toward Personalized and On-Demand Music

Personalized listening experiences strengthen the demand for cloud music services. Users prefer on-demand streaming over physical storage or downloaded files, driven by curated playlists, mood-based mixes, and algorithmic recommendations. Music platforms invest in machine learning to study user behavior, listening patterns, favorite artists, and preferred genres. Integrated lyrics display, podcast streaming, and collaborative playlists increase engagement. Social media sharing, playlist trends, and viral music shorten discovery cycles and boost app usage. In many markets, younger generations view streaming apps as the primary music source, replacing radio and MP3 formats. Easy access across smartphones, smart speakers, laptops, and wearables expands the ecosystem. The preference for access over ownership continues to shift choices toward cloud-based services, supporting long-term market growth.

Key Trends & Opportunities

Expansion of Regional Language Content and Independent Music Catalogs

Regional language music and independent artist catalogs create strong opportunities for platforms. Listeners prefer music in local languages, especially in India, China, Latin America, and the Middle East. Streaming providers sign licensing deals with regional labels and offer targeted recommendations for local content discovery. Independent musicians use these platforms for faster global reach, skipping traditional distribution barriers. Features such as artist dashboards, fan engagement tools, and monetization options attract independent creators. Live sessions, digital concerts, and exclusive content releases allow platforms to differentiate offerings while boosting subscriber loyalty. As cultural music gains digital popularity, regional catalogs support deeper market penetration and subscriber growth.

- For instance, Spotify reported that more than 28,000 artists from India use its Spotify for Artists platform, which doubled in number compared to a year prior, supported by playlist placement and recommendation tools

Integration with Smart Devices and Connected Ecosystems

Smart speakers, smart TVs, automotive infotainment systems, and wearables create new growth avenues. Music streaming integrates seamlessly with voice assistants, enabling users to play songs through voice commands. Car manufacturers include cloud music apps to enhance in-car entertainment. Fitness apps and smartwatches support music syncing for offline workouts. These touchpoints increase user convenience and deepen engagement across daily activities. Multi-device access encourages longer subscription periods and premium upgrades. Companies invest in partnerships with consumer electronics brands, telecom operators, and app stores to expand access. The rise of connected homes and IoT ecosystems continues to open opportunities for bundled subscriptions and personalized audio experiences.

- For instance, As of May 2023, Amazon confirmed that over 500 million Alexa-enabled devices had been sold globally. This makes voice-activated streaming and smart home control a mainstream access point, with continued growth evidenced by a 200% increase in connected smart home devices over the past few years.

Key Challenges

High Licensing Costs and Complex Royalty Structures

Music platforms face heavy financial pressure from licensing costs and royalty agreements. Streaming providers must secure rights from music labels, publishers, and artists, which often involves dynamic fee structures linked to listener counts and regions. Expanding catalog size increases cost burdens, limiting profitability for smaller platforms. Royalty disputes between artists, labels, and platforms create additional challenges, sometimes resulting in content takedowns. Price-sensitive markets make it difficult to raise subscription prices to offset costs. Complex global licensing rules also delay cross-border content availability. To stay competitive, platforms must balance pricing, catalog size, and payout agreements without weakening margins.

Data Privacy Issues and Network Dependency

Cloud music services depend heavily on network stability and secure data storage. Users store personal data, playlists, and payment information, creating vulnerability to cyber threats. Any breach affects customer trust and can lead to legal penalties. Streaming quality declines in low-network regions, reducing user satisfaction. Rising concerns around data privacy and consent require strict compliance with regional laws such as GDPR and data localization rules. Providers must invest in encryption, secure authentication, and transparent data policies. High infrastructure costs and regulatory pressure increase operational complexity, making data and network-related risks a persistent market challenge.

Regional Analysis

North America

North America holds the largest market share in the cloud music service industry. Widespread smartphone adoption, strong digital infrastructure, and high subscription spending support market leadership. Leading platforms deploy advanced recommendation engines, exclusive artist deals, and high-resolution audio formats to attract users. Telecom partnerships and bundled premium plans drive subscriber growth in the United States and Canada. The region also shows strong adoption of smart speakers and in-car streaming, increasing multi-device usage. Growth remains steady due to high internet penetration, tech-savvy consumers, and increasing demand for on-demand and personalized listening experiences.

Europe

Europe secures a significant market share, driven by high broadband penetration and rapid growth in subscription-based streaming. Countries such as the U.K., Germany, France, and the Nordics show strong premium plan adoption due to high disposable income and demand for multilingual music libraries. Cloud platforms invest in exclusive regional releases and licensing agreements with European labels. Strict data privacy laws encourage the use of secure cloud infrastructure. The rise of connected cars, smart wearables, and music-integrated fitness apps strengthens daily usage. European users prefer curated playlists, live sessions, and high-quality streaming, supporting growth across western and central Europe.

Asia Pacific

Asia Pacific records the fastest growth rate and holds a rapidly rising market share. India, China, South Korea, and Southeast Asia drive adoption through affordable data plans and low-cost subscription bundles. Regional language content, independent music catalogs, and social media integration attract young listeners. Local platforms compete with global providers by offering localized playlists and micro-subscription plans. Smartphone expansion and 4G-5G connectivity fuel heavy streaming activity. Partnerships with telecom operators and entertainment apps strengthen customer reach. Asia Pacific remains a high-potential region due to its large population, expanding digital payments, and increasing preference for mobile-first music consumption.

Latin America

Latin America shows growing market share, supported by increasing smartphone penetration and rising awareness of legal streaming services. Brazil, Mexico, Argentina, and Colombia lead regional demand. Platforms offer flexible subscription tiers, family packs, and prepaid billing options to reach price-sensitive listeners. Growth in cloud music adoption is also supported by expanding high-speed internet coverage. Regional genres, podcasts, and exclusive collaborations strengthen user engagement. Although piracy remains a challenge, improved payment access and partnerships with telecom companies continue to increase paid subscription growth. Latin America is expected to remain an emerging yet promising region for cloud-based music services.

Middle East & Africa

The Middle East & Africa region holds a smaller but steadily increasing market share. Mobile-first users, expanding telecom networks, and rising digital streaming demand support growth. Countries such as the UAE, Saudi Arabia, South Africa, and Nigeria show strong adoption of global and regional platforms. Cloud providers expand Arabic and African language catalogs to improve relevance for local listeners. Affordable smartphone access and prepaid digital payment methods boost usage. However, limited broadband coverage and price sensitivity slow premium subscription growth. Despite these barriers, rising youth populations and improving streaming infrastructure create long-term opportunities for cloud music services.

Market Segmentations:

By Service Type

- Cloud music streaming

- Subscription-based

- AD-based

- Cloud music storage

- Personal music storage

- Sync & access

By Platform

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cloud music service market features strong competition between global tech giants and regional streaming platforms. Key players such as Spotify AB, Apple Inc., Amazon.com Inc., YouTube Music, and Pandora Media LLC invest heavily in personalized recommendations, exclusive releases, and high-quality audio formats to retain subscribers. These companies adopt bundle strategies with smart devices, telecom plans, and OTT services to expand user reach. Regional platforms like Gaana, Saavn, and NetEase build loyalty through local language catalogs and lower-priced subscription tiers for price-sensitive audiences. Partnerships with music labels, independent artists, and podcast creators help expand content libraries. Firms increasingly focus on AI-driven playlist curation, social listening features, and in-app engagement. Continuous competition drives frequent updates, competitive pricing, personalized features, and enhanced user experience, pushing the market toward innovation and premium content integration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pandora Media LLC (Sirius XM Holdings)

- Gamma Gaana Ltd. (Times Internet)

- Spotify AB

- Rhapsody International Inc. (RealNetworks Inc.)

- Apple Inc.

- Deezer

- YouTube Music (Google LLC)

- Saavn Media Pvt Ltd

- NetEase Inc.

- com Inc.

Recent Developments

- In October 2023, Label Foundation, a pioneering Web 3.0 music platform, entered into a partnership with LG Electronics to introduce Tracks, an innovative Web3-based music streaming service. This groundbreaking collaboration marked the first instance where Web3 technology was seamlessly integrated with television platforms, thereby offering users with a unique & immersive music streaming experience.

- In March 2023, Universal Music Group entered a fresh collaboration with Deezer to foster a novel model music supporting streaming’s ongoing growth. This partnership emphasizes recognizing the contributions of both artists and listeners, striving for a balanced approach that benefits all stakeholders involved in the streaming ecosystem

Report Coverage

The research report offers an in-depth analysis based on Service Type, Platform, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Subscription models will grow as users shift from ad-supported streaming to premium plans.

- AI-based personalization will improve playlist curation, mood detection, and discovery experiences.

- Regional language catalogs and independent artists will gain higher global visibility.

- Smart speakers, connected cars, and wearables will expand music access points.

- Cloud platforms will add more podcasts, live sessions, and exclusive artist collaborations.

- Lossless and spatial audio formats will attract audiophiles seeking premium sound quality.

- Telecom bundling and prepaid subscription models will drive adoption in emerging markets.

- Social sharing, collaborative playlists, and in-app engagement will increase listening hours.

- Advanced data security and payment protection will become priority features.

- Faster 5G networks will improve mobile streaming quality and boost global user growth.