Market Overview

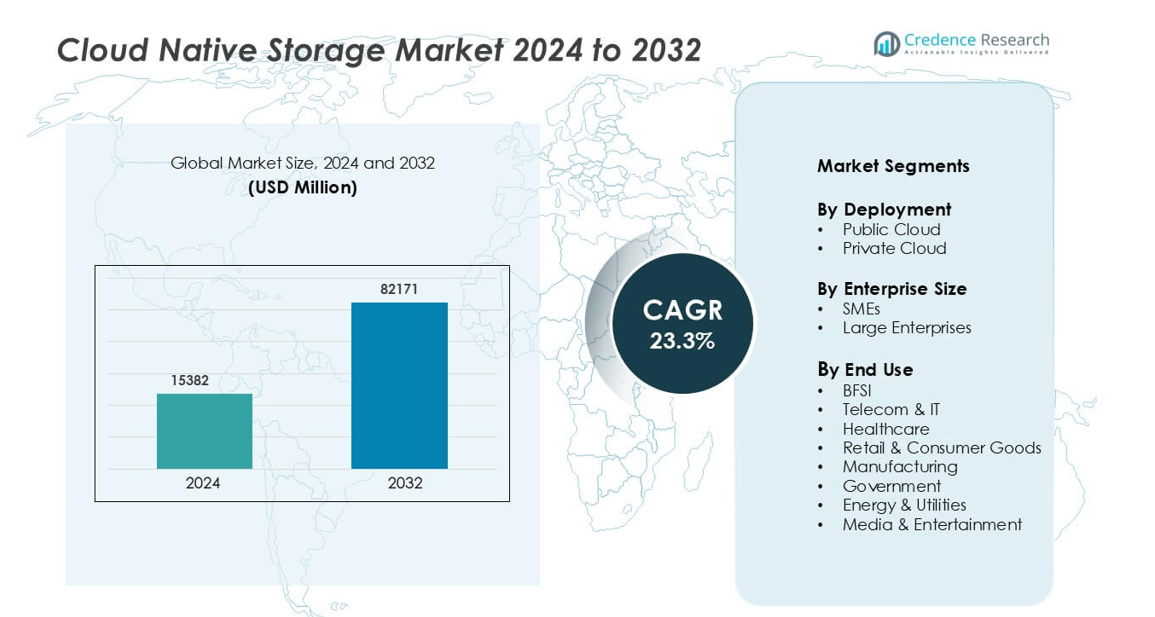

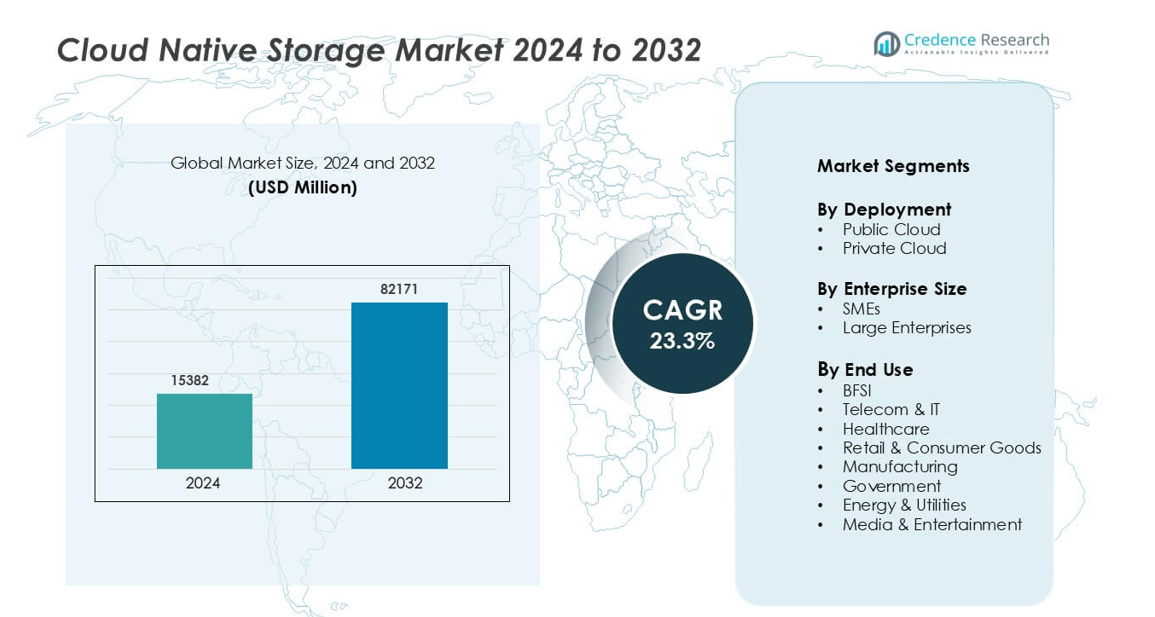

Cloud Native Storage market was valued at USD 15382 million in 2024 and is anticipated to reach USD 82171 million by 2032, growing at a CAGR of 23.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Native Storage Market Size 2024 |

USD 15382 million |

| Cloud Native Storage Market, CAGR |

23.3% |

| Cloud Native Storage Market Size 2032 |

USD 82171 million |

Leading companies in the Cloud Native Storage market include Amazon Web Services, Microsoft Corporation, Google LLC, IBM Corporation, Alibaba Group, Broadcom, Citrix Systems, Rackspace Technology, Splunk, and Huawei Technologies. These vendors compete by offering scalable, container-aware storage platforms that support Kubernetes, microservices, persistent volumes, and cross-cloud data management. Amazon Web Services and Microsoft lead with extensive storage services integrated into multi-cloud and DevOps environments, while Google and IBM strengthen the market by supporting AI-driven data management and hybrid storage deployments. North America remains the largest regional market, holding 38% share due to strong cloud adoption and enterprise investment in data modernization.

Market Insights

- The Cloud Native Storage market reached USD 15382 million in 2024 and will reach USD 82171 million by 2032, expanding at a CAGR of 23.3%.

- Growing adoption of microservices, containers, and Kubernetes drives demand for scalable and persistent cloud-native storage, with large enterprises holding the highest segment share due to complex data requirements.

- Multi-cloud and hybrid strategies accelerate deployment of cloud-native storage, supported by automated scaling, cross-region replication, and container-aware data management solutions.

- Competition remains strong among Amazon Web Services, Microsoft, Google, IBM, Alibaba, Rackspace, and Huawei, as vendors enhance AI-driven optimization, encryption, and disaster recovery capabilities.

- North America leads with 38% regional share, while Asia-Pacific records the fastest growth as telecom, BFSI, and e-commerce sectors expand adoption of cloud-native data platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

Public cloud holds the dominant share in the Cloud Native Storage market due to high scalability, faster provisioning, and integration with containerized applications. Organizations prefer public cloud for its flexible capacity, lower infrastructure costs, and support for Kubernetes and microservices-based workloads. Enterprises running distributed applications use public cloud storage to manage unstructured data, DevOps pipelines, and analytics workloads. Demand rises further as companies adopt multi-cloud strategies and shift legacy systems to cloud-native platforms. Private cloud continues to grow among regulated industries that require stronger control over sensitive data and compliance-driven workloads, but public cloud remains the leading revenue contributor.

- For instance, for Amazon EFS, multiple pods across different nodes and Availability Zones can share a single EFS file system. Each EFS file system supports up to 25,000 connections.

By Enterprise Size

Large enterprises represent the dominant segment in the Cloud Native Storage market. These organizations handle massive data volumes generated from microservices, edge systems, and digital applications. Large enterprises invest heavily in scalable storage platforms that support container orchestration, high availability, and automated data replication. Strict compliance requirements in BFSI, healthcare, and government increase the need for secure cloud-native storage. SMEs show rising adoption fueled by SaaS-based storage services and lower upfront costs. However, large enterprises continue to hold the highest market share due to advanced IT spending and complex storage demands.

- For instance, IBM Storage Scale is documented to support a single namespace exceeding 8 exabytes, allowing enterprises to manage unstructured data across hybrid and multi-cloud environments without performance degradation.

By End Use

Telecom & IT is the leading end-use segment, holding the largest share in the Cloud Native Storage market. The sector manages extensive data from cloud applications, customer usage, streaming services, and real-time analytics. Enterprises prefer cloud-native storage to support containerized workloads and rapid scaling of digital services. BFSI, healthcare, and government follow due to growing adoption of secure storage for transactions, patient records, and public data. Retail, energy, and manufacturing adopt cloud-native storage for IoT, supply chain analytics, and automation workloads. Despite wide adoption across industries, Telecom & IT remains the top revenue-contributing segment.

Key Growth Drivers

Rapid Adoption of Microservices and Containerized Workloads

Enterprises continue to replace monolithic applications with microservices and container-based architectures, creating strong demand for Cloud Native Storage. Traditional storage systems fail to support dynamic scaling and persistent data requirements in Kubernetes and container ecosystems. Cloud Native Storage platforms offer automated provisioning, self-healing storage volumes, data replication, and low-latency access for distributed workloads. Industries such as IT, telecom, BFSI, and e-commerce rely on cloud-native environments to deliver real-time services and faster application updates. As organizations expand DevOps pipelines and edge deployments, scalable storage becomes essential to handle metadata, logs, AI workloads, and unstructured data. Vendors invest in container storage interfaces (CSI), snapshot automation, and NVMe-based storage to improve performance and reliability. This architectural transformation continues to power market growth.

- For instance, Google Kubernetes Engine (GKE) integrates with Persistent Disk and Filestore and documents support for clusters with up to 15,000 nodes and thousands of persistent volume claims.

Increasing Data Volumes and Scalability Requirements

The exponential rise in enterprise data from IoT devices, analytics platforms, remote work infrastructure, and digital services drives demand for scalable Cloud Native Storage. Traditional hardware storage restricts elasticity and capacity expansion, making it unsuitable for fast-growing workloads. Cloud-native platforms offer on-demand capacity, automated tiering, and global replication, supporting petabyte-scale data without manual provisioning. Organizations leverage object storage for backups, logs, AI training datasets, and large file repositories. Real-time streaming applications require persistent volumes with low latency and high throughput, further boosting demand. As enterprises adopt edge computing and hybrid cloud models, scalable storage becomes a core requirement for business continuity and performance improvement.

- For instance, Google Cloud Filestore High Scale supports a single file share with capacity up to 0.1 petabytes and documented throughput of 26,000 MB/s, allowing enterprises to train AI models and run analytics against large unstructured datasets without performance loss.

Emphasis on Cost Efficiency and Infrastructure Modernization

Organizations seek storage platforms that reduce capital expenditure and optimize long-term costs. Cloud Native Storage eliminates the need for hardware expansion, maintenance, and data center upgrades. Vendors offer pay-as-you-go models, automated lifecycle management, and intelligent data tiering to minimize overhead. Legacy storage creates silos and bottlenecks, while cloud-native platforms unify data across applications and cloud providers. Enterprises migrating core systems to cloud platforms adopt native storage to maintain compatibility with DevOps tools and orchestration engines. Reduced administrative effort and automation accelerate modernization initiatives across BFSI, telecom, and healthcare.

Key Trend & Opportunity

Growth of Multi-Cloud and Hybrid Storage Models

Organizations increasingly distribute workloads across AWS, Azure, GCP, and private cloud environments. This shift creates demand for storage platforms that deliver unified visibility, centralized policy management, and automated data replication across clouds. Cloud Native Storage solutions help avoid vendor lock-in and improve resilience during outages. Edge computing adoption further boosts demand as businesses run storage at remote sites while linking back to cloud platforms. Vendors offering hybrid data mobility, geo-replication, and cross-cloud backup gain competitive advantage. As global enterprises standardize multi-cloud, cloud-native storage adoption continues rising.

- For instance, NetApp Cloud Volumes ONTAP supports data replication across AWS, Azure, and Google Cloud and documents a single virtual storage instance with capacity up to 368 terabytes and throughput of 12,500 IOPS.

Rising Integration of AI and Automation

AI-driven storage management reduces manual workload, predicts capacity needs, and prevents performance bottlenecks. Cloud Native Storage platforms automate data placement, compression, deduplication, and disaster recovery policies. Machine learning models analyze usage patterns and optimize cost and performance across distributed environments. Automated snapshots, dynamic scaling, and predictive failure alerts improve reliability for mission-critical workloads. As enterprises face skill shortages in IT and data management, intelligent storage systems become a key opportunity for vendors.

- For instance, IBM Storage Insights uses embedded machine learning trained on telemetry from more than 73,000 storage systems to detect performance anomalies and predict capacity exhaustion.

Key Challenge

Data Security and Compliance Risks

Cloud-native architectures increase exposure to breaches, ransomware, and unauthorized data access. Distributed workloads create complexity in enforcing encryption, identity management, and access controls. Regulated sectors such as BFSI and healthcare require audit trails, retention policies, and sovereign data hosting, which complicate storage decisions. Misconfigurations in cloud storage buckets remain a major risk. Vendors need to enhance built-in encryption, role-based access, ransomware protection, and automated compliance checks to address enterprise concerns.

High Integration Complexity with Legacy Infrastructure

Enterprises running legacy databases and storage arrays face difficulties migrating to cloud-native platforms. Compatibility gaps between old systems and containerized architectures delay adoption. Data migration, latency management, and reconstruction of storage policies create operational dependencies. Large enterprises struggle with retraining teams and restructuring applications for persistent cloud-native volumes. Without seamless integration, modernization remains slow and costly.

Regional Analysis

North America

North America holds the largest market share in the Cloud Native Storage market. Rapid enterprise cloud adoption and strong investments in Kubernetes, microservices, and DevOps workflows drive demand for scalable storage platforms. The U.S. contributes heavily due to advanced IT infrastructure and large volumes of data generated across IT, telecom, and BFSI sectors. Vendors expand hybrid and multi-cloud offerings to support regulated industries requiring security and compliance. Strong presence of hyperscalers and storage innovators further boosts regional dominance. North America accounts for around 38% of total market revenue.

Europe

Europe represents a significant share of the Cloud Native Storage market, supported by strict GDPR policies, digital banking modernization, and growing cloud migration across enterprises. Countries such as Germany, the UK, and France invest in object storage, backup automation, and cross-cloud data mobility for enterprise workloads. Adoption rises among healthcare, public sector, and manufacturing organizations that require secure data retention and high-availability storage. Vendors expand managed cloud storage and data governance tools to address regulatory needs. Europe holds approximately 26% of the market.

Asia-Pacific

Asia-Pacific shows the fastest growth in the Cloud Native Storage market driven by digital transformation, heavy data generation, and rapid cloud expansion across China, India, Japan, and Singapore. Telecom, e-commerce, fintech, and media industries adopt cloud-native storage to support real-time analytics and scalable digital services. Growing edge computing and 5G rollouts increase demand for distributed persistent storage. SMEs accelerate adoption through low-cost cloud storage subscriptions and SaaS applications. Asia-Pacific accounts for about 24% of the global market and continues expanding at a strong pace.

Latin America

Latin America holds a moderate share of the Cloud Native Storage market. Countries such as Brazil, Mexico, and Chile invest in digital banking, online retail, and cloud migration projects. Rising cyberattacks and data compliance needs push enterprises to adopt secure cloud-native storage for backups and application workloads. Limited IT budgets and skills gaps slow adoption, but cloud service providers support growth through managed storage and pay-as-you-use models. The region contributes around 7% of total market revenue and is gradually expanding.

Middle East & Africa

The Middle East & Africa region shows steady adoption supported by smart government projects, fintech expansion, and hybrid cloud investments. Organizations in the UAE, Saudi Arabia, and South Africa deploy cloud-native storage to modernize public services, energy operations, and telecom infrastructure. Secure storage and high-availability data management are essential for mission-critical workloads in banking and oil & gas. Vendors partner with local data centers to reduce latency and meet data residency requirements. The region holds nearly 5% of the global market and continues to grow with increased cloud adoption.

Market Segmentations:

By Deployment

- Public Cloud

- Private Cloud

By Enterprise Size

By End Use

- BFSI

- Telecom & IT

- Healthcare

- Retail & Consumer Goods

- Manufacturing

- Government

- Energy & Utilities

- Media & Entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cloud Native Storage market is shaped by major cloud service providers and specialized storage vendors focused on scalable, container-aware architectures. Companies such as Amazon Web Services, Microsoft, Google, IBM, and Alibaba lead the market with integrated storage services that support Kubernetes, microservices, and multi-cloud workloads. Vendors expand capabilities in persistent volumes, automated backup, high-availability storage, and cross-region replication to support enterprise workloads. Broadcom, Rackspace, Citrix, and Huawei strengthen portfolios with hybrid cloud storage and data orchestration tools that reduce latency and simplify migration. Competition intensifies as enterprises demand secure, low-latency storage for real-time analytics, AI workloads, DevOps pipelines, and edge computing. Providers differentiate through automated scaling, AI-driven optimization, and data encryption to meet compliance and resilience needs. Strategic partnerships with Kubernetes platform providers and managed service providers further accelerate adoption across industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2024, NetApp, U.S.-based data Infrastructure Company, expanded its collaboration with Google Cloud to simplify how companies can use their data for generative AI (GenAI) applications and various hybrid cloud tasks. The enhancement includes the introduction of the Flex service tier for Google Cloud NetApp Volumes, accommodating storage volumes of virtually any dimension. Additionally, NetApp is rolling out a beta version of its GenAI toolkit’s reference architecture, designed for retrieval-augmented generation (RAG) tasks on Google Cloud’s Vertex AI platform

- In October 2023, IBM unveiled the IBM Storage Scale System 6000, marking the latest advancement within its IBM Storage for Data and AI collection. This data solution is tailored for the landscape of data-heavy and AI-focused tasks. The IBM Storage Scale System 6000 aims to further IBM’s leading role by offering an upgraded, high-performance parallel file system tailored for demanding data application

Report Coverage

The research report offers an in-depth analysis based on Deployment, Enterprise Size, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for scalable storage will rise as enterprises adopt microservices and container-based applications.

- Kubernetes-native storage solutions will gain broader deployment across large and mid-sized organizations.

- Data replication and backup features will become more automated through AI-driven orchestration.

- Edge computing growth will push vendors to deliver low-latency, cloud-native storage closer to data sources.

- Integration with DevOps workflows will increase, enabling faster data management within CI/CD pipelines.

- Security-focused storage architectures will expand as compliance and ransomware risks continue to increase.

- Multi-cloud and hybrid-cloud models will drive demand for unified data management across platforms.

- Persistent storage options for stateful applications will see stronger adoption in production environments.

- Open-source storage frameworks will attract investment as enterprises seek cost-efficient flexibility.

- Vendors will focus on high-performance storage that supports real-time analytics and AI workloads.