Market Overview

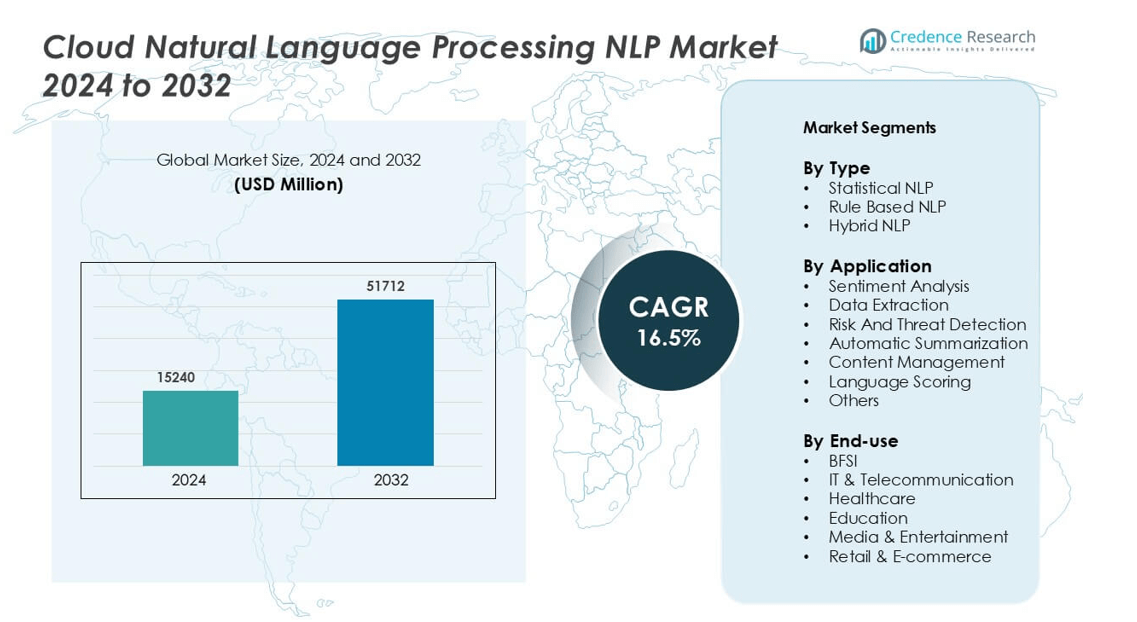

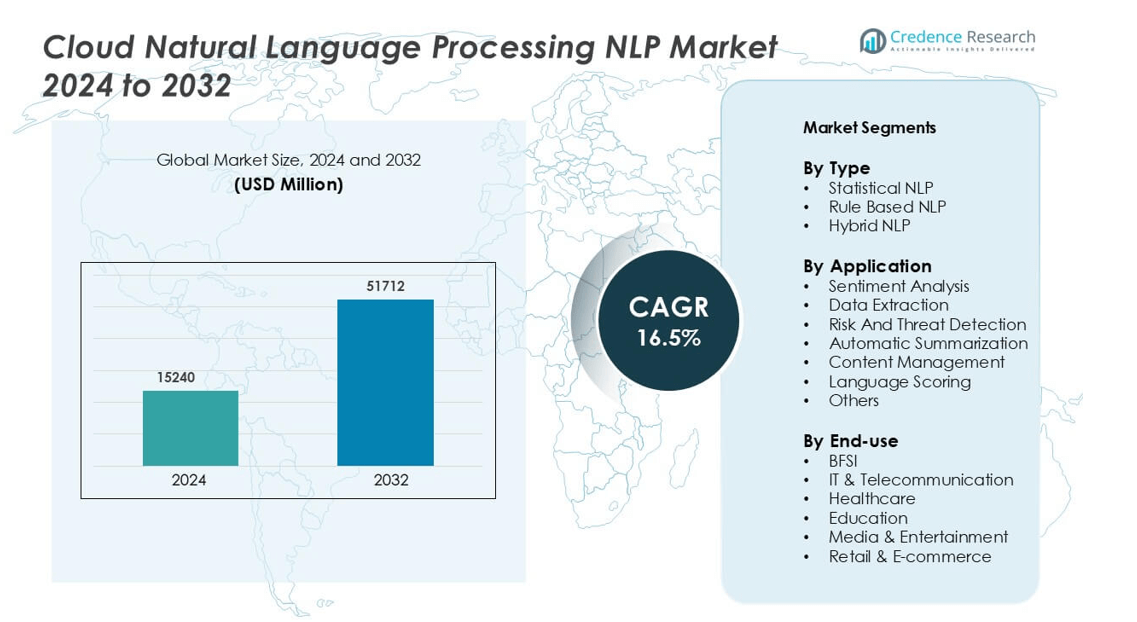

Cloud Natural Language Processing NLP Market was valued at USD 15240 million in 2024 and is anticipated to reach USD 51712 million by 2032, growing at a CAGR of 16.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Natural Language Processing (NLP) Market Size 2024 |

USD 15240 million |

| Cloud Natural Language Processing (NLP) Market, CAGR |

16.5% |

| Cloud Natural Language Processing (NLP) Market Size 2032 |

USD 51712 million |

The Cloud NLP market is highly competitive, led by major technology providers and specialized analytics companies. Key players include Amazon Web Services, Google LLC, Apple Inc., IBM Corporation, Baidu Inc., IQVIA, Inbenta, Crayon Data, Health Fidelity, and 3M. These vendors invest in advanced AI models, multilingual support, and industry-focused solutions for healthcare, BFSI, telecom, and retail. Their cloud-based NLP platforms help enterprises automate customer interactions, analyze text at scale, and improve decision-making. North America remains the dominant region with a 38% market share, driven by strong cloud adoption, high digital transformation spending, and rapid integration of generative and conversational AI into enterprise workflows.

Market Insights

- The Cloud NLP market was valued at USD 15240 million in 2024 and is projected to grow at a CAGR of 16.5 % through 2032, supported by rising enterprise adoption and cloud-based deployment models.

- Strong market drivers include increasing automation in customer service, real-time sentiment analysis, and demand for intelligent chatbots across BFSI, telecom, retail, and healthcare.

- Key trends center on multilingual NLP, generative AI integration, and industry-specific language models that improve accuracy and domain understanding for regulated sectors.

- Competition remains intense with players like Amazon Web Services, Google, IBM, Apple, Baidu, IQVIA, and 3M focusing on API-based delivery, data security, and advanced deep learning features.

- North America leads with 38% regional share, while Hybrid NLP holds the highest segment share due to superior contextual accuracy; Asia Pacific shows the fastest growth driven by e-commerce expansion and mobile usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Hybrid NLP holds the largest share in this segment due to its combined strength of statistical learning and rule-based language understanding. Organizations prefer hybrid systems because they deliver higher accuracy in entity recognition, language translation, and contextual analysis. Statistical NLP supports large-scale language modeling, but hybrid frameworks reduce errors caused by ambiguity in human language. Rule-based systems remain relevant in regulated workflows where deterministic outputs are required. The shift toward hybrid NLP continues to grow as enterprises need scalable, reliable, and context-aware solutions for multilingual and domain-specific tasks.

- For instance, Google’s BERT-based multilingual model supports 104 languages and is trained on a dataset of more than 3.3 billion words.

By Application

Sentiment Analysis leads this segment with the highest market share, driven by rising adoption in e-commerce, social media analytics, and customer experience platforms. Retailers and consumer brands rely on sentiment engines to track product perception, customer satisfaction, and brand loyalty. Data Extraction and Risk & Threat Detection grow strongly due to increased digital transactions and compliance monitoring. Automatic summarization and content management gain traction with rising enterprise data volumes. Language scoring supports online learning and language testing platforms, expanding usage across EdTech companies and assessment providers.

- For instance, IBM Watson NLU is typically offered on a per-item or subscription basis, which implies varying usage levels rather than a fixed global volume. For example, a “Lite” plan offers a limit of 30,000 NLU items per month for proof-of-concept use cases.

By End-use

BFSI represents the dominant end-use segment with the largest market share, supported by strong demand for fraud detection, chatbots, regulatory compliance, and automated customer service. Banks and insurers deploy NLP engines to analyze claims, monitor transactions, and reduce operational workload. IT & Telecom and Healthcare follow due to their heavy data processing needs, while Education benefits from language assessment and learning analytics. Media & Entertainment and Retail & E-commerce adopt NLP to improve recommendation engines, search relevance, and personalized content delivery.

Key Growth Drivers

Rising Cloud Adoption and Enterprise Digital Transformation

Enterprises are shifting workloads from on-premise systems to cloud infrastructure to improve scalability, speed, and cost efficiency. This transition increases demand for cloud-based NLP, as organizations want language processing tools that run quickly without heavy hardware investment. Cloud NLP platforms offer on-demand computing power, real-time analytics, and easy integration with CRM, helpdesks, chatbots, and data warehouses. Businesses use these tools to automate customer support, extract insights from text, and analyze feedback across emails, chats, and social media. As companies expand remote work and digital customer interactions, cloud NLP provides faster deployment, pay-as-you-go pricing, and global access. These factors strongly push market growth.

- For instance, IBM Watson Discovery enables NLP-based search over enterprise datasets and can analyze over 10 million documents with automated relevance ranking and semantic search features.

Increasing Use of NLP in Customer Experience and Automation

Companies in banking, telecom, retail, and healthcare now handle large volumes of customer conversations. Cloud NLP enables automated call transcripts, real-time sentiment scoring, intent detection, and knowledge-based responses. Brands rely on NLP-powered chatbots and virtual assistants to reduce waiting time and offer 24/7 support. Customer service platforms use text classification and entity extraction to route requests more accurately. These tools improve customer experience and lower operating costs. Cloud deployment makes updates faster and supports multi-language processing, helping global businesses handle large customer bases. As organizations focus on customer retention and service quality, NLP adoption keeps rising.

- For instance, Google Dialogflow (both ES and CX) has default quotas for API requests per minute per project, typically in the hundreds or low thousands, which can be increased upon request to Google Cloud Support.

Growth of AI-Driven Analytics Across Unstructured Data Sources

Enterprises generate massive unstructured text from documents, medical notes, email, research papers, compliance reports, and user reviews. Cloud NLP applies machine learning to extract meaning from this data at scale, turning text into actionable information. Companies use NLP to detect risks, summarize information, and classify sensitive content for compliance. In healthcare, NLP assists in clinical decision support and electronic health records. In finance, it helps detect fraud patterns and analyze regulatory documents. Cloud platforms handle sudden data spikes, store large datasets, and deliver faster query processing. As more industries shift from manual text review to automated analytics, cloud NLP becomes essential.

Key Trends & Opportunities

Multilingual and Cross-Language NLP Expansion

Global commerce, cross-border e-commerce, and multicultural user bases increase demand for NLP tools that support many languages. Cloud NLP vendors are adding regional language models for Asian, Middle Eastern, and European markets. This creates a major opportunity in customer service, media platforms, and government services where translation, sentiment, and voice recognition are required. Enterprises also want localized chatbots and voice assistants that understand cultural context, slang, and dialects. Countries with fast digital adoption, such as India and Southeast Asia, drive growth for multilingual NLP. The market benefits from expanding internet penetration and rising digital payments, creating large volumes of multilingual text.

- For instance, Microsoft Translator provides neural models for more than 125 languages and dialects, including Hindi, Tamil, Arabic, and Turkish. Baidu’s speech recognition system handles over 7.5 billion voice queries per day in Mandarin and regional Chinese dialects, supporting e-commerce and smart devices.

Adoption of Generative AI and Large Language Models

Cloud providers now integrate large language models and generative AI into NLP tools for text creation, summarization, automated reporting, and code suggestions. Enterprises see value in faster content production, automated knowledge extraction, and smarter search functions. Generative NLP improves productivity in marketing, customer support, healthcare documentation, and education content. Vendors offer API-based services, so companies can run advanced NLP without training their own models. As businesses adopt AI policies and data governance frameworks, the use of generative NLP becomes more mainstream. This shift opens opportunities in content automation, enterprise knowledge management, and advanced text analytics.

- For instance, Microsoft’s Azure AI Foundry provides access to more than 11,000 models from various partners, including OpenAI, Cohere, and Meta.

Key Challenges

Data Privacy, Compliance, and Security Concerns

Cloud NLP processes sensitive data such as customer identities, financial information, and medical records. Many organizations remain concerned about storing and analyzing such data on external cloud servers. Industries like banking and healthcare face strict compliance rules, which demand data encryption, access control, and audit trails. Any gaps in security can lead to legal risks and trust issues. Enterprises also worry about exposure of proprietary information when sending documents through cloud APIs. Vendors must offer strong security certifications, on-premise deployment options, private cloud support, and regional data centers to overcome these concerns.

Accuracy Limits in Complex and Domain-Specific Language

While NLP has advanced, it still struggles with sarcasm, slang, informal text, and mixed languages. Industries like healthcare, legal, and finance use specialized vocabulary that general NLP models may interpret incorrectly. Errors in sentiment analysis or document classification can lead to misinformation or poor decision-making. Training domain-specific NLP models requires large, labeled datasets, which many companies do not have. Multilingual accuracy is also uneven across languages. To overcome this, vendors must improve model training, add supervised learning options, and allow custom models tailored to industry-specific needs.

Regional Analysis

North America

North America holds 38% of the Cloud NLP market, driven by high cloud adoption, strong AI investments, and advanced digital infrastructure. U.S. enterprises lead in deploying NLP for chatbots, customer analytics, regulatory compliance, and fraud detection. Major cloud providers and NLP innovators headquartered in the region accelerate technology maturity and enterprise adoption. Banks, telecom operators, hospitals, and e-commerce platforms rely on cloud NLP to improve service quality and automate text-heavy workflows. Rapid integration of generative AI, multilingual models, and real-time analytics sustains market dominance and keeps North America the primary revenue hub.

Europe

Europe accounts for 27% of the Cloud NLP market, supported by fast digital transformation across finance, healthcare, manufacturing, and government sectors. Strict GDPR regulations increase demand for secure NLP platforms with strong data governance. Banks and insurers deploy NLP for risk modeling, document screening, and customer engagement. Healthcare providers use clinical text mining and EHR analytics for decision support. Multilingual support is a major driver, as NLP tools must handle English, French, German, Spanish, and regional languages. Expanding AI innovation centers, strong enterprise cloud spending, and public-sector modernization help Europe maintain a leading share.

Asia Pacific

Asia Pacific holds 24% of the market and records the highest growth rate due to rapid cloud adoption, booming e-commerce, and strong mobile penetration. China, India, Japan, and South Korea are major contributors, with enterprises using NLP for sentiment monitoring, voice assistants, smart customer care, and real-time translation. Telecom, retail, e-learning, and payments platforms generate huge volumes of unstructured data, increasing reliance on cloud-based analytics. Local language support drives adoption across diverse linguistic markets. Government investments in AI education and smart city programs, along with cloud expansion by global hyperscalers, boost regional momentum.

Latin America

Latin America captures 7% of the Cloud NLP market as organizations shift from legacy systems to cloud-based analytics and customer automation. Banks and fintech platforms use NLP for fraud detection, credit analytics, and customer chatbots. Retailers and telecom companies deploy sentiment monitoring to track customer feedback on social platforms. Brazil and Mexico lead with strong digital transformation and growing start-up ecosystems. Cloud subscription models reduce infrastructure costs for small and mid-sized enterprises. Expanding regional data centers and improved NLP support for Spanish and Portuguese help Latin America accelerate adoption and expand its market share.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the market, with steady growth led by BFSI, telecom, government services, and energy sectors. Gulf countries deploy NLP in smart city initiatives, digital identity verification, and AI-based public services. Banks use cloud NLP for compliance, customer onboarding, and multilingual chatbots. Africa’s growth comes from mobile banking, e-learning, and social commerce platforms adopting text analytics. Expanding cloud data centers, rising internet penetration, and localized models for Arabic and African languages support long-term market development. The region shows high future potential as digital infrastructure strengthens

Market Segmentations:

By Type

- Statistical NLP

- Rule Based NLP

- Hybrid NLP

By Application

- Sentiment Analysis

- Data Extraction

- Risk And Threat Detection

- Automatic Summarization

- Content Management

- Language Scoring

- Others

By End-use

- BFSI

- IT & Telecommunication

- Healthcare

- Education

- Media & Entertainment

- Retail & E-commerce

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Cloud Natural Language Processing (NLP) market features strong competition among global cloud providers, AI platform companies, and specialized language technology vendors. Major players like Amazon Web Services, Google, Apple, IBM, Baidu, and IQVIA invest heavily in deep learning models, multilingual processing, generative AI, and real-time text analytics to strengthen their portfolios. These companies offer NLP through cloud APIs, enabling enterprises to deploy chatbots, voice assistants, translation tools, and sentiment engines without building models from scratch. Vendors also focus on industry-specific solutions for banking, telecom, healthcare, and e-commerce to increase adoption. Partnerships, acquisitions, and AI research collaborations help accelerate innovation and expand data processing capabilities. Pricing models, data security features, and language coverage remain key differentiators in the competitive space. Leading providers are also integrating explainable AI and domain-trained models to improve accuracy and meet compliance requirements, keeping competition intense and innovation continuous.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IQVIA

- Crayon Data

- Amazon Web Services, Inc.

- Health Fidelity

- Inbenta

- IBM Corporation

- Baidu Inc.

- Google LLC

- 3M

- Apple Inc.

Recent Developments

- In 2025, IQVIA NVIDIA’s GTC Paris keynote highlighted IQVIA’s AI agent work. The collaboration advances agentic AI for life sciences workflows. It supports large-scale NLP on cloud GPUs.

- In April 2025, Amazon Web Services (AWS) WBD Sports Europe launched Cycling Central Intelligence on AWS. It uses Amazon Bedrock, Comprehend, Textract, and Translate for natural-language queries. The system powers real-time insights for live broadcasts.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud NLP adoption will increase as enterprises automate customer support and digital communication.

- Multilingual language models will expand, improving accuracy for regional languages and dialects.

- Generative AI will enhance summarization, content creation, and intelligent virtual assistant performance.

- Industry-specific NLP models will gain traction in healthcare, banking, legal, and education.

- Real-time sentiment and intent analysis will strengthen brand monitoring and customer experience.

- Speech-to-text and voice recognition tools will integrate deeper with smart devices and call centers.

- Privacy-focused NLP solutions will rise due to stricter compliance and data security needs.

- Low-code and API-based platforms will make NLP accessible to small and midsize businesses.

- Edge computing will support faster, localized NLP processing for telecom and IoT applications.

- Continuous advances in deep learning will reduce errors and improve contextual understanding across complex language tasks.