Market Overview

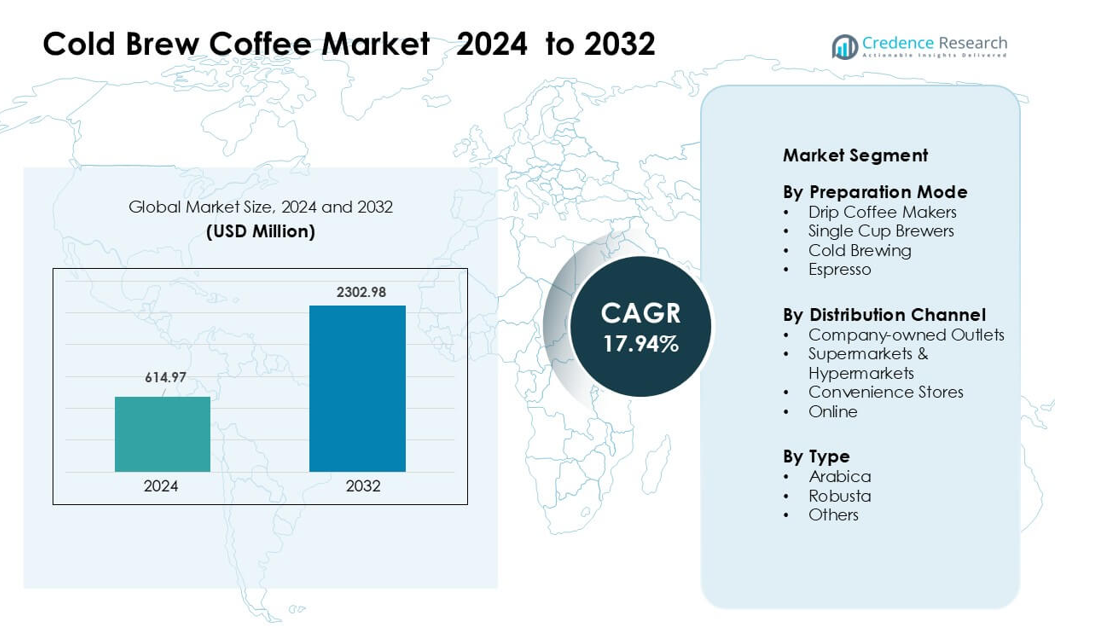

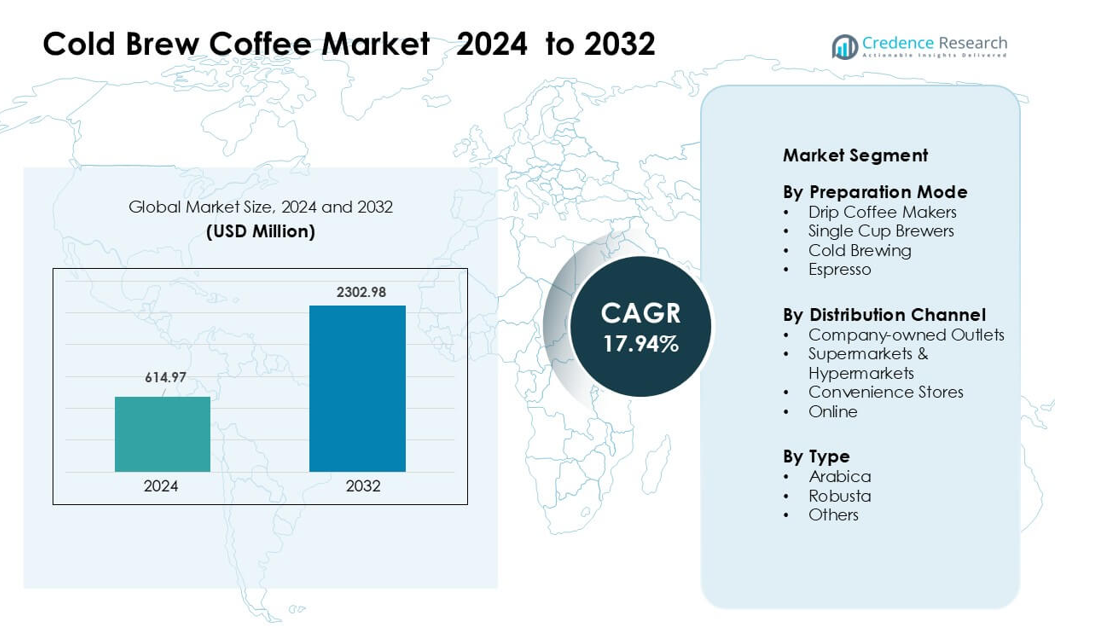

Cold Brew Coffee Market was valued at USD 614.97 million in 2024 and is anticipated to reach USD 2302.98 million by 2032, growing at a CAGR of 17.94% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cold Brew Coffee Market Size 2024 |

USD 614.97 million |

| Cold Brew Coffee Market , CAGR |

17.94% |

| Cold Brew Coffee Market Size 2032 |

USD 2302.98 million |

The cold brew coffee market is shaped by leading companies such as La Colombe Coffee Roasters, Nestlé, Sleepy Owl Coffee, JAB Holding Company, RISE Brewing Co., Califia Farms, HighBrewCoffee, Starbucks Coffee Company, Heartland Food Products Group, and Kohana Coffee. These players focus on expanding ready-to-drink lines, improving brewing technology, and strengthening retail and online distribution to capture rising demand for smooth, low-acidity beverages. Product innovation in flavored, nitro, and clean-label cold brew continues to drive brand differentiation. North America led the market in 2024 with about 46% share, supported by strong café culture and high adoption of premium coffee beverages.

Market Insights

- The cold brew coffee market reached USD 97 million in 2024 and is projected to hit USD 2302.98 million by 2032 at a CAGR of 17.94 %.

- Demand grew as consumers shifted toward smooth, low-acidity beverages, with Arabica holding the largest type share of about 64% due to its clean flavor profile.

- Brands introduced nitro variants, flavored concentrates, and functional cold brew options, driving strong innovation across retail and café channels.

- Competition intensified as players like Nestlé, Starbucks Coffee Company, Califia Farms, and La Colombe Coffee Roasters expanded RTD product lines and strengthened distribution networks.

- North America led the market with nearly 46% share, followed by Europe at 27%, while drip coffee makers remained the dominant preparation mode segment with about 43% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Preparation Mode

Drip coffee makers led the cold brew coffee market in 2024 with about 43% share. Many households and cafés preferred drip systems because these machines deliver steady extraction and allow large-batch brewing for chilled beverages. Brands also expanded automatic drip models with adjustable flow controls, which supported stronger flavor consistency. Single cup brewers and espresso units grew through urban demand, but drip systems stayed dominant due to wider availability, lower maintenance needs, and strong use in ready-to-drink production setups.

- For instance, Technivorm, the Dutch maker of the Moccamaster drip brewer, had by 2017 manufactured over 10 million units.

By Distribution Channel

Supermarkets and hypermarkets dominated the market in 2024 with nearly 48% share. Shoppers bought more cold brew products from these outlets because stores offer broad varieties, combo deals, and stable in-store visibility. Large chains also increased shelf space for premium cold brew bottles and concentrates, which boosted footfall conversions. Company-owned outlets and convenience stores saw steady demand, while online channels rose through subscription packs, but supermarkets remained ahead due to high reach and strong retail promotions.

- For instance, Peet’s Coffee launch the Coldcraft business unit in May 2017 to handle the innovation and chilled distribution of its refrigerated ready-to-drink (RTD) cold brew products across the West Coast.

By Type

Arabica held the leading position in 2024 with about 64% share. Coffee brands favored Arabica for its mild acidity, smoother taste, and strong alignment with premium cold brew products. Many roasters promoted single-origin Arabica lines, which attracted younger consumers seeking cleaner flavor notes. Robusta showed gradual growth due to higher caffeine content and use in blended cold brew formulas, yet Arabica maintained dominance as demand for specialty and craft cold brew beverages increased across cafés and retail shelves.

Key Growth Drivers

Rising Preference for Smooth, Low-Acidity Coffee

Cold brew coffee gained strong consumer interest because the brewing method delivers a smoother taste with lower acidity than hot-brewed options. Many health-focused buyers shifted toward cold brew as it reduces stomach irritation, supports easier digestion, and pairs well with functional ingredients such as probiotics or plant-based additives. Younger consumers also adopted cold brew due to its clean flavor profile and versatility in ready-to-drink formats. Brands introduced flavored and unsweetened variants to appeal to calorie-conscious buyers. This shift in taste preference, combined with wellness-driven purchasing behavior, continued to push cold brew into mainstream retail shelves and foodservice menus.

- For instance, La Colombe s 32-oz cold brew concentrate delivers 230 mg of caffeine per prepared serving while being formulated for low acidity & natural sweetness via a cold-press process.

Expansion of Ready-to-Drink (RTD) Coffee Consumption

Ready-to-drink cold brew products grew rapidly as busy consumers looked for quick, premium, café-style beverages without preparation time. Many companies widened distribution through supermarkets and online channels, making bottled cold brew more accessible. Advancements in packaging, including nitrogen-infused cans and long-shelf-life bottles, increased product stability and consumer trust. RTD cold brew also benefitted from rising demand for energy substitutes, offering a cleaner caffeine source compared with traditional energy drinks. Continuous investments by global beverage brands further strengthened market penetration across urban and semi-urban regions, supporting strong long-term growth.

- For instance, Starbucks and PepsiCo, via their North American Coffee Partnership, launched RTD Starbucks® Nitro Cold Brew in grocery and convenience channels.

Growing Café Culture and Premium Coffee Consumption

The rise in specialty cafés and micro-roasters improved cold brew awareness, especially in major metropolitan areas. Cafés promoted cold brew as a premium, craft beverage with higher flavor clarity and customizable strength. Many chains adopted cold brew taps and seasonal cold brew menus, boosting repeat purchases. The shift toward experiential coffee consumption also encouraged customers to explore new cold brew styles such as nitro cold brew, flavored profiles, and single-origin batches. This expanding premium coffee culture supported strong demand across both dine-in and takeaway channels, reinforcing cold brew as a core product in modern café portfolios.

Key Trend & Opportunity

Growth of Functional and Health-Focused Cold Brew

A major trend in the cold brew coffee market is the expansion of functional formulations. Brands introduced products enriched with adaptogens, MCT oil, vitamins, protein, and plant-based components to attract health-conscious consumers. This development opened new opportunities in sports nutrition, weight management, and clean-energy segments. The trend also aligned well with rising demand for low-sugar beverages, enabling brands to position cold brew as a healthier alternative to conventional iced coffee. As wellness-oriented consumption continues to rise, functional cold brew beverages present strong long-term potential for product differentiation.

- For instance, Danone’s STōK Cold Brew Energy cans are crafted to deliver 195 mg of caffeine per 11-oz serving, and are enhanced with functional ingredients like B-vitamins, ginseng, and guarana.

Rapid Digital Commerce Growth and Subscription Models

Online platforms and direct-to-consumer channels created strong opportunities for cold brew brands to build recurring revenue. Subscription-based services gained traction as consumers sought convenient home delivery of chilled bottles, concentrates, and cold brew kits. Social media marketing, influencer partnerships, and digital brand storytelling also helped smaller roasters expand visibility without large retail investments. Online platforms allowed brands to test flavors, gather customer feedback, and launch limited-edition batches quickly. This trend widened market access and supported strong adoption across younger consumers and remote workers.

- For instance, Drip Queen Coffee offers a Latte-ish Trio subscription plan, shipping freshly brewed cold brew in small batches twice a month directly to customers nationwide.

Innovation in Brewing Equipment and Home Preparation

Another emerging trend is the rise in home brewing. Consumers purchased drip systems, cold brew makers, and single-serve brewers to recreate café-style beverages at home. Manufacturers innovated with compact cold brew appliances, faster extraction technology, and reusable filters. These advancements encouraged higher household consumption and reduced dependence on café purchases. The home brewing trend also opened opportunities for selling cold brew concentrates and coffee grounds designed specifically for cold extraction.

Key Challenge

High Production Costs and Labor-Intensive Brewing

Cold brew brewing requires long extraction times, higher coffee-to-water ratios, and considerable storage capacity. These requirements increase production costs and limit the scalability of small roasters. Maintaining consistent flavor profiles across batches is also challenging due to variations in coffee beans, grind size, and steeping processes. RTD cold brew products add further complexity, requiring advanced filtration, refrigeration, and shelf-stability solutions. High manufacturing costs often translate to premium pricing, which restricts adoption among price-sensitive consumers.

Limited Cold Chain and Distribution Constraints

Cold brew coffee often needs chilled storage, especially for fresh or minimally processed variants. Many emerging markets lack reliable cold chains, increasing distribution costs and product spoilage risk. Smaller brands struggle to compete with large beverage companies that have established refrigerated logistics. Retail shelf space for chilled beverages is also limited, restricting penetration in supermarkets and convenience stores. These distribution challenges create barriers for expansion in rural and semi-urban areas, slowing market growth where cold chain infrastructure remains underdeveloped.

Regional Analysis

North America

North America dominated the cold brew coffee market in 2024 with about 46% share, driven by strong café culture, high RTD coffee adoption, and widespread availability across supermarkets and convenience stores. Consumers preferred cold brew for its smooth taste and functional variants, supporting steady growth across the U.S. and Canada. Major brands expanded distribution through retail chains and foodservice outlets, strengthening market depth. The region also saw a rise in nitro cold brew and flavored options, which boosted premium product sales. Strong digital commerce and subscription models further increased household consumption.

Europe

Europe accounted for nearly 27% share in 2024, supported by rising specialty café penetration and growing demand for premium chilled beverages. Consumers in the U.K., Germany, and the Nordics adopted cold brew due to interest in low-acidity drinks and clean-label formulations. Retailers expanded shelf space for bottled cold brew, while cafés promoted seasonal cold brew menus. The region also benefited from strong innovation in organic and sustainably sourced coffee, which matched local consumer preferences. Online delivery platforms and private-label offerings helped increase market access, contributing to consistent regional expansion.

Asia Pacific

Asia Pacific captured about 19% share in 2024, driven by rapid café expansion, rising urban incomes, and strong youth adoption. Markets such as South Korea, Japan, China, and Australia embraced cold brew due to its smooth taste and alignment with lifestyle-focused consumption. Global coffee chains expanded cold brew menus, prompting local brands to launch RTD products and e-commerce bundles. Social media trends and premium gifting culture supported category visibility. Despite varying coffee consumption patterns across countries, demand increased steadily as buyers explored western-style beverages and innovative cold brew flavors.

Latin America

Latin America held close to 5% share in 2024, with growth supported by rising interest in specialty coffee and export-driven branding. Brazil, Colombia, and Mexico saw early adoption in urban cafés that promoted cold brew as a premium alternative to traditional iced coffee. Many regional roasters used locally sourced beans to market single-origin cold brew, expanding appeal among younger consumers. Retail penetration remained limited, but online channels and boutique cafés improved product reach. As awareness increases, Latin America is expected to become a strong emerging market for premium cold brew beverages.

Middle East & Africa

The Middle East & Africa region accounted for around 3% share in 2024, with growth led by the UAE, Saudi Arabia, and South Africa. Rising specialty café culture and higher acceptance of western coffee formats supported early cold brew adoption. Premium hotels and upscale cafés introduced cold brew menus, attracting tourists and young professionals. Retail availability remains limited, but e-commerce and ready-to-drink offerings are gaining traction. As café chains expand into major cities, the region is set to show steady, urban-driven growth in cold brew consumption.

Market Segmentations:

By Preparation Mode

- Drip Coffee Makers

- Single Cup Brewers

- Cold Brewing

- Espresso

By Distribution Channel

- Company-owned Outlets

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

By Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cold brew coffee market features strong competition led by major brands such as La Colombe Coffee Roasters, Nestlé, Sleepy Owl Coffee, JAB Holding Company, RISE Brewing Co., Califia Farms, HighBrewCoffee, Starbucks Coffee Company, Heartland Food Products Group, and Kohana Coffee. These companies expanded portfolios with ready-to-drink bottles, concentrates, nitro cold brew, and flavored variants to capture wider consumer groups. Many players invested in sustainable sourcing, premium Arabica blends, and clean-label recipes to strengthen brand trust. Retail penetration increased through supermarkets, cafés, and direct-to-consumer platforms, supported by digital marketing and subscription programs. Innovation in brewing technology, packaging formats, and low-sugar formulations helped brands differentiate in a crowded space. Companies also focused on expanding café networks, forging distribution partnerships, and entering emerging markets across Asia Pacific and Europe. Growing product launches and rising household adoption continue to intensify competition across both global and regional brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- La Colombe Coffee Roasters

- Sleepy Owl Coffee

- JAB Holding Company

- RISE Brewing Co.

- Califia Farms, LLC

- HighBrewCoffee

- Starbucks Coffee Company

- Heartland Food Products Group

- Kohana Coffee

Recent Developments

- In 2025, Starbucks Launched Coco Cold Brew (a coconut-water based cold brew innovation) as part of limited tests in select U.S. stores (part of the company’s 2025 wellness “Starting 5” testing program).

- In May 2025, Nestlé introduced a freeze-drying technique for premium soluble coffee that dissolves in cold liquids.

- In April 2024, Nestlé announced plans to expand its cold-coffee footprint, noting cold coffee consumption grew about 15 % in the past four years.

Report Coverage

The research report offers an in-depth analysis based on Preparation Mode, Distribution Channel, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as more consumers choose smooth, low-acidity coffee options.

- Ready-to-drink cold brew products will gain traction across retail and online channels.

- Functional cold brew with protein, adaptogens, and plant-based ingredients will rise in demand.

- Café chains will broaden cold brew menus, boosting premium and seasonal offerings.

- Home brewing systems and cold brew kits will support steady household adoption.

- Brands will invest more in sustainable sourcing and eco-friendly packaging.

- Innovation in nitro, flavored, and single-origin cold brew will strengthen product diversity.

- Emerging markets in Asia Pacific will see faster growth due to rising café culture.

- Digital subscriptions and direct-to-consumer models will expand customer reach.

- Competition will intensify as global beverage companies enter new cold brew segments.