Market Overview

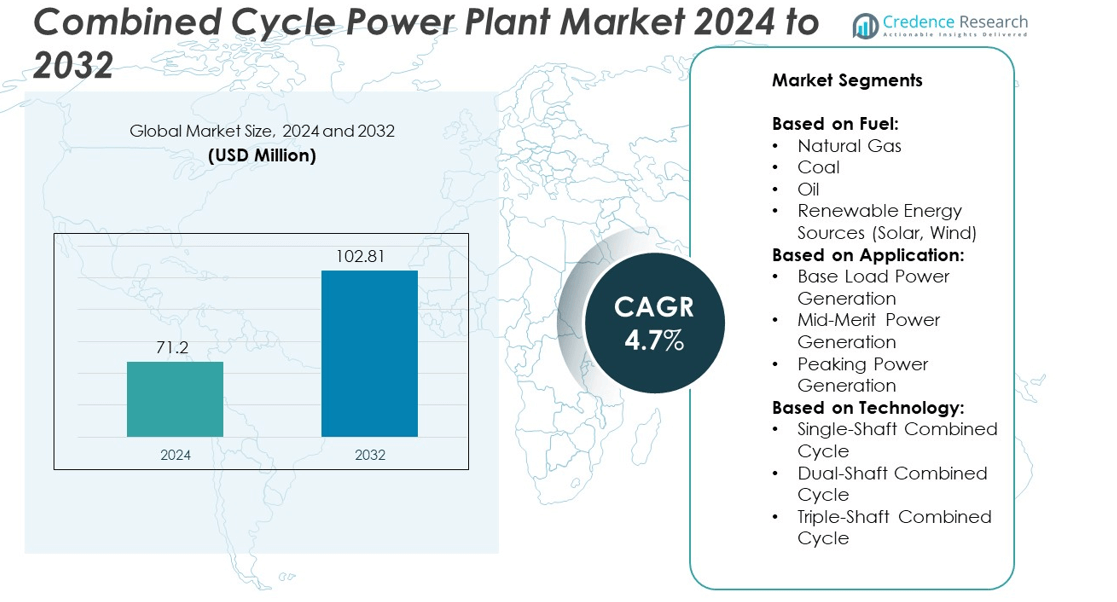

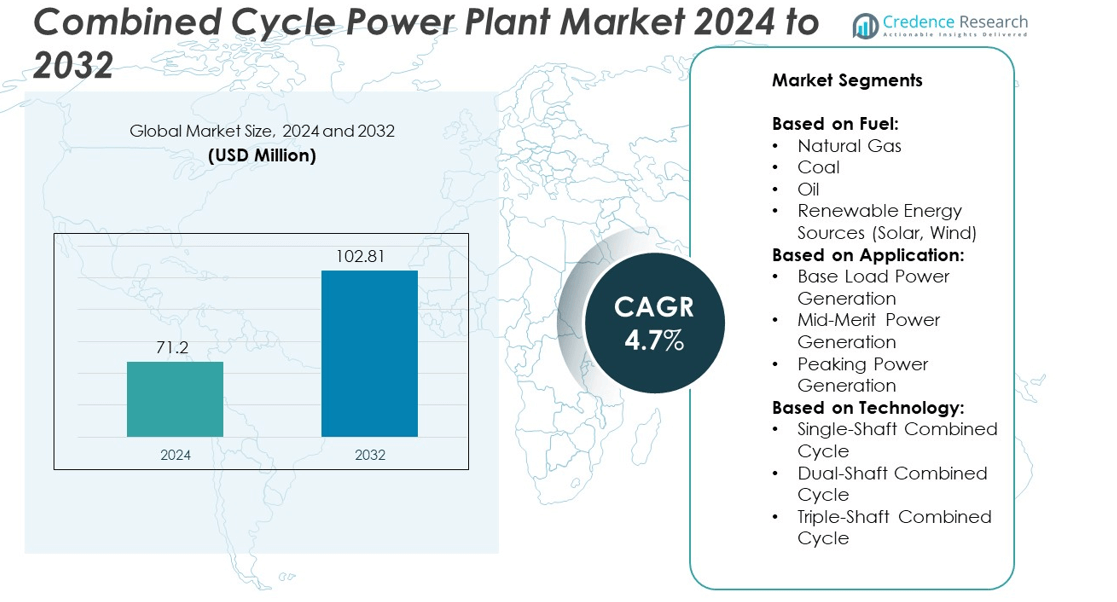

The Combined Cycle Power Plant market size was valued at USD 71.2 million in 2024 and is anticipated to reach USD 102.81 million by 2032, growing at a compound annual growth rate (CAGR) of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Combined Cycle Power Plant Market Size 2024 |

USD 71.2 million |

| Combined Cycle Power Plant Market, CAGR |

4.7% |

| Combined Cycle Power Plant Market Size 2032 |

USD 102.81 million |

The Combined Cycle Power Plant market grows driven by rising demand for efficient and low-emission power generation, supported by stringent environmental regulations worldwide. Technological advancements in turbine efficiency and digital monitoring enhance operational performance and reduce costs. Increasing adoption of natural gas as a cleaner fuel and integration with renewable energy sources further propel market expansion. Governments promote investments through favorable policies and incentives, especially in emerging economies facing rising electricity demand. These factors collectively create a dynamic environment that accelerates the deployment and modernization of combined cycle power plants globally.

The Combined Cycle Power Plant market demonstrates strong growth across North America, Europe, and Asia Pacific, driven by increasing energy demand and a shift toward cleaner power generation. North America leads with advanced infrastructure and technological adoption, while Asia Pacific experiences rapid expansion due to industrialization and urbanization. Key players shaping the market include General Electric, Mitsubishi Hitachi Power Systems, Siemens, and Baker Hughes. These companies focus on innovation, efficiency improvements, and expanding their global footprint to meet evolving energy needs and environmental regulations. Their strategic investments and technology development remain crucial to market advancement worldwide.

Market Insights

- The Combined Cycle Power Plant market was valued at USD 71.2 million in 2024 and is projected to reach USD 102.81 million by 2032, growing at a CAGR of 4.7% during the forecast period.

- Rising demand for efficient and low-emission power generation drives market growth, supported by stricter environmental regulations and increasing industrialization.

- Technological advancements in turbine efficiency and digital monitoring systems improve plant performance, reduce operational costs, and enhance reliability.

- Integration of renewable energy sources such as solar and wind with combined cycle plants gains momentum, promoting cleaner and more stable power supply solutions.

- High initial capital investment and infrastructure requirements limit market expansion, particularly in developing regions with limited financial resources.

- North America, Europe, and Asia Pacific dominate the market, fueled by advanced infrastructure, regulatory support, and rising energy demand in emerging economies.

- Leading companies like General Electric, Mitsubishi Hitachi Power Systems, Siemens, and Baker Hughes compete through innovation, technology development, and strategic partnerships to strengthen market presence globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient and Cleaner Power Generation Solutions

The growing global need for reliable electricity and stricter environmental regulations drive the adoption of combined cycle power plants. These plants offer higher efficiency by utilizing both gas and steam turbines to maximize energy output. Their ability to reduce greenhouse gas emissions compared to traditional power plants makes them an attractive option for governments and private sectors aiming to meet sustainability goals. Increasing industrialization and urbanization further push the demand for cleaner and more efficient energy sources. This demand supports investments in modernizing existing infrastructure and constructing new combined cycle facilities. The market benefits from this trend by providing solutions that align with energy transition policies worldwide.

- For instance, General Electric’s HA gas turbine technology operates with a firing temperature exceeding 2,600 degrees Fahrenheit, achieving combined cycle efficiencies above 62%.

Technological Advancements Enhancing Plant Efficiency and Performance

Continuous innovations in turbine technology and heat recovery systems enhance the overall performance of combined cycle power plants. Improvements in materials and design allow these plants to operate at higher temperatures and pressures, increasing efficiency and reducing fuel consumption. It enables operators to lower operational costs while meeting stricter emissions standards. Digitalization and automation also optimize plant management, minimizing downtime and improving output reliability. The integration of advanced control systems supports predictive maintenance and real-time monitoring. These technological strides make combined cycle power plants more competitive against alternative energy sources.

- For instance, Siemens’ SGT-8000H gas turbine has achieved output power above 400 MW in combined cycle mode with a heat rate reduction of approximately 2,700 kcal/kWh.

Government Initiatives Supporting Clean Energy Investments

Government policies and incentives aimed at reducing carbon footprints significantly influence the combined cycle power plant market. Many countries implement subsidies, tax benefits, and regulatory frameworks favoring natural gas-based power generation. It encourages utilities and independent power producers to invest in combined cycle projects. Public funding for research and development further accelerates technology improvements and deployment. These initiatives create a stable investment environment, attracting private sector participation. The supportive regulatory landscape also helps streamline project approvals and permits, reducing time to market.

Growing Demand in Emerging Economies Due to Energy Access Needs

Emerging economies experience rapid population growth and expanding industrial bases, increasing electricity consumption. Limited access to reliable power sources drives the adoption of combined cycle power plants, which offer flexible and scalable energy solutions. It supports efforts to bridge the energy gap while maintaining environmental standards. The market finds significant growth opportunities in regions where energy infrastructure development remains a priority. Investments in combined cycle technology help meet growing electricity demands with lower emissions compared to coal-fired plants. This dynamic creates a favorable environment for market expansion in developing countries.

Market Trends

Integration of Renewable Energy Sources with Combined Cycle Power Plants

The combined cycle power plant market increasingly moves toward hybrid configurations that integrate renewable energy sources such as solar and wind. This integration improves grid stability and reduces reliance on fossil fuels. Combining gas turbines with renewable inputs allows operators to manage variability in power supply more effectively. It supports smoother transitions between energy sources while maintaining continuous output. Utilities adopt these hybrid systems to meet clean energy targets without compromising reliability. This trend reflects a broader shift toward decarbonizing power generation. The market adapts by developing technologies that facilitate efficient coupling of renewables with combined cycle systems.

- For instance, Mitsubishi Hitachi Power Systems completed the installation of a 1,500 MW combined cycle power plant in Japan with government support that integrated advanced ultra-supercritical steam technology to improve efficiency and lower emissions, MHPS will provide a M701F gas turbine.

Shift Towards Advanced Gas Turbine Technologies for Enhanced Efficiency

Innovations in gas turbine design shape market trends by enabling higher operational temperatures and improved fuel flexibility. New turbine models deliver greater efficiency and lower emissions, which appeal to power producers seeking cost-effective and environmentally friendly options. The market experiences increased demand for turbines capable of running on hydrogen blends or alternative fuels. It encourages manufacturers to expand their product portfolios with advanced materials and cooling technologies. These improvements contribute to longer service life and reduced maintenance costs. The adoption of cutting-edge turbines reinforces the competitive advantage of combined cycle plants within the energy sector.

- For instance, Doosan Heavy Industries & Construction delivered a 1,200 MW combined cycle power project in India that features heat recovery steam generators designed to optimize efficiency in high ambient temperatures common in emerging markets.

Growing Focus on Digitalization and Predictive Maintenance

Digital technologies play a vital role in transforming the combined cycle power plant market by enhancing operational performance. It employs data analytics, artificial intelligence, and Internet of Things (IoT) sensors to monitor equipment health and optimize processes. Predictive maintenance minimizes unplanned outages and extends asset life by identifying issues before failures occur. Operators gain better control over fuel consumption and emissions through real-time insights. The use of digital tools improves overall plant efficiency and lowers operational expenses. This trend accelerates the shift toward smarter, more responsive power generation facilities.

Expansion of Market Presence in Emerging Economies Driven by Infrastructure Development

Emerging economies continue to drive growth by expanding power infrastructure to meet rising electricity demand. The combined cycle power plant market benefits from investments in natural gas projects due to its lower emissions profile compared to coal. It supports governments’ objectives to increase energy access while adhering to environmental regulations. Growing urbanization and industrialization create consistent demand for efficient power generation solutions. These regions attract significant foreign direct investment and international partnerships. This expansion positions the market for sustained growth in the coming years.

Market Challenges Analysis

High Initial Capital Investment and Infrastructure Requirements Limit Market Expansion

The combined cycle power plant market faces significant challenges due to the substantial upfront capital needed for construction and commissioning. Large-scale projects require extensive infrastructure, including fuel supply networks and cooling systems, which add to the overall cost. These financial barriers often deter smaller utilities and emerging market players from investing in new facilities. It also leads to longer project timelines and complex regulatory approvals, affecting the pace of market growth. Limited availability of skilled workforce to operate and maintain sophisticated equipment further complicates project execution. Financing difficulties and risk perception in volatile energy markets constrain investment flows. This challenge underscores the need for cost-effective solutions and streamlined project management.

Competition from Renewable Energy Sources and Fuel Price Volatility Impact Market Stability

The increasing penetration of renewable energy technologies presents strong competition to combined cycle power plants, putting pressure on market demand. Renewable power sources benefit from declining costs and government incentives, making them attractive alternatives. It must compete in markets with growing mandates for zero-emission energy, which affects long-term viability. Fluctuations in natural gas prices create uncertainty for operational costs and profitability. Supply disruptions or geopolitical tensions affecting fuel availability can further impact plant performance. Market players face challenges in maintaining consistent output and economic feasibility amid these variables. These factors demand strategic planning to balance efficiency, cost, and environmental compliance.

Market Opportunities

Expansion in Emerging Economies Driven by Rising Energy Demand and Infrastructure Development

The combined cycle power plant market holds significant opportunities in emerging economies where rapid industrialization and urbanization fuel growing electricity consumption. Many of these regions face challenges in meeting energy demand with existing infrastructure, creating a need for efficient and reliable power generation solutions. It offers a scalable and cleaner alternative to traditional coal-fired plants, aligning with government initiatives to reduce emissions. Investments in natural gas infrastructure and favorable regulatory frameworks encourage the development of new combined cycle facilities. This growth potential attracts foreign investment and technology transfer, supporting economic development. Market players can capitalize on this by tailoring solutions to local conditions and energy requirements.

Adoption of Advanced Technologies to Improve Efficiency and Environmental Performance

Technological advancements in turbine design, fuel flexibility, and digital monitoring present considerable growth avenues for the combined cycle power plant market. Innovations that increase plant efficiency and enable operation on hydrogen blends or other low-carbon fuels expand market relevance amid energy transition efforts. It benefits from integrating digital tools that optimize performance and reduce operational risks through predictive maintenance. This enhances asset life and lowers overall costs, making combined cycle plants more competitive. Growing emphasis on sustainability drives demand for plants that comply with stricter emissions standards. Market participants investing in research and development can leverage these opportunities to capture market share and strengthen their position in a shifting energy landscape.

Market Segmentation Analysis:

By Fuel:

Natural gas dominates the market due to its abundance, cost-effectiveness, and lower emissions compared to coal and oil. It supports cleaner power generation and aligns with global decarbonization goals. Coal and oil continue to play roles in certain regions with existing infrastructure but face declining demand due to environmental regulations. The integration of renewable energy sources, such as solar and wind, in hybrid combined cycle systems presents emerging opportunities. These hybrid configurations improve overall efficiency and grid stability, enhancing market appeal.

- For instance, Siemens Energy developed a hybrid power plant solution that integrates a 100 MW solar photovoltaic system with a 250 MW combined cycle gas turbine, enabling flexible operation and grid balancing while reducing carbon emissions.

By Application:

Base load power generation represents a significant share of the market. Combined cycle power plants provide stable and continuous power output, meeting the consistent demand required by base load operations. Mid-merit power generation serves periods of fluctuating demand, with plants offering flexibility and quicker ramp-up times. Peaking power generation applications benefit from combined cycle plants’ ability to start and stop rapidly compared to conventional plants, catering to peak load demands efficiently. This versatility across different demand scenarios strengthens the market position of combined cycle technology.

- For instance, General Electric’s 7HA gas turbine can reach full load in less than 30 minutes, providing rapid start-up capability essential for peaking and mid-merit applications.

By Technology:

Single-shaft combined cycle plants are widely adopted due to their compact design and operational simplicity. They integrate a single gas turbine, steam turbine, and generator on a shared shaft, optimizing space and reducing capital costs. Dual-shaft combined cycle plants separate the gas and steam turbines onto independent shafts, offering operational flexibility and easier maintenance. This configuration suits larger plants with varying load requirements. Triple-shaft combined cycle plants, although less common, provide maximum operational flexibility and efficiency by independently controlling two gas turbines and one steam turbine. This technology targets high-capacity plants requiring optimized performance.

Segments:

Based on Fuel:

- Natural Gas

- Coal

- Oil

- Renewable Energy Sources (Solar, Wind)

Based on Application:

- Base Load Power Generation

- Mid-Merit Power Generation

- Peaking Power Generation

Based on Technology:

- Single-Shaft Combined Cycle

- Dual-Shaft Combined Cycle

- Triple-Shaft Combined Cycle

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the market with an estimated share of approximately 35% in 2024. The region’s extensive natural gas infrastructure, technological advancements, and focus on reducing carbon emissions drive strong adoption of combined cycle technology. The United States remains the largest contributor within North America, leveraging abundant natural gas reserves and supportive regulatory frameworks. Investments in upgrading aging power plants and expanding capacity reinforce the region’s leadership position in this market.

Europe

Europe holds the second-largest market share at around 28%. Stringent environmental regulations and ambitious renewable energy targets push utilities to adopt cleaner and more efficient combined cycle power plants. Countries like Germany, the United Kingdom, and France actively invest in natural gas-based power generation to transition away from coal. The European Union’s climate policies encourage modernization of power infrastructure and integration of hybrid systems combining renewables with combined cycle plants. Despite challenges related to high capital costs and regulatory complexities, Europe maintains steady growth, driven by its commitment to sustainability and energy security.

The Asia Pacific

The Asia Pacific region accounts for roughly 25% of the combined cycle power plant market. Rapid industrialization, urbanization, and rising electricity demand in countries such as China, India, Japan, and South Korea fuel market expansion. Governments in these countries emphasize cleaner energy sources to reduce pollution and meet climate goals. The market benefits from increasing investments in natural gas infrastructure and technological upgrades. China leads within the region due to its vast energy needs and efforts to replace coal-fired plants with more efficient combined cycle facilities. Market growth in Asia Pacific also stems from the adoption of advanced technologies and favorable financing mechanisms that support large-scale projects.

The Middle East and Africa (MEA)

The Middle East and Africa (MEA) region holds about 8% of the market share. The abundant natural gas reserves in the Middle East support the development of combined cycle power plants, contributing to energy diversification and export capabilities. Countries such as Saudi Arabia, the United Arab Emirates, and Qatar invest heavily in modern power infrastructure to meet growing domestic demand and improve export potential. Africa’s market remains smaller but gradually expands due to electrification efforts and international investments in power generation. The MEA region’s strategic focus on leveraging gas resources and improving energy efficiency underpins its market growth.

Latin America

Latin America represents approximately 4% of the combined cycle power plant market. Emerging economies like Brazil, Mexico, and Argentina increasingly adopt natural gas combined cycle technology to enhance power generation capacity and reduce reliance on hydropower, which faces seasonal variability. Government incentives and international partnerships support market development, although infrastructure challenges and economic fluctuations can limit rapid expansion. The region’s focus on energy diversification and reducing emissions drives steady demand for combined cycle plants.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Baker Hughes

- Siemens

- Kawasaki Heavy Industries

- Hyundai Heavy Industries

- General Electric

- Doosan Heavy Industries Construction

- MAN Energy Solutions

- Mitsubishi Hitachi Power Systems

- Pratt Whitney

- Ansaldo Energia

- Wartsila

- Shanghai Electric Group

- IHI Corporation

- Harbin Electric International

- Toshiba Energy Systems Solutions

Competitive Analysis

Key players in the Combined Cycle Power Plant market include General Electric, Mitsubishi Hitachi Power Systems, Siemens, Baker Hughes, Doosan Heavy Industries Construction, and Ansaldo Energia. These companies maintain a strong competitive position through continuous innovation, expanding product portfolios, and strategic partnerships. They focus on developing advanced turbine technologies that offer higher efficiency, lower emissions, and enhanced fuel flexibility, meeting stringent environmental regulations worldwide. Investment in research and development remains a priority to improve operational performance and reduce costs. Market leaders also emphasize digitalization and predictive maintenance solutions to optimize plant uptime and reliability. Strategic collaborations and regional expansion enable them to capture emerging market opportunities, particularly in Asia Pacific and the Middle East. These companies leverage their global manufacturing and service networks to provide customized solutions, addressing specific customer needs. Their ability to offer comprehensive after-sales support and long-term service agreements further strengthens customer loyalty and market share. Overall, the competitive landscape is shaped by technological advancements, sustainable energy goals, and the need for cost-efficient power generation solutions.

Recent Developments

- In June 16, 2025, Pratt & Whitney Canada announced a collaboration with ATR to advance propulsion technology for regional turboprop aircraft, focusing on improving thermal efficiency, engine durability, reliability, and exploring hybrid-electric propulsion as part of ATR’s next-generation aircraft concept “EVO.” Since 2022, the PW127XT-M engine has amassed over 300,000 flight hours and delivered improved maintenance and fuel efficiency.

- In 2025, Pratt & Whitney established a $73 million Center of Excellence at Purdue University’s Zucrow Labs to enhance research capabilities in propulsion technologies including gas turbine engines, combustion, and advanced materials.

- In October 2024, GE Vernova Inc. reported that the Dongguan Ningzhou combined-cycle power plant in Guangdong Province, China, had started commercial operations. The power plant, which is fitted with three 9HA.02 gas turbines, will contribute up to 2.4 gigawatts (GW) of electricity to the grid, complementing the 1.34 GW already coming from the GE Vernova HA-powered Huizhou power plant.

Market Concentration & Characteristics

The Combined Cycle Power Plant market exhibits a moderately concentrated competitive landscape, dominated by a few key multinational corporations that hold substantial market shares. These leading companies leverage advanced technological capabilities, extensive manufacturing infrastructure, and broad service networks to maintain their positions. The market features high barriers to entry due to the significant capital investment required for research, development, and production of sophisticated turbine systems. It demands continuous innovation to meet evolving efficiency standards and stricter environmental regulations. The presence of strong regional players in emerging economies adds complexity to the competitive environment, driving tailored solutions to local market needs. The market’s characteristics include a focus on fuel flexibility, operational efficiency, and integration with renewable energy sources to address shifting energy policies globally. Customer contracts often emphasize long-term service and maintenance agreements, reflecting the capital-intensive nature of combined cycle projects. Furthermore, the market experiences steady growth driven by the demand for cleaner and more efficient power generation technologies, prompting existing players to invest in digitalization and automation for improved performance and reliability. This combination of factors creates a dynamic yet challenging environment where companies must balance innovation, cost management, and sustainability to secure and expand their market share.

Report Coverage

The research report offers an in-depth analysis based on Fuel, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue growing due to increasing demand for efficient and low-emission power generation.

- Technological advancements will focus on improving turbine efficiency and fuel flexibility.

- Integration with renewable energy sources will become more common to support grid stability.

- Governments will enhance policies and incentives to promote cleaner energy solutions.

- Digitalization and predictive maintenance will optimize plant operations and reduce downtime.

- Emerging economies will drive market expansion through infrastructure development and rising electricity demand.

- Companies will invest heavily in research and development to meet stricter environmental standards.

- Hybrid combined cycle systems will gain traction for their ability to balance reliability and sustainability.

- The shift toward hydrogen and alternative fuels will influence future turbine designs.

- Market competition will intensify with innovation and strategic partnerships shaping industry leadership.