Market overview

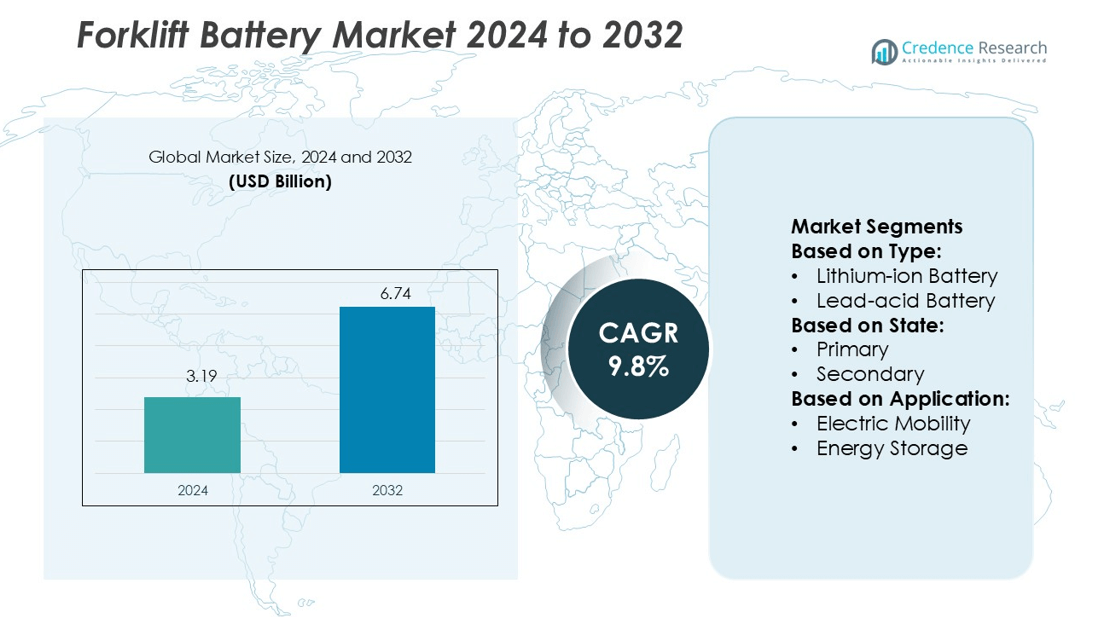

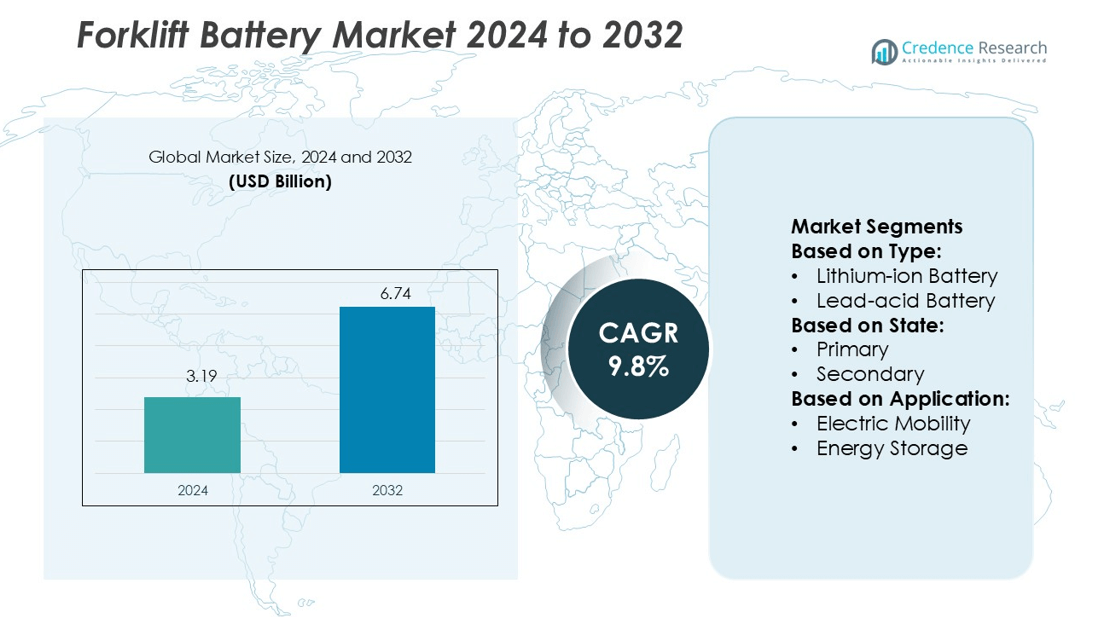

Forklift Battery Market size was valued USD 3.19 billion in 2024 and is anticipated to reach USD 6.74 billion by 2032, at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Forklift Battery Market Size 2024 |

USD 3.19 billion |

| Forklift Battery Market, CAGR |

9.8% |

| FForklift Battery Market Size 2032 |

USD 6.74 billion |

The forklift battery market is shaped by key players such as EnerSys, BYD, Flux Power Holdings, Exide Technologies, Godrej Enterprises Group, Amara Raja Batteries, GB Industrial Battery, Electrovaya, Crown Equipment, and East Penn Manufacturing. These companies focus on advanced battery chemistries, improved charging efficiency, and expanded production capacity to strengthen their global presence. Strategic investments in lithium-ion technology and energy storage innovation drive competition and product differentiation. North America leads the forklift battery market with a 38.5% share, supported by strong logistics infrastructure, high warehouse automation levels, and rapid electrification of material handling equipment.

Market Insights

- The forklift battery market was valued at USD 3.19 billion in 2024 and is projected to reach USD 6.74 billion by 2032, growing at a CAGR of 9.8%.

- Rising demand for electric forklifts and warehouse automation boosts adoption of advanced battery systems across logistics, retail, and manufacturing sectors.

- Lithium-ion batteries dominate the segment with strong growth, driven by higher energy efficiency, lower maintenance, and faster charging compared to lead-acid batteries.

- The competitive landscape is shaped by players such as EnerSys, BYD, Flux Power Holdings, Exide Technologies, and Amara Raja Batteries focusing on product innovation and capacity expansion.

- North America leads the market with a 38.5% share, supported by robust e-commerce growth and rapid electrification of material handling equipment, while Asia Pacific shows strong future expansion potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The lithium-ion battery segment leads the forklift battery market with a 46.3% share in 2024. This dominance is driven by its higher energy density, faster charging time, and longer lifecycle compared to lead-acid and nickel-based alternatives. Lithium-ion technology also supports opportunity charging, reducing downtime in warehouse operations. The growing shift toward sustainable material-handling solutions further accelerates adoption. Lead-acid batteries continue to hold a notable share due to cost efficiency, while nickel–cadmium and nickel-metal hydride batteries serve specialized applications requiring high durability.

- For instance, EnerSys has expanded its NexSys® iON lithium-ion range with 80 V models engineered for heavy-duty Class I forklift trucks. These batteries deliver energy capacities between 17.8 kWh and 35.7 kWh, enabling high-power operation during multi-shift warehouse activity.

By State

The secondary battery segment dominates the market with a 92.6% share in 2024. Rechargeable batteries, particularly lithium-ion and advanced lead-acid types, are widely used for electric forklifts in logistics, manufacturing, and warehousing operations. The strong preference for secondary batteries stems from their lower total cost of ownership, reduced replacement frequency, and compatibility with fast-charging technologies. Primary batteries remain limited to niche applications due to their disposable nature and lower energy efficiency. The shift toward electrification of industrial equipment further strengthens secondary battery demand.

- For instance, BYD’s iron-phosphate (LiFePO₄) forklift battery in the “ECC 22” model runs on an 80-volt pack engineered for 24/7 indoor operations. It supports opportunity charging, with a reported charge time of 1.3 hours, and is backed by a 10-year battery warranty.

By Application

Electric mobility is the leading application segment, holding a 55.8% market share in 2024. The rapid expansion of e-commerce, warehouse automation, and sustainable logistics operations fuels demand for battery-powered forklifts. These vehicles offer zero emissions, lower operational costs, and improved maneuverability in confined spaces. Energy storage applications are also growing steadily due to increased use of batteries for backup power in distribution centers. Consumer electronics and other segments maintain smaller shares, serving supporting roles in diversified operational environments.

Key Growth Drivers

Rising Adoption of Electric Forklifts

The growing shift toward electric material handling solutions is driving forklift battery demand. Companies are replacing internal combustion forklifts with electric models to lower emissions and improve energy efficiency. Lithium-ion batteries offer faster charging and longer life cycles, making them suitable for high-duty operations. Industries such as automotive, logistics, and manufacturing are investing heavily in electric fleets. Government incentives for clean energy solutions further strengthen this shift, increasing market opportunities for advanced battery technologies in large-scale warehouse and distribution centers.

- For instance, Flux Power introduced its L-Series “L36” battery pack for Class 1 3-wheel counterbalance forklifts with capacity options of 630 Ah and 840 Ah at 36 V, incorporating integrated active cooling and heating systems plus a built-in BMS for over-charge, over-discharge and thermal protection.

Expansion of E-Commerce and Warehousing Operations

Rapid growth in e-commerce and logistics is creating strong demand for efficient warehouse equipment. Forklifts powered by advanced batteries ensure faster material movement, lower downtime, and better operational safety. Automated and high-capacity warehouses are increasingly relying on electric forklift fleets for round-the-clock operations. Lithium-ion and nickel–metal hydride batteries are gaining preference for their low maintenance and extended life span. This expansion in storage and distribution networks directly boosts forklift battery sales across multiple industrial sectors.

- For instance, Exide Technologies in October 2024 launched its “Solition Material Handling” lithium-iron-phosphate battery system, which supports up to 4,000 charge-discharge cycles under high-discharge conditions.

Technological Advancements in Battery Systems

Battery technology is evolving to deliver higher performance, safety, and energy density. Modern forklift batteries integrate smart battery management systems, enabling real-time monitoring and predictive maintenance. Fast-charging features reduce downtime and enhance operational efficiency in high-demand environments. Manufacturers are developing compact, high-capacity batteries that fit multiple forklift models. Advancements in thermal management, energy recovery, and improved charging infrastructure are making electric forklifts more reliable, supporting wider adoption in large manufacturing and logistics operations.

Key Trends & Opportunities

Increasing Demand for Lithium-Ion Batteries

Lithium-ion batteries are gaining traction due to their longer service life and lower maintenance needs. These batteries support opportunity charging, which helps maintain continuous forklift operation. Industries are replacing lead-acid batteries to minimize downtime and improve cost efficiency. The decline in lithium-ion cell prices is further expanding their adoption. As automation grows, the preference for high-efficiency batteries offers strong opportunities for manufacturers to innovate and capture new segments within the forklift battery market.

- For instance, Godrej & Boyce’s lithium-ion forklift battery system offers up to 5,000 charge/discharge cycles, compared to ~1,200 cycles for traditional lead-acid packs.

Growth of Renewable Energy Integration

The integration of renewable power sources in charging infrastructure is emerging as a key trend. Companies are adopting solar-powered charging stations to reduce energy costs and carbon footprints. This move aligns with sustainability goals and regulatory pressure to cut emissions. Energy storage systems paired with forklift batteries are supporting efficient power use and grid stability. These green initiatives are creating opportunities for battery producers to offer eco-friendly solutions with better energy utilization and operational resilience.

- For instance, GB Industrial Battery offers its model 18-125-15 traction battery, which operates at 36 V, contains 18 cells, delivers 875 Ah @ 6-hour rate, 933 Ah @ 8-hour rate, and 1,379 Ah @ 20-hour rate, with a kWh rating of 30.56 kWh.

Rising Investment in R&D and Automation

Manufacturers are investing in R&D to enhance battery efficiency, durability, and smart features. Automated charging and battery swapping technologies are improving fleet productivity. AI-based monitoring tools are being used to track battery health and predict failures, reducing unplanned downtime. These innovations are increasing forklift deployment in automated warehouses and cold storage facilities. Such investments are expected to expand market opportunities by offering advanced solutions tailored to industry-specific operational needs.

Key Challenges

High Initial Cost of Advanced Batteries

Lithium-ion and other advanced batteries require higher upfront investment compared to lead-acid batteries. Small and medium-sized enterprises often face financial barriers to adopting these solutions. While lower operating costs provide long-term savings, the initial cost can slow adoption. Infrastructure upgrades such as fast chargers also add to expenses. This cost challenge is pushing many companies to extend the use of traditional batteries, affecting the pace of market transformation.

Limited Charging Infrastructure in Emerging Markets

Many developing regions lack the charging infrastructure needed for advanced battery systems. Inadequate power supply and limited access to fast chargers reduce operational efficiency and limit large-scale adoption. Companies face challenges in managing charging schedules, leading to downtime in warehouse operations. Infrastructure gaps also affect the integration of renewable power sources. Overcoming these issues will be essential for expanding the forklift battery market in emerging economies.

Regional Analysis

North America

North America holds a 34.1% share of the forklift battery market in 2024. The region’s strong position is supported by advanced warehousing infrastructure, rapid automation, and the widespread adoption of electric forklifts. The U.S. leads the market due to its large logistics and manufacturing base. Key industries such as automotive, retail, and e-commerce are driving the demand for efficient material handling solutions. Supportive government incentives and a focus on sustainability are boosting lithium-ion battery installations. Investment in smart charging infrastructure and high-capacity battery systems is further accelerating the market’s expansion across major industrial hubs.

Europe

Europe accounts for a 29.8% share of the forklift battery market in 2024. The region benefits from strong environmental regulations, encouraging companies to shift from fuel-powered to electric forklifts. Germany, France, and the UK dominate the regional market, driven by logistics, automotive, and food processing sectors. Widespread adoption of lithium-ion batteries and renewable energy integration enhances operational efficiency. Advanced charging infrastructure and fleet electrification initiatives are supporting market growth. The EU’s focus on carbon neutrality and sustainable industrial practices continues to create opportunities for battery manufacturers to expand their presence in high-demand sectors.

Asia Pacific

Asia Pacific leads with a 31.2% share of the forklift battery market in 2024. China, Japan, and India are the major contributors due to rapid industrialization and strong manufacturing output. Growing e-commerce and logistics activities are driving high demand for efficient warehouse equipment. The region is witnessing large-scale adoption of lithium-ion batteries, supported by declining battery prices and government incentives for electrification. Expanding warehouse capacity and increasing investment in smart factories are key growth factors. Domestic battery production capabilities also enhance supply chain efficiency, positioning Asia Pacific as the fastest-growing forklift battery market.

Latin America

Latin America holds a 2.9% share of the forklift battery market in 2024. The region’s market is growing steadily with increased investment in logistics and manufacturing infrastructure. Brazil and Mexico lead the regional demand due to their expanding industrial bases. The adoption of electric forklifts is rising as companies aim to reduce operational costs and improve efficiency. However, limited charging infrastructure and higher upfront battery costs restrict faster growth. Ongoing modernization projects in supply chain facilities and government-led energy initiatives are expected to boost demand for advanced battery technologies in the coming years.

Middle East & Africa

The Middle East & Africa region accounts for a 2.0% share of the forklift battery market in 2024. Growth is supported by expanding construction, logistics, and warehousing activities in key economies like the UAE, Saudi Arabia, and South Africa. Companies are increasingly adopting electric forklifts to meet sustainability goals and reduce operational expenses. However, infrastructure limitations and lower adoption rates of lithium-ion technologies remain key barriers. Government initiatives to modernize logistics and integrate renewable energy sources are creating new opportunities for forklift battery suppliers to strengthen their presence in emerging markets.

Market Segmentations:

By Type:

- Lithium-ion Battery

- Lead-acid Battery

By State:

By Application:

- Electric Mobility

- Energy Storage

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The forklift battery market is shaped by strong competition among EnerSys, BYD, Flux Power Holdings, Exide Technologies, Godrej Enterprises Group, Amara Raja Batteries, GB Industrial Battery, Electrovaya, Crown Equipment, and East Penn Manufacturing. The forklift battery market is experiencing strong competitive momentum, driven by rapid electrification and warehouse automation. Manufacturers are prioritizing the development of advanced lithium-ion and hybrid battery systems that offer higher energy density, lower maintenance, and longer life cycles. Strategic investments are being directed toward expanding production capacity and improving charging infrastructure. Many companies are integrating smart battery management systems to enhance operational efficiency and safety. Mergers, acquisitions, and strategic alliances are common, aimed at strengthening market positioning and global distribution. The focus on cost efficiency, sustainability, and technological differentiation is intensifying competition, encouraging innovation and regional expansion across key industrial hubs worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EnerSys

- BYD

- Flux Power Holdings

- Exide Technologies

- Godrej Enterprises Group

- Amara Raja Batteries

- GB Industrial Battery

- Electrovaya

- Crown Equipment

- East Penn Manufacturing

Recent Developments

- In May 2025, Vivo launched the V50 Elite edition with a snapdragon processor, a 6000 mAh battery, and bundled earbuds in India. The brand provides 3 years of OS updates and 4 years of security support.

- In May 2025, NHOA Energy, a global provider of large-scale energy storage systems, started the construction of a 400 megawatt-hour battery energy storage system (BESS) in Kallo, Beveren, Belgium, in partnership with ENGIE.

- In May 2025, Prometheus hyperscale and XL Batteries partnered to install long-duration energy storage at U.S. Data centers. The revolution in the battery industry is paving the way for enhancements and improvements, leading to expansion and recognition of the new and existing businesses.

- In August 2024, Godrej Industries announced the introduction of lithium ion (Li-ion) powered electric forklifts in India. This makes a huge impact on the country’s material handling business. This eco-friendly forklift is expected to achieve greater efficiency and lower operating cost as well as shortened charging time than existing lead acid forklifts. The new Li-ion forklift is alligned with the company’s environmental policy of energy efficient technologies that aim to make India green and cutting edge friendly.

Report Coverage

The research report offers an in-depth analysis based on Type, State, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The adoption of lithium-ion technology will continue to accelerate across industries.

- Smart battery management systems will become standard in modern forklift fleets.

- Renewable energy integration will strengthen sustainable warehouse operations.

- Fast-charging infrastructure will expand to support round-the-clock logistics.

- R&D investment will drive higher energy density and longer battery life.

- Automation and electrification will increase battery demand in emerging economies.

- Battery recycling and reuse practices will gain more industry focus.

- Wireless charging and modular battery systems will see growing adoption.

- Strategic partnerships will shape global supply chains and product innovation.

- Government incentives and green regulations will support wider electric forklift deployment.Top of Form