Market Overview

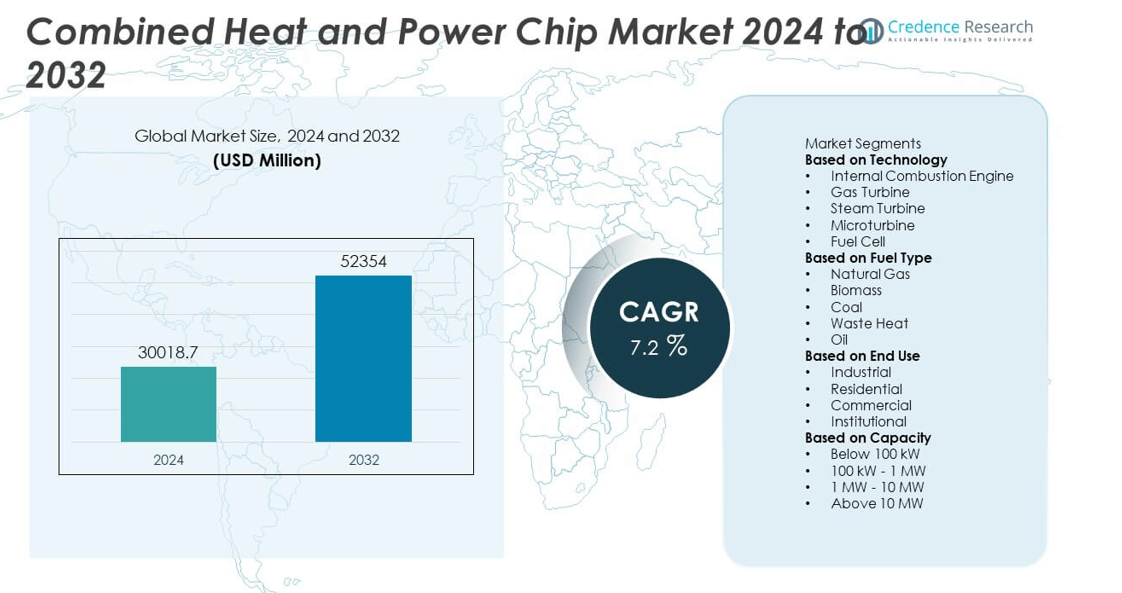

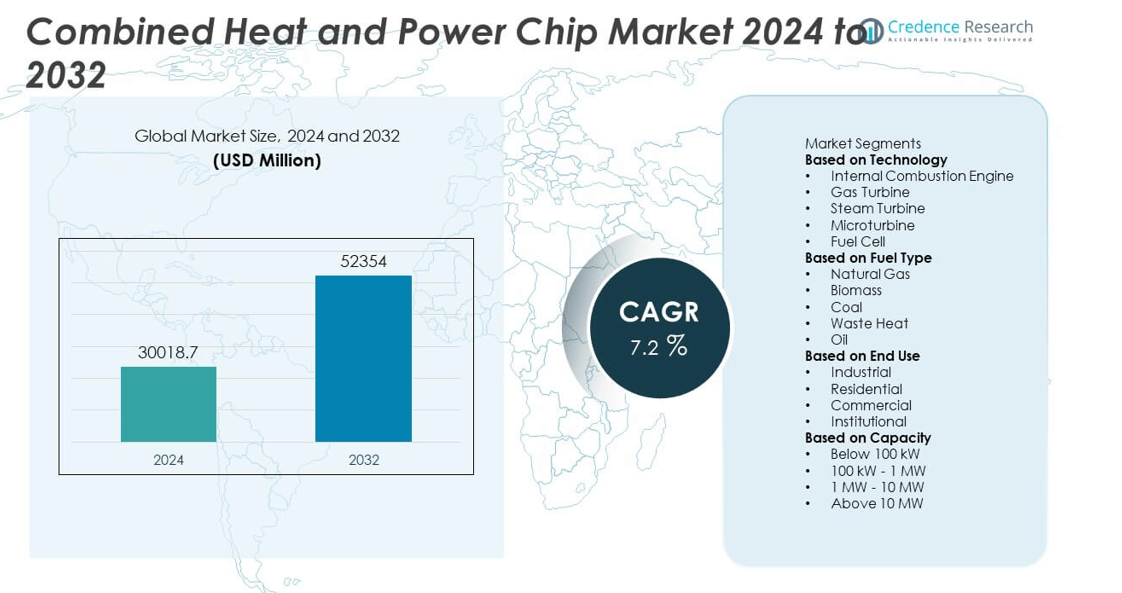

The Combined Heat and Power (CHP) Chip market was valued at USD 30,018.7 million in 2024 and is projected to reach USD 52,354 million by 2032, growing at a compound annual growth rate (CAGR) of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Combined Heat and Power Chip Market Size 2024 |

USD 30,018.7 million |

| Combined Heat and Power Chip Market, CAGR |

7.2% |

| Combined Heat and Power Chip Market Size 2032 |

USD 52,354 million |

The Combined Heat and Power Chip Market grows driven by increasing demand for energy-efficient solutions across industrial and commercial sectors, supported by government incentives promoting clean energy adoption. Technological advancements enhance chip efficiency and integration with smart grids, enabling optimized energy management. The market trends include rising incorporation of IoT and smart technologies for real-time monitoring, expansion into decentralized and renewable energy systems.

The Combined Heat and Power Chip Market experiences dynamic growth across key regions, driven by varying energy demands and regulatory environments. North America leads with strong industrial adoption and supportive government policies focused on energy efficiency. Europe follows closely, emphasizing stringent environmental regulations and investments in clean energy technologies. The Asia Pacific region shows rapid expansion due to industrialization, urbanization, and increasing focus on sustainable energy solutions. Prominent players in the market include General Electric, Siemens, Mitsubishi Heavy Industries, and Cummins. These companies invest heavily in research and development to improve CHP chip performance, enhance integration with smart grids, and expand application across industrial, commercial, and residential sectors.

Market Insights

- The Combined Heat and Power Chip Market was valued at USD 30,018.7 million in 2024 and is projected to reach USD 52,354 million by 2032, growing at a CAGR of 7.2% during the forecast period.

- Increasing demand for energy efficiency in industrial and commercial sectors drives market growth by lowering operational costs and reducing carbon emissions.

- Integration of smart technologies and IoT enhances system monitoring and control, enabling real-time data analytics and predictive maintenance that improve overall CHP system performance.

- Expansion of CHP applications in decentralized energy systems and renewable energy integration supports diversified energy sources and strengthens grid resilience.

- Market growth faces challenges due to high initial investment costs and complex integration requirements with existing infrastructure, limiting adoption among smaller enterprises.

- Regulatory variability and lack of standardization across regions complicate product development and market entry, increasing time and cost for manufacturers.

- North America leads market growth due to strong industrial demand and favorable policies, while Asia Pacific shows rapid expansion driven by urbanization and infrastructure development, with Europe focusing on strict environmental regulations and technological advancements.

Market Drivers

Rising Demand for Energy Efficiency and Cost Reduction in Industrial and Commercial Sectors

The Combined Heat and Power Chip Market benefits significantly from increasing emphasis on energy efficiency in industrial and commercial operations. Companies seek to optimize fuel usage by simultaneously generating electricity and useful heat, thereby lowering overall energy expenses. The ability of CHP chips to improve system performance and reduce carbon footprints encourages adoption across multiple sectors. It supports regulatory compliance with stringent energy efficiency standards worldwide. Rising operational costs push organizations to invest in CHP technology to achieve sustainable and cost-effective energy management.

- For instance, General Electric’s LM2500 microturbine system, which incorporates advanced CHP chip technology, delivers 33 megawatts of electric power with a thermal efficiency reaching up to 60%, facilitating substantial energy recovery in industrial applications (GE Power Systems, 2024). This system also reduces NOx emissions to less than 9 ppm, supporting environmental compliance.

Government Policies and Incentives Driving Adoption of Combined Heat and Power Solutions

Government initiatives promoting cleaner energy and emissions reduction positively influence the market. Policies offering tax credits, subsidies, and grants for implementing combined heat and power systems stimulate demand. Regulatory frameworks targeting reductions in greenhouse gas emissions motivate industries to transition toward CHP technologies. It aligns with global commitments to combat climate change and promote sustainable development. Supportive measures also encourage research and innovation within the sector, enhancing product offerings and performance capabilities.

- For instance, Siemens recently developed a fuel cell-based CHP chip that delivers 60 kW of continuous power with an operating lifespan exceeding 40,000 hours, designed to meet strict emission regulations and qualify for several renewable energy incentives in European markets.

Technological Advancements Enhancing Efficiency and Integration Capabilities of CHP Chips

Continuous improvements in semiconductor materials and microchip design contribute to enhanced efficiency of combined heat and power systems. Innovations enable better thermal management, reduced energy losses, and seamless integration with existing energy infrastructures. It allows manufacturers to develop smaller, more reliable, and cost-effective chips that meet diverse application needs. These technological strides expand CHP usage in residential, commercial, and industrial settings. Increased performance and scalability foster wider adoption and strengthen market growth prospects.

Growing Focus on Reducing Environmental Impact and Achieving Sustainability Goals

The market benefits from rising environmental awareness among businesses and consumers. Companies aim to reduce their carbon footprint and meet corporate sustainability targets by incorporating CHP technologies. It supports lower emissions compared to traditional energy generation methods. The combined heat and power chip market plays a vital role in enabling cleaner energy solutions and promoting circular energy use. This environmental focus drives investments and encourages long-term market expansion globally.

Market Trends

Increased Integration of Smart Technologies and IoT in Combined Heat and Power Systems

The Combined Heat and Power Chip Market shows a clear shift toward integrating smart technologies and the Internet of Things (IoT) for enhanced system monitoring and control. It enables real-time data analytics and predictive maintenance, improving operational efficiency and reducing downtime. Smart CHP systems offer remote accessibility and automated adjustments based on energy demand, leading to optimized performance. This trend supports the growing demand for intelligent energy management solutions in commercial and industrial applications. Companies invest in developing chips that facilitate seamless connectivity and interoperability within complex energy networks.

- For instance, Siemens’ Sicart microgrid control system processes over 15,000 sensor data points per second and uses advanced algorithms to optimize load balancing, reducing energy losses by up to 12% in industrial sites (Siemens, 2024). The platform integrates CHP chip telemetry with IoT devices to enable predictive maintenance cycles that extend equipment life by approximately 25%.

Expansion of CHP Applications in Decentralized and Renewable Energy Systems

Market growth reflects increased use of combined heat and power chips in decentralized energy generation, including microgrids and renewable energy integration. It allows localized energy production, reducing transmission losses and increasing overall system resilience. The trend supports global efforts to diversify energy sources and enhance grid stability through distributed generation. Incorporating CHP chips into renewable setups such as biomass and solar-thermal plants broadens their operational scope. This expansion contributes to the market’s rapid adoption across various geographies and industry verticals.

- For instance, Mitsubishi Heavy Industries developed a biomass CHP system equipped with advanced CHP chips capable of delivering 5 MW of electric power continuously while maintaining emissions below 50 mg/Nm³ of NOx, meeting stringent environmental standards for distributed generation.

Rising Focus on Miniaturization and Enhanced Power Density of CHP Chips

Manufacturers emphasize developing smaller, more powerful combined heat and power chips to meet the demand for compact and efficient energy solutions. It allows deployment in space-constrained environments like residential buildings and mobile applications. Higher power density improves energy output without increasing physical size, addressing limitations of conventional systems. The trend drives innovation in semiconductor technology and thermal management to achieve these advancements. This progress enables broader application possibilities and strengthens market competitiveness.

Increased Collaboration Between Technology Providers and Energy Companies

The market benefits from growing partnerships and joint ventures between semiconductor manufacturers, energy service providers, and system integrators. It fosters faster development cycles and accelerates the commercialization of advanced CHP chip technologies. Collaboration enhances customization and scalability of solutions tailored to specific client needs. This trend improves market responsiveness and drives adoption by ensuring compatibility with existing infrastructure. Stronger industry alliances support sustained innovation and market expansion globally.

Market Challenges Analysis

High Initial Investment and Complex Integration Requirements Limit Market Expansion

The Combined Heat and Power Chip Market faces challenges due to significant upfront capital costs associated with CHP system installation. It often requires substantial investment in both hardware and infrastructure modifications, which can deter small and medium-sized enterprises. Complex integration with existing energy systems demands technical expertise, increasing project timelines and costs. This complexity limits adoption in regions with less developed energy infrastructure. Uncertainty around return on investment and long payback periods further restrict market penetration. Companies must navigate these financial and operational barriers to accelerate deployment.

Regulatory Variability and Technical Standardization Hinder Widespread Adoption

Diverse regulatory environments across different regions create challenges for the Combined Heat and Power Chip Market. Varying emissions standards, safety regulations, and certification processes complicate market entry and product development. It requires manufacturers to customize solutions to meet specific local requirements, increasing costs and time to market. Lack of uniform technical standards slows interoperability and system compatibility, affecting scalability. Regulatory uncertainty may delay project approvals and investments. Addressing these challenges demands coordinated efforts from industry stakeholders and policymakers to streamline regulations and promote standardization.

Market Opportunities

Expansion into Emerging Markets and Industrial Sectors Offers Significant Growth Potential

The Combined Heat and Power Chip Market can capitalize on rising industrialization and urbanization in emerging economies. Increasing energy demand and the need for reliable power solutions in these regions create strong growth prospects. It presents an opportunity to deploy CHP systems in manufacturing, commercial buildings, and district heating applications. Governments in developing countries are also promoting energy efficiency initiatives, further supporting market expansion. Companies that tailor affordable and scalable solutions for these markets can achieve a competitive advantage. Growing infrastructure development projects provide additional avenues for CHP chip integration.

Advancements in Technology Enable Diversification of Applications and Enhanced Performance

Technological innovation opens new opportunities for the Combined Heat and Power Chip Market to penetrate diverse sectors such as residential, transportation, and renewable energy. It supports development of compact, high-efficiency chips suitable for distributed energy systems and microgrids. Improved thermal management and power density allow CHP integration into smaller, mobile, and off-grid applications. This versatility expands potential use cases and increases market reach. Collaborations between technology providers and energy companies can accelerate innovation and adoption. Focusing on R&D to improve chip performance will drive future market growth.

Market Segmentation Analysis:

By Technology

The market divides into microturbine-based, reciprocating engine-based, and fuel cell-based CHP chip technologies. Microturbine technology leads with high efficiency and low emissions, favored in commercial and industrial sectors. Reciprocating engine-based CHP chips maintain significant market share due to their reliability and lower initial costs, especially in small to medium-sized installations. Fuel cell-based technology, while currently less widespread, shows strong growth potential thanks to its superior environmental performance and suitability for integration with renewable fuels. Continuous innovation in chip design enhances efficiency and durability across these technologies, driving adoption in varied applications.

- For instance, Capstone Turbine’s C1000 microturbine chip delivers a net power output of 1 megawatt with a peak electrical efficiency of 33%, operating continuously with emissions below 9 ppm NOx.

By Fuel Type

Natural gas, biomass, coal, and oil represent the primary fuel categories driving CHP chip utilization. Natural gas dominates due to its cleaner-burning properties, availability, and cost-effectiveness. Biomass fuels gain traction amid increasing emphasis on renewable energy sources and sustainability goals. Coal and oil maintain niche segments, mostly in regions where infrastructure and fuel availability favor their use. Transition toward cleaner fuels like natural gas and biomass supports market growth and aligns with regulatory trends pushing for emissions reduction.

- For instance, GE’s Jenbacher J624 natural gas engine achieves an electrical output of 4.5 megawatts with ultra-low emissions and fuel flexibility. This engine, a product of GE’s Jenbacher gas engine business in Austria, is known for its high efficiency and ability to operate on various fuels beyond natural gas, including biogas, landfill gas, and coal mine gas.

By End Use

Industrial, commercial, and residential sectors constitute the main end-use segments in the Combined Heat and Power Chip Market. The industrial sector commands the largest share, leveraging CHP chips to reduce energy costs and improve operational efficiency in manufacturing, chemical processing, and large-scale facilities. Commercial applications include hospitals, hotels, and office complexes that benefit from reliable and efficient combined heat and power solutions. Residential adoption remains limited but grows with advancements in compact CHP chip technologies designed for small-scale, on-site power generation. Expansion into microgrid and distributed energy systems across these end-use categories further boosts market prospects.

Segments:

Based on Technology

- Internal Combustion Engine

- Gas Turbine

- Steam Turbine

- Microturbine

- Fuel Cell

Based on Fuel Type

- Natural Gas

- Biomass

- Coal

- Waste Heat

- Oil

Based on End Use

- Industrial

- Residential

- Commercial

- Institutional

Based on Capacity

- Below 100 kW

- 100 kW – 1 MW

- 1 MW – 10 MW

- Above 10 MW

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Combined Heat and Power Chip Market in North America accounts for approximately 35% of the total market in 2024. The region benefits from strong industrial demand, well-established infrastructure, and favorable government policies promoting energy efficiency and emissions reduction. The United States leads with widespread adoption in commercial, industrial, and institutional sectors. High investment in research and development drives innovation in CHP chip technology, enhancing system efficiency and integration with smart grids. Canada also contributes through increasing deployment in manufacturing and district energy systems. The region’s focus on sustainability and reducing dependence on traditional fossil fuels continues to propel market expansion.

Europe

Europe holds about 28% of the global market share, driven by stringent environmental regulations and ambitious climate targets. Countries such as Germany, the United Kingdom, and France invest heavily in clean energy solutions, including combined heat and power technologies. The European Union’s regulatory framework incentivizes adoption through subsidies and grants, accelerating CHP chip integration in industrial facilities, residential complexes, and public infrastructure. The demand for decentralized energy generation and smart energy management systems further supports growth. Europe’s mature market prioritizes technological advancements, with a focus on fuel cells and renewable fuel integration, boosting overall market potential.

Asia Pacific

The Asia Pacific region represents around 25% of the global market share and is the fastest-growing market for combined heat and power chips. Rapid industrialization, urbanization, and increasing energy consumption in countries like China, India, Japan, and South Korea drive demand. Governments promote energy-efficient technologies to address rising pollution levels and energy security concerns. Investments in infrastructure development and expansion of manufacturing sectors create significant opportunities for CHP chip manufacturers. China, in particular, leads large-scale adoption, supported by national policies favoring clean energy and carbon neutrality goals. The expanding commercial sector and growing adoption in microgrids and distributed energy systems further enhance market prospects in the region.

Middle East and Africa

The Middle East and Africa contribute around 7% of the market share, with growth primarily fueled by industrial applications and expanding infrastructure projects. The region’s abundant energy resources combined with efforts to diversify energy portfolios create demand for efficient CHP solutions. Countries like the United Arab Emirates and Saudi Arabia invest in sustainable energy technologies to reduce carbon emissions and improve energy efficiency. Challenges related to regulatory frameworks and infrastructure development remain, but ongoing government initiatives present significant opportunities.

Latin America

Latin America accounts for roughly 5% of the global market share, driven by increasing industrialization and government incentives aimed at enhancing energy efficiency. Brazil and Mexico stand out as key markets, investing in combined heat and power systems for industrial and commercial use. The region faces challenges including inconsistent regulatory environments and limited infrastructure in some areas. However, growing awareness of sustainability and cost-saving benefits of CHP technologies encourages gradual market expansion.

Key Player Analysis

- Engie

- Mitsubishi Heavy Industries

- Bosch

- General Electric

- ABB

- Ricardo

- Siemens

- Cummins

- ON

- Enertime

Competitive Analysis

The Combined Heat and Power Chip Market features intense competition among several leading players, including General Electric, Siemens, Mitsubishi Heavy Industries, Cummins, Bosch, ABB, Engie, Ricardo, ON, and Enertime. These companies focus on continuous innovation and technological advancement to maintain and expand their market positions. They invest heavily in research and development to improve chip efficiency, durability, and integration capabilities with existing energy systems and smart grid technologies. Key players differentiate themselves through strategic partnerships, mergers, and collaborations with energy service providers and technology firms to accelerate product development and market penetration. Many emphasize the development of fuel cell-based CHP chips and microturbine technologies, targeting applications in industrial, commercial, and residential sectors. Cost reduction and miniaturization efforts also play a critical role in their competitive strategies, enabling broader adoption across various end uses. Furthermore, these companies leverage their global presence to capture opportunities in emerging markets, adapting their products to meet local regulatory requirements and energy needs. Their strong distribution networks and after-sales service capabilities strengthen customer relationships and ensure sustained market growth. Overall, competitive dynamics in the Combined Heat and Power Chip Market revolve around technological leadership, strategic alliances, and geographic expansion.

Recent Developments

- In March 2025, Engie launched a new integrated combined heat and power (CHP) system targeting commercial buildings in Europe. The system features advanced CHP chips designed to enhance energy efficiency and real-time monitoring capabilities.

- In January 2025, Mitsubishi introduced a new microturbine combined heat and power (CHP) platform designed for industrial applications. This platform focuses on enhancing fuel flexibility and reducing emissions, with the aim of improving overall efficiency.

- In December 2024, GE introduced an upgraded combined heat and power (CHP) chip solution that incorporates improved thermal management and IoT integration for predictive maintenance. This enhancement aims to increase system reliability and lower operational costs.

Market Concentration & Characteristics

The Combined Heat and Power Chip Market exhibits a moderately concentrated competitive landscape dominated by a few key multinational corporations that hold significant market shares. Leading players such as General Electric, Siemens, Mitsubishi Heavy Industries, and Cummins leverage their technological expertise, extensive R&D capabilities, and global distribution networks to maintain strong positions. The market is characterized by high entry barriers due to substantial capital investment requirements and advanced technological development. It demands continuous innovation to improve chip efficiency, integration with smart grids, and compatibility with diverse fuel types. Smaller players and new entrants focus on niche applications, specialized technologies, or regional markets to establish footholds. The market’s competitive dynamics also involve strategic partnerships, joint ventures, and acquisitions aimed at expanding product portfolios and geographic reach. Customer demand for customized, energy-efficient solutions encourages manufacturers to tailor products for industrial, commercial, and residential sectors. Despite the dominance of a few large companies, technological advancements and growing adoption in emerging economies promote increased competition and market fragmentation over time.

Report Coverage

The research report offers an in-depth analysis based on Technology, Fuel Type, End Use, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow driven by increasing energy efficiency demands across industries.

- Technological innovations will enhance chip performance and reduce costs.

- Integration with smart grids and IoT will become more widespread.

- Adoption in decentralized and renewable energy systems will expand significantly.

- Miniaturization of CHP chips will enable new applications in residential and mobile sectors.

- Government policies and incentives will support faster market penetration.

- Emerging markets will offer substantial growth opportunities due to industrialization.

- Collaboration between technology providers and energy companies will accelerate innovation.

- Focus on sustainability and emissions reduction will drive investments in CHP solutions.

- Competitive pressure will increase, encouraging continuous product development and differentiation.