Market Overview

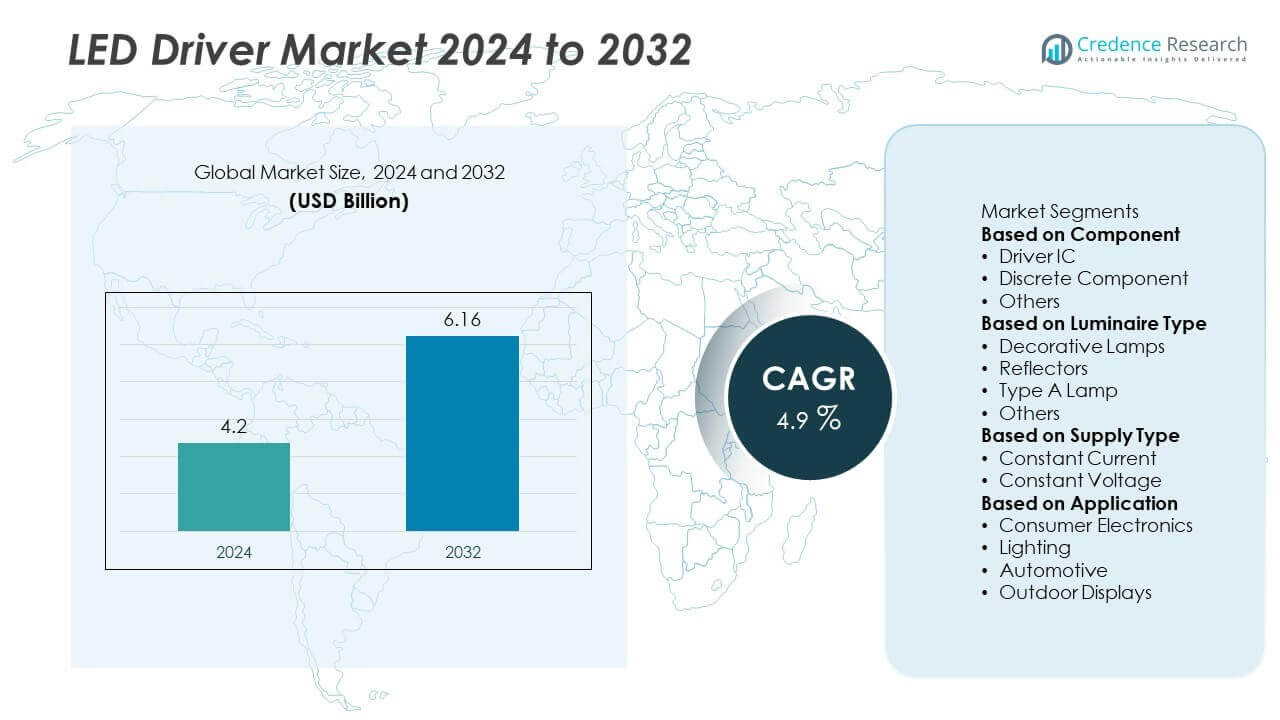

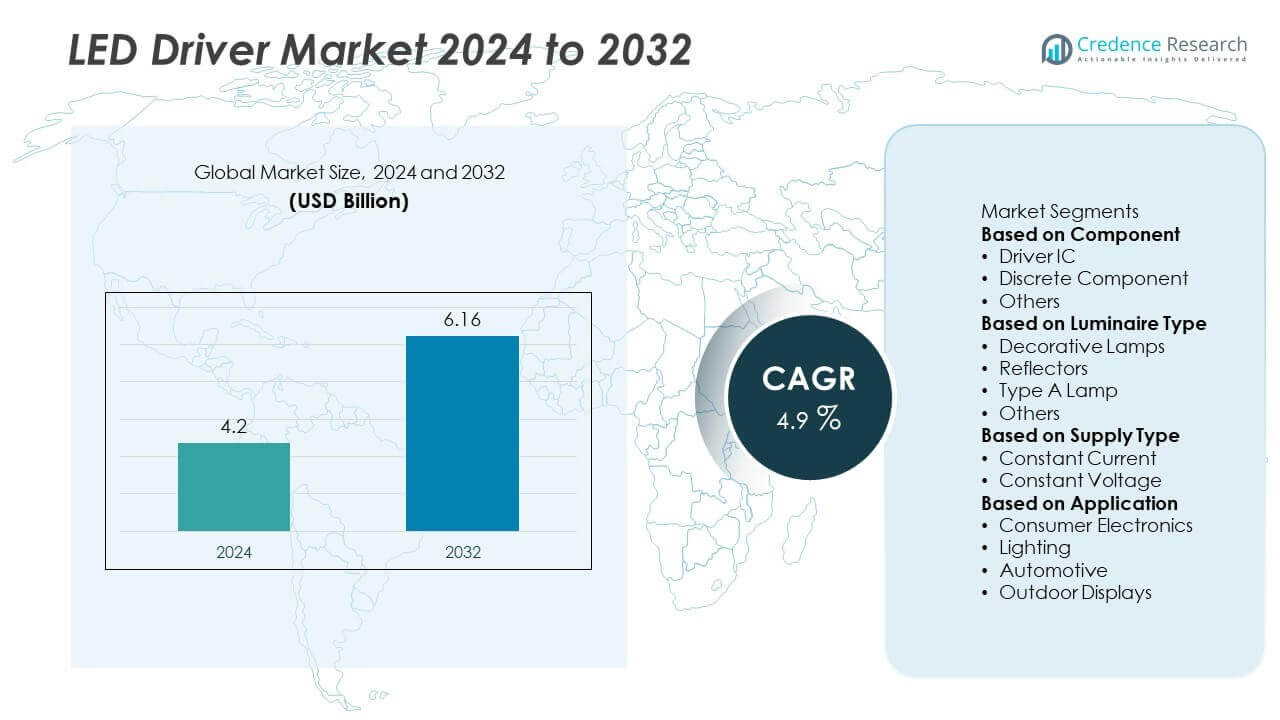

The global LED Driver Market was valued at USD 4.2 billion in 2024. It is projected to reach USD 6.16 billion by 2032, expanding at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| LED Driver Market Size 2024 |

USD 4.2 Billion |

| LED Driver Market, CAGR |

4.9% |

| LED Driver Market Size 2032 |

USD 6.16 Billion |

The LED driver market is led by major players such as Signify Holding, Macroblock, Inc., NXP Semiconductors, Cree LED, SAMSUNG, Microchip Technology Inc., Lutron Electronics Co., Inc., Semiconductor Components Industries, LLC, Analog Devices, Inc., and HLI SOLUTIONS, INC. These companies emphasize product innovation, smart connectivity, and high-efficiency solutions to cater to diverse applications, including residential, commercial, automotive, and industrial lighting. Regionally, North America dominated the market in 2024 with 34% share, driven by strong smart lighting adoption and regulatory policies. Europe accounted for 29% share, supported by sustainability initiatives and automotive demand, while Asia Pacific held 26% share, fueled by rapid urbanization, large-scale infrastructure projects, and expanding manufacturing capacity.

Market Insights

Market Insights

- The global LED driver market was valued at USD 4.2 billion in 2024 and is projected to reach USD 6.16 billion by 2032, expanding at a CAGR of 4.9% during the forecast period.

- Growth is fueled by rising demand for energy-efficient lighting, with the driver IC segment holding 46% share in 2024, supported by widespread use in residential, automotive, and industrial applications.

- Market trends highlight the adoption of constant current drivers, which accounted for 55% share, and increasing integration of IoT and wireless technologies in smart lighting systems.

- The market is highly competitive, with key players such as Signify Holding, SAMSUNG, Cree LED, Microchip Technology Inc., and NXP Semiconductors focusing on innovation, connectivity, and regulatory compliance.

- Regionally, North America led with 34% share, followed by Europe at 29% and Asia Pacific at 26%, while Latin America and the Middle East & Africa contributed 6% and 5% shares, respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The driver IC segment dominated the LED driver market in 2024 with 46% share. Driver ICs are widely adopted due to their compact size, efficiency, and ability to regulate power with precision. They are essential in applications requiring high reliability, such as automotive lighting, consumer electronics, and industrial luminaires. Growing demand for energy-efficient lighting and advanced dimming functions further drives adoption. Discrete components continue to serve cost-sensitive markets but are losing share to integrated IC solutions that offer superior performance and reduced design complexity.

- For instance, Macroblock’s MBI6034Q automotive driver IC supports 12 channels with 16-bit grayscale and delivers output currents up to 45 mA per channel, enabling adaptive ambient lighting in vehicles with precise dimming control.

By Luminaire Type

The decorative lamps segment held the largest share of the LED driver market in 2024 with 41% share. These lamps are increasingly used in residential, commercial, and hospitality spaces where aesthetic appeal and energy efficiency are critical. Rising adoption of LED-based decorative fixtures in smart homes and retail establishments has strengthened this segment. Reflectors and Type A lamps also contribute significantly, supported by retrofitting projects and widespread replacement of traditional lighting. Decorative lamps remain dominant due to continuous innovation in design, integration with smart lighting controls, and consumer demand for efficient yet visually appealing solutions.

- For instance, Signify’s Philips Hue decorative smart lamps integrate driver technology that supports over 16 million color options with dimming down to 1% light output, ensuring both aesthetic flexibility and energy efficiency in residential and hospitality settings.

By Supply Type

The constant current segment led the market in 2024 with 55% share, driven by its superior capability to regulate current flow and enhance LED lifespan. It is the preferred choice for applications requiring consistent brightness and reliability, such as streetlights, industrial lighting, and automotive headlamps. The growing need for high-performance lighting solutions in both indoor and outdoor applications has strengthened its dominance. Constant voltage drivers, while holding a smaller share, continue to see adoption in strip lights and signage where flexibility and parallel connections are needed.

Key Growth Drivers

Rising Demand for Energy-Efficient Lighting

The global shift toward energy efficiency is driving LED driver adoption. Governments are phasing out incandescent and halogen lamps, creating demand for LEDs and supporting components. LED drivers enable consistent performance and long lifespan, making them essential in residential, commercial, and industrial applications. The surge in urban development, smart cities, and green building initiatives further boosts the market. With energy-saving requirements becoming more stringent, LED drivers play a critical role in meeting sustainability goals and reducing electricity consumption across sectors.

- For instance, Samsung’s LM301H Evo LED package, integrated with advanced driver technology, achieves a photosynthetic photon efficacy (PPE) of up to 3.14 µmol/J at 65 mA, enabling horticultural lighting systems to exceed stringent energy performance standards.

Expansion of Smart Lighting and IoT Integration

The rise of smart homes and connected infrastructure is fueling demand for advanced LED drivers. These drivers support dimming, color tuning, and wireless connectivity, enabling seamless integration with IoT platforms. Consumers and businesses are increasingly adopting smart lighting systems for automation, convenience, and energy savings. Demand is particularly strong in commercial buildings and smart city projects, where intelligent lighting systems improve efficiency. This integration trend positions LED drivers as a key enabler of digital lighting solutions, enhancing both functionality and user experience.

- For instance, Lutron’s Athena control system integrates LED drivers with wireless IoT modules, offering smooth dimming down to 0.1%, and is scalable for large-scale commercial building deployments with the potential for thousands of controllable zones by using multiple processors.

Growth in Automotive and Industrial Applications

Automotive lighting and industrial illumination are expanding opportunities for LED drivers. The shift to LED headlights, daytime running lights, and interior lighting in vehicles requires reliable drivers with thermal management and durability. In the industrial sector, demand for high-performance drivers is rising in warehouses, factories, and outdoor facilities where lighting reliability is critical. Safety standards and regulations are accelerating this adoption. Automotive electrification and industrial automation further strengthen growth, as LED drivers ensure long-term efficiency and reduced maintenance in demanding environments.

Key Trends & Opportunities

Adoption of Constant Current Drivers for Reliability

Constant current LED drivers are gaining traction due to their ability to extend LED life and ensure uniform brightness. They dominate applications such as street lighting, industrial facilities, and automotive systems, where consistency and reliability are essential. The rising need for durable and high-performance lighting in infrastructure and smart city projects supports this trend. Manufacturers are also innovating with compact, efficient designs that reduce energy losses and improve overall performance, making constant current drivers a core focus in product development.

- For instance, Cree LED’s XLamp XP-G3 S Line integrates constant current driver compatibility and delivers up to 225 lm/W at 350 mA (at 25°C), remaining a popular choice for long-lifetime, highly efficient outdoor lighting due to its efficacy and best-in-class sulfur resistance

Integration with Wireless and Dimming Technologies

LED drivers are increasingly incorporating wireless communication and advanced dimming features. Technologies like Zigbee, Bluetooth, and Wi-Fi enable remote control, smart scheduling, and adaptive brightness. This trend aligns with consumer demand for personalized lighting in homes, as well as energy optimization in commercial and industrial facilities. Opportunities are emerging in integrating drivers with smart building management systems, offering enhanced convenience and efficiency. Such innovations are creating strong market potential, particularly as lighting shifts from simple functionality to intelligent energy management solutions.

- For instance, Signify’s Xitanium SR LED drivers with Zigbee and DALI-2 support allow dimming down to 1% light output while enabling remote diagnostics across networks of up to 500 luminaires, making them widely deployed in smart office and retail environments.

Key Challenges

High Cost of Advanced Drivers

Advanced LED drivers with smart features and connectivity come at higher costs compared to conventional drivers. This pricing challenge restricts adoption in cost-sensitive markets, particularly in developing regions. While long-term energy savings justify the investment, the upfront expense remains a deterrent for budget-conscious consumers and small businesses. Manufacturers face pressure to balance innovation with affordability, requiring scalable production methods and cost-optimized designs to expand market reach effectively.

Complexity in Design and Compatibility Issues

Designing LED drivers that meet diverse application needs and comply with global standards is a challenge. Drivers must match different LED modules, dimming protocols, and voltage requirements, often creating compatibility issues. This complexity increases development costs and limits interoperability across systems. Inconsistent standards between regions also add hurdles for global manufacturers. Overcoming these challenges requires investment in modular, standardized driver designs and collaborative efforts to ensure seamless integration across lighting ecosystems.

Regional Analysis

North America

North America led the LED driver market in 2024 with 34% share, driven by rapid adoption of energy-efficient lighting solutions across commercial, industrial, and residential sectors. The United States dominates demand with government-backed initiatives to reduce energy consumption and strong integration of smart lighting in urban infrastructure. Canada also contributes significantly through rising adoption of LED drivers in smart homes and public projects. Robust presence of leading manufacturers and early adoption of IoT-based lighting systems support the region’s growth. Rising investments in connected infrastructure continue to position North America as a key driver of global demand.

Europe

Europe accounted for 29% share of the LED driver market in 2024, supported by stringent EU energy regulations and the widespread shift toward sustainable lighting. Countries such as Germany, the United Kingdom, and France are leading adopters due to smart city initiatives and extensive replacement of traditional lighting. Automotive applications also drive demand, with LED drivers used in advanced headlights and interior lighting systems. Strong investments in renewable energy integration and advanced dimming technologies enhance growth. Europe’s regulatory environment and focus on decarbonization ensure continued adoption of LED drivers across multiple end-use sectors.

Asia Pacific

Asia Pacific held 26% share of the LED driver market in 2024, fueled by large-scale urbanization and expanding infrastructure projects. China dominates regional demand with government-driven energy efficiency programs and growing manufacturing capacity. India and Southeast Asian countries are witnessing rapid adoption due to increasing electricity demand and replacement of conventional lighting in residential and commercial spaces. Japan contributes with advanced automotive and industrial applications. Expanding smart city projects and rising consumer adoption of smart homes strengthen growth. Asia Pacific remains the fastest-growing region, supported by cost advantages, rising investments, and strong policy support for efficient lighting.

Latin America

Latin America represented 6% share of the LED driver market in 2024, supported by ongoing electrification and rising demand for energy-efficient lighting solutions. Brazil and Mexico drive most of the demand, with adoption in commercial facilities, street lighting, and residential projects. Government initiatives to improve energy efficiency and reduce grid stress also support market growth. However, high upfront costs of advanced drivers remain a challenge in cost-sensitive areas. Despite these constraints, growing urban populations and increasing awareness of energy savings are expected to strengthen the role of LED drivers across the region in the coming years.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the LED driver market in 2024. Rising investments in infrastructure modernization and urban development projects in Gulf countries, particularly Saudi Arabia and the UAE, are driving adoption. Demand is also supported by initiatives to replace conventional lighting with LEDs in commercial and residential sectors. South Africa contributes through applications in street lighting and industrial facilities, though limited affordability and lack of awareness hinder broader adoption. Growing integration of smart city projects and focus on energy efficiency are expected to provide long-term opportunities in the region.

Market Segmentations:

By Component

- Driver IC

- Discrete Component

- Others

By Luminaire Type

- Decorative Lamps

- Reflectors

- Type A Lamp

- Others

By Supply Type

- Constant Current

- Constant Voltage

By Application

- Consumer Electronics

- Lighting

- Automotive

- Outdoor Displays

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the LED driver market is shaped by leading players including Signify Holding, Macroblock, Inc., NXP Semiconductors, Cree LED, SAMSUNG, Microchip Technology Inc., Lutron Electronics Co., Inc., Semiconductor Components Industries, LLC, Analog Devices, Inc., and HLI SOLUTIONS, INC. These companies focus on developing innovative driver solutions that enhance energy efficiency, enable smart connectivity, and support diverse lighting applications across residential, commercial, automotive, and industrial sectors. Strategies center on expanding portfolios with constant current and constant voltage drivers, integrating IoT and wireless technologies, and meeting global efficiency standards. Partnerships with lighting manufacturers and infrastructure developers strengthen their market reach, while R&D investments drive advancements in dimming, miniaturization, and thermal management. Asia Pacific remains a key manufacturing hub, while North America and Europe provide strong demand from smart home and automotive markets. Intense competition pushes companies toward cost optimization, regulatory compliance, and next-generation driver solutions tailored for smart lighting ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Macroblock launched its DaVinci Series LED driver ICs (e.g. MBI5292) featuring 19-bit grayscale, adaptive refresh, and low-knee voltage designs.

- In 2025, Samsung announced its “Micro RGB” display technology using micro-scale RGB LEDs (each less than 100 µm in size), showcasing fine control over each red, green, blue LED.

- In 2025, Macroblock introduced the MBI6034Q 12-channel driver IC supporting 16-bit grayscale, now used in ambient lighting systems for automobile interiors.

- In 2025, Samsung System LSI began mass production of a 22 nm display driver IC (for mobile displays), emphasizing low-power operation and improved efficiency.

Report Coverage

The research report offers an in-depth analysis based on Component, Luminaire Type, Supply Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for LED drivers will increase with rising adoption of energy-efficient lighting worldwide.

- Constant current drivers will continue to dominate due to their reliability and performance benefits.

- Integration of IoT and wireless technologies will strengthen the role of drivers in smart lighting.

- Automotive lighting will expand as LED drivers support advanced headlamps and interior systems.

- Miniaturization and compact driver designs will gain traction in portable and consumer electronics.

- Europe will see strong growth due to sustainability regulations and green building initiatives.

- Asia Pacific will record the fastest expansion supported by urbanization and large-scale infrastructure projects.

- North America will maintain leadership with strong demand from smart homes and commercial projects.

- High production and design costs will remain a challenge in price-sensitive markets.

- Competition will intensify as companies focus on innovation, connectivity, and advanced thermal management.

Market Insights

Market Insights