Market Overview

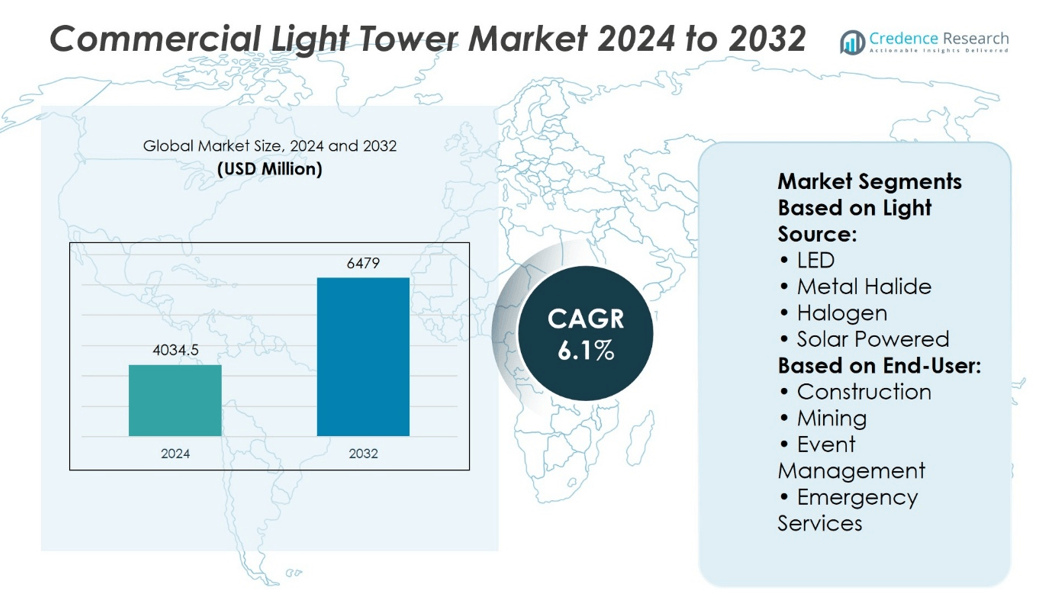

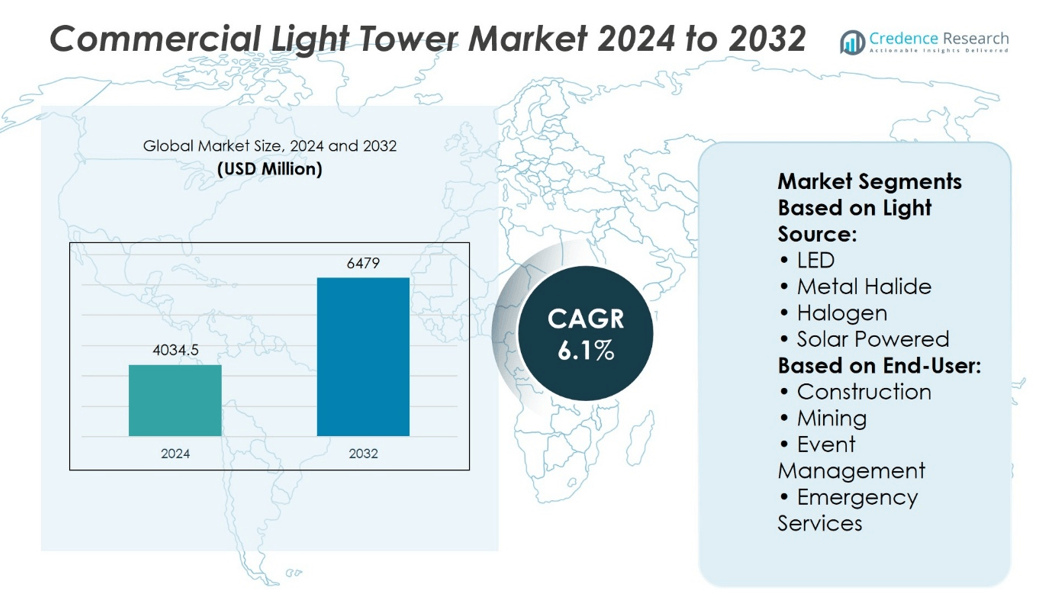

Commercial Light Tower Market size was valued at USD 4034.5 million in 2024 and is anticipated to reach USD 6479 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Commercial Light Tower Market Size 2024 |

USD 4034.5 million |

| Commercial Light Tower Market, CAGR |

6.1% |

| Commercial Light Tower Market Size 2032 |

USD 6479 million |

The Commercial Light Tower Market experiences strong growth driven by expanding infrastructure projects, mining activities, and increased demand in emergency and event management sectors. Technological advancements, including LED lighting and hybrid power systems, improve energy efficiency and operational reliability. Rising environmental regulations push manufacturers to develop low-emission, low-noise solutions. The growing rental industry further supports market expansion by requiring portable, easy-to-deploy equipment. Integration of telematics enhances asset management and reduces downtime. These drivers, combined with a shift toward sustainable lighting and expanding applications, shape evolving market trends and encourage continuous innovation across the industry.

The Commercial Light Tower Market shows significant regional variation, with Asia-Pacific leading due to rapid infrastructure development and mining activities, followed by strong demand in North America and Europe driven by modernization and stringent regulations. Emerging markets in the Middle East, Africa, and Latin America also present growth opportunities. Key players in the market focus on innovation, sustainability, and global expansion to maintain competitiveness. Their strategic investments and diverse product portfolios address specific regional needs, enabling them to capture substantial market share worldwide.

Market Insights

- The Commercial Light Tower Market size was valued at USD 4034.5 million in 2024 and is expected to reach USD 6479 million by 2032, growing at a CAGR of 6.1%.

- Growth is driven by expanding infrastructure projects, mining activities, and rising demand in emergency and event management sectors.

- Technological advancements such as LED lighting and hybrid power systems improve energy efficiency and reliability.

- Increasing environmental regulations compel manufacturers to develop low-emission and low-noise solutions.

- The growing rental industry fuels market expansion by demanding portable and easy-to-deploy equipment.

- Asia-Pacific leads the market due to rapid infrastructure development, followed by North America and Europe with modernization and strict regulations.

- Competitive players focus on innovation, sustainability, and regional customization to capture market share and address diverse customer needs globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Infrastructure Development in Emerging and Developed Economies

The expansion of road networks, rail systems, and large-scale construction projects continues to drive demand in the Commercial Light Tower Market. Governments in regions such as Asia-Pacific and the Middle East invest heavily in public infrastructure, creating a consistent requirement for temporary lighting solutions. Light towers support extended work hours in low-light conditions, which is critical for completing high-priority infrastructure projects on schedule. In the U.S. and parts of Europe, aging infrastructure and ongoing upgrades also contribute to consistent utilization. The versatility of diesel, solar, and hybrid models ensures deployment across different project types and terrain. The Commercial Light Tower Market benefits directly from the frequency and intensity of these activities.

- For instance, Dubai’s Roads and Transport Authority completed a street‑lighting initiative that installed over 1 million AED worth of advanced LED lighting

Expanding Use of Light Towers in Oil, Gas, and Mining Operations

The need for mobile and high-intensity lighting in oilfields, drilling sites, and mining zones has intensified in recent years. Operators rely on commercial light towers for safe night-time operations and to comply with worker safety standards. In remote locations where grid power is unavailable, solar and diesel-powered towers ensure reliable illumination. The Commercial Light Tower Market sees steady adoption in these industries due to their dependence on 24-hour production cycles. Equipment durability and fuel efficiency play a critical role in procurement decisions. It continues to find new application scopes within energy and resource extraction zones worldwide.

- For instance, Pacific Energy installed a 3.8 MW solar array supported by two battery energy storage systems at Mineral Resources’ Ken’s Bore iron ore site in Pilbara, equipping it with over 6,600 solar panels.

Growing Preference for LED and Hybrid Technology for Energy Efficiency

Industry preference has shifted toward LED lighting systems integrated with hybrid and solar technology. These systems reduce fuel consumption, extend operational runtime, and lower maintenance intervals. The Commercial Light Tower Market has responded to this demand by offering product lines with longer service life and higher lumen output. Manufacturers focus on developing systems with onboard power management and remote diagnostics. It provides contractors and event managers with more cost-effective lighting solutions. The appeal of reduced downtime and improved energy control continues to influence purchasing behavior.

High Utility in Disaster Response and Emergency Management Operations

Commercial light towers serve a vital role in disaster relief efforts, emergency construction, and military deployments. Government agencies and NGOs rely on them for setting up safe zones, temporary camps, and operational headquarters in low-visibility conditions. The Commercial Light Tower Market supports procurement for national and regional emergency preparedness programs. Rapid deployment capabilities and high mobility make them a staple in emergency response kits. It delivers critical lighting solutions where conventional infrastructure fails or remains damaged. Recent global events have highlighted their operational importance during crisis situations.

Market Trends

Increased Integration of Renewable Energy Sources in Light Tower Design

Manufacturers are shifting toward solar and hybrid-powered light towers to reduce fuel dependency. This trend aligns with global initiatives focused on lowering carbon emissions and minimizing operational costs. Solar-powered units with battery storage allow silent operation, making them suitable for urban sites and nighttime work. Hybrid systems combine the reliability of diesel with the sustainability of renewables. The Commercial Light Tower Market reflects this shift through expanded product offerings from key players. It continues to prioritize innovations that support clean energy use across diverse environments.

- For instance, Globe Power deployed its Mine Spec GP125k hybrid lighting tower outputting 125,000 lumens and powered by a 15.4 kWh lithium-ion battery during a deployment that included 3 million watt-hours of energy storage capacity in remote mining operations in Western Australia.

Adoption of LED Lighting for Higher Efficiency and Extended Lifespan

The transition from metal halide to LED lighting continues to accelerate across construction, event, and emergency response sectors. LED fixtures offer higher lumen output, faster startup times, and reduced power draw. These benefits allow for longer operation on limited fuel or battery power. Manufacturers now equip most new light towers with high-intensity LED modules as standard. The Commercial Light Tower Market has evolved in response to this preference, with demand concentrating on units offering greater efficiency. It has pushed suppliers to reengineer legacy models with advanced lighting technologies.

- For instance, Globe Power’s GP270K Hybrid Cube light tower emits 270,000 lumens and runs for 353 hours per fuel cycle, supported by an energy storage system that holds 1 million watt-hours of battery capacity, ideal for sustained off-grid operations at remote mining sites.

Increased Demand for Remote Monitoring and Telematics Capabilities

Fleet operators seek real-time visibility into fuel levels, run hours, location data, and maintenance alerts. This demand drives adoption of telematics systems in commercial light towers. Remote monitoring tools help reduce downtime, improve scheduling, and enhance asset utilization across job sites. Manufacturers offer cloud-based dashboards and mobile apps for managing equipment fleets from central locations. The Commercial Light Tower Market now includes digital performance features as a key selling point. It reflects a shift toward smarter, data-driven equipment management practices.

Customization and Compact Designs for Urban and Short-Term Applications

Light tower models are now tailored to meet the demands of compact urban spaces, short-term events, and quick-deployment scenarios. Equipment rental companies prioritize versatile units that can be transported easily and deployed with minimal setup. Compact towers with telescopic masts, foldable frames, and trailer-mount systems address this requirement. Manufacturers emphasize portability without compromising lighting coverage or durability. The Commercial Light Tower Market has expanded product lines to address these constraints. It supports diverse applications from inner-city roadwork to temporary public gatherings.

Market Challenges Analysis

Operational Limitations Due to Fuel Dependence, Noise Emissions, and Regulatory Constraints

Diesel-powered commercial light towers remain the industry standard but face growing challenges related to fuel consumption, noise pollution, and stricter regulatory compliance. Many urban and environmentally sensitive locations enforce stringent noise and emission limits, which restrict the hours and sites where these towers can operate. Managing fuel supply logistics becomes complicated in remote, disaster-affected, or off-grid areas, increasing the risk of operational downtime. The Commercial Light Tower Market encounters resistance in regions with evolving environmental policies, forcing manufacturers and end users to balance performance with regulatory adherence. While alternative energy models such as solar and hybrid units gain traction, the widespread presence of legacy fleets limits rapid transition. It complicates modernization efforts and places financial strain on small and mid-sized contractors, who face higher upfront costs to replace or retrofit existing equipment. Operational efficiency often suffers where compliance costs and logistical challenges coincide.

High Maintenance Demands Coupled with Skilled Workforce Shortages Impact Operational Efficiency

Light towers require regular maintenance of diesel engines, lighting modules, hydraulic lifts, and electronic controls to sustain reliable performance. Extended service intervals and reactive maintenance practices contribute to increased downtime, particularly for rental fleets that operate across multiple sites. The Commercial Light Tower Market depends significantly on robust after-sales support and service networks, which remain patchy in rural or developing regions. Limited availability of qualified technicians capable of conducting diagnostics, repairs, and preventive maintenance slows turnaround times and diminishes asset utilization. It also raises operational costs due to emergency repairs and unplanned service interruptions. These challenges underscore the need for investment in workforce training, remote diagnostic technologies, and standardized service protocols. Without addressing these gaps, operators risk lower productivity and reduced profitability, particularly in markets with growing demand for reliable, round-the-clock lighting solutions.

Market Opportunities

Expanding Infrastructure Development and Growing Demand for Environmentally Sustainable Lighting Solutions Create Significant Growth Potential

Ongoing urbanization and large-scale infrastructure projects across Asia-Pacific, the Middle East, and North America present substantial opportunities for the Commercial Light Tower Market. Governments and private sector entities increase spending on roads, railways, airports, and energy facilities, all of which require reliable and mobile lighting to support round-the-clock operations. Rising awareness of environmental impact and stricter regulations encourage adoption of solar-powered and hybrid light towers that minimize fuel consumption and reduce carbon footprints. It incentivizes manufacturers to develop innovative, energy-efficient models with longer runtimes and reduced maintenance needs. The growing trend toward night-shift work in construction and emergency response also expands the demand for flexible and high-performance lighting solutions. The market can capitalize on cross-sector demand from construction companies, event organizers, mining operations, and disaster management agencies, broadening its end-user base and driving product diversification.

Technological Innovations in Telematics, IoT Integration, and Smart Lighting Systems Offer New Avenues for Market Expansion

Advancements in digital technologies transform how commercial light towers operate and are managed in the field. Integration of telematics and IoT-based remote monitoring enables operators to track real-time data on fuel levels, operational hours, geolocation, and maintenance status. These capabilities improve fleet management efficiency, reduce unplanned downtime, and optimize resource allocation. Smart lighting systems that automatically adjust brightness based on ambient conditions enhance energy savings and extend operational runtime. The Commercial Light Tower Market witnesses increasing incorporation of advanced diagnostics and predictive maintenance tools that help anticipate equipment failures before they occur. These innovations improve reliability, lower lifecycle costs, and create a strong competitive advantage. It also responds to the growing demand from rental companies and contractors seeking data-driven asset management solutions. Continuous development in these areas provides the industry with opportunities to deliver differentiated products tailored to evolving customer needs.

Market Segmentation Analysis:

By Light Source:

LED light towers dominate due to their superior energy efficiency, longer lifespan, and reduced maintenance compared to traditional options. Their rapid startup time and higher lumen output support demanding work environments, making them the preferred choice in construction and emergency services. Metal halide units, once the industry standard, remain in use where high-intensity illumination over large areas is essential, such as mining sites. Halogen light towers find niche applications due to lower initial costs, though their higher power consumption and shorter bulb life limit wider adoption. Solar-powered towers gain traction driven by sustainability goals and noise-sensitive project sites. These models provide silent operation and reduce fuel dependency, expanding opportunities in urban and environmentally sensitive locations. The Commercial Light Tower Market continuously adapts to evolving energy preferences by developing hybrid models that combine solar and diesel power for enhanced reliability.

- For instance, Globe Power’s GP270K LED light tower operates continuously for up to 285 hours per fuel cycle and outputs 270,000 lumens, supported by an integrated battery system.

By End User:

Construction constitutes the largest end-use segment, requiring versatile and reliable lighting solutions to facilitate 24-hour operations and meet strict safety standards. Demand in this segment emphasizes durability and mobility, with a focus on models that withstand harsh weather and rough terrain. The mining sector relies heavily on high-intensity illumination to ensure worker safety during night shifts and in underground environments. Equipment longevity and fuel efficiency play crucial roles in procurement decisions for mining operations, where downtime carries significant costs. Event management uses light towers for temporary setups requiring quick deployment and flexible positioning, favoring compact and quieter LED or solar-powered units. Emergency services demand rapid deployment and dependable lighting in disaster zones and accident sites, often in locations lacking grid power. The Commercial Light Tower Market addresses these varied needs by offering tailored solutions, supporting critical operations across industries with specialized features and power sources.

- For instance, Allmand Bros MVP1000 light tower delivers 1,000,000 lumens and operates for 150 hours on a single fuel tank.

Segments:

Based on Light Source:

- LED

- Metal Halide

- Halogen

- Solar Powered

Based on End-User:

- Construction

- Mining

- Event Management

- Emergency Services

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America represents roughly 27% of the Commercial Light Tower Market. The United States leads this region due to its extensive infrastructure modernization programs, heightened safety requirements, and advanced technological adoption. The region’s construction, mining, and emergency response sectors rely heavily on mobile lighting equipment that complies with stringent environmental standards governing emissions and noise pollution. LED and hybrid light towers have gained significant traction here for their efficiency and lower environmental impact. Integration of telematics and IoT-enabled remote monitoring capabilities enhances fleet management, enabling operators to optimize fuel use, track location, and schedule proactive maintenance. This market benefits from a mature rental industry where equipment uptime and flexibility are critical. Overall, North America’s focus on innovation, sustainability, and regulatory compliance continues to propel growth and product advancement.

Europe

Europe commands close to 20% of the global Commercial Light Tower Market. The region’s demand stems from extensive infrastructure renovations, urban development projects, and strict environmental and noise control regulations. Countries such as Germany, the United Kingdom, and France emphasize green construction practices, pushing wider adoption of solar-powered and hybrid light towers that reduce carbon emissions and noise levels in urban settings. The mature rental sector in Europe drives demand for compact, portable, and smart lighting solutions equipped with remote diagnostics and real-time performance monitoring. Regulatory frameworks enforce compliance, requiring manufacturers to develop low-emission, energy-efficient models tailored to diverse industrial needs ranging from construction to emergency services. The evolving regulatory environment combined with technological innovation encourages continued investment and growth in this region.

Asia-Pacific

The Asia-Pacific region holds the largest portion of the Commercial Light Tower Market, accounting for about 38% of the global share. Rapid urbanization across countries such as China, India, and Australia fuels the demand for robust lighting solutions in construction, mining, and public infrastructure projects. Significant investments in transportation infrastructure, including highways, railways, and airports, increase the need for reliable light towers that enable 24/7 operations. Furthermore, mining expansions in Australia and Southeast Asia contribute heavily to market growth by requiring high-intensity lighting to enhance safety and productivity during night shifts. Environmental concerns and governmental regulations promote the adoption of solar and hybrid-powered light towers, especially in remote and off-grid areas where fuel logistics pose challenges. Manufacturers respond with cost-effective, energy-efficient products offering longer runtimes and reduced maintenance. The ongoing pace of industrialization and infrastructure upgrades is expected to sustain strong demand for commercial light towers across this region.

Latin America

Latin America accounts for roughly 5% of the global Commercial Light Tower Market, with Brazil and Mexico emerging as key contributors. The market growth is primarily fueled by infrastructure development projects, expanding mining activities, and increasing event management needs. There is a gradual shift toward LED and solar-powered light towers, driven by growing awareness of energy efficiency and evolving environmental regulations. Despite slower penetration compared to other regions, government investments aimed at urban development, transportation infrastructure, and energy projects provide a positive outlook for market expansion. The commercial light tower demand also benefits from rising construction activity and disaster management preparedness. Manufacturers are focusing on offering affordable, flexible, and easily deployable lighting solutions designed to accommodate both urban settings and remote work sites, thus positioning themselves to capitalize on growth opportunities in the region.

Middle East and Africa

The Middle East and Africa region contributes approximately 10% of the global Commercial Light Tower Market. The market growth here is propelled by expanding infrastructure development and ongoing oil and gas exploration. The extreme climatic conditions—characterized by high temperatures and dusty environments—require commercial light towers that offer high durability and operational reliability. Diesel-powered light towers remain predominant due to their proven performance under such conditions; however, solar and hybrid options are gradually gaining acceptance as sustainability initiatives take hold. Large-scale mining, construction, and energy projects drive demand for portable, high-capacity lighting solutions capable of functioning efficiently in remote and challenging locations. Manufacturers prioritize rugged designs, fuel efficiency, and ease of transport to meet the operational requirements of this region, creating opportunities for product customization and innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar

- J C Bamford Excavators

- Doosan Portable Power

- Generac Power Systems

- Allmand Bros

- HIMOINSA

- Chicago Pneumatic

- Atlas Copco

- Inmesol gensets

- DMI

Competitive Analysis

The Commercial Light Tower Market include Caterpillar Inc., Generac Holdings Inc., Wacker Neuson SE, Atlas Copco AB, and Terex Corporation. The Commercial Light Tower Market remains highly competitive, driven by continuous innovation and a focus on meeting diverse customer needs across industries. Companies prioritize the development of energy-efficient lighting technologies such as LED and hybrid power systems to reduce fuel consumption and emissions. Integration of telematics and remote monitoring features enhances operational efficiency, enabling users to manage fleets effectively and minimize downtime. Durability and portability remain critical factors, especially for applications in harsh environments like mining and construction sites. Market players also respond to stringent environmental regulations by offering low-noise, eco-friendly models that comply with regional standards. The growing rental market further encourages manufacturers to design versatile and easy-to-deploy products that support short-term projects and emergency response scenarios. Expansion into emerging markets and customization for local conditions play key roles in maintaining competitive advantage. Overall, innovation, regulatory compliance, and customer-centric approaches define the competitive landscape, shaping the evolution of the Commercial Light Tower Market.

Recent Developments

- In March 2025, Atlas Copco launched the MS4 and MS5 solar light towers designed to offer reliable, sustainable, and accessible lighting. These towers have zero emissions for environmental friendliness, require minimal maintenance, and have high performance, which makes them particularly suitable for construction, events, and remote sites. These light towers utilize modern solar energy and storage capabilities for economical off-grid illumination.

- In July 2024, Caterpillar’s light tower offerings evolved with enhancements focusing on rugged durability, improved fuel efficiency, and advanced LED lighting technology. These updates included LED light towers with reduced energy consumption and longer operational life.

- In November 2023, the facility is located in Murcia, Spain, and covers. It significantly increases production capacity in Europe with an emphasis on electrification, connectivity, efficiency, and safety.

- In December 2023, Atlas Copco launched its first hybrid light tower, the HiLight HVT 500, combining battery and diesel technologies. The model is designed to reduce fuel consumption by and cut CO₂ emissions significantly. It operates silently during battery mode, making it ideal for urban and noise-sensitive environments.

Market Concentration & Characteristics

The Commercial Light Tower Market exhibits a moderately concentrated structure, with a handful of established manufacturers dominating key segments through technological innovation and broad distribution networks. It features a mix of global players and regional specialists who compete by offering differentiated products tailored to specific end-use industries such as construction, mining, and emergency services. Market participants invest heavily in research and development to enhance energy efficiency, portability, and durability of their light towers, responding to growing demand for sustainable and low-emission solutions. The rental sector plays a significant role, influencing product design toward easy deployment and maintenance. Competitive advantage depends on the ability to provide reliable equipment compliant with environmental and safety regulations across diverse geographic regions. Barriers to entry remain moderate due to the technical expertise required and capital investment in manufacturing and after-sales support. Customer preferences shift toward LED and hybrid light towers, encouraging continuous product upgrades. Regional market dynamics vary, with emerging economies offering growth opportunities and mature markets emphasizing innovation and regulatory compliance. It operates within a framework of evolving technological standards and increasing emphasis on operational efficiency, driving companies to optimize performance and reduce total cost of ownership for end users. The combination of these factors shapes a competitive environment where agility, innovation, and customer focus determine market positioning and long-term success.

Report Coverage

The research report offers an in-depth analysis based on Light Source, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.