| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Computer Aided Dispatch Market Size 2024 |

USD 10,692.67 million |

| Computer Aided Dispatch Market, CAGR |

7.37% |

| Computer Aided Dispatch MarketSize 2032 |

USD 19,668.83 million |

Market Overview

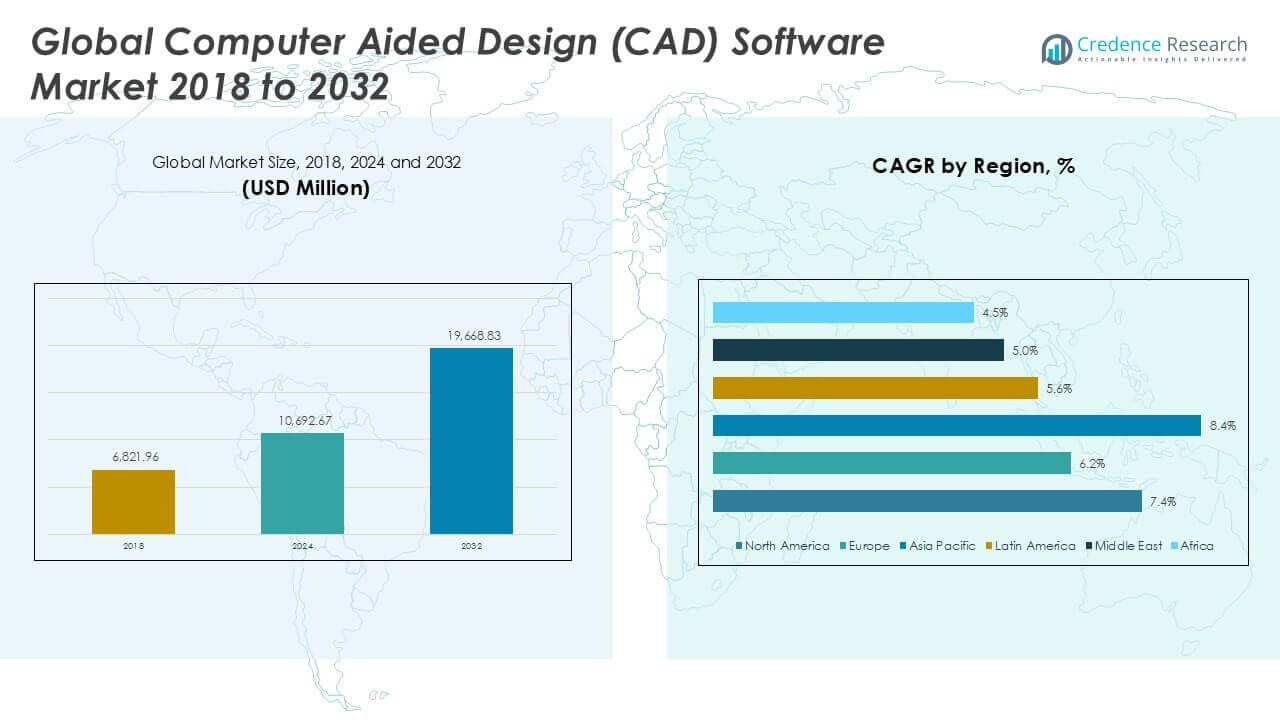

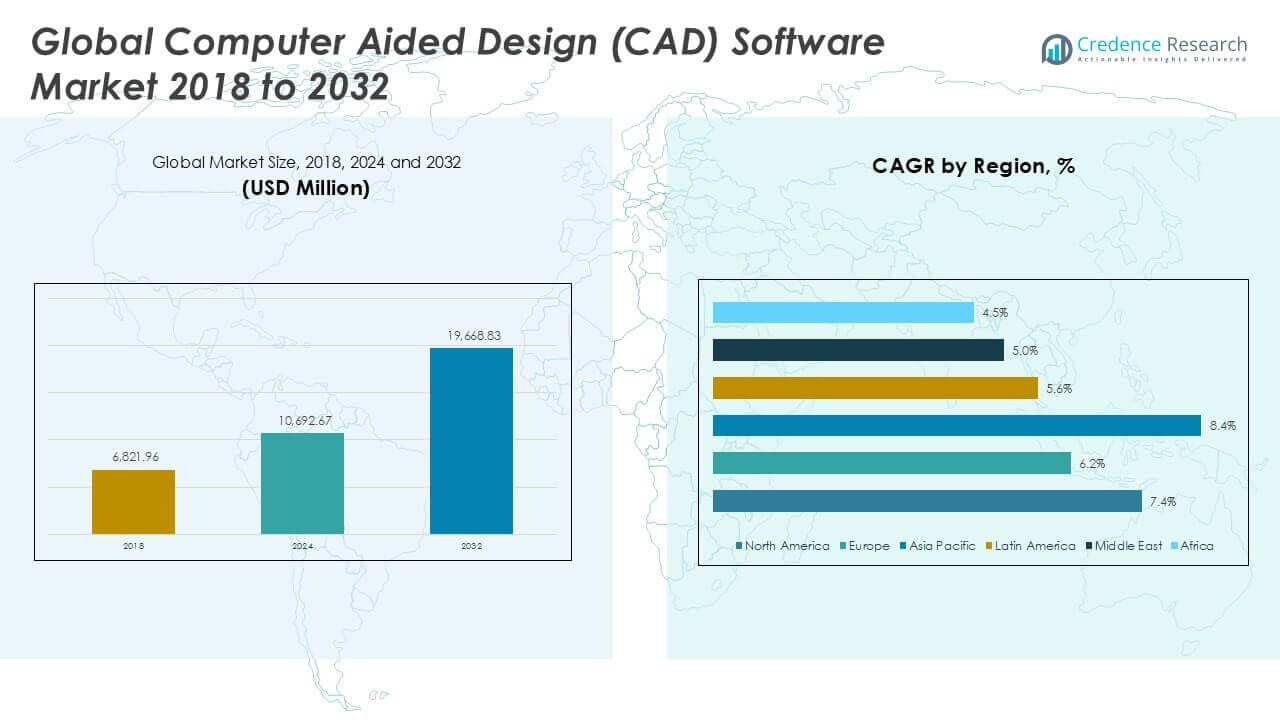

Computer Aided Dispatch Market size was valued at USD 6,821.96 million in 2018 to USD 10,692.67 million in 2024 and is anticipated to reach USD 19,668.83 million by 2032, at a CAGR of 7.37% during the forecast period.

The Computer Aided Dispatch (CAD) market is driven by the growing demand for efficient emergency response systems, rising public safety concerns, and increasing adoption of advanced communication technologies across law enforcement, fire, and emergency medical services. Governments and agencies are prioritizing the modernization of dispatch operations to streamline incident management, enhance resource allocation, and improve real-time data sharing. Market growth is further supported by the integration of CAD solutions with geographic information systems (GIS), cloud-based platforms, and mobile devices, enabling seamless coordination and situational awareness. Trends indicate a shift toward interoperable and scalable dispatch solutions, leveraging artificial intelligence and analytics to optimize decision-making and response times. Additionally, the increasing focus on cybersecurity and data privacy is shaping product innovation, while ongoing investments in smart city infrastructure and public safety digitalization continue to expand the scope and application of CAD technologies worldwide.

The Computer Aided Dispatch Market exhibits dynamic growth across key regions, with North America, Europe, and Asia Pacific leading the adoption of advanced dispatch solutions. North America remains at the forefront due to robust public safety investments and technological innovation, while Europe emphasizes regulatory compliance and cross-border interoperability, and Asia Pacific benefits from rapid urbanization and expanding public infrastructure. Latin America, the Middle East, and Africa are also experiencing steady adoption, supported by modernization efforts and international collaborations. The competitive landscape features prominent players such as Hexagon AB, CentralSquare Technologies, and Motorola Solutions, each delivering comprehensive CAD platforms tailored to diverse public safety requirements. These companies focus on innovation, integration, and service reliability to address the unique needs of agencies worldwide, strengthening their positions in a rapidly evolving market.

Market Insights

- The Computer Aided Dispatch Market was valued at USD 10,692.67 million in 2024 and is projected to reach USD 19,668.83 million by 2032, at a CAGR of 7.37%.

- Growing demand for efficient emergency response systems, technological advancements, and rising public safety concerns drive market expansion.

- Increasing integration with GIS, AI, and cloud-based platforms shapes market trends, enabling real-time coordination and enhanced situational awareness for emergency services.

- Leading players such as Hexagon AB, CentralSquare Technologies, and Motorola Solutions compete by offering innovative CAD solutions and expanding their global footprint.

- The market faces restraints due to complex integration with legacy systems, stringent regulatory requirements, and the need for continuous investment in cybersecurity.

- North America, Europe, and Asia Pacific are the primary regions for CAD market growth, while Latin America, the Middle East, and Africa witness steady adoption due to modernization initiatives.

- Regional agencies prioritize interoperability, mobile-first solutions, and scalability to meet evolving public safety demands, with key countries including the United States, Germany, China, and Brazil leading adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Advanced Emergency Response Solutions

The Computer Aided Dispatch Market benefits significantly from the increasing demand for efficient and advanced emergency response solutions. Public safety agencies, including law enforcement, fire departments, and emergency medical services, require quick and accurate incident response to protect lives and property. Governments worldwide recognize the value of CAD systems for streamlining dispatch operations, improving communication, and enhancing situational awareness during emergencies. Investment in robust dispatch platforms allows agencies to optimize resource allocation and reduce response times. The growing urban population and complexity of emergencies have further accelerated the adoption of CAD technologies. It helps agencies operate with greater efficiency and coordination. The market continues to expand as authorities seek ways to modernize and digitize emergency management infrastructure.

- For instance, supportive government initiatives and growing awareness of CAD solutions are driving market expansion, as agencies recognize the importance of efficient emergency response systems.

Integration with Geographic Information Systems and Emerging Technologies

The integration of Computer Aided Dispatch Market solutions with geographic information systems (GIS), mobile devices, and cloud-based platforms enables seamless sharing and management of critical information. Modern CAD systems leverage real-time data feeds, mapping tools, and remote access capabilities, which allow dispatchers and responders to collaborate more effectively. Organizations are adopting AI-powered analytics and automation to enhance decision-making and optimize workflows. It supports the accurate tracking of assets and personnel, ensuring the right resources reach incidents swiftly. The evolution of smart cities further drives the need for interconnected dispatch solutions. This trend positions the market to deliver smarter, more responsive emergency services.

- For instance, CAD solutions integrate with GIS and real-time communication networks to dispatch first responders with precision and ensure rapid deployments in disaster situations.

Increasing Focus on Interoperability and Scalability Across Agencies

Public safety organizations increasingly demand interoperable and scalable Computer Aided Dispatch Market systems that connect various agencies and departments. Interoperability allows different emergency response units to communicate seamlessly, reducing confusion and facilitating a unified approach. Scalable solutions enable agencies to adapt to evolving operational needs and accommodate future growth. It supports multi-agency coordination during complex incidents, including natural disasters and large-scale public events. Agencies prioritize platforms that can integrate with existing infrastructure and support new functionalities without disruption. Vendors focus on developing flexible CAD solutions that support long-term operational resilience.

Emphasis on Cybersecurity and Data Privacy in Dispatch Operations

With the growing reliance on digital platforms, cybersecurity and data privacy have become central concerns for the Computer Aided Dispatch Market. Public safety agencies handle sensitive information that must be protected from cyber threats and unauthorized access. Strict regulatory requirements and compliance standards now shape procurement decisions. Agencies invest in solutions offering robust encryption, secure data storage, and regular system updates. It ensures the integrity and confidentiality of mission-critical data. The heightened focus on digital security drives ongoing innovation and encourages vendors to prioritize the development of secure, future-ready dispatch systems.

Market Trends

Adoption of Cloud-Based and Mobile-First Dispatch Platforms Accelerates Modernization

The Computer Aided Dispatch Market is experiencing a notable shift toward cloud-based and mobile-first platforms, enabling agencies to modernize operations efficiently. Cloud solutions offer scalability, remote accessibility, and seamless updates, reducing the burden of on-premise infrastructure management. Public safety organizations embrace mobile-enabled CAD applications to improve field communication and real-time data access. It empowers first responders to receive incident alerts, route information, and resource updates on mobile devices while in the field. The flexibility and resilience of cloud deployments have gained traction among agencies aiming to future-proof their dispatch capabilities. This shift supports uninterrupted services and remote work scenarios, especially during unforeseen events. The growing demand for digital transformation in public safety further accelerates this trend.

- For instance, mobile CAD applications enable real-time communication and coordination, enhancing the efficiency of emergency response teams.

Integration of Artificial Intelligence and Predictive Analytics Enhances Operational Intelligence

Artificial intelligence and predictive analytics are transforming the Computer Aided Dispatch Market, providing advanced insights for incident management and resource planning. Agencies utilize AI-driven algorithms to automate call triage, prioritize responses, and analyze historical data for future event forecasting. It improves situational awareness by delivering real-time recommendations and automating routine tasks. Predictive analytics enables agencies to anticipate peak periods and deploy resources more effectively, improving overall efficiency. The combination of AI and analytics strengthens the ability to identify patterns, prevent incidents, and optimize workflows. Agencies now expect CAD vendors to deliver intelligent solutions that adapt to evolving safety challenges. Market growth aligns with broader adoption of these advanced digital capabilities.

- For instance, predictive analytics in CAD systems is enabling agencies to anticipate peak periods and deploy resources more effectively.

Emphasis on Interoperability and Multi-Agency Collaboration Expands System Capabilities

The Computer Aided Dispatch Market reflects a growing emphasis on interoperability and multi-agency collaboration, allowing different emergency response entities to work in unison. Interconnected dispatch systems facilitate the seamless sharing of incident data and coordinated response across municipal, regional, and national levels. It reduces duplication, accelerates information flow, and enhances coordinated resource deployment during complex emergencies. Agencies invest in platforms that integrate with other mission-critical systems, including records management, video surveillance, and GIS tools. The trend toward unified command structures drives the need for systems capable of supporting integrated operations. Solutions enabling this level of collaboration are in high demand, shaping market evolution.

Prioritization of Data Security and Regulatory Compliance Shapes Product Development

Vendors in the Computer Aided Dispatch Market prioritize data security and regulatory compliance in response to rising cyber threats and evolving privacy regulations. Public safety agencies demand CAD solutions that protect sensitive information, ensure system integrity, and align with international standards. It has led to the introduction of robust encryption, advanced access controls, and continuous monitoring features within dispatch platforms. Vendors invest in regular security audits, vulnerability testing, and compliance certifications to gain client trust. The focus on protecting mission-critical data influences procurement and deployment decisions. This trend underpins ongoing innovation and reinforces the need for secure, compliant CAD systems in global public safety operations.

Market Challenges Analysis

Complex Integration with Legacy Systems and Infrastructure Impedes Deployment

The Computer Aided Dispatch Market faces significant challenges due to complex integration requirements with legacy systems and infrastructure. Many public safety agencies continue to operate older communication and data platforms, creating compatibility issues when adopting modern CAD solutions. System interoperability, data migration, and seamless connectivity demand careful planning and specialized expertise. It often leads to extended implementation timelines and higher costs, especially for agencies with limited technical resources. The complexity of integrating new and existing technologies can disrupt daily operations and hinder effective information flow. Agencies must address these obstacles to fully realize the benefits of advanced dispatch platforms.

- For instance, the intricate nature of integrating CAD systems with existing infrastructure and concerns about data security present barriers to adoption.

Stringent Regulatory Standards and Escalating Cybersecurity Threats Create Operational Risks

Compliance with stringent regulatory standards and escalating cybersecurity threats poses ongoing challenges for the Computer Aided Dispatch Market. Public safety agencies must navigate a landscape of evolving data privacy laws and sector-specific regulations that govern the management of sensitive information. It requires continuous updates to security protocols, system monitoring, and staff training. The increasing sophistication of cyberattacks puts mission-critical data and operational continuity at risk, driving the need for robust defense mechanisms. Maintaining regulatory compliance while safeguarding against emerging threats demands significant investment and resources. Agencies must prioritize risk mitigation to protect the integrity and reliability of dispatch operations.

Market Opportunities

Expansion of Smart City Initiatives and Digital Public Safety Infrastructure Drives Growth

The Computer Aided Dispatch Market holds significant opportunities with the global expansion of smart city initiatives and the increasing digitalization of public safety infrastructure. Cities invest in advanced technologies to enhance emergency response, traffic management, and urban security, fueling demand for integrated dispatch platforms. The adoption of IoT devices, real-time data analytics, and cloud-based services creates new avenues for CAD solutions to deliver greater situational awareness and operational efficiency. It enables agencies to connect seamlessly with various municipal systems, improving overall public safety outcomes. Vendors can capitalize on the growing smart city ecosystem by offering scalable, interoperable dispatch platforms tailored to urban environments. Collaboration between technology providers and local governments further expands the market’s reach.

Development of AI-Enabled and Predictive Dispatch Systems Enhances Value Proposition

Opportunities in the Computer Aided Dispatch Market increase as agencies embrace AI-enabled and predictive dispatch systems. Advanced analytics, machine learning, and artificial intelligence unlock new capabilities in call prioritization, resource allocation, and incident forecasting. It helps agencies anticipate emerging risks and optimize emergency response strategies. The demand for intelligent, automated decision-support tools positions CAD vendors to differentiate their offerings in a competitive market. Continuous innovation in AI and data-driven applications strengthens the value proposition for public safety agencies. The focus on proactive, data-informed dispatch operations drives future market expansion and long-term adoption.

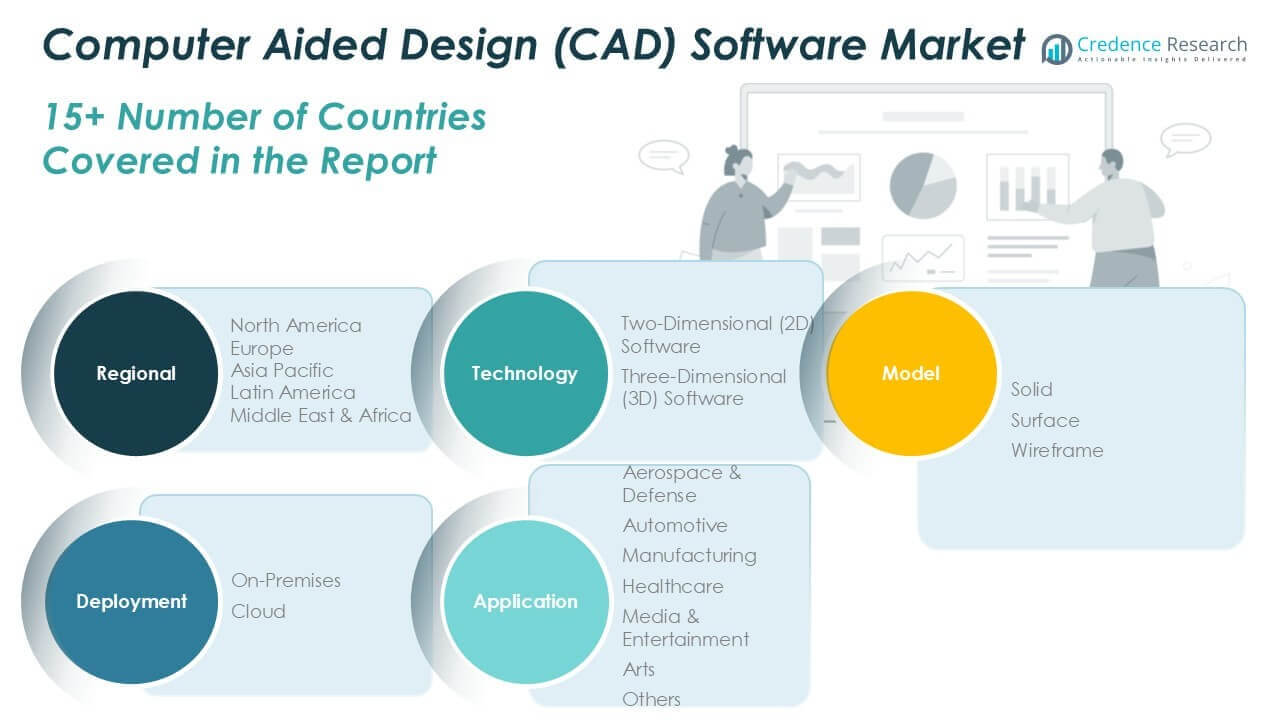

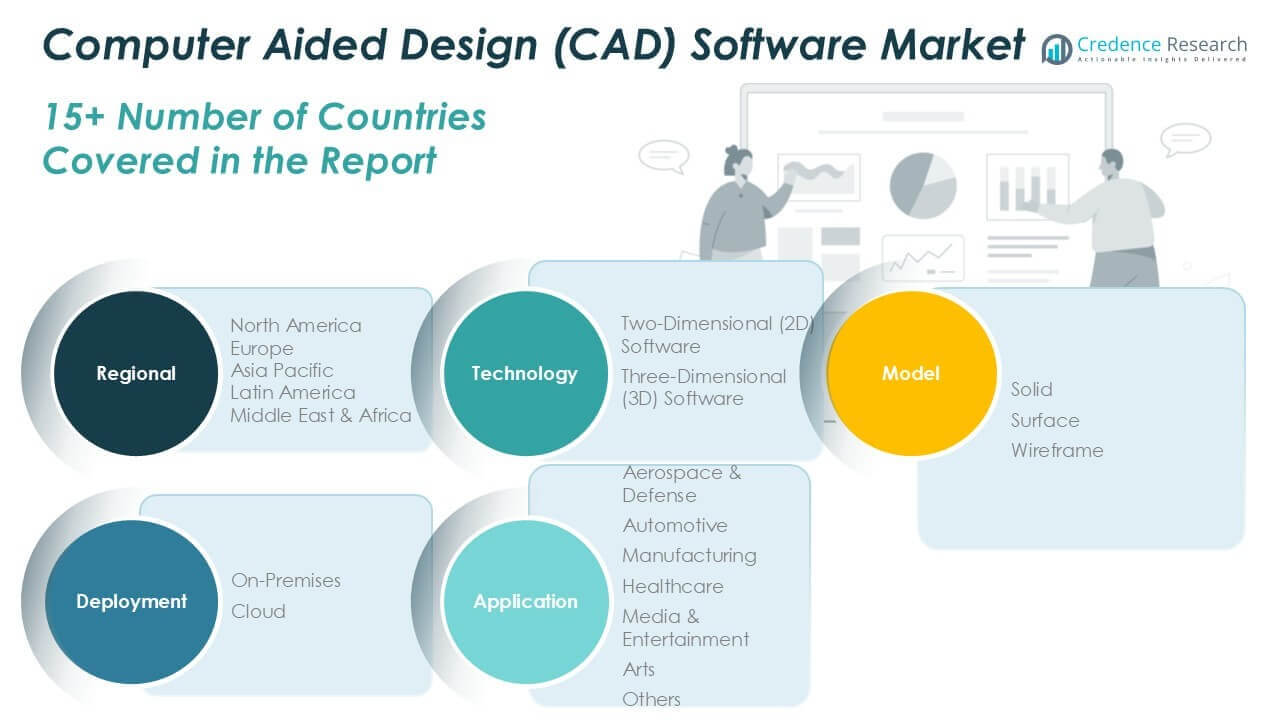

Market Segmentation Analysis:

By Technology:

By technology, the market includes Two-Dimensional (2D) Software and Three-Dimensional (3D) Software. Two-Dimensional (2D) Software remains widely used for its simplicity, efficiency, and cost-effectiveness in routine dispatch operations, particularly for agencies with fundamental mapping and reporting requirements. Three-Dimensional (3D) Software, on the other hand, is gaining traction due to its advanced visualization capabilities. It supports more dynamic incident mapping and enhances situational awareness for emergency response teams, making it suitable for complex, high-density urban environments and large-scale operations.

By Model:

The market covers Solid, Surface, and Wireframe models. Solid models provide comprehensive data and visualization, supporting incident management with high precision. Agencies rely on solid modeling for tasks that require detailed spatial analysis, such as resource placement or traffic management during emergencies. Surface models offer a balance between visualization depth and processing speed, often used where topographical details and incident overlays are required. Wireframe models, while less common, serve specific niche applications that prioritize structural layouts over visual realism, helping to streamline quick decision-making in straightforward dispatch scenarios.

By Deployment:

Deployment preferences within the Computer Aided Dispatch Market reveal a strong divide between On-Premises and Cloud-based solutions. On-premises deployments appeal to agencies with strict data security policies, greater control requirements, or limited internet infrastructure. These solutions provide reliability and compliance for critical missions where data sovereignty is non-negotiable. Cloud-based deployments are expanding rapidly, driven by the need for scalability, remote access, and cost efficiency. Cloud solutions enable real-time collaboration, continuous updates, and seamless integration with other digital platforms, supporting dynamic, mobile-first public safety operations. Agencies adopting cloud models benefit from improved flexibility, disaster recovery, and lower upfront investment, positioning the market to evolve alongside digital transformation trends in emergency management.

Segments:

Based on Technology:

- Two-Dimensional (2D) Software

- Three-Dimensional (3D) Software

Based on Model:

Based on Deployment:

Based on Application:

- Aerospace & Defense

- Automotive

- Manufacturing

- Healthcare

- Media & Entertainment

- Arts

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Computer Aided Dispatch Market

North America Computer Aided Dispatch Market grew from USD 2,711.43 million in 2018 to USD 4,201.37 million in 2024 and is projected to reach USD 7,751.90 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.4%. North America is holding a 39% market share. The United States and Canada dominate this region, driven by robust public safety investments, technological innovation, and early adoption of cloud-based CAD platforms. Regional agencies emphasize interoperability and advanced analytics, ensuring rapid incident response and effective resource management. Government initiatives for emergency services digitalization and disaster preparedness further support market expansion. North America’s advanced infrastructure enables seamless integration of CAD systems with other public safety technologies. Key players actively introduce next-generation features to maintain a competitive edge.

Europe Computer Aided Dispatch Market

Europe Computer Aided Dispatch Market grew from USD 1,361.39 million in 2018 to USD 2,024.47 million in 2024 and is projected to reach USD 3,409.25 million by 2032, reflecting a CAGR of 6.2%. Europe accounts for a 17% market share. Germany, the United Kingdom, and France lead this region due to stringent regulatory requirements, public safety reforms, and growing investments in smart city solutions. European agencies focus on seamless communication and cross-border interoperability. The demand for secure, scalable CAD platforms is accelerating, especially within the EU’s digital transformation agenda. Vendors adapt their offerings to address language and compliance requirements unique to each country. Integration with Geographic Information Systems (GIS) and analytics drives operational efficiency.

Asia Pacific Computer Aided Dispatch Market

Asia Pacific Computer Aided Dispatch Market grew from USD 2,145.92 million in 2018 to USD 3,536.01 million in 2024 and is projected to reach USD 7,048.03 million by 2032, reflecting a CAGR of 8.4%. Asia Pacific holds a 36% market share. China, Japan, and India serve as key contributors, benefiting from rapid urbanization, government safety initiatives, and major investments in public infrastructure. The need for real-time coordination during emergencies, natural disasters, and large-scale events increases demand for CAD solutions. Agencies prioritize mobile-first and cloud-enabled platforms to address regional connectivity challenges. The integration of AI and IoT technology is shaping market advancement. Regional market expansion is supported by public-private partnerships.

Latin America Computer Aided Dispatch Market

Latin America Computer Aided Dispatch Market grew from USD 303.99 million in 2018 to USD 470.19 million in 2024 and is projected to reach USD 759.47 million by 2032, reflecting a CAGR of 5.6%. Latin America accounts for a 4% market share. Brazil and Mexico lead the region, propelled by efforts to modernize emergency response and invest in public safety digitalization. Budget constraints and infrastructural disparities create challenges, but international funding and support from global technology providers help drive adoption. Agencies increasingly seek cloud-based and cost-effective CAD solutions. The emphasis on urban security and law enforcement modernization sustains market demand. Local governments collaborate with technology vendors for pilot projects and training programs.

Middle East Computer Aided Dispatch Market

Middle East Computer Aided Dispatch Market grew from USD 186.51 million in 2018 to USD 266.61 million in 2024 and is projected to reach USD 411.74 million by 2032, reflecting a CAGR of 5.0%. The Middle East holds a 2% market share. The United Arab Emirates and Saudi Arabia represent key markets, fueled by investments in smart city projects, critical infrastructure, and public safety modernization. Security concerns and large-scale public events encourage agencies to deploy advanced CAD systems. It enables rapid resource allocation and effective emergency coordination. Cloud deployments are gradually gaining traction, but on-premises solutions remain prominent. Regional governments pursue partnerships with international vendors to support digital transformation.

Africa Computer Aided Dispatch Market

Africa Computer Aided Dispatch Market grew from USD 112.73 million in 2018 to USD 194.02 million in 2024 and is projected to reach USD 288.44 million by 2032, reflecting a CAGR of 4.5%. Africa accounts for a 2% market share. South Africa, Nigeria, and Egypt are the primary adopters, supported by urbanization and increasing public safety awareness. Infrastructure challenges and funding limitations slow broader market penetration, yet international aid and government programs drive pilot implementations. Agencies prioritize scalable, low-cost CAD solutions that address local communication needs. The focus remains on improving basic emergency response and enhancing interoperability. Gradual investment in digital public safety infrastructure supports steady market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Autodesk

- Dassault Systèmes

- PTC

- Siemens Digital Industries Software

- Bentley Systems

- Hexagon AB

- ZWSOFT

- Graphisoft

- Trimble

- Altium

- ANSYS

- Altair Engineering

- Bricsys

- Zuken

Competitive Analysis

The Computer Aided Dispatch Market features intense competition among leading players such as Hexagon AB, CentralSquare Technologies, Motorola Solutions, RapidSOS, and Spillman Technologies. Leading vendors emphasize robust, scalable CAD platforms that address the complex requirements of modern public safety agencies. Solutions increasingly offer advanced analytics, real-time data visualization, and interoperability with various communication and data management systems. Many providers invest in cloud-based and mobile-first technologies, enabling agencies to improve response times and maintain operational flexibility. Strategic partnerships, continuous product development, and dedicated customer support help differentiate offerings and foster client loyalty. Vendors also address challenges such as cybersecurity, regulatory compliance, and seamless integration with legacy infrastructure to strengthen their market positions. The competitive landscape is defined by rapid technological advancements and the ability to adapt solutions to the evolving needs of emergency services worldwide.

Recent Developments

- In August 2024, CARBYNE and Axon Enterprise, Inc. announced a partnership to integrate CARBYNE’s advanced 9-1-1 caller data with Axon Enterprise, Inc.’s Fusus platform, enabling seamless data sharing and improved situational awareness for emergency response teams. This collaboration combines real-time 9-1-1 data, AI-powered features, and security camera feeds to enhance decision-making and streamline emergency response processes, paving the way for next-generation public safety solutions.

- In July 2024, Priority Dispatch Corp. announced a partnership with GoodSAM Platform to integrate its Automated External Defibrillators (AED) registry into the ProQA software, enhancing emergency response capabilities by providing dispatchers with access to both fixed and mobile AED locations. This collaboration aims to improve cardiac emergency response times, empowering dispatchers to direct callers to the nearest available AED, potentially saving lives during critical situations.

- In March 2023, Motorola Solutions’ PremierOne computer-aided dispatch (CAD) software was successfully integrated by Peel Regional Police to strengthen safety measures for officers and the approximately 1.4 million residents in the Peel region. This cutting-edge CAD system, PremierOne, is pivotal in facilitating real-time communication and fostering better collaboration between dispatchers and field personnel. Its advanced capabilities enable the seamless sharing of time-sensitive and critical information among various agencies, leading to heightened operational efficiency and more effective response strategies.

- In February 2023, Zetron acquired GeoConex, a long-standing computer-aided dispatch (CAD) solution partner. This strategic acquisition aims to enable closer integration between the two companies’ respective 911 technologies, which complement each other. By joining forces, Zetron and GeoConex will enhance their capabilities in delivering comprehensive CAD solutions for emergency services, further empowering efficient and seamless emergency response operations.

- In September 2022, Harris, a global software provider and acquirer focusing on vertical markets, expanded its public sector offerings by acquiring Cushing Systems Inc. (CSI), a leading public safety software provider. This strategic acquisition further enhances Harris’ portfolio in the public sector domain, enabling them to provide comprehensive and advanced solutions for public safety organizations. By incorporating CSi’s expertise and software solutions, Harris aims to strengthen its position as a trusted provider of innovative software solutions tailored specifically for the public safety sector.

- In August 2022, Mark43, a cloud-native public safety software provider, announced a groundbreaking partnership with the Tennessee Highway Patrol (THP), a Tennessee Department of Public Safety and Homeland Security division, to introduce integrated Computer-Aided Dispatch (CAD) and mobile capabilities. Implementing Mark43’s CAD system will encompass many advanced features, including a mobile dispatch application, powerful analytics tools, and multiple user interfaces. This collaborative effort marks a significant step forward in leveraging cutting-edge technology to bolster public safety and optimize emergency response operations to benefit the communities served.

Market Concentration & Characteristics

The Computer Aided Dispatch Market displays a moderate to high degree of market concentration, with a few established players controlling significant market share and influencing industry standards. It is characterized by the presence of both global vendors and regional specialists who deliver tailored solutions to meet the unique requirements of public safety agencies. The market’s core features include advanced interoperability, real-time data processing, and seamless integration with other public safety and communication systems. Strong emphasis on technological innovation, cybersecurity, and compliance with regulatory frameworks defines vendor differentiation. It attracts sustained investment due to growing demand for scalable, cloud-based platforms and AI-driven dispatch capabilities. The market evolves rapidly, driven by digital transformation initiatives across emergency response sectors and the critical need for efficient incident management.

Report Coverage

The research report offers an in-depth analysis based on Technology, Model, Deployment, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The computer aided dispatch market is expected to grow steadily with increasing demand for efficient emergency response systems.

- Integration with next-generation communication technologies will enhance real-time data sharing and situational awareness.

- Rising adoption of cloud-based solutions will improve scalability, flexibility, and system accessibility.

- Growing emphasis on public safety and security is likely to drive investment in advanced dispatch platforms.

- The market will benefit from the increasing use of GIS and GPS technologies for accurate location tracking.

- Expansion of smart city initiatives will support the implementation of advanced dispatch systems.

- Artificial intelligence and machine learning integration will improve decision-making and predictive capabilities.

- Interoperability between agencies and platforms is becoming a priority, boosting demand for unified systems.

- Continuous advancements in mobile and wearable technologies will enhance field communication and coordination.

- Strategic partnerships and vendor innovations are expected to fuel technological upgrades and market expansion.