Market Overview

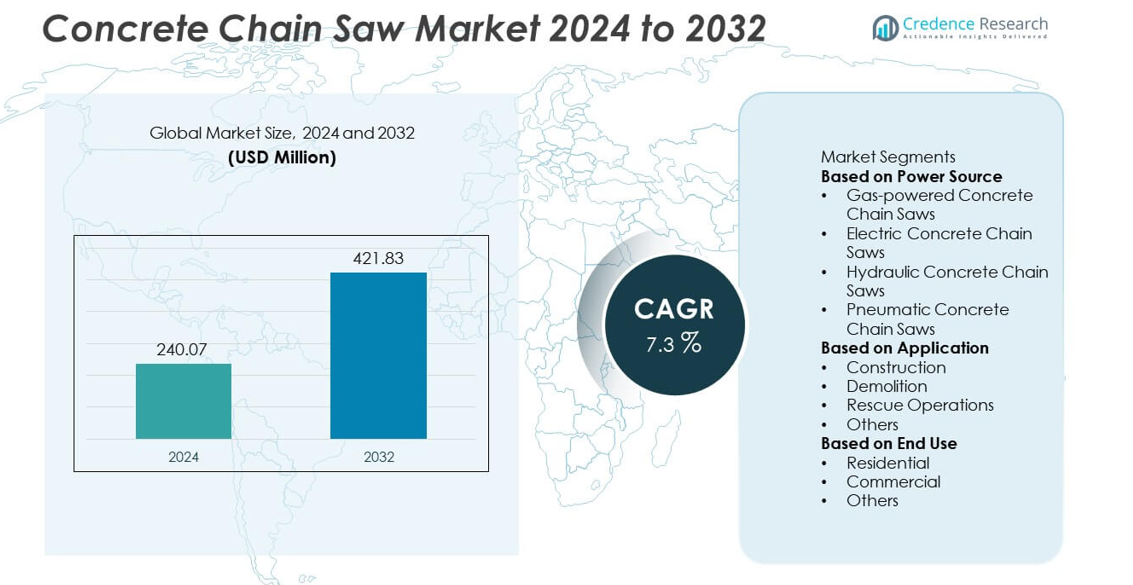

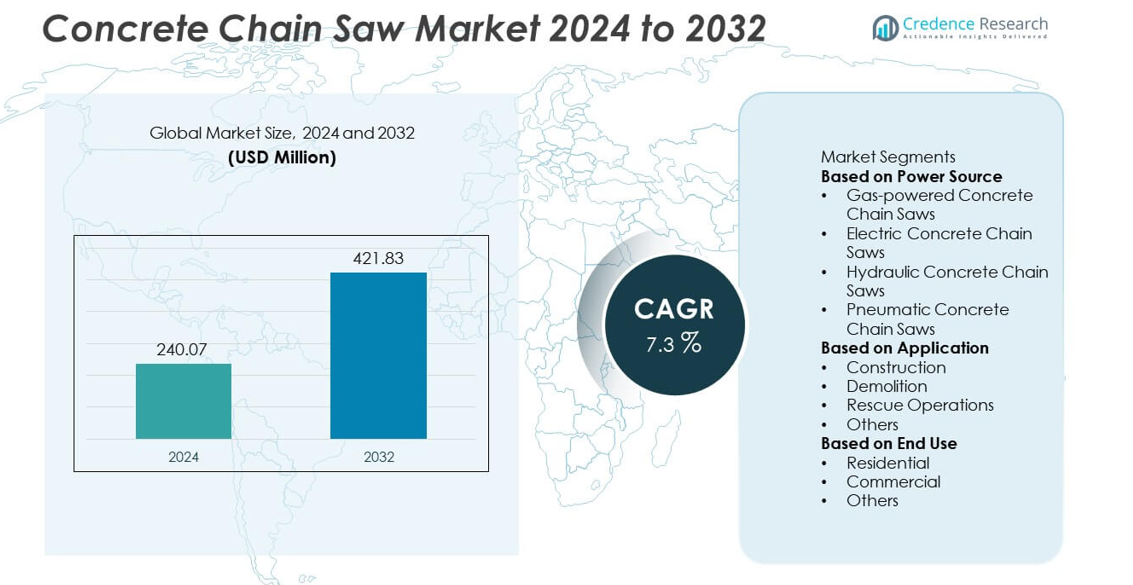

The Concrete Chain Saw market was valued at USD 240.07 million in 2024 and is projected to reach USD 421.83 million by 2032, expanding at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Concrete Chain Saw Market Size 2024 |

USD 240.07 million |

| Concrete Chain Saw Market, CAGR |

7.3% |

| Concrete Chain Saw Market Size 2032 |

USD 421.83 million |

The concrete chain saw market is led by key players such as Husqvarna AB, ICS Diamond Tools & Equipment, Stanley Infrastructure, Diamond Products, and Andreas Stihl AG & Co. KG. These companies dominate through strong product portfolios, advanced cutting technologies, and global distribution networks. North America held the largest share of 37% in 2024, supported by extensive infrastructure development and renovation projects. Europe followed with 29%, driven by rising demand for precision cutting tools in construction and demolition. Asia-Pacific accounted for 26%, fueled by rapid urbanization and growing adoption of advanced construction equipment in emerging economies.

Market Insights

- The concrete chain saw market was valued at USD 240.07 million in 2024 and is projected to reach USD 421.83 million by 2032, expanding at a CAGR of 7.3% during the forecast period.

- Rising demand for durable and precision cutting tools in construction and infrastructure projects is driving market growth across residential, commercial, and industrial sectors.

- Advancements in electric and hydraulic chain saw technologies, coupled with ergonomic and safety features, are shaping product innovation trends.

- Leading players such as Husqvarna AB, ICS Diamond Tools & Equipment, and Stanley Infrastructure focus on expanding their portfolios and improving performance efficiency.

- North America holds 37%, Europe 29%, and Asia-Pacific 26% market share, while the gas-powered segment leads with 46% share due to its high cutting power and suitability for large-scale construction projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Source

The gas-powered concrete chain saw segment dominated the market in 2024 with a 46% share, driven by its high cutting power, portability, and suitability for heavy-duty applications. These saws are preferred for outdoor construction and infrastructure projects due to their ability to cut through reinforced concrete efficiently without reliance on electric power sources. Contractors favor gas-powered models for their long runtime and durability in remote or large-scale job sites. Continuous improvements in engine efficiency and emission control further strengthen this segment’s position in professional-grade concrete cutting applications.

- For instance, Husqvarna AB introduced the 572 XP gas-powered chainsaw equipped with a 70.6 cm³ (cc) X-Torq engine producing 4.3 kW output power and a maximum chain speed of 22 m/s. The saw features the AutoTune system for optimal engine performance and low vibrations to reduce user fatigue.

By Application

The construction segment held the largest share of 52% in 2024, fueled by widespread use of concrete chain saws in building foundations, structural modifications, and concrete wall openings. Increasing demand for precision cutting tools in residential and commercial projects supports this dominance. The equipment’s ability to perform clean, deep cuts with minimal vibration makes it ideal for structural and renovation tasks. Additionally, growing infrastructure projects, such as bridges and tunnels, are boosting adoption in the construction sector, supported by the need for efficiency and reduced operational downtime on job sites.

- For instance, ICS Diamond Tools & Equipment developed its 890 F4 hydraulic concrete chainsaw, which is capable of a cutting depth of 25 inches. When configured with the 8 GPM motor, it delivers 11.5 hp, or 17.5 hp with the 12 GPM motor, allowing contractors to perform deep, square openings in dense concrete structures without overcutting or compromising stability.

By End Use

The commercial segment accounted for a 44% share in 2024, driven by rising adoption of concrete chain saws in large-scale commercial infrastructure and urban redevelopment projects. Commercial contractors prefer these saws for their precision and adaptability in complex cutting operations across office buildings, retail spaces, and public facilities. The demand is further supported by growing safety regulations that encourage the use of advanced cutting tools for controlled demolition and renovation. Continuous urban expansion and investment in non-residential construction globally are expected to sustain the segment’s strong market presence over the forecast period.

Key Growth Drivers

Rising Infrastructure Development and Urbanization

Global infrastructure expansion and rapid urbanization are major drivers of the concrete chain saw market. Governments and private developers are investing heavily in roadways, bridges, tunnels, and commercial complexes, increasing demand for efficient concrete cutting equipment. Concrete chain saws provide precision, speed, and deep cutting capabilities essential for complex structural works. The growing adoption of advanced machinery in construction enhances productivity and safety. This trend is particularly strong in developing economies where urban infrastructure projects are accelerating at a fast pace.

- For instance, Diamond Products introduced its CC6571 hydraulic concrete saw featuring a 71 hp Kubota diesel engine and a maximum cutting depth of 17-3/4 inches with a 42-inch blade. The system is optimized for infrastructure applications such as bridge deck cutting and tunnel reinforcement, offering high torque output for stable, continuous operation on reinforced concrete structures.

Increasing Demand for Efficient Demolition Equipment

The growing need for controlled demolition and renovation of aging buildings supports market expansion. Concrete chain saws enable accurate cutting with minimal vibration and reduced structural damage, making them ideal for selective demolition tasks. Their ability to cut through reinforced concrete and masonry with precision enhances their adoption in restoration and remodeling projects. Rising safety standards and environmental regulations encouraging dust and noise control are driving replacement of traditional cutting tools with advanced, efficient, and operator-friendly concrete saws.

- For instance, CARDI s.r.l. developed its TSS K-3000 electric concrete chain saw equipped with a 2300 W motor capable of cutting reinforced concrete up to 14 inches deep.

Technological Advancements in Power Tools

Advancements in motor technology, blade design, and ergonomics are improving performance and user safety. Manufacturers are introducing lightweight, high-torque electric and hydraulic models with reduced emissions and better energy efficiency. Integration of vibration-dampening systems and dust suppression features enhances operator comfort and compliance with workplace safety standards. Innovations in diamond chain technology also enable faster, deeper, and cleaner cuts in reinforced materials. These technological improvements are broadening the application scope of concrete chain saws across construction, demolition, and rescue operations.

Key Trends and Opportunities

Shift Toward Electric and Hydraulic Models

The industry is witnessing a shift toward electric and hydraulic concrete chain saws due to their lower emissions, reduced noise, and higher operational control. These models cater to indoor projects and urban environments where sustainability and safety are key priorities. Improved power efficiency and reduced maintenance needs are boosting adoption among contractors. This transition aligns with global trends toward eco-friendly construction equipment and supports compliance with stringent emission norms in developed markets such as Europe and North America.

- For instance, Husqvarna AB launched the K 7000 Ring electric concrete cutter, which has a 5.5 kW high-frequency motor. The tool’s maximum cutting depth varies by model, with the 17-inch version reaching up to 12.8 inches (325 mm). The K 7000 Ring comes in two variants, 14-inch and 17-inch, to accommodate different cutting depths.

Growing Use in Emergency and Rescue Operations

Concrete chain saws are increasingly used in rescue and emergency operations for cutting through debris, reinforced walls, and concrete barriers. Their portability and ability to perform under high-stress conditions make them indispensable tools for disaster response teams. Fire departments and emergency services are investing in high-performance models with enhanced reliability and cutting depth. This growing non-construction demand presents new opportunities for manufacturers to design specialized tools catering to safety, speed, and efficiency in emergency situations.

- For instance, Andreas Stihl AG & Co. KG introduced the GS 461 Rock Boss rescue saw equipped with a 76.5 cc two-stroke engine delivering 4.3 kW of power and a maximum cutting depth of 16 inches. The model features an integrated water supply system for dust suppression and reinforced diamond chain segments, enabling first responders to cut through concrete, masonry, and steel-reinforced barriers during emergency rescue missions.

Key Challenges

High Equipment and Maintenance Costs

Concrete chain saws involve high initial investment and maintenance expenses, limiting their adoption among small contractors. The cost of replacement chains, diamond segments, and frequent servicing adds to the operational burden. Hydraulic and electric variants, though efficient, also demand compatible power units and accessories, further increasing costs. These economic barriers hinder widespread use, especially in cost-sensitive developing markets. Manufacturers are focusing on modular designs and durable components to enhance affordability and extend product life cycles.

Operator Safety and Skill Requirements

Operating a concrete chain saw requires specialized skills and adherence to strict safety protocols. Improper handling can lead to injuries, equipment damage, or inefficient cuts. Despite technological advancements, vibration, dust exposure, and kickback remain significant risks. The lack of trained operators, especially in emerging economies, limits optimal usage. Training programs and compliance with occupational safety regulations are essential to ensure safe and effective operation. Manufacturers are responding with safety features such as automatic shut-offs and ergonomic designs to reduce risk and improve usability.

Regional Analysis

North America

North America held a 36% share of the concrete chain saw market in 2024, driven by large-scale infrastructure rehabilitation and construction projects. The United States dominates regional growth due to high adoption of advanced power tools in commercial and industrial applications. Rising demand for precision cutting in concrete restoration, bridge maintenance, and urban redevelopment supports market expansion. Canada also contributes through steady investments in residential and public infrastructure. Strong presence of global manufacturers, combined with strict safety standards and technological advancements, continues to strengthen North America’s leadership in the concrete chain saw industry.

Europe

Europe accounted for a 28% share of the concrete chain saw market in 2024, supported by modern construction practices and sustainable building initiatives. Countries such as Germany, France, and the United Kingdom lead adoption due to stringent safety regulations and increased renovation of aging infrastructure. Growing demand for electric and hydraulic models aligns with the region’s environmental goals and emission standards. The expansion of residential and commercial redevelopment projects further drives product usage. Ongoing innovation in noise reduction, dust suppression, and energy efficiency enhances Europe’s position as a key market for advanced concrete cutting tools.

Asia-Pacific

Asia-Pacific captured a 29% share of the global concrete chain saw market in 2024, emerging as the fastest-growing region. Rapid urbanization, industrial development, and infrastructure megaprojects in China, India, and Japan are driving demand. The region’s increasing focus on efficient construction and controlled demolition practices boosts market penetration. Rising investments in smart cities, road expansion, and high-rise construction enhance equipment utilization. Local manufacturers are introducing cost-effective electric and pneumatic models to cater to small contractors. Expanding government funding for infrastructure modernization and rising construction safety awareness continue to support strong regional growth.

Latin America

Latin America held a 4% share of the concrete chain saw market in 2024, driven by growing construction activities in Brazil and Mexico. Increasing demand for renovation and road infrastructure upgrades supports regional adoption. Government investments in housing and public infrastructure, coupled with expanding industrial projects, are boosting product use. However, limited access to advanced tools and high equipment costs restrict broader penetration. Rising awareness about efficient demolition and concrete cutting solutions is gradually improving market potential. Partnerships with global tool manufacturers are expected to enhance availability and support long-term growth in this region.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the concrete chain saw market in 2024, fueled by rapid urban expansion and infrastructure development. Countries such as Saudi Arabia, the UAE, and South Africa are witnessing increased adoption in construction and demolition projects. Mega infrastructure projects like NEOM and large-scale housing initiatives are major contributors to market demand. The growing need for advanced and durable cutting tools in extreme environments drives the use of high-performance models. Although high costs limit small-scale adoption, ongoing industrialization and modernization efforts are expected to strengthen future growth.

Market Segmentations:

By Power Source

- Gas-powered Concrete Chain Saws

- Electric Concrete Chain Saws

- Hydraulic Concrete Chain Saws

- Pneumatic Concrete Chain Saws

By Application

- Construction

- Demolition

- Rescue Operations

- Others

By End Use

- Residential

- Commercial

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the concrete chain saw market features leading players such as ICS Diamond Tools & Equipment, Husqvarna AB, Michigan Pneumatic, Reimann & Georger Corp, MaxCut, Inc., CARDI s.r.l., Stanley Infrastructure, Diamond Products, Andreas Stihl AG & Co. KG, and CS Unitec, Inc. These companies focus on product innovation, durability, and safety improvements to strengthen their market presence. Manufacturers are developing advanced models with enhanced cutting depth, reduced vibration, and dust suppression systems to meet the demands of modern construction and demolition projects. Strategic partnerships with construction firms and distributors help expand their global footprint. Companies are also investing in battery-powered and eco-efficient variants to align with sustainability goals. Continuous technological upgrades, after-sales support, and ergonomic designs remain central to maintaining competitive differentiation in this growing industrial equipment market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, ICS launched a retrofit conversion kit enabling compatibility of its FORCE4 diamond chains with the Stihl GS 461 Rock Boss platform. This upgrade enhances versatility and performance by allowing cross-platform use of high-strength concrete cutting chains in existing tools.

- In January 2025, ICS Diamond Tools & Equipment introduced its FORCE3 Speedster™ diamond chain, designed for reinforced concrete applications. The chain achieves cutting speeds up to 30% faster than the previous FORCE3 model and incorporates Seal Pro lubrication technology to extend operational life under heavy-duty cutting conditions.

- In May 2024, CARDI s.r.l. introduced an electric wall and concrete chain saw designed for professional contractors, integrating a water-cooled 2300 W motor. The model supports continuous cutting through reinforced materials while minimizing vibration and operator fatigue

Report Coverage

The research report offers an in-depth analysis based on Power Source, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for concrete chain saws will rise with the growth of global construction and infrastructure projects.

- Adoption of electric and battery-powered models will increase due to focus on sustainability and low emissions.

- Advancements in blade design and vibration control will improve cutting precision and operator safety.

- Manufacturers will invest in lightweight, ergonomic designs to enhance user comfort during long operations.

- Integration of dust suppression and cooling technologies will boost equipment efficiency and lifespan.

- Growth in renovation and demolition projects will create strong demand for high-performance chain saws.

- Asia-Pacific will emerge as the fastest-growing region due to rapid urbanization and industrial expansion.

- Partnerships between equipment manufacturers and contractors will strengthen product reach and service support.

- Increasing safety regulations in construction will drive the use of advanced and compliant cutting tools.

- Continued innovation in hydraulic and pneumatic systems will expand industrial and rescue applications.