Market overview

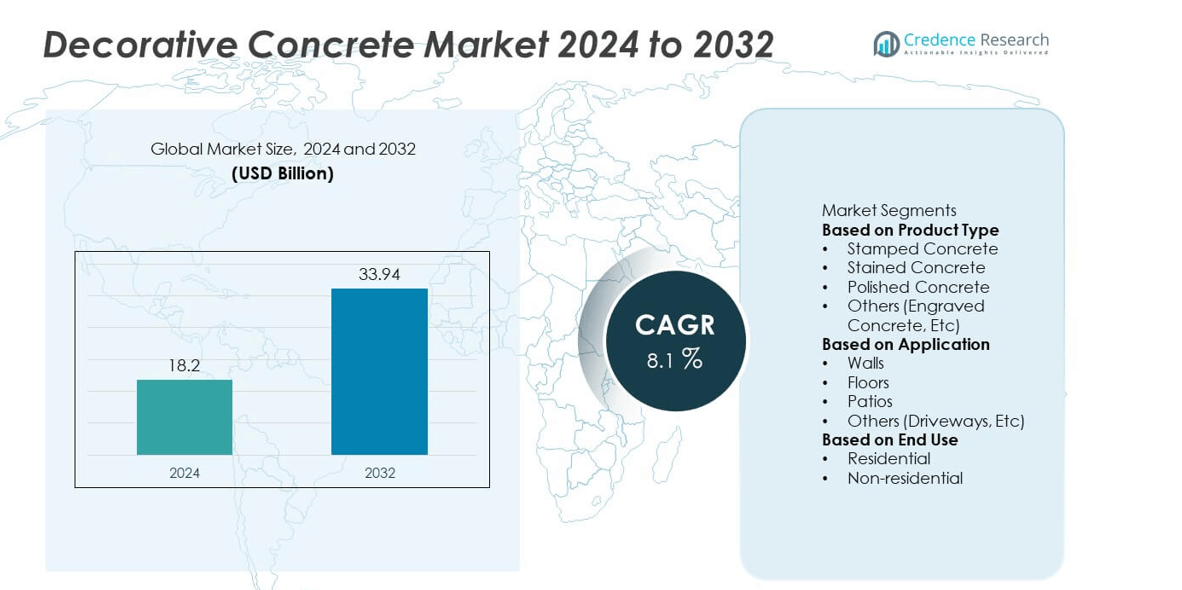

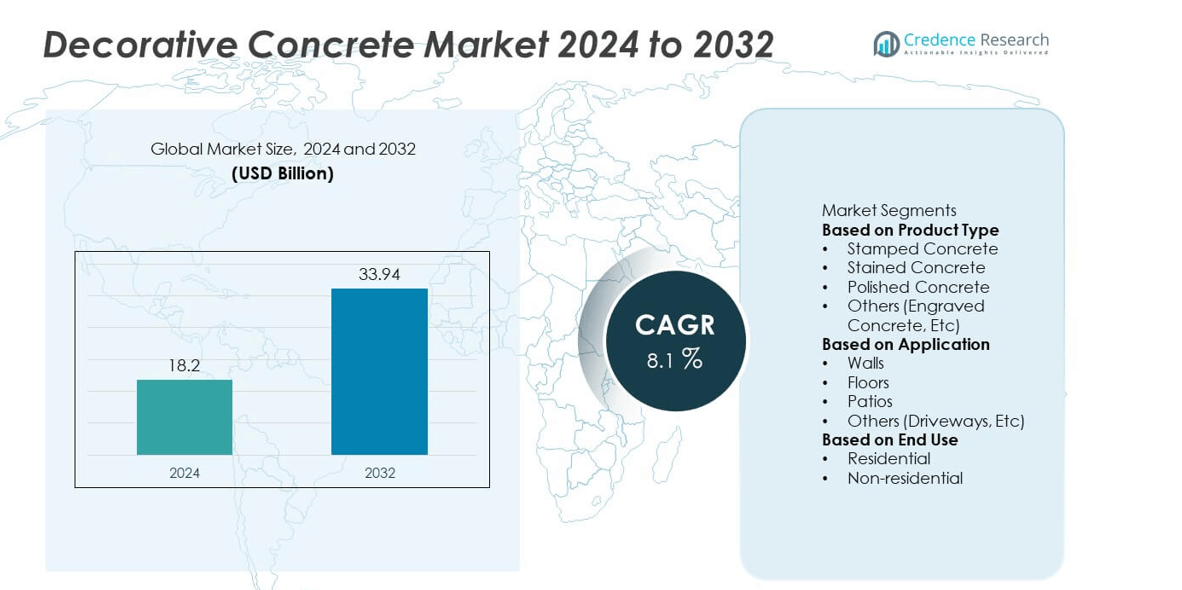

The Decorative Concrete market was valued at USD 18.2 billion in 2024 and is projected to reach USD 33.94 billion by 2032, expanding at a CAGR of 8.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Decorative Concrete Market Size 2024 |

USD 18.2 billion |

| Decorative Concrete Market, CAGR |

8.1% |

| Decorative Concrete Market Size 2032 |

USD 33.94 billion |

The decorative concrete market is led by key players such as Sika AG, L.M. Scofield Company, Ardex Group, BASF SE, Proline Concrete Tools, Decorative Concrete Supply, Cemex S.A.B. de C.V., LATICRETE International, Inc., GCP Applied Technologies, and Bomanite. These companies dominate through advanced surface technologies, sustainable formulations, and strong regional distribution. North America leads the global market with a 37% share, driven by large-scale residential renovations and commercial infrastructure projects. Europe follows with 30%, supported by sustainable construction practices and advanced surface finishing techniques, while Asia-Pacific holds 25%, emerging as the fastest-growing region due to rapid urbanization and infrastructure expansion.

Market Insights

- The decorative concrete market was valued at USD 18.2 billion in 2024 and is projected to reach USD 33.94 billion by 2032, growing at a CAGR of 8.1%.

- Rising demand for durable, aesthetic, and cost-effective flooring solutions across residential and commercial construction drives market growth.

- The market trend highlights increasing adoption of sustainable materials, innovative surface finishes, and advanced polishing technologies.

- Key players such as Sika AG, BASF SE, and Cemex S.A.B. de C.V. lead through innovation, eco-friendly formulations, and regional expansion strategies.

- North America holds a 37% share, followed by Europe at 30% and Asia-Pacific at 25%, while the stamped concrete segment leads the product category with a 39% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The stamped concrete segment dominated the decorative concrete market in 2024 with a 39% share. Its popularity stems from versatility, cost efficiency, and the ability to replicate natural materials such as stone, tile, or brick. Stamped concrete offers superior strength and minimal maintenance, making it ideal for both residential and commercial use. Advancements in color hardeners and sealants enhance design quality and durability. Growing demand for decorative yet durable surfacing in patios, walkways, and driveways continues to strengthen the segment’s position in the overall market.

- For instance, Sika AG offers its SikaColor®-200 Color Hardener, which is applied to fresh stamped concrete to create abrasion-resistant interior floors and exterior hardscapes. Sika products, like the SikaColor® Color Hardeners, are shown to significantly increase abrasion resistance and improve the longevity of outdoor stamped surfaces, including those in high-traffic areas.

By Application

The floors segment led the market in 2024 with a 44% share. Decorative concrete flooring is widely adopted in commercial and residential interiors due to its high durability, aesthetic appeal, and ease of cleaning. The demand for polished and stained concrete floors is increasing in retail, hospitality, and office spaces for their long lifespan and low lifecycle cost. Advancements in surface finishing techniques, such as diamond polishing and micro-topping, are improving texture quality. Growing preference for modern, seamless floor designs drives the segment’s continued dominance.

- For instance, BASF’s MasterTop 1325 polyurethane-based flooring system is designed for comfort and noise reduction in areas with heavy pedestrian traffic, such as hospitals and schools. For industrial applications with heavy forklift movement, BASF offers extremely durable polyurethane concrete flooring, such as its Ucrete systems.

By End Use

The non-residential segment held the largest share of 57% in 2024, driven by extensive use in commercial buildings, hotels, and public infrastructure projects. Decorative concrete enhances architectural appeal while maintaining structural strength, making it ideal for high-traffic areas. Increasing construction of malls, airports, and office complexes supports steady demand. Additionally, the integration of decorative finishes in public spaces aligns with urban infrastructure modernization efforts. The residential segment also shows notable growth, supported by rising investments in home renovation and the growing preference for sustainable, visually appealing building materials.

Key Growth Drivers

Rising Demand for Aesthetic and Durable Flooring Solutions

The growing emphasis on visually appealing and long-lasting construction materials drives the decorative concrete market. Consumers prefer surfaces that combine durability with design flexibility for both indoor and outdoor applications. Stamped, stained, and polished concretes offer cost-effective alternatives to tiles or natural stones. Rising urbanization and increasing residential and commercial renovation projects further accelerate adoption. The ability of decorative concrete to deliver custom finishes while maintaining structural integrity makes it a preferred material across global construction markets.

- For instance, Bomanite has supplied decorative and polished concrete solutions for a variety of large-scale commercial projects across the United States. The company’s high-performance concrete systems, such as Bomanite Modena and VitraFlor, are engineered for durability in heavy footfall areas and can achieve compressive strengths over 42 MPa (or 6000 psi).

Increasing Infrastructure and Commercial Construction Projects

Rapid infrastructure development and expanding commercial spaces are fueling decorative concrete demand. Governments and private developers are investing in modern public structures, airports, and commercial complexes that require both durability and visual appeal. Decorative concrete’s ability to withstand heavy foot traffic while offering design versatility supports its adoption in large-scale projects. Additionally, growing focus on sustainable building materials encourages the use of low-maintenance and long-lasting decorative finishes, driving consistent growth across developing and developed economies.

- For instance, Cemex S.A.B. de C.V. supplied Vertua lower-carbon concrete for the construction of the new Terminal 2 at Puerto Vallarta’s International Airport. The project involved the delivery of over 85,000 cubic meters of Vertua concrete, which avoided the emission of 16,000 tons of CO2 compared to traditional concretes.

Advancements in Concrete Finishing and Coloring Technologies

Technological innovation in polishing, stamping, and staining techniques is enhancing the performance and aesthetics of decorative concrete. Improved pigments, surface sealers, and protective coatings now offer better color retention, abrasion resistance, and weather durability. Manufacturers are introducing eco-friendly additives and water-based stains to meet sustainability goals. These advancements allow architects and builders to create diverse textures and finishes suitable for both interior and exterior designs. Continuous R&D investments are making decorative concrete more customizable, increasing its appeal across residential and commercial segments.

Key Trends & Opportunities

Growing Adoption of Sustainable and Green Construction Materials

Sustainability is shaping purchasing decisions in the construction industry, favoring decorative concrete. The material’s long lifespan, energy efficiency, and ability to utilize recycled aggregates make it environmentally preferable. Builders are increasingly adopting low-VOC sealants and water-based coatings to meet green building standards. The trend toward eco-conscious architecture is driving decorative concrete use in LEED-certified projects. As governments and developers prioritize sustainable materials, this shift presents significant opportunities for manufacturers offering eco-friendly decorative concrete solutions.

- For instance, Master Builders Solutions Green Sense Concrete Technology uses optimized mixture designs, which can incorporate recycled materials and provide performance benefits. The exact mix proportions, including the percentage of recycled aggregates, are specific to each project and optimized to meet performance goals.

Rising Popularity of Customization and Smart Design Integration

The demand for personalized and smart decorative concrete designs is expanding rapidly. Modern consumers and architects prefer customizable patterns, embedded lighting, and unique surface textures to enhance visual appeal. Integration with digital modeling and 3D printing allows precise design execution. This trend is transforming decorative concrete into a key element of modern architecture. Advancements in surface treatments and design tools also enable greater creativity, giving rise to opportunities in luxury housing, retail architecture, and commercial interiors worldwide.

- For instance, Proline Decorative Concrete Systems offers over 150 unique pattern stamps, along with custom solutions. Their innovations include magnetic seamless pattern stamps (SPS system), which are lightweight, durable, and reduce labor by aligning automatically with magnets to ensure a seamless pattern.

Key Challenges

High Installation and Maintenance Costs

Despite its durability, decorative concrete installation often requires skilled labor and specialized tools, increasing project costs. Complex patterns, coloring, and surface finishing techniques can make decorative applications more expensive than conventional concrete. Maintenance costs also rise with polishing, resealing, and color restoration needs in high-traffic areas. These factors may limit adoption among cost-sensitive builders. To overcome this challenge, manufacturers are focusing on developing affordable installation solutions and offering training programs to improve workforce expertise in decorative concrete application.

Surface Cracking and Weather-Related Durability Issues

Decorative concrete surfaces are prone to cracking and color fading under extreme weather or poor installation practices. Temperature fluctuations and moisture intrusion can compromise surface quality and appearance over time. This poses challenges in outdoor applications such as driveways and patios. Maintaining consistent performance across climates requires advanced sealants and curing technologies. Manufacturers are working on enhanced formulations to improve flexibility, UV resistance, and thermal stability. Continued innovation in surface protection and material composition remains essential to ensure long-term durability and aesthetic performance.

Regional Analysis

North America

North America held the largest share of 37% in the decorative concrete market in 2024. Strong demand from residential renovation projects and commercial infrastructure supports market growth. The U.S. dominates due to the widespread use of polished and stamped concrete in flooring, driveways, and patios. Technological advancements in surface finishing and sustainable construction materials further enhance adoption. Increasing investment in modern urban infrastructure and outdoor landscaping projects also drives demand. Canada contributes to growth through rising adoption of decorative concrete in commercial and institutional building projects across major metropolitan areas.

Europe

Europe accounted for 30% of the decorative concrete market in 2024, driven by strong demand for sustainable and aesthetic building materials. The region benefits from stringent environmental regulations promoting eco-friendly construction. Countries such as Germany, France, and the U.K. lead adoption due to extensive renovation of historical buildings and modern architectural projects. Decorative concrete’s low maintenance and long lifespan align well with regional sustainability goals. Growth is further supported by rising demand for energy-efficient flooring solutions and advancements in decorative surface technologies across both residential and commercial spaces.

Asia-Pacific

Asia-Pacific captured a 25% share of the decorative concrete market in 2024 and is the fastest-growing region. Rapid urbanization and expanding construction activity in China, India, and Southeast Asia drive strong demand. The region’s booming residential and commercial real estate sectors encourage the use of cost-effective decorative flooring and wall applications. Governments’ focus on smart city development and infrastructure modernization further supports growth. Increasing consumer awareness of design aesthetics and durable materials is also boosting adoption. Local manufacturers are expanding production capabilities to meet the rising demand for decorative finishes.

Latin America

Latin America held a 5% share of the decorative concrete market in 2024. Growth is driven by increasing construction activity in Brazil and Mexico, particularly in residential and commercial sectors. Decorative concrete is gaining popularity for its durability, affordability, and ability to withstand tropical climates. The rising focus on tourism-related infrastructure and public space beautification also supports market expansion. Government-backed housing projects and urban renewal initiatives further stimulate demand. However, limited technological expertise and fluctuating raw material prices remain challenges that could slow widespread adoption in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 3% share of the decorative concrete market in 2024. Rising investments in commercial infrastructure, hospitality, and urban beautification projects are key growth factors. Countries such as the United Arab Emirates and Saudi Arabia are adopting decorative concrete for modern architectural designs in luxury developments. Africa is witnessing gradual growth through infrastructure modernization and residential construction projects. The region’s hot climate encourages the use of reflective and heat-resistant decorative coatings. Despite promising opportunities, limited technical capabilities and high material costs pose short-term challenges.

Market Segmentations:

By Product Type

- Stamped Concrete

- Stained Concrete

- Polished Concrete

- Others (Engraved Concrete, Etc)

By Application

- Walls

- Floors

- Patios

- Others (Driveways, Etc)

By End Use

- Residential

- Non-residential

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The decorative concrete market is highly competitive, with leading players including Sika AG, L.M. Scofield Company, Ardex Group, BASF SE, Proline Concrete Tools, Decorative Concrete Supply, Cemex S.A.B. de C.V., LATICRETE International, Inc., GCP Applied Technologies, and Bomanite. These companies compete through strong distribution networks, extensive product portfolios, and continuous innovation in concrete finishes and coloring systems. Market leaders focus on developing high-performance coatings, surface treatments, and eco-friendly admixtures to meet rising demand for sustainable and aesthetic construction materials. Strategic partnerships, mergers, and acquisitions remain key strategies to expand global presence and strengthen production capabilities. Many players are investing in advanced polishing, stamping, and sealing technologies to enhance product durability and design flexibility. As consumer preference shifts toward low-maintenance and customizable surfaces, competition is intensifying across residential, commercial, and infrastructure construction segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sika AG

- M. Scofield Company

- Ardex Group

- BASF SE

- Proline Concrete Tools

- Decorative Concrete Supply

- Cemex S.A.B. de C.V.

- LATICRETE International, Inc.

- GCP Applied Technologies

- Bomanite

Recent Developments

- In April 2025, Sika AG opened a new plant in Ust-Kamenogorsk, Kazakhstan, for mortar and concrete admixtures.

- In March 2025, Sika AG fully acquired HPS North America (distributor of Schönox finishing products) to strengthen its finishing/overlay offering.

- In February 2025, LATICRETE International, Inc. showcased a coordinated color/finish system suite at KBIS 2025, emphasizing integrated system design.

- In September 2024, BASF SE announced a new corporate strategy called “Winning Ways” to become the preferred chemical company for enabling customers’ green transformation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for decorative concrete will rise with growing urbanization and infrastructure development.

- Adoption of eco-friendly and low-VOC coatings will strengthen due to sustainability goals.

- Advanced stamping and polishing technologies will enhance design precision and durability.

- Integration of digital design tools will support greater customization in architectural projects.

- Residential renovation and landscaping activities will continue to drive market expansion.

- Commercial buildings will increasingly use decorative concrete for flooring and facade enhancement.

- Smart concrete solutions with self-healing and temperature control features will gain traction.

- Strategic partnerships between manufacturers and builders will expand global market presence.

- Emerging economies in Asia-Pacific will experience rapid growth in decorative applications.

- Innovations in pigments and surface protectants will improve longevity and aesthetic appeal.