Market overview

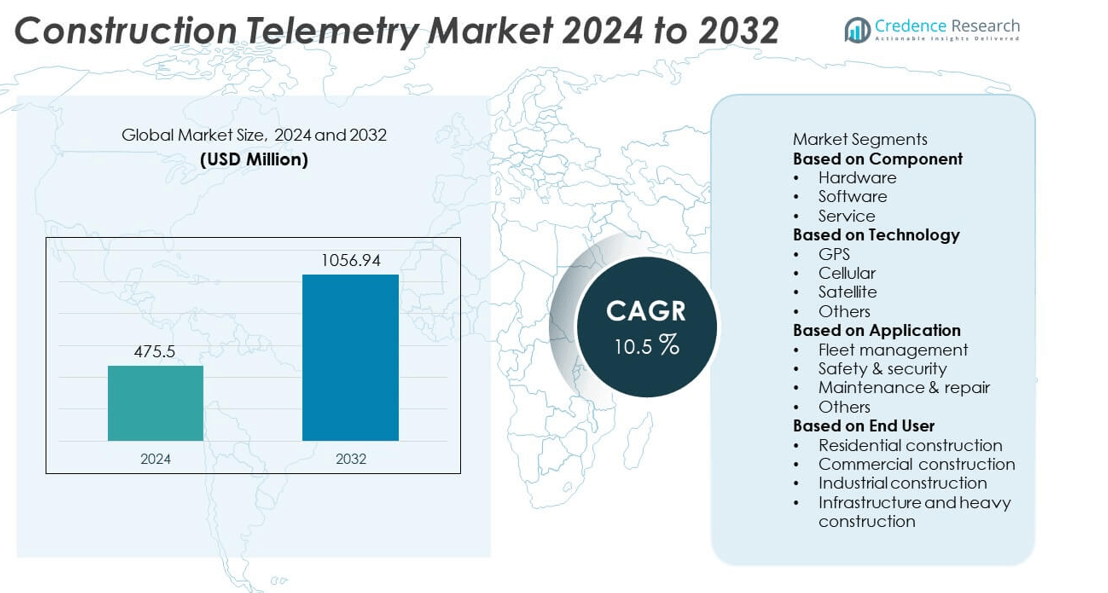

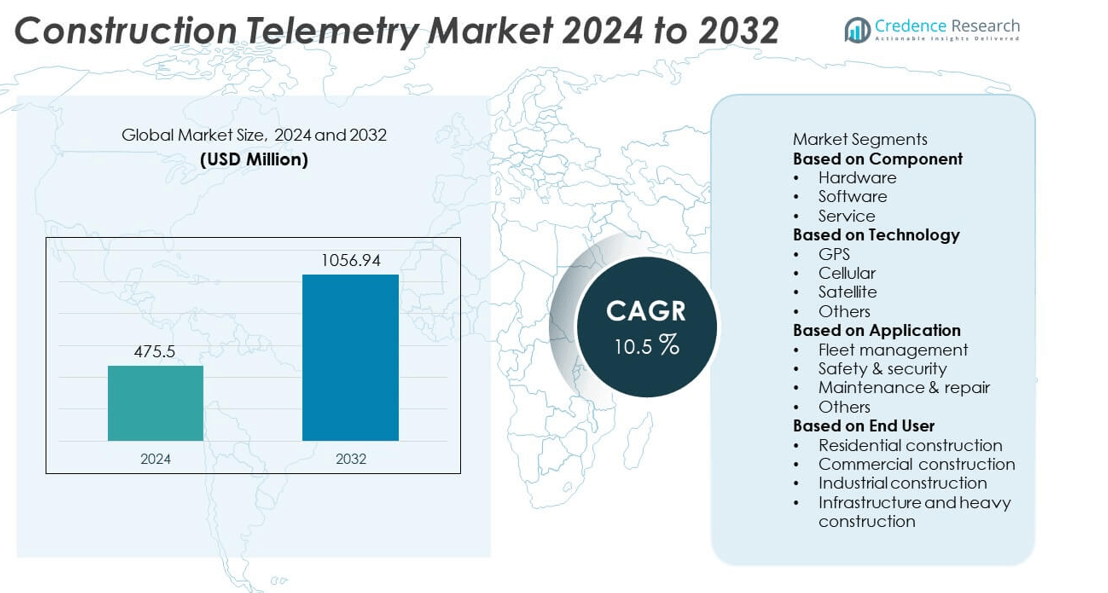

The Construction Telemetry market was valued at USD 475.5 million in 2024 and is projected to reach USD 1,056.94 million by 2032, growing at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Telemetry Market Size 2024 |

USD 475.5 million |

| Construction Telemetry Market, CAGR |

10.5% |

| Construction Telemetry Market Size 2032 |

USD 1,056.94 million |

The Construction Telemetry market is led by major players including Trimble Inc., Procore Technologies Inc., Komatsu Ltd., Verizon Connect LLC, Skycatch Inc., Hilti Corporation, Leica Geosystems AG, Caterpillar Inc., Autodesk Inc., and Topcon Corporation. These companies are driving innovation through IoT-based monitoring systems, cloud analytics, and AI-integrated telematics platforms that enhance equipment efficiency and safety. North America dominated the global market with a 36% share in 2024, supported by high digital adoption and strong infrastructure investment. Europe followed with 29%, driven by strict safety regulations and technological modernization, while Asia-Pacific accounted for 25% due to rapid urbanization and large-scale construction activities across emerging economies.

Market Insights

- The Construction Telemetry market was valued at USD 475.5 million in 2024 and is projected to reach USD 1,056.94 million by 2032, expanding at a CAGR of 10.5% during the forecast period.

- Growing demand for real-time monitoring, predictive maintenance, and efficient equipment management is driving adoption of telemetry systems across construction projects.

- Key trends include the integration of IoT, AI, and cloud analytics for advanced data visualization, automation, and remote control of heavy equipment.

- The market is competitive, with leading players such as Trimble, Komatsu, Caterpillar, and Procore Technologies focusing on partnerships, innovation, and cloud-based telematics expansion.

- North America leads with 36% share, followed by Europe at 29% and Asia-Pacific at 25%, while by component, the hardware segment dominates with 49% share due to high demand for IoT-enabled sensors and telematics devices in fleet and equipment monitoring.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The hardware segment dominated the Construction Telemetry market in 2024, accounting for 49% share. This dominance is driven by the extensive use of sensors, control modules, and telematics units installed in construction machinery and vehicles. Hardware components enable real-time monitoring of engine performance, fuel usage, and equipment location, improving operational efficiency. Rising demand for IoT-enabled and ruggedized devices designed for harsh construction environments supports continued growth. Meanwhile, the software segment is expanding rapidly as analytics and cloud-based platforms gain traction for predictive maintenance and fleet optimization.

- For instance, Caterpillar Inc. developed its VisionLink® telematics hardware with integrated Cat Product Link™ devices capable of transmitting data across mixed fleets. The system records many operational parameters, including engine hours, idle time, and fuel consumption, helping operators reduce downtime through data-driven preventive maintenance.

By Technology

The cellular segment held the largest share of 45% in the Construction Telemetry market in 2024. Its dominance stems from widespread network availability and lower implementation costs compared to satellite-based systems. Cellular telemetry allows real-time data transmission from remote construction sites to centralized dashboards, enhancing decision-making and safety. GPS technology follows closely, playing a key role in asset tracking and route optimization for construction fleets. Satellite systems are gaining importance for off-grid projects and infrastructure developments in remote regions where terrestrial connectivity is limited.

- For instance, Komatsu Ltd. implemented its KOMTRAX™ cellular telemetry platform that transmits machine health and productivity data via cellular and satellite networks. The system supports a global fleet of connected construction machines, providing operators with detailed analytics on fuel efficiency, load cycles, and equipment utilization across multiple job sites.

By Application

Fleet management led the Construction Telemetry market in 2024 with a 41% share. This segment’s growth is supported by the need for continuous monitoring of construction vehicles, fuel consumption, and equipment utilization. Telemetry solutions enable contractors to optimize logistics, reduce idle time, and prevent unauthorized use of machinery. The safety and security segment is also expanding as companies implement telemetry-based alerts to prevent accidents and theft. Maintenance and repair applications benefit from real-time fault detection, enabling predictive maintenance that minimizes downtime and extends asset lifespan.

Key Growth Drivers

Rising Demand for Real-Time Equipment Monitoring

The growing need for real-time visibility into construction equipment operations is a major market driver. Telemetry systems enable continuous tracking of fuel consumption, engine health, and machine usage, improving operational efficiency. Construction firms are adopting IoT-enabled sensors and GPS modules to optimize performance and reduce idle time. The ability to access live data through cloud-based dashboards supports better decision-making and proactive maintenance. This real-time monitoring reduces equipment downtime, enhances safety, and lowers project costs across infrastructure and commercial developments.

- For instance, Trimble Inc. integrated its WorksOS platform with the Trimble Earthworks Grade Control Platform to provide real-time jobsite metrics, such as cut, fill, volume, and compaction data. The system uses cellular networks to transmit data to a cloud-based dashboard, giving project managers instant visibility into jobsite progress.

Expansion of Smart Construction and IoT Integration

The rapid shift toward smart construction practices is accelerating the use of telemetry technologies. Integration of IoT, AI, and telematics systems allows seamless connectivity between on-site machinery, vehicles, and management platforms. These solutions enable predictive maintenance, safety alerts, and data-driven planning. Government support for digital infrastructure and growing adoption of connected equipment further drive this trend. As construction operations become more automated, IoT-based telemetry ensures efficient project execution, real-time monitoring, and better utilization of resources.

- For instance, Topcon Corporation developed its MC-Mobile compact 3D machine control system, equipped with GNSS and inertial sensors capable of achieving positional accuracy within 10 millimeters. The system wirelessly syncs with Topcon’s cloud-based platform, allowing real-time synchronization between equipment and project models, thereby enhancing precision in automated excavation and grading operations.

Increasing Focus on Safety and Asset Utilization

Rising concerns about worker safety and asset efficiency are fueling demand for telemetry systems in construction. These systems deliver real-time alerts for unsafe conditions, helping reduce site accidents and compliance risks. Telemetry also enables better equipment tracking and maintenance scheduling, improving operational productivity. The growing push for sustainability and cost control encourages contractors to use data insights for optimized fleet and asset management. This focus on preventive maintenance and safe operations strengthens the role of telemetry in modern construction management.

Key Trends & Opportunities

Adoption of Predictive Analytics and Cloud Platforms

The increasing integration of predictive analytics and cloud computing is transforming construction telemetry. Cloud-based platforms allow centralized monitoring of multiple projects, ensuring faster data access and remote management. Predictive algorithms analyze performance trends to anticipate equipment failures, lowering maintenance costs and downtime. Construction firms are shifting toward scalable, subscription-based telemetry systems that integrate with ERP and fleet management software. This evolution supports digital transformation, enhances collaboration, and strengthens operational visibility across large construction networks.

- For instance, Procore Technologies introduced its Helix AI, an intelligence layer that leverages AI-powered predictive analytics, agents, and insights to inform decision-making, identify potential risks across projects, and automate workflows. This technology helps construction teams boost efficiency and improve overall project performance.

Growth of Autonomous and Connected Equipment

The emergence of autonomous and connected construction machinery presents a major opportunity for telemetry adoption. These machines rely heavily on telemetry for navigation, diagnostics, and performance feedback. Equipment manufacturers are integrating AI-based monitoring systems and communication modules to enable real-time tracking and remote operation. This technology enhances accuracy, reduces labor costs, and increases safety on construction sites. As automation expands, telemetry will play a key role in maintaining efficiency and coordination across connected equipment ecosystems.

- For instance, Leica Geosystems developed its Leica iCON iXE3 semi-automated excavator control system, utilizing GNSS and 3D telemetry sensors to assist operators in achieving higher digging accuracy and faster fine grading. The system communicates with cloud-based platforms like Leica ConX, allowing stakeholders to share design files and track progress.

Key Challenges

High Initial Implementation and Integration Costs

High deployment and integration costs continue to challenge widespread telemetry adoption. Installing sensors, communication modules, and software platforms demands significant capital investment, especially for small and medium-sized contractors. Compatibility issues with legacy machinery add to the financial burden. The return on investment often requires time, discouraging rapid adoption. However, the gradual decline in hardware costs and the rise of cloud-based service models are expected to ease these challenges and promote broader implementation over time.

Data Security and Connectivity Issues

Data security and inconsistent network connectivity remain key obstacles in the Construction Telemetry market. Many construction sites operate in remote areas where stable communication networks are limited, affecting real-time data transmission. The vast amount of operational information generated also raises cybersecurity risks. Unauthorized access or data breaches can disrupt project operations and compromise safety. Ensuring strong encryption, secure data storage, and reliable connectivity infrastructure will be essential for maintaining trust and consistent telemetry performance in construction environments.

Regional Analysis

North America

North America held the largest share of 36% in the Construction Telemetry market in 2024. The region’s dominance is supported by high adoption of IoT-enabled monitoring systems and digital construction practices. The U.S. leads due to widespread use of connected equipment, predictive maintenance tools, and data analytics for project optimization. Government investment in smart infrastructure and strong presence of leading telematics providers further enhance market growth. Canada also contributes significantly with growing implementation of cloud-based fleet management and remote monitoring solutions across large construction and infrastructure projects.

Europe

Europe accounted for a 29% share of the Construction Telemetry market in 2024. The region benefits from increasing focus on digital transformation and safety compliance in construction operations. Countries such as Germany, the U.K., and France are leading adopters of telemetry technologies for equipment tracking, emissions monitoring, and workforce management. Strict environmental and operational safety regulations encourage the integration of advanced telematics systems. The European market also benefits from government-led smart infrastructure initiatives and partnerships between construction firms and technology providers to improve project efficiency and sustainability.

Asia-Pacific

Asia-Pacific captured a 25% share of the Construction Telemetry market in 2024, driven by rapid urbanization and expanding infrastructure development. Major economies such as China, Japan, India, and South Korea are adopting telemetry to improve productivity and reduce project downtime. The region’s growing investment in smart city projects and government-backed digital construction initiatives further boost demand. Increasing adoption of GPS and IoT-enabled equipment across large-scale projects strengthens market penetration. Local manufacturers and global telematics providers are expanding their presence to support regional construction modernization and data-driven operational management.

Latin America

Latin America held a 6% share of the Construction Telemetry market in 2024. Countries such as Brazil and Mexico are leading adoption due to growing construction activity and investment in large infrastructure projects. The focus on improving equipment efficiency and reducing operational costs drives telemetry use across construction fleets. Limited connectivity in remote regions and high system costs, however, remain key challenges. Nevertheless, increasing partnerships with global solution providers and rising adoption of cloud-based fleet monitoring are expected to support gradual market expansion in the region.

Middle East & Africa

The Middle East and Africa accounted for a 4% share of the Construction Telemetry market in 2024. The region’s growth is supported by ongoing investments in megaprojects and smart city initiatives across the UAE, Saudi Arabia, and South Africa. Telemetry systems are increasingly deployed for fleet management, safety monitoring, and remote equipment control. Government efforts to modernize infrastructure and enhance operational efficiency are encouraging digital adoption. Although challenges such as limited network infrastructure persist, growing collaboration with international technology vendors is improving telemetry accessibility and accelerating regional market development.

Market Segmentations:

By Component

- Hardware

- Software

- Service

By Technology

- GPS

- Cellular

- Satellite

- Others

By Application

- Fleet management

- Safety & security

- Maintenance & repair

- Others

By End User

- Residential construction

- Commercial construction

- Industrial construction

- Infrastructure and heavy construction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the Construction Telemetry market is defined by major players such as Trimble Inc., Procore Technologies Inc., Komatsu Ltd., Verizon Connect LLC, Skycatch Inc., Hilti Corporation, Leica Geosystems AG, Caterpillar Inc., Autodesk Inc., and Topcon Corporation. These companies focus on developing advanced telematics, IoT-enabled monitoring solutions, and cloud-based platforms to enhance construction productivity and safety. Strategic partnerships, mergers, and acquisitions are common as firms aim to integrate data analytics, GPS tracking, and predictive maintenance features into their offerings. Leading players are investing in AI-driven platforms and real-time equipment management tools to support digital transformation in construction operations. Competitive intensity remains strong, with companies expanding global footprints and offering scalable, subscription-based telemetry systems for both large enterprises and mid-sized contractors. This continuous innovation is strengthening their positions in the evolving market for connected and data-driven construction solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Procore Technologies Inc. introduced Procore Helix, an intelligence layer to connect data and workflows across construction. Helix underpins telemetry-driven insights across the platform.

- In June 2025, Leica Geosystems AG launched Leica Xsight360, an AI-powered awareness solution for construction vehicles that surfaces hazards and operational insights.

- In April 2025, Komatsu Ltd. made Smart Construction Remote standard with all guidance/control systems for the lifetime of the machine, enabling remote updates and support.

- In January 2025, Trimble Inc. launched tiered Works Subscription bundles for civil contractors, unifying hardware and software under one contract. The bundles simplify access to site positioning, machine control, and office tools

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IoT-based telemetry solutions will continue to grow across construction projects.

- Integration of AI and predictive analytics will enhance real-time decision-making and maintenance planning.

- Cloud-based platforms will dominate as companies shift toward centralized monitoring and data management.

- Demand for automated equipment tracking and fleet optimization will rise among large contractors.

- Growing focus on worker safety will drive adoption of telemetry for hazard detection and alerts.

- Expansion of 5G connectivity will improve data transmission speed and network reliability on job sites.

- Partnerships between technology firms and construction equipment manufacturers will strengthen innovation.

- Rising digitalization in infrastructure and smart city projects will boost telemetry demand.

- Small and medium enterprises will increasingly adopt cost-effective, subscription-based telemetry systems.

- Government initiatives supporting sustainable and data-driven construction will further accelerate market growth.