Market Overview

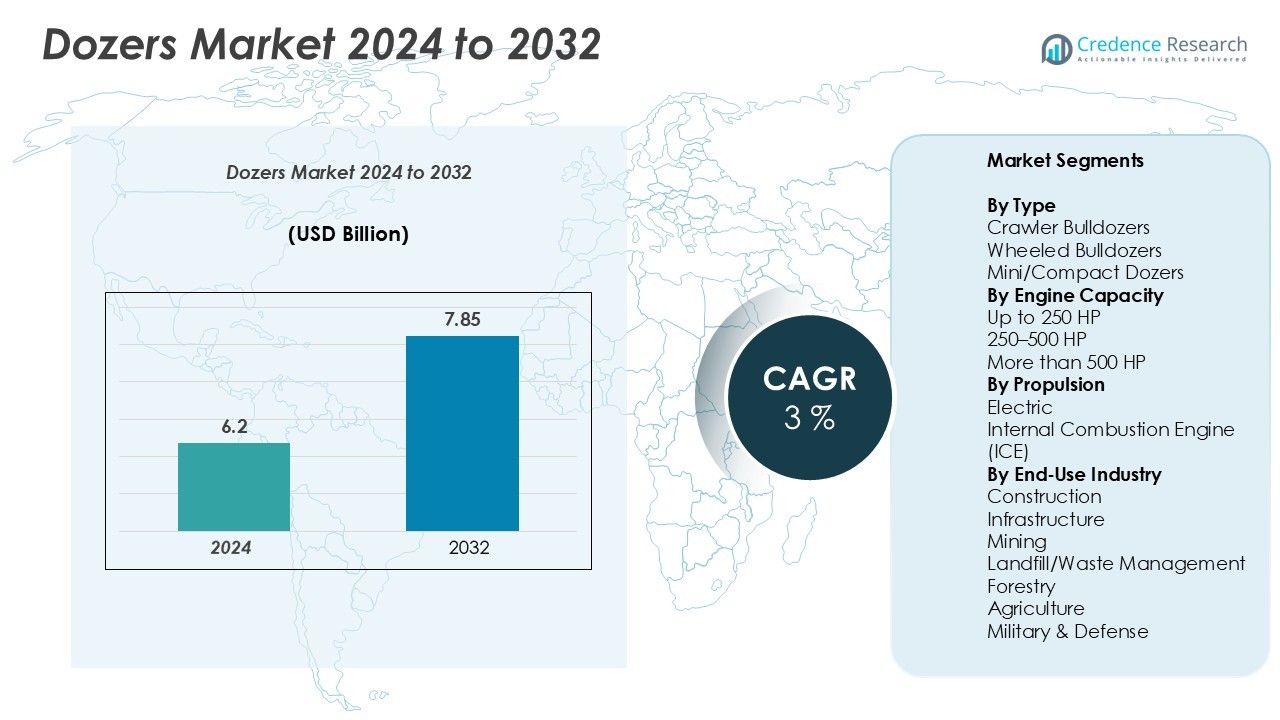

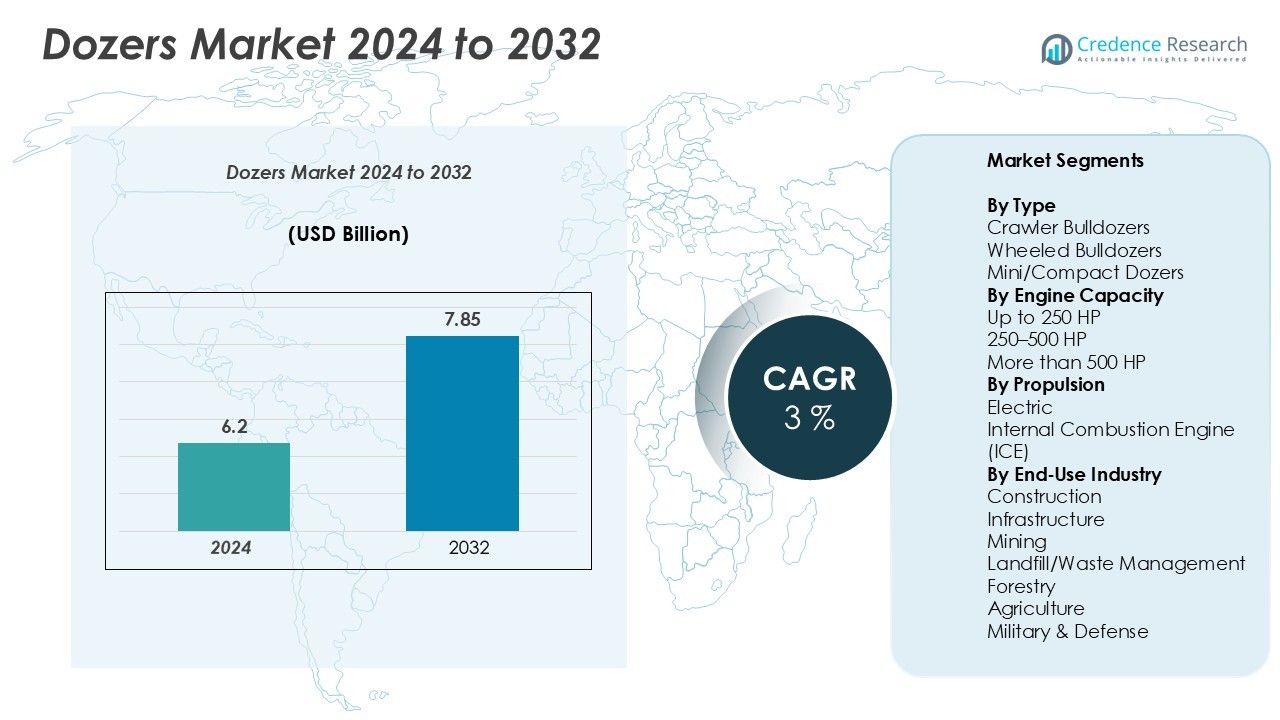

Dozers market size was valued at USD 6.2 billion in 2024 and is anticipated to reach USD 7.85 billion by 2032, at a CAGR of 3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dozers Market Size 2024 |

USD 6.2 Billion |

| Dozers Market, CAGR |

3% |

| Dozers Market Size 2032 |

USD 7.85 Billion |

The global dozers market is led by prominent players including Caterpillar Inc., Komatsu Ltd., SANY Group, Volvo Construction Equipment AB, Deere & Company, Hitachi Construction Machinery, Shantui, XCMG, Liebherr, and Guangxi LiuGong. Caterpillar and Komatsu hold significant shares owing to their extensive product portfolios, technological innovations, and strong global distribution networks. Regionally, North America dominates with approximately 30% of the market, driven by advanced construction and mining activities in the U.S. and Canada. Europe accounts for 25%, supported by infrastructure modernization and emission-compliant machinery adoption. Asia-Pacific follows closely with 28%, fueled by rapid urbanization, industrial expansion, and government-backed infrastructure projects in China, India, and Australia. Leading players continue to expand in emerging economies through localized manufacturing, strategic partnerships, and technology-focused solutions, maintaining competitive strength and capturing growth opportunities across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global dozers market was valued at USD 6.2 billion in 2024 and is expected to reach USD 7.85 billion by 2032, growing at a CAGR of 3% during the forecast period.

- Strong demand is driven by increasing infrastructure and construction activities, mining projects, and urban development across North America, Europe, and Asia-Pacific, with crawler dozers and 250–500 HP engines dominating the segment.

- Key trends include the adoption of electric and hybrid dozers, integration of telematics and automated control systems, and increasing investments in smart and sustainable construction equipment.

- The market remains highly competitive, led by companies such as Caterpillar, Komatsu, SANY, Volvo, Deere, Hitachi, Shantui, XCMG, Liebherr, and LiuGong, who focus on product innovation, regional expansion, and technology-driven solutions.

- Challenges include high acquisition and operating costs, along with strict emission and regulatory compliance, while North America holds around 30%, Europe 25%, and Asia-Pacific 28% of the market share.

Market Segmentation Analysis:

By Type:

The dozers market is segmented into Crawler Bulldozers, Wheeled Bulldozers, and Mini/Compact Dozers. Crawler bulldozers dominate the market with a substantial share, driven by their superior traction, stability, and ability to operate in challenging terrains such as mining sites and construction zones. Wheeled bulldozers are gaining traction for urban infrastructure projects due to their mobility and speed, while mini/compact dozers are preferred for smaller-scale construction and landscaping activities. The increasing demand for efficient earthmoving operations and large-scale construction projects continues to fuel the growth of crawler bulldozers globally.

- For instance, Dressta’s TD-25 crawler bulldozer delivers powerful traction and stability with a 247 HP engine and is widely used in heavy earthmoving and mining projects due to its track design that enables efficient operation in rough terrains.

By Engine Capacity:

Dozers are classified based on engine power into Up to 250 HP, 250–500 HP, and More than 500 HP. The 250–500 HP segment holds the dominant market share, as it offers an optimal balance between operational efficiency and fuel consumption for mid-sized construction and mining projects. Dozers with higher engine capacities are increasingly deployed in heavy-duty mining and large-scale infrastructure projects, while compact units serve smaller projects. Rising infrastructure investments and the need for machines that can deliver higher productivity without excessive fuel costs drive growth in the 250–500 HP segment.

- For instance, the Caterpillar 950 GC Wheel Loader is powered by a 225 horsepower (168 kW) engine (gross power, or 202 hp net power) and has an operating weight of 18,849 kg (41,554 lbs).

By Propulsion:

The propulsion segment is divided into Electric and Internal Combustion Engine (ICE) dozers. ICE-powered dozers currently dominate the market, accounting for the majority of sales due to their established performance, reliability, and availability of fuel in remote project sites. Electric dozers, although holding a smaller share, are witnessing growing adoption driven by sustainability initiatives, stricter emission regulations, and operational cost reduction goals. As governments and private operators increasingly prioritize eco-friendly equipment, the demand for electric propulsion in dozers is expected to rise steadily over the forecast period.

Key Growth Drivers

Increasing Infrastructure and Construction Activities

Rapid urbanization and government investments in infrastructure development are major growth drivers for the dozers market. Expanding road networks, commercial buildings, and residential projects create a consistent demand for heavy machinery capable of efficient earthmoving and grading. Crawler and wheeled dozers are particularly favored for large-scale projects due to their stability, traction, and versatility in handling diverse terrains. Mid-sized engine capacity dozers (250–500 HP) are widely deployed for optimal performance and cost efficiency, while compact dozers cater to smaller urban construction tasks. The rise in public-private partnerships and infrastructure modernization programs in emerging economies further accelerates equipment procurement. As construction timelines tighten and operational efficiency becomes critical, contractors increasingly rely on advanced dozers with higher productivity, fueling sustained market growth globally.

- For instance, The Caterpillar D6T Crawler Dozer is equipped with a Cat C9 ACERT engine in older models and a Cat C9.3 ACERT engine in newer, emissions-compliant models (Tier 4 Final/Stage IV). The power output typically ranges from 185 to 215 horsepower net power, depending on the specific model and year of manufacture.

Technological Advancements and Automation

The integration of advanced technologies in dozers, such as GPS-based grade control, telematics, and automated blade control, is transforming the market. These innovations enhance operational efficiency, reduce human error, and optimize fuel consumption, making machines more cost-effective and environmentally friendly. For instance, telematics allow real-time performance monitoring and predictive maintenance, reducing downtime and extending equipment lifespan. Automation and remote operation features are particularly gaining traction in mining and large-scale construction projects, where safety and precision are critical. Manufacturers are also incorporating hybrid and electric propulsion systems to comply with stringent emission regulations. The continuous technological evolution attracts end users seeking productivity gains and operational sustainability, driving market expansion and encouraging equipment upgrades.

- For instance, telematics allow real-time performance monitoring and predictive maintenance, reducing downtime and extending equipment lifespan.

Rising Demand from Mining and Heavy-Duty Applications

Mining, infrastructure, and large-scale earthmoving projects are increasingly relying on high-capacity dozers to handle tough terrains and heavy workloads. Dozers with engine capacities above 500 HP dominate these applications due to their ability to deliver high traction and force in extreme conditions. The demand is particularly strong in regions with growing mining activities and large infrastructure projects. These sectors require robust, durable, and high-performance machines capable of continuous operation under challenging environments, prompting investments in technologically advanced and high-efficiency dozers. Increasing global mining operations, coupled with the expansion of industrial zones and heavy construction projects, are key factors sustaining demand, thus propelling growth in both emerging and mature markets.

Key Trends & Opportunities

Adoption of Electric and Hybrid Dozers

The shift toward sustainable and low-emission machinery is a significant trend in the dozers market. Electric and hybrid dozers are gaining attention for reducing carbon emissions, minimizing fuel costs, and complying with environmental regulations. Manufacturers are investing in R&D to improve battery efficiency, power-to-weight ratios, and operational range of electric machines. These solutions are particularly attractive for urban construction sites and areas with strict emission norms. The growing focus on sustainability among government projects and private contractors presents a promising opportunity for expanding the electric dozer segment. Early adoption in commercial projects can lead to operational savings, making these machines a viable alternative to conventional ICE-powered equipment.

- For instance, the Komatsu D155AX-8 WH (Waste Handler) dozer is a specialized, conventionally-powered machine equipped with a 354 horsepower (264 kW) engine and has an operating weight of 42,828 kg (94,421 lbs).

Integration of IoT and Smart Fleet Management

Connected machinery and IoT-enabled fleet management solutions are emerging as key opportunities in the market. These technologies allow real-time monitoring of equipment performance, predictive maintenance scheduling, and remote diagnostics, reducing operational downtime. Contractors can track fuel consumption, machine utilization, and maintenance needs efficiently, optimizing costs and improving productivity. The integration of smart sensors and telematics provides actionable insights, supporting data-driven decision-making. Companies adopting connected fleets can enhance operational efficiency, improve safety, and minimize unplanned expenses. This trend is particularly strong in large-scale construction and mining operations, presenting a significant growth avenue for technology-driven dozers.

Expansion in Emerging Economies

Emerging economies in Asia-Pacific, Africa, and Latin America are witnessing rapid urbanization, industrialization, and infrastructure expansion, creating a strong demand for construction and mining equipment. Governments are investing heavily in roads, railways, and commercial projects, driving the need for dozers across multiple applications. Local contractors and international OEMs are capitalizing on these opportunities by expanding their distribution networks, offering tailored financing options, and introducing mid-range and compact dozers suitable for varied terrains. This trend represents a substantial growth opportunity, as market penetration remains lower in these regions compared to mature markets, allowing both manufacturers and service providers to increase sales and establish long-term presence.

- For instance, Caterpillar continues to lead with its advanced Cat Grade system in dozers like the D8, enhancing precision for large infrastructure projects, and maintains a strong presence with dealer networks across over 50 African countries.

Key Challenges

High Initial Investment and Operating Costs

The high acquisition cost of advanced dozers, especially models with larger engine capacities or electric propulsion, remains a major challenge for small and mid-sized contractors. Maintenance and operational expenses, including fuel, spare parts, and skilled labor requirements, add to the total cost of ownership. The investment barrier can delay procurement decisions or limit adoption in price-sensitive markets. Moreover, depreciation and the need for regular maintenance in harsh working conditions affect profitability, particularly in mining and heavy-duty construction projects. Companies must weigh operational efficiency and long-term cost savings against upfront expenses, which can constrain market growth in certain regions.

Regulatory Compliance and Environmental Restrictions

Strict emission regulations and safety standards are increasingly influencing dozer design and operation. Compliance with Tier 4/Stage V emission norms, noise restrictions, and environmental guidelines requires manufacturers to invest in cleaner engines, advanced exhaust systems, and low-emission technologies. Meeting these requirements increases production costs and can limit availability in price-sensitive markets. Operators in regions with stringent environmental regulations must also adapt their fleets, which may slow down adoption of conventional ICE-powered machines. Navigating these regulatory challenges while balancing performance, cost, and sustainability presents a key hurdle for market players globally.

Regional Analysis

North America

North America holds a significant share of the global dozers market, driven by large-scale infrastructure projects, mining operations, and advanced construction activities in the U.S. and Canada. The region’s preference for high-capacity crawler and wheeled dozers, coupled with mid-range engine capacity models (250–500 HP), supports steady demand. Technological adoption, including telematics, GPS-based grade control, and automation, enhances operational efficiency and safety. Strong government spending on roads, bridges, and commercial development projects further strengthens market growth. North America accounts for approximately 30% of the global dozers market, reflecting its well-established construction and mining industries.

Europe

Europe represents a key market segment, holding around 25% of the global share, propelled by infrastructure modernization, urban development, and industrial projects across Germany, France, and the U.K. Environmental regulations and emission standards drive the adoption of hybrid and electric dozers, particularly in urban and restricted construction zones. The demand for crawler and mini/compact dozers is high for precision-based earthmoving and landscaping activities. Manufacturers are investing in advanced technologies, including automated blade control and telematics, to meet regulatory compliance while enhancing productivity. Strong government initiatives and urban infrastructure programs support consistent demand growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the dozers market, accounting for approximately 28% of global share, fueled by rapid urbanization, industrialization, and government investments in infrastructure and mining projects. Countries like China, India, and Australia are witnessing rising demand for mid- and high-capacity dozers, both crawler and wheeled types. Compact and mini dozers are gaining traction in urban construction projects due to space constraints. Increasing adoption of advanced technologies, such as telematics and automation, along with expansion of local manufacturing, further drives market growth. Rising private and public infrastructure spending positions Asia-Pacific as a key growth hub.

Middle East & Africa (MEA)

The MEA region holds an estimated 10% share of the global dozers market, driven primarily by large-scale mining, oil, and infrastructure projects in countries like Saudi Arabia, UAE, and South Africa. Demand for high-capacity crawler dozers is significant due to rugged terrains and heavy-duty applications. Government initiatives to develop transportation and urban infrastructure, coupled with mining industry growth, support consistent equipment procurement. Limited availability of skilled operators and harsh environmental conditions pose challenges, but technological adoption in fleet management and automated operation helps improve efficiency. The market is expanding steadily, with increasing foreign investments in construction and industrial sectors.

Latin America

Latin America accounts for % of the global dozers market, with Brazil, Mexico, and Chile as key contributors. Mining, road construction, and industrial development drive demand for crawler and wheeled dozers, particularly in mid- to high-capacity ranges. Governments are investing in infrastructure modernization, including highways, railways, and urban projects, supporting steady market growth. Compact and mini dozers are increasingly used for urban and small-scale projects. Challenges include economic volatility and high operational costs, but growth opportunities arise from rising infrastructure budgets, mining expansion, and gradual adoption of hybrid and electric equipment.

Market Segmentations:

By Type

- Crawler Bulldozers

- Wheeled Bulldozers

- Mini/Compact Dozers

By Engine Capacity

- Up to 250 HP

- 250–500 HP

- More than 500 HP

By Propulsion

- Electric

- Internal Combustion Engine (ICE)

By End-Use Industry

- Construction

- Infrastructure

- Mining

- Landfill/Waste Management

- Forestry

- Agriculture

- Military & Defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global dozers market is highly competitive, with leading players focusing on product innovation, strategic partnerships, and geographic expansion to maintain market position. Key companies such as Caterpillar Inc., Komatsu Ltd., SANY Group, and Volvo Construction Equipment dominate the market through a combination of advanced crawler and wheeled dozers, high-capacity engines, and technology-integrated solutions including telematics, automation, and electric propulsion. Manufacturers are investing heavily in R&D to enhance machine efficiency, fuel economy, and emission compliance, while also offering tailored financing and after-sales support to attract end users. Regional players such as Shantui, XCMG, and LiuGong are strengthening their presence in emerging economies through localized manufacturing and distribution networks. Strategic initiatives, including mergers, acquisitions, and alliances, are enabling companies to expand product portfolios and enter new markets. This competitive environment drives continuous innovation, cost optimization, and differentiation, benefiting contractors with improved performance, sustainability, and operational efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Caterpillar Inc.

- Volvo Construction Equipment AB

- Komatsu Ltd.

- Deere & Company

- Hitachi Construction Machinery Co., Ltd.

- SANY Group (Sany Heavy Industry Co., Ltd.)

- XCMG Construction Machinery Co., Ltd.

- Shantui Construction Machinery Co., Ltd.

- Liebherr Machines Bulle S.A.

- Guangxi LiuGong Machinery Co., Ltd.

Recent Developments

- In April 2025, Liebherr-Canada delivered four new PR 776 dozers, including the latest Generation 8 model, to Taseko’s Gibraltar mine, highlighting fuel efficiency, lower emissions, and advanced operator assistance systems.

- In April 2025, Leica Geosystems and Shantui launched new aftermarket machine control kits for the DH20M dozer, enabling seamless integration of 3D guidance systems to improve precision, productivity, and operational efficiency on job sites.

- In December 2024, BEML Ltd launched India’s largest crawler dozer, the BD475-2, featuring a 950 HP engine and advanced in-house engineering to support heavy-duty mining applications and strengthen India’s self-reliance goals.

- In April 2023, Develon unveiled the DD130 bulldozer at ConExpo, offering enhanced power, fine grading, and customizable blade options for residential and light commercial construction in the North American market.

Report Coverage

The research report offers an in-depth analysis based on Type, Engine Capacity, Propulsion, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-capacity crawler dozers will continue to rise in large-scale mining and infrastructure projects.

- Adoption of electric and hybrid dozers will accelerate due to stricter emission regulations and sustainability initiatives.

- Integration of telematics and smart fleet management will enhance operational efficiency and predictive maintenance.

- Compact and mini dozers will see increased use in urban construction and landscaping projects.

- Asia-Pacific will remain the fastest-growing region due to rapid urbanization and industrial expansion.

- Manufacturers will focus on product innovation to improve fuel efficiency, automation, and machine durability.

- Strategic partnerships and regional expansions will help companies capture emerging market opportunities.

- Contractors will increasingly prefer mid-range engine dozers for optimal balance between performance and cost.

- Digital monitoring and AI-driven controls will reduce downtime and enhance precision in operations.

- Market competition will intensify, driving continuous improvement and differentiation in products and services.