Market Overview

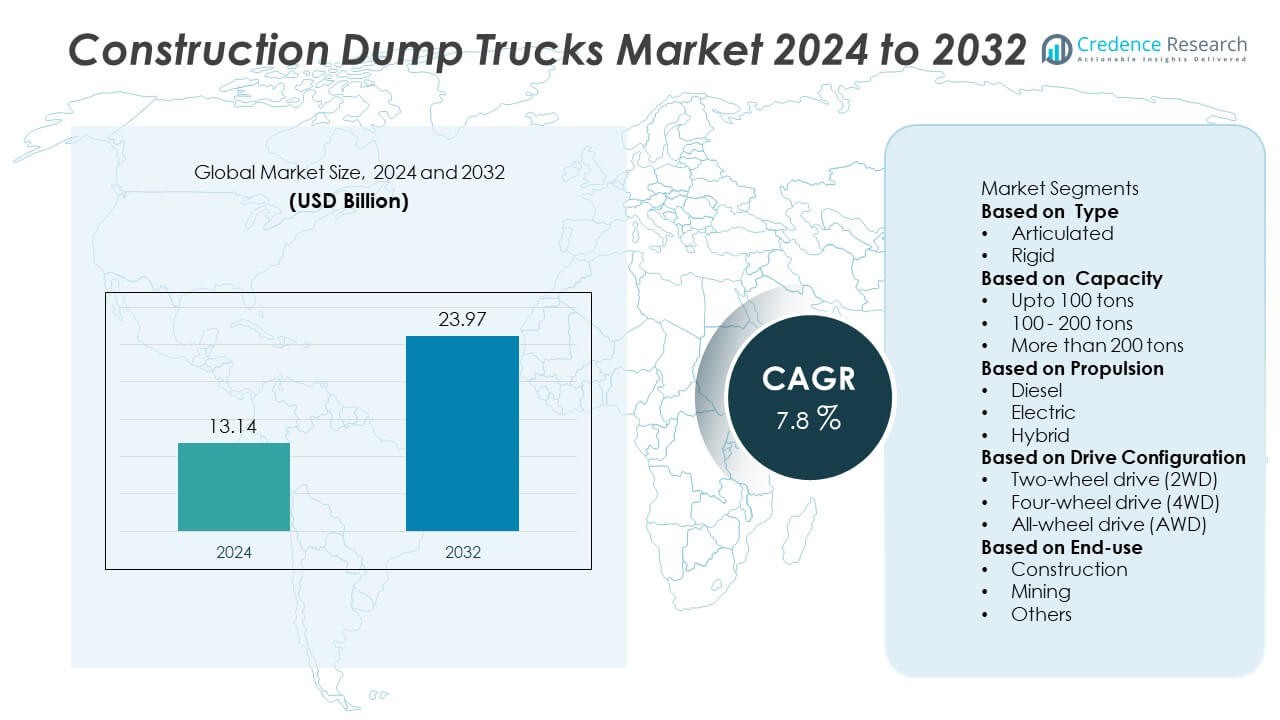

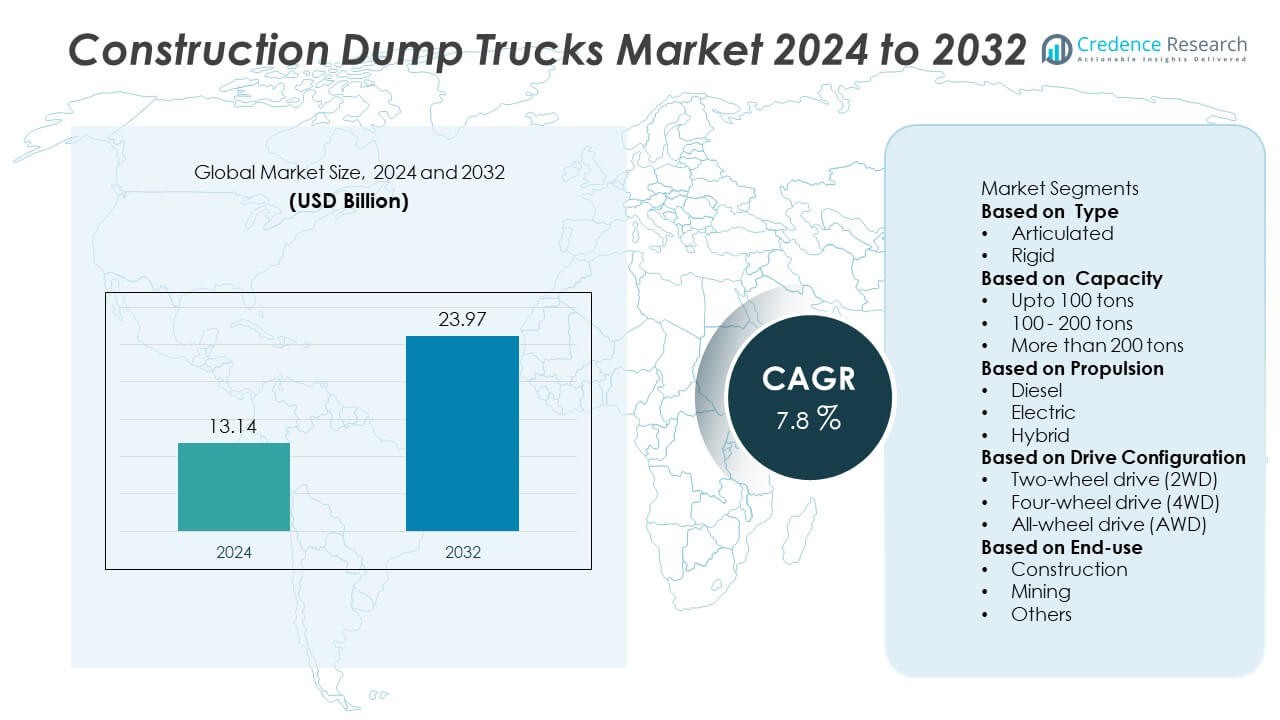

The Construction Dump Trucks Market was valued at USD 13.14 billion in 2024 and is projected to reach USD 23.97 billion by 2032, growing at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Dump Trucks Market Size 2024 |

USD 13.14 Billion |

| Construction Dump Trucks Market, CAGR |

7.8% |

| Construction Dump Trucks Market Size 2032 |

USD 23.97 Billion |

The Construction Dump Trucks Market is led by major players such as Caterpillar Inc., Deere & Company, Doosan Corporation, Hitachi Construction Machinery, Liebherr Group, Sany Group, XCMG Group, Komatsu Ltd., Volvo Construction Equipment, and Terex Corporation. These companies dominate through advanced product innovation, durable vehicle designs, and global service networks supporting large infrastructure and mining projects. Asia-Pacific emerged as the leading region in 2024, holding a 39% market share driven by rapid industrialization, expanding mining operations, and large-scale infrastructure development. North America followed with 27%, supported by heavy investments in road construction, oil exploration, and modernization of public infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Construction Dump Trucks Market was valued at USD 13.14 billion in 2024 and is projected to reach USD 23.97 billion by 2032, growing at a CAGR of 7.8%.

- Increasing infrastructure development, mining expansion, and urban construction projects are driving the demand for high-capacity dump trucks globally.

- The market is witnessing a shift toward advanced telematics, automation, and hybrid propulsion systems to improve efficiency and reduce emissions.

- Leading players such as Caterpillar, Komatsu, XCMG, and Volvo Construction Equipment focus on durable designs, localized production, and sustainable technology to maintain competitiveness.

- Asia-Pacific led the market with a 39% share, followed by North America at 27% and Europe at 21%; by type, the rigid dump truck segment dominated with 62% share, supported by heavy industrial and infrastructure applications.

Market Segmentation Analysis:

By Type

The rigid dump truck segment dominated the Construction Dump Trucks Market in 2024, holding a 62% market share. Its dominance is attributed to high load-bearing capacity and superior performance in large-scale construction and mining projects. Rigid trucks are preferred for transporting heavy materials such as aggregates, sand, and debris across rough terrains. Their robust design and lower maintenance requirements make them ideal for continuous heavy-duty operations. Growing investments in infrastructure and quarrying activities are further boosting the demand for rigid dump trucks across major global markets.

- For instance, Caterpillar Inc. developed the Cat 798 AC rigid dump truck, designed with a 410-ton payload capacity and powered by a 3,500-horsepower Cat C175-16 engine. The truck features an electric drive system capable of achieving a top speed of 64 km/h while maintaining productivity in extreme mining environments, supported by its autonomous-ready Command system for operator-free hauling.

By Capacity

The 100–200 tons segment led the Construction Dump Trucks Market in 2024, capturing a 45% share. This range provides an optimal balance between payload efficiency and maneuverability, making it suitable for large infrastructure and mining projects. These trucks are widely used in highway construction, cement production, and quarrying operations requiring reliable material transport. Manufacturers are integrating advanced suspension systems and fuel-efficient engines to enhance performance and durability. Expanding mega construction projects across Asia-Pacific and the Middle East continues to drive the dominance of this capacity range.

- For instance, Komatsu Ltd. introduced the HD1500-8 dump truck featuring a 142-ton payload capacity and a 1,175 kW (1,574 hp) Komatsu SDA16V159 engine. The truck is equipped with an automatic retard speed control system and an electronically controlled transmission, allowing downhill speeds of up to 23 km/h under full load, significantly improving operational safety and efficiency in large-scale construction and quarrying applications.

By Propulsion

The diesel segment held the largest share of 81% in the Construction Dump Trucks Market in 2024. Diesel-powered dump trucks remain the preferred choice for heavy-duty operations due to high torque output, fuel efficiency, and widespread refueling infrastructure. These vehicles are extensively used in remote construction and mining areas where consistent power and durability are critical. Manufacturers are introducing low-emission diesel engines to comply with global environmental standards. The segment’s stability is further supported by ongoing demand for reliable and cost-effective powertrains in large-scale infrastructure projects worldwide.

Key Growth Drivers

Infrastructure Development and Urban Expansion

Rapid infrastructure growth and urbanization are fueling demand for construction dump trucks worldwide. Large-scale road, bridge, and residential projects rely heavily on high-capacity trucks for material transport. Governments in emerging economies are investing in smart cities and industrial corridors, increasing the need for efficient hauling equipment. The ability of dump trucks to operate under harsh conditions and move heavy loads efficiently supports their widespread adoption across major infrastructure projects.

- For instance, Volvo Construction Equipment deployed its A60H articulated hauler in large-scale infrastructure projects, featuring a 55-metric-ton payload capacity and powered by a 16-liter Volvo engine, with the specific engine model varying by emissions standard.

Rising Mining and Quarrying Activities

Expanding mining operations and quarrying projects are major drivers for the construction dump truck market. These trucks are essential for transporting minerals, ores, and overburden materials in open-pit mining sites. Increasing demand for coal, iron ore, and aggregates is boosting the use of rigid and articulated dump trucks. Manufacturers are developing high-performance models with improved durability, traction, and payload capacity to meet the growing operational requirements of the mining and quarrying sectors.

- For instance, Liebherr Group manufactures the T 284 ultra-class mining truck with a 363-ton payload capacity and an engine that offers up to 4,023 horsepower. The truck achieves a top speed of 64 km/h and uses Liebherr’s Litronic Plus AC drive system, which provides optimal traction control, enabling efficient hauling of ore and overburden in large open-pit mining environments.

Technological Advancements in Equipment Efficiency

Technological innovations in dump trucks are improving operational productivity and fuel efficiency. Modern trucks feature telematics systems, GPS-based monitoring, and automated load optimization to reduce downtime and operational costs. Advanced engine designs and hybrid propulsion systems are helping manufacturers meet stringent emission norms. These advancements enhance performance, reliability, and driver safety, making technologically advanced dump trucks a preferred choice for large construction and mining fleets.

Key Trends & Opportunities

Adoption of Electric and Hybrid Dump Trucks

Growing focus on sustainability is driving the adoption of electric and hybrid construction dump trucks. These models help reduce fuel consumption, lower emissions, and minimize operational noise. Governments promoting green construction and emission reduction initiatives are supporting this shift. Manufacturers are investing in battery-powered and hybrid systems that provide longer range and faster charging. This transition presents a major opportunity for companies developing low-emission, energy-efficient heavy vehicles.

- For instance, XCMG Group developed the XDE240H, an intelligent hybrid mining dump truck, equipped with a 441 kWh lithium iron phosphate battery system. The truck has a maximum output torque of 720,000 Nm and recovers over 96% of braking energy, significantly improving energy efficiency during continuous mining operations.

Integration of Telematics and Fleet Management Systems

The use of telematics and real-time monitoring technologies is transforming fleet management in construction operations. Advanced telematics enable predictive maintenance, route optimization, and driver performance tracking. These systems help reduce fuel costs, prevent breakdowns, and increase fleet productivity. Construction firms are increasingly adopting data-driven solutions to enhance operational efficiency, creating new opportunities for technology providers and OEMs offering integrated digital platforms.

- For instance, Komatsu Ltd. operates the Komtrax telematics platform, which tracks its connected machines globally, including dump trucks and excavators. The system records various parameters, such as engine load, idle time, and fuel usage, transmitting data via a combination of satellite and mobile networks.

Key Challenges

High Initial Investment and Maintenance Costs

The high upfront cost of construction dump trucks remains a major barrier for small and mid-scale contractors. Maintenance, fuel, and spare parts expenses add to overall ownership costs. The complexity of modern engines and electronic systems also increases servicing requirements. Limited access to financing options in developing regions further restricts new truck adoption, slowing down market expansion among smaller construction operators.

Stringent Emission Regulations

Tightening global emission norms are posing challenges for dump truck manufacturers. Compliance with standards such as Euro VI and Tier 4 requires significant investment in cleaner engine technologies and after-treatment systems. These regulations raise production costs and increase vehicle prices. Manufacturers are under pressure to balance performance with emission control while ensuring cost efficiency. Adapting to these regulations without compromising productivity remains a key challenge across global markets.

Regional Analysis

North America

North America accounted for a 27% market share in the Construction Dump Trucks Market in 2024. The region’s growth is driven by large-scale road construction, mining operations, and residential redevelopment projects. The United States leads demand due to ongoing infrastructure renewal and investments in highway and energy projects. Manufacturers are focusing on fuel-efficient and low-emission trucks that comply with EPA standards. The adoption of telematics and automated systems enhances fleet management efficiency. Steady replacement of aging fleets with advanced dump trucks continues to support strong regional demand.

Europe

Europe held a 21% share of the Construction Dump Trucks Market in 2024, supported by growing investments in sustainable construction and urban infrastructure. Countries such as Germany, France, and the United Kingdom are adopting low-emission and hybrid dump trucks to meet strict EU Stage V regulations. The region emphasizes smart city development and green construction practices, encouraging the use of efficient heavy vehicles. Continuous infrastructure upgrades, quarrying operations, and digital fleet management adoption are strengthening the European market. Regional manufacturers are also investing in electric truck development to align with carbon reduction goals.

Asia-Pacific

Asia-Pacific dominated the Construction Dump Trucks Market in 2024 with a 39% market share. The region’s leadership is driven by rapid urbanization, expanding mining activities, and extensive infrastructure projects in China, India, and Southeast Asia. High government spending on roads, bridges, and industrial zones boosts truck deployment across construction sites. Local and global OEMs are introducing cost-effective, high-capacity dump trucks tailored to regional needs. Frequent power and fuel price fluctuations are encouraging demand for efficient diesel and hybrid models. The growing construction equipment industry solidifies Asia-Pacific as the primary growth engine of the market.

Latin America

Latin America captured a 7% market share in the Construction Dump Trucks Market in 2024. Demand is primarily driven by large-scale mining and quarrying projects in Brazil, Chile, and Peru. Infrastructure development and public housing programs also support truck utilization in construction sectors. Limited road connectivity and rugged terrains make dump trucks essential for material transport. Manufacturers are expanding their presence through partnerships with regional distributors. Increasing adoption of durable and fuel-efficient models is strengthening market penetration. Economic recovery and foreign investment in mining projects are expected to sustain market growth in coming years.

Middle East & Africa

The Middle East & Africa region held a 6% share of the Construction Dump Trucks Market in 2024. Growth is supported by major infrastructure and oil-related construction projects across Saudi Arabia, the United Arab Emirates, and South Africa. Ongoing megaprojects such as smart cities, industrial hubs, and transportation corridors are increasing equipment demand. In Africa, mining and road construction projects continue to drive heavy-duty truck utilization. Manufacturers are introducing trucks with enhanced cooling and durability features suited for harsh environments. Government initiatives promoting infrastructure expansion and local manufacturing are further supporting regional market development.

Market Segmentations:

By Type

By Capacity

- Upto 100 tons

- 100 – 200 tons

- More than 200 tons

By Propulsion

By Drive Configuration

- Two-wheel drive (2WD)

- Four-wheel drive (4WD)

- All-wheel drive (AWD)

By End-use

- Construction

- Mining

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Construction Dump Trucks Market includes key players such as Caterpillar Inc., Deere & Company, Doosan Corporation, Hitachi Construction Machinery, Liebherr Group, Sany Group, XCMG Group, Komatsu Ltd., Volvo Construction Equipment, and Terex Corporation. These companies compete through advanced product design, fuel efficiency, and technological integration to meet global construction and mining demands. Manufacturers are investing in telematics, automation, and hybrid power technologies to enhance productivity and reduce emissions. Strategic partnerships, localized production, and after-sales service expansion remain central to market leadership. Asian manufacturers such as Sany and XCMG are strengthening global positions through cost-effective, high-capacity models, while Western brands like Caterpillar and Volvo emphasize innovation, durability, and compliance with stringent environmental standards. Growing focus on hybrid and electric dump trucks is reshaping competition, pushing companies to adopt sustainable and smart manufacturing approaches.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, XCMG Group secured an order from Fortescue for 150–200 units of 240-ton battery-electric haul trucks to deploy in Australian mining operations.

- In May 2025, XCMG shipped 100 XG1 6×4 DH380T fuel-powered dump trucks abroad for infrastructure projects, fulfilling demand in overseas construction markets.

- In April 2025, Caterpillar previewed the new Cat 775 off-highway truck with a 65-ton payload and designs built for future full autonomy.

- In 2024, XCMG delivered a batch of its XDE260 double-bridge rigid dump trucks to a customer in Oceania, marking its entry with large open-pit models in that market.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Propulsion, Drive Configuration, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising infrastructure and mining investments worldwide.

- Demand for fuel-efficient and low-emission dump trucks will continue to increase.

- Electric and hybrid dump trucks will gain traction as sustainability regulations tighten.

- Automation and telematics adoption will enhance fleet efficiency and safety.

- Asia-Pacific will remain the dominant region due to rapid urbanization and industrial growth.

- Manufacturers will focus on lightweight materials to improve fuel performance and payload capacity.

- Technological partnerships between OEMs and digital solution providers will expand.

- Replacement of aging fleets will create consistent demand across developed markets.

- Stringent emission norms will drive innovation in cleaner engine technologies.

-

Growing preference for smart and connected dump trucks will reshape competitive strategies.